As filed with the Securities and Exchange Commission

on November 25, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

ALARUM TECHNOLOGIES LTD.

(Exact name of

registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s Name into English)

| Israel |

|

Not Applicable |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

30 Haarba’a Street

Tel Aviv

6473926 Israel +97298666110

(Address and telephone number of registrant’s

principal executive offices)

NetNut Networks Inc.

4607 Library Rd Ste 220 #1067

Bethel Park, PA 15102

Tel: 973.506.8810

(Name, address, and telephone number of agent for

service)

Copies to:

|

Oded Har-Even, Esq.

Howard E. Berkenblit, Esq.

Sullivan & Worcester LLP

1251 Avenue of the Americas

New York, NY 10020

Tel: (212) 660-3000 |

Reut Alfiah, Adv.

Sullivan & Worcester Tel-Aviv (Har-Even

& Co.)

28 HaArba’a St. HaArba’a Towers

North Tower, 35th floor

Tel-Aviv, Israel 6473925

Tel: +972 74-758-0480 |

Approximate date of commencement of proposed sale

to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

| † | The term “new or revised financial accounting standard”

refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The information in

this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities and it is not soliciting an offer

to buy securities in any state where the offer or sale is not permitted.

Subject

to Completion, dated November 25, 2024

PROSPECTUS

$100,000,000

ALARUM TECHNOLOGIES

LTD.

American Depositary

Shares Representing Ordinary Shares

We may offer and sell from

time to time in one or more offerings up to a total amount of $100,000,000 of American Depositary Shares, or ADSs, which we also refer

to as the “securities.” Each ADS represents ten (10) of our ordinary shares, no par value. Each time we sell securities pursuant

to this prospectus, we will provide in a supplement to this prospectus the price and any other material terms of any such offering. We

may also authorize one or more free writing prospectuses to be provided to you in connection with each offering. Any prospectus supplement

and related free writing prospectuses may also add, update or change information contained in the prospectus. You should read this prospectus,

any applicable prospectus supplement and related free writing prospectuses, as well as the documents incorporated by reference or deemed

incorporated by reference into this prospectus, carefully before you invest in the securities.

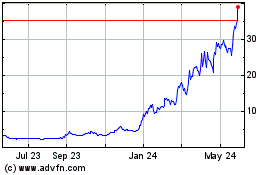

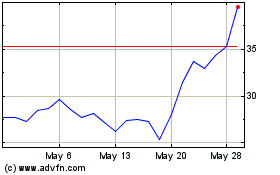

The ADSs are traded on the

Nasdaq Capital Market under the symbol “ALAR.”

Investing in the securities

involves a high degree of risk, including that the trading price of ADSs has been subject to volatility and investors in this offering

may not be able to sell their ADSs above the actual offering price or at all. Risks associated with an investment in the securities will

be described in any applicable prospectus supplement and are and will be described in certain of our filings with the Securities and Exchange

Commission, or SEC, as described in “Risk Factors” on page 2.

The securities may be sold

directly by us to investors, through agents designated from time to time or to or through underwriters or dealers, or through a combination

of such methods, on a continuous or delayed basis. For additional information on the methods of sale, you should refer to the section

entitled “Plan of Distribution” in this prospectus. If any agents or underwriters are involved in the sale of the securities

with respect to which this prospectus is being delivered, the names of such agents or underwriters and any applicable fees, commissions,

discounts and over-allotment options will be set forth in a prospectus supplement. The price to the public of the securities and the net

proceeds that we expect to receive from such sale will also be set forth in a prospectus supplement.

Neither the Securities

and Exchange Commission nor any state or other securities commission has approved or disapproved of these securities or determined if

this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus

is , 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement on Form F-3 that we filed with the U.S. Securities and Exchange Commission, or the SEC, utilizing a “shelf”

registration process. Under this shelf registration process, we may offer from time to time up to an aggregate of $100,000,000 of the

securities in one or more offerings.

Each time we sell securities,

we will provide you with a prospectus supplement that will describe the specific amounts, prices and terms of such offering. We may also

authorize one or more free writing prospectuses to be provided to you in connection with such offering. The prospectus supplement and

any related free writing prospectuses may also add, update or change information contained in this prospectus. You should read carefully

both this prospectus, the applicable prospectus supplement and any related free writing prospectus together with additional information

described below under “Incorporation of Certain Information by Reference” and “Where You Can Find Additional Information”

before buying the securities being offered.

This prospectus does not contain

all of the information provided in the registration statement that we filed with the SEC. For further information about us or the securities,

you should refer to that registration statement, which you can obtain from the SEC as described below under “Incorporation of Certain

Information by Reference” and “Where You Can Find Additional Information.”

You should rely only on the

information contained or incorporated by reference in this prospectus, a prospectus supplement and related free writing prospectuses.

We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. This prospectus is not an offer to sell these securities and it is not soliciting an offer to

buy these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained

in this prospectus and the accompanying prospectus supplement or related free writing prospectuses is accurate on any date subsequent

to the date set forth on the front of the document or that any information that we have incorporated by reference is correct on any date

subsequent to the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects

may have changed since those dates.

Unless

otherwise indicated, all references to the “Company,” “we,” “our” and “Alarum” refer to

Alarum Technologies Ltd. and its wholly owned Israeli subsidiaries NetNut Ltd., or NetNut, NetNut Ltd.’s wholly owned subsidiary

- NetNut Networks Inc., a Delaware corporation, Safe-T Data A.R Ltd., CyberKick Ltd., CyberKick Ltd.’s wholly owned subsidiaries

- RoboVPN Technologies Ltd., a Cyprus corporation (under voluntary dissolution), and Spell Me Ltd., a Seychelles corporation. References

to “Ordinary Shares” mean our Ordinary Shares, no par value.

OUR COMPANY

We are a global internet access

and web data collection provider. We operate in two distinct segments, providing solutions according to specific needs. The segments include

the enterprise internet access segment, which is our main segment, and the consumer internet access segment.

Our enterprise internet access

and web data collection solutions offer a global web data collection cloud service, based on our proprietary proxy traffic optimization

and routing technology, and built on partnership agreements with tens of Internet Service Providers, or ISPs, and with application publishers.

Our service allows organizations

to collect vast amounts of web and internet data by simultaneously connecting to the internet from different IP addresses while maintaining

full anonymity and privacy. Our customers can choose from various types of Internet Protocol addresses, or IPs, from our IP pool which

contains millions of IPs, including ISP IPs, data center IPs and residential service provider IPs.

With our web data collection

service, organizations can collect accurate, transparent web data from public online sources. The solution also allows access to undiscovered

data from non-traditional data sources and allows customers to gain additional data-driven information that provides valuable insights

with respect to predictive capabilities or behaviors, thereby assisting ongoing business management operation and decision making. An

added benefit to our customers is the fact that utilizing our network completely hides enterprises from the internet by modifying IP addresses,

thus ensuring high levels of privacy for their online presence.

Our consumer internet access

solutions provide a powerful, secured and encrypted connection, masking consumers’ online activity and keeping them safe from

hackers. The solutions are designed for advanced and basic users, ensuring complete protection for all personal and digital information.

As part of our focus on generating profitable revenues, we decided in July 2023 to downscale our investment in the consumer internet access

segment of our business. We continue to maintain our products and the service only to current paying users, which allows us to generate

revenue from past investments in acquiring such users, with minimal costs.

RISK FACTORS

Investing in our securities

involves significant risks. Before making an investment decision, you should carefully consider the risks described under the summary

above, under “Risk Factors” in the applicable prospectus supplement and under Item 3.D. - “Risk Factors” in our

most recent Annual Report on Form 20-F, or any updates in our Reports on Form 6-K, together with all of the other information appearing

in this prospectus or incorporated by reference into this prospectus and any applicable prospectus supplement, in light of your particular

investment objectives and financial circumstances. The risks so described are not the only risks facing us. Additional risks not presently

known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition and results

of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any

of these risks, and you may lose all or part of your investment. The discussion of risks includes or refers to forward-looking statements;

you should read the explanation of the qualifications and limitations on such forward-looking statements discussed elsewhere in this prospectus.

NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus contains,

and any accompanying prospectus supplement will contain, forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act,

and the Private Securities Litigation Reform Act of 1995. Also, documents that we incorporate by reference into this prospectus, including

documents that we subsequently file with the SEC, contain and will contain forward-looking statements. Forward-looking statements are

those that predict or describe future events or trends and that do not relate solely to historical matters. You can generally identify

forward-looking statements as statements containing the words “may,” “will,” “could,” “should,”

“expect,” “anticipate” “objective,” “goal,” “intend,” “estimate,”

“believe,” “project,” “plan,” “assume” or other similar expressions, or negatives of those

expressions, although not all forward-looking statements contain these identifying words. All statements contained or incorporated by

reference in this prospectus and any prospectus supplement regarding our future strategy, future operations, projected financial position,

proposed products, anticipated collaborations, estimated future revenues, projected costs, future prospects, the future of our industry

and results that might be obtained by pursuing management’s current plans and objectives, are forward-looking statements.

You should not place undue

reliance on our forward-looking statements because the matters they describe are subject to certain risks, uncertainties and assumptions,

including in many cases decisions or actions by third parties, that are difficult to predict. Our forward-looking statements are based

on the information currently available to us and speak only as of the date on the cover of this prospectus, the date of any prospectus

supplement, or, in the case of forward-looking statements incorporated by reference, the date of the filing that includes the statement.

Over time, our actual results, performance or achievements may differ from those expressed or implied by our forward-looking statements,

and such difference might be significant and materially adverse to our security holders. We undertake no obligation to update publicly

any forward-looking statements, whether as a result of new information, future events or otherwise.

We have identified some of

the important factors that could cause future events to differ from our current expectations and they are described in this prospectus

and supplements to this prospectus (if any) under the caption “Risk Factors,” as well as in our most recent Annual Report

on Form 20-F, including without limitation under the captions “Risk Factors” and “Operating and Financial Review and

Prospects,” and in other documents that we may file with the SEC, all of which you should review carefully. Please consider our

forward-looking statements in light of those risks as you read this prospectus, the documents incorporated by reference herein, and any

prospectus supplement.

capitalization

The following table sets forth

our cash and cash equivalents and capitalization as of September 30, 2024. The information in this table is derived from our interim unaudited

financial information as of September 30, 2024, and should be read in conjunction with and is qualified by reference to such financial

information and other financial information incorporated by reference into this prospectus.

| U.S. dollars in thousands | |

As of September 30,

2024 | |

| | |

| |

| Cash and cash equivalents | |

$ | 24,011 | |

| | |

| | |

| Long-term loan and current maturities of long-term loan | |

| 937 | |

| Derivative financial instruments | |

| 224 | |

| | |

| | |

| Equity: | |

| | |

| Ordinary shares, no par value: | |

| | |

| 150,000,000 Ordinary Shares authorized; 68,722,484 Ordinary Shares issued and outstanding | |

| - | |

| Share premium | |

| 111,607 | |

| Other equity reserves | |

| 10,362 | |

| Accumulated deficit | |

| (96,995 | ) |

| Total shareholders’ equity | |

| 24,974 | |

| Total capitalization (1) | |

$ | 26,135 | |

| (1) | Consists of long-term loan, derivative financial instruments

and total shareholders’ equity. |

USE

OF PROCEEDS

Unless otherwise set forth

in the related prospectus supplement or, if applicable, the pricing supplement, we intend to use the net proceeds from the sale of securities

offered through this prospectus for general corporate purposes, which include financing our operations, capital expenditures and business

development, and for pursuing strategic opportunities, including, but not limited to, strategic acquisitions. The specific purpose of

any individual issuance of securities will be described in the related prospectus supplement.

DESCRIPTION OF SHARE CAPITAL

As

of November 25, 2024, our authorized share capital consisted of 150,000,000 Ordinary Shares, no par value per share, of which 68,931,797

Ordinary Shares (representing 6,893,179 ADSs) were issued and outstanding as of such date. All of our outstanding Ordinary Shares have

been validly issued, fully paid and non-assessable. Our Ordinary Shares are not redeemable and are not subject to any preemptive right.

Our

registration number with the Israeli Registrar of Companies is 511418477.

Purposes and Objectives of the Company

Our purpose is set forth in

our articles of association and includes every lawful purpose.

The Powers of the

Directors

Our Board of Directors shall

direct our policy and shall supervise the performance of our Chief Executive Officer and his actions. Our Board of Directors may exercise

all powers that are not required under the Israeli Companies Law 5759-1999, or the Israeli Companies

Law, or under our articles of association to be exercised or taken by our shareholders.

Rights Attached

to Shares

Our Ordinary Shares shall

confer upon the holders thereof:

| |

● |

equal right to attend and

to vote at all of our general meetings, whether regular or special, with each Ordinary Share entitling the holder thereof, which

attend the meeting and participate at the voting, either in person or by a proxy or by a written ballot, to one vote; |

| |

|

|

| |

● |

equal right to participate

in distribution of dividends, if any, whether payable in cash or in bonus shares, in distribution of assets or in any other distribution,

on a per share pro rata basis; and |

| |

|

|

| |

● |

equal right to participate,

upon our dissolution, in the distribution of our assets legally available for distribution, on a per share pro rata basis. |

Election of Directors

Pursuant to our articles of

association, our Board of Directors is divided into three classes with staggered three-year terms, in a manner that each director, except

external directors, serves for a term of three years, and holds office until the annual general meeting of our shareholders for the year

in which his or her term expires, unless (i) he or she is removed by a 65% majority of the shareholders voting on such matter at an annual

meeting of our shareholders, provided that such majority constitutes more than 50% of the our then issued and outstanding share capital

or (ii) upon the occurrence of certain events, in accordance with the Israeli Companies Law and our articles of association. Pursuant

to our articles of association, other than external directors, for whom special election requirements apply under the Israeli

Companies Law, the vote required to appoint a director is a simple majority vote of holders of our voting shares, participating and voting

at the relevant meeting. In addition, our articles of association allow our Board of Directors to appoint directors to fill vacancies

and/or as an addition to the Board of Directors (subject to the maximum number of twelve directors) to serve for the remaining period

of time during which the director whose service has ended would have held office, or in case of an addition to the Board of Directors,

in accordance with the class assigned to such appointed director, as determined by the Board of Directors at the time of such appointment.

External directors are elected for an initial term of three years, may be elected for additional terms of three years each under certain

circumstances, and may be removed from office pursuant to the terms of the Israeli Companies

Law. See “Item 6.C— Management—Board Practices—External Directors” in our most recent Annual Report on Form

20-F incorporated by reference herein for additional information.

Annual and Special Meetings

Under the Israeli Companies

Law, we are required to hold an annual general meeting of our shareholders once every calendar year, at such time and place which shall

be determined by our Board of Directors, that must be no later than 15 months after the date of the previous annual general meeting. All

meetings other than the annual general meeting of shareholders are referred to as special general meetings. Under the Israeli Companies

Law, our Board of Directors may call special general meetings whenever it sees fit and upon the request of: (a) any two of our directors

or such number of directors equal to one quarter of the directors then at office; and/or (b) one or more shareholders holding, in the

aggregate, (i) 5% or more of our outstanding issued shares and 1% of our outstanding voting power or (ii) 5% or more of our outstanding

voting power, or the Non Exempted Holding. However, under new exemptions applicable as of March 12, 2024, or the New Exemptions, the board

of directors of an Israeli company whose shares are listed outside of Israel, shall convene a special general meeting at the request of

one or more shareholders holding at least 10% of the issued and outstanding share capital instead of 5% in the past, and at least 1% of

the voting rights in the company, or one or more shareholders holding at least 10% of the voting rights in the company, provided that

if the applicable law as applicable to companies incorporated in the country which the Company is listed for trade, establishes a right

to demand convening of such a meeting for those holding a percentage of holdings lower than 10%, then the Non Exempted Holding shall apply.

Subject to the provisions

of the Israeli Companies Law and the regulations promulgated thereunder, shareholders entitled to participate and vote at general meetings

are the shareholders of record on a date to be decided by the board of directors, which may be between four and 60 days prior to the date

of the meeting. Resolutions regarding the following matters must be passed at a general meeting of our shareholders:

| |

● |

amendments to our articles

of association; |

| |

|

|

| |

● |

the exercise of our Board

of Director’s powers by a general meeting if our Board of Directors is unable to exercise its powers and the exercise of any

of its powers is required for our proper management; |

| |

|

|

| |

● |

appointment or termination

of our auditors, and their compensation; |

| |

|

|

| |

● |

appointment of directors,

including external directors; |

| |

|

|

| |

● |

approval of acts and transactions

requiring general meeting approval pursuant to the provisions of the Israeli Companies Law (mainly certain related party transactions)

and any other applicable law; |

| |

|

|

| |

● |

increases or reductions

of our authorized share capital; |

| |

|

|

| |

● |

a merger (as such term

is defined in the Israeli Companies Law); and |

| |

|

|

| |

● |

dissolution of the company

pursuant to the provisions of the Israeli Companies Law. |

Notices

The Israeli Companies Law

and the regulations promulgated thereunder require that a notice of any annual or special shareholders meeting be provided at least 21

days prior to the meeting, and if the agenda of the meeting includes, among others, the appointment or removal of directors, the approval

of transactions with office holders or interested or related parties, approval of the company’s general manager to serve as the

chairman of the board of directors or an approval of a merger, notice must be provided at least 35 days prior to the meeting.

Quorum

As permitted under the Israeli

Companies Law and according to our articles of association, the quorum required for our general meetings consists of at least two shareholders

present in person, by proxy, written ballot or voting by means of electronic voting system, who hold or represent between them at least

15% of the total outstanding voting rights. If within half an hour of the time set forth for the general meeting a quorum is not present,

if the general meeting was summoned following the request of a shareholder in accordance with Section 63 of the Israeli Companies Law,

then the meeting shall be cancelled, and in any other case, without any further notice the general meeting shall stand adjourned: (i)

to the same day of the following week, at the same hour and in the same place; (ii) to such other date, time and place as prescribed in

the notice to the shareholders; or (iii) to such day and at such time and place as the chairperson of the general meeting shall determine

(which may be earlier or later than the date pursuant to clause (i) above), or the Adjourned Meeting. In such Adjourned Meeting, any number

of shareholders present in person or by proxy shall constitute a quorum.

Adoption of Resolutions

Our articles of association

provide that the resolutions amending provisions of the articles related to the staggered board of directors and the composition of the

board, as well as a resolution to dismiss a director in office, will require an affirmative vote of 65% of the voting power represented

at a general meeting and voting thereon, provided that such majority constitutes more than 50% of our then issued and outstanding share

capital. Other than that, and unless otherwise required under the Israeli Companies Law,

all resolutions of our shareholders require a simple majority vote. A shareholder may vote in a general meeting in person, by proxy, by

a written ballot.

Changing Rights Attached to Shares

As permitted under the Israeli

Companies Law and according to our articles of association, unless otherwise provided by the terms of the shares and subject to any applicable

law, any modification of rights attached to any class of shares must be adopted by the Company by a resolution of the general meeting

of the holders of all shares as one class, without any required separate resolution of any class of shares.

The enlargement of an existing

class of shares or the issuance of additional shares thereof, shall not be deemed to modify the rights attached to the previously issued

shares of such class or of any other class, unless otherwise provided by the terms of the shares.

Limitations on the Right to Own Securities

in Our Company

There are no limitations on

the right to own our securities.

Provisions Restricting Change in Control

of Our Company

Our articles of association

provide for a staggered board of directors, which mechanism may delay, defer or prevent a change of control of the Company. Other than

that, there are no specific provisions of our articles of association that would have an effect of delaying, deferring or preventing a

change in control of the Company or that would operate only with respect to a merger, acquisition or corporate restructuring involving

us (or our Subsidiary).

However, as described below,

certain provisions of the Israeli Companies Law may have such delaying, deferring or preventing effect.

The Israeli Companies Law

includes provisions that allow a merger transaction and requires that each company that is a party to the merger have the transaction

approved by its board of directors and, unless certain requirements described under the Israeli Companies Law are met, a vote of the majority

of shareholders, and, in the case of the target company, also a majority vote of each class of its shares. For purposes of the shareholder

vote of each party, unless a court rules otherwise, the merger will not be deemed approved if shares representing a majority of the voting

power present at the shareholders meeting and which are not held by the other party to the merger (or by any person or group of persons

acting in concert who holds 25% or more of the voting power or the right to appoint 25% or more of the directors of the other party) vote

against the merger. If, however, the merger involves a merger with a company’s own controlling shareholder or if the controlling

shareholder has a personal interest in the merger, then the merger is instead subject to the same Special Majority approval that governs

all extraordinary transactions with controlling shareholders. Upon the request of a creditor of either party to the proposed merger, the

court may delay or prevent the merger if it concludes that there exists a reasonable concern that as a result of the merger the surviving

company will be unable to satisfy the obligations of any of the parties to the merger, and may further give instructions to secure the

rights of creditors. If the transaction would have been approved by the shareholders of a merging company but for the separate approval

of each class or the exclusion of the votes of certain shareholders as provided above, a court may still approve the merger upon the petition

of holders of at least 25% of the voting rights of a company. For such petition to be granted, the court must find that the merger is

fair and reasonable, considering the value of the parties to the merger and the consideration offered to the shareholders. In addition,

a merger may not be completed unless at least (1) 50 days have passed from the time that the requisite proposals for approval of the merger

were filed with the Israeli Registrar of Companies by each merging company and (2) 30 days have passed since the merger was approved by

the shareholders of each merging company.

The

Israeli Companies Law also provides that, subject to certain exceptions, an acquisition of shares in an Israeli public company must be

made by means of a “special” tender offer if as a result of the acquisition (1) the purchaser would become a holder of 25%

or more of the voting rights in the company, unless there is already another holder of at least 25% or more of the voting rights in the

company or (2) the purchaser would become a holder of 45% or more of the voting rights in the company, unless there is already a holder

of more than 45% of the voting rights in the company. These requirements do not apply if, in general, the acquisition (1) was made in

a private placement that received shareholders’ approval, subject to certain conditions, (2) was from a holder of 25% or more of

the voting rights in the company which resulted in the acquirer becoming a holder of 25% or more of the voting rights in the company,

or (3) was from a holder of more than 45% of the voting rights in the company which resulted in the acquirer becoming a holder of more

than 45% of the voting rights in the company. A “special” tender offer must be extended to all shareholders. In general, a

“special” tender offer may be consummated only if (1) at least 5% of the voting power attached to the company’s outstanding

shares will be acquired by the offeror and (2) the offer is accepted by a majority of the offerees who notified the company of their position

in connection with such offer (excluding the offeror, controlling shareholders, holders of 25% or more of the voting rights in the company

or anyone on their behalf, or any person having a personal interest in the acceptance of the tender offer). If a special tender offer

is accepted, then the purchaser or any person or entity controlling it or under common control with the purchaser or such controlling

person or entity may not make a subsequent tender offer for the purchase of shares of the target company and may not enter into a merger

with the target company for a period of one year from the date of the offer, unless the purchaser or such person or entity undertook to

effect such an offer or merger in the initial special tender offer.

However,

under the New Exemptions the aforesaid limitations do not apply for an Israeli company whose shares are listed outside of Israel, provided

that the applicable law as applicable to companies incorporated in the country which the company is listed for trade provide a restriction

on the acquisition of control of any proportion of the company or that the acquisition of control of any proportion requires the purchaser

to also offer a purchase offer to shareholders from among the public.

If, as a result of an acquisition

of shares, the acquirer will hold more than 90% of an Israeli company’s outstanding shares or of certain class of shares, the acquisition

must be made by means of a tender offer for all of the outstanding shares, or for all of the outstanding shares of such class, as applicable.

In general, if less than 5% of the outstanding shares, or of applicable class, are not tendered in the tender offer and more than half

of the offerees who have no personal interest in the offer tendered their shares, all the shares that the acquirer offered to purchase

will be transferred to it by operation of law. However, a tender offer will also be accepted if the shareholders who do not accept the

offer hold less than 2% of the issued and outstanding share capital of the company or of the applicable class of shares. Any shareholders

that was an offeree in such tender offer, whether such shareholder accepted the tender offer or not, may request, by petition to an Israeli

court, (i) appraisal rights in connection with a full tender offer, and (ii) that the fair value should be paid as determined by the court,

for a period of six months following the acceptance thereof. However, the acquirer is entitled to stipulate, under certain conditions,

that tendering shareholders will forfeit such appraisal rights.

Lastly, Israeli tax law treats

some acquisitions, such as stock-for-stock exchanges between an Israeli company and a foreign company, less favorably than U.S. tax laws.

For example, Israeli tax law may, under certain circumstances, subject a shareholder who exchanges his Ordinary Shares for shares in another

corporation to taxation prior to the sale of the shares received in such stock-for-stock swap.

Changes in Our Capital

The general meeting may, by

a simple majority vote of the shareholders attending the general meeting:

| |

● |

increase our registered

share capital by the creation of new shares from the existing class or a new class, as determined by the general meeting; |

| |

|

|

| |

● |

cancel any registered share

capital which have not been taken or agreed to be taken by any person; |

| |

|

|

| |

● |

consolidate and divide

all or any of our share capital into shares of larger nominal value than our existing shares; |

| |

|

|

| |

● |

subdivide our existing

shares or any of them, our share capital or any of it, into shares of smaller nominal value than is fixed; and |

| |

|

|

| |

● |

reduce our share capital

and any fund reserved for capital redemption in any manner, and with and subject to any incident authorized, and consent required,

by the Israeli Companies Law. |

DESCRIPTION OF THE AMERICAN DEPOSITARY SHARES

The Bank of New York Mellon,

as depositary, will register and deliver ADSs. Each ADS represents ten Ordinary Shares (or a right to receive ten Ordinary Shares) deposited

with Bank Hapoalim or Leumi Bank, as custodian for the depositary in Tel Aviv. Each ADS will also represent any other securities, cash

or other property which may be held by the depositary. The deposited shares together with any other securities, cash or other property

held by the depositary are referred to as the deposited securities. The depositary’s office at which the ADSs will be administered

is located at 240 Greenwich Street, New York, New York 10286. The Bank of New York Mellon’s principal executive office is located

at 240 Greenwich Street New York, NY 10286.

You may hold ADSs either (A)

directly (i) by having an American Depositary Receipt, also referred to as an ADR, which is a certificate evidencing a specific number

of ADSs, registered in your name, or (ii) by having unregistered ADSs registered in your name, or (B) indirectly by holding a security

entitlement in ADSs through your broker or other financial institution that is a direct or indirect participant in the Depositary Trust

Company, or DTC. If you hold ADSs directly, you are a registered ADS holder, also referred to as an ADS holder. This description assumes

you are an ADS holder. If you hold the ADSs indirectly, you must rely on the procedures of your broker or other financial institution

to assert the rights of ADS holders described in this section. You should consult with your broker or financial institution to find out

what those procedures are.

Registered holders of uncertificated

ADSs will receive statements from the depositary confirming their holdings.

As an ADS holder, we will

not treat you as one of our shareholders and you will not have shareholder rights. Israeli law governs shareholder rights. The depositary

will be the holder of the shares underlying your ADSs. As a registered holder of ADSs, you will have ADS holder rights. A deposit agreement

among us, the depositary, ADS holders, and all other persons indirectly or beneficially holding ADSs sets out ADS holder rights as well

as the rights and obligations of the depositary. New York law governs the deposit agreement and the ADSs.

The following is a summary

of the material provisions of the deposit agreement. For more complete information, you should read the entire deposit agreement and the

form of ADR.

Dividends and Other Distributions

How will you receive dividends and other distributions on the

shares?

The depositary has agreed

to pay or distribute to ADS holders the cash dividends or other distributions it or the custodian receives on shares or other deposited

securities, upon payment or deduction of its fees and expenses. You will receive these distributions in proportion to the number of shares

your ADSs represent.

Cash. The depositary

will convert any cash dividend or other cash distribution we pay on the shares into U.S. dollars, if it can do so on a reasonable basis

and can transfer the U.S. dollars to the United States. If that is not possible or if any government approval is needed and cannot be

obtained, the deposit agreement allows the depositary to distribute the foreign currency only to those ADS holders to whom it is possible

to do so. It will hold the foreign currency it cannot convert for the account of the ADS holders who have not been paid. It will not invest

the foreign currency and it will not be liable for any interest.

Before making a distribution,

any withholding taxes, or other governmental charges that must be paid will be deducted. It will distribute only whole U.S. dollars and

cents and will round fractional cents to the nearest whole cent. If the exchange rates fluctuate during a time when the depositary

cannot convert the foreign currency, you may lose some or all of the value of the distribution.

Shares. The depositary

may distribute additional ADSs representing any shares we distribute as a dividend or free distribution. The depositary will only distribute

whole ADSs. It will sell shares which would require it to deliver a fraction of an ADS (or ADSs representing those shares) and distribute

the net proceeds in the same way as it does with cash. If the depositary does not distribute additional ADSs, the outstanding ADSs will

also represent the new shares. The depositary may sell a portion of the distributed shares (or ADSs representing those shares) sufficient

to pay its fees and expenses in connection with that distribution.

Rights to purchase additional

shares. If we offer holders of our securities any rights to subscribe for additional shares or any other rights, the depositary may

(i) exercise those rights on behalf of ADS holders, (ii) distribute those rights to ADS holders or (iii) sell those rights and distribute

the net proceeds to ADS holders, in each case after deduction or upon payment of its fees and expenses. To the extent the depositary does

not do any of those things, it will allow the rights to lapse. In that case, you will receive no value for them. The depositary will exercise

or distribute rights only if we ask it to and provide satisfactory assurances to the depositary that it is legal to do so. If the depositary

will exercise rights, it will purchase the securities to which the rights relate and distribute those securities or, in the case of shares,

new ADSs representing the new shares, to subscribing ADS holders, but only if ADS holders have paid the exercise price to the depositary.

U.S. securities laws may restrict the ability of the depositary to distribute rights or ADSs or other securities issued on exercise of

rights to all or certain ADS holders, and the securities distributed may be subject to restrictions on transfer.

Other Distributions.

The depositary will send to ADS holders anything else we distribute on deposited securities by any means it thinks is legal, fair and

practical. If it cannot make the distribution in that way, the depositary has a choice. It may decide to sell what we distributed and

distribute the net proceeds, in the same way as it does with cash. Or, it may decide to hold what we distributed, in which case ADSs will

also represent the newly distributed property. However, the depositary is not required to distribute any securities (other than ADSs)

to ADS holders unless it receives satisfactory evidence from us that it is legal to make that distribution. The depositary may sell a

portion of the distributed securities or property sufficient to pay its fees and expenses in connection with that distribution. U.S. securities

laws may restrict the ability of the depositary to distribute securities to all or certain ADS holders, and the securities distributed

may be subject to restrictions on transfer.

The depositary is not responsible

if it decides that it is unlawful or impractical to make a distribution available to any ADS holders. We have no obligation to register

ADSs, shares, rights or other securities under the Securities Act. We also have no obligation to take any other action to permit the distribution

of ADSs, shares, rights or anything else to ADS holders. This means that you may not receive the distributions we make on our shares or

any value for them if it is illegal or impractical for us to make them available to you.

Deposit, Withdrawal and Cancellation

How are ADSs issued?

The depositary will deliver

ADSs if you or your broker deposits shares or evidence of rights to receive shares with the custodian. Upon payment of its fees and expenses

and of any taxes or charges, such as stamp taxes or stock transfer taxes or fees, the depositary will register the appropriate number

of ADSs in the names you request and will deliver the ADSs to or upon the order of the person or persons that made the deposit.

How can ADS holders withdraw the deposited securities?

You may surrender your ADSs

to the depositary for the purpose of withdrawal. Upon payment of its fees and expenses and of any taxes or charges, such as stamp taxes

or stock transfer taxes or fees, the depositary will deliver the shares and any other deposited securities underlying the ADSs to the

ADS holder or a person the ADS holder designates at the office of the custodian. Or, at your request, risk and expense, the depositary

will deliver the deposited securities at its office, if feasible. However, the depositary is not required to accept surrender of ADSs

to the extent it would require delivery of a fraction of a deposited share or other security. The depositary may charge you a fee and

its expenses for instructing the custodian regarding delivery of deposited securities.

How do ADS holders interchange between certificated ADSs and

uncertificated ADSs?

You may surrender your ADR

to the depositary for the purpose of exchanging your ADR for uncertificated ADSs. The depositary will cancel that ADR and will send to

the ADS holder a statement confirming that the ADS holder is the registered holder of uncertificated ADSs. Upon receipt by the depositary

of a proper instruction from a registered holder of uncertificated ADSs requesting the exchange of uncertificated ADSs for certificated

ADSs, the depositary will execute and deliver to the ADS holder an ADR evidencing those ADSs.

Voting Rights

How do you vote?

ADS holders may instruct the

depositary how to vote the number of deposited shares their ADSs represent. If we request the depositary to solicit your voting instructions

(and we are not required to do so), the depositary will notify you of a shareholders’ meeting and send or make voting materials

available to you. Those materials will describe the matters to be voted on and explain how ADS holders may instruct the depositary how

to vote. For instructions to be valid, they must reach the depositary by a date set by the depositary. The depositary will try, as far

as practical, subject to the laws of Israel and the provisions of our amended and restated articles of association or similar documents,

to vote or to have its agents vote the shares or other deposited securities as instructed by ADS holders. If we do not request the depositary

to solicit your voting instructions, you can still send voting instructions, and, in that case, the depositary may try to vote as you

instruct, but it is not required to do so.

Except by instructing the

depositary as described above, you won’t be able to exercise voting rights unless you surrender your ADSs and withdraw the shares.

However, you may not know about the meeting enough in advance to withdraw the shares. In any event, the depositary will not exercise

any discretion in voting deposited securities and it will only vote or attempt to vote as instructed.

We cannot assure you that

you will receive the voting materials in time to ensure that you can instruct the depositary to vote your shares. In addition, the depositary

and its agents are not responsible for failing to carry out voting instructions or for the manner of carrying out voting instructions.

This means that you may not be able to exercise voting rights and there may be nothing you can do if your shares are not voted as you

requested.

In order to give you a reasonable

opportunity to instruct the depositary as to the exercise of voting rights relating to Deposited Securities, if we request the depositary

to act, we agree to give the depositary notice of any such meeting and details concerning the matters to be voted upon at least 45 days

in advance of the meeting date.

Fees and Expenses

| Persons depositing or withdrawing shares or ADS holders must pay: |

|

For: |

| |

|

|

| $5.00 (or less) per 100 ADSs (or portion of 100 ADSs). |

|

Issuance of ADSs, including issuances resulting

from a distribution of shares or rights or other property.

Cancellation of ADSs for the purpose of withdrawal,

including if the deposit agreement terminates. |

| |

|

|

| $0.05 (or less) per ADS. |

|

Any cash distribution to ADS holders. |

| |

|

|

| A fee equivalent to the fee that would be payable if securities distributed to you had been shares and the shares had been deposited for issuance of ADSs. |

|

Distribution of securities distributed to holders of deposited securities (including rights) that are distributed by the depositary to ADS holders. |

| |

|

|

| $0.05 (or less) per ADSs per calendar year. |

|

Depositary services. |

| |

|

|

| Registration or transfer fees. |

|

Transfer and registration of shares on our share register to or from the name of the depositary or its agent when you deposit or withdraw shares. |

| |

|

|

| Expenses of the depositary. |

|

Cable, telex and facsimile transmissions (when

expressly provided in the deposit agreement).

Converting foreign currency to U.S. dollars. |

| |

|

|

| Taxes and other governmental charges the depositary or the custodian have to pay on any ADS or share underlying an ADS, for example, stock transfer taxes, stamp duty or withholding taxes. |

|

As necessary. |

| |

|

|

| Any charges incurred by the depositary or its agents for servicing the deposited securities. |

|

As necessary. |

The depositary collects its

fees for delivery and surrender of ADSs directly from investors depositing shares or surrendering ADSs for the purpose of withdrawal or

from intermediaries acting for them. The depositary collects fees for making distributions to investors by deducting those fees from the

amounts distributed or by selling a portion of distributable property to pay the fees. The depositary may collect its annual fee for depositary

services by deduction from cash distributions or by directly billing investors or by charging the book-entry system accounts of participants

acting for them. The depositary may collect any of its fees by deduction from any cash distribution payable (or by selling a portion of

securities or other property distributable) to ADS holders that are obligated to pay those fees. The depositary may generally refuse to

provide fee-attracting services until its fees for those services are paid.

From time to time, the depositary

may make payments to us to reimburse us for costs and expenses generally arising out of establishment and maintenance of the ADS program,

waive fees and expenses for services provided to us by the depositary or share revenue from the fees collected from ADS holders. In performing

its duties under the deposit agreement, the depositary may use brokers, dealers, foreign currency dealers or other service providers that

are owned by or affiliated with the depositary and that may earn or share fees, spreads or commissions.

The depositary may convert

currency itself or through any of its affiliates and, in those cases, acts as principal for its own account and not as agent, advisor,

broker or fiduciary on behalf of any other person and earns revenue, including, without limitation, transaction spreads, that it will

retain for its own account. The revenue is based on, among other things, the difference between the exchange rate assigned to the currency

conversion made under the deposit agreement and the rate that the depositary or its affiliate receives when buying or selling foreign

currency for its own account. The depositary makes no representation that the exchange rate used or obtained in any currency conversion

under the deposit agreement will be the most favorable rate that could be obtained at the time or that the method by which that rate will

be determined will be the most favorable to ADS holders, subject to the depositary’s obligations under the deposit agreement. The

methodology used to determine exchange rates used in currency conversions is available upon request.

Payment of Taxes

You will be responsible for

any taxes or other governmental charges payable on your ADSs or on the deposited securities represented by any of your ADSs. The depositary

may refuse to register any transfer of your ADSs or allow you to withdraw the deposited securities represented by your ADSs until those

taxes or other charges are paid. It may apply payments owed to you or sell deposited securities represented by your ADS to pay any taxes

owed and you will remain liable for any deficiency. If the depositary sells deposited securities, it will, if appropriate, reduce the

number of ADSs to reflect the sale and pay to ADS holders any proceeds, or send to ADS holders any property, remaining after it has paid

the taxes.

Tender and Exchange Offers; Redemption, Replacement or Cancellation

of Deposited Securities

The depositary will not tender

deposited securities in any voluntary tender or exchange offer unless instructed to do by an ADS holder surrendering ADSs and subject

to any conditions or procedures the depositary may establish.

If deposited securities are

redeemed for cash in a transaction that is mandatory for the depositary as a holder of deposited securities, the depositary will call

for surrender of a corresponding number of ADSs and distribute the net redemption money to the holders of called ADSs upon surrender of

those ADSs.

If there is any change in

the deposited securities such as a sub-division, combination or other reclassification, or any merger, consolidation, recapitalization

or reorganization affecting the issuer of deposited securities in which the depositary receives new securities in exchange for or in lieu

of the old deposited securities, the depositary will hold those replacement securities as deposited securities under the deposit agreement.

However, if the depositary decides it would not be lawful and practical to hold the replacement securities because those securities could

not be distributed to ADS holders or for any other reason, the depositary may instead sell the replacement securities and distribute the

net proceeds upon surrender of the ADSs.

If there is a replacement

of the deposited securities and the depositary will continue to hold the replacement securities, the depositary may distribute new ADSs

representing the new deposited securities or ask you to surrender your outstanding ADRs in exchange for new ADRs identifying the new deposited

securities.

If there are no deposited

securities underlying ADSs, including if the deposited securities are cancelled, or if the deposited securities underlying ADSs have become

apparently worthless, the depositary may call for surrender or of those ADSs or cancel those ADSs upon notice to the ADS holders.

Amendment and Termination

How may the deposit agreement be amended?

We may agree with the depositary

to amend the deposit agreement and the ADRs without your consent for any reason. If an amendment adds or increases fees or charges, except

for taxes and other governmental charges or expenses of the depositary for registration fees, facsimile costs, delivery charges or similar

items, or prejudices a substantial right of ADS holders, it will not become effective for outstanding ADSs until 30 days after the depositary

notifies ADS holders of the amendment. At the time an amendment becomes effective, you are considered, by continuing to hold your ADSs,

to agree to the amendment and to be bound by the ADRs and the deposit agreement as amended.

How may the deposit agreement be terminated?

The depositary will initiate

termination of the deposit agreement if we instruct it to do so. The depositary may initiate termination of the deposit agreement if

| |

● |

60 days have passed since the depositary told us it wants to resign but a successor depositary has not been appointed and accepted its appointment; |

| |

● |

we delist our shares from an exchange on which they were listed and do not list the shares on another exchange; |

| |

● |

we appear to be insolvent or enter insolvency proceedings |

| |

● |

all or substantially all the value of the deposited securities has been distributed either in cash or in the form of securities; |

| |

● |

there are no deposited securities underlying the ADSs or the underlying deposited securities have become apparently worthless; or |

| |

● |

there has been a replacement of deposited securities. |

If the deposit agreement terminates,

the depositary will notify ADS holders at least 90 days before the termination date. At any time after the termination date, the depositary

may sell the deposited securities. After that, the depositary will hold the money it received on the sale, as well as any other cash it

is holding under the deposit agreement, unsegregated and without liability for interest, for the pro rata benefit of the ADS holders that

have not surrendered their ADSs. Normally, the depositary will sell as soon as practicable after the termination date.

After the termination date

and before the depositary sells, ADS holders can still surrender their ADSs and receive delivery of deposited securities, except that

the depositary may refuse to accept a surrender for the purpose of withdrawing deposited securities or reverse previously accepted surrenders

of that kind if it would interfere with the selling process. The depositary may refuse to accept a surrender for the purpose of withdrawing

sale proceeds until all the deposited securities have been sold. The depositary will continue to collect distributions on deposited securities,

but, after the termination date, the depositary is not required to register any transfer of ADSs or distribute any dividends or other

distributions on deposited securities to the ADSs holder (until they surrender their ADSs) or give any notices or perform any other duties

under the deposit agreement except as described in this paragraph.

Limitations on Obligations and Liability

Limits on our Obligations and the Obligations of the Depositary;

Limits on Liability to Holders of ADSs

The deposit agreement expressly

limits our obligations and the obligations of the depositary. It also limits our liability and the liability of the depositary. We and

the depositary:

| |

● |

are only obligated to take the actions specifically set forth in the deposit agreement without negligence or bad faith, and the depositary will not be a fiduciary or have any fiduciary duty to holders of ADSs; |

| |

● |

are not liable if we are or it is prevented or delayed by law or by events or circumstances beyond our or its ability to prevent or counteract with reasonable care or effort from performing our or its obligations under the deposit agreement; |

| |

● |

are not liable if we or it exercises discretion permitted under the deposit agreement; |

| |

● |

are not liable for the inability of any holder of ADSs to benefit from any distribution on deposited securities that is not made available to holders of ADSs under the terms of the deposit agreement, or for any special, consequential or punitive damages for any breach of the terms of the deposit agreement, or for any; |

| |

● |

have no obligation to become involved in a lawsuit or other proceeding related to the ADSs or the deposit agreement on your behalf or on behalf of any other person; |

| |

● |

may rely upon any documents we believe or it believes in good faith to be genuine and to have been signed or presented by the proper person; |

| |

● |

are not liable for the acts or omissions of any securities depositary, clearing agency or settlement system; and |

| |

● |

the depositary has no duty to make any determination or provide any information as to our tax status, or any liability for any tax consequences that may be incurred by ADS holders as a result of owning or holding ADSs or be liable for the inability or failure of an ADS holder to obtain the benefit of a foreign tax credit, reduced rate of withholding or refund of amounts withheld in respect of tax or any other tax benefit. |

In the deposit agreement,

we and the depositary agree to indemnify each other under certain circumstances.

Requirements for Depositary Actions

Before the depositary will

deliver or register a transfer of ADSs, make a distribution on ADSs, or permit withdrawal of shares, the depositary may require:

| |

● |

payment of stock transfer or other taxes or other governmental charges and transfer or registration fees charged by third parties for the transfer of any shares or other deposited securities; |

| |

● |

satisfactory proof of the identity and genuineness of any signature or other information it deems necessary; and |

| |

● |

compliance with regulations it may establish, from time to time, consistent with the deposit agreement, including presentation of transfer documents. |

The depositary may refuse

to deliver ADSs or register transfers of ADSs when the transfer books of the depositary or our transfer books are closed or at any time

if the depositary or we think it advisable to do so.

Your Right to Receive the Shares Underlying

your ADSs

ADS holders have the right

to cancel their ADSs and withdraw the underlying shares at any time except:

| |

● |

when temporary delays arise because: (i) the depositary has closed its transfer books or we have closed our transfer books; (ii) the transfer of shares is blocked to permit voting at a shareholders’ meeting; or (iii) we are paying a dividend on our shares; |

| |

● |

when you owe money to pay fees, taxes and similar charges; or |

| |

● |

when it is necessary to prohibit withdrawals in order to comply with any laws or governmental regulations that apply to ADSs or to the withdrawal of shares or other deposited securities. |

This right of withdrawal may

not be limited by any other provision of the deposit agreement.

Pre-release of ADSs

The deposit agreement permits

the depositary to deliver ADSs before deposit of the underlying shares. This is called a pre-release of the ADSs. The depositary may also

deliver shares upon cancellation of pre-released ADSs (even if the ADSs are canceled before the pre-release transaction has been closed

out). A pre-release is closed out as soon as the underlying shares are delivered to the depositary. The depositary may receive ADSs instead

of shares to close out a pre-release. The depositary may pre-release ADSs only under the following conditions: (1) before or at the time

of the pre-release, the person to whom the pre-release is being made represents to the depositary in writing that it or its customer owns

the shares or ADSs to be deposited; (2) the pre-release is fully collateralized with cash or other collateral that the depositary considers

appropriate; and (3) the depositary must be able to close out the pre-release on not more than five business days’ notice. In addition,

the depositary will limit the number of ADSs that may be outstanding at any time as a result of pre-release, although the depositary may

disregard the limit from time to time if it thinks it is appropriate to do so.

Direct Registration System

In the deposit agreement,

all parties to the deposit agreement acknowledge that the Direct Registration System, also referred to as DRS, and Profile Modification

System, also referred to as Profile, will apply to the ADSs. DRS is a system administered by DTC that facilitates interchange between

registered holding of uncertificated ADSs and holding of security entitlements in ADSs through DTC and a DTC participant. Profile is feature

of DRS that allows a DTC participant, claiming to act on behalf of a registered holder of uncertificated ADSs, to direct the depositary

to register a transfer of those ADSs to DTC or its nominee and to deliver those ADSs to the DTC account of that DTC participant without

receipt by the depositary of prior authorization from the ADS holder to register that transfer.

In connection with and in

accordance with the arrangements and procedures relating to DRS/Profile, the parties to the deposit agreement understand that the depositary

will not determine whether the DTC participant that is claiming to be acting on behalf of an ADS holder in requesting registration of

transfer and delivery as described in the paragraph above has the actual authority to act on behalf of the ADS holder (notwithstanding

any requirements under the Uniform Commercial Code). In the deposit agreement, the parties agree that the depositary’s reliance

on and compliance with instructions received by the depositary through the DRS/Profile System and in accordance with the deposit agreement

will not constitute negligence or bad faith on the part of the depositary.

Shareholder communications; inspection of register of holders of

ADSs

The depositary will make available

for your inspection at its office all communications that it receives from us as a holder of deposited securities that we make generally

available to holders of deposited securities. The depositary will send you copies of those communications or otherwise make those communications

available to you if we ask it to. You have a right to inspect the register of holders of ADSs, but not for the purpose of contacting those

holders about a matter unrelated to our business or the ADSs.

Jury Trial Waiver

The deposit agreement provides

that, to the extent permitted by law, ADS holders waive the right to a jury trial of any claim they may have against us or the Depositary

arising out of or relating to our shares, the ADSs or the deposit agreement, including any claim under the U.S. federal securities laws.

If we or the Depositary opposed a jury trial demand based on the waiver, the court would determine whether the waiver was enforceable

in the facts and circumstances of that case in accordance with applicable case law.

PLAN OF DISTRIBUTION

We may sell the securities

being offered hereby in one or more of the following methods from time to time:

| |

● |

a block trade (which may involve crosses) in which the broker or dealer so engaged will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

● |

purchases by a broker or dealer as principal and resale by such broker or dealer for its own account pursuant to this prospectus; |

| |

● |

exchange distributions and/or secondary distributions; |

| |

● |

through put or call option transactions relating to the securities; |

| |

● |

ordinary brokerage transactions and transactions in which the broker solicits purchasers; |

| |

● |

to one or more underwriters for resale to the public or to investors; |

| |

● |

directly to purchasers, including our affiliates, through a specific bidding or auction process, on a negotiated basis or otherwise; |

| |

● |

to or through one or more underwriters on a firm commitment or best-efforts basis; |

| |

● |

to the extent we are eligible, in “at the market offerings,” within the meaning of Rule 415(a)(4) of the Securities Act, to or through a market maker or into an existing trading market, on an exchange or otherwise; |

| |

● |

directly to a purchaser pursuant to what is known as an “equity line of credit” as described below; |

| |

● |

transactions not involving market makers or established trading markets, including direct sales or privately negotiated transactions; or |

| |

● |

through a combination of these methods of sale. |

The securities that we distribute

by any of these methods may be sold, in one or more transactions, at:

| |

● |

a fixed price or prices, which may be changed; |

| |

● |

market prices prevailing at the time of sale; |

| |

● |

prices related to prevailing market prices; or |

We will set forth in a prospectus

supplement the terms of the offering of securities, including:

| |

● |

the name or names of any agents, dealers or underwriters; |

| |

● |

the purchase price of the securities being offered and the proceeds we will receive from the sale; |

| |

● |

any over-allotment options under which underwriters may purchase additional securities from us; |

| |

● |

any agency fees or underwriting discounts and other items constituting agents’ or underwriters’ compensation; |

| |

● |

the public offering price; |

| |

● |

any discounts or concessions allowed or re-allowed or paid to dealers; and |

| |

● |

any securities exchanges or markets on which such securities may be listed. |

If underwriters are used in

the sale, they will acquire the securities for their own account and may resell the securities from time to time in one or more transactions

at a fixed public offering price or at varying prices determined at the time of sale. The obligations of the underwriters to purchase

the securities will be subject to the conditions set forth in the applicable underwriting agreement. We may offer the securities to the

public through underwriting syndicates represented by managing underwriters or by underwriters without a syndicate. Subject to certain

conditions, the underwriters will be obligated to purchase all of the securities offered by the prospectus supplement, other than securities

covered by any over-allotment option. Any public offering price and any discounts or concessions allowed or re-allowed or paid to dealers

may change from time to time. We may use underwriters with whom we have a material relationship. We will describe in the prospectus supplement,

naming the underwriter, the nature of any such relationship.

We may also sell securities

pursuant to an “equity line of credit”. In such event, we will enter into a purchase agreement with the purchaser to be named

therein, which will be described in a Report on Form 6-K that we will file with the SEC. In that Form 6-K, we will describe the total

amount of securities that we may require the purchaser to purchase under the purchase agreement and the other terms of purchase, and any

rights that the purchaser is granted to purchase securities from us. In addition to our issuance of ADSs to the equity line purchaser

pursuant to the purchase agreement, this prospectus (and the applicable prospectus supplement or post-effective amendment to the registration

statement of which this prospectus forms a part) also covers the resale of those shares from time to time by the equity line purchaser

to the public. The equity line purchaser will be considered an “underwriter” within the meaning of Section 2(a)(11) of the

Securities Act. Its resales may be effected through a number of methods, including without limitation, ordinary brokerage transactions

and transactions in which the broker solicits purchasers and block trades in which the broker or dealer so engaged will attempt to sell

the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction. The equity line purchaser

will be bound by various anti-manipulation rules of the SEC and may not, for example, engage in any stabilization activity in connection

with its resales of our securities and may not bid for or purchase any of our securities or attempt to induce any person to purchase any

of our securities other than as permitted under the Exchange Act.

We may sell securities directly

or through agents we designate from time to time. We will name any agent involved in the offering and sale of securities and we will describe

any commissions we will pay the agent in the prospectus supplement. Unless the prospectus supplement states otherwise, our agent will

act on a best-efforts basis for the period of its appointment.

We may also sell securities

directly to one or more purchasers without using underwriters or agents.

Underwriters, dealers and

agents that participate in the distribution of the securities may be underwriters as defined in the Securities Act and any discounts or

commissions they receive from us and any profit on their resale of the securities may be treated as underwriting discounts and commissions

under the Securities Act. We will identify in the applicable prospectus supplement any underwriters, dealers or agents and will describe

their compensation. We may have agreements with the underwriters, dealers and agents to indemnify them against specified civil liabilities,

including liabilities under the Securities Act. Underwriters, dealers and agents may engage in transactions with or perform services for

us in the ordinary course of their businesses.

In connection with an offering,

an underwriter may purchase and sell securities in the open market. These transactions may include short sales, stabilizing transactions

and purchases to cover positions created by short sales. Short sales involve the sale by the underwriters of a greater number of securities

than they are required to purchase in the offering.

Accordingly, to cover these

short sales positions or to otherwise stabilize or maintain the price of the securities, the underwriters may bid for or purchase securities

in the open market and may impose penalty bids. If penalty bids are imposed, selling concessions allowed to syndicate members or other

broker-dealers participating in the offering are reclaimed if securities previously distributed in the offering are repurchased, whether

in connection with stabilization transactions or otherwise. The effect of these transactions may be to stabilize or maintain the market