Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

18 August 2023 - 7:28AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

|

Aesthetic Medical International Holdings Group Limited

|

|

(Name of Issuer)

|

| |

|

Ordinary shares, par value $0.001 per share

|

|

(Title of Class of Securities)

|

| |

|

00809M104**

|

|

(CUSIP Number)

|

| |

Vistra (Cayman) Limited

P. O. Box 31119

Grand Pavilion, Hibiscus Way

802 West Bay Road, Grand Cayman

KY1 - 1205 Cayman Islands

|

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

|

| |

August 16, 2023

|

|

(Date of Event which Requires Filing of this Statement)

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

** No CUSIP number has been assigned to ordinary shares, par value $0.001 per share (“Ordinary Shares”), of Aesthetic Medical International Holdings Group Limited (the “Issuer”). CUSIP number 00809M104 was assigned to the American Depositary

Shares (“ADSs”) of, which are quoted on the Nasdaq Global Market under the symbol “AIH.” Each ADS represents three Ordinary Shares.

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

Peak Asia Investment Holdings V Limited

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☑

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

WC

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

| |

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

British Virgin Islands

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

27,665,768

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

| |

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

26.0% (1)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

(1) Calculated based on the number of Ordinary Shares owned by the Reporting Person divided by 94,044,740 issued and outstanding Ordinary Shares of the Issuer as of December 31, 2022, as reported in

by the Issuer in its Form 20-F filed on April 21, 2023.

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

Beacon Technology Investment Holdings Limited

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☑

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

WC

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

| |

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Hong Kong

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

27,665,768

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

| |

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

26.0% (1)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

(1) Calculated based on the number of Ordinary Shares owned by the Reporting Person divided by 94,044,740 issued and outstanding Ordinary Shares of the Issuer as of December 31, 2022, as

reported in by the Issuer in its Form 20-F filed on April 21, 2023.

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

ADV Opportunities Fund I, L.P.

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☑

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

WC

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

| |

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

27,665,768

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

| |

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

26.0% (1)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

(1) Calculated based on the number of Ordinary Shares owned by the Reporting Person divided by 94,044,740 issued and outstanding Ordinary Shares of the Issuer as of December 31, 2022, as

reported in by the Issuer in its Form 20-F filed on April 21, 2023.

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

ADV Opportunities Fund I, GP, L.P.

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☑

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

WC

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

| |

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

27,665,768

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

| |

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

26.0% (1)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

(1) Calculated based on the number of Ordinary Shares owned by the Reporting Person divided by 94,044,740 issued and outstanding Ordinary Shares of the Issuer as of December 31, 2022, as

reported in by the Issuer in its Form 20-F filed on April 21, 2023.

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

ADV Opportunities Fund I GP Ltd

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☑

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

WC

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

| |

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

27,665,768

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

| |

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

26.0% (1)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

(1) Calculated based on the number of Ordinary Shares owned by the Reporting Person divided by 94,044,740 issued and outstanding Ordinary Shares of the Issuer as of December 31, 2022, as

reported in by the Issuer in its Form 20-F filed on April 21, 2023.

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

ADV Partners Holdings Ltd

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☑

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

WC

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

| |

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

27,665,768

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

| |

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

26.0% (1)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

(1) Calculated based on the number of Ordinary Shares owned by the Reporting Person divided by 94,044,740 issued and outstanding Ordinary Shares of the Issuer as of December 31, 2022, as

reported in by the Issuer in its Form 20-F filed on April 21, 2023.

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

Bradley Dean Landes

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☑

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

WC

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

| |

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

United States

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

27,665,768

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

| |

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

26.0% (1)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

IN

|

|

|

|

|

|

(1) Calculated based on the number of Ordinary Shares owned by the Reporting Person divided by 94,044,740 issued and outstanding Ordinary Shares of the Issuer as of December 31, 2022, as

reported in by the Issuer in its Form 20-F filed on April 21, 2023.

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

Suresh Eshwara Prabhala

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☑

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

WC

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

| |

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

India

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

27,665,768

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

| |

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

26.0% (1)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

IN

|

|

|

|

|

|

(1) Calculated based on the number of Ordinary Shares owned by the Reporting Person divided by 94,044,740 issued and outstanding Ordinary Shares of the Issuer as of December 31, 2022, as

reported in by the Issuer in its Form 20-F filed on April 21, 2023.

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☑

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

WC

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

| |

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Japan

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

27,665,768

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

27,665,768

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

| |

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

26.0% (1)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

IN

|

|

|

|

|

|

(1) Calculated based on the number of Ordinary Shares owned by the Reporting Person divided by 94,044,740 issued and outstanding Ordinary Shares of the Issuer as of December 31, 2022, as

reported in by the Issuer in its Form 20-F filed on April 21, 2023.

Item 1. Security and Issuer.

This Amendment No. 2 on Schedule 13D (the “Amendment”) is being jointly filed by Peak Asia Investment V Holdings Limited (“ADV”), Beacon Technology Investment Holdings Limited (“Beacon”), ADV Opportunities Fund

I, L.P. (“ADV LP”), ADV Opportunities Fund I, GP, L.P., (“ADV GP LP”), ADV Opportunities Fund I GP Ltd. (“ADV GP”), ADV Partners Holdings Ltd (“ADV Holdings”), Mr. Bradley Dean Landes, Mr. Suresh Eshwara Prabhala, and Mr. Jianyi Zhu (Kenichi Shu)

(Mr. Zhu, together with ADV, Beacon, ADV LP, ADV GP LP, ADV GP, ADV Holdings Messrs. Landes and Prabhala, collectively referred to as the “Reporting Persons”) to amend the Statement on Schedule 13D, initially filed with the Securities and

Exchange Commission (the “Commission”) on September 22, 2020 (the “Original 13D”), as amended by Amendment No. 1 to Schedule 13D filed on July 29, 2022 (together with the Original 13D, the “Statement”), with respect to ordinary shares, par value

$0.001 per share (“Ordinary Shares”), of Aesthetic Medical International Holdings Group Limited (the “Issuer”). The Issuer’s principal executive office is located at 1122 Nanshan Boulevard, Nanshan District, Shenzhen, Guangdong Province, China

518052. Unless specifically amended hereby, the disclosure set forth in the Statement shall remain unchanged. Capitalized terms used but not otherwise defined in this Amendment shall have the meanings set forth in the Statement.

Item 4. Purpose of Transaction.

Item 4 of the Statement is hereby amended by the addition of the following:

On August 16, 2023, ADV delivered a conversion notice to the Issuer under that certain Convertible Note of the Issuer dated September 17, 2020, as amended by the Cooperation Agreement dated as of

July 20, 2022 (the “Convertible Note”), pursuant to which ADV converted $5,000,000 USD principal amount of the Convertible Note at a conversion price of $0.586 USD, resulting in 12,088,808 Ordinary Shares being issued to ADV (the “Conversion”).

The Conversion reflects the entire principal amount outstanding under the Convertible Note and, as a result of the Conversion, no principal amount is remaining under the Convertible Note.

Item 5. Interest in Securities of the Issuer.

Paragraphs (a) – (b) of Item 5 of the Statement are hereby amended to include the following language:

(a) (b) The information set forth in the cover pages hereto is hereby incorporated in its entirety herein.

Paragraph (c) of Item 5 of the Statement is hereby amended by adding the following:

|

(c) |

Except as otherwise described herein, no other transactions were effected by the Reporting Persons in the past 60 days.

|

SIGNATURE

After reasonable inquiry and to the best of my or its knowledge and belief, the undersigned certifies that the information in this statement is true, complete and correct.

Dated:August 17, 2023

| |

PEAK ASIA INVESTMENT HOLDINGS V LIMITED

|

| |

|

|

| |

By:

|

/s/ Ramanathan Subramanian Arun Kumar

|

|

| |

|

Name: Ramanathan Subramanian Arun Kumar

|

| |

|

Title: Director

|

| |

|

|

| |

BEACON TECHNOLOGY INVESTMENT HOLDINGS LIMITED

|

| |

|

|

| |

By:

|

/s/ Ramanathan Subramanian Arun Kumar

|

|

| |

|

Name: Ramanathan Subramanian Arun Kumar

|

| |

|

Title: Authorized Signatory

|

| |

|

|

| |

ADV OPPORTUNITIES FUND I, L.P.

|

| |

|

|

| |

By:

|

/s/ Ramanathan Subramanian Arun Kumar

|

|

| |

|

Name: Ramanathan Subramanian Arun Kumar

|

| |

|

Title: Authorized Signatory

|

| |

|

|

| |

ADV OPPORTUNITIES FUND I, GP, L.P.

|

| |

|

|

| |

By:

|

/s/ Ramanathan Subramanian Arun Kumar

|

|

| |

|

Name: Ramanathan Subramanian Arun Kumar

|

| |

|

Title: Authorized Signatory

|

| |

|

|

| |

ADV OPPORTUNITIES FUND I GP LTD

|

| |

|

|

| |

By:

|

/s/ Ramanathan Subramanian Arun Kumar

|

|

| |

|

Name: Ramanathan Subramanian Arun Kumar

|

| |

|

Title: Authorized Signatory

|

[Signature Page to Form 13D Filing]

| |

ADV PARTNERS HOLDINGS LTD

|

| |

|

|

| |

By:

|

/s/ Bradley Dean Landes

|

|

| |

|

Name: Bradley Dean Landes

|

| |

|

Title: Director

|

| |

|

|

| |

|

|

| |

By:

|

/s/ Suresh Eshwara Prabhala

|

|

| |

|

Name: Suresh Eshwara Prabhala

|

| |

|

Title: Director

|

| |

|

|

| |

By:

|

/s/ Kenichi Shu

|

|

|

|

|

| |

|

Name: Kenichi Shu

|

| |

|

Title: Director

|

| |

|

|

|

|

/s/ Bradley Dean Landes

|

|

|

|

|

|

Mr. Bradley Dean Landes

|

|

|

|

|

|

|

|

/s/ Suresh Eshwara Prabhala

|

|

|

|

|

|

Mr. Suresh Eshwara Prabhala

|

|

|

|

|

|

|

|

/s/ Kenichi Shu

|

|

|

|

|

|

Mr. Kenichi Shu

|

|

[

Signature Page to Form 13D Filing]

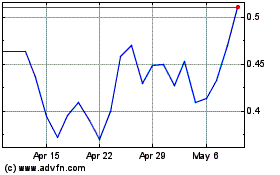

Aesthetic Medical (NASDAQ:AIH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aesthetic Medical (NASDAQ:AIH)

Historical Stock Chart

From Apr 2023 to Apr 2024