As filed with the Securities and Exchange Commission

on May 13, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Akoustis Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

33-1229046 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

9805 Northcross Center Court, Suite A

Huntersville, North Carolina 28078

(704) 997-5735

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Jeffrey B. Shealy

President and Chief Executive Officer

Akoustis Technologies, Inc.

9805 Northcross Center Court, Suite A

Huntersville, North Carolina 28078

(704) 997-5735

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Sean M. Jones

Coleman Wombwell

K&L Gates LLP

300 South Tryon Street, Suite 1000

Charlotte, North Carolina 28202

(704) 331-7400

Approximate date of commencement of proposed sale

to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box. þ

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

þ |

Smaller reporting company |

þ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

The information in this

prospectus is not complete and may be changed. The Selling Stockholders may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the Selling

Stockholders are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion,

dated May 13, 2024

AKOUSTIS TECHNOLOGIES, INC.

Prospectus

5,028,291 Shares of Common Stock for sale by

the Selling Stockholders

This prospectus relates to the sale or other disposition

from time to time of up to 5,028,291 shares (the “Shares”) of common stock, par value $0.001 per share (“Common Stock”),

by the persons described in this prospectus, whom we call the “Selling Stockholders,” identified in the section of this prospectus

entitled “Selling Stockholders,” or their transferees.

5,000,000 of the Shares (the “Note Shares”)

represent shares that may be issued, at our election, as payment of accrued interest on our 6.0% Convertible Senior Notes due 2027 (the

“Notes”), as make-whole payments made in connection with certain conversions of the Notes or as payments made in connection

with qualifying fundamental changes of Akoustis Technologies, Inc. (the “Company”) which exceed the estimate of shares of

Common Stock that that were included for such purpose in the Company’s previously filed Registration Statement on Form S-3 (File

No. 333-267394). We are registering the Note Shares as required by the terms of the registration rights agreement among the purchasers

of the Notes (the “Selling Noteholders”), us, and the guarantor party thereto, for the benefit of the Selling Noteholders.

The registration of the Shares does not mean that

the Selling Stockholders will actually offer or sell any of the Shares. We will not receive any of the proceeds from the sale or other

disposition of such securities offered by the Selling Stockholders.

The Shares may be sold by the Selling Stockholders

from time to time in the open market, through privately negotiated transactions or a combination of these methods, at market prices prevailing

at the time of sale or at negotiated prices. We will not receive any proceeds from the sale of the Shares by the Security Holders. We

will bear all expenses of registration incurred in connection with this offering, but all selling and other expenses incurred by the Selling

Stockholders will be borne by them.

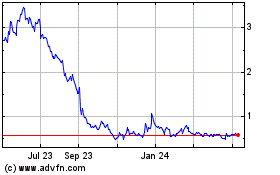

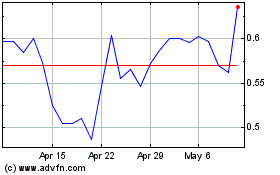

Our Common Stock is traded on the Nasdaq Capital

Market (“Nasdaq”) under the symbol “AKTS.” On May 10, 2024, the last reported sale price for our Common Stock

was $0.57 per share.

Our business and an investment in our securities

involve a high degree of risk. Before making any investment in our securities, you should read and carefully consider risks described

in the “Risk Factors” section beginning on page 7 of this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

This prospectus is dated ,

2024.

You should rely only on the information contained

in this prospectus. We have not authorized any other person to provide you with information that is different from that contained in this

prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for,

and can provide no assurance as to the reliability of, any other information that others may give you. The Selling Stockholders are offering

to sell and seeking offers to buy the Shares only in jurisdictions where offers and sales are permitted. You should assume that the information

contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus

or of any sale of our Securities. Our business, financial condition, results of operations and prospects may have changed since that date.

We are not making an offer of any Shares in any jurisdiction where the offer is not permitted.

TABLE OF CONTENTS

PROSPECTUS SUMMARY

The following summary highlights information contained

elsewhere in this prospectus. This summary is not complete and does not contain all of the information that should be considered before

investing in our securities. Potential investors should read the entire prospectus carefully, including the more detailed information

regarding our business provided in our Annual Report on Form 10-K for the fiscal year ended June 30, 2023 and our subsequently filed Quarterly

Reports on Form 10-Q, which are incorporated herein by reference, the risks of purchasing our Shares discussed under the “Risk Factors”

section, and our financial statements and the accompanying notes to the financial statements incorporated herein by reference.

Unless the context indicates or requires otherwise,

all references in this registration statement to “Akoustis Technologies,” “Akoustis,” the “Company,”

“we,” “us” and “our” refer to Akoustis Technologies, Inc. and its wholly owned consolidated subsidiary,

Akoustis, Inc., each a Delaware corporation.

This prospectus includes the trademarks of Akoustis,

Inc., Akoustis™ and XBAW™. All references to Akoustis and XBAW in this prospectus are intended to include reference to such

trademarks.

Our Company

Akoustis® is an emerging commercial product

company focused on developing, designing, and manufacturing innovative RF filter solutions for the wireless industry, including for products

such as smartphones and tablets, network infrastructure equipment, Wi-Fi Customer Premise Equipment (“CPE”) and defense applications.

Filters are critical in selecting and rejecting signals, and their performance enables differentiation in the modules defining the RF

front-end (“RFFE”). Located between the device’s antenna and its digital backend, the RFFE is the circuitry that performs

the analog signal processing and contains components such as amplifiers, filters and switches. We have developed a proprietary microelectromechanical

system (“MEMS”) based bulk acoustic wave (“BAW”) technology and a unique manufacturing process flow, called “XBAW®”,

for our filters produced for use in RFFE modules. Our XBAW® filters incorporate optimized high purity piezoelectric

materials for high power, high frequency and wide bandwidth operation. We are developing RF filters for 5G, Wi-Fi and defense bands using

our proprietary resonator device models and product design kits (“PDKs”). As we qualify our RF filter products, we are engaging

with target customers to evaluate our filter solutions. Our initial designs target UHB, sub 7 GHz 5G, Wi-Fi and defense bands. We expect

our filter solutions will address problems (such as loss, bandwidth, power handling, and isolation) created by the growing number of frequency

bands in the RFFE of mobile devices, infrastructure and premise equipment to support 5G, and Wi-Fi. We have prototyped, sampled and begun

commercial shipment of our single-band low loss BAW filter designs for 5G frequency bands and 5 GHz and 6 GHz Wi-Fi bands which are suited

to competitive BAW solutions and historically cannot be addressed with low-band, lower power handling surface acoustic wave (“SAW”)

technology. Additionally, through our wholly owned subsidiary, RFMi, we operate a fabless business whereby we make sales of complementary

SAW resonators, RF filters, crystal (“Xtal”) resonators and oscillators, and ceramic products—addressing opportunities

in multiple end markets, such as automotive and industrial applications. We also offer back end semiconductor supply chain services through

our wholly owned subsidiary, Grinding & Dicing Services, Inc. (“GDSI”), which we acquired in January 2023.

We own and/or have filed applications for patents

on the core resonator device technology, manufacturing facility and intellectual property (“IP”) necessary to produce our

RF filter chips and operate as a “pure-play” RF filter supplier, providing discrete filter solutions direct to Original Equipment

Manufacturers (“OEMs”) and aligning with the front- end module manufacturers that seek to acquire high performance filters

to expand their module businesses. We believe this business model is the most direct and efficient means of delivering our solutions to

the market.

Technology. Our device technology

is based upon bulk-mode acoustic resonance, which we believe is superior to surface-mode resonance for high-band and ultra-high- band

(“UHB”) applications that include 4G/LTE, 5G, Wi-Fi, and defense applications. Although some of our target customers utilize

or manufacture the RFFE module, they may lack access to critical UHB filter technology that we produce, which is necessary to compete

in high frequency applications.

Manufacturing. We currently

manufacture Akoustis’ high-performance RF filter circuits, using our first generation XBAW® wafer process, in

our 125,000-square foot wafer-manufacturing facility located in Canandaigua, New York (the “NY Facility”), which we acquired

in June 2017. Our SAW-based RF filter products are manufactured by a third party and sold either directly or through a sales distributor.

Intellectual Property. As

of May 1, 2024, our IP portfolio included 103 patents, including a blocking patent that we have licensed from Cornell University. Additionally,

as of May 1, 2024, we have 79 pending patent applications. These patents cover our XBAW® RF filter technology from

raw materials through the system architectures. Given the significance of the Company’s intellectual property to its business, the

Company enforces its intellectual property rights and protects its patent portfolio, which may include filing lawsuits against companies

that the Company believes are infringing upon its patents. The Company considers protecting its intellectual property rights to be central

to its business model and competitive position in the RF filter industry.

Plan of Operation

By designing, manufacturing, and marketing our

RF filter products to mobile phone OEMs, defense OEMs, network infrastructure OEMs, and Wi-Fi CPE OEMs, we seek to enable broader competition

among the front-end module manufacturers.

Since we own and/or have filed applications for

patents on the core technology and control access to our intellectual property, we expect to offer several ways to engage with potential

customers. First, we intend to engage with multiple wireless markets, providing standardized filters that we design and offer as standard

catalog components. Second, we expect to deliver unique filters to customer-supplied specifications, which we will design and fabricate

on a customized basis. Finally, we may offer our models and design kits for our customers to design their own filters utilizing our proprietary

technology.

We expect to continue to incur substantial costs

for commercialization of our technology on a continuous basis because our business model involves materials and solid-state device technology

development and engineering of catalog and custom filter design solutions. To succeed across our combined portfolio of Akoustis, XBAW,

and RFMi products, we must convince customers in a wide range of industries including mobile phone OEMs, RFFE module manufacturers, network

infrastructure OEMs, WiFi CPE OEMs, medical device makers, automotive and defense customers to use our products in their systems and modules.

For example, since there are two dominant BAW filter suppliers in the industry that have high-band technology, and both utilize such technology

as a competitive advantage at the module level, we expect customers that lack access to high-band filter technology will be open to engage

with our company for XBAW filters.

To help drive our XBAW filter business, we plan

to continue to pursue RF filter design and R&D development agreements and potentially joint ventures with target customers and other

strategic partners, although we cannot guarantee we will be successful in these efforts. These types of arrangements may subsidize technology

development costs and qualification, filter design costs, and offer complementary technology and market intelligence and other avenues

to revenue. However, we intend to retain ownership of our core XBAW technology, intellectual property, designs, and related improvements.

Across our combined portfolio of Akoustis, XBAW, and RFMi products, we expect to continue development of catalog designs for multiple

customers and to offer such catalog products in multiple sales channels.

About This Offering

This prospectus relates to the public offering

by the Selling Stockholders listed in this prospectus of up to 4,266,680 shares of Common Stock issuable in respect of the Notes or that

are currently held by such Selling Stockholders. The Shares offered by this prospectus may be sold by the Selling Stockholders from time

to time in the open market, through negotiated transactions or otherwise at market prices prevailing at the time of sale or at negotiated

prices or otherwise as described in the section of this prospectus titled “Plan of Distribution.” We will receive no proceeds

from the sale of the Shares by the Selling Stockholders or from the issuance of Common Stock in respect of the Notes. We will bear all

expenses of registration incurred in connection with this offering, but all selling and other expenses incurred by the Selling Stockholders

will be borne by them.

Selected Risks Associated with an Investment

in the Shares

An investment in shares of

our common stock is highly speculative and is subject to numerous risks described in the section entitled “Risk Factors” and

elsewhere in this prospectus and in the documents incorporated by reference herein. You should carefully consider these risks before making

an investment. Some of these risks include:

| ● | We have a history of operating losses and will need to raise significant additional capital to continue

our business and operations. Additionally, the trial with respect to Qorvo Inc. vs. Akoustis Technologies, Inc. DE Case 1:21-cv-01417-JPM

is currently in process. An adverse outcome in this trial will severely constrain our liquidity. If we are unable to raise capital or

secure financing on favorable terms, or at all, in the near term to meet our capital and operating needs, we may be forced to further

delay, reduce or eliminate our operating activities, or cease operations and seek protection by filing a voluntary petition for relief

under the Bankruptcy Code, which would have a material adverse effect on our business and could cause you to lose all of your investment. |

| ● | Our failure to meet the minimum bid price for continued listing on The Nasdaq Capital Market could adversely

affect our ability to publicly or privately sell equity securities and the liquidity of our common stock. |

| ● | Servicing and repaying the debt represented by the $44.0 million aggregate principal amount of our 6.0%

Convertible Senior Notes due 2027 (the “2027 Notes”) and a $4.0 million promissory note issued in connection with our acquisition

of GDSI will require a significant amount of cash, and we may not have sufficient cash flow from our business to pay our substantial debt. |

| ● | You may experience dilution of your ownership interests because of the future issuance of additional shares

of our common or preferred stock or other securities that are convertible into or exercisable for our common or preferred stock. |

| ● | Our products may not be able to be meet the required specifications of customers and achieve qualification

for commercial manufacturing in a timely manner. |

| ● | Claims of infringement, misappropriation or misuse of third party intellectual property, including the

lawsuit filed by Qorvo, Inc. in October 2021, that, regardless of merit, has resulted in significant expense. |

| ● | If we are unable to establish effective marketing and sales capabilities or enter into agreements with

third parties to market and sell our RF filters, we may not be able to effectively generate product revenues. |

| ● | If we fail to obtain, maintain and enforce our intellectual property rights, we may not be able to prevent

third parties from using our proprietary technologies and may lose access to technologies critical to our products. |

Company Information

Our principal executive offices are

located at 9805 Northcross Center Court, Suite A, Huntersville, North Carolina 28078. Our telephone number is (704) 997-5735. Our website

address is www.akoustis.com. The information on, or that can be accessed through, our website is not part of this prospectus and is not

incorporated by reference in this prospectus.

THE OFFERING

| Common Stock currently outstanding |

|

98,654,282 shares. (1) |

| |

|

|

| Common Stock offered by the Company |

|

None. |

| |

|

|

| Common stock offered by the Selling Stockholders |

|

Up to 5,028,291 shares. |

| |

|

|

| Use of proceeds |

|

We will not receive any of the proceeds from the sales of the Shares by the Selling Stockholders or upon the issuance of any Shares in respect of the Notes. |

| |

|

|

| Nasdaq symbol for Common Stock |

|

AKTS. |

| |

|

|

| Risk factors |

|

You should carefully consider the information set forth in this

prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 7 of this

prospectus before deciding whether or not to invest in the Shares. |

(1) As of March 31, 2024. This number excludes:

| |

● |

options to purchase 3,031,625 shares of Common Stock, |

| |

● |

unvested restricted stock units for 5,102,956 shares of Common Stock (assuming maximum level of achievement of the performance criteria for the restricted stock units with market value appreciation conditions (“MVSUs”) is achieved), and |

| |

● |

in addition to the shares covered by this prospectus, up to approximately 9,897,556 shares of common stock registered for issuance upon the conversion of the Notes or additional shares issuable as payment of interest on the 2027 Notes, as make-whole payments made in connection with certain conversions of the Notes or as payments made in connection with qualifying fundamental changes of the Company. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

INFORMATION

This prospectus and documents we have filed with

the SEC that are incorporated by reference herein and therein contain forward-looking statements that relate to our plans objectives,

estimates, and goals within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”). In addition, from time to time we or our representatives have made or will make forward-looking

statements in various other filings that we make with the U.S. Securities and Exchange Commission (the “SEC”) or in other

documents, including press releases or other similar announcements. Any and all statements contained in this prospectus supplement and

the accompanying prospectus that are not statements of historical fact may be deemed to be forward-looking statements. Terms such as “may,”

“will,” “might,” “would,” “should,” “could,” “project,” “estimate,”

“predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,”

“plan,” “help,” “seek,” “believe,” “continue,” “intend,” “expect,”

“future,” and terms of similar import (including the negative of any of the foregoing) may identify forward-looking statements.

However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this prospectus

and documents we have filed with the SEC that are incorporated by reference herein and therein may include, without limitation, statements

regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the development

of commercially viable radio frequency (“RF”) filters, (ii) projections of income (including income/loss), earnings (including

earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance,

including any such statement contained in the management’s discussion and analysis of financial condition or in the results of operations

included pursuant to the rules and regulations of the SEC, (iv) our ability to efficiently utilize cash and cash equivalents to support

our operations for a given period of time, (v) our ability to engage customers while maintaining ownership of our intellectual property,

and (vi) the assumptions underlying or relating to any statement described in (i), (ii), (iii), (iv) or (v) above.

Forward-looking statements are not meant to predict

or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections,

plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences,

many of which are beyond our control. Actual results and the timing of certain events and circumstances may differ materially from those

described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to

the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include,

without limitation:

| ● | our limited operating history; |

| ● | our inability to generate revenues or achieve profitability; |

| ● | the failure of our common stock to meet the minimum requirements for continued listing on the Nasdaq Capital

Market, the impact of a pandemic or epidemic or natural disaster, including the COVID-19 pandemic, the Russian-Ukrainian and Middle East

conflicts and other sources of volatility on our operations, financial condition and the worldwide economy, including our ability to access

the capital markets; |

| ● | increases in prices for raw materials, labor, and fuel caused by rising inflation; |

| ● | our inability to obtain adequate financing and sustain our status as a going concern; |

| ● | the results of our research and development (“R&D”) activities; |

| ● | our inability to achieve acceptance of our products in the market; |

| ● | general economic conditions, including upturns and downturns in the industry; |

| ● | existing or increased competition; |

| ● | our inability to successfully scale our New York wafer fabrication facility and related operations while

maintaining quality control and assurance and avoiding delays in output; |

| ● | contracting with customers and other parties with greater bargaining power and agreeing to terms and conditions

that may adversely affect our business; |

| ● | the possibility that the anticipated benefits from business acquisitions will not be realized in full

or at all or may take longer to realize than expected; |

| ● | the possibility that costs or difficulties related to the integration of acquired businesses’ operations

will be greater than expected and the possibility of disruptions to our business during integration efforts and strain on management time

and resources; |

| ● | risks related to doing business in foreign countries, including rising tensions between the United States

and China; |

| ● | any cybersecurity breaches or other disruptions compromising our proprietary information and exposing

us to liability; |

| ● | our limited number of patents; |

| ● | failure to obtain, maintain, and enforce our intellectual property rights; |

| ● | claims of infringement, misappropriation or misuse of third party intellectual property, including the

lawsuit filed by Qorvo, Inc. in October 2021, that, regardless of merit, has resulted in significant expense; |

| ● | our inability to attract and retain qualified personnel; |

| ● | the outcome of current and any future litigation; |

| ● | our reliance on third parties to complete certain processes in connection with the manufacture of our

products; |

| ● | product quality and defects; |

| ● | our inability to successfully manufacture, market and sell products based on our technologies; |

| ● | our ability to meet the required specifications of customers and achieve qualification of our products

for commercial manufacturing in a timely manner; |

| ● | our failure to innovate or adapt to new or emerging technologies, including in relation to our competitors; |

| ● | our failure to comply with regulatory requirements; |

| ● | stock volatility and illiquidity; our failure to implement our business plans or strategies; |

| ● | our failure to maintain effective internal control over financial reporting; |

| ● | our failure to obtain or maintain a Trusted Foundry accreditation or our New York fabrication facility;

and |

| ● | shortages in supplies needed to manufacture our products, or needed by our customers to manufacture devices

incorporating our products. |

A description of

some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking

statements in this prospectus appears in the section captioned “Risk Factors” as well as the risk factors described under

the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for our most recent fiscal year (together

with any material changes thereto contained in subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) and

those contained in our other filings with the SEC, which are incorporated by reference in this prospectus and elsewhere in this prospectus.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them

and to the risk factors. The forward-looking statements in this prospectus speak only as of the date hereof and, except as may be required

by law, we do not undertake any obligation to update the forward-looking statements contained in this prospectus to reflect any new information

or future events or circumstances or otherwise.

RISK

FACTORS

Investing in our securities involves a high degree

of risk. Before purchasing our Shares, you should read and consider carefully the risk factors described under the section captioned “Risk

Factors” contained in our Annual Report on Form 10-K for our most recent fiscal year (together with any material changes thereto

contained in subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) and those contained in our other filings

with the SEC, which are incorporated by reference in this prospectus supplement and the accompanying prospectus, together with the other

information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus, including our consolidated

financial statements and the related notes. Each of these risk factors, either alone or taken together, could adversely affect our business,

operating results and financial condition, as well as adversely affect the value of an investment in our Shares. There may be additional

risks that we do not presently know of or that we currently believe are immaterial, which could also impair our business and financial

position. If any of the events described in the risk factors incorporated herein by reference were to occur, our financial condition,

our ability to access capital resources, our results of operations and/or our future growth prospects could be materially and adversely

affected and the value of our Shares could decline. As a result, you could lose some or all of any investment you may make in our Shares.

SELLING

STOCKHOLDERS

This prospectus covers the resale from time to

time by the Selling Stockholders identified in the first table below of (i) up to 5,000,000 shares of Common Stock that may be issued,

at our election, as payment of accrued interest on the Notes, as make-whole payments made in connection with certain conversions of the

Notes or as payments made in connection with qualifying fundamental changes of the Company and (ii) 28,291 outstanding shares of Common

Stock held by certain Selling Stockholders.

The Selling Stockholders identified in the table

below may from time to time offer and sell under this prospectus any or all of the shares of Common Stock issuable in respect of the Notes

or otherwise described under the column “Shares of Common Stock Registered Hereby,” in such table below.

The table below has been prepared based upon the

information furnished to us by the Selling Stockholders and/or our transfer agent as of the date of this prospectus. The Selling Stockholders

identified below may have sold, transferred or otherwise disposed of some or all of their shares of Common Stock since the date on which

the information in the following table is presented. Information concerning the Selling Stockholders may change from time to time and,

if necessary, we will amend or supplement this prospectus accordingly. We cannot give an estimate as to the number of shares of Common

Stock that will actually be held by the Selling Stockholders upon termination of this offering because the Selling Stockholders may offer

some or all of their Common Stock under the offering contemplated by this prospectus or may acquire additional shares of Common Stock.

The total number of shares of Common Stock that may be sold hereunder will not exceed the number of shares of Common Stock offered hereby.

Please read the section entitled “Plan of Distribution” in this prospectus.

The following table sets forth the name of each

Selling Stockholder, the number of shares of our Common Stock beneficially owned by such stockholder before this offering, the aggregate

number of shares of Common Stock to be offered for such stockholder’s account and the number and (if one percent or more) the percentage

of the class of stock to be beneficially owned by such stockholder after completion of the offering. The number of shares of Common Stock

owned are those beneficially owned, as determined under the rules of the SEC, and such information is not necessarily indicative of beneficial

ownership for any other purpose. Under such rules, the Selling Stockholders’ beneficial ownership includes any shares of our Common

Stock as to which a person has sole or shared voting power or investment power and any shares of Common Stock which the person has the

right to acquire within 60 days after May 8, 2024 (as used in this section, the “Determination Date”), through the exercise

of any option, warrant or right, through conversion of any security or pursuant to the automatic termination of a power of attorney or

revocation of a trust, discretionary account or similar arrangement, and such shares are deemed to be beneficially owned and outstanding

for computing the share ownership and percentage of the person holding such options, warrants or other rights, but are not deemed outstanding

for computing the percentage of any other person.

Unless otherwise set forth below, based upon the

information furnished to us, (a) the persons and entities named in the table have sole voting and sole investment power with respect to

the shares set forth opposite the Selling Stockholder’s name, subject to community property laws, where applicable, (b) no Selling

Stockholder had any position, office or other material relationship within the past three years with us or with any of our predecessors

or affiliates, and (c) no Selling Stockholder is a broker-dealer or an affiliate of a broker-dealer. The number of shares of Common Stock

shown as beneficially owned before the offering is based on information furnished to us or otherwise based on information available to

us at the timing of the filing of the registration statement of which this prospectus forms a part.

| Selling

Security Holder |

|

Shares of

Common

Stock

Beneficially

Owned

Prior to

this

Offering

(1) |

|

|

Shares of

Common

Stock

Registered

Hereby

(2) |

|

|

Shares of

Common

Stock

Beneficially

Owned

upon

Completion

of this

Offering

(3) |

|

|

Percentage

of

Common

Stock

Beneficially

Owned

upon

Completion

of this

Offering

(4) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Nineteen77 Global Multi-Strategy Alpha Master Limited (5) |

|

|

4,670,912 |

|

|

|

2,500,000 |

(6) |

|

|

4,670,912 |

|

|

|

4.5 |

% |

| Blackwell Partners LLC - Series B (7) |

|

|

3,782,225 |

|

|

|

738,636 |

(6) |

|

|

3,782,225 |

|

|

|

3.8 |

% |

| Silverback Convertible Master Fund Limited (8) |

|

|

477,706 |

|

|

|

255,682 |

(6) |

|

|

477,706 |

|

|

|

* |

|

| Silverback Opportunistic Credit Master Fund Limited (9) |

|

|

2,123,905 |

|

|

|

397,727 |

(6) |

|

|

2,123,905 |

|

|

|

2.1 |

% |

| KASAD 2, L.P. (10) |

|

|

2,525,463 |

|

|

|

1,107,955 |

(6) |

|

|

2,525,463 |

|

|

|

2.5 |

% |

| Shankari Somayaji |

|

|

28,291 |

|

|

|

28,291 |

|

|

|

-- |

|

|

|

* |

|

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting

or investment power with respect to securities. Shares of Common Stock underlying the Notes, as well as options or warrants currently

exercisable, or exercisable within 60 days of the Determination Date, are deemed outstanding for purposes of computing the beneficial

ownership of the person holding such options or warrants but are not deemed outstanding for computing the beneficial ownership of any

other person. Except where we had knowledge of such ownership, the number presented in this column may not include shares held in street

name or through other entities over which the selling stockholder has voting and dispositive power. Includes shares issuable upon conversion

of the Notes, subject to the Beneficial Ownership Limitation (defined below). |

| (2) | Assumes the issuance of the maximum number of shares issuable in respect of the Notes (including shares

issuable as payment of accrued interest, as make-whole payments, or in connection with qualifying fundamental changes). Pursuant to the

terms of the Notes, none of the holders may convert any Notes that it beneficially owns, or receive shares of Common Stock in respect

of such Notes, to the extent that such conversions or receipt would result in such holder and its affiliates, together with any other

persons whose beneficial ownership would be aggregated for purposes of Section 13(d) of the Exchange Act, beneficially owning in excess

of 4.9% of the outstanding shares of our Common Stock (as determined in accordance with Section 13(d) of the Exchange Act) (the “Beneficial

Ownership Limitation”). Amounts registered for sale hereby do not give effect to this limitation on conversions and receipt of shares

of Common Stock. |

| (3) | Assumes all of the shares of Common Stock to be registered on the registration statement of which this

prospectus is a part are sold in the offering, that shares of Common Stock beneficially owned by the Selling Stockholders but not being

offered pursuant to this prospectus (if any) are not sold, and that no additional shares of Common Stock are purchased or otherwise acquired. |

| (4) | Percentages are based on the 98,669,282 shares of Common Stock issued and outstanding as of the

Determination Date. Shares of our Common Stock subject to options, warrants or conversion rights that are currently exercisable or

convertible, or exercisable or convertible within 60 days of the Determination Date, are deemed to be outstanding for the purpose of

computing the percentage ownership of the person holding those options, warrants or conversion rights, but are not treated as

outstanding for the purpose of computing the percentage ownership of any other person. |

| (5) | UBS Asset Management (Americas) LLC (“UBS Asset Management”) is the investment manager of

Nineteen77 Global Multi-Strategy Alpha Master Limited (“Nineteen77”) and accordingly has voting control and investment discretion

over the securities described herein held by Nineteen77. Blake Hiltabrand (“Mr. Hiltabrand”), the Chief Investment Officer

of UBS Asset Management, also has voting control and investment discretion over the securities described herein held by Nineteen77. As

a result, each of UBS Asset Management and Mr. Hiltabrand may be deemed to have beneficial ownership (as determined under Section 13(d)

of the Securities Exchange Act of 1934, as amended) of the securities described herein held by Nineteen77. |

| (6) | Represents shares of Common Stock issuable in respect of the Notes as payment of accrued interest, as

make-whole payments, or in connection with qualifying fundamental changes that exceed the estimate of shares of Common Stock so issuable

that that were included in the Company’s previously filed Registration Statement on Form S-3 (File No. 333-267394). |

| (7) | Voting or investment control over the securities held by Blackwell Partners LLC - Series B is held by

Elliot Bossen (“Mr. Bossen”), CEO of Silverback Asset Management, trading advisor of Blackwell Partners LLC - Series B. |

| (8) | Voting or investment control over the securities held by Silverback Convertible Master Fund Limited is

held by Mr. Bossen, CEO of Silverback Asset Management, trading advisor of Silverback Convertible Master Fund Limited. |

| (9) | Voting or investment control over the securities held by Silverback Opportunities Credit Master Fund Limited

is held by Mr. Bossen, CEO of Silverback Asset Management, trading advisor of Silverback Opportunities Credit Master Fund Limited. |

| (10) | Voting or investment control over the securities held by KASAD 2, L.P. is held by Mr. Bossen, CEO of Silverback

Asset Management, trading advisor of KASAD 2. L.P. |

USE

OF PROCEEDS

We will not receive proceeds from sales Common

Stock made under this prospectus by the Selling Stockholders, or any proceeds from the issuance of Common Stock in respect of the Notes.

DETERMINATION

OF OFFERING PRICE

The Selling Stockholders will determine at what

price they may sell the offered Shares, and such sales may be made at prevailing market prices or at privately negotiated prices. See

“Plan of Distribution” below for more information.

MATERIAL

U.S. FEDERAL INCOME TAX CONSIDERATIONS TO NON-U.S. HOLDERS

The following discussion is a summary of certain

material U.S. federal income tax considerations relevant to Non-U.S. Holders (as defined below) relating to the purchase, ownership and

disposition of our common stock issued pursuant to this offering. This discussion is based on the U.S. Internal Revenue Code of 1986,

as amended, or the “Code,” Treasury Regulations promulgated thereunder, judicial decisions, and published rulings and administrative

pronouncements of the U.S. Internal Revenue Service, or the “IRS,” in each case in effect as of the date hereof. These authorities

may change or be subject to differing interpretations that may be applied retroactively in a manner that could adversely affect a Non-U.S.

Holder of our common stock. We have not sought and will not seek any rulings from the IRS regarding the matters discussed below. There

can be no assurance that the IRS or a court will not take a contrary position to that discussed below regarding the U.S. federal income

tax consequences of the purchase, ownership and disposition of our common stock.

This discussion is limited to Non-U.S. Holders

that hold our common stock as a “capital asset” within the meaning of the Code (generally, property held for investment).

This discussion does not purport to be a complete analysis of all potential tax consequences and does not address the effects of other

U.S. federal tax laws, such as the U.S. estate and gift tax laws, and any applicable state, local or non-U.S. tax laws or tax treaties.

This summary does not address all U.S. federal income tax consequences relevant to a Non-U.S. Holder’s particular circumstances,

including the impact of the Medicare contribution tax on net investment income. In addition, it does not address consequences relevant

to Non-U.S. Holders subject to special rules, including, without limitation:

| ● | U.S. expatriates and former citizens or long-term residents of the United States; |

| ● | persons subject to the alternative minimum tax; |

| ● | persons holding our common stock as part of a hedge, straddle or other risk reduction strategy or as part of a conversion transaction

or other integrated investment or who have elected to mark securities to market; |

| ● | banks, thrifts, regulated investment companies, real estate investment trusts, insurance companies and other financial institutions; |

| ● | brokers, dealers or traders in securities or currencies; |

| ● | “controlled foreign corporations” or “passive foreign investment companies”; |

| ● | partnerships or other entities or arrangements treated as partnerships for U.S. federal income tax purposes (and partners therein); |

| ● | tax-exempt entities, organizations or arrangements, or governmental organizations (or controlled entities thereof); |

| ● | persons deemed to sell our common stock under the constructive sale provisions of the Code; |

| ● | persons who hold or receive our common stock pursuant to the exercise of any option, warrant, or similar derivative security or otherwise

as compensation; |

| ● | persons who hold our common stock and have a function currency other than the U.S. dollar; |

| ● | persons who hold our common stock required to accelerate the recognition of any item of gross income with respect to such security,

as a result of such income being recognized on an applicable financial statement; and |

| ● | tax-deferred or other retirement accounts and pension plans. |

If an entity or arrangement treated as a partnership

or other entities or arrangements that are pass-through entity for U.S. federal income tax purposes holds our common stock, the tax treatment

of such partnership or pass-through entity and a partner of the partnership or owner of the pass-through entity will depend on the activities

of the partnership or pass-through entity and certain determinations made at the partner or owner level, respectively. Accordingly, partnerships

and pass-through entities holding our common stock and the partners or owners in such partnerships or pass-through entities, respectively,

should consult their tax advisors regarding the U.S. federal income tax consequences to them in connection with the purchase, ownership

and disposition of our common stock.

THIS DISCUSSION IS FOR INFORMATIONAL PURPOSES

ONLY AND DOES NOT CONSTITUTE TAX ADVICE. INVESTORS SHOULD CONSULT THEIR TAX ADVISORS WITH RESPECT TO THE APPLICATION OF THE U.S. FEDERAL

INCOME TAX LAWS TO THEIR PARTICULAR SITUATIONS AS WELL AS ANY TAX CONSEQUENCES OF THE PURCHASE, OWNERSHIP AND DISPOSITION OF OUR COMMON

STOCK ARISING UNDER THE U.S. FEDERAL ESTATE OR GIFT TAX LAWS OR UNDER THE LAWS OF ANY STATE, LOCAL OR NON-U.S. TAXING JURISDICTION OR

UNDER ANY APPLICABLE INCOME TAX TREATY.

Definition of a Non-U.S. Holder

For purposes of this discussion, a “Non-U.S.

Holder” is any beneficial owner of our common stock that is neither a “U.S. person” nor an entity treated as a partnership

for U.S. federal income tax purposes. A U.S. person is any person that, for U.S. federal income tax purposes, is or is treated as any

of the following:

| ● | an individual who is a citizen or resident of the United States; |

| ● | a corporation or other entity treated as a corporation that is created or organized under the laws of the United States, any state

thereof, or the District of Columbia; |

| ● | an estate, the income of which is subject to U.S. federal income tax regardless of its source; or |

| ● | a trust that (i) is subject to the primary supervision of a U.S. court and the control of one or more “United States persons”

(within the meaning of Section 7701(a)(30) of the Code), or (ii) has a valid election in effect to be treated as a United States person

for U.S. federal income tax purposes. |

Distributions

We do not currently intend to pay any cash dividends

on our common stock in the foreseeable future. However, if we make distributions of cash or property on our common stock, such distributions

will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits,

as determined under U.S. federal income tax principles. Amounts not treated as dividends for U.S. federal income tax purposes will constitute

a return of capital and first be applied against and reduce a Non-U.S. Holder’s adjusted tax basis in its common stock, but not

below zero. Any excess will be treated as capital gain and will be treated as described below under “—Sale or Other Taxable

Disposition.”

Subject to the discussions below on effectively

connected income, backup withholding and the Foreign Account Tax Compliance Act (“FATCA”), dividends paid to a Non-U.S. Holder

of our common stock will be subject to U.S. federal withholding tax at a rate of 30% of the gross amount of the dividends (or such lower

rate specified by an applicable income tax treaty, provided the Non-U.S. Holder furnishes a valid IRS Form W-8BEN or W-8BEN-E (or other

applicable documentation) certifying qualification for the lower treaty rate). A Non-U.S. Holder that does not timely furnish the required

documentation, but that qualifies for a reduced treaty rate, may obtain a refund of any excess amounts withheld by timely filing an appropriate

claim for refund with the IRS. Non-U.S. Holders should consult their tax advisors regarding their entitlement to benefits under any applicable

income tax treaty.

If dividends paid to a Non-U.S. Holder are effectively

connected with the Non-U.S. Holder’s conduct of a trade or business within the United States (and, if required by an applicable

income tax treaty, the Non-U.S. Holder maintains a permanent establishment or fixed base in the United States to which such dividends

are attributable), the Non-U.S. Holder will be exempt from the U.S. federal withholding tax described above. To claim the exemption, the

Non-U.S. Holder must furnish to the applicable withholding agent a valid IRS Form W-8ECI (or applicable successor form or other applicable

documentation), certifying that the dividends are effectively connected with the Non-U.S. Holder’s conduct of a trade or business

within the United States.

Any such effectively connected dividends will

be subject to U.S. federal income tax on a net income basis at the regular graduated rates. A Non-U.S. Holder that is a corporation also

may be subject to an additional branch profits tax at a rate of 30% (or such lower rate specified by an applicable income tax treaty)

on such effectively connected dividends, as adjusted for certain items. Non-U.S. Holders should consult their tax advisors regarding any

applicable tax treaties that may provide for different rules.

Sale or Other Taxable Disposition

Subject to the discussions below regarding backup

withholding and FATCA, a Non-U.S. Holder will not be subject to U.S. federal income tax on any gain realized upon the sale or other taxable

disposition of our common stock unless:

| ● | the gain is effectively connected with the Non-U.S. Holder’s conduct of a trade or business within

the United States (and, if required by an applicable income tax treaty, the Non-U.S. Holder maintains a permanent establishment or fixed

base in the United States to which such gain is attributable); |

| ● | the Non-U.S. Holder is a nonresident alien individual present in the United States for 183 days or more

during the taxable year of the disposition and certain other requirements are met; or |

| ● | our common stock constitutes a U.S. real property interest, or USRPI, by reason of our status as a U.S.

real property holding corporation, or USRPHC, for U.S. federal income tax purposes. |

Gain described in the first bullet point above

generally will be subject to U.S. federal income tax on a net income basis at the regular graduated rates. A Non-U.S. Holder that is a

corporation also may be subject to an additional branch profits tax at a rate of 30% (or such lower rate specified by an applicable income

tax treaty) on such effectively connected gain, as adjusted for certain items.

Gain described in the second bullet point above

will be subject to U.S. federal income tax at a rate of 30% (or such lower rate specified by an applicable income tax treaty), which may

be offset by U.S.-source capital losses of the Non-U.S. Holder (even though the individual is not considered a resident of the United

States), provided the Non-U.S. Holder has timely filed U.S. federal income tax returns with respect to such losses.

With respect to the third bullet point above,

we believe we currently are not, and do not anticipate becoming, a USRPHC. Because the determination of whether we are a USRPHC depends,

however, on the fair market value of our USRPIs relative to the fair market value of our non-USRPIs and our other business assets, there

can be no assurance we currently are not a USRPHC or will not become one in the future. Even if we are or were to become a USRPHC, gain

arising from the sale or other taxable disposition by a Non-U.S. Holder of our common stock will not be subject to U.S. federal income

tax if our common stock is considered “regularly traded,” as defined by applicable Treasury Regulations, on an established

securities market, and such Non-U.S. Holder owned, actually or constructively, 5% or less of our common stock throughout the shorter of

the five-year period ending on the date of the sale or other taxable disposition or the Non-U.S. Holder’s holding period. If we

are a USRPHC and either our common stock is not regularly traded on an established securities market or a Non-U.S. Holder holds more than

5% of our common stock, actually or constructively, during the applicable period, such Non-U.S. Holder will generally be taxed on any

gain in the same manner as gain that is effectively connected with the conduct of a U.S. trade or business, except that the branch profits

tax generally will not apply. No assurance can be provided that our common stock will be regularly traded on an established securities

market for purposes of the rule described above.

Non-U.S. Holders should consult their tax advisors

regarding potentially applicable income tax treaties that may provide for different rules.

Information Reporting and Backup Withholding

Payments of dividends on our common stock will

not be subject to backup withholding at the applicable rate (currently, 24%), provided the applicable withholding agent does not have

actual knowledge or reason to know the holder is a U.S. person and the holder either certifies its non-U.S. status, such as by furnishing

a valid IRS Form W-8BEN, W-8BEN-E or W-8ECI, or otherwise establishes an exemption. However, information returns are required to be filed

with the IRS in connection with any dividends on our common stock paid to a Non-U.S. Holder, regardless of whether any tax was actually

withheld. In addition, proceeds from the sale or other taxable disposition of our common stock within the United States or conducted through

certain U.S.-related brokers generally will not be subject to backup withholding or information reporting, if the applicable withholding

agent receives the certification described above and does not have actual knowledge or reason to know that such holder is a United States

person, or the holder otherwise establishes an exemption. Proceeds of a disposition of our common stock conducted through a non-U.S. office

of a non-U.S. broker that does not have certain enumerated relationships with the United States generally will not be subject to backup

withholding or information reporting.

Copies of information returns that are filed with

the IRS may also be made available under the provisions of an applicable treaty or agreement to the tax authorities of the country in

which the Non-U.S. Holder resides or is established.

Backup withholding is not an additional tax. Any

amounts withheld under the backup withholding rules may be allowed as a refund or a credit against a Non-U.S. Holder’s U.S. federal

income tax liability, provided the required information is timely furnished to the IRS.

FATCA

Withholding taxes may be imposed

under Sections 1471 to 1474 of the Code (such Sections commonly referred to as FATCA) on certain types of payments made to non-U.S. financial

institutions and certain other non-U.S. entities. Specifically, a 30% withholding tax may be imposed on dividends on, or gross proceeds

from the sale or other disposition of, our common stock paid to a “foreign financial institution” or a “non-financial

foreign entity” (each as defined in the Code), unless (i) the foreign financial institution undertakes certain diligence and reporting

obligations, (ii) the non-financial foreign entity either certifies it does not have any “substantial United States owners”

(as defined in the Code) or furnishes identifying information regarding each substantial United States owner or (iii) the foreign financial

institution or non-financial foreign entity otherwise qualifies for an exemption from these rules. If the payee is a foreign financial

institution and is subject to the diligence and reporting requirements in (i) above, it must enter into an agreement with the U.S. Department

of the Treasury requiring, among other things, that it undertake to identify accounts held by certain “specified United States persons”

or “United States-owned foreign entities” (each as defined in the Code), annually report certain information about such accounts,

and withhold 30% on certain payments to non-compliant foreign financial institutions and certain other account holders. Foreign financial

institutions located in jurisdictions that have an intergovernmental agreement with the United States governing FATCA may be subject to

different rules.

Under the applicable Treasury

Regulations and administrative guidance, these withholding requirements generally currently apply to payments of dividends on our common

stock. Although withholding under FATCA would have applied to payments of gross proceeds from the taxable disposition of our common stock

on or after January 1, 2019, proposed regulations from the U.S. Department of the Treasury eliminate FATCA withholding on payments of

gross proceeds entirely. Taxpayers generally may rely on those proposed regulations until final regulations are issued, such that this

withholding tax currently will not apply to the gross proceeds from the sale or other disposition of our common stock.

Prospective investors should

consult their tax advisors regarding the potential application of withholding under FATCA to their investment in our common stock.

PLAN

OF DISTRIBUTION

The Selling Stockholders may, from time to time,

sell any or all of their Shares on any stock exchange, market or trading facility on which the Shares are traded or in private transactions.

If the Shares are sold through underwriters, the Selling Stockholders will be responsible for underwriting discounts or commissions or

agent’s commissions. These sales may be at fixed prices, at prevailing market prices at the time of the sale, at varying prices

determined at the time of sale or at negotiated prices. The Selling Stockholders may use any one or more of the following methods when

selling the Shares:

| |

● |

any national securities exchange or quotation service on which the Shares may be listed or quoted at the time of sale; |

| |

● |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

● |

block trades in which the broker-dealer will attempt to sell the Shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

● |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

● |

transactions other than on these exchanges or systems or in the over-the-counter market; |

| |

● |

through the writing of options, whether such options are listed on an options exchange or otherwise; |

| |

● |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

● |

privately negotiated transactions; |

| |

● |

broker-dealers may agree with the Selling Stockholders to sell a specified number of such Shares at a stipulated price; |

| |

● |

a combination of any such methods of sale; and |

| |

● |

any other method permitted pursuant to applicable law. |

The Selling Stockholders may also sell Shares

under Rule 144 under the Securities Act, if available, rather than under this prospectus, or they may engage in short sales against the

box, puts and calls and other transactions in our securities or derivatives of our securities and may sell or deliver shares in connection

with these trades.

Broker-dealers engaged by the Selling Stockholders

may arrange for other broker-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Stockholders

(or, if any broker-dealer acts as agent for the purchaser of Securities, from the purchaser) in amounts to be negotiated. The Selling

Stockholders do not expect these commissions and discounts to exceed what is customary in the types of transactions involved. Any profits

on the resale of Shares by a broker-dealer acting as principal might be deemed to be underwriting discounts or commissions under the Securities

Act. Discounts, concessions, commissions and similar selling expenses, if any, attributable to the sale of Shares will be borne by a Selling

Stockholders. Any Selling Security Holder may agree to indemnify any agent, dealer or broker-dealer that participates in transactions

involving sales of the shares if liabilities are imposed on that person under the Securities Act.

In connection with the sale of the Shares or otherwise,

the Selling Stockholders may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of the Shares

in the course of hedging in positions they assume. The Selling Stockholders may also sell Shares short and deliver Shares covered by this

prospectus to close out short positions and to return borrowed Shares in connection with such short sales. The Selling Stockholders may

also loan or pledge Shares to broker-dealers that in turn may sell such Shares.

The Selling Stockholders may from time to time

pledge or grant a security interest in some or all of the Shares owned by them and, if they default in the performance of their secured

obligations, the pledgees or secured parties may offer and sell the Shares from time to time under this prospectus after we have filed

an amendment to this prospectus under Rule 424 or other applicable provision of the Securities Act amending the list of Selling Stockholders

to include the pledgee, transferee or other successors in interest as a Selling Stockholder under this prospectus.

The Selling Stockholders also may transfer the

Shares in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial

owners for purposes of this prospectus and may sell the Shares from time to time under this prospectus after we have filed an amendment

to this prospectus under Rule 424 or other applicable provision of the Securities Act amending the list of Selling Stockholders to include

the pledgees, transferees or other successors in interest as a Security Holder under this prospectus. The Selling Stockholders also may

transfer and donate the Shares in other circumstances in which case the transferees, donees, pledgees or other successors in interest

will be the selling beneficial owners for purposes of this prospectus.

The Selling Stockholders and any broker-dealers

or agents that are involved in selling the Shares may be deemed to be “underwriters” within the meaning of the Securities

Act in connection with such sales. In such event, any commissions paid, or any discounts or concessions allowed to, such broker-dealers

or agents and any profit realized on the resale of the Shares purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. At the time a particular offering of the Shares is made, a prospectus supplement, if required, will be distributed,

which will set forth the aggregate amount of Shares being offered and the terms of the offering, including the name or names of any broker-dealers

or agents, any discounts, commissions and other terms constituting compensation from the Selling Stockholders, as applicable, and any

discounts, commissions or concessions allowed or re-allowed or paid to broker-dealers. Under the securities laws of some states, the Shares

may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the Shares may not be sold

unless such securities have been registered or qualified for sale in such state or an exemption from registration or qualification is

available and is complied with. There can be no assurance that any Selling Stockholders will sell any or all of the Shares registered

pursuant to the registration statement of which this prospectus forms a part.

Each Selling Security Holder has informed us that

it does not have any agreement or understanding, directly or indirectly, with any person to distribute the Shares. Based on information

provided to us, none of the Selling Stockholders are broker-dealers or affiliates of broker-dealers.

We are paying all fees and expenses incident to

the registration of the Shares. Except with respect to indemnification of the Selling Noteholders pursuant to the Registration Rights

Agreement entered into in connection with the Notes offering, we are not obligated to pay any of the expenses of any attorney or other

advisor engaged by a Selling Stockholder. We have agreed to indemnify the Selling Noteholders against certain losses, claims, damages

and liabilities, including liabilities under the Securities Act.

If we are notified by any Selling Stockholder

that any material arrangement has been entered into with a broker-dealer for the sale of Shares, we will file a post-effective amendment

to the registration statement. If the Selling Stockholders use this prospectus for any sale of the Shares, they will be subject to the

prospectus delivery requirements of the Securities Act.

The anti-manipulation rules of Regulation M under

the Exchange Act may apply to sales of the Shares and activities of the Selling Stockholders, which may limit the timing of purchases

and sales of any of the Shares by the Selling Stockholders and any other participating person. Regulation M may also restrict the ability

of any person engaged in the distribution of the Shares to engage in passive market-making activities with respect to the Shares. Passive

market making involves transactions in which a market maker acts as both our underwriter and as a purchaser of the Shares in the secondary

market. All of the foregoing may affect the marketability of the Shares and the ability of any person or entity to engage in market-making

activities with respect to the Shares.

Once sold under the registration statement of

which this prospectus forms a part, the Shares will be freely tradable in the hands of persons other than our affiliates.

LEGAL

MATTERS

The validity of the Shares offered hereby will

be passed upon for us by K&L Gates LLP, Charlotte, North Carolina.

EXPERTS

The consolidated financial statements of Akoustis

Technologies, Inc. as of June 30, 2023 and 2022 and for the years then ended incorporated by reference in this prospectus and the registration

statement of which this prospectus forms a part, have been audited by Marcum LLP, independent registered public accounting firm, as set

forth in its report thereon appearing in our annual report on Form 10-K for the fiscal year ended June 30, 2023 and are incorporated by

reference in reliance on such report given upon such firm’s authority as an expert in auditing and accounting.

WHERE

YOU CAN FIND MORE INFORMATION

We file annual reports, quarterly reports, current

reports and other information with the SEC. You may read or obtain a copy of these reports at our website address, www.akoustis.com, or

at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of

the public reference room and their copy charges by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains registration

statements, reports, proxy information statements and other information regarding registrants that file electronically with the SEC. The

address of the website is http://www.sec.gov.

We have filed with the SEC a Registration Statement

on Form S-3 under the Securities Act to register the Shares offered by this prospectus. The term “registration statement”

means the original registration statement and any and all amendments thereto, including the schedules and exhibits to the original registration

statement or any amendment. This prospectus is part of that registration statement. This prospectus does not contain all of the information

set forth in the registration statement or the exhibits to the registration statement. For further information with respect to us and

the Shares being offered pursuant to this prospectus, you should refer to the registration statement and its exhibits. Statements contained

in this prospectus as to the contents of any contract, agreement or other document referred to are not necessarily complete, and you should

refer to the copy of that contract or other documents filed as an exhibit to the registration statement. You may read or obtain a copy

of the registration statement at the SEC’s public reference facilities and Internet sites referred to above.

The information found on, or otherwise accessible

through, any website referenced in this prospectus is not incorporated into, and does not form a part of, this prospectus.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference”

information from other documents that we file with it, which means that we can disclose important information to you by referring you

to those documents. The information incorporated by reference is considered to be part of this prospectus. Information in this prospectus

supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus.

We incorporate by reference into this prospectus

and the registration statement of which this prospectus is a part the information or documents listed below that we have filed with the

SEC:

| ● | our annual report on Form 10-K for the fiscal year ended June 30, 2023 filed with the SEC on September

6, 2023; |

| ● | our quarterly reports on Form 10-Q for the fiscal quarters ending September 30, 2023, December 31, 2023,

and March 31, 2024, filed with the SEC on November 13, 2023, February 13, 2024, and May 13, 2024, respectively; |

| ● | the description of our Common Stock contained in our Registration Statement on Form 8-A (File No. 001-38029)

filed with the SEC on March 10, 2017, including any amendment or report filed for the purpose of updating such description. |

All documents we file with the SEC pursuant to

Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, except as to any portion of any report or documents that is not deemed filed under

such provisions, (1) on or after the date of filing of the registration statement containing this prospectus and prior to the effectiveness

of the registration statement and (2) on or after the date of this prospectus until the earlier of the date on which all of the securities

registered hereunder have been sold or the registration statement of which this prospectus is a part has been withdrawn, shall be deemed

incorporated by reference in this prospectus and to be a part of this prospectus from the date of filing of those documents.

We will furnish without charge to you, on written

or oral request, a copy of any or all of the documents incorporated by reference, including exhibits to these documents. You should direct

any requests for documents to Akoustis Technologies, Inc., 9805 Northcross Center Court, Suite A, Huntersville, North Carolina 28078,

Attention: Corporate Secretary; Telephone: (704) 997-5735. Copies of the above reports may also be accessed from our web site at www.akoustis.com.

We have authorized no one to provide you with any information that differs from that contained in this prospectus. Accordingly, you should

not rely on any information that is not contained in this prospectus. You should not assume that the information in this prospectus is

accurate as of any date other than the date of the front cover of this prospectus.

Any statement contained in a document incorporated

or deemed to be incorporated by reference in this prospectus will be deemed modified, superseded or replaced for purposes of this prospectus

to the extent that a statement contained in this prospectus modifies, supersedes or replaces such statement.

AKOUSTIS TECHNOLOGIES, INC.

5,028,291 Shares of Common Stock for sale by

the Selling Stockholders

PROSPECTUS

,

2024

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

Set forth below is an estimate (except for registration

fees, which are actual) of the approximate amount of the fees and expenses payable by us in connection with the issuance and distribution

of the shares of our Common Stock. The Selling Stockholders will not be responsible for any of the expenses of this offering.

| SEC registration fee | |

$ | 423 | |

| Accounting fees and expenses | |

$ | 12,000 | |

| Legal fees and expenses | |

$ | 15,000 | |

| Miscellaneous | |

$ | 577 | |

| Total | |

$ | 26,000 | |

Item 15. Indemnification of Directors and Officers.

Section 102(b)(7) of the DGCL allows a corporation