As filed with the Securities

and Exchange Commission on November 2, 2023

Registration No. 333-_____

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Allarity

Therapeutics, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

2834 |

|

87-2147982 |

| (State or jurisdiction of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Classification Code Number) |

|

Identification No.) |

24 School Street, 2nd Floor

Boston, MA 02108

(401) 426-4664

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

James G. Cullem

Chief Executive Officer

c/o Allarity Therapeutics, Inc.

24 School Street, 2nd Floor

Boston, MA 02108

(401) 426-4664

(Name, address, including zip code, and telephone

number, Including area code, of agent for service)

Copies to:

Scott E. Bartel

Daniel B. Eng

Lewis Brisbois Bisgaard & Smith LLP

633 West 5th Street, Suite 4000

Los Angeles, CA 90071

(213) 358-6174

Approximate date of commencement of proposed

sale to the public: As soon as practicable after the effective date of this Registration Statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous

basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box.

☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of

securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided to Section 7(a)(2)(B) of the Securities Act ☐

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

The information in

this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed

with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does

it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| Prospectus |

Subject To Completion |

Dated November 2, 2023 |

$50,000,000

Common Stock

Preferred Stock

Warrants

Debt Securities

Units

From

time to time, we may offer up to $50,000,000 of our common stock, preferred stock, warrants

to purchase common stock or preferred stock, debt securities and units consisting of common

stock, preferred stock, warrants, or debt securities or any combination of these securities,

in one or more transactions.

This prospectus provides

a general description of the securities we may offer. Each time we sell securities, we will provide a supplement to this prospectus that

contains specific information about the offering and the terms of the securities. The supplement may also add, update or change information

contained in this prospectus. We may also authorize one or more free writing prospectuses to be provided in connection with a specific

offering. You should read this prospectus, any prospectus supplement and any free writing prospectus together with the documents we incorporate

by reference, before you invest in any of these securities.

We may sell the securities on a continuous or delayed basis, independently

or together with any other securities registered hereunder to or through one or more underwriters, dealers and agents, or directly to

purchasers, or through a combination of these methods, on a continuous or delayed basis. See “Plan of Distribution.” If any

underwriters, dealers or agents are involved in the sale of any of the securities, their names, and any applicable purchase price, fee,

commission or discount arrangements between or among them, will be set forth, or will be calculable from the information set forth, in

the applicable prospectus supplement.

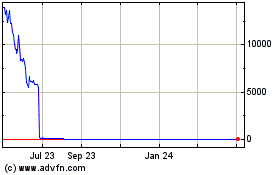

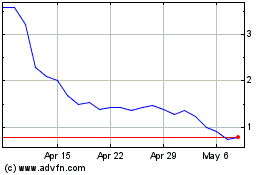

Our common stock is listed

on the Nasdaq Capital Market under the symbol “ALLR.” On November 1, 2023, the last reported sales price of our common

stock was $0.5520 per share. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell the shelf securities

pursuant to such General Instruction with a value exceeding more than one-third of the aggregate market value of our common stock

held by non-affiliates in any 12-month period so long as the aggregate market value of our outstanding common stock held by

non-affiliates remains below $75 million. We have not sold any securities in reliance on General Instruction I.B.6 of Form S-3

during the 12 calendar months prior to and including the date of this prospectus.

INVESTING

IN OUR SECURITIES INVOLVES RISKS. YOU SHOULD REVIEW CAREFULLY THE RISKS AND UNCERTAINTIES

DESCRIBED UNDER THE HEADING “RISK FACTORS” CONTAINED IN THIS PROSPECTUS, THE

APPLICABLE PROSPECTUS SUPPLEMENT AND ANY RELATED FREE WRITING PROSPECTUS, AND UNDER SIMILAR

HEADINGS IN THE OTHER DOCUMENTS THAT ARE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS.

NEITHER THE SECURITIES AND

EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS

IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is ________, 2023

Table of Contents

We have not authorized anyone

to provide you with information other than that contained in this prospectus or any free writing prospectus prepared by or on behalf

of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other

information that others may give you. We are offering to sell our securities only in jurisdictions where offers and sales are permitted.

The information contained in this prospectus is accurate only as of the date on the front cover page of this prospectus, or other earlier

date stated in this prospectus, regardless of the time of delivery of this prospectus or of any sale of our securities.

No action is being taken

in any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution of this prospectus

in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to

inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that

jurisdiction.

SPECIAL NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus contains

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve substantial risks

and uncertainties. Forward-looking statements provide current expectations or forecasts of future events. Forward-looking statements

include statements about Allarity’s expectations, beliefs, plans, objectives, intentions, assumptions and other statements that

are not historical facts. The words “anticipates,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,”

“predicts,” “project,” “should,” “would” and similar expressions may identify forward-looking

statements, but the absence of these words does not mean that a statement is not forward-looking. These statements speak only as of the

date of this prospectus and involve known and unknown risks, uncertainties and other important factors that may cause our actual results,

performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the

forward-looking statements. These statements are based upon information available to us as of the date of this prospectus, and while

we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and these statements

should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information.

In addition to factors identified under the section titled “Risk Factors” in this prospectus, factors that may impact such

forward-looking statements include:

| |

● |

our estimates regarding expenses, capital requirements and need for additional financing. We have insufficient cash to continue our operations, and our continued operations are dependent on us raising capital and these conditions give rise to substantial doubt over our ability continue as a going concern; |

| |

|

|

| |

● |

the number of shares that may be sold under this prospectus is significant in relation to the number of our outstanding shares of common stock. If these shares of common stock are sold in the market all at once or at about the same time, it could depress the market price of our common stock and would also affect our ability to raise equity capital; |

| |

|

|

| |

● |

our ability to meet the Nasdaq Capital Market (“Nasdaq”) continued listing standards. The listing of our common stock on Nasdaq is contingent on our compliance with Nasdaq’s conditions for continued listing. We have a history of non-compliance. Although we are currently in compliance with the Nasdaq listing requirements, if we fail to meet the Nasdaq listing requirements and do not regain compliance, we will be subject to delisting by Nasdaq. In the event our common stock is no longer listed for trading on Nasdaq, our trading volume and share price may decrease, and you may have a difficult time selling your shares of common stock. In addition, we may experience difficulties in raising capital which would materially adversely affect our operations and financial results. Further, delisting from Nasdaq markets could also have other negative effects, including potential loss of confidence by partners, lenders, suppliers and employees; |

| |

|

|

| |

● |

our ability to remediate our material weakness and to maintain effective internal control over financial reporting, disclosures and procedures. If we do not maintain effective internal controls, our ability to record, process and report financial information timely and accurately could be adversely affected and could result in a material misstatement in our financial statements, which could subject us to litigation or investigations, require management resources, increase our expenses, negatively affect investor confidence in our financial statements and adversely impact the trading price of our common stock; |

| |

|

|

| |

● |

the impact of adjustments to our outstanding warrants because of future dilutive financings resulting in the decrease of exercise price and increase the number of shares of issuable under outstanding warrants, adjustment and exercise of such warrants would result in the material dilution of the percentage ownership of our stockholders and increase the number of shares of common stock in the public markets. The perception that such sales could occur could cause our stock price to fall; |

| |

|

|

| |

● |

Our ability to cure the default under our license agreement with Novartis. We failed to make a milestone payment, and on April 4, 2023, we received notice from Novartis stating that Allarity Therapeutics Europe ApS was in breach of the license agreement and has 30 days from April 4, 2023, to cure. As a result of ongoing negotiations with Novartis to address our non-payment, we made a payment of $100,000 to Novartis in April 2023 and on August 11, 2023, we paid Novartis $300,000. We intend to cure this breach upon and subject to availability of funds and/or continue working with Novartis on an alternate payment structure. However, no assurance can be given that Novartis will accept an alternative payment structure and if we fail to make the milestone payments, Novartis does not agree to an alternative payment structure or we are otherwise in breach of the license agreement, we may lose our right to use dovitinib, which will adversely affect our ability to conduct our clinical trials and to achieve our business objectives and adversely affect our financial results [Update from company]; |

| |

|

|

| |

● |

the impacts of the ongoing COVID-19 pandemic and related restrictions as they may relate to our clinical trials; |

| |

|

|

| |

● |

the initiation, cost, timing, progress and results of our current and future preclinical studies and clinical trials, as well as our research and development programs; |

| |

|

|

| |

● |

our plans to develop and commercialize our drug candidates; |

| |

|

|

| |

● |

our ability to successfully acquire or in-license additional product candidates on reasonable terms; |

| |

|

|

| |

● |

our ability to maintain and establish collaborations or obtain additional funding; |

| |

|

|

| |

● |

our ability to obtain regulatory approval of its current and future drug candidates; |

| |

|

|

| |

● |

our expectations regarding the potential market size and the rate and degree of market acceptance of such drug candidates; |

| |

● |

our expectations regarding our ability to fund operating expenses and capital expenditure requirements with our existing cash and cash equivalents, and future expenses and expenditures; |

| |

|

|

| |

● |

our ability to secure sufficient funding and alternative sources of funding to support when needed and on terms favorable to us to support our business objective, product development, other operations or commercialization efforts; |

| |

|

|

| |

● |

our ability to enroll patients in our clinical trials, or our clinical development activities; |

| |

|

|

| |

● |

our ability to retain key employees, consultants and advisors; |

| |

|

|

| |

● |

our ability to retain reliable third parties to perform work associated with our drug discovery, preclinical activities and to conduct our preclinical studies and clinical trials in a satisfactory manner; |

| |

|

|

| |

● |

our ability to secure reliable third party manufacturers to produce clinical and commercial supplies of API for our therapeutic candidates; |

| |

|

|

| |

● |

our ability to obtain, maintain, protect and enforce sufficient patent and other intellectual property rights for our therapeutic candidates and technology; |

| |

|

|

| |

● |

our anticipated strategies and our ability to manage our business operations effectively; |

| |

|

|

| |

● |

the impact of governmental laws and regulations; |

| |

|

|

| |

● |

the possibility that we may be adversely impacted by other economic, business, and/or competitive factors; and |

| |

|

|

| |

● |

our ability to maintain our licensed intellectual property rights to develop, use and market our therapeutic candidates. |

These forward-looking statements

are based on information available as of the date of this prospectus, and current expectations, forecasts and assumptions, and involve

a number of risks and uncertainties. We do not assume any obligation to update any forward-looking statements, Accordingly, forward-looking

statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update

forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future

events or otherwise, except as may be required under applicable securities laws.

MARKET AND INDUSTRY DATA

This prospectus contains

estimates, projections and other information concerning our industry, our business and the markets for our therapeutic candidates, including

data regarding the estimated size of such markets and the incidence of certain medical conditions. We obtained the industry, market and

similar data set forth in this prospectus from our internal estimates and research and from academic and industry research, publications,

surveys and studies conducted by third parties, including governmental agencies. In some cases, we do not expressly refer to the sources

from which this data is derived. Information that is based on estimates, forecasts, projections, market research or similar methodologies

is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances that are

assumed in this information. While we believe our internal research is reliable, such research has not been verified by any third party.

ABOUT THIS PROSPECTUS

This

document is called a prospectus and is part of a registration statement that we have filed with the Securities and Exchange Commission

(“SEC”), using a “shelf” registration process. Under this shelf registration process, we may, from time to time,

offer shares of our common stock, preferred stock, warrants to purchase common stock or preferred stock, debt securities and units either

individually or a combination thereof, in one or more offerings, in amounts we will determine from time to time, up to a total dollar

amount of $50,000,000.

This prospectus provides you with a general description of the securities

we may offer. Each time we sell securities under this shelf registration, we will provide a prospectus supplement that will contain certain

specific information about the terms of that offering, including a description of any risks related to the offering, if those terms and

risks are not described in this prospectus. A prospectus supplement may also add, update, or change information contained in this prospectus.

If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on

the information in the prospectus supplement. The registration statement we filed with the SEC includes exhibits that provide more details

on the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC and the accompanying

prospectus supplement together with additional information described under the headings “Where You Can Find Additional Information”

and “Incorporation of Certain Information by Reference” before buying any of the securities being offered.

We may sell securities to

or through underwriters or dealers, and also may sell securities directly to other purchasers or through agents. To the extent not described

in this prospectus, the names of any underwriters, dealers or agents employed by us in the sale of the securities covered by this prospectus,

the principal amounts or number of shares or other securities, if any, to be purchased by such underwriters or dealers and the compensation,

if any, of such underwriters, dealers or agents will be set forth in the accompanying prospectus supplement.

The information in this prospectus

is accurate as of the date on the front cover. Information incorporated by reference into this prospectus is accurate as of the date

of the document from which the information is incorporated. You should not assume that the information contained in this prospectus is

accurate as of any other date.

You should rely only on the

information provided or incorporated by reference in this prospectus. We have not authorized anyone to provide you with additional or

different information. This document may only be used where it is legal to sell these securities. You should not assume that any information

in this prospectus is accurate as of any date other than the date of this prospectus.

No dealer, salesperson or

other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus

supplement or any related free writing prospectus.

In this prospectus, unless

the context otherwise requires, references to the “Company,” “Allarity,” “we,” “us,”

“our” and similar terms refer to Allarity Therapeutics, Inc., Allarity Therapeutics A/S (as predecessor) and its respective

consolidated subsidiaries. On June 28, 2023, the Company effected a 1-for-40 reverse stock split of the shares of common stock of the

Company and on March 24, 2023 we effected a 1-for-35 reverse stock split (collectively, the “Reverse Stock Splits”). All

historical share and per share amounts reflected throughout this prospectus, which may be supplemented by a prospectus supplement, have

been adjusted to reflect the Reverse Stock Splits. When we refer to “you,” we mean the potential holders of the applicable

series of securities.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus

and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities,

you should carefully read this entire prospectus, including our consolidated financial statements and the related notes thereto and the

information set forth in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” contained in our Annual Report on Form 10-K for the year ended December 31, 2022, our Form

10-Q for the Quarterly Period Ended June 30, 2023, and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we

file after the date of this prospectus and all other information contained in the applicable prospectus supplement and applicable free

writing prospectus.

Overview

We are a clinical-stage,

precision medicine pharmaceutical company actively advancing a pipeline of in-licensed oncology therapeutics for patients with difficult-to-treat

cancers. Our clinical program includes three anti-cancer assets in mid- to late-stage clinical development and one anti-cancer asset

in early stage clinical development. Our programs and partnerships leverage our proprietary, highly accurate Drug Response Predictor

(DRP®) technology to refine patient selection and improve clinical outcomes. Our DRP® technology has been

broadly validated across an extensive array of therapies and tumor types with a high degree of accuracy for matching the right patient

to the right drug. By identifying those patients who will and who will not respond, the DRP® companion diagnostics have

the potential to transform cancer therapeutic development across many indications by increasing clinical success rates with trials involving

a fewer number of patients and improve patient outcomes by matching them to the right drug.

Our pipeline currently consists of three mid-to-late stage clinical candidates

for cancer and one anti-cancer asset in early stage clinical development. We are focused on the clinical development of three priority

programs with stenoparib (a poly-ADP-ribose polymerase (“PARP”) inhibitor) as our lead program: dovitinib in combination with

stenoparib for the treatment of a number of solid tumors (including ovarian cancer), stenoparib as a monotherapy for the second-line or

later treatment of metastatic ovarian cancer, and IXEMPRA® as a monotherapy for the second-line or later treatment of metastatic

breast cancer. In addition, Allarity is supporting the development of one additional clinical asset through business development activities

which are considered at mid-stage development. Each Allarity pipeline program is being co-developed with a drug specific DRP®

companion diagnostic to select and treat patients most likely to benefit from treatment.

While we have not yet successfully

received regulatory or marketing approval for any of our therapeutic candidates or companion diagnostics, and while we believe that our

approach has the potential to reduce the cost and time of drug development through the identification and selection of patient populations

more likely to respond to therapy, our strategy involves risks and uncertainties that differ from other biotechnology companies that

focus solely on new therapeutic candidates that do not have a history of failed clinical development. By utilizing our DRP®

platform to generate a drug-specific companion diagnostic for each of our therapeutic candidates, if approved by the FDA, we believe

our therapeutic candidates have the potential to advance the goal of personalized medicine by selecting the patients most likely to benefit

from each of our therapeutic candidates and avoid the treatment of non-responder patients. All of our therapeutic candidates are clinical

stage assets and the FDA has not yet approved any of our therapeutic candidates or any of our DRP® companion diagnostics.

As used in this prospectus, statements regarding the use of our proprietary DRP® companion diagnostics or our proprietary

DRP® platform or our observations that a therapeutic candidate may have anti-cancer or anti-tumor activity or is observed

to be well tolerated in a patient population should not be construed to mean that we have resolved all issues of safety and/or efficacy

for any of our therapeutic candidates or DRP® companion diagnostic. Issues of safety and efficacy for any therapeutic

candidate or companion diagnostic may only be determined by the U.S. FDA or other applicable regulatory authorities in jurisdictions

outside the United States.

Our clinical and commercial

development team is advancing our pipeline of targeted oncology therapeutic candidates, all of which have previously succeeded at least

through Phase 1 clinical trials demonstrating that the therapeutic candidate is well tolerated. Our three priority assets, stenoparib,

dovitinib, and IXEMPRA® (ixabepilone) are all former drug candidates of large pharmaceutical companies. We recently announced

that PARP inhibitor, stenoparib, is now our lead clinical asset, and is currently being advanced in two out of three of our ongoing clinical

trials. We will continue to focus our energies, efforts, and resources on advancing clinical development of stenoparib, supported by

continuing clinical development of our IXEMPRA® and dovitinib assets, both of which we continue to believe have substantial clinical

and commercial potential.

Our lead therapeutic candidate is stenoparib (formerly E7449), a novel

inhibitor of the key DNA damage repair enzyme PARP, which also has an observed inhibitory action against Tankyrases, another important

group of DNA damage repair enzymes. Stenoparib was formerly developed by Eisai, Inc. (“Eisai”) through Phase 1 clinical trials,

and we are currently advancing a Phase 2 clinical trial of this therapeutic candidate for the treatment of ovarian cancer at trial sites

in the U.S. and Europe together with its stenoparib-specific DRP® companion diagnostic, for which the FDA has previously

approved an Investigational Device Exemption (“IDE”) application. In addition, as a result of our July Offering (as defined

below), we are continuing a stenoparib in combination with dovitinib Phase 1b/2 clinical trial for second-line or later treatment of metastatic

ovarian cancer.

Our

most clinically-advanced therapeutic candidate, dovitinib, is a selective inhibitor of several

classes of tyrosine kinases, including FGFR and VEGFR, and was formerly developed by Novartis

Pharma AG (“Novartis”) through Phase 3 clinical trials in numerous indications.

We submitted a New Drug Application (“NDA”) with the FDA on December 21, 2021,

for the third line treatment of metastatic renal cell carcinoma (mRCC or kidney cancer) in

patients selected by our Dovitinib-DRP® companion diagnostic. Prior to submission

of the NDA, we submitted a Pre-Market Approval (“PMA”) application to the FDA

for approval of our dovitinib-specific DRP® companion diagnostic for use to

select and treat patients likely to respond to dovitinib. On February 15, 2022, we received

Refusal to File (RTF) letters for both our dovitinib NDA and our DRP®-Dovitinib

companion diagnostic PMA. The FDA had asserted that neither our NDA or PMA meets the regulatory

requirements to warrant a complete agency review. The primary grounds of rejection asserted

by the FDA relates to our use of prior Phase 3 clinical trial data, generated by Novartis

in a “superiority” endpoint study against sorafenib (Bayer), to support a “non-inferiority”

endpoint in connection with the DRP®-Dovitinib companion diagnostic. Based

upon the reasons given in the RTF letters and a subsequent Type C meeting with the FDA on

May 31, 2022, we anticipate that the FDA will require a prospective Phase 3 clinical trial

as well as additional dose optimization studies before regulatory approval of Dovitinib as

a monotherapy and its companion diagnostic Dovitinib-DRP for the treatment of third-line

mRCC can be obtained. While we have decided that the costs, risks and potential benefits

of conducting these studies for dovitinib as a monotherapy for mRCC are no longer the best

path toward commercial success, we continue to evaluate other potential Phase 1b/2 clinical

trials for dovitinib combined with other approved drugs in the mRCC space and in other indications.

On March 20, 2023, we announced that we had dosed our first patient in a Phase 1b clinical

study to evaluate the combination of stenoparib and dovitinib for the treatment of advanced

solid tumors, including ovarian cancer. The completion of the July Offering provided us with

some financing to dose additional patients and our ability to continue these clinical trials

will be dependent upon additional financing. Our decision to advance dovitinib as a combination

therapy and not as a monotherapy is based on our belief that both the science and the market

for oncology therapies has shifted towards combination therapies and away from monotherapies

for multiple indications of cancer. We further believe that our DRP®-Dovitinib

companion diagnostic is indication agnostic and our retrospective analysis of the clinical

data generated in the Novartis clinical studies for mRCC will also support a companion diagnostic

for dovitinib in second-line or later treatment of metastatic ovarian cancer, as well as

other indications.

Our third priority therapeutic candidate is IXEMPRA® (ixabepilone),

a selective microtubule inhibitor, which has been shown to interfere with cancer cell division, leading to cell death. IXEMPRA®

was formerly developed and brought to market by Bristol-Myers Squibb, is currently marketed and sold in the U.S. by R-PHARM US LLC, for

the treatment of metastatic breast cancer treated with two or more prior chemotherapies. We are currently advancing IXEMPRA®,

together with its drug-specific DRP® companion diagnostic, in a Phase 2 European clinical trial for the same indication,

with the goal of eventually submitting an application for Marketing Authorization with the European Medicine Agency to market IXEMPRA®,

together with its drug-specific DRP® companion diagnostic, in the European market.

We have in-licensed the intellectual

property rights to develop, use and market our two most advanced therapeutic candidates, dovitinib and stenoparib. Consequently, we must

perform all of the obligations under these license agreements, including the payment of substantial development milestones payments and

royalty payments on future sales in the event we receive marketing approval for dovitinib or stenoparib in the future. If we fail to

perform our obligations under our license agreements, we may lose the intellectual property rights to these therapeutic candidates which

will have a material adverse effect on our business.

Our focused approach to address

major unmet needs in oncology leverages our management’s expertise in discovery, medicinal chemistry, manufacturing, clinical development,

and commercialization. As a result, we have created substantial intellectual property around the composition of matter for our new chemical

entities. The foundations of our approach include:

| |

● |

The pursuit of clinical-stage assets: We strive

to identify and pursue novel oncology therapeutic candidates that have advanced beyond Phase 1 clinical trials and are preferably

Phase 2 to Phase 3 clinical stage assets. Accordingly, the assets we have acquired, and intend to acquire, have undergone prior clinical

trials by other pharmaceutical companies with clinical data that helps us evaluate whether these candidates will be well tolerated

in the tested patient population, and in some cases, have observed anti-cancer or anti-tumor activity that would support additional

clinical trials using our DRP® platform. We often focus our acquisition efforts on therapeutic candidates that have

been the subject of clinical trials conducted by large pharmaceutical companies. Further we intend to select therapeutic candidates

for which we believe we can develop a drug-specific DRP® to advance together with the therapeutic candidate in further

clinical trials as a companion diagnostic to select and treat the patients most likely to respond to the therapeutic candidate. We

further consider whether the licensor or assignor can provide us substantial clinical grade active pharmaceutical ingredients (“API”)

for the therapeutic candidate, at low-to-no cost, for our use in future clinical trials. The availability of API at low-to-no cost

reduces both our future clinical trial costs and the lead time it takes us to start a new clinical trial for the therapeutic candidate.

As an example, our therapeutic candidate, dovitinib, was developed by Novartis through Phase 2 clinical trials in numerous indications

and in Phase 3 clinical trials for RCC before we acquired the therapeutic candidate, and it came with a substantial API. |

| |

● |

Our proprietary DRP® companion diagnostics: We

believe our proprietary and patentedDRP® platform provides us with a substantial clinical and commercial competitive

advantage for each of the therapeutic candidates in our pipeline. Our DRP® companion diagnostic platform

is a proprietary, predictive biomarker technology that employs complex systems biology, bio-analytics with a proprietary clinical

relevance filter to bridge the gap between in vitro cancer cell responsiveness to a given therapeutic candidate and in vivo likelihood

of actual patient response to that therapeutic candidate. The DRP® companion diagnostic platform has been retrospectively

validated by us using retrospective observational studies in 35 clinical trials that were conducted or sponsored by other companies.

We intend to develop and validate a drug-specific DRP® biomarker for each and every therapeutic candidate in our therapeutic

candidate pipeline to serve as a companion diagnostic to select and treat patients most likely to respond to that therapeutic candidate.

Although we are in the early stages of our companion diagnostic development and have not yet received a PMA from the FDA, our DRP®

technology has been peer-reviewed by numerous publications and we have patented our DRP® platform for more than

70 anti-cancer drugs. While retrospective studies guide our clinical development of our companion diagnostics, prospective

clinical trials may be required in order to receive a PMA from the FDA. |

| |

● |

A precision oncology approach: Our focused

strategy is to advance our pipeline of therapeutic candidates, together with DRP® companion diagnostics, to bring

these therapeutic candidates, once approved, to market and to patients through a precision oncology approach. Our DRP®

companion diagnostic platform provides a gene expression fingerprint that we believe reveals whether a specific tumor in a specific

patient is likely to respond to one of our therapeutic candidates and therefore can be used to identify those patients who are most

likely to respond to a particular therapeutic treatment in order to guide therapy decisions and lead to better treatment outcomes.

We believe our DRP® companion diagnostic platform may be used both to identify a susceptible patient population for

inclusion in clinical trials during the drug development process (and to exclude the non-susceptible patient population), and further

to select the optimal anti-cancer drug for individual patients in the treatment setting once an anti-cancer drug is approved and

marketed. By including only patients that have tumors that we believe may respond to our therapeutic candidate in our clinical trials,

we believe our proprietary DRP® companion diagnostics platform has the potential to improve the overall treatment

response in our clinical trials and thereby improving our chances for regulatory approval to market our therapeutic candidate, while

potentially reducing the time, cost, and risk of clinical development. |

The following chart summarizes

our therapeutic candidate pipeline:

Corporate Information

Our former parent, Allarity

Therapeutics A/S, was founded in Denmark in 2004 by our chief scientific officer, Steen Knudsen, Ph.D., and our Director and Senior Vice

President of Investor Relations, Thomas Jensen, both of whom were formerly academic researchers at the Technical University of Denmark

working to advance novel bioinformatic and diagnostic approaches to improving cancer patient response to therapeutics. On May 20, 2021,

we entered a Plan of Reorganization and Asset Purchase Agreement (the “Recapitalization Share Exchange”), between us, Allarity

Acquisition Subsidiary, our wholly owned Delaware subsidiary (“Acquisition Sub”), and Allarity Therapeutics A/S, an Aktieselskab

organized under the laws of Denmark. Pursuant to the terms of the Recapitalization Share Exchange, our Acquisition Sub acquired substantially

all of the assets and liabilities of Allarity Therapeutics A/S in exchange for shares of our common stock on December 20, 2021, and our

common stock began trading on the Nasdaq Global Market on that same day.

Our principal executive offices

are located at 24 School Street, 2nd Floor, Boston, MA 02108 and our telephone number is (401) 426-4664. Our corporate website

address is www.allarity.com. Information contained on or accessible through our website is not a part of this prospectus, and

the inclusion of our website address in this prospectus is an inactive textual reference only.

Allarity and its subsidiaries

own or have rights to trademarks, trade names and service marks that they use in connection with the operation of their business. In

addition, their names, logos and website names and addresses are their trademarks or service marks. Other trademarks, trade names and

service marks appearing in this prospectus are the property of their respective owners. Solely for convenience, in some cases, the trademarks,

trade names and service marks referred to in this prospectus are listed without the applicable ®, ™ and

SM symbols, but they will assert, to the fullest extent under applicable law, their rights to these trademarks, trade names and service

marks.

Implications of Being an Emerging Growth Company

and a Smaller Reporting Company

We are an “emerging

growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and we intend to take advantage

of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging

growth companies” including not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley

Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from

the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments

not previously approved. In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take

advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act, for complying with new or revised accounting

standards.

Additionally, we are a “smaller

reporting company” as defined in Item 10(f)(1) of Regulation S-K. Even after we no longer qualify as an emerging growth company,

we may still qualify as a “smaller reporting company,” which would allow us to continue to take advantage of many of the

same exemptions from disclosure requirements, including presenting only the two most recent fiscal years of audited financial statements

and reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements. We may continue to

be a smaller reporting company if either (i) the market value of our stock held by non-affiliates is less than $250 million or (ii) our

annual revenue was less than $100 million during the most recently completed fiscal year and the market value of our stock held by non-affiliates

is less than $700 million. To the extent we take advantage of such reduced disclosure obligations, it may also make comparison of our

financial statements with other public companies difficult or impossible.

RISK FACTORS

Investing in our securities involves a high degree of risk. You should

carefully consider the risks and uncertainties described in this prospectus and any accompanying prospectus supplement, including the

risk factors set forth in our filings we make with the SEC from time to time, that are incorporated by reference herein, including the

risk factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2022, our Form 10-Q for the quarterly period

ended June 30, 2023, and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus

and all other information contained in the applicable prospectus supplement and applicable free writing prospectus, and other documents

we file with the SEC that are deemed incorporated by reference into this prospectus before making an investment decision pursuant to this

prospectus and any accompanying prospectus supplement relating to a specific offering.

Our business, financial condition

and results of operations could be materially and adversely affected by any or all of these risks or by additional risks and uncertainties

not presently known to us or that we currently deem immaterial that may adversely affect us in the future.

USE OF PROCEEDS

Unless we specify otherwise

in an accompanying prospectus supplement, we intend to use the net proceeds from the issuance or sale of our securities for working capital

and for general corporate purposes. Any specific allocation of the net proceeds of an offering of securities to a specific purpose will

be determined at the time of such offering and will be described in the accompanying prospectus supplement to this prospectus. We will

retain broad discretion over the use of the net proceeds from the issuance or sale of our securities.

MARKET INFORMATION

Our common stock is listed on the Nasdaq Capital Market under the symbol

“ALLR.” Our common stock previously was listed on the Nasdaq Global Market prior to June 27, 2023. Prior to the consummation

of the Recapitalization Share Exchange on December 20, 2021, Allarity Therapeutics A/S ordinary shares were listed on the Nasdaq First

North Growth Market: Stockholm under the symbol “ALLR:ST.” As of October 13, 2023, there was one (1) holder of record of our

common stock. The foregoing number of stockholders of record does not include an unknown number of stockholders who hold their stock in

“street name.”

On November 22, 2022, our

Board declared a dividend of Series B Preferred Stock to the stockholders of record of common stock and Series A Preferred Stock as of

December 5, 2022. On December 5, 2022, each share of common stock then outstanding received 0.016 of a share of Series B Preferred Stock

and each share of Series A Preferred Stock outstanding received 1.744 shares of Series B Preferred Stock. All Series B Preferred Stock

were redeemed at $0.01 per share. Pursuant to the terms of the Original Series A COD and Certificate of Designations of Series C Preferred

Stock, the Company recorded a deemed dividend of 8% on the Series A Preferred Stock of $1,572,000 for the year ended December 31, 2022

and a deemed dividend of 5% on the Series C Preferred Stock of $4,000,000 for the quarter ended March 31, 2023. In the quarter ended

June 30, 2023, the Company recorded a deemed dividend of $119,000 on the Series C Preferred Stock and a deemed dividend of $7,287,000

on the Series A Preferred Stock.

We do not anticipate declaring

or paying, in the foreseeable future, any cash dividends on our common stock. We intend to retain all available funds and future earnings,

if any, to fund the development and expansion of our business, and we do not anticipate paying any cash dividends in the foreseeable

future. Any future determination regarding the declaration and payment of dividends, if any, will be at the discretion of our Board of

Directors and will depend on then-existing conditions, including our financial condition, operating results, contractual restrictions,

capital requirements, business prospects and other factors our Board of Directors may deem relevant.

DESCRIPTION OF CAPITAL

STOCK

The following description

of the material terms of our capital stock. We urge you to read the applicable provisions of DGCL and our Certificate of Incorporation

and bylaws carefully and in their entirety because they describe your rights as a holder of shares of our capital stock. This description

gives effect to the Share Consolidations.

General

Our purpose is to engage in

any lawful act or activity for which corporations may now or hereafter be organized under the DGCL. Our Certificate of Incorporation authorizes

capital stock consisting of 750,000,000 shares of common stock, par value $0.0001 per share, and 500,000 shares of preferred stock, par

value $0.0001 per share, of which 20,000 shares of preferred stock have been designated Series A Convertible Preferred Stock; 200,000

shares of preferred stock have been designated as Series B Preferred Stock; and 50,000 shares of preferred stock have been designated

as Series C Preferred Stock.

On March 24, 2023, we effected

the 1-for-35 share consolidation of our common stock. Subsequently on June 28, 2023, we effected a 1-for-40 share consolidation of our

common stock. The par value of our common stock remains unchanged.

As of November 1, 2023, we

had:

| |

● |

4,185,623 shares of common stock issued and outstanding; |

| |

|

|

| |

● |

up to 9,452,667 shares of Common Stock issuable upon exercise of a warrant to purchase Common Stock at an exercise price of $1.00 per share, subject to adjustment (“Exchange Warrant”), issued to 3i, LP pursuant to a Modification and Exchange Agreement dated April 20, 2023, as amended (the “Exchange Agreement”); |

| |

|

|

| |

● |

2,095,867 shares of common stock issuable upon the exercise of common stock purchase warrants issued in connection with public offering that closed in April 2023(“April 2023 Common Stock Warrants”) and common stock purchase warrants issued in connection with public offering that closed in July 2023 (“July 2023 Common Stock Warrants”) at an exercise price of $1.00 per share; |

| |

|

|

| |

● |

412 shares common stock issuable pursuant to outstanding options, with a weighted-average exercise price of $7,634; |

| |

|

|

| |

● |

1,401 shares of common stock available under our 2021 Equity Incentive Plan |

| |

|

|

| |

● |

up to 4,877,778 shares of Common Stock issuable upon exercise of warrants to purchase shares of Common Stock at an exercise price of $1.00 per share (the “Inducement Warrants”) issued by us to certain of investors (“September Investors”) in a private placement of the Inducement Warrants which closed in September 2023 pursuant to Warrant Exercise Inducement Letters dated September 14, 2023 (“Inducement Letter”); |

| |

|

|

| |

● |

up to 1,530,360 shares of common stock issuable to 3i, LP upon conversion of 1,417 share of our Series A Preferred Stock based upon a conversion price of $1.00 and stated value of $1,080, subject to adjustment; and |

| |

|

|

| |

● |

no shares of Series B Preferred Stock and no shares of Series C Preferred Stock issued and outstanding. |

Common Stock

Holders of our common stock

are entitled to one vote for each share held of record on all matters submitted to a vote of shareholders, including the election or removal

of directors, except for any directors who are elected exclusively by the holders of a class of our preferred stock that entitles that

class of stock to elect one or more directors. The holders of our common stock do not have cumulative voting rights in the election of

directors.

Upon our liquidation, dissolution

or winding up and after payment in full of all amounts required to be paid to creditors and to the holders of preferred stock having liquidation

preferences, if any, the holders of our common stock (and the holders of any preferred stock that may then be outstanding, to the extent

required by our Certificate of Incorporation, including any certificate of designation with respect to any series of preferred stock)

will be entitled to receive pro rata our remaining assets available for distribution, unless holders of a majority of the outstanding

shares of common stock approve a different treatment of the shares. Holders of our common stock do not have preemptive, subscription,

redemption or conversion rights. Our common stock will not be subject to further calls or assessment by us. There will be no redemption

or sinking fund provisions applicable to our common stock. All shares of our common stock that will be outstanding at the effective time

will be fully paid and non-assessable. The rights, powers, preferences and privileges of holders of our common stock will be subject to

those of the holders of our Series A Preferred Stock and any other shares of preferred stock we may authorize and issue in the future.

Preferred Stock

Our Certificate of Incorporation

authorizes our Board of Directors to establish one or more series of preferred stock (including convertible preferred stock). Unless required

under the Certificate of Incorporation, or bylaw or Nasdaq, the authorized shares of preferred stock will be available for issuance without

further action by stockholders. Our Board of Directors may determine, with respect to any series of preferred stock, the powers including

preferences and relative participations, optional or other special rights, and the qualifications, limitations or restrictions thereof,

of that series, including, without limitation:

| |

● |

the designation of the series; |

| |

● |

the number of shares of the series, which our Board of Directors may, except where otherwise provided in the preferred stock designation, increase (but not above the total number of authorized shares of the class) or decrease (but not below the number of shares then outstanding); |

| |

● |

whether dividends, if any, will be cumulative or non-cumulative and the dividend rate of the series; |

| |

● |

the dates at which dividends, if any, will be payable; |

| |

● |

the redemption rights and price or prices, if any, for shares of the series; |

| |

● |

the terms and amounts of any sinking fund provided for the purchase or redemption of shares of the series; |

| |

● |

the amounts payable on shares of the series in the event of any voluntary or involuntary liquidation, dissolution or winding-up of our affairs; |

| |

● |

whether the shares of the series will be convertible into shares of any other class or series, or any other security, of ours or any other corporation, and, if so, the specification of the other class or series or other security, the conversion price or prices or rate or rates, any rate adjustments, the date or dates as of which the shares will be convertible and all other terms and conditions upon which the conversion may be made; |

| |

● |

restrictions on the issuance of shares of the same series or of any other class or series; and |

| |

● |

the voting rights, if any, of the holders of the series. |

We may issue a series of preferred

stock that could, depending on the terms of the series, impede or discourage an acquisition attempt or other transaction that some, or

a majority, of the holders of our common stock might believe to be in their best interests or in which the holders of our common stock

might receive a premium for your common stock over the market price of the common stock. Additionally, the issuance of preferred stock

may adversely affect the rights of holders of our common stock by restricting dividends on our common stock, diluting the voting power

of our common stock or subordinating the liquidation rights of our common stock. As a result of these or other factors, the issuance of

preferred stock could have an adverse impact on the market price of our common stock.

Series A Convertible

Preferred Stock

On December 8, 2021, the Board

adopted resolutions to create a series of twenty thousand (20,000) shares of preferred stock, par value $0.0001, designated as “Series

A Convertible Preferred Stock.” On December 14, 2021, we filed the Original Series A COD for 20,000 shares of Series A Preferred

Stock. On April 21, 2023, in connection with the transactions contemplated under the Exchange Agreement, the Company filed the Series

A COD with the Delaware Secretary of State. The Series A COD eliminated the Series A Preferred Stock redemption right and dividend (except

for certain exceptions as specified therein), and provided for the conversion of Series A Preferred Stock into common stock at an initial

conversion price equal to the price for a share of common stock sold in the Offering, $30.00 per share and based on the stated value of

$1,080 per share.

On May 30, 2023, the Company

filed the Amended COD with the Delaware Secretary of State to amend the voting rights of the Series A Preferred Stock which among other

things provided additional voting rights to the Series A Preferred Stock Under the Amended COD, holders of the Series A Preferred stock

have the following voting rights: (1) holders of the Series A Preferred Stock have a right to vote on all matters presented at the Special

Meeting together with the common stock as a single class on an “as converted” basis using the conversion price of $30.00 and

based on stated value of $1,080 subject to a beneficial ownership limitation of 9.99%, and (2), in addition, holders of Series A Preferred

Stock have granted the Board the right to vote, solely for the purpose of satisfying quorum and casting the votes necessary to adopt the

Reverse Stock Split Proposal and the Adjournment Proposal under Delaware law, that will “mirror” the votes cast by the holders

of shares of common stock and Series A Preferred Stock , together as a single class, with respect to the Reverse Stock Split Proposal

and the Adjournment Proposal. The number of votes per each share of Series A Preferred Stock that may be voted by the Board shall be equal

to the quotient of (x) the sum of (1) the original aggregated stated value of the Series A Preferred Stock when originally issued on December

20, 2021 (calculated based on the original stated value of $1,000 of the Series A Preferred Stock multiplied by 20,000 shares of Series

A Preferred Stock) and (2) $1,200,000, which represents the purchase price of the Series C Preferred Stock when originally issued; divided

by (y) the conversion price of $30.00. If the Board decides to cast the vote, it must vote all votes created by Amended COD in the same

manner and proportion as votes cast by the holders of common stock and Series A Preferred Stock, voting as single class. The Series A

Preferred Stock voting rights granted to the holders thereof relating to the Reverse Stock Split Proposal and the Adjournment Proposal

expire automatically on July 31, 2023.

Except to the extent that

the holders of at least a majority of the outstanding Series A Preferred Stock (the “Required Holders”) expressly consent

to the creation of Parity Stock (as defined below) or Senior Preferred Stock (as defined below), all shares of capital stock are junior

in rank to all Series A Preferred Stock with respect to the preferences as to dividends, distributions and payments upon the liquidation,

dissolution and winding up of the Company (such junior stock is referred to herein collectively as “Junior Stock”). The rights

of all such shares of capital stock of the Company will be subject to the rights, powers, preferences and privileges of the Series A Preferred

Stock. Without limiting any other provision of this Certificate of Designations, without the prior express consent of the Required Holders,

voting separate as a single class, the Company will not hereafter authorize or issue any additional or other shares of capital stock that

is (i) of senior rank to the Series A Preferred Stock in respect of the preferences as to dividends, distributions and payments upon the

liquidation, dissolution and winding up of the Company (collectively, the “Senior Preferred Stock”), (ii) of pari passu rank

to the Series A Preferred Stock in respect of the preferences as to dividends, distributions and payments upon the liquidation, dissolution

and winding up of the Company (collectively, the “Parity Stock”) or (iii) any Junior Stock having a maturity date or any other

date requiring redemption or repayment of such shares of Junior Stock that is prior to the first anniversary from December 21, 2021. In

the event of the merger or consolidation of the Company with or into another corporation, the Series A Preferred Stock will maintain their

relative rights, powers, designations, privileges and preferences provided for herein and no such merger or consolidation will result

inconsistent therewith.

The

Series A Preferred Stock has a liquidation preference equal to an amount per Series A Preferred Stock equal to the sum of (i) the Black

Scholes Value (as defined in the Warrants, which was sold concurrent with the Series A Preferred Stock) with respect to the outstanding

portion of all Warrants held by such holder (without regard to any limitations on the exercise thereof) as of the date of such event and

(ii) the greater of (A) 125% of the Conversion Amount of such Series A Preferred Stock on the date of such payment and (B) the amount

per share such holder would receive if such holder converted such Series A Preferred Stock into common stock immediately prior to the

date of such payment, and will be entitled to convert into shares of common stock at an initial fixed conversion price of $30.00 per share,

subject to a beneficial ownership limitation of 9.99%.

If certain defined “triggering

events” defined in the Series A COD, as amended and restated and amended, occur, or our failure to convert the Series A Preferred

Stock into common stock when a conversion right is exercised, failure to issue our common stock when the Exchange Warrant is exercised,

failure to declare and pay to any holder any dividend on any dividend date, then we may be required to pay a dividend on the stated value

on the Series A Preferred Stock in the amount of 18% per annum, but paid quarterly in cash, so long as the triggering event is continuing.

As a result of the Company’s

delay in filing its periodic reports with the SEC in 2022, a “triggering event” under Section 5(a)(ii) of the Original Series

A COD, occurred on or about April 29, 2022, and because of the delay the Company was obligated to pay (i) registration delay payments

under the RRA, (ii) additional amounts under the Original Series A COD, and (iii) legal fees incurred in the preparation of the Forbearance

Agreement and Waiver to 3i, LP in an aggregate amount of $538,823 which was paid pursuant to that certain Forbearance Agreement and Waiver

with 3i, LP

On June 6, 2023, 3i, LP and

Company entered into the 3i Waiver Agreement pursuant to which 3i, LP (“3i Waiver Agreement”) agreed to waive certain rights

granted under a Series A Preferred Stock securities purchase agreement dated December 20, 2021, the Exchange Agreement and the securities

purchase agreement related to the April Offering in exchange for (i) amending the conversion price of the Series A Preferred Stock to

equal the public offering price of the shares of common stock in July Offering if the public offering price of the shares of common stock

in July Offering is lower than the then-current conversion price of the Series A Preferred Stock; (ii) participating in July Offering,

at its option, under the same terms and conditions as other investors, of which proceeds from 3i, LP’s participation were agreed

to be used to redeem a portion of shares of Series A Preferred Stock 3i, LP received from the Exchange Agreement; and (iii) (1) the repricing

of the exercise price of the April 2023 Common Warrants to the exercise price of the common warrant offered in July Offering if the exercise

price of the common warrant is lower than the then-current common warrants issued in the April Offering (the “April 2023 Common

Warrant”) exercise price; and (2) extending the termination date of the April 2023 Common Warrants to the date of termination of

the common warrants offered in July Offering.

On June 29, 2023, the Company

entered into the June 2023 Purchase Agreement with 3i LP pursuant to which on June 30, 2023, 3i, LP purchased the 3i June Promissory Note

for principal amount of $350,000. The terms of the 3i June Promissory Note provides that the outstanding obligations thereunder, including

accrued interest will be paid in full at the Next Financing; provided, however, that if the gross proceeds from the financing are insufficient

to settle the payment of the outstanding balance of the 3i June Promissory Note, together with all accrued interest thereon, in full,

then the Company will instead be obligated to convert all of the unpaid principal balance of the note, together with all accrued interest

thereon, into 486 shares of Series A Preferred Stock, In connection with the Purchase Agreement, the Company and 3i LP agreed to adjust

the then conversion price of the Series A Preferred Stock to the Downward Adjustment to Conversion Price. Based on the closing price of

the shares of common stock on June 28, 2023, the Downward Adjustment to Conversion Price is equal to $8.00 per share. In connection therewith,

the Company filed the Second Certificate of Amendment to the Series A COD with the Delaware Secretary of State to amend the Series A COD

to reflect the Downward Adjustment to Conversion Price.

Upon the consummation of the

July Offering, pursuant to the 3i Waiver Agreement, the conversion price of the Series A Preferred Stock was further reduced to $4.50.

On July 10, 2023, the Company filed the Third Amendment to effect the change to conversion price to $4.50.

Pursuant to the 3i Waiver

Agreement upon the consummation of the July Offering, the conversion price of the Series A Preferred Stock was reduced to $4.50. On July

10, 2023, the Company filed a Third Certificate of Amendment to Amended and Restated Certificate of Designations of Series A Convertible

Preferred Stock (“Third Amendment”) to effect the change to conversion price.

From the proceeds of the July

Offering, on July 10, 2023, the Company redeemed (i) 4,630 shares of Series A Preferred Stock held by 3i, LP, for $5,000,400 in cash,

and (ii) the 3i June Promissory Note for $350,886 in cash. Consequently, the 3i June Promissory Note was paid in full on July 10, 2023.

In connection with the Inducement

Letter and the transactions contemplated therein, the Company and 3i, LP entered into the Waiver pursuant to which 3i, LP agreed to allow

the filing of the Resale Registration Statement not otherwise permitted under certain agreements with 3i, LP. In consideration of entering

in the Waiver, the Company agreed to amend the “Conversion Price” of the Series A Convertible Preferred Stock to equal $1.00

as soon as practicable. On September 22, 2023 the Company filed the Fourth Certificate of Amendment to Amended and Restated Certificate

of Designations of Series A Convertible Preferred Stock with the Secretary of State of the State of Delaware to reflect the new conversion

price of the Series A Preferred Stock of $1.00. In addition, as a result of the Inducement Warrants, pursuant to the terms of the Exchange

Warrant, in September 2023 the number of shares exercisable and the exercise price of the Exchange Warrant were adjusted to 9,452,667

shares of common stock and $1.00 per share, respectively.

Series B Preferred Stock

On

November 22, 2022, the Board of Directors established the Series B Preferred Stock, par value $0.0001 per share (“Series B Preferred

Stock”). On November 22, 2022, we filed a Certificate of Designations setting forth the rights, preferences, privileges, and restrictions

for 200,000 shares of Series B Preferred Stock. The holders of Series B Preferred Stock are not entitled to receive dividends of any kind.

Each outstanding share of Series B Preferred Stock has 400 votes per share; The Series B Preferred Stock ranks senior to the common stock,

but junior to the Series A Preferred Stock, as to any distribution of assets upon a liquidation, dissolution or winding up of the Company,

whether voluntarily or involuntarily The Series B Preferred Stock shall rank senior to the common stock, but junior to the Series A Preferred

Stock. All shares of Series B Preferred Stock that are not present in person or by proxy through the presence of such holder’s shares

of common stock or Series A Preferred Stock, in person or by proxy, at any meeting of stockholders held to vote on the proposals relating

to reverse stock split, the Share Increase Proposal and the adjournment proposal as of immediately prior to the opening of the polls at

such meeting (the “Initial Redemption Time”) will be automatically be redeemed by the Company at the Initial Redemption Time

without further action on the part of the Company or the holder thereof (the “Initial Redemption”). Any outstanding shares

of Series B Preferred Stock that have not been redeemed pursuant to an Initial Redemption will be redeemed in whole, but not in part,

(i) if such redemption is ordered by the Board of Directors in its sole discretion, automatically and effective on such time and date

specified by the Board of Directors in its sole discretion or (ii) automatically upon the approval by the Company’s stockholders

of the Reverse Stock Split Proposal and the Share Increase Proposal at any meeting of stockholders held for the purpose of voting on such

proposals. Each share of Series B Preferred Stock redeemed in any Redemption will be redeemed in consideration for the right to receive

an amount equal to $0.01 in cash for each share of Series B Preferred Stock as of the applicable Redemption Time. Each share of Series

B Preferred Stock has 400 votes per share and is entitled to vote with the common stock and Series A Preferred Stock, together as a single

class, on the certain proposals. The power to vote, or not to vote, the shares of Series B Preferred Stock is vested solely and exclusively

in the Board of Directors, or its authorized proxy. As of February 3, 2023, all shares of Series B preferred stock have redeemed, and

none are issued and outstanding.

Series C Preferred Stock

On February 24, 2023, the

Board of Directors established the Series C Preferred Stock, and on February 24, 2023, we filed a Certificate of Designations of Series

C Preferred Stock (the “Series C Certificate of Designations”) setting forth the rights, preferences, privileges, and restrictions

for 50,000 shares of Series C Preferred Stock, as amended on February 28, 2023. As a result of transactions pursuant to an April 20, 2023,

Modification and Exchange Agreement, as amended on May 26, 2023 (the “Exchange Agreement”), with 3i, LP, there are no shares

of Series C Preferred Stock issued and outstanding.

Dividends. Under the

terms of the Series C Certificate of Designations, the holders of Series C Preferred Stock will be entitled to receive dividends, based

on the stated value of $27.00 per share, at a rate of five percent (5%) per annum, which shall accrue and be compounded daily, commencing

on the date of first issuance of any Series C Preferred Stock until the date that the Series C Preferred Stock is converted to common

stock.

Voting Rights. The

Series C Certificate of Designations provides that the Series C Preferred Stock will have no voting rights other than the exclusive right

to vote with respect to the Share Increase Proposal (as defined in the Series C Certificate of Designations) and the Reverse Stock Split

Proposal (as defined in the Series C Certificate of Designations) and shall not be entitled to vote on any other matter except to the

extent required under the DGCL, and the right to cast 620 votes per share of Series C Preferred Stock on the Share Increase and Reverse

Stock Split Proposals.

Liquidation. In addition,

upon any liquidation, dissolution or winding-up of the Company, prior and in preference to the common stock, holders of Series C Preferred

Stock shall be entitled to receive out of the assets available for distribution to stockholders an amount in cash equal to 105% of the

aggregate stated value of $27.00 per share of all shares of Series C Preferred Stock held by such holder.

Conversion. The conversion

price for the Series C Preferred Stock shall initially equal the lower of: (i) $6.37, which is the official closing price of the common

stock on the Nasdaq Global Market (as reflected on Nasdaq.com) on the Trading Day immediately preceding the Original Issuance Date; and

(ii) the lower of: (x) the official closing price of the common stock on the Nasdaq Global Market (as reflected on Nasdaq.com) on the

Trading Day immediately preceding the Conversion Date or such other date of determination; and (y) the average of the official closing

prices of the common stock on the Nasdaq Global Market (as reflected on Nasdaq.com) for the five (5) trading days immediately preceding

the Conversion Date or such other date of determination, subject to adjustment herein. In no event shall the Series C Preferred Stock

Conversion Price be less than $1.295 (the “Floor Price”). In the event that the Series C Preferred Stock Conversion Price

on a Conversion Date would have been less than the applicable Floor Price if not for the immediately preceding sentence, then on any such

Conversion Date the Company shall pay the Holder an amount in cash, to be delivered by wire transfer out of funds legally and immediately

available therefor pursuant to wire instructions delivered to the Company by the Holder in writing, equal to the product obtained by multiplying

(A) the higher of (I) the highest price that the common stock trades at on the Trading Day immediately preceding such Conversion Date

and (II) the applicable Series C Preferred Stock Conversion Price and (B) the difference obtained by subtracting (I) the number of shares

of common stock delivered (or to be delivered) to the Holder on the applicable Share Delivery Date with respect to such conversion of

Series C Preferred Stock from (II) the quotient obtained by dividing (x) the applicable Conversion Amount that the Holder has elected

to be the subject of the applicable conversion of Series C Preferred Stock, by (y) the applicable Series C Preferred Stock Conversion

Price without giving effect to clause (x) of such definition.

Redemption. Each holder

of Series C Preferred Stock shall have the right to cause the Company to redeem in cash all or part of such holder’s shares of Series

C Preferred Stock at a price per share equal to 110% of the stated value of $27.00 per share (i) after the earlier of (1) the receipt

of Authorized Stockholder Approval (as defined in the Series C Certificate of Designations) and (2) the date that is 60 days following

the original issue date and (ii) before the date that is 365 days after the original issue date. Upon receipt of a written notice to the

Company by each holder (each, a “Redemption Notice”) setting forth the number of shares of Series C Preferred Stock that such

holder wishes to redeem, the Company shall redeem such shares of Series C Preferred Stock in accordance with the Redemption Notice no

later than 5 days after the date on which the Redemption Notice is delivered to the Company.

Dividends

The DGCL permits a corporation

to declare and pay dividends out of “surplus” or, if there is no “surplus,” out of its net profits for the fiscal

year in which the dividend is declared and/or the preceding fiscal year. “Surplus” is defined as the excess of the net assets

of the corporation over the amount determined to be the capital of the corporation by the Board of Directors. The capital of the corporation