SCHEDULE 14C

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

| | | | | |

| ☒ | Preliminary Information Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)2)) |

| ☐ | Definitive Information Statement |

ALPINE 4 HOLDINGS, INC.

(Name of the Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| ☒ | No fee required |

| | |

| ☐ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Regulation 14C

of the Securities Exchange Act of 1934 as amended

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

_____________________________________________

TO OUR STOCKHOLDERS:

The purpose of this information statement (the “Information Statement”) is to inform you that, on December 20, 2023 (the “Voting Record Date”), holders of the voting capital, including any shares for which such holders have been designated by another stockholder of Alpine 4 Holdings, Inc., a Delaware corporation (the “Company,” “us,” “we,” or “our”) as such stockholder’s proxy and attorney-in-fact, representing in the aggregate approximately 72.41% of the outstanding voting power of the Company on the Voting Record Date (the “Written Consent Stockholders”), approved the following corporate actions by written consent in lieu of a special meeting of stockholders:

–For purposes of Nasdaq Rule 5635(d), the potential issuance of shares of Class A common stock to Ionic Ventures, LLC (“Ionic Ventures”), pursuant to the Purchase Agreement, dated as of November 17, 2023, (the “Ionic Ventures Purchase Agreement”), between the Company and Ionic Ventures; and the issuance and potential issuance of shares of Class A common stock to Mast Hill Fund, L.P. (“Mast Hill”) pursuant to a securities purchase agreement with Mast Hill dated as of June 29, 2023 (the “Mast Hill SPA”), pursuant to which the Company issued and sold to Mast Hill a senior convertible promissory note in the aggregate principal amount of $1,670,000 dated as of June 29, 2023 (the “Senior Note”), convertible into shares (the “Conversion Shares”) of the Company’s Class A common stock, as well as the issuance issue to Mast Hill of (i) shares of our Class A common stock underlying a common stock purchase warrant (the “Mast Hill Warrant”) to purchase 200,000 shares of Common Stock dated as of June 29, 2023 (the “MH Warrant Shares”), (ii) 67,400 shares of Common Stock (the “MH First Commitment Shares”), and 1,200,000 shares of Common Stock (the “MH Second Commitment Shares”), collectively representing more than 19.99% of the Company’s outstanding Class A common stock on the date the Company entered into the Ionic Ventures Purchase Agreement (the “Written Consent Approval”).

The foregoing Written Consent Approval is required because under the terms of the Ionic Ventures Purchase Agreement as well as Mast Hill SPA, Senior Note, and Mast Hill Warrant, we may have to issue more than 19.99% of the Company's outstanding Class A common stock as of the date the Company entered into the Ionic Ventures Purchase Agreement.

Under Nasdaq Rule 5635(d), we cannot issue shares of Class A common stock (or securities convertible into or exercisable for Class A common stock) in transactions other than public offerings without stockholder approval if the aggregate number of shares issued would be equal to or greater than 20% of the Company’s outstanding voting power before the applicable issuance and the price per share of Class A common stock issued is less than the lower if (i): the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the applicable binding agreement and (ii) the average Nasdaq Official Closing Price of the Class A common stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing of the applicable binding agreement (the “Minimum Price”).

As a result of the Written Consent Approval, on the date which is 20 calendar days after this Information Statement is first distributed and made available to stockholders, we will comply with Nasdaq Rule 5635(d), as the Written Consent Approvals constitute stockholder approval for the Company to issue shares of Class A common stock pursuant to the Ionic Ventures Purchase Agreement in an amount more than 19.99% of the outstanding voting power on the date of the Ionic Ventures Purchase Agreement even if the price per share of Class A common stock issued in connection with any particular issuance is less than the applicable Minimum Price for such transaction.

Accordingly, we are not soliciting proxies for the action by written consent by the Written Consent Stockholders, but are providing this Information Statement to our stockholders in accordance with Rule 14c-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

You will find important information about the Written Consent Approvals in the accompanying Notice of Action by Written Consent and Information Statement.

This Information Statement is first being distributed and made available to stockholders of record as of December ___, 2023, on or about December ___, 2023. Pursuant to Rule 14c-2 under the Exchange Act, the written consent of the Written Consent Stockholders will not become effective until at least 20 calendar days after this Information Statement is first distributed and made available to stockholders.

Very truly yours,

/s/ Kent B. Wilson

PRELIMINARY INFORMATION STATEMENT

SUBJECT TO COMPLETION, DATED DECEMBER ___, 2023

NOTICE OF ACTION BY WRITTEN CONSENT AND INFORMATION STATEMENT

-For purposes of Nasdaq Rule 5635(d), the potential issuance of shares of Class A common stock to Ionic Ventures, LLC (“Ionic Ventures”), pursuant to the Purchase Agreement, dated as of November 17, 2023, (the “Ionic Ventures Purchase Agreement”), between the Company and Ionic Ventures; and the issuance and potential issuance of shares of Class A common stock to Mast Hill Fund, L.P. (“Mast Hill”) pursuant to a securities purchase agreement with Mast Hill dated as of June 29, 2023 (the “Mast Hill SPA”), pursuant to which the Company issued and sold to Mast Hill a senior convertible promissory note in the aggregate principal amount of $1,670,000 dated as of June 29, 2023 (the “Senior Note”), convertible into shares (the “Conversion Shares”) of the Company’s Class A common stock, as well as the issuance issue to Mast Hill of (i) shares of our Class A common stock underlying a common stock purchase warrant (the “Mast Hill Warrant”) to purchase 200,000 shares of Common Stock dated as of June 29, 2023 (the “MH Warrant Shares”), (ii) 67,400 shares of Common Stock (the “MH First Commitment Shares”), and 1,200,000 shares of Common Stock (the “MH Second Commitment Shares”), collectively representing more than 19.99% of the Company’s outstanding Class A common stock on the date the Company entered into the Ionic Ventures Purchase Agreement (the “Written Consent Approval”).

Record Date

Holders of record of our issued and outstanding preferred and common stock on December ___, 2023, the notice record date, are entitled to receive this Information Statement.

By Order of the Board of Directors of

Alpine 4 Holdings, Inc.

/s/ Gerry Garcia

Gerry Garcia

Chairwoman

Phoenix, Arizona

December __, 2023

TABLE OF CONTENTS

PRELIMINARY INFORMATION STATEMENT — SUBJECT TO COMPLETION, DATED DECEMBER ___, 2023

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

INFORMATION STATEMENT

QUESTIONS AND ANSWERS ABOUT THE STOCKHOLDER APPROVALS

Why did I receive these Information Statement materials?

The purpose of this information statement (this “Information Statement”) is to inform you that, on December 20, 2023 (the “Voting Record Date”), holders of shares of Series B Preferred Stock of Alpine 4 Holdings, Inc. (the “Company,” “us,” “we,” or “our”) as such stockholder’s proxy and attorney-in-fact, representing in the aggregate approximately 200% of the outstanding voting power of the Company as of the Voting Record Date (the “Written Consent Stockholders”), approved the following corporate actions by written consent in lieu of a special meeting:

-For purposes of Nasdaq Rule 5635(d), the potential issuance of shares of Class A common stock to Ionic Ventures, LLC (“Ionic Ventures”), pursuant to the Purchase Agreement, dated as of November 17, 2023, (the “Ionic Ventures Purchase Agreement”), between the Company and Ionic Ventures; and the issuance and potential issuance of shares of Class A common stock to Mast Hill Fund, L.P. (“Mast Hill”) pursuant to a securities purchase agreement with Mast Hill dated as of June 29, 2023 (the “Mast Hill SPA”), pursuant to which the Company issued and sold to Mast Hill a senior convertible promissory note in the aggregate principal amount of $1,670,000 dated as of June 29, 2023 (the “Senior Note”), convertible into shares (the “Conversion Shares”) of the Company’s Class A common stock, as well as the issuance issue to Mast Hill of (i) shares of our Class A common stock underlying a common stock purchase warrant (the “Mast Hill Warrant”) to purchase 200,000 shares of Common Stock dated as of June 29, 2023 (the “MH Warrant Shares”), (ii) 67,400 shares of Common Stock (the “MH First Commitment Shares”), and 1,200,000 shares of Common Stock (the “MH Second Commitment Shares”), collectively representing more than 19.99% of the Company’s outstanding Class A common stock on the date the Company entered into the Ionic Ventures Purchase Agreement (the “Written Consent Approval”).

The foregoing Written Consent Approval is required because under the terms of the Ionic Ventures Purchase Agreement, the Mast Hill SPA, and the Mast Hill Warrant, we may have to issue more than 19.99% of the Company's outstanding Class A common stock as of the date the Company entered into the Ionic Ventures Purchase Agreement.

Under Nasdaq Rule 5635(d), we cannot issue shares of Class A common stock (or securities convertible into or exercisable for Class A common stock) in transactions other than public offerings without stockholder approval if the aggregate number of shares issued would be equal to or greater than 20% of the Company’s outstanding voting power outstanding before the applicable issuance and the price per share of Class A common stock issued is less than the lower of: (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the applicable binding agreement and the (ii) the average Nasdaq Official Closing Price of the Class A common stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing of the applicable binding agreement (the “Minimum Price”).

As a result of the Written Consent Approvals, on the date which is 20 calendar days after this Information Statement is first distributed and made available to stockholders, we will comply with Nasdaq Rule 5635(d), as the Written Consent Approvals constitute stockholder approval for the Company to issue shares of Class A common stock upon pursuant to the Ionic Ventures Purchase Agreement as well as the Mast Hill SPA, Senior Note, and Mast Hill Warrant, collectively as applicable to each, in an amount more than 19.99% of the outstanding voting power on the

date of the binding agreement for the respective transactions, even if the price per share of Class A common stock issued in connection with any particular issuance is less than the applicable Minimum Price for each transaction.

Accordingly, we are not soliciting proxies for the action by written consent by the Written Consent Stockholders, but we are providing this Information Statement to our stockholders in accordance with Rule 14c-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

In order to obtain the approval of our stockholders contained in the Written Consent Approvals, we could have convened a special meeting of our stockholders for the specific purpose of voting on such matters. However, as permitted by the General Corporation Law of the State of Delaware (the “DGCL”), our bylaws provide that any action that may be taken at any annual or special meeting of stockholders of the Company, may be taken without a meeting, without prior notice, and without a vote, if a consent or consents in writing, setting forth the action so taken, is signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. In order to eliminate the costs and management time involved in holding a meeting and obtaining proxies and in order to effect the above Written Consent Approvals as quickly as possible in order to accomplish the purposes described herein, we elected to utilize the written consent of the holders of a majority of the outstanding shares of our voting capital stock.

This Information Statement is first being distributed and made available to stockholders of record as of December ___, 2023 (the “Notice Record Date”) on or about December ___, 2023. Pursuant to Rule 14c-2 under the Exchange Act, the written consent of the Written Consent Stockholders will not become effective until at least 20 calendar days after this Information Statement is first distributed and made available to stockholders.

What matters were approved by written consent of the Written Consent Stockholders?

On the Voting Record Date, the Written Consent Stockholders approved the following corporate actions by written consent:

(1)For purposes of Nasdaq Rule 5635(d), the potential issuance of shares of Class A common stock to Ionic Ventures, LLC (“Ionic Ventures”), pursuant to the Purchase Agreement, dated as of November 17, 2023, (the “Ionic Ventures Purchase Agreement”), between the Company and Ionic Ventures; and the issuance and potential issuance of shares of Class A common stock to Mast Hill Fund, L.P. (“Mast Hill”) pursuant to a securities purchase agreement with Mast Hill dated as of June 29, 2023 (the “Mast Hill SPA”), pursuant to which the Company issued and sold to Mast Hill a senior convertible promissory note in the aggregate principal amount of $1,670,000 dated as of June 29, 2023 (the “Senior Note”), convertible into shares (the “Conversion Shares”) of the Company’s Class A common stock, as well as the issuance issue to Mast Hill of (i) shares of our Class A common stock underlying a common stock purchase warrant (the “Mast Hill Warrant”) to purchase 200,000 shares of Common Stock dated as of June 29, 2023 (the “MH Warrant Shares”), (ii) 67,400 shares of Common Stock (the “MH First Commitment Shares”), and 1,200,000 shares of Common Stock (the “MH Second Commitment Shares”), collectively representing more than 19.99% of the Company’s outstanding Class A common stock on the date the Company entered into the Ionic Ventures Purchase Agreement (the “Written Consent Approval”).

Pursuant to Rule 14c-2 under the Exchange Act, the written consent of the Written Consent Stockholders will not become effective until at least 20 calendar days after this Information Statement is first distributed and made available to stockholders.

Can I vote?

As of the Voting Record Date, the Written Consent Stockholders held shares of the Company’s capital stock, including shares of Class A, Class B, and Class C common stock and shares of Series B Preferred Stock representing in the aggregate approximately 200% of the outstanding voting power of the Company, which is more than the minimum number of votes that would be necessary to authorize or approve the Written Consent Approvals at a meeting of stockholders at which all shares entitled to vote thereon were present and voted. Accordingly, there is no

additional stockholder vote being held with respect to the Written Consent Approvals, we are not asking for a proxy, and you are requested not to send us a proxy.

Our capital stock currently outstanding consists of our Class A common stock, Class B common stock, Class C common stock, and our Series B preferred stock. Holders of the Class A common stock are entitled to one (1) vote per share; the holders of the Class B common stock are entitled to ten (10) votes per share; and the holders of the Class C common stock are entitled to five (5) votes per share.

Pursuant to our Certificate of Incorporation, as amended to date, if at least one share of Series B Preferred Stock is issued and outstanding, then the total aggregate issued shares of Series B Preferred Stock at any given time, regardless of their number, shall have that number of votes (identical in every other respect to the voting rights of the holders of all classes of common stock or series of preferred stock entitled to vote at any regular or special meeting of stockholders) equal to two hundred percent (200%) of the total voting power of all holders of the Company’s common and preferred stock then outstanding, but not including the Series B Preferred Stock. If more than one share of Series B Preferred Stock is issued and outstanding at any time, then each individual share of Series B Preferred Stock shall have the voting rights equal to two hundred percent (200%) of the total voting power of all holders of the Company’s common and preferred stock then outstanding, but not including the Series B Preferred Stock divided by the number of shares of Series B Preferred Stock issued and outstanding at the time of voting.

As of the Voting Record Date, there were three (3) shares of Series B Preferred Stock issued and outstanding, held by Kent B. Wilson and Ian Kantrowitz, two of the Company’s directors and officers. Additionally, as of the Voting Record Date, the following number of shares of each class were issued and outstanding: (i) 24,607,833 shares of our Class A common stock issued and outstanding; (ii) 906,012 shares of our Class B common stock issued and outstanding; and (iii) 1,500,413 shares of our Class C common stock issued and outstanding. As such, the aggregate voting power was as follows: (i) 24,607,833 votes by the holders of the Class A common stock; (ii) 9,060,120 votes by holders of the Class B common stock; and (iii) 7,502,065 votes by holders of shares of our Class C common stock, for a total of 41,170,018 votes by the three classes of common stock.

As of the Voting Record Date, the Written Consent Stockholders held an aggregate total of 82,340,036 votes, pursuant to the terms of our Certificate of Incorporation, which represented, in the aggregate, approximately 200% of the outstanding voting power of the Company as of such date and sufficient voting power to approve the Written Consent Approvals by written consent. Accordingly, there is no additional stockholder vote being held with respect to the Written Consent Approvals, we are not asking for a proxy or consent, and you are requested not to send us a proxy.

The following table sets forth the names of the Written Consent Stockholders, the number of shares of Series B Preferred Stock beneficially owned by the Written Consent Stockholders as of the Voting Record Date, the total number of votes in favor of the Written Consent Approvals, and the percentage of the issued and outstanding voting power of the Company that voted in favor thereof:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Name of Written Consent Stockholder | | Number of Shares of Series B Preferred Stock Held | | Number of Votes Held by Such Written Consent Stockholder | | Number of Votes that Voted in Favor of the Approvals | | Percentage of Aggregate Voting Power that Voted in Favor of the Approvals (1)(2) |

Kent B. Wilson Chief Executive Officer, Director | | 2 | | 59,370,092 | | 59,370,092 | | 48.07% |

Ian Kantrowitz Vice President of Investor Relations, Director | | 1 | | 30,056,236 | | 30,056,236 | | 24.34% |

| Total | | 3 | | 89,426,328 | | 89,426,328 | | 72.41% |

___________________

(1)Represents the percentage of voting power of the Series B Preferred Stock with respect to all shares of the Company’s outstanding Class A, Class B, and Class C common stock, aggregating the total voting power as described above. The holders of Class A common stock are entitled to one (1) vote per share; the holders of Class B common stock are entitled to ten (10) votes per share; and the holders of Class C

common stock are entitled to five (5) votes per share. As noted above, the holders of the Series B Preferred Stock are entitled to vote in the aggregate a number of votes equal to 200% of the total voting power of the Company’s common and preferred stock outstanding.

(2)Aggregate voting power of the Class A, Class B, and Class C common stock was equal to 41,170,018 votes as of the Voting Record Date. Accordingly, the aggregate voting power of the Series B Preferred Stock was equal to 82,340,036 votes as of the Voting Record Date.

Who will pay the costs of distributing the Information Statement?

We will bear all expenses incurred in connection with the distribution of this Information Statement, including the costs of printing and mailing. On request, we will reimburse banks, brokers, other institutions, nominees, fiduciaries, and custodians for their reasonable expenses in forwarding Information Statement materials to beneficial owners.

THE EQUITY ISSUANCE APPROVAL

Background

Equity Line Facility

On November 17, 2023, we entered into a purchase agreement (the "Ionic Ventures Purchase Agreement") with Ionic Ventures, LLC (“Ionic Ventures”), which provides that, upon the terms and subject to the conditions and limitations set forth therein, we have the right to direct Ionic Ventures to purchase up to an aggregate of $32,000,000 of shares of our Class A common stock over the 36-month term of the Ionic Ventures Purchase Agreement.

Purchase of Shares under the Ionic Ventures Purchase Agreement

Our right to commence sales under the Ionic Ventures Purchase Agreement is subject to the satisfaction of certain commencement conditions, including, without limitation, the effectiveness of the registration statement of which this prospectus forms a part, that all securities to be issued to Ionic Ventures under the Ionic Ventures Purchase Agreement and the Registration Rights Agreement shall have been approved for listing on the Nasdaq Capital Market, and Ionic Ventures’ representations and warranties shall be true and correct in all material respects as of the commencement date.

Additionally, Ionic Ventures’ obligation to buy purchase shares under the Ionic Ventures Purchase Agreement is subject to the satisfaction of certain commencement conditions, including, without limitation, the effectiveness of the registration statement of which this prospectus forms a part, our Class A common stock shall be listed or quoted on the Nasdaq Capital Market and all securities to be issued to Ionic Ventures pursuant to the Ionic Ventures Purchase Agreement shall have been approved for listing on the Nasdaq Capital Market, and our representations and warranties shall be true and correct in all material respects as of the commencement date.

After the satisfaction of the commencement conditions, we will have the right to present Ionic Ventures with a regular purchase notice directing Ionic Ventures to purchase any amount up to $2,000,000 of our Class A common stock per trading day, at a per share price equal to 95% (or 80% if our Class A common stock is not then trading on the Nasdaq Capital Market) of the average of the two lowest VWAPs over a specified measurement period (as described below).

We are also eligible to present Ionic Ventures with an exemption purchase notice directing Ionic Ventures to purchase, (i) on the date of the execution of the Ionic Ventures Purchase Agreement up to an aggregate amount of $1,000,000 and (ii) immediately following the date that the Registration Statement covering resale of the purchase shares has been declared effective and the requisite stockholder approval for the transactions contemplated by the Ionic Ventures Purchase Agreement has been obtained by Company, up to an aggregate amount of $1,000,000, at a per share price equal to 90% (or 80% if our Class A common stock is not then trading on the Nasdaq Capital Market) of the average of the two lowest VWAPs over a specified measurement period (as described below). Upon delivery of an exemption purchase notice to Ionic Ventures, we shall also deliver an additional 250,000 shares of Class A common stock to Ionic Ventures.

Under the Ionic Ventures Purchase Agreement, no later than two trading days after Ionic Ventures receives a valid purchase notice (the “Regular Purchase Notice Date” or “Exemption Purchase Notice Date”, as applicable), we are required to cause our transfer agent to deliver to Ionic Ventures such number of shares of Class A common stock (the “Pre-Settlement Purchase Shares”) equal to the product of (A) the quotient of (y) the purchase amount divided by (z) 90% of the closing price of our Class A common stock on the date immediately preceding the Regular Purchase Notice Date or the Exemption Purchase Notice Date, as applicable (the “Pre-Settlement Purchase Price”), and as to which Ionic Ventures shall be the owner thereof as of such time of delivery of such Pre-Settlement Purchase Shares, multiplied by (B) 125%.

Then, no later than two trading days after the Regular Purchase Measurement Period or the Exemption Regular Purchase Measurement Period, as applicable (the “Purchase Settlement Date”), we are required to cause our transfer agent to deliver to Ionic Ventures such number of shares of Class A common stock (the “Settlement Purchase Shares”) equal to the purchase amount divided by the Regular Purchase Price, which is equal to 95% (or, if the Class

A common stock is suspended from trading or delisted from the Nasdaq Capital Market at any time after the Commencement Date, 80%) (the “RPP Percentage”), or the Exemption Purchase Price, which is equal to 90% (or, if the Class A common stock is suspended from trading or delisted from the Nasdaq Capital Market at any time after the Commencement Date, 80%) (the “EPP Percentage”), of the arithmetic average of the two lowest daily VWAPs during the Regular Purchase Measurement Period or the Exemption Purchase Measurement Period, as applicable; provided, however, that the number of shares of Class A common stock to be delivered on the Purchase Settlement Date shall be reduced by the number of Pre-Settlement Purchase Shares delivered. If the number of Pre-Settlement Purchase Shares delivered to Ionic Ventures exceeds the number of Settlement Purchase Shares, then Ionic Ventures is required to return the excess shares. The “Regular Purchase Measurement Period” is the period starting on the trading day immediately following the receipt of Pre-Settlement Purchase Shares and ending on the trading day immediately following the date upon which the aggregate dollar volume of our Class A common stock traded on the Nasdaq Capital Market equals six times the purchase amount, in the aggregate, subject to a five trading day minimum. The “Exemption Purchase Measurement Period” is the period starting on the day of the receipt of the exemption purchase notice and ending on the trading day immediately following the date upon which the aggregate dollar volume of our Class A common stock traded on the Nasdaq Capital Market equals six times the purchase amount, in the aggregate, subject to a five-trading-day minimum.

With each purchase under the Ionic Ventures Purchase Agreement, we are also required to deliver to Ionic Ventures commitment shares, which is equal to 2.5% of the number of shares of Class A common stock deliverable upon such purchase (the "Commitment Shares"). The Commitment Shares shall be issued to Ionic Ventures on the Purchase Settlement Date. The number of shares of Class A common Stock that we can issue to Ionic Ventures from time to time under the Ionic Ventures Purchase Agreement shall be subject to the Beneficial Ownership Limitation.

In addition, Ionic Ventures will not be required to buy any shares of our Class A common stock pursuant to a purchase notice on any trading day on which the closing trade price of our Class A common stock is below $0.20. We will control the timing and amount of sales of our Class A common stock to Ionic Ventures. Ionic Ventures has no right to require any sales by us, and is obligated to make purchases from us as directed solely by us in accordance with the Ionic Ventures Purchase Agreement. The Ionic Ventures Purchase Agreement provides that we will not be required or permitted to issue, and Ionic Ventures will not be required to purchase, any shares under the Ionic Ventures Purchase Agreement if such issuance would violate Nasdaq rules, and we may, in our sole discretion, determine whether to obtain stockholder approval to issue shares in excess of 19.99% of our outstanding shares of Class A common stock if such issuance would require stockholder approval under Nasdaq rules.

The purchase price of the purchase shares purchased by Ionic Ventures under the Ionic Ventures Purchase Agreement will be derived from the market prices of our Class A common stock. We will control the timing and amount of future sales, if any, of purchase shares to Ionic Ventures. Ionic Ventures has no right to require us to sell any purchase shares to Ionic, but Ionic Ventures is obligated to make purchases as we direct, subject to certain conditions.

Ionic Ventures may not assign or transfer its rights and obligations under the Ionic Ventures Purchase Agreement.

The Ionic Ventures Purchase Agreement may be terminated by us if certain conditions to commence have not been satisfied by December 31, 2023. The Ionic Ventures Purchase Agreement may also be terminated by us at any time after commencement, at our discretion; provided, however, that if we sold less than $15,000,000 to Ionic Ventures (other than as a result of our inability to sell shares to Ionic Ventures as a result of the Beneficial Ownership Limitation, our failure to have sufficient shares authorized or our failure to obtain stockholder approval to issue more than 19.99% of our outstanding shares), we will be required to pay to Ionic Ventures a termination fee of $500,000, which is payable, at our option, in cash or in shares of Class A common stock, as additional commitment shares, at a price equal to the closing price on the day immediately preceding the date of receipt of the termination notice. Further, the Ionic Ventures Purchase Agreement will automatically terminate on the date that we sell, and Ionic Ventures purchases, the full $32,000,000 amount under the agreement or, if the full amount has not been purchased, on the expiration of the 36-month term of the Ionic Ventures Purchase Agreement.

Mast Hill Purchase Agreement

On June 29, 2023, the Company entered into a securities purchase agreement with Mast Hill (the "Mast Hill SPA"), pursuant to which the Company issued and sold to Mast Hill a senior convertible promissory note in the aggregate principal amount of $1,670,000 (the “Senior Note”), convertible into shares (the “Conversion Shares”) of the Company’s Class A common stock (the “Common Stock”), pursuant to the terms, conditions, and limitations set forth in the Senior Note. The Company also agreed to issue to Mast Hill (i) a common stock purchase warrant (the “Mast Hill Warrant”) to purchase 200,000 shares of Common Stock (the “MH Warrant Shares”), (ii) 67,400 shares of Common Stock (the “MH First Commitment Shares”), and 1,200,000 shares of Common Stock (the “MH Second Commitment Shares”). Under the transaction agreement, the MH Second Commitment Shares will be returned to the Company upon the Company’s full performance of certain specified obligations under the Mast Hill transaction agreements, but will become non-returnable should certain events of default occur as defined under the terms of the Mast Hill transaction agreements.

Our issuance of the 1,467,400 shares of Class A common stock, consisting of the MH Warrant Shares, the MH First Commitment Shares, and the MH Second Commitment Shares to Mast Hill, when combined with the shares issuable under the Senior Note as well as to Ionic Ventures under the Purchase Agreement may cause us to issue more than 19.99% of the total shares outstanding as of the date we entered into the Purchase Agreement.

Warrants and Shares Issued and to be Issued to J.H. Darbie & Co.

JH Darbie & Co. (“JH Darbie”) served as the finder in connection with the offer and sale of the Note to Mast Hill. JH Darbie received a warrant (the “JH Darbie Warrant”) to purchase 3,579 shares of the Company’s Common stock (the “JH Darbie Warrant Shares”).

Our issuance of the JH Darbie Warrant Shares, when combined with the shares issuable to Ionic Ventures under the Purchase Agreement and the shares issuable to Mast Hill as described above may cause us to issue more than 19.99% of the total shares outstanding as of the date we entered into the Purchase Agreement.

Nasdaq Limitation

Pursuant to Nasdaq Rule 5635(d), if an issuer intends to issue securities in a transaction which could result in the issuance of 20% or more of the issued and outstanding shares of the issuer’s common stock on a pre-transaction basis for less than the Minimum Price for such stock, the issuer generally must obtain the prior approval of its stockholders (the “Equity Issuance Approval”).

Under the applicable Nasdaq rules, in no event could we have issued more than 4,921,566 shares of our Class A common stock to the Investor under the Ionic Ventures Purchase Agreement or to Mast Hill under the Mast Hill agreements, or both, which number of shares is equal to 19.99% of the sum of (i) shares of the Class A common stock issued and outstanding immediately prior to the execution of the Ionic Ventures Purchase Agreement (the “Exchange Cap”), unless (a) we obtained stockholder approval to issue shares of Class A common stock in excess of the Exchange Cap in accordance with applicable Nasdaq rules (which condition was satisfied by the obtainment of the Equity Issuance Approval), or (b) the average price per share paid by the Investor for all of the shares of Class A common stock that we direct the Investor to purchase from us pursuant to the Ionic Ventures Purchase Agreement, if any, equals or exceeds $0.8919 per share (representing the lower of the official closing price of the Class A common stock on Nasdaq on the trading day immediately preceding the date of the Ionic Ventures Purchase Agreement and the average official closing price of the Class A common stock on Nasdaq for the five consecutive trading days ending on the trading day immediately preceding the date of the Ionic Ventures Purchase Agreement, as adjusted in accordance with applicable Nasdaq rules). Moreover, we may not issue or sell any shares of Class A common stock to the Investor under the Ionic Ventures Purchase Agreement which, when aggregated with all other shares of Class A common stock then beneficially owned by the Investor and its affiliates (as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder), would result in the Investor beneficially owning more than 4.99% of the outstanding shares of Class A common stock.

The foregoing is only a summary of the material terms of the Ionic Ventures Purchase Agreement, and the other transaction documents, and does not purport to be a complete description of the rights and obligations of the parties

thereunder. The summary of the Ionic Ventures Purchase Agreement is qualified in its entirety by reference to such agreement, which is filed as an exhibit to our Current Report on Form 8-K, filed with the SEC on November 22, 2023. A copy of this documents is also available from us free of charge upon request.

Reasons for the Equity Issuance Approval

Our Class A common stock is currently listed on the Nasdaq Capital Market and, as such, we are subject to Nasdaq Rule 5635(d), which requires us to obtain stockholder approval prior to the sale, issuance or potential issuance of shares of Class A common stock (or securities convertible into or exercisable for Class A common stock) in connection with a transaction other than a public offering without stockholder approval if the aggregate number of shares issued would be equal to or greater than 20% of the Company’s outstanding voting power before the applicable issuance and the price per share of Class A common stock issued is less than the Minimum Price, which is defined as the lower of: (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the applicable binding agreement and the (ii) the average Nasdaq Official Closing Price of the Class A common stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing of the applicable binding agreement.

The issuance prices under the Ionic Ventures Purchase Agreement, Mast Hill SPA, Senior Note, and Mast Hill Warrant at any given time may be lower than the Minimum Price applicable to the shares of Class A common stock to be sold under the Ionic Ventures Purchase Agreement, Mast Hill SPA, Senior Note, and Mast Hill Warrant. Accordingly, stockholder approval is required to issue shares in an amount more than 19.99% of the outstanding voting power on November 17, 2023, even if the price per share of Class A common stock issued in connection with any particular issuance is less than the applicable Minimum Price for the Ionic Ventures Purchase Agreement, Mast Hill SPA, Senior Note, and Mast Hill Warrant, respectively. The Equity Issuance Approval constituted stockholder approval for purposes of Nasdaq Listing Rule 5635(d).

As a result of the Equity Issuance Approval, on the date which is 20 calendar days after this Information Statement is first distributed or made available to stockholders, we will comply with Nasdaq Rule 5635(d), as the Equity Issuance Approval constitutes stockholder approval for the Company to issue shares of Class A common stock in an amount more than 19.99% of the outstanding voting power on November 17, 2023, even if the price per share of Class A common stock issued in connection with any particular issuance is less than the applicable Minimum Price for the Ionic Ventures Purchase Agreement, Mast Hill SPA, Senior Note, and Mast Hill Warrant.

Our Board has also previously determined that the Ionic Ventures Purchase Agreement, Mast Hill SPA, Senior Note, and Mast Hill Warrant and the transactions contemplated thereby are in the best interests of the Company and its stockholders.

Consequences of Non-Approval

We are not seeking the approval of our stockholders to authorize our entry into the Ionic Ventures Purchase Agreement and related transaction documents, as we have already entered into the Ionic Ventures Purchase Agreement and related transaction documents, which are binding obligations on us. We are not seeking the approval of our stockholders to authorize our entry into the Mast Hill SPA, Senior Note, Mast Hill Warrant, and related transaction documents, as we have already entered into the aforementioned documents, which are binding obligations to us. The failure of our stockholders to approve Equity Issuance Approval would not have negated the existing terms of the documents relating to the Ionic Ventures Purchase Agreement and related transaction documents, Mast Hill SPA, Senior Note, Mast Hill Warrant, and related transaction documents. The Ionic Ventures Purchase Agreement and related transaction documents, Mast Hill SPA, Senior Note, Mast Hill Warrant, and related transaction documents would have remained a binding obligation of the Company.

However, if the Equity Issuance Approval had not been approved by the Written Consent Stockholders, we may have, among other things, been unable to issue shares to the Investor or Mast Hill in excess of the Exchange Cap, which would have limited our ability to raise additional capital. Our ability to successfully implement our business plans and ultimately generate value for our stockholders is dependent upon our ability to raise capital and satisfy our ongoing business needs. If we had prevented from issuing shares to the Investor or Mast Hill in excess of the

Exchange Cap, we may not have the capital necessary to fully satisfy our ongoing business needs, the effect of which would adversely impact future operating results, and result in a delay in our business plans.

Effect on Current Stockholders

The issuance of shares of Class A common stock representing more than 19.99% of our outstanding voting power on November 17, 2023, would result in an increase in the number of shares of Class A common stock outstanding, and our stockholders will incur dilution of their percentage ownership. The dilutive effect may be material to our current stockholders.

No Consent Required

As of the Voting Record Date, the following number of shares of each class were issued and outstanding: (i) Class A common stock – 24,607,833 shares; (ii) Class B common stock – 906,012 shares; (iii) Class C common stock – 1,500,413 shares; and (iv) Series B preferred stock – 3 shares.

On the Voting Record Date, pursuant to the applicable provisions of the DGCL and our bylaws, we received a written consent approving the Equity Issuance Approval from the Written Consent Stockholders, who held shares of Class A, Class B, and Class C common stock and an aggregate of three shares of Series B Preferred Stock, representing together 200% of the total voting power of our outstanding Class A, Class B, and Class C common stock as of such date and sufficient voting power to approve the Equity Issuance Approval by written consent. Accordingly, the requisite stockholder approval of the Equity Issuance Approval was obtained. Thus, your consent is not required and is not being solicited in connection with the approval of the Equity Issuance Approval.

Dissenters’ Rights

Pursuant to the DGCL, our stockholders are not entitled to dissenters’ rights with respect to the Equity Issuance Approval.

BENEFICIAL OWNERSHIP OF SECURITIES

The following table sets forth certain information regarding beneficial ownership of Alpine 4 Class A, Class B, and Class C common stock and Series B Preferred Stock as of December 21, 2023, (i) by each person (or group of affiliated persons) who owns beneficially more than five percent of the outstanding shares of common stock, (ii) by each director and executive officer of Alpine 4, and (iii) by all of the directors and executive officers of Alpine 4 as a group. The percentages are based on the following figures:

•24,607,833 shares of Class A common stock;

•906,012 shares of Class B common stock;

•1,500,413 shares of Class C common stock; and

•3 shares of Series B Preferred stock.

Except as otherwise noted, the persons named in the table have sole voting and dispositive power with respect to all shares beneficially owned, subject to community property laws where applicable. Unless otherwise noted, the address of each person listed below is c/o Alpine 4 Holdings, Inc. 2525 E Arizona Biltmore Circle, Suite 237, Phoenix, Arizona, 85016.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Address of beneficial owner (1); Class of Securities | | Title/Class of Security | | Number of Shares | | Beneficial Ownership of Shares Listed | | Votes | | Total Voting Power (2) |

Kent B. Wilson Chief Executive Officer, Director | | CLASS A | | 188,515 | | | 0.77 | % | | 188,515 | | | |

| | CLASS B | | 366,936 | | | 40.50 | % | | 3,669,360 | | | |

| | CLASS C | | 123,772 | | | 8.25 | % | | 618,860 | | | |

| | B Preferred | | 2 | | | 66.67 | % | | 54,893,357 | | | |

| Total Votes | | | | | | | | 59,370,092 | | | 48.07 | % |

| | | | | | | | | | |

Ian Kantrowitz Director | | CLASS A | | 104,177 | | | 0.42 | % | | 104,177 | | | |

| | CLASS B | | 187,429 | | | 20.69 | % | | 1,874,290 | | | |

| | CLASS C | | 126,218 | | | 8.41 | % | | 631,090 | | | |

| | B Preferred | | 1 | | | 33.33 | % | | 27,446,679 | | | |

| Total Votes | | | | | | | | 30,056,236 | | | 24.34 | % |

| | | | | | | | | | |

Jeff Hail Chief Operating Officer | | CLASS A | | 10,816 | | | 0.04 | % | | 10,816 | | | |

| | CLASS B | | 140,527 | | | 15.51 | % | | 1,405,270 | | | |

| | CLASS C | | 100,938 | | | 6.73 | % | | 504,690 | | | |

| | B Preferred | | — | | | — | % | | — | | | |

| Total Votes | | | | | | | | 1,920,776 | | | 1.56 | % |

| | | | | | | | | | |

Christopher Meinerz Chief Financial Officer | | CLASS A | | 25,000 | | | 0.10 | % | | 25,000 | | | |

| | CLASS B | | — | | | — | % | | — | | | |

| | CLASS C | | — | | | — | % | | — | | | |

| | B Preferred | | — | | | — | % | | — | | | |

| Total Votes | | | | | | | | 25,000 | | | 0.02 | % |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gerry Garcia Director | | CLASS A | | 1,250 | | | 0.01 | % | | 1,250 | | | |

| | CLASS B | | — | | | — | % | | — | | | |

| | CLASS C | | 126 | | | 0.01 | % | | 630 | | | |

| | B Preferred | | — | | | — | % | | — | | | |

| Total Votes | | | | | | | | 1,880 | | | *% |

| | | | | | | | | | |

Edmond Lew Director | | CLASS A | | 15,460 | | | 0.06 | % | | 15,460 | | | |

| | CLASS B | | — | | | — | % | | — | | | |

| | CLASS C | | 1,021 | | | 0.07 | % | | 5,105 | | | |

| | B Preferred | | — | | | — | % | | — | | | |

| Total Votes | | | | | | | | 20,565 | | | 0.02 | % |

| | | | | | | | | | |

Christophe Jeunot Director | | CLASS A | | 22,112 | | | 0.09 | % | | 22,112 | | | |

| | CLASS B | | — | | | — | % | | — | | | |

| | CLASS C | | 3,403 | | | 0.23 | % | | 17,015 | | | |

| | B Preferred | | — | | | — | % | | — | | | |

| Total Votes | | | | | | | | 39,127 | | | 0.03 | % |

| | | | | | | | | | |

Jonathan Withem Director | | CLASS A | | — | | | — | % | | — | | | |

| | CLASS B | | — | | | — | % | | — | | | |

| | CLASS C | | — | | | — | % | | — | | | |

| | B Preferred | | — | | | — | % | | — | | | |

| Total Votes | | | | | | | | — | | | — | % |

| | | | | | | | | | |

Andrew Call Director | | CLASS A | | — | | | — | % | | — | | | |

| | CLASS B | | — | | | — | % | | — | | | |

| | CLASS C | | — | | | — | % | | — | | | |

| | B Preferred | | — | | | — | % | | — | | | |

| Total Votes | | | | | | | | — | | | — | % |

| | | | | | | | | | |

As Officers and Directors as a Group | | CLASS A | | 367,330 | | | 1.49 | % | | 367,330 | | | |

(9 people) | | CLASS B | | 694,892 | | | 76.70 | % | | 6,948,920 | | | |

| | CLASS C | | 355,478 | | | 23.70 | % | | 1,777,390 | | | |

| | B Preferred | | 3 | | | 100.00 | % | | 82,340,036 | | | |

| Total Votes | | | | | | | | 90,870,092 | | | 74.04 | % |

| | | | | | | | | | |

| There are no stockholders with greater than 5% ownership |

_______________

*Less than 0.01%

(1)Except as otherwise indicated, the address of the stockholder is: Alpine 4 Holdings, Inc., 2525 E Arizona Biltmore Cir, Suite 237, Phoenix AZ 85016.

(2)The Voting Power column includes the effect of shares of Class B common stock, Class C common stock, and Series B Preferred Stock held by the named individuals, as indicated in the footnotes below. Each share of Class B common stock has 10 votes. Each share of Class C common stock has 5 votes. Collectively, all of the shares of Series B Preferred have voting power equal to 200% of the total voting power of all other Classes or series of outstanding shares. Each Series B Preferred share has a fractional portion of that aggregate vote.

INTEREST OF CERTAIN PERSONS IN THE STOCKHOLDER APPROVALS

No officer, director, or beneficial owner of more than 5% of any class of our voting securities, or an affiliate or immediate family member thereof, has any substantial interest in the matters acted upon by the Written Consent Stockholders, other than in their role as an officer, director, or beneficial owner.

HOUSEHOLDING

We have adopted a practice called “householding.” This practice allows us to deliver only one copy of certain of our stockholder communications (such as a notice regarding the internet availability of information statement or proxy materials, our annual reports, or our proxy materials) to stockholders who have the same address and last name and who do not participate in email delivery of these materials, unless one or more of these stockholders notifies us that he or she would like to receive an individual copy of these notices or materials. If you share an address with another stockholder and receive only one set of information statement-related materials and would like to request a separate copy or for any future meetings or stockholder communications, please send your written request to Alpine 4 Holdings, Inc., 2525 E Arizona Biltmore Circle Suite 237, Attention: Investor Relations, or call us at 480-702-2431. Upon written or oral request, we will promptly deliver a separate copy to you. Similarly, you may also contact us through either of these methods if you receive multiple copies of proxy- or information statement- related materials and other stockholder communications and would prefer to receive a single copy in the future.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly, and special reports, proxy statements and other information with the SEC. The SEC maintains an internet website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us. You may also access our reports and proxy statements free of charge at our website, www.alpine4.com. The information contained in, or that can be accessed through, our website is not part of this Information Statement. The Information Statement can be obtained from the SEC, as indicated above, or from us.

INCORPORATION BY REFERENCE

The SEC allows the Company to “incorporate by reference” information that it files with the SEC in other documents into this Information Statement. This means that the Company may disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be part of this Information Statement. This Information Statement and the information that the Company files later with the SEC may update and supersede the information incorporated by reference. Such updated and superseded information will not, except as so modified or superseded, constitute part of this Information Statement.

The Company is incorporating by reference the filings listed below and any additional documents that the Company may file with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of the initial filing of this Information Statement and before the actions described in this Information Statement become effective, except the Company is not incorporating by reference any information furnished (but not filed) under Item 2.02 or Item 7.01 of any Current Report on Form 8-K and corresponding information furnished under Item 9.01 as an exhibit thereto:

•The Company’s Annual Report;

•The Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023, filed with the SEC on June 21, 2023; •The Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, filed with the SEC on August 11, 2023; •The Company’s Current Reports on Form 8-K filed with the SEC on March 27, 2023; April 14, 2023; April 18, 2023; April 20, 2023; April 21, 2023; May 12, 2023; May 30, 2023; June 1, 2023; June 2, 2023; June 5,

2023; June 22, 2023; June 27, 2023; July 6, 2023; July 10, 2023; August 4, 2023; August 11, 2023; August 29, 2023; August 31, 2023; September 6, 2023; September 13, 2023; November 14, 2023; and November 22, 2023; and December 22, 2023. •The description of the Company’s securities registered pursuant to Section 12 of the Exchange Act, included in the Company’s Registration Statement on Form S-1, filed with the SEC on August 4, 2023, as amended to date.

The Company undertakes to provide without charge to each person to whom a copy of this Information Statement has been delivered, upon request, by first class mail or other equally prompt means, a copy of any or all of the documents incorporated by reference in this Information Statement, other than the exhibits to these documents, unless the exhibits are specifically incorporated by reference into the information that this Information Statement incorporates. You may obtain documents incorporated by reference by requesting them in writing at Alpine 4 Holdings, Inc., 2525 E Arizona Biltmore Circle Suite 237, Attention: Investor Relations, or call us at 480-702-2431.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Information Statement contains forward-looking statements within the meaning of Section 21E of the Exchange Act and Section 27A of the Securities Act. Any statements contained in this Information Statement that are not statements of historical fact may be forward-looking statements, including, without limitation, the timing of and the anticipated benefits of the shares issuable to Ionic Ventures pursuant to the Ionic Ventures Purchase Agreement, as well as the shares issued and issuable to Mast Hill and JH Darbie. Words such as “anticipates,” “could,” “may,” “estimates,” “expects,” “projects,” “intends,” “plans,” “believes,” “will,” and words or phrases of similar substance used in connection with any discussion of future operations, financial performance, plans, events, trends or circumstances can be used to identify some, but not all, forward-looking statements. These forward-looking statements are just predictions and involve significant risks and uncertainties, many of which are beyond our control, and actual results may differ materially from these statements. Factors that could cause actual outcomes or results to differ materially from those reflected in forward-looking statements include, but are not limited to, those discussed in our filings with the SEC.

Except as may be required by applicable law, the Company expressly disclaims any intention or obligation to update or revise any forward-looking statements, and the Company assumes no obligation to update any forward-looking statements contained in this Information Statement as a result of new information or future events or developments. Thus, you should not assume that the Company’s silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements.

| | | | | | | | |

| By Order of the Board of Directors, | |

| | |

| | |

| | ALPINE 4 HOLDINGS, INC. |

| | |

| | |

| | |

| | /s/ Kent B. Wilson |

| | Chief Executive Officer |

| | Phoenix, Arizona |

| | December ___, 2023 |

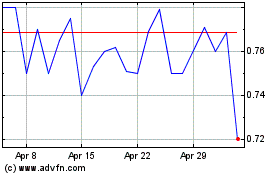

Alpine 4 (NASDAQ:ALPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alpine 4 (NASDAQ:ALPP)

Historical Stock Chart

From Apr 2023 to Apr 2024