New survey shows that 41% of all U.S. shoppers say inflation will impact their plans to buy Halloween candy

05 October 2023 - 12:00AM

Advantage Solutions Inc. (NASDAQ: ADV) today unveiled “Halloween

2023: Shoppers Reveal Plans to Spend and Celebrate,” an annual

survey of 1,000 U.S. adults who celebrate Halloween and serve as

their household’s primary grocery shopper or share the

responsibility.

During a period marked by rising prices, 41% of shoppers say

inflation will alter their candy spending this year, according to

the survey, which was conducted between September 5-7, 2023.

Advantage Solutions’ research also reveals that among that 41%,

half expect to spend the same amount but buy less candy due to

higher prices and about three in 10 anticipate spending less and

buying less candy. One in six say they plan to pay more to account

for higher prices.

“The effect of surging prices and persistent inflation on

Halloween shopper spending is undeniable,” said Andy Keenan,

executive vice president, retail services for Advantage Solutions.

“While most Americans still plan to celebrate Halloween this year

by dressing up and trick-or-treating, a significant number of

shoppers indicate that rising prices will curb the amount of money

they spend on candy, costumes and decorations.”

Among the survey’s other findings:

- Nearly nine in 10 survey

respondents plan to purchase candy, and about six in 10 plan to buy

decorations and costumes (72% of those with children will buy

costumes). Nearly three in 10 will buy food treats other than

candy.

- More than half (55%) of Halloween

candy buyers will spend more than $25 on confectionary this year ―

with one-fifth planning to spend more than $50. Almost 60% of those

buying other Halloween-themed edible treats will spend more than

$25 on these food products — and one-fourth of them will spend more

than $50 on these food items.

- Chocolate will reign supreme again

this Halloween, as nearly 90% of candy buyers say they’ll be eating

or treating others to chocolate candy. Almost 60% will pick up

gummies and nearly half of Halloween candy buyers (45%) will put

sour candy in their physical or digital carts. More than 40% will

purchase hard candy and/or lollipops. Nearly three in 10 (28%) will

be buying gum.

- The top two factors influencing

shoppers’ Halloween candy purchases are price (33% ranked this the

most important factor) and individual or family candy preferences

(29%). For 10% of candy buyers, package size matters most, with

many looking for full-size or Halloween-sized candies.

- About half (48%) of candy buyers

will make their purchases a week or less before Halloween, and 17%

will buy their candy within three days of the holiday.

- Among those handing out candy to

trick-or-treaters, 75% will distribute treats at the door, while

only 13% will leave an unattended bowl outside. Of those handing

out candy, 41% will give three to four pieces of candy, 35% will

distribute two pieces and only 8% will offer one piece.

“Nine in 10 grocery shoppers will buy Halloween candy and nearly

three-fourths of them will walk into stores during the last two

weeks of October looking for their favorite treats at a perceived

value,” added Keenan. “Keeping these products on the shelf and in

displays couldn’t be more critical for both candy brands and

retailers, especially during the run-up to Halloween when shoppers

are most active.”

The complete findings can be viewed here.

About Advantage SolutionsAdvantage Solutions is

a leading provider of outsourced sales and marketing solutions to

consumer goods companies and retailers. Our data- and

technology-driven services — which include headquarter sales,

retail merchandising, in-store and online sampling, digital

commerce, omnichannel marketing, retail media and others — help

brands and retailers of all sizes get products into the hands of

consumers, wherever they shop. As a trusted partner and problem

solver, we help our clients sell more while spending less.

Headquartered in Irvine, California, we have offices throughout

North America and strategic investments in select markets

throughout Africa, Asia, Australia and Europe, through which we

serve the global needs of multinational, regional and local

manufacturers. For more information,

visit www.advantagesolutions.net.

Peter Frostpress@advantagesolutions.net

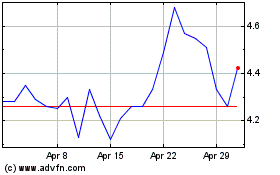

Advantage Solutions (NASDAQ:ADV)

Historical Stock Chart

From Oct 2024 to Dec 2024

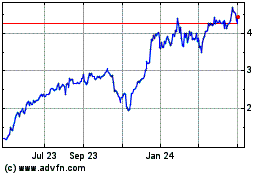

Advantage Solutions (NASDAQ:ADV)

Historical Stock Chart

From Dec 2023 to Dec 2024