Amended Statement of Beneficial Ownership (sc 13d/a)

16 November 2022 - 1:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 3)*

Allot Ltd.

(Name of Issuer)

Ordinary Shares, par value ILS 0.10 per share

(Title of Class of

Securities)

M0854Q105

(CUSIP Number)

Lynrock Lake LP

Attn: Cynthia Paul

2 International Drive, Suite 130

Rye Brook, NY 10573

914-449-4660

(Name, Address

and Telephone Number of Person

Authorized to Receive Notices and Communications)

November 14, 2022

(Date of Event Which

Requires Filing of this Statement)

If the filing person has previously filed a statement on

Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. x

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out

for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. M0854Q105 |

| 1. |

Names of Reporting Persons

Lynrock Lake LP |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a)

(b) |

¨

x

(1) |

| 3. |

SEC Use Only |

| 4. |

Source of Funds (See Instructions)

AF |

| 5. |

Check if Disclosure of Legal Proceedings Is

Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

Citizenship or Place of Organization

Delaware |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

8,768,666 (2) |

| 8. |

Shared Voting Power

0 |

| 9. |

Sole Dispositive Power

8,768,666 (2) |

| 10. |

Shared Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

8,768,666 (2) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain

Shares (See Instructions) ¨ |

| 13. |

Percent of Class Represented by Amount in Row (11)

23.97% (3) |

| 14. |

Type of Reporting Person (See Instructions)

PN, IA |

| (1) | This Schedule 13D is filed by Lynrock Lake LP (the “Investment Manager”), Lynrock Lake Partners

LLC (the “General Partner”) and Cynthia Paul (“Ms. Paul” and, with the Investment Manager and the General

Partner, collectively, the “Reporting Persons”). The Reporting Persons expressly disclaim status as a “group”

for purposes of this Schedule 13D. |

| (2) | Consists of 8,768,666 Ordinary Shares held directly by Lynrock Lake Master Fund LP (“Lynrock Fund”).

In addition, as of November 14, 2022, Lynrock Fund directly held a convertible note of the Issuer (the Note, as defined in Item 6

below) that is not presently convertible into Ordinary Shares within 60 days of the date of this filing due to a provision of the Note

that limits Lynrock Fund’s ability to convert the Note to the extent that conversion would result in beneficial ownership of greater

than 19.99% of the Ordinary Shares outstanding immediately after any such conversion, which percentage may be decreased upon notice by

Lynrock Fund or increased to 24.99% upon 61 days’ notice by Lynrock Fund. The Investment Manager is the investment manager of Lynrock

Fund, and pursuant to an investment management agreement, the Investment Manager has been delegated full voting and investment power over

securities of the Issuer held by Lynrock Fund. Ms. Paul, the Chief Investment Officer of the Investment Manager and Sole Member of

the General Partner, the general partner of the Investment Manager, may be deemed to exercise voting and investment power over securities

of the Issuer held by Lynrock Fund. The information with respect to the ownership of the Ordinary Shares is provided as of November 14,

2022. |

| (3) | This calculation is based on (i) 36,587,444 Ordinary Shares outstanding as of April 3, 2022,

as reported in the Issuer’s Prospectus on Form 424B3 filed with the Securities and Exchange Commission (“SEC”)

on April 19, 2022 and (ii) excluding any Ordinary Shares issuable upon conversion of the Note, reflecting the limitation described

in footnote (2) above. |

| CUSIP No. M0854Q105 |

| 1. |

Names of Reporting Persons

Lynrock Lake Partners LLC |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a)

(b) |

¨

x

(1) |

| 3. |

SEC Use Only |

| 4. |

Source of Funds (See Instructions)

AF |

| 5. |

Check if Disclosure of Legal Proceedings Is

Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

Citizenship or Place of Organization

Delaware |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

8,768,666 (2) |

| 8. |

Shared Voting Power

0 |

| 9. |

Sole Dispositive Power

8,768,666 (2) |

| 10. |

Shared Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

8,768,666 (2) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain

Shares (See Instructions) ¨ |

| 13. |

Percent of Class Represented by Amount in Row (11)

23.97% (3) |

| 14. |

Type of Reporting Person (See Instructions)

OO, HC |

| (1) | This Schedule 13D is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13D. |

| (2) | Consists of 8,768,666 Ordinary Shares held directly by Lynrock Fund. In addition, as of November 14,

2022, Lynrock Fund directly held a Note that is not presently convertible into Ordinary Shares within 60 days of the date of this filing

due to a provision of the Note that limits Lynrock Fund’s ability to convert the Note to the extent that conversion would result

in beneficial ownership of greater than 19.99% of the Ordinary Shares outstanding immediately after any such conversion, which percentage

may be decreased upon notice by Lynrock Fund or increased to 24.99% upon 61 days’ notice by Lynrock Fund. The Investment Manager

is the investment manager of Lynrock Fund, and pursuant to an investment management agreement, the Investment Manager has been delegated

full voting and investment power over securities of the Issuer held by Lynrock Fund. Ms. Paul, the Chief Investment Officer of the

Investment Manager and Sole Member of the General Partner, the general partner of the Investment Manager, may be deemed to exercise voting

and investment power over securities of the Issuer held by Lynrock Fund. The information with respect to the ownership of the Ordinary

Shares is provided as of November 14, 2022. |

| (3) | This calculation is based on (i) 36,587,444 Ordinary Shares outstanding as of April 3, 2022,

as reported in the Issuer’s Prospectus on Form 424B3 filed with the SEC on April 19, 2022 and (ii) excluding any

Ordinary Shares issuable upon conversion of the Note, reflecting the limitation described in footnote (2) above. |

| CUSIP No. M0854Q105 |

| 1. |

Names of Reporting Persons

Cynthia Paul |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a)

(b) |

¨

x (1) |

| 3. |

SEC Use Only |

| 4. |

Source of Funds (See Instructions)

AF |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

Citizenship or Place of Organization

United States of America |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

8,768,666 (2) |

| 8. |

Shared Voting Power

0 |

| 9. |

Sole Dispositive Power

8,768,666 (2) |

| 10. |

Shared Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

8,768,666 (2) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| 13. |

Percent of Class Represented by Amount in Row (11)

23.97% (3) |

| 14. |

Type of Reporting Person (See Instructions)

IN, HC |

| (1) | This Schedule 13D is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13D. |

| (2) | Consists of 8,768,666 Ordinary Shares held directly by Lynrock Fund. In addition, as of November 14,

2022, Lynrock Fund directly held a Note that is not presently convertible into Ordinary Shares within 60 days of the date of this filing

due to a provision of the Note that limits Lynrock Fund’s ability to convert the Note to the extent that conversion would result

in beneficial ownership of greater than 19.99% of the Ordinary Shares outstanding immediately after any such conversion, which percentage

may be decreased upon notice by Lynrock Fund or increased to 24.99% upon 61 days’ notice by Lynrock Fund. The Investment Manager

is the investment manager of Lynrock Fund, and pursuant to an investment management agreement, the Investment Manager has been delegated

full voting and investment power over securities of the Issuer held by Lynrock Fund. Ms. Paul, the Chief Investment Officer of the

Investment Manager and Sole Member of the General Partner, the general partner of the Investment Manager, may be deemed to exercise voting

and investment power over securities of the Issuer held by Lynrock Fund. The information with respect to the ownership of the Ordinary

Shares is provided as of November 14, 2022. |

| (3) | This calculation is based on (i) 36,587,444 Ordinary Shares outstanding as of April 3, 2022,

as reported in the Issuer’s Prospectus on Form 424B3 filed with the SEC on April 19, 2022 and (ii) excluding any

Ordinary Shares issuable upon conversion of the Note, reflecting the limitation described in footnote (2) above. |

Explanatory

Note: This Amendment No. 3 (the “Amendment”), which amends the Schedule13D filed with the SEC on March 30,

2022, as amended by Amendment No. 1 filed June 15, 2022 and Amendment No. 2 filed September 15, 2022 (the “Original

Schedule 13D”) filed on behalf of Lynrock Lake LP (the “Investment Manager”), Lynrock Lake Partners LLC (the “General

Partner”) and Cynthia Paul (“Ms. Paul” and, with the Investment Manager and the General Partner, collectively,

the “Reporting Persons”), relates to the Ordinary Shares, par value ILS 0.10 per share (“Ordinary Shares”) of

Allot Ltd., an Israeli corporation (the “Issuer”).

The Original Schedule 13D is hereby amended to

the extent hereinafter expressly set forth and, except as amended hereby, the Original Schedule 13D remains in full force and effect.

All capitalized terms used in this Amendment but not defined herein shall have the meanings ascribed thereto in the Original Schedule

13D.

| Item 3. | Source and Amount of Funds or Other Consideration |

Item 3 of the Original Schedule 13D is hereby

amended and restated in its entirety as follows:

The source of the capital to acquire the

Ordinary Shares reported herein and the Note (as defined in Item 6) was Lynrock Fund’s working capital, consisting of

contributions from its general and limited partners (and which may, at any given time, include margin loans made by brokerage firms

in the ordinary course of business). The aggregate purchase price of the 8,768,666 Ordinary Shares reported herein was approximately

$64,305,164, excluding brokerage commissions. The total purchase price of the Note was $40 million.

| Item 4. | Purpose of Transaction |

Item 4 of the Original Schedule 13D is hereby

amended by adding the following to the end thereof:

On

September 22, 2022, a member of the Issuer’s board of directors (the “Board”) introduced Ms. Paul to the chairperson

of the Issuer’s Compensation and Nominating Committee (the “Committee Chairperson”). Ms. Paul met with the Committee

Chairperson on September 30, 2022, and the two parties discussed business strategy and board composition. During October 2022,

representatives of the Issuer engaged in periodic discussions with Ms. Paul regarding the possibility of joining the Board. On November 14,

2022, the Board extended an invitation to Ms. Paul to join the Board, and Ms. Paul consented to serve, if elected. Ms. Paul’s

nomination is subject to shareholder approval at the Issuer’s upcoming Annual Meeting of Shareholders, and, if elected, her service

as a director would commence as of such date.

| Item 5. | Interest in Securities of the Issuer |

Item 5 of the Original Schedule 13D is hereby

amended and restated in its entirety as follows:

| (a) | See responses to Item 13 on the cover pages of this filing, which are incorporated herein by reference. |

| (b) | See responses to Items 7, 8, 9 and 10 on the cover pages of this filing, which are incorporated herein

by reference. |

| (c) | The transactions in the Ordinary Shares by the Reporting Persons during the past sixty days are set forth

on Schedule A and are incorporated herein by reference. |

| (d) | No other person is known to have the right to receive or the power to direct the receipt of dividends

from, or any proceeds from the sale of, the Ordinary Shares beneficially owned by any of the Reporting Persons. |

Signature

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete, and correct.

Dated: November 15, 2022

| LYNROCK LAKE LP |

|

| |

|

| By: Lynrock Lake Partners LLC |

|

| its General Partner |

|

| |

|

| By: |

/s/ Cynthia Paul |

|

| |

Name: Cynthia Paul |

|

| |

Title: Sole Member |

|

| |

|

| LYNROCK LAKE PARTNERS LLC |

|

| |

|

| By: |

/s/ Cynthia Paul |

|

| |

Name: Cynthia Paul |

|

| |

Title: Sole Member |

|

| |

|

| /s/ Cynthia Paul |

|

| Cynthia Paul |

|

| |

ATTENTION |

|

| Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001). |

SCHEDULE A

Transactions in the Ordinary Shares During

the Past Sixty Days

Lynrock Lake Master Fund LP

| Nature of the Transaction | |

Amount of Securities

Purchased/(Sold) | | |

Weighted

Average Price ($) | | |

Date of

Purchase/Sale | | |

Low Price ($) | | |

High Price ($) | |

| Purchase of Ordinary Shares | |

| 30,081 | | |

$ | 4.08 | | |

| 09/15/22 | | |

$ | 3.93 | | |

$ | 4.16 | |

| Purchase of Ordinary Shares | |

| 2,000 | | |

$ | 3.76 | | |

| 09/16/22 | | |

$ | 3.74 | | |

$ | 3.76 | |

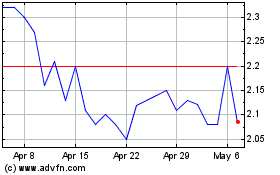

Allot (NASDAQ:ALLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Allot (NASDAQ:ALLT)

Historical Stock Chart

From Apr 2023 to Apr 2024