0001757143

false

--12-31

2022

FY

Aesthetic Medical International Holdings Group Ltd

true

NASDAQ

0001757143

2022-01-01

2022-12-31

0001757143

dei:BusinessContactMember

2022-01-01

2022-12-31

0001757143

aih:AmericanDepositarySharesMember

2022-01-01

2022-12-31

0001757143

ifrs-full:OrdinarySharesMember

2022-01-01

2022-12-31

0001757143

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 20-F/A

¨ REGISTRATION

STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

fiscal year ended December 31, 2022

OR

¨ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

¨ SHELL

COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring

this shell company report for the transition period from ____________to ____________

Commission file

number: 001-39088

Aesthetic Medical

International Holdings Group Limited

(Exact Name of Registrant

as Specified in its Charter)

N/A

(Translation of Registrant’s

Name into English)

Cayman Islands

(Jurisdiction of

Incorporation or Organization)

1122 Nanshan Boulevard

Nanshan District, Shenzhen

Guangdong Province, China 518052

(Address of principal

executive offices)

Wu Guanhua, Chief

Financial Officer

E-mail: toby@pengai.com.cn

1122 Nanshan Boulevard

Nanshan District, Shenzhen

Guangdong Province, China 518052

Telephone: +86 (755) 2665 0533

(Name, Telephone,

E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered

or to be registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

Trading

Symbol |

Name

of Each Exchange on Which

Registered |

American depositary shares, each representing three ordinary shares

Ordinary shares, par value US$0.001 per share* |

AIH

true |

NASDAQ

Stock Market LLC

NASDAQ |

* Not

for trading, but only in connection with the listing of the American depositary shares on The NASDAQ Stock Market LLC.

Securities registered

or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which

there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number

of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual

report:

As of December 31,

2022, the issuer had 94,044,740 shares outstanding.

Indicate by check

mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is

an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check

mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check

mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to

Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes x No ¨

Indicate by check

mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company.

See definition of “large accelerated filer,” accelerated filer,” and “emerging growth company” in Rule 12b-2

of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| Non-accelerated filer |

x |

Emerging growth company |

x |

If an emerging growth

company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not

to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of

the Exchange Act.

† The term

“new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to

its Accounting Standards Codification after April 5, 2012.

Indicate by check

mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal

control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public

accounting firm that prepared or issued its audit report. ¨

If securities are

registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check

mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received

by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check

mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ¨ |

International Financial Reporting Standards as issued by

the International Accounting Standards Board x |

Other ¨ |

| * |

If “Other” has been checked in response to the previous

question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨Item

18 ¨ |

If this is an annual

report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨

No x

(APPLICABLE ONLY

TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check

mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal

control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public

accounting firm that prepared or issued its audit report. Yes ¨ No ¨

| Auditor name: Union Power HK CPA Limited |

Location: Hong Kong, China |

Auditor Firm ID: 3004 |

EXPLANATORY NOTE

This Amendment No.1 on Form 20-F (“Form 20-F/A”)

is being filed to amend the Annual Report on Form 20-F for the fiscal year ended December 31, 2022, filed with the

Securities and Exchange Commission on April 21, 2023 (the “Original Form 20-F”) of Aesthetic Medical International

Holdings Group Limited (the “Company”, “we”, “us”, “our” or “our company”).

This Form 20-F/A is being filed to add the following paragraphs as “ITEM 16I. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT

PREVENT INSPECTIONS”:

ITEM 16I. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

(a). Please see

the Supplemental Submission Pursuant to Item 16I(a) of Form 20-F, which has been furnished as Exhibit 15.3 to this Form 20-F/A.

(b). On June 14,

2022, we were conclusively identified by the SEC as a “Commission-Identified Issuer” under the HFCAA following the filing

of our annual report on Form 20-F for the fiscal year ended December 31, 2021. Our auditor, a registered public accounting firm

that the PCAOB was unable to inspect or investigate completely in 2021, issued an audit report for our fiscal year ended December 31,

2021. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland

China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting

firms. As a result, we do not expect to be identified as a “Commission-Identified Issuer” under the HFCAA for the fiscal year

ended December 31, 2022 after we file our annual report on Form 20-F for such fiscal year.

As of the date of the Original

Form 20-F:

| (i) | MY Universe (HK) Limited (“MYU”) held 36,402,570 ordinary shares of our company, representing

27.9% of the total number of ordinary shares issued and outstanding as of the same date. MYU is a company incorporated in Hong Kong, which

is wholly owned by Hainan Oriental Jiechuang Investment Partnership (“Jiechuang”). Jiechuang is a limited partnership incorporated

in Hainan Province, China, which has two general partners, namely, Shenzhen Lafang Investment Management Co., Ltd. (“LaFang

Investment”) and Shenzhen Venture Capital M&A Fund Management (Shenzhen) Co., Ltd. (“SVC”). SVC owned 11.72%

of equity interest in Jiechuang. The majority of the equity interest of SVC is collectively and beneficially owned by several government-owned

entities of the PRC. Other than the ordinary shares of our company owned by MYU, none of the shares of our company or our consolidated

foreign operating entities (as set out in Exhibit 15.4 filed herein) is owned by governmental entities in the Cayman Islands, the

British Virgin Islands, Singapore, the United States, Hong Kong, or mainland China. |

| (ii) | none of the governmental entities in Hong Kong or mainland China have a controlling financial interest

in us or any of our consolidated foreign operating entities; |

| (iii) | none of the members of our board of directors or the board of directors of our consolidated foreign operating

entities is an official of the Chinese Communist Party; and |

| (iv) | the currently effective memorandum and articles of association of our company or equivalent organizing

documents of our consolidated foreign operating entities do not contain any charter of the Chinese Communist Party, including the text

of any such articles or organizing documents. |

Item 19. EXHIBITS

EXHIBIT INDEX

SIGNATURES

The registrant hereby certifies that it meets

all of the requirements for filing on Form 20-F/A and that it has duly caused and authorized the undersigned to sign this annual

report on its behalf.

| |

Aesthetic Medical International Holdings Group Limited |

| |

|

|

| |

By: |

/s/ Zhang Chen |

| |

Name: |

Zhang Chen |

| |

Title: |

Chairman |

| |

|

|

| |

Dated: |

September 22, 2023 |

Exhibit 12.1

Certification by the Chief Executive Officer

Pursuant to Section 302 of the Sarbanes-Oxley

Act of 2002

I, Zhang Chen, certify that:

| 1. |

I have reviewed this annual report on Form 20-F/A of Aesthetic Medical International Holdings Group Limited; |

| 2. |

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. |

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the company as of, and for, the periods presented in this report; |

| 4. |

The company’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the company and have: |

| |

(a) |

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the company, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| |

(b) |

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

(c) |

Evaluated the effectiveness of the company’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

(d) |

Disclosed in this report any change in the company’s internal control over financial reporting that occurred during the period covered by the annual report that has materially affected, or is reasonably likely to materially affect, the company’s internal control over financial reporting; and |

| 5. |

The company’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the company’s auditors and the audit committee of the company’s board of directors (or persons performing the equivalent functions): |

| |

(a) |

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the company’s ability to record, process, summarize and report financial information; and |

| |

(b) |

Any fraud, whether or not material, that involves management or other employees who have a significant role in the company’s internal control over financial reporting. |

| Date: September 22, 2023 |

|

| |

|

|

| By: |

/s/ Zhang Chen |

|

| Name: |

Zhang Chen |

|

| Title: |

Chairman |

|

Exhibit 12.2

Certification by the Chief Financial Officer

Pursuant to Section 302 of the Sarbanes-Oxley

Act of 2002

I, Wu Guanhua, certify that:

| 1. |

I have reviewed this annual report on Form 20-F/A of Aesthetic Medical International Holdings Group Limited; |

| 2. |

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. |

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the company as of, and for, the periods presented in this report; |

| 4. |

The company’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the company and have: |

| |

(a) |

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the company, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| |

(b) |

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

(c) |

Evaluated the effectiveness of the company’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

(d) |

Disclosed in this report any change in the company’s internal control over financial reporting that occurred during the period covered by the annual report that has materially affected, or is reasonably likely to materially affect, the company’s internal control over financial reporting; and |

| 5. |

The company’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the company’s auditors and the audit committee of the company’s board of directors (or persons performing the equivalent functions): |

| |

(a) |

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the company’s ability to record, process, summarize and report financial information; and |

| |

(b) |

Any fraud, whether or not material, that involves management or other employees who have a significant role in the company’s internal control over financial reporting. |

| Date: September 22,

2023 |

|

| |

|

|

| By: |

/s/ Wu Guanhua |

|

| Name: |

Wu Guanhua |

|

| Title: |

Chief Financial Officer |

|

Exhibit 13.1

Certification by the Chief Executive Officer

Pursuant to Section 906 of the Sarbanes-Oxley

Act of 2002

In connection with the Annual

Report of Aesthetic Medical International Holdings Group Limited (the “Company”) on Form 20-F/A for the year ended December 31,

2022 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Zhang Chen, Chairman

of the Company, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of

2002, that to my knowledge:

| |

(1) |

The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and |

| |

(2) |

The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. |

| Date: September 22, 2023 |

|

| |

|

|

| By: |

/s/ Zhang Chen |

|

| Name: |

Zhang Chen |

|

| Title: |

Chairman |

|

Exhibit 13.2

Certification by the Chief Financial Officer

Pursuant to Section 906 of the Sarbanes-Oxley

Act of 2002

In connection with the Annual

Report of Aesthetic Medical International Holdings Group Limited (the “Company”) on Form 20-F/A for the year ended December 31,

2022 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Wu Guanhua, Chief Financial

Officer of the Company, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley

Act of 2002, that to my knowledge:

| |

(1) |

The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and |

| |

(2) |

The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. |

| Date: September 22, 2023 |

|

| |

|

|

| By: |

/s/ Wu Guanhua |

|

| Name: |

Wu Guanhua |

|

| Title: |

Chief Financial Officer |

|

Exhibit 15.3

Supplemental Submission Pursuant to Item 16I(a) of

Form 20-F

On June 14, 2022, the Company was conclusively

identified by the U.S. Securities and Exchange Commission (the “SEC”) as a Commission-Identified Issuer pursuant to the HFCAA

because it filed an annual report on Form 20-F for the year ended December 31, 2021 with the SEC on May 16, 2022 with

an audit report issued by Union Power HK CPA Limited (“Union Power”), a registered public accounting firm retained by the

Company, for the preparation of the audit report on the Company’s financial statements included therein. On December 15, 2022,

the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list

of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. For this reason, we do not

expect to be identified as a Commission-Identified Issuer under the HFCAA after we file the annual report on the Original Form 20-F.

Based on an examination of its register of members

and public filings made by its shareholders, as of April 21, 2023, shareholders held 10% or more of the total outstanding ordinary

shares of the Company included MYU (as defined below), Hawyu (HK) Limited, Mr. Zhou Pengwu and Ms. Ding Wenting and Peak Asia

Investment Holdings V Limited. To the Company’s knowledge, as of April 21, 2023, other than MYU, none of the shareholders that

hold 10% or more of the total outstanding ordinary shares of the Company are controlled by any government entity in Hong Kong or mainland

China.

| (i) | Dr. Zhou Pengwu and Ms. Ding Wenting, together owned 25.7% of the Company’s total outstanding

ordinary shares by themselves and through their affiliate entities, namely Seefar Global Holdings Limited, Jubilee Set Investments Limited

and Pengai Hospital Management Corporation. Each of Dr. Zhou Pengwu and Ms. Ding Wenting is a natural person not affiliated

with any government entities. |

| (ii) | Hawyu (HK) Limited owned 16.4% of the Company’s total outstanding ordinary shares, which is ultimately

beneficially owned by Lafang China Co., Ltd (603630.SS), a company listed on the Shanghai Stock Exchange. Based on the review of the public

filings concerning Lafang China Co., Ltd on the Shanghai Stock Exchange, other than Mr. Wu Guiqian, Australia Wanda International

Company Limited and Ms. Wu Binhua, no shareholder interested in 5% or more of the shares of Lafang China Co., Ltd, and none these

three shareholders is affiliated with any government entities. |

| (iii) | Peak Asia Investment Holdings V Limited owned 11.9% of the Company’s total outstanding ordinary

shares, which is ultimately beneficially owned by Mr. Bradley Dean Landes, Mr. Suresh Eshwara Prabhala and Mr. Jianyi Zhu

(Kenichi Shu), and none of these three shareholders is affiliated with any government entities. |

As the Company previously announced on Form 6-K

filed on February 16, 2023, the Company closed the private placement entered into and initiated announced on July 20, 2022.

As a result, as of April 21, 2023, the date of the Original Form 20-F, Hainan Oriental Jiechuang Investment Partnership (“Jiechuang”),

through its wholly-owned subsidiary, MY Universe (HK) Limited (“MYU”), held 36,402,570 ordinary shares of our Company (the

“Jiechuang Shares”), representing 27.9% of the total number of ordinary shares issued and outstanding as of the same date.

MYU is a company incorporated in Hong Kong. Jiechuang is a limited partnership incorporated in Hainan Province, China, which has two general

partners, namely, Shenzhen Lafang Investment Management Co., Ltd. (“LaFang Investment”) and Shenzhen Venture Capital

M&A Fund Management (Shenzhen) Co., Ltd. (“SVC”). The majority of the equity interest of SVC is collectively and

beneficially owned by several government-owned entities of the PRC.

Pursuant to the Limited Partnership Agreement

of Jiechuang, LaFang Investment acts as the executive general partner and is responsible for directing and managing the day-to-day operations

and shall act as a legal representative for Jiechuang vis-a-vis third parties. LaFang Investment’s responsibilities with regard

to Jiechuang include but not limited to, (i) executing investment, (ii) procurement, management and disposal of assets; (iii) directing

and managing day-to-day operations and (iv) execution, delivery and performance contracts. Conversely, SVC, as a general partner,

has the right to (a) monitor the opening, maintenance and cancellation of bank accounts on behalf of Jiechuang and (b) receive

prior notice from LaFang Investment and give written consent over certain matters, including but not limited to decisions made by LaFang

Investment related to investment, legal proceeding, and contractual obligations.

In addition, Shenzhen Luohu Red Earth Venture

Capital Asset Management Limited (“Red Earth”) acts as a manager of Jiechuang. Red Earth is mainly responsible for fund management

related matters, including but not limited to procuring limited partners, fund raising, evaluating investment opportunities and monitoring

invested companies. Red Earth is a government-owned enterprise.

Furthermore, pursuant to the shareholder agreement

among the Company, Jiechuang and certain other shareholders entered into on July 20, 2022, the board of directors of our Company

shall be no more than eleven members, and Jiechuang has the right to nominate four directors of our Company.

Based on the analyses below, the board of Directors

of the Company is of the view that it is not owned or controlled by a governmental entity in mainland China by nature of beneficiary ownership

of the Jiechuang Shares as of the date of the Original Form 20-F, in particular because as beneficiary owners of Jiechuang, LaFang

Investment is capable of exerting more direct and substantive influence on our Company than SVC in relation to the Jiechuang Shares:

| (i) | LaFang Investment, as the executive general partner of Jiechuang, is responsible for directing and managing

the day-to-day operations, including making decisions on voting and the disposal of the Jiechuang Shares. Such decisions will be initiated

by LaFang Investment in its discretion, and SVC’s consent right is in comparison passive and protective in nature; |

| (ii) | As of the date of this Form 20-F/A, Jiechuang did not nominate any director to the board of directors

of the Company. Jiechuang has indicated to the Company that if and when Jiechuang designates nominees for directors of the Company, the

nomination will be made by LaFang Investment subject to notification to and consent by SVC; and |

| (iii) | Red Earth’s role as a manager of Jiechuang focuses on fund management of Jiechuang and not the decision

making and direction of voting in relation to the Jiechuang Shares. |

Based on the analysis above, the board of Directors

of the Company believes that it is not owned or controlled by a governmental entity in Hong Kong or mainland China.

| Date: |

September 22,

2023 |

|

| |

|

|

| By: |

/s/ Zhang Chen |

|

| Name: |

Zhang Chen |

|

| Title: |

Chairman |

|

Exhibit 15.4

LIST OF CONSOLIDATED FOREIGN OPERATING ENTITIES

OF THE REGISTRANT

| Subsidiaries |

|

Place of Incorporation |

| Dragon Jade Holdings Limited |

|

BVI |

| Stargaze Wealth Limited |

|

BVI |

| Newa Medical Aesthetics Limited |

|

Hong Kong |

| Peng Oi Investment (Hong Kong) Holdings Limited |

|

Hong Kong |

| Shengli Aesthetic Technology Investment (Hong Kong) Company Limited |

|

Hong Kong |

| Beijing Aomei Yixin Investment Consultant Co., Ltd.* |

|

PRC |

| Beijing Aomei Yixin Investment Consultant Co., Ltd. Pengai Aesthetic Medical Clinic* |

|

PRC |

| Shenzhen Miaoyan Medical Technology Investment Co., Ltd. |

|

PRC |

| Guangzhou Pengai Aesthetic Medical Hospital Co., Ltd.* |

|

PRC |

| Haikou Pengai Aesthetic Medical Hospital Co., Ltd. |

|

PRC |

| Hangzhou Pengai Aesthetic Medical Outpatient Department Co., Ltd. |

|

PRC |

| Huizhou Pengai Aesthetic Medical Hospital Co., Ltd. |

|

PRC |

| Peng Yida Business Consulting (Shenzhen) Co., Ltd. |

|

PRC |

| Shanghai Jiahong Aesthetic Medical Outpatient Department Co., Ltd.* |

|

PRC |

| Shanghai Pengai Aesthetic Medical Outpatient Department Co., Ltd.* |

|

PRC |

| Shanghai Pengai Medical Technology Co., Ltd. |

|

PRC |

| Shenzhen Pengai Beauty Promise Cosmetic Co., Ltd. |

|

PRC |

| Shenzhen Pengai Aesthetic Medical Hospital |

|

PRC |

| Shenzhen Pengai Culture Broadcast Co., Ltd. |

|

PRC |

| Shenzhen Pengai Hospital Investment Management Co., Ltd. |

|

PRC |

| Shenzhen Pengai Xiuqi Aesthetic Medical Hospital* |

|

PRC |

| Shenzhen Pengcheng Hospital |

|

PRC |

| Yantai Pengai Cosmetic Surgery Hospital Co., Ltd.* |

|

PRC |

| Aesthetic Medical International Holdings (Singapore) Pte. Ltd. |

|

Singapore |

| Aih Investment Management Corp. |

|

U.S.A. |

| Guangzhou Pengai Xiuqi Aesthetic Medical Outpatient Department Co., Ltd.* |

|

PRC |

| Chengdu Pengai Yueji Aesthetic Medical Outpatient Department Co., Ltd. |

|

PRC |

| Ningbo Beilun Pengai Aesthetic Medical Clinic Co., Ltd. |

|

PRC |

| Ningbo Fenghua Pengai Aesthetic Medical Clinic Co., Ltd. |

|

PRC |

| Shenzhen Ruimei Enterprise Management Co., Ltd. |

|

PRC |

* Relevant

Subsidiaries of the Company.

v3.23.3

Cover

|

12 Months Ended |

|

Dec. 31, 2022

shares

|

|---|

| Entity Addresses [Line Items] |

|

| Document Type |

20-F/A

|

| Amendment Flag |

false

|

| Document Registration Statement |

false

|

| Document Annual Report |

true

|

| Document Transition Report |

false

|

| Document Shell Company Report |

false

|

| Document Period End Date |

Dec. 31, 2022

|

| Document Fiscal Period Focus |

FY

|

| Document Fiscal Year Focus |

2022

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-39088

|

| Entity Registrant Name |

Aesthetic Medical International Holdings Group Ltd

|

| Entity Central Index Key |

0001757143

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

1122 Nanshan Boulevard

|

| Entity Address, Address Line Two |

Nanshan District

|

| Entity Address, Address Line Three |

Guangdong Province

|

| Entity Address, City or Town |

Shenzhen

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

518052

|

| Entity Well-known Seasoned Issuer |

No

|

| Entity Voluntary Filers |

No

|

| Entity Current Reporting Status |

Yes

|

| Entity Interactive Data Current |

Yes

|

| Entity Filer Category |

Non-accelerated Filer

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Document Accounting Standard |

International Financial Reporting Standards

|

| Entity Shell Company |

false

|

| Entity Common Stock, Shares Outstanding |

94,044,740

|

| ICFR Auditor Attestation Flag |

false

|

| Auditor Name |

Union Power HK CPA Limited

|

| Auditor Location |

Hong Kong, China

|

| Auditor Firm ID |

3004

|

| American depositary shares |

|

| Entity Addresses [Line Items] |

|

| Title of 12(b) Security |

American depositary shares, each

|

| Trading Symbol |

AIH

|

| Security Exchange Name |

NASDAQ

|

| Ordinary shares [member] |

|

| Entity Addresses [Line Items] |

|

| Title of 12(b) Security |

Ordinary shares, par value US$0.001 per share*

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NASDAQ

|

| Business Contact [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

1122 Nanshan Boulevard

|

| Entity Address, Address Line Two |

Nanshan District

|

| Entity Address, Address Line Three |

Guangdong Province

|

| Entity Address, City or Town |

Shenzhen

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

518052

|

| Country Region |

86

|

| City Area Code |

755

|

| Local Phone Number |

2665 0533

|

| Contact Personnel Name |

Wu Guanhua

|

| Contact Personnel Email Address |

toby@pengai.com.cn

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe basis of accounting the registrant has used to prepare the financial statements included in this filing This can either be 'U.S. GAAP', 'International Financial Reporting Standards', or 'Other'. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

| Name: |

dei_DocumentAccountingStandard |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:accountingStandardItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a registration statement. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

| Name: |

dei_DocumentRegistrationStatement |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true for a Shell Company Report pursuant to section 13 or 15(d) of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

| Name: |

dei_DocumentShellCompanyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ifrs-full_ClassesOfShareCapitalAxis=aih_AmericanDepositarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

ifrs-full_ClassesOfShareCapitalAxis=ifrs-full_OrdinarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

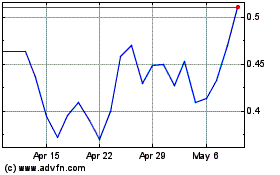

Aesthetic Medical (NASDAQ:AIH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aesthetic Medical (NASDAQ:AIH)

Historical Stock Chart

From Apr 2023 to Apr 2024