0001606698FALSE00016066982023-12-222023-12-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

___________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) December 22, 2023

Alpine 4 Holdings, Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-40913 | | 46-5482689 |

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) | | (COMMISSION FILE NO.) | | (IRS EMPLOYER IDENTIFICATION NO.) |

2525 E Arizona Biltmore Circle, Suite 237

Phoenix, AZ 85016

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

480-702-2431

(ISSUER TELEPHONE NUMBER)

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock | ALPP | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 1.01 Entry into Material Definitive Agreement.

On December 22, 2023, Alpine 4 Holdings, Inc., a Delaware corporation (the “Company,” “we,” “us,” or “our”), along with several of its subsidiaries, listed below, entered into a binding letter of intent (the “LOI”) with Bright Sheet Metal Company, Inc., an Indiana corporation (“Bright”), relating to the sale by the Company of 100% of the assets of Morris Sheet Metal Corp. (“Morris”), JTD Spiral Inc. (“JTD”), Morris Enterprises, LLC (“MorrisE”), Morris Transport LLC (“MorrisT”), and Deluxe Sheet Metal, Inc. (“Deluxe,” and with Morris, JTD, MorrisE, and MorrisT, the “Subsidiaries”), and the assumption by Bright of certain liabilities of Morris Sheet Metal Corp. and JTD Spiral, Inc.

Pursuant to the LOI, the Company agreed to sell to Bright and Bright agreed to purchase from the Seller 100% ownership of all assets owned by the Subsidiaries (the “Assets”). The parties to the LOI intend to enter into more comprehensive definitive purchase agreements and other ancillary agreements incorporating the terms set forth in the LOI. Nevertheless, the Company, the Subsidiaries, and Bright agreed that in the event that other definitive agreements have not been executed as of the closing date of the purchase and sale of the Assets, the LOI would be the definitive agreement between the parties. In the event that the parties enter into one or more definitive agreements, the Company will provide disclosures of the terms, conditions, and provisions of those agreements in a subsequent filing.

Under the terms of the LOI, the purchase of the Assets by Bright is intended to be accomplished in such a way as to satisfy Bright that it has obtained all such rights to the Assets owned by the Subsidiaries. The LOI provides that the Assets do not include the Employer Identification Number (“EIN”) of any of the Subsidiaries, or any IRS filing made under such EIN and any funds received pursuant therefrom, including but not limited to any pending or future application by Seller or the Subsidiaries with the IRS for employee retention credits (“ERC”), or any funds received therefrom.

The parties to the LOI anticipate that the purchase and sale of the Assets will close on or before January 12, 2024 (the “Anticipated Closing Date”), at which time the Company and the Subsidiaries will transfer, sell, and assign to Bright all Assets of the Subsidiaries, in exchange for which Bright will pay to the Company the cash consideration as described in the LOI and will assume liability for payment of the Assumed Liabilities as defined in the LOI. The cash consideration and the assumption of liabilities collectively constitute the “Purchase Price” for the Assets.

The cash component of the Purchase Price will be the net-asset value as determined by the Company and Bright based on information set forth in a valuation spreadsheet created by the Company (the “Closing Valuation Spreadsheet”) as updated by the Company as of the close of the day prior to the Anticipated Closing Date. The liabilities to be assumed consist of the payment of any then-existing liability of Morris and JDT comprising any part of certain liabilities set forth in the Closing Valuation Spreadsheet meeting the closing conditions of the LOI, as well as the Subsidiaries’ union Unfunded Pension Liabilities, but not including Excluded Pension Remittance Liabilities (as defined in the LOI) (collectively the “Assumed Liabilities”). The Company estimates that the cash consideration portion of the Purchase Price will be approximately $1.5 million dollars, which represents the difference between the Assets and Assumed Liabilities with the exact Purchase Price determined based on the Closing Valuation Spreadsheet.

The LOI includes standard pre-closing covenants of the Company and the Subsidiaries relating to the operation of the Subsidiaries by the Company, certain indemnification holdbacks, and no-shop provisions, as well as mutual covenants to work to satisfy all closing conditions by the Anticipated Closing Date.

Additionally, the LOI includes certain covenants by the parties. Bright covenanted, among other things, (i) to enter into a one-year sublease of premises currently leased by Morris and to pay a sublease of approximately $30,000 per month, subject to anticipated increases; (ii) to not solicit or attempt to take away any business, customers, or business partners of the Subsidiaries, or to solicit any employee or contractor of the Subsidiaries to terminate his or her employment or contractor status; (iii) to employ union labor in its use of the Assets acquired from the Subsidiaries, and to contribute substantially the same number of contribution base units to the union National Pension Fund (the “Plan”) as the Subsidiaries contributed prior to the sale; and (iv) to perform any existing contractor or subcontractor contract to which Morris or JTD is a party, subject to certain conditions.

The LOI also included representations and warranties by the Company and the Subsidiaries standard for transactions of this nature.

The foregoing description of the LOI does not purport to be complete and is qualified in its entirety to the full text of the LOI, which is filed as Exhibit 10.1 hereto, and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| 10.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Alpine 4 Holdings, Inc.

By: /s/ Kent B. Wilson

Kent B. Wilson

Chief Executive Officer, President

(Principal Executive Officer)

Date: December 29, 2023

December 22, 2023

Mr. Gary Aletto

Bright Sheet Metal Company, Inc. 4212 W. 71st Street

Suite A

Indianapolis , IN 46268

Re: Binding Letter of Intent for Purchase and Sale of 100% of the Assets of Morris Sheet Metal Corp., JTD Spiral Inc., Morris Enterprises, LLC, Morris Transport LLC, and Deluxe Sheet Metal, Inc., and the Assumption of Certain Liabilities of Morris Sheet Metal Corp. and JTD Spiral, Inc.

Dear Gary:

This binding letter of intent (the “Letter”) is entered into as of December 22, 2023 (the “Effective Date”) and summarizes the principal terms of the purchase by Bright Sheet Metal Company, Inc., an Indiana corporation (“Bright” or “Buyer”), of 100% of the assets of:

Morris Sheet Metal Corp., an Indiana corporation (“Morris”);

JTD Spiral Inc., an Indiana corporation (“JTD”;

Morris Enterprises, LLC, an Indiana limited liability company (“MorrisE”);

Morris Transport LLC, an Indiana limited liability company (“MorrisT”);

Deluxe Sheet Metal, Inc., an Indiana corporation (“Deluxe”),

(Morris, JTD, MorrisE, MorrisT, and Deluxe are collectively the “Subsidiaries”).

The Subsidiaries are each wholly owned subsidiaries of Alpine4 Holdings Inc., a Delaware corporation (“Alpine” or “Seller”). Certain capitalized terms not defined below have the meanings set forth on Exhibit A attached hereto.

1.Background; Agreement.

1.1.Background and Purpose. Bright’s business is similar to that of the Subsidiaries. Alpine no longer wishes to be in the business conducted by the Subsidiaries. Bright has expressed interest in purchasing the assets of the Subsidiaries with the intention of continuing to perform the business for which the Subsidiaries employed its assets, and Alpine is willing to sell Subsidiaries’ assets to Bright subject to mutually agreed terms, including but not limited to Bright’s assumption of certain Liabilities of the Subsidiaries. Following the Effective Date, the parties intend to enter into a more comprehensive definitive purchase agreement and other ancillary agreements (together the “Agreements”) incorporating the material terms and conditions described in this Letter.

1.2.Definitive Agreements; Nature of Letter. Unless and until the Agreements become effective, the parties agree to be bound by all of the terms and conditions of this Letter. If the parties have not executed the Agreements by the Closing Date and if this Letter has not been terminated pursuant to Section 9 herein, then this Letter, together with such other agreements as the parties mutually execute and deliver, shall become the definitive agreement.

2.Purchase and Sale of Assets of the Subsidiaries. Subject to the satisfaction of the closing conditions set forth below, at the closing of the Transaction contemplated by this Letter and the Agreements (the “Closing”), the Seller shall sell to Bright and Bright shall purchase from the Seller 100% ownership of all assets owned by the Subsidiaries (the “Assets”). The Transaction shall be accomplished in such a way as to satisfy Bright that it has obtained all such rights to the assets owned by the Subsidiaries. To be clear, Assets do not include the Employer Identification Number (“EIN”) of any of the Subsidiaries, and any IRS filing made under such EIN and any funds received pursuant therefrom, including but not limited to any pending or future application by Seller or the Subsidiaries with the IRS for employee retention credits (“ERC”), or any funds received therefrom.

3.Due Diligence. As promptly as reasonably practical following the Effective Date, The Subsidiaries will allow Bright to conduct due diligence as provided in this Section (“Due Diligence”). At Bright’s election, Bright will engage an auditor to complete any or all of the classes of items identified on the valuation spreadsheet provided in Exhibit C.

During the period of the Audit, Bright, its representatives and the Auditors will be permitted to have discussions with all the Subsidiaries employees, contractors, agents, customers, suppliers and other third parties, including without limitation, any outside advisors of the Subsidiaries, and access to available schedule details of Assets, Assumed Liabilities, work in progress, existing leases, and Construction Contracts, and any other document that Bright believes is germane to the conduct of its Due Diligence.

4.Closing. The Closing will occur promptly upon satisfaction or waiver of all closing conditions set forth in Section 8, but not later than January 12, 2024 (the “Closing Date”). At the Closing, the Seller shall transfer, sell and assign to Bright all assets of the Subsidiaries, and Bright shall pay to the Seller cash consideration as described in Section 5.1.(a) herein, and Bright shall assume liability for payment of the Assumed Liabilities (as defined in Section 5.1(b)) (the “Closing Actions”). All Closing Actions have to be completed simultaneously and Closing will only occur when all Closing Actions are fully completed or waived.

5.Purchase Consideration and Payment.

5.1.Purchase Consideration. In consideration for the purchase of the assets of the Subsidiaries, Bright will pay the purchase consideration (the “Purchase Price”) to the Seller and assume Seller’s liabilities as follows:

(a)Cash Payment. At the Closing, Bright will pay to Seller the net-asset value as determined by performing the calculations to complete the valuation spreadsheet in Exhibit C, whose inputs have been updated by Seller to reflect their values as of the close of the previous business day (the “Closing Valuation Spreadsheet”), where such Closing Valuation Worksheet meets the Closing conditions of Section 8.1(a).

(b)Assumption of Liabilities. In addition to the cash payments set forth in Section 5.1(a) above, Bright will assume all responsibility for the payment of any then-existing liability of Morris and JDT comprising any part of the “Liabilities Grand Total” in the Closing Valuation Spreadsheet meeting the Closing conditions of Section 8.1(a),as well as the Subsidiaries’ union Unfunded Pension Liabilities, but not including Excluded Pension Remittance Liabilities (collectively the “Assumed Liabilities”).

6.Representations and Warranties. Each of the Subsidiaries and Seller make the representations and warranties to Bright that are set forth on Exhibit B attached to this Letter. Any representations and warranties of The Subsidiaries and each of the Seller made in the Agreements may be qualified by written exceptions provided in disclosures schedules delivered to Bright at Closing. Bright makes the representations and warranties to Seller that are set forth on Exhibit B attached to this Letter.

7.Covenants.

-

7.1 Subsidiary and Seller Covenants.

(a)Prohibition against upstreaming. During the period between the Effective Date and the Closing Date, Seller and its affiliates agrees that it not take or accept any funds transferred from the Subsidiaries other than reimbursement for employee benefits paid by Seller on behalf of the Subsidiaries non-union employees.

(b)Conduct of Business. During the period between the Effective Date and the Closing Date, Seller shall cause the Subsidiaries to conduct the Business in the ordinary course and shall notify Bright as soon as practicable of the occurrence of any Material Adverse Effect or any event which would be outside the ordinary course of the Business or could cause the terms, conditions, and representations included herein or in the

Agreements to become breached or violated. The Subsidiaries shall operate in a way consistent with past practices and will not enter into any new material agreements or materially alter any existing agreement without notification to Bright, detailing such new agreement(s) or changes.

(c)Additional Covenants. The Subsidiaries and Seller will cooperate with Bright and will use their good faith efforts to satisfy the conditions to Closing described herein and, upon satisfaction of such conditions, to consummate the Transactions contemplated hereby. From the Effective Date until the Closing Date, the Subsidiaries and the Seller will: (a) use their best efforts to protect the business of the Subsidiaries and take such actions as Bright may reasonably request relating to protection of such business, and effect no transfer, sale or Encumbrance of or on any of the Business (other than in the ordinary course of the Business); (b) engage in no transactions materially inconsistent with its representations and warranties in this Letter; (c) obtain, before the Closing, the written consent of all third parties necessary for the Subsidiaries or the Seller to consummate the Transaction; (d) notify Bright promptly upon receipt of any communication or legal process which commences or threatens litigation against the Subsidiaries; and (e) provide Bright, whether before or after the Closing, with any further documents that Bright reasonably requests relating to the Business or to carry into effect the Transaction.

(d)No Shop. From the Effective Date of this Letter until termination of this Letter or until Closing, whichever is the earlier (the “Exclusive Period”), the Subsidiaries and Seller will not, directly or indirectly, through any representative or otherwise, and will not allow any manager or officer of the Subsidiaries or Seller or any other person on its or their behalf (i) solicit, initiate, or encourage submission of any Alternate Transaction, or (ii) engage in any discussions with or furnish any information with respect to the foregoing to any person or any entity, or furnish any information to any person or entity that has made any proposal with respect to any such Alternative Transaction. In addition, The Subsidiaries and the Seller agree to immediately cease and cause to be terminated any such contacts or negotiations with third parties. The Subsidiaries and Seller shall immediately notify Bright of all inquiries related to an Alternative Transaction, including information as to the identity of the party making the proposal and the specific terms of such proposal.

(e)Indemnification. Seller and the Subsidiaries shall, jointly and severally, indemnify and hold harmless Buyer, and its representatives, shareholders, subsidiaries and affiliates (collectively, the “Buyer Indemnified Persons”), and will reimburse the Buyer Indemnified Persons for any loss, liability, claim, damage, expense (including costs of investigation and defense and reasonable attorneys’ fees and expenses) or diminution of value, (collectively, “Damages”), arising from or in connection with: (i) any breach of any representation or warranty made by Seller; (ii) any breach of any covenant or obligation of Seller, (iii) any liability arising out of the ownership or operation of the Assets prior to the Closing other than the Assumed Liabilities; (iv) any brokerage or finder’s fees or commissions or similar payments based upon any agreement or understanding made, or alleged to have been made, by any person with Seller (or any person acting on its behalf) in connection with any of the transactions contemplated herein; or (v) any Retained Liabilities.

(f)Hold Back. Seller and the Subsidiaries agree that at Closing Buyer may hold back 10% of the Purchase Price (or 15% of the Purchase Price if the Closing Date were to occur prior to January 1st, 2024) for a period of twelve (12) months following the Closing to secure the foregoing indemnification obligations, provided that Buyer will release such amounts to Seller on the 12 month anniversary of the Closing if there are no pending unresolved indemnification claims at that time.

7.2 Buyers Covenants.

(a)Materials provided by Bright prior to close. From the Effective Date until Closing, any materials provided to Morris or JDT by Bright to facilitate Morris’ or JDT’s completion of work for Morris’ or JDT’s customers will be charged to Morris or JDT respectively at Bright’s cost, with such cost booked by Morris or JDT on its accounts payable schedule, to be reconciled at Closing using Closing Valuation Worksheet. Upon termination of this Letter in lieu of Closing, Morris and JDT shall pay Bright for any materials provided to Morris and JDT respectively under this Section 7.23 within 30 days from this Letter’s termination.

(b)One-year Sublease of Morris’ Premises. As of the Closing, Bright will, with the real estate landlord’s written consent, enter a one year sublease (the “SubLease”) to the premises currently leased by Morris, promising to paya sublease rate of [$29,766.00] per month (Increasing In February to [$30,363.00] per month), plus payment of all other expenses required to be paid under the lease during that one year period. Seller and the Subsidiaries agree that Bright’s obligation under the Sublease terminates one year from the Closing Date, and thereafter Seller and its Subsidiaries tenants are fully responsible for any further obligations under their existing lease with the landlord. Bright also agrees to pay the landlord the rent in arrears as indicated in the Closing Valuation Spreadsheet.

(c)Non-Solicitation. From the Effective Date until termination of this Letter or until Closing, whichever is the earlier, Bright agrees not to, either alone or in association with others, solicit, divert or take away, or attempt to divert or take away, the business or patronage of any of the customers, or business partners of the Subsidiaries, nor to solicit any employee or contractor of the Company to terminate his or her employment or contractors status with the Subsidiaries.

(d)Union Shop. Buyer agrees that after the Closing Date, Buyer will employ union labor in its use of the assets acquired from the Subsidiaries, and will continue to contribute substantially the same number of contribution base units to the union National Pension Fund (the “Plan”) as the Subsidiaries contributed prior to the sale. The Subsidiaries agree that if the Buyer withdraws from contributing to the union Plan during the five Plan years following the sale, and the Buyer refuses to make withdrawal liability payments when due, the Subsidiaries will be secondarily liable to the Plan.

(e)Contract Continuance. Buyer agrees that after the Closing Date, Buyer will perform any existing contractor or subcontractor contract to which Morris and JTD is a party as indicated on backlog schedules (“Construction Contracts”) provided to Buyer prior to or during Due Diligence, and Buyer will indemnify and hold harmless Seller and the Subsidiaries, and their representatives, shareholders, subsidiaries and affiliates (collectively, the “Seller Indemnified Persons”), and will reimburse the Seller Indemnified Persons for any Damages arising from or in connection with any liability arising from the Buyer’s execution or acts or omissions under the Construction Contracts subsequent to Closing; provided that Buyer will not assume any liabilities or obligations arising from a breach by the Subsidiaries under any Construction Contract prior to the Closing date and such obligations, if any, will be “Retained Liabilities”.

(f)Bright’s forbearance under the note. If the Horizon Bank note is purchased by Bright or its affiliates prior to the time of Closing, Bright agrees that from the date of purchase of Morris’ note from Horizon Bank, until termination of this Letter or until Closing, whichever is the earlier, Bright will not sell the note, and Bright will forbear from taking any action against the note makers or any note guarantors as a result of any default under the note, and shall not charge any default fees, default interest, acceleration or any other penalties as a result of any default under the note.

8.Conditions to Closing.

8.1.Bright’s Conditions to Close. Bright’s obligations to close the Transaction are subject to satisfaction or waiver by Bright of each of the following conditions on or before the Closing Date:

(a)Due Diligence. Bright shall be satisfied with the results of its due diligence investigation in its sole discretion. Buyer shall have entered the Sublease on terms satisfactory to it.

(b)Other Items. (i) No Material Adverse Effect shall have occurred since the Effective Date in the condition of Morris or JDT shall exist at the time of the Closing; (ii) all third party consents required to transfer and assign the assets for operation by Bright after the Closing as anticipated herein, and all required approvals to transfer any permits, shall have been obtained; (iii) the Subsidiaries’ and Seller representations and warranties shall remain true and correct as if made on the Closing Date; (iv) Seller and the Subsidiaries shall have performed in all material respects all of the terms and obligations of this Letter that are required to be performed by the Subsidiaries and the Seller before the Closing; (v) no Action shall have been brought or threatened

against any party seeking to challenge or prohibit the transactions contemplated hereby or claims any rights to any of the Business or its assets; (vii) Landlord has provided their written consent for the one year Sublease; and (vii) on the Closing Date, all actions, proceedings, instruments and documents required to effect the Transaction and all other related matters shall have been completed to the reasonable satisfaction of Bright and its counsel.

8.2.Seller’s Conditions to Close. Seller’s obligation to close the Transaction is subject to satisfaction or waiver by Seller of each of the following conditions on or before the Closing Date: (i) Bright’s representations and warranties shall remain true and correct as if made on the Closing Date; (ii) Bright shall have performed in all material respects all of the terms and obligations of this Letter and the Agreement that are required to be performed by Bright before the Closing; and (iii) no Action shall have been brought or threatened against any party seeking to challenge or prohibit the transactions contemplated hereby; and (iv) on the Closing Date, all actions, proceedings, instruments and documents required to effect the Transaction and all other related matters shall have been completed to the reasonable satisfaction of the Seller.

9.Termination. This Letter may be terminated as follows: (i) by mutual written agreement of the parties; (ii) by Bright if in its sole discretion it is not satisfied with its due diligence investigation or the final Closing Valuation Spreadsheet, (iii) by either party if a Governmental Authority shall have permanently prohibited or enjoined the Transaction; and (iv) by either Bright or the Seller upon a material breach of any provision of this Letter if such breach is not cured by (if capable of cure) within 30 days of notice from the terminating parties. Except as expressly set forth in this Section 9, this Letter may not be terminated by Seller.

10.Miscellaneous.

10.1.Attorney’s Fees. In the event of arbitration or other action relating to this Letter, if an arbitrator or court of competent jurisdiction determines that any party or any of its representatives have breached this Letter, then the breaching party shall be liable and pay to the non-breaching parties the reasonable legal fees incurred in connection therewith, including any appeal therefrom.

10.2.Governing Law; Dispute Resolution. This Letter shall be governed by and construed under the laws of the State of Indiana (excluding its choice of law rules). The parties agree that the exclusive means for resolving any dispute arising out of or relating to this Letter shall be binding arbitration to be held as provided above. The parties shall each pay one-half of the costs of the arbitrator(s).

10.3.Notices. All notices and other communications hereunder shall be in writing and shall be deemed given upon receipt if delivered personally or by email, three business days after deposit in the mails if sent by registered or certified mail (return receipt requested) or one business day if given by reputable overnight express courier (charges prepaid), to the parties at the addresses set forth for such party herein (or at such other address for a party as shall be specified by like notice.

If to Seller and any of the Subsidiaries:

Alpine 4 Holdings, Inc.

2525 E Arizona Biltmore Circle, Ste. C-237

Phoenix, AZ 85016.

kwilson@alpine4.com

With a copy to:

Tom Laubhan

6212 Highview Drive Ft. Wayne, IN 46818

tom@morrissheetmetal.com

If to Buyer:

Gary Aletto

4212 W 71st St Suite A

Indianapolis, IN 46268

galetto@brightsheetmetal.com

With a copy to:

Josh Hollingsworth

Barnes & Thornburg LLP

11 S.Meridian Street

Indianapolis, IN 46204-3535

joshua.hollingsworth@btlaw.com

10.4.Counterparts. This Letter may be executed by electronic signatures and will be considered and construed as valid as an original signature. This Letter may be executed in one or more counterparts, all of which shall be considered one and the same agreement, and shall become effective when one or more such counterparts have been signed by the parties and delivered.

10.5.Entire Agreement. This Letter along with the Exhibits contain the entire agreement and understanding between the parties hereto with respect to the subject matter hereof and supersede all prior agreements. No party shall be liable or bound to any other party in any manner by any representations, warranties or covenants relating to such subject matter except as specifically set forth herein.

10.6.Fees and Expenses. Unless otherwise specifically provided herein regardless of whether or not the Transactions contemplated by this Letter are consummated, each party shall bear its own fees and expenses incurred in connection with the Transactions contemplated by this Letter.

10.7.Successors and Assigns; Third Party Beneficiaries. This Letter shall be binding upon and inure solely to the benefit of the parties hereto, their successors and permitted assigns (for the avoidance of doubt Bright shall be free to assign this Letter to any of its subsidiaries or affiliates without the need for consent, but this Agreement shall not be assigned by the Subsidiaries without Bright’s prior written consent); and notwithstanding any provision of this Letter, nothing in this Letter, express or implied, is intended to or shall confer upon any other person or persons who is not a party to this Letter any right, benefits or remedies of any nature whatsoever under or by reason of this Letter.

10.8.Severability. In the event that any one or more of the provisions contained herein, or the application thereof in any circumstances, is held invalid, illegal or unenforceable in any respect for any reason, the parties shall negotiate in good faith with a view to the substitution therefore of a suitable and equitable solution in order to carry out, so far as may be valid and enforceable, the intent and purpose of such invalid provision; provided, however, that the validity, legality and enforceability of any such provision in every other respect and of the remaining provisions contained herein shall not be in any way impaired thereby, it being intended that all of the rights and privileges of the parties hereto shall be enforceable to the fullest extent permitted by law.

10.9.No Waiver. No failure or delay by a party to exercise or enforce any rights conferred on it by this Letter shall be construed or operate as a waiver thereof nor shall any single or partial exercise of any right, power or privilege or further exercise thereof operate so as to bar the exercise or enforcement thereof at any time or times.

10.10.Asset Sale is As Is/Where is. EACH OF THE CONVEYED ASSETS IS BEING CONVEYED “AS IS”, “WHERE IS”, AND “WITH ALL FAULTS” AS OF THE CLOSING, WITHOUT ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO ITS CONDITON, FITNESS FOR ANY PARTICULAR PURPOSE, MERCHANTABILITY OR ANY OTHER WARRANTY, EXPRESS OR IMPLIED

OTHER THAN AS SET FORTH IN THIS LETTER. SELLER AND THE SUBSIDIARIES SPECIFICALLY DISCLAIMS ANY WARRANTY, GUARANTY OR REPRESENTATION, ORAL OR WRITTEN, PAST OR PRESENT, THERETO EXCEPT AS OTHERWISE SET FORTH IN THIS LETTER. BUYER IS HEREBY THUS ACQUIRING THE CONVEYED ASSETS BASED SOLEY UPON BUYER’S OWN INDEPENDENT INVESTIGATIONS AND INSPECTION OF THAT PROPERTY AND NOT IN RELIANCE UPON ANY INFORMATION PROVIDED BY SELLER OR SELLER’S AGENTS OR CONTRACTORS EXCEPT AS OTHERWISE SET FORTH IN THIS LETTER.

[Signature Page to Follow.]

{Binding Letter of Intent Signature Page}

If the foregoing is acceptable to you, please execute and return a copy of this binding Letter of Intent. Upon executed by all parties, this Letter shall be considered effective as of the elate set forth above.

| | | | | | | | | | | | | | |

For Seller: | | | For Buyer: | |

Alpine 4 Holdings, Inc.: | | | Bright Sheet Metal Company |

| | | | |

| | /s/ Gary Aletto | |

Kent B. Wilson, CEO | | | Gary Aletto, Owner/COO/Treasurer |

| | | | |

| | | | |

For Morris Sheet Metal Corp.: | | | |

| | | |

Kent B. Wilson, CEO | | | | |

| | | | |

| | | | |

For JTD Spiral Inc.: | | | | |

| | | |

Kent B. Wilson, CEO | | | | |

| | | | |

| | | | |

For Morris Enterprises, LLC: | | | |

| | | |

Kent B. Wilson, CEO | | | | |

| | | | |

| | | | |

For Morris Transport, LLC: | | | |

| | | |

Kent B. Wilson, CEO | | | | |

| | | | |

| | | | |

For Deluxe Sheet Metal, Inc.: | | | |

| | | |

Kent B. Wilson, CEO | | | | |

{Binding Letter of Intent Signature Page}

If the foregoing is acceptable to you, please execute and return a copy of this binding Letter of Intent. Upon executed by all parties, this Letter shall be considered effective as of the elate set forth above.

| | | | | | | | | | | | | | |

For Seller: | | | For Buyer: | |

Alpine 4 Holdings, Inc.: | | | Bright Sheet Metal Company |

| | | | |

/s/ Kent B. Wilson | | | |

Kent B. Wilson, CEO | | | Gary Aletto, Owner/COO/Treasurer |

| | | | |

| | | | |

For Morris Sheet Metal Corp.: | | | |

/s/ Kent B. Wilson | | | |

Kent B. Wilson, CEO | | | | |

| | | | |

| | | | |

For JTD Spiral Inc.: | | | | |

/s/ Kent B. Wilson | | | |

Kent B. Wilson, CEO | | | | |

| | | | |

| | | | |

For Morris Enterprises, LLC: | | | |

/s/ Kent B. Wilson | | | |

Kent B. Wilson, CEO | | | | |

| | | | |

| | | | |

For Morris Transport, LLC: | | | |

/s/ Kent B. Wilson | | | |

Kent B. Wilson, CEO | | | | |

| | | | |

| | | | |

For Deluxe Sheet Metal, Inc.: | | | |

/s/ Kent B. Wilson | | | |

Kent B. Wilson, CEO | | | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

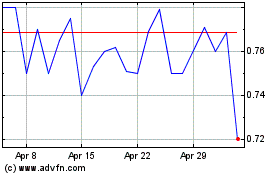

Alpine 4 (NASDAQ:ALPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alpine 4 (NASDAQ:ALPP)

Historical Stock Chart

From Apr 2023 to Apr 2024