0001823406false00018234062023-10-262023-10-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 26, 2023 |

Affinity Bancshares, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

001-39914 |

82-1147778 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

3175 Highway 278 |

|

Covington, Georgia |

|

30014 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 770 786-7088 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value per share |

|

AFBI |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 26, 2023, Affinity Bancshares, Inc. issued a press release announcing its financial results for the quarter ended September 30, 2023. The press release is attached to this Current Report as Exhibit 99.1. This Current Report and the press release are being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for any purpose.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

AFFINITY BANCSHARES, INC. |

|

|

|

|

Date: |

October 26, 2023 |

By: |

/s/ Brandi Pajot |

|

|

|

Brandi Pajot

Senior Vice President and Chief Financial Officer |

Affinity Bancshares, Inc.

Announces Third Quarter 2023

Financial Results

Affinity Bancshares, Inc. (NASDAQ:“AFBI”) (the “Company”), the holding company for Affinity Bank (the “Bank”), today announced net income of $1.6 million for the three months ended September 30, 2023, as compared to $1.9 million for the three months ended September 30, 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or for the three months ended, |

|

Performance Ratios: |

|

September 30, 2023 |

|

|

June 30, 2023 |

|

|

March 31, 2023 |

|

|

December 31, 2022 |

|

|

September 30, 2022 |

|

Net income (in thousands) |

|

$ |

1,623 |

|

|

$ |

1,590 |

|

|

$ |

1,722 |

|

|

$ |

1,699 |

|

|

$ |

1,861 |

|

Diluted earnings per share |

|

|

0.25 |

|

|

|

0.24 |

|

|

|

0.26 |

|

|

|

0.26 |

|

|

|

0.27 |

|

Common book value per share |

|

|

18.50 |

|

|

|

18.34 |

|

|

|

18.02 |

|

|

|

17.73 |

|

|

|

17.37 |

|

Tangible book value per share (1) |

|

|

15.63 |

|

|

|

15.47 |

|

|

|

15.20 |

|

|

|

14.92 |

|

|

|

14.57 |

|

Total assets (in thousands) |

|

|

855,431 |

|

|

|

876,905 |

|

|

|

932,302 |

|

|

|

791,283 |

|

|

|

776,390 |

|

Return on average assets |

|

|

0.74 |

% |

|

|

0.71 |

% |

|

|

0.84 |

% |

|

|

0.84 |

% |

|

|

0.95 |

% |

Return on average equity |

|

|

5.42 |

% |

|

|

5.37 |

% |

|

|

5.90 |

% |

|

|

5.78 |

% |

|

|

6.30 |

% |

Equity to assets |

|

|

13.85 |

% |

|

|

13.45 |

% |

|

|

12.69 |

% |

|

|

14.80 |

% |

|

|

14.84 |

% |

Tangible equity to tangible assets (1) |

|

|

11.95 |

% |

|

|

11.59 |

% |

|

|

10.92 |

% |

|

|

12.75 |

% |

|

|

12.75 |

% |

Net interest margin |

|

|

3.36 |

% |

|

|

3.17 |

% |

|

|

3.58 |

% |

|

|

3.85 |

% |

|

|

4.12 |

% |

Efficiency ratio |

|

|

71.78 |

% |

|

|

71.68 |

% |

|

|

69.73 |

% |

|

|

71.38 |

% |

|

|

67.62 |

% |

(1) Non-GAAP measure - see “Explanation of Certain Unaudited Non-GAAP Financial Measures” for more information and reconciliation to GAAP. |

|

Net Income

•Net income was $1.6 million for the three months ended September 30, 2023, as compared to $1.9 million for the three months ended September 30, 2022, as a result of an increase in deposit interest expense offset by an increase in interest income.

•Net income was $4.9 million for nine months ended September 30, 2023 as compared to $5.4 million for the nine months ended September 30, 2022, as a result of an increase in deposit interest expense and recognition of the remaining fair value mark on the acquired Federal Home Loan Bank advances that was recognized upon payoff during the first quarter 2022, partially offset by an increase in interest income.

.

Results of Operations

•Net interest income was $6.9 million for the three months ended September 30, 2023 compared to $7.5 million for the three months ended September 30, 2022. The decrease was due to an increase in deposit costs partially offset by an increase in interest income.

•Net interest income was $20.5 million for the nine months ended September 30, 2023 compared to $22.4 million for the nine months ended September 30, 2022. The decrease was due to an increase in deposit costs and recognition of the remaining fair value mark on acquired FHLB advances that was recognized upon payoff during the first quarter of 2022, partially offset by an increase in interest income.

•Net interest margin for the three months ended September 30, 2023 decreased to 3.36% from 4.12% for the three months ended September 30, 2022. Net interest margin for the nine months ended September 30, 2023 decreased to 3.36% from 4.24% for the nine months ended September 30, 2022. The decreases in the margin relate to

increases in our costs of funds exceeding our increases in our yield on interest-earning assets. The decrease in the margin for the nine months ended September 30, 2023 was also impacted by the fair value mark on the FHLB advances from acquisition that was recognized upon payoff during the first quarter of 2022.

oAdjusted net interest margin for the nine months ended September 30, 2023 (see Non-GAAP reconciliation) decreased 59 basis points from 3.95% at nine months ended September 30, 2022 to 3.36%.

•Noninterest income increased $37,000 to $630,000 for the three months ended September 30, 2023 and remained stable at $1.8 million for the nine months ended September 30, 2023 and 2022.

•Non-interest expense decreased $84,000 to $5.4 million for the three months ended September 30, 2023 compared to the respective period in 2022, due to decreases in salaries, occupancy, and advertising expenses offset by increases in data processing and other expenses. Non-interest expense decreased $601,000 to $15.9 million for the nine months ended September 30, 2023 compared to the respective period in 2022 and was a result of the FHLB prepayment penalties paid in first quarter 2022 and decreases in salaries expense.

Financial Condition

•Total assets increased $64.1 million to $855.4 million at September 30, 2023 from $791.3 million at December 31, 2022, as we increased cash to further enhance liquidity.

•Total gross loans increased $14.8 million to $661.0 million at September 30, 2023 from $646.2 million at December 31, 2022. The increase was due to steady loan demand.

•Non-owner occupied office loans totaled $25.4 million at September 30, 2023; average LTV on these loans is 43.0%

o$9.3 million medical/dental tenants

o$16.1 million to other various tenants.

•Investment securities held-to-maturity unrealized losses were $970,000, net of tax. Investment securities available-for-sale unrealized losses were $7.8 million, net of tax.

•Cash and cash equivalents increased to $61.5 million at September 30, 2023 from $26.3 million at December 31, 2022, primarily due to an increase in deposits.

•Deposits increased by $51.9 million to $709.0 million at September 30, 2023 compared to $657.2 million at December 31, 2022, in part due to an increase in certificates of deposits of $96.3 million offset by a $44.5 million decrease in non-time deposits, as customers increased deposits in higher-yielding accounts during the current interest rate environment. The certificates of deposit increase included brokered deposits issued in 2023 totaling $72.4 million. Brokered deposits have an average life of 2.6 years and an average interest rate of 4.87%.

•Uninsured deposits were approximately $98.7 million at September 30, 2023 and represented 13.9% of total deposits.

•Borrowings increased by $10.0 million to $20.0 million at September 30, 2023 compared to $10.0 million at December 31, 2022 as we continue to evaluate borrowing needs related to enhancing bank liquidity.

Asset Quality

•Non-performing loans increased to $7.6 million at September 30, 2023 from $6.7 million at December 31, 2022.

•The allowance for credit losses as a percentage of non-performing loans was 120.6% at September 30, 2023, as compared to 138.8% at December 31, 2022.

•Allowance for credit losses to total loans decreased to 1.39% at September 30, 2023 from 1.46% at December 31, 2022.

•Net loan charge-offs were $114,000 for the nine months ended September 30, 2023, as compared to net recoveries of $108,000 for the nine months ended September 30, 2022.

About Affinity Bancshares, Inc.

The Company is a Maryland corporation based in Covington, Georgia. The Company’s banking subsidiary, Affinity Bank, opened in 1928 and currently operates a full-service office in Atlanta, Georgia, two full-service offices in Covington, Georgia, and a loan production office serving the Alpharetta and Cumming, Georgia markets.

Forward-Looking Statements

In addition to historical information, this release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which describe the future plans, strategies and expectations of the Company. Forward-looking statements can be identified by the use of words such as “estimate,” “project,” “believe,” “intend,” “anticipate,” “assume,” “plan,” “seek,” “expect,” “will,” “may,” “should,” “indicate,” “would,” “contemplate,” “continue,” “target” and words of similar meaning. Forward-looking statements are based on our current beliefs and expectations and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Accordingly, you should not place undue reliance on such statements. We are under no duty to and do not take any obligation to update any forward-looking statements after the date of this report. Factors which could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to, changes in general economic conditions, interest rates and inflation; changes in asset quality; our ability to access cost-effective funding; fluctuations in real estate values; changes in laws or regulations; changes in liquidity, including the size and composition of our deposit portfolio and the percentage of uninsured deposits in the portfolio; changes in technology; failures or breaches of our IT security systems; our ability to introduce new products and services and capitalize on growth opportunities; changes in the value of our goodwill and other intangible assets; our ability to successfully integrate acquired operations or assets; changes in accounting policies and practices; our ability to retain key employees; and the effects of natural disasters and geopolitical events, including terrorism, conflict and acts of war. These risks and other uncertainties are further discussed in the reports that the Company files with the Securities and Exchange Commission.

Average Balance Sheets

The following tables set forth average balance sheets, average annualized yields and costs, and certain other information for the periods indicated. No tax-equivalent yield adjustments have been made, as the effects would be immaterial. All average balances are monthly average balances. Non-accrual loans were included in the computation of average balances. The yields set forth below include the effect of deferred fees, discounts, and premiums that are amortized or accreted to interest income or interest expense.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

|

Average

Outstanding

Balance |

|

|

Interest |

|

|

Average

Yield/Rate |

|

|

Average

Outstanding

Balance |

|

|

Interest |

|

|

Average

Yield/Rate |

|

|

|

(Dollars in thousands) |

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

$ |

660,456 |

|

|

$ |

9,113 |

|

|

|

5.47 |

% |

|

$ |

639,115 |

|

|

$ |

7,734 |

|

|

|

4.80 |

% |

Investment securities held-to-maturity |

|

|

34,158 |

|

|

|

525 |

|

|

|

6.10 |

% |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Investment securities available-for-sale |

|

|

49,242 |

|

|

|

461 |

|

|

|

3.71 |

% |

|

|

44,690 |

|

|

|

289 |

|

|

|

2.56 |

% |

Interest-earning deposits and federal funds |

|

|

68,892 |

|

|

|

889 |

|

|

|

5.12 |

% |

|

|

39,384 |

|

|

|

189 |

|

|

|

1.91 |

% |

Other investments |

|

|

2,053 |

|

|

|

36 |

|

|

|

6.96 |

% |

|

|

1,163 |

|

|

|

12 |

|

|

|

4.19 |

% |

Total interest-earning assets |

|

|

814,801 |

|

|

|

11,024 |

|

|

|

5.37 |

% |

|

|

724,352 |

|

|

|

8,224 |

|

|

|

4.50 |

% |

Non-interest-earning assets |

|

|

51,971 |

|

|

|

|

|

|

|

|

|

49,770 |

|

|

|

|

|

|

|

Total assets |

|

$ |

866,772 |

|

|

|

|

|

|

|

|

$ |

774,122 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing checking accounts |

|

$ |

90,682 |

|

|

$ |

73 |

|

|

|

0.32 |

% |

|

$ |

98,473 |

|

|

$ |

47 |

|

|

|

0.19 |

% |

Money market accounts |

|

|

142,346 |

|

|

|

987 |

|

|

|

2.75 |

% |

|

|

159,478 |

|

|

|

100 |

|

|

|

0.25 |

% |

Savings accounts |

|

|

81,756 |

|

|

|

569 |

|

|

|

2.76 |

% |

|

|

83,484 |

|

|

|

187 |

|

|

|

0.89 |

% |

Certificates of deposit |

|

|

232,276 |

|

|

|

2,286 |

|

|

|

3.90 |

% |

|

|

89,871 |

|

|

|

291 |

|

|

|

1.28 |

% |

Total interest-bearing deposits |

|

|

547,060 |

|

|

|

3,915 |

|

|

|

2.84 |

% |

|

|

431,306 |

|

|

|

625 |

|

|

|

0.57 |

% |

FHLB advances and other borrowings |

|

|

20,000 |

|

|

|

208 |

|

|

|

4.13 |

% |

|

|

13,696 |

|

|

|

73 |

|

|

|

2.12 |

% |

Total interest-bearing liabilities |

|

|

567,060 |

|

|

|

4,123 |

|

|

|

2.88 |

% |

|

|

445,002 |

|

|

|

698 |

|

|

|

0.62 |

% |

Non-interest-bearing liabilities |

|

|

180,868 |

|

|

|

|

|

|

|

|

|

211,986 |

|

|

|

|

|

|

|

Total liabilities |

|

|

747,928 |

|

|

|

|

|

|

|

|

|

656,988 |

|

|

|

|

|

|

|

Total stockholders' equity |

|

|

118,844 |

|

|

|

|

|

|

|

|

|

117,134 |

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

|

$ |

866,772 |

|

|

|

|

|

|

|

|

$ |

774,122 |

|

|

|

|

|

|

|

Net interest rate spread |

|

|

|

|

|

|

|

|

2.49 |

% |

|

|

|

|

|

|

|

|

3.88 |

% |

Net interest income |

|

|

|

|

$ |

6,901 |

|

|

|

|

|

|

|

|

$ |

7,526 |

|

|

|

|

Net interest margin |

|

|

|

|

|

|

|

|

3.36 |

% |

|

|

|

|

|

|

|

|

4.12 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

|

Average

Outstanding

Balance |

|

|

Interest |

|

|

Average

Yield/Rate |

|

|

Average

Outstanding

Balance |

|

|

Interest |

|

|

Average

Yield/Rate |

|

|

|

(Dollars in thousands) |

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

$ |

659,416 |

|

|

$ |

26,131 |

|

|

|

5.30 |

% |

|

$ |

616,141 |

|

|

$ |

22,013 |

|

|

|

4.78 |

% |

Investment securities held-to-maturity |

|

|

33,733 |

|

|

|

1,549 |

|

|

|

6.14 |

% |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Investment securities available-for-sale |

|

|

49,616 |

|

|

|

1,299 |

|

|

|

3.50 |

% |

|

|

46,585 |

|

|

|

827 |

|

|

|

2.37 |

% |

Interest-earning deposits and federal funds |

|

|

69,340 |

|

|

|

2,527 |

|

|

|

4.87 |

% |

|

|

43,125 |

|

|

|

286 |

|

|

|

0.89 |

% |

Other investments |

|

|

2,285 |

|

|

|

109 |

|

|

|

6.38 |

% |

|

|

1,117 |

|

|

|

30 |

|

|

|

3.57 |

% |

Total interest-earning assets |

|

|

814,390 |

|

|

|

31,615 |

|

|

|

5.19 |

% |

|

|

706,968 |

|

|

|

23,156 |

|

|

|

4.38 |

% |

Non-interest-earning assets |

|

|

51,675 |

|

|

|

|

|

|

|

|

|

51,687 |

|

|

|

|

|

|

|

Total assets |

|

$ |

866,065 |

|

|

|

|

|

|

|

|

$ |

758,655 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing checking accounts |

|

$ |

92,614 |

|

|

$ |

172 |

|

|

|

0.25 |

% |

|

$ |

97,463 |

|

|

$ |

134 |

|

|

|

0.18 |

% |

Money market accounts |

|

|

139,726 |

|

|

|

2,472 |

|

|

|

2.37 |

% |

|

|

151,654 |

|

|

|

282 |

|

|

|

0.25 |

% |

Savings accounts |

|

|

88,528 |

|

|

|

1,680 |

|

|

|

2.54 |

% |

|

|

84,042 |

|

|

|

356 |

|

|

|

0.57 |

% |

Certificates of deposit |

|

|

207,734 |

|

|

|

5,691 |

|

|

|

3.66 |

% |

|

|

91,493 |

|

|

|

840 |

|

|

|

1.23 |

% |

Total interest-bearing deposits |

|

|

528,602 |

|

|

|

10,015 |

|

|

|

2.53 |

% |

|

|

424,652 |

|

|

|

1,612 |

|

|

|

0.51 |

% |

FHLB advances and other borrowings |

|

|

33,975 |

|

|

|

1,109 |

|

|

|

4.36 |

% |

|

|

12,350 |

|

|

|

(874 |

) |

|

|

-9.46 |

% |

Total interest-bearing liabilities |

|

|

562,577 |

|

|

|

11,124 |

|

|

|

2.64 |

% |

|

|

437,002 |

|

|

|

738 |

|

|

|

0.23 |

% |

Non-interest-bearing liabilities |

|

|

184,871 |

|

|

|

|

|

|

|

|

|

203,164 |

|

|

|

|

|

|

|

Total liabilities |

|

|

747,448 |

|

|

|

|

|

|

|

|

|

640,166 |

|

|

|

|

|

|

|

Total stockholders' equity |

|

|

118,617 |

|

|

|

|

|

|

|

|

|

118,489 |

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

|

$ |

866,065 |

|

|

|

|

|

|

|

|

$ |

758,655 |

|

|

|

|

|

|

|

Net interest rate spread |

|

|

|

|

|

|

|

|

2.55 |

% |

|

|

|

|

|

|

|

|

4.15 |

% |

Net interest income |

|

|

|

|

$ |

20,491 |

|

|

|

|

|

|

|

|

$ |

22,418 |

|

|

|

|

Net interest margin |

|

|

|

|

|

|

|

|

3.36 |

% |

|

|

|

|

|

|

|

|

4.24 |

% |

AFFINITY BANCSHARES, INC.

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

|

|

(unaudited) |

|

|

|

|

|

|

(Dollars in thousands except per share amounts) |

|

Assets |

|

Cash and due from banks |

|

$ |

5,441 |

|

|

$ |

2,928 |

|

Interest-earning deposits in other depository institutions |

|

|

56,062 |

|

|

|

23,396 |

|

Cash and cash equivalents |

|

|

61,503 |

|

|

|

26,324 |

|

Investment securities available-for-sale |

|

|

48,012 |

|

|

|

46,200 |

|

Investment securities held-to-maturity (estimated fair value of $32,925, net of allowance for credit losses of $42 at September 30, 2023 and estimated fair value of $26,251 at December 31, 2022) |

|

|

34,183 |

|

|

|

26,527 |

|

Other investments |

|

|

4,885 |

|

|

|

1,082 |

|

Loans |

|

|

661,016 |

|

|

|

646,234 |

|

Allowance for credit loss on loans |

|

|

(9,211 |

) |

|

|

(9,325 |

) |

Net loans |

|

|

651,805 |

|

|

|

636,909 |

|

Other real estate owned |

|

|

2,901 |

|

|

|

2,901 |

|

Premises and equipment, net |

|

|

3,872 |

|

|

|

4,257 |

|

Bank owned life insurance |

|

|

15,991 |

|

|

|

15,724 |

|

Intangible assets |

|

|

18,414 |

|

|

|

18,558 |

|

Other assets |

|

|

13,865 |

|

|

|

12,801 |

|

Total assets |

|

$ |

855,431 |

|

|

$ |

791,283 |

|

Liabilities and Stockholders' Equity |

|

Liabilities: |

|

|

|

|

|

|

Non-interest-bearing checking |

|

$ |

170,654 |

|

|

$ |

190,297 |

|

Interest-bearing checking |

|

|

92,177 |

|

|

|

91,167 |

|

Money market accounts |

|

|

144,439 |

|

|

|

148,097 |

|

Savings accounts |

|

|

79,446 |

|

|

|

101,622 |

|

Certificates of deposit |

|

|

222,329 |

|

|

|

125,989 |

|

Total deposits |

|

|

709,045 |

|

|

|

657,172 |

|

Federal Home Loan Bank advances and other borrowings |

|

|

20,000 |

|

|

|

10,025 |

|

Accrued interest payable and other liabilities |

|

|

7,910 |

|

|

|

6,983 |

|

Total liabilities |

|

|

736,955 |

|

|

|

674,180 |

|

Stockholders' equity: |

|

|

|

|

|

|

Common stock (par value $0.01 per share, 40,000,000 shares authorized;

6,404,961 issued and outstanding at September 30, 2023 and 6,605,384

issued and outstanding at December 31, 2022) |

|

|

64 |

|

|

|

66 |

|

Preferred stock (10,000,000 shares authorized, no shares outstanding) |

|

|

— |

|

|

|

— |

|

Additional paid in capital |

|

|

60,978 |

|

|

|

63,130 |

|

Unearned ESOP shares |

|

|

(4,639 |

) |

|

|

(4,795 |

) |

Retained earnings |

|

|

69,832 |

|

|

|

65,357 |

|

Accumulated other comprehensive loss |

|

|

(7,759 |

) |

|

|

(6,655 |

) |

Total stockholders' equity |

|

|

118,476 |

|

|

|

117,103 |

|

Total liabilities and stockholders' equity |

|

$ |

855,431 |

|

|

$ |

791,283 |

|

AFFINITY BANCSHARES, INC.

Consolidated Statements of Income

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

(Dollars in thousands except per share amounts) |

|

Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, including fees |

|

|

$ |

9,113 |

|

|

$ |

7,734 |

|

|

$ |

26,131 |

|

|

$ |

22,013 |

|

Investment securities |

|

|

|

1,022 |

|

|

|

301 |

|

|

|

2,957 |

|

|

|

857 |

|

Interest-earning deposits |

|

|

|

889 |

|

|

|

189 |

|

|

|

2,527 |

|

|

|

286 |

|

Total interest income |

|

|

|

11,024 |

|

|

|

8,224 |

|

|

|

31,615 |

|

|

|

23,156 |

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

|

3,915 |

|

|

|

625 |

|

|

|

10,015 |

|

|

|

1,612 |

|

FHLB advances and other borrowings |

|

|

|

208 |

|

|

|

73 |

|

|

|

1,109 |

|

|

|

(874 |

) |

Total interest expense |

|

|

|

4,123 |

|

|

|

698 |

|

|

|

11,124 |

|

|

|

738 |

|

Net interest income before provision for credit losses |

|

|

|

6,901 |

|

|

|

7,526 |

|

|

|

20,491 |

|

|

|

22,418 |

|

Provision for credit losses |

|

|

|

— |

|

|

|

187 |

|

|

|

7 |

|

|

|

654 |

|

Net interest income after provision for credit losses |

|

|

|

6,901 |

|

|

|

7,339 |

|

|

|

20,484 |

|

|

|

21,764 |

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Service charges on deposit accounts |

|

|

|

426 |

|

|

|

420 |

|

|

|

1,222 |

|

|

|

1,205 |

|

Other |

|

|

|

204 |

|

|

|

173 |

|

|

|

638 |

|

|

|

631 |

|

Total noninterest income |

|

|

|

630 |

|

|

|

593 |

|

|

|

1,860 |

|

|

|

1,836 |

|

Noninterest expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

|

3,007 |

|

|

|

3,187 |

|

|

|

9,047 |

|

|

|

9,219 |

|

Occupancy |

|

|

|

637 |

|

|

|

675 |

|

|

|

1,919 |

|

|

|

1,798 |

|

Advertising |

|

|

|

59 |

|

|

|

128 |

|

|

|

238 |

|

|

|

326 |

|

Data processing |

|

|

|

525 |

|

|

|

486 |

|

|

|

1,504 |

|

|

|

1,476 |

|

FHLB prepayment penalties |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

647 |

|

Other |

|

|

|

1,178 |

|

|

|

1,014 |

|

|

|

3,176 |

|

|

|

3,019 |

|

Total noninterest expenses |

|

|

|

5,406 |

|

|

|

5,490 |

|

|

|

15,884 |

|

|

|

16,485 |

|

Income before income taxes |

|

|

|

2,125 |

|

|

|

2,442 |

|

|

|

6,460 |

|

|

|

7,115 |

|

Income tax expense |

|

|

|

502 |

|

|

|

581 |

|

|

|

1,525 |

|

|

|

1,680 |

|

Net income |

|

|

$ |

1,623 |

|

|

$ |

1,861 |

|

|

$ |

4,935 |

|

|

$ |

5,435 |

|

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

6,417,754 |

|

|

|

6,652,811 |

|

|

|

6,500,562 |

|

|

|

6,683,052 |

|

Diluted |

|

|

|

6,493,114 |

|

|

|

6,752,152 |

|

|

|

6,575,923 |

|

|

|

6,782,393 |

|

Basic earnings per share |

|

|

$ |

0.25 |

|

|

$ |

0.28 |

|

|

$ |

0.76 |

|

|

$ |

0.81 |

|

Diluted earnings per share |

|

|

$ |

0.25 |

|

|

$ |

0.27 |

|

|

$ |

0.75 |

|

|

$ |

0.80 |

|

Explanation of Certain Unaudited Non-GAAP Financial Measures

Reported amounts are presented in accordance with GAAP. Additionally, the Company believes the following information is utilized by regulators and market analysts to evaluate a company’s financial condition and, therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for financial results in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures which may be presented by other companies. Refer to the Non-GAAP Reconciliation tables below for details on the earnings impact of these items.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

Non-GAAP Reconciliation |

|

September 30, 2023 |

|

|

June 30, 2023 |

|

|

March 31, 2023 |

|

|

December 31, 2022 |

|

|

September 30, 2022 |

|

Tangible book value per common share reconciliation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Book Value per common share (GAAP) |

|

$ |

18.50 |

|

|

$ |

18.34 |

|

|

$ |

18.02 |

|

|

$ |

17.73 |

|

|

$ |

17.37 |

|

Effect of goodwill and other intangibles |

|

|

(2.87 |

) |

|

|

(2.87 |

) |

|

|

(2.82 |

) |

|

|

(2.81 |

) |

|

|

(2.80 |

) |

Tangible book value per common share |

$ |

15.63 |

|

|

$ |

15.47 |

|

|

$ |

15.20 |

|

|

$ |

14.92 |

|

|

$ |

14.57 |

|

Tangible equity to tangible assets reconciliation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity to assets (GAAP) |

|

13.85 |

% |

|

|

13.45 |

% |

|

|

12.69 |

% |

|

|

14.80 |

% |

|

|

14.84 |

% |

Effect of goodwill and other intangibles |

|

|

(1.90 |

)% |

|

|

(1.86 |

)% |

|

|

(1.77 |

)% |

|

|

(2.05 |

)% |

|

|

(2.09 |

)% |

Tangible equity to tangible assets (1) |

|

|

11.95 |

% |

|

|

11.59 |

% |

|

|

10.92 |

% |

|

|

12.75 |

% |

|

|

12.75 |

% |

(1) Tangible assets is total assets less intangible assets. Tangible equity is total equity less intangible assets. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the |

|

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

Operating net income reconciliation |

|

|

|

|

|

|

Net income (GAAP) |

|

$ |

4,935 |

|

|

$ |

5,435 |

|

FHLB mark from called borrowings |

|

|

— |

|

|

|

(988 |

) |

FHLB prepayment penalties |

|

|

— |

|

|

|

647 |

|

Income tax expense |

|

|

— |

|

|

|

87 |

|

Operating net income |

$ |

4,935 |

|

|

$ |

5,181 |

|

Weighted average diluted shares |

|

|

6,575,923 |

|

|

|

6,782,393 |

|

Adjusted diluted earnings per share |

|

$ |

0.75 |

|

|

$ |

0.76 |

|

|

|

|

|

|

|

|

Net interest income |

|

$ |

20,491 |

|

|

$ |

22,418 |

|

FHLB mark from called borrowings |

|

|

— |

|

|

|

(988 |

) |

Adjusted Net interest income |

$ |

20,491 |

|

|

$ |

21,430 |

|

Adjusted Net interest income reconciliation |

|

|

|

|

|

|

Net interest margin (GAAP) |

|

|

3.36 |

% |

|

|

4.24 |

% |

Effect of FHLB mark from called borrowings |

|

|

0.00 |

|

|

|

(0.29 |

) |

Adjusted Net interest margin |

|

|

3.36 |

% |

|

|

3.95 |

% |

AFBI Selected Data Company Highlights $855 million in assets $661 million in loans $709 million in deposits 10.8%* growth in assets 3.1%* growth in loans 10.6%* growth in deposits As of 2023Q3 YTD *Growth is annualized.

AFBI Selected Data Company Highlights $25.4 million in NOO office loans 43% avg LTV on NOO office loans 37% DDA/Total Deposits $4.9 million in YTD earnings 13.9% uninsured deposits approximately $0.75 YTD diluted earnings per share

AFBI Selected Data Tangible Book Value Calculation Tangible Equity Shares Outstanding Tangible Book Value Ending balance December 31, 2022 $98,545 6,605 $14.92 Stock Activity including repurchase (2,154) Unearned stock comp change 156 AOCI Change (1,104) Effect of goodwill and other intangibles 144 Adoption of new accounting pronouncement (460) Net earnings before stock compensation 5,710 Stock Compensation, net of taxes (775) Ending balance September 30, 2023 $100,062 6,405 $15.62 (in thousands, including shares) * See Non-GAAP Reconciliation

AFBI Selected Data NIM, NI, and EPS – Adjusted for 1st Quarter 2022 FHLB Advance Prepayments * For the Nine Months Ended September 30, 2023 2022 Net Interest Margin 3.36% 3.95% Net Income (in thousands) $4,935 $5,181 Earnings Per Share $0.75 $0.76 * See Non-GAAP Reconciliation

AFBI Selected Data Loan Composition as of September 30, 2023

AFBI Selected Data Deposit Composition as of September 30, 2023

AFBI Selected Deposit Data Deposits * All deposits are held at AFBI and include the Company’s own funds Estimated uninsured deposits are approximately $98.7 million or 13.9% of total deposits.* Consumer deposits total $20.7 million or 21.0% of estimated uninsured deposits. Business deposits total $78.0 million or 79.0% of estimated uninsured deposits. Demand deposits represent 37% of total deposits. Consumer and Business demand deposits each represent approximately 46% and 54% of total demand deposits. Dental deposits total $117.3 million and represent 16.5% of total deposits. Cost of Funds – 2.21% 3Q23, 2.17% 2Q23, 2.01% YTD

AFBI Share Information NON-GAAP RECONCILIATION (in thousands) For the Three Months Ended Non-GAAP Reconciliation September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 Tangible book value per common share reconciliation Book Value per common share (GAAP) $18.50 $18.34 $18.02 $17.73 $17.37 Effect of goodwill and other intangibles (2.87) (2.87) (2.82) (2.81) (2.80) Tangible book value per common share $15.62 $15.47 $15.20 $14.92 $14.57 Tangible equity to tangible assets reconciliation Equity to assets (GAAP) 13.85% 13.45% 12.69% 14.80% 14.84% Effect of goodwill and other intangibles (1.90)% (1.86)% (1.77)% (2.05)% (2.09)% Tangible equity to tangible assets (1) 11.95% 11.59% 10.92% 12.75% 12.75% (1) Tangible assets is total assets less intangible assets. Tangible equity is total equity less intangible assets. For the Nine Months Ended September 30, 2023 2022 Operating net income reconciliation Net income (GAAP) $4,935 $5,435 FHLB mark from called borrowings — (988) FHLB prepayment penalties — 647 Income tax expense — 87 Operating net income $4,935 $5,181 Weighted average diluted shares 6,575,923 6,782,393 Adjusted earnings per share $0.75 $0.76 Net interest income $20,491 $22,418 FHLB mark from called borrowings — (988) Adjusted Net interest income $20,491 $21,430 Adjusted Net interest income reconciliation Net interest margin (GAAP) 3.36% 4.24% Effect of FHLB mark from called borrowings 0.00 (0.29) Adjusted Net interest margin 3.36% 3.95%

v3.23.3

Document And Entity Information

|

Oct. 26, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 26, 2023

|

| Entity Registrant Name |

Affinity Bancshares, Inc.

|

| Entity Central Index Key |

0001823406

|

| Entity Emerging Growth Company |

false

|

| Securities Act File Number |

001-39914

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Tax Identification Number |

82-1147778

|

| Entity Address, Address Line One |

3175 Highway 278

|

| Entity Address, City or Town |

Covington

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30014

|

| City Area Code |

770

|

| Local Phone Number |

786-7088

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

AFBI

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

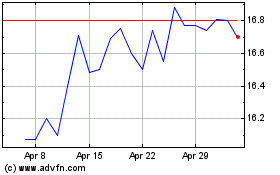

Affinity Bancshares (NASDAQ:AFBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Affinity Bancshares (NASDAQ:AFBI)

Historical Stock Chart

From Apr 2023 to Apr 2024