UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of February 2024

ANTELOPE

ENTERPRISE HOLDINGS LTD.

(Translation

of registrant’s name into English)

Room

1802, Block D, Zhonghai International Center,

Hi-Tech

Zone, Chengdu, Sichuan Province, PRC

Telephone

+86 (28) 8532 4355

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Entry

into Material Agreements

On

February 15, 2024, Antelope Enterprise Holdings Limited, a British Virgin Islands exempted limited company (the “Company”)

entered into warrant exchange agreements (the “Exchange Agreements”) with each of several holders (each, a “Holder”,

collectively the “Holders”) of warrants (the “Warrants”) to purchase Class A ordinary shares, no

par value each, (the “Class A Ordinary Shares”) of the Company, pursuant to which the Holders agreed to surrender

the Warrants for cancellation and the Company agreed, in exchange, to issue 0.5 restricted Class A Ordinary Shares and $1.0 in cash for

each Warrant. The Holders, collectively, owned 202,030 Warrants at the time of entering into the Exchange Agreement, and received 101,018

restricted Class A Ordinary Shares (the “Exchanged Shares”) and $202,030 in cash upon closing of the transaction as

contemplated in the Exchange Agreements.

The

Exchanged Shares were issued pursuant to the exemption from the registration requirements of the Securities Act of 1933, as amended (the

“Securities Act”), provided by Section 4(a)(2) of the Securities Act.

The

foregoing description of the Exchange Agreements does not purport to be complete and is subject to and qualified in its entirety by reference

to the full text of such document, the form of which is attached as Exhibit 10.1 to this Current Report on Form 6-K and are incorporated

by reference herein.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

| |

ANTELOPE

ENTERPRISE HOLDINGS LTD. |

| |

|

|

| |

By: |

/s/

Hen Man Edmund |

| |

|

Hen

Man Edmund |

| |

|

Chief

Financial Officer |

| |

|

|

| Date:

February 21, 2024 |

|

|

Exhibit

10.1

WARRANT

EXCHANGE AGREEMENT

This

Warrant Exchange Agreement (this “Agreement”) is made and entered into as of February 15, 2024, (the “Effective

Date”), by and between Antelope Enterprise Holdings Limited, a British Virgin Islands exempted limited company(the “Company”),

and [ ] (the “Holder” and, together with the Company, the “parties”).

RECITALS

WHEREAS,

the Holder currently owns warrants (collectively, the “Existing Warrants”), each of which is exercisable to purchase

one Class A ordinary share of the Company, no par value, (the “Class A Ordinary Shares”) at $[ ];

WHEREAS,

subject to the terms and conditions set forth herein, the Company and the Holder desire to cancel and retire [ ] of Holder’s Existing

Warrants in exchange for $[ ] in cash (“Cash Consideration”) and [ ] Class A Ordinary Shares (collectively, the “Exchange

Shares”); and

NOW,

THEREFORE, in consideration of the premises and the agreements set forth below, and for other good and valuable consideration, the receipt

and sufficiency of which are hereby acknowledged, the parties agree as follows:

ARTICLE

I

EXCHANGE

Section

1.1 Exchange of Existing Warrants. Upon the terms and subject to the conditions of this Agreement, the Holder hereby conveys,

assigns, transfers and surrenders the Existing Warrants to the Company and, in exchange, the Company shall cancel the Existing Warrants

and issue the Exchange Shares and pay the Cash Consideration via wire transfer to the Holder. In connection with the Exchange, upon the

Effective Date defined below, the Holder hereby relinquishes all rights, title and interest in the Existing Warrants (including any claims

the Holder may have against the Company related thereto other than for receipt of the Exchange Shares and the Cash Consideration) and

assigns the same to the Company. The term “Effective Date” mean the later of (i) the receipt by the Holder of the Cash Consideration

in United States funds by means of a wire, and (ii) the delivery to the Holder of the Exchange Shares. The issuance of the Exchange Shares

to the Holder will be made without registration of such Exchange Shares under the Securities Act, in reliance upon the exemption therefrom

provided by Section 4(a)(2) of the Securities Act and accordingly, the Exchange Shares will be issued by the Company to the Holder with

restrictive legends.

Section

1.2 Issuance of Exchange Shares. Within three (3) business days after the execution and delivery of this Agreement by the Company,

the Company shall use commercially reasonable efforts to pay the Cash Consideration to the Holder via wire, and cause its transfer agent,

TranShare Corporation (the “Transfer Agent”), to issue to the Holder the Exchange Shares. On the Effective Date, the

Holder shall deliver, or caused to be delivered, to the Company, the Existing Warrants, and such Existing Warrants shall be deemed automatically

cancelled in full and of no force and effect as of the Effective Date.

ARTICLE

II

REPRESENTATIONS,

WARRANTIES AND COVENANTS OF THE HOLDER

The

Holder hereby makes the following representations, warranties and covenants, each of which is true and correct on the date hereof, and

shall survive the consummation of the transactions contemplated hereby to the extent set forth herein:

Section

2.1 Existence and Power.

(a)

The Holder is duly organized, validly existing and in good standing under the laws of the jurisdiction in which it is organized.

(b)

The Holder has all requisite power, authority and capacity to execute and deliver this Agreement, to perform its obligations hereunder,

and to consummate the transactions contemplated hereby. The execution, delivery and performance of this Agreement, and the consummation

of the transactions contemplated hereby have been duly authorized by all necessary action on the part of the Holder, and no further consent,

approval or authorization is required by the Holder in order for the Holder to execute, deliver and perform this Agreement and consummate

the transactions contemplated hereby.

Section

2.2 Valid and Enforceable Agreement; Authorization. This Agreement has been duly executed and delivered by the Holder and, assuming

due execution and delivery by the Company, constitutes the legal, valid and binding obligation of the Holder, enforceable against the

Holder in accordance with its terms, except that such enforcement may be subject to (a) bankruptcy, insolvency, reorganization, moratorium

or other similar laws affecting or relating to the enforcement of creditors’ rights generally, and (b) general principles of equity.

Section

2.3 Reserved.

Section

2.4 Title to Warrants. The Holder owns and holds, beneficially and of record, the entire right, title, and interest in and to

its Existing Warrants, free and clear of any Liens (as defined below). The Holder has the full power and authority to transfer and dispose

of the Existing Warrants and will deliver such Existing Warrants free and clear of any Lien other than restrictions under the Securities

Act and applicable state securities laws and except as set forth herein the Holder has not, in whole or in part, (i) assigned, transferred,

hypothecated, pledged or otherwise disposed of the Existing Warrants or its rights in such Existing Warrants, or (ii) given any person

or entity any transfer order, power of attorney, vote, plan, pending proposal or other right of any nature whatsoever with respect to

such Existing Warrants which would limit the Holder’s power to transfer the Existing Warrants hereunder. As used herein, “Liens”

shall mean any security or other property interest or right, claim, lien, pledge, option, charge, security interest, contingent or conditional

sale, or other title claim or retention agreement, interest or other right or claim of third parties, whether perfected or not perfected,

voluntarily incurred or arising by operation of law, and including any agreement (other than this Agreement) to grant or submit to any

of the foregoing in the future.

Section

2.5 Non-Contravention. The execution, delivery and performance of this Agreement by the Holder and the consummation by the Holder

of the transactions contemplated hereby do not and will not (i) result in any violation of the provisions of the organizational documents

of the Holder or (ii) constitute or result in a breach, violation, conflict or default under any indenture, mortgage, deed of trust,

loan agreement or other agreement or instrument to which the Holder is a party or by which the Holder is bound or to which any of the

property or assets of the Holder is subject, or any statute, order, rule or regulation of any court or governmental agency or body having

jurisdiction over the Holder or any of its properties or cause the acceleration or termination of any obligation or right of the Holder,

except in the case of clause (ii) above for such breaches, conflicts, defaults, rights or violations which would not, individually or

in the aggregate, reasonably be expected to materially adversely affect the ability of the Holder to perform its obligations hereunder.

Section

2.6 Investment Decision.

(a)

(i) The Holder is a sophisticated investor acquiring the Exchange Shares in the ordinary course of its business and has such knowledge

and experience in financial and business matters as to be capable of evaluating the merits and risks of investing in the Exchange Shares

and has so evaluated the merits and risks of investing in the Exchange Shares, (ii) the Holder is able to bear the entire economic risk

of investing in the Exchange Shares, (iii) the Holder is investing in the Exchange Shares with a full understanding of all of the terms,

conditions and risks of such an investment and willingly assume those terms, conditions and risks and (iv) the Holder has not relied

on any statement or other information provided by any person concerning the Company, the Exchange or the Exchange Shares.

(b)

The Holder acknowledges that an investment in the Exchange Shares involves a high degree of risk, and the Exchange Shares are, therefore,

a speculative investment. The Holder acknowledges that the terms of the Exchange have been established by negotiation between the Company

and the Holder. The Holder acknowledges that the Company has not given any investment advice, rendered any opinion or made any representation

to the Holder about the advisability of this decision or the potential future value of any of the Existing Warrants. THE HOLDER ACKNOWLEDGES

THAT, BY EXCHANGING THE EXISTING WARRANTS FOR COMMON SHARES PURSUANT TO THIS AGREEMENT, THE HOLDER WILL NOT BENEFIT FROM ANY FUTURE APPRECIATION

IN THE MARKET VALUE OF THE EXISTING WARRANTS.

(c)

The Holder has been given full and adequate access to information relating to the Company, including its business, finances and operations

as the Holder has deemed necessary or advisable in connection with the Holder’s evaluation of the Exchange. The Holder has not

relied upon any representations or statements made by the Company or its agents, officers, directors, employees or stockholders in regard

to this Agreement or the basis thereof. The Holder has sought such accounting, legal and tax advice as it has considered necessary to

make an informed investment decision with respect to its acquisition of the Exchange Shares and is not relying on the Company or any

of its affiliates for any such advice. The Holder has had the opportunity to review the Company’s filings with the Securities and

Exchange Commission. The Holder and its advisors, if any, have been afforded the opportunity to ask questions of the Company. The Holder

has made an independent decision to exchange its Existing Warrants for Exchange Shares and is relying solely on its own accounting, legal

and tax advisors, and not on any statements of the Company or any of its agents or representatives, for such accounting, legal and tax

advice with respect to its acquisition of the Exchange Shares and the transactions contemplated by this Agreement.

(d)

The Holder is not (i) an “affiliate” of the Company (as defined in Rule 144 under the Securities Act) or (ii) the “beneficial

owner” (as that term is defined under the Exchange Act of 1934, as amended) of more than 10% of the Company’s outstanding

ordinary shares.

(e)

The Exchange Shares may only be disposed of in compliance with state and federal securities laws. In connection with any transfer of

the Exchange Shares other than pursuant to an effective registration statement or Rule 144, to the Company or to an affiliate of the

Holder or in connection with a pledge, the Company may require the Holder thereof to provide to the Company an opinion of counsel selected

by the transferor and reasonably acceptable to the Company, the form and substance of which opinion shall be reasonably satisfactory

to the Company, to the effect that such transfer does not require registration of such transferred Exchange Shares under the Securities

Act of 1933, as amended (the “Securities Act”). As a condition of transfer, any such transferee shall agree in writing to

be bound by the terms of this Agreement.

(f)

The Holder acknowledges and consents, subject to the provisions of Section 3.6, that certificates now or hereafter issued for the Exchange

Shares will bear a legend substantially as follows:

THE

SECURITIES EVIDENCED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES

ACT”), OR QUALIFIED UNDER ANY APPLICABLE STATE SECURITIES LAWS (THE “STATE ACTS”), HAVE BEEN ACQUIRED FOR INVESTMENT

AND MAY NOT BE SOLD, PLEDGED, HYPOTHECATED OR OTHERWISE TRANSFERRED EXCEPT PURSUANT TO A REGISTRATION STATEMENT UNDER THE SECURITIES

ACT AND QUALIFICATION UNDER THE STATE ACTS OR PURSUANT TO EXEMPTIONS FROM SUCH REGISTRATION OR QUALIFICATION REQUIREMENTS (INCLUDING,

IN THE CASE OF THE SECURITIES ACT, THE EXEMPTIONS AFFORDED BY SECTION 4(A)(2) OF THE SECURITIES ACT AND RULE 144 THEREUNDER). AS A PRECONDITION

TO ANY SUCH TRANSFER, THE ISSUER OF THESE SECURITIES SHALL BE FURNISHED WITH AN OPINION OF COUNSEL OPINING AS TO THE AVAILABILITY OF

EXEMPTIONS FROM SUCH REGISTRATION AND QUALIFICATION AND/OR SUCH OTHER EVIDENCE AS MAY BE SATISFACTORY THERETO THAT ANY SUCH TRANSFER

WILL NOT VIOLATE THE SECURITIES LAWS.

Section

2.7 No Remuneration. Neither the Holder nor anyone acting on the Holder’s behalf has paid or given any person a commission

or other remuneration directly or indirectly in connection with or in order to solicit or facilitate the Exchange.

ARTICLE

III

REPRESENTATIONS,

WARRANTIES AND COVENANTS OF THE COMPANY

The

Company hereby makes the following representations, warranties and covenants each of which is true and correct on the date hereof and

shall survive the consummation of the transactions contemplated hereby to the extent set forth herein.

Section

3.1 Existence and Power.

(a)

The Company is duly established, validly existing and in good standing under the laws of British Virgin Islands.

(b)

The Company has all requisite power, authority and capacity to enter into this Agreement and consummate the transactions contemplated

hereby. The execution and delivery of this Agreement by the Company and the consummation by the Company of the transactions contemplated

hereby, including, without limitation, the payment of Cash Consideration and the issuance of all of the Exchange Shares hereunder, have

been duly authorized by all necessary action on the part of the Company and its board of directors (or a duly authorized committee thereof)

(the “Board of Directors”), and no further consent, approval or authorization is required by the Company or of its

Board of Directors or its shareholders in order for the Company to execute, deliver and perform this Agreement and consummate the transactions

contemplated hereby, including, without limitation, the payment of Cash Consideration and the issuance of all of the Exchange Shares

hereunder.

(c)

The execution, delivery and performance of this Agreement by the Company and the consummation by the Company of the transactions contemplated

hereby will not (i) result in any violation of the provisions of the memorandum and articles of association (or other organizational

documents) of the Company or (ii) constitute or result in a breach, violation, conflict or default under any indenture, mortgage, deed

of trust, loan agreement or other agreement or instrument to which the Company is a party or by which the Company is bound or to which

any of the property or assets of the Company is subject, or any statute, order, rule or regulation of any court or governmental agency

or body having jurisdiction over the Company or any of its properties or cause the acceleration or termination of any obligation or right

of the Company, except in the case of clause (ii) above for such breaches, conflicts, defaults, rights or violations which would not,

individually or in the aggregate, reasonably be expected to have a Material Adverse Effect on the Company. As used in this Agreement,

the term “Material Adverse Effect” shall mean a material adverse effect on the business, condition (financial or otherwise),

properties or results of operations of the party, or an event, change or occurrence that would materially adversely affect the ability

of the party to perform its obligations under this Agreement.

Section

3.2 Valid and Enforceable Agreement; Authorization. This Agreement has been duly executed and delivered by the Company and, assuming

due execution and delivery by the Holder, constitutes a legal, valid and binding obligation of the Company, enforceable against the Company

in accordance with its terms, except that such enforcement may be subject to (a) bankruptcy, insolvency, reorganization, moratorium or

other similar laws affecting or relating to the enforcement of creditors’ rights generally, and (b) general principles of equity.

Section

3.3 Valid Issuance of the Exchange Shares. The Exchange Shares, when issued and delivered in accordance with the terms and for

the consideration set forth in this Agreement, will be validly issued, fully paid and non-assessable and free from all preemptive or

similar rights, taxes, Liens, charges and other encumbrances with respect to the issue thereof. Assuming the accuracy of the representations

of the Holder in Article II of this Agreement, the Exchange Shares will be issued in compliance with all applicable federal and state

securities laws. The offer and issuance of the Exchange Shares is exempt from registration under the Securities Act pursuant to the exemption

provided by Section 4(a)(2) thereof.

Section

3.4 No Remuneration. Neither the Company nor anyone acting on the Company’s behalf has paid or given any commission or other

remuneration to any person directly or indirectly in connection with or in order to solicit or facilitate the Exchange.

Section

3.5 Listing and Maintenance Requirements. The Class A Ordinary Shares are registered pursuant to Section 12(b) or 12(g) of the

Exchange Act of 1934, as amended (the “Exchange Act”), and the Company has taken no action designed to, or which to its knowledge

is likely to have the effect of, terminating the registration of the Class A Ordinary Shares under the Exchange Act nor has the Company

received any notification that the Commission is contemplating terminating such registration. Except as disclosed in the press release

or filings of the Company made with the U.S. Securities and Exchange Commission (the “SEC”), the Company has not, in the

12 months preceding the date hereof, received notice from any Trading Market (defined below) on which the Class A Ordinary Shares is

or has been listed or quoted to the effect that the Company is not in compliance with the listing or maintenance requirements of such

Trading Market. The Company is, and has no reason to believe that it will not in the foreseeable future continue to be, in compliance

with all such listing and maintenance requirements. The Class A Ordinary Shares are currently eligible for electronic transfer through

the Depository Trust Company or another established clearing corporation and the Company is current in payment of the fees to the Depository

Trust Company (or such other established clearing corporation) in connection with such electronic transfer. “Trading Market”

means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the

NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock Exchange, OTCQB

or OTCQX (or any successors to any of the foregoing).

Section

3.6 Legend Removal & Prompt Processing of Exchange Share Reissuances. Certificates evidencing the Exchange Shares shall not

contain any legend (including the legend set forth in Section 2.6(f) hereof), (i) following any sale of such Exchange Shares pursuant

to Rule 144, (ii) if such Exchange Shares are eligible for sale under Rule 144, without the requirement for the Company to be in compliance

with the current public information required under Rule 144 as to such Exchange Shares and without volume or manner-of-sale restrictions,

or (iii) if such legend is not required under applicable requirements of the Securities Act (including judicial interpretations and pronouncements

issued by the staff of the Commission). The Company shall cause its counsel to issue a legal opinion to the Transfer Agent or the Holder

if required by the Transfer Agent to effect the removal of the legend hereunder, or if requested by a Purchaser, respectively. If the

Exchange Shares may be sold under Rule 144 and the Company is then in compliance with the current public information required under Rule

144, or if the Exchange Shares may be sold under Rule 144 without the requirement for the Company to be in compliance with the current

public information required under Rule 144 as to such Exchange Shares or if such legend is not otherwise required under applicable requirements

of the Securities Act (including judicial interpretations and pronouncements issued by the staff of the Commission) then such Exchange

Shares shall be issued free of all legends. The Company agrees that at such time as such legend is no longer required under this Section

2.6(g), it will, at the request of the Holder and within five (5) business days following the delivery by the Holder to the Company or

the Transfer Agent of a certificate representing the Exchange Shares, issued with a restrictive legend (such date, the “Legend

Removal Date”), deliver or cause to be delivered to such Holder a certificate representing such shares that is free from all restrictive

and other legends. The Company may not make any notation on its records or give instructions to the Transfer Agent that enlarge the restrictions

on transfer set forth in this Section 2.6(g). Certificates for the Exchange Shares subject to legend removal hereunder shall be transmitted

by the Transfer Agent to the Holder by crediting the account of the Holder’s prime broker or clearing firm with the Depository

Trust Company System as directed by the Holder.

Section

3.7 Liquidated Damages. In addition to such Holder’s other available remedies, the Company shall pay to the Holder, in United

States currency cash, (i) as partial liquidated damages and not as a penalty, for each $1,000 of Exchange Shares (based on the closing

transaction price reported by the principal Trading Market for the Class A Ordinary Shares on the date Exchange Shares are submitted

to the Transfer Agent) delivered for removal of the restrictive legend and subject to Sections 2.6(f) and 3.6, $10 per Trading Day (defined

below), and increasing to $20 per Trading Day five (5) Trading Days after such damages have begun to accrue, for each Trading Day after

the Legend Removal Date until such certificate is delivered without a legend and (ii) if the Company fails to (a) issue and deliver (or

cause to be delivered) to the Holder by the Legend Removal Date a certificate representing the Exchange Shares so delivered to the Company

by such Holder that is free from all restrictive and other legends and (b) if after the Legend Removal Date such Holder purchases (in

an open market transaction or otherwise) Class A Common Shares to deliver in satisfaction of a sale by such Holder of all or any portion

of the number of Exchange Shares, or a sale of a number of Class A Common Shares equal to all or any portion of the number of exchange

Shares that such Holder anticipated receiving from the Company without any restrictive legend, then, an amount equal to the excess of

such Holder’s total purchase price (including brokerage commissions and other out-of-pocket expenses, if any) for the Class A Common

Shares so purchased (including brokerage commissions and other out-of-pocket expenses, if any) (the “Buy-In Price”) over

the product of (A) such number of Exchange Shares that the Company was required to deliver to such Holder by the Legend Removal Date

multiplied by (B) the lowest closing sale price of the Class A Common Shares on any Trading Day during the period commencing on the date

of the delivery by such Holder to the Company of the applicable Exchange Shares and ending on the date of such delivery and payment under

this clause (ii). “Trading Day” means a day on which the principal Trading Market is open for trading.

ARTICLE

IV

MISCELLANEOUS

PROVISIONS

Section

4.1 Survival of Representations and Warranties. The agreements of the Company, as set forth herein, and the respective representations

and warranties of the Holder and the Company as set forth herein in Articles II and III, respectively, shall survive the consummation

of the transactions contemplated herein.

Section

4.2 Notice. Any notice provided for in this Agreement shall be in writing and shall be either personally delivered, or mailed

first class mail (postage prepaid) with return receipt requested or sent by reputable overnight courier service (charges prepaid):

(a)

if to the Holder, at its respective address set forth in the signature page hereto; and

(b)

if to the Company, at its address, as follows:

Antelope

Enterprise Holdings Ltd.

Room

1802, Block D, Zhonghai International Center,

Hi-

Tech Zone, Chengdu, Sichuan Province, PRC

c/o:

Hen Man Edmund, CFO

Email:

[ ]

with

a copy to (which shall not constitute notice):

Hunter

Taubman Fischer & Li LLC

950

Third Avenue, Floor 19th

New

York, NY 10022

c/o:

Joan Wu, Esq

Email:

[ ]

Each

party hereto by notice to the other party may designate additional or different addresses for subsequent notices or communications. All

notices and communications will be deemed to have been duly given (i) at the time delivered by hand, if personally delivered; (ii) five

business days after being deposited in the mail, postage prepaid, if mailed, (iii) when receipt acknowledged, if transmitted by email;

and (iv) the next business day after timely delivery to the courier, if sent by overnight air courier guaranteeing next day delivery.

Section

4.4 Entire Agreement. This Agreement and the other documents and agreements executed in connection with the Exchange embody the

entire agreement and understanding of the parties hereto with respect to the subject matter hereof and supersede all prior and contemporaneous

oral or written agreements, representations, warranties, contracts, correspondence, conversations, memoranda and understandings between

or among the parties or any of their agents, representatives or affiliates relative to such subject matter, including, without limitation,

any term sheets, emails or draft documents.

Section

4.5 Assignment; Binding Agreement. This Agreement and the various rights and obligations arising hereunder shall inure to the

benefit of and be binding upon the parties hereto and their successors and assigns.

Section

4.6 Counterparts. This Agreement may be executed in multiple counterparts, and on separate counterparts, each of which shall be

deemed an original, but all of which taken together shall constitute one and the same instrument. Any counterpart or other signature

hereupon delivered by facsimile or in portable document format (.pdf) shall be deemed for all purposes as constituting good and valid

execution and delivery of this Agreement by such party.

Section

4.7 Remedies Cumulative. Except as otherwise provided herein, all rights and remedies of the parties under this Agreement are

cumulative and without prejudice to any other rights or remedies available at law.

Section

4.8 Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Agreement shall

be governed by the internal laws of the State of New York, without giving effect to any choice of law or conflict of law provision or

rule (whether of the State of New York or any other jurisdictions) that would cause the application of the laws of any jurisdictions

other than the State of New York. Each party hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts

sitting in The City of New York, Borough of Manhattan, for the adjudication of any dispute hereunder or in connection herewith or with

any transaction contemplated hereby or discussed herein, and hereby irrevocably waives, and agrees not to assert in any suit, action

or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that such suit, action or proceeding

is brought in an inconvenient forum or that the venue of such suit, action or proceeding is improper. Each party hereby irrevocably waives

personal service of process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof to

such party at the address for such notices to it under this Agreement and agrees that such service shall constitute good and sufficient

service of process and notice thereof. Nothing contained herein shall (i) limit, or be deemed to limit, in any way any right to serve

process in any manner permitted by law, (ii) operate, or shall be deemed to operate, to preclude the Holder from bringing suit or taking

other legal action against the Company in any other jurisdiction to collect on the Company’s obligations to the Holder or to enforce

a judgment or other court ruling in favor of the Holder. EACH PARTY HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE TO, AND AGREES NOT

TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR IN CONNECTION WITH OR ARISING OUT OF THIS AGREEMENT OR ANY

TRANSACTION CONTEMPLATED HEREBY.

Section

4.9 No Third Party Beneficiaries or Other Rights. Nothing herein shall grant to or create in any person not a party hereto, or

any such person’s dependents or heirs, any right to any benefits hereunder, and no such party shall be entitled to sue any party

to this Agreement with respect thereto.

Section

4.10 Waiver; Consent. This Agreement may not be changed, amended, terminated, augmented, rescinded or discharged (other than in

accordance with its terms), in whole or in part, except by a writing executed by the parties hereto. No waiver of any of the provisions

or conditions of this Agreement or any of the rights of a party hereto shall be effective or binding unless such waiver shall be in writing

and signed by the party claimed to have given or consented thereto. Except to the extent otherwise agreed in writing, no waiver of any

term, condition or other provision of this Agreement, or any breach thereof shall be deemed to be a waiver of any other term, condition

or provision or any breach thereof, or any subsequent breach of the same term, condition or provision, nor shall any forbearance to seek

a remedy for any noncompliance or breach be deemed to be a waiver of a party’s rights and remedies with respect to such noncompliance

or breach.

Section

4.11 Word Meanings. The words such as “herein,” “hereof” and “hereunder” refer to this Agreement

as a whole and not merely to a subdivision in which such words appear unless the context otherwise requires. The singular shall include

the plural, and vice versa, unless the context otherwise requires. The masculine shall include the feminine and neuter, and vice versa,

unless the context otherwise requires.

Section

4.12 No Broker. Neither party has engaged any third party as broker or finder or incurred or become obligated to pay any broker’s

commission or finder’s fee in connection with the transactions contemplated by this Agreement other than such fees and expenses

for which that particular party shall be solely responsible.

Section

4.13 Further Assurances. The Holder and the Company each hereby agree to execute and deliver, or cause to be executed and delivered,

such other documents, instruments and agreements, and take such other actions, as either party may reasonably request in connection with

the transactions contemplated by this Agreement.

Section

4.14 Costs and Expenses. The Holder and the Company shall each pay their own respective costs and expenses incurred in connection

with the negotiation, preparation, execution, and performance of this Agreement, including, but not limited to, the fees and expenses

of their respective advisers, counsel, accountants and other experts, if any.

Section

4.15 Headings. The headings in this Agreement are for convenience of reference only and shall not limit or otherwise affect the

meaning hereof.

Section

4.16 Severability. If any one or more of the provisions contained herein, or the application thereof in any circumstance, is held

invalid, illegal or unenforceable, the validity, legality and enforceability of any such provision in every other respect and of the

remaining provisions contained herein shall not be affected or impaired thereby.

[The

remainder of this page is intentionally left blank]

IN

WITNESS WHEREOF, each of the parties hereto has caused this Agreement to be executed and delivered as of the date first above written.

| |

Antelope

Enterprise Holdings Ltd. |

| |

|

|

| |

By: |

|

| |

Name:

|

Edmund

Hen Man |

| |

Title: |

Chief

Financial Officer |

| |

The

Holder: |

| |

|

|

| |

By: |

|

| |

Name: |

[ ] |

| |

Title: |

[ ] |

| |

Address: |

[

] |

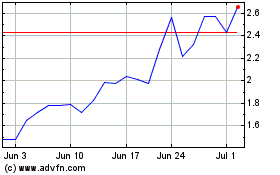

Antelope Enterprise (NASDAQ:AEHL)

Historical Stock Chart

From Mar 2024 to Apr 2024

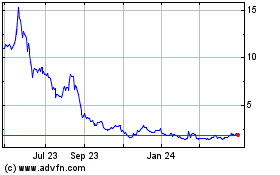

Antelope Enterprise (NASDAQ:AEHL)

Historical Stock Chart

From Apr 2023 to Apr 2024