American Lithium Announces Financial and Operating Highlights for Year and Quarter Ended February 29, 2024

31 May 2024 - 6:30AM

American Lithium Corp. (“American Lithium” or the “Company”)

(TSX-V:LI | Nasdaq:AMLI | Frankfurt:5LA1) is pleased to provide

financial and operating highlights for the fiscal year and quarter

ended February 29, 2024. Unless otherwise stated, all amounts

presented are in Canadian dollars.

Simon Clarke, CEO of American Lithium, comments,

“This was an extremely successful year operationally for both

Falchani and TLC, our advanced lithium projects in Peru and Nevada,

respectively. We also made strong progress in positioning our

large-scale uranium project, Macusani (in Peru), to unlock value

for the Company and its shareholders. The filing of the maiden PEA

for TLC and an updated PEA on Falchani demonstrated robust

economics for both projects and led to a combined after-tax net

present value of approximately US$8.37 billion. However, the

overall market conditions for lithium developers have been very

challenging throughout the financial year, with a major correction

in the commodity price driving equity prices to very low

valuations.

Going forward, with lithium prices appearing to

have bottomed and uranium prices having strengthened further, we

feel we are uniquely placed to benefit from any sustained recovery

and in the interim, we continue to prudently manage our working

capital.”

Highlights for the Year:

Nevada:

-

Filed the maiden TLC Preliminary Economic Assessment (“PEA”) (1)

yielding robust economics on the second largest Measured and

Indicated (“M&I”) resource and the second highest flow-sheet

head-grade for Nevada Claystones:

-

After-Tax NPV8 (US$3.26 billion), IRR (27.5%), Opex estimated at

$7,443/t LCE;

-

M&I Resources of 8.83 million tonnes (“t”) (2052 Mt @ 809 ppm

Li) of Lithium Carbonate Equivalent (“LCE”) from latest Mineral

Resource Estimate (“MRE”);

-

Average annual production of 38,000 t of LCE over 40 year Life of

Mine (“LOM”);

-

Targeted head grade over 2,000 parts per million (“ppm”) over LOM

and approximately 2,200 ppm at start;

-

Ability to pre-concentrate TLC mineralization.

-

Continued refinement of TLC flow sheet driving higher lithium

(“LI”) purity, optimization of pre-concentration and enhanced

economic potential.

-

Drilling at TLC continued to significantly expand the existing

footprint with additional higher grade, near-surface sections.

Peru:

- Intersected the highest grades of Li

and Cesium (“Cs”) encountered to date at Falchani, up to 5,645 ppm

Li and 12,610 ppm Cs. Significantly extended lithium

mineralization up to 400 metres (“m”) west at Falchani;

- Announced a 476% increase in M&I

resources over prior MRE (2) to 5.53 million tonnes of LCE (447 Mt

@ 2,327 ppm Li) at Falchani:

- Additional Updated Inferred Resource

to 3.99 Mt LCE (506 Mt @ 1,481 ppm Li);

- Published results of updated PEA (3)

at Falchani:

- After-tax NPV8% tripled to US$5.11

billion, IRR 32.0%, low Opex of $5,093/t LCE;

- Average annual production of 61,400

t of LCE over 43 year LOM;

- Targeted head grade > 2,700 ppm

over LOM;

-

New lithium discovery 6km west of Falchani with assays up to 2,668

ppm Li, averaging 1,560 ppm Li over 222 m of continuous

mineralization;

-

Semi-Detailed Environmental Impact Assessment (“EIA”) submitted for

Falchani ahead of schedule:

-

Starts mine permitting process for Falchani and key step to

completion of full EIA;

-

Upon approval, enables drilling from up to 420 drill platforms

across Falchani without the need for additional drill permits;

and

-

Approval expected mid-2024.

Corporate:

- Unanimous ruling confirming title to

32 disputed concessions made by Superior Court in Peru:

- Fully supportive of the Company’s

position;

- Subsequent petition by INGEMMET

& MINEM to Peruvian Supreme Court in final attempt to reverse

Superior Court Ruling:

- Over 75% of such petitions are

rejected/do not meet Supreme Court threshold;

- Company believes no grounds for

Supreme Court to take jurisdiction;

- Dispute relates to approximately 18%

of the Company’s 174 concessions;

- Title to these 32 concessions

remains fully protected by injunction;

-

Strategic investment of $5,360,000 into Surge Battery Metals

Inc.;

-

Published maiden ESG report covering year-end 2023;

-

Year-end cash / cash equivalents of $11,889,416 and marketable

securities worth $6,700,000; and

-

No debt or material royalties.

For all technical information related to the (1)

TLC PEA Report effective as of January 31st, 2023, the (2) Falchani

MRE filed on December 15th, 2023, and the (3) Falchani PEA Report

effective as of January 10th, 2024, please refer to the Company’s

SEDAR+ page at www.sedarplus.ca or the Company’s website at

www.americanlithiumcorp.com.

Readers are cautioned that PEAs are preliminary

in nature and include inferred resources that are considered too

speculative to have the economic considerations applied to them

that would enable them to be categorized as mineral reserves and

there is no certainty the estimates presented in the PEAs will be

realized.

Ted O'Connor, PGeo, Executive Vice-President of

American Lithium and a qualified person as defined by NI 43-101,

has reviewed and approved the scientific and technical information

contained in this news release.

Selected Financial Data

The following selected financial data is

summarized from the Company’s consolidated financial statements and

related notes thereto (the “Financial Statements”)

for the fiscal year and fourth quarter ended February 29, 2024.

Copies of the Financial Statements and MD&A are available at

www.americanlithiumcorp.com or on SEDAR+ at www.sedarplus.ca.

|

|

Year EndFebruary 29, 2024 |

Year End February 28, 2023 |

|

Loss and comprehensive loss |

($39,883,230) |

($34,985,004) |

|

Loss per share - basic and diluted |

($0.19) |

($0.17) |

|

Cash, cash equivalents and guaranteed investment certificates |

$11,889,416 |

$40,622,180 |

|

Total assets |

$173,594,831 |

$194,280,141 |

|

Total current liabilities |

$3,115,623 |

$1,738,766 |

|

Total liabilities |

$4,246,386 |

$1,890,074 |

|

Total shareholders’ equity |

$169,348,445 |

$192,390,067 |

|

|

Fourth QuarterFebruary 29, 2024 |

Fourth QuarterFebruary 28, 2023 |

|

Loss and comprehensive loss |

($7,011,816) |

($9,845,287) |

|

Loss per share - basic and diluted |

($0.03) |

($0.05) |

|

Cash, cash equivalents and guaranteed investment certificates |

$11,889,416 |

$40,622,180 |

|

Total assets |

$173,594,831 |

$194,280,141 |

|

Total current liabilities |

$3,115,623 |

$1,738,766 |

|

Total liabilities |

$4,246,386 |

$1,890,074 |

|

Total shareholders’ equity |

$169,348,445 |

$192,390,067 |

About American

Lithium

American Lithium is actively engaged in the

development of large-scale lithium projects within mining-friendly

jurisdictions throughout the Americas. The Company is currently

focused on enabling the shift to the new energy paradigm through

the continued development of its strategically located TLC lithium

project (“TLC”) in the richly mineralized Esmeralda lithium

district in Nevada, as well as continuing to advance its Falchani

lithium (“Falchani”) and Macusani uranium (“Macusani”)

development-stage projects in southeastern Peru. All three

projects, TLC, Falchani and Macusani have been through robust

preliminary economic assessments, exhibit strong significant

expansion potential and enjoy strong community support.

Pre-feasibility is advancing well TLC and Falchani.

For more information, please contact the Company

at info@americanlithiumcorp.com or visit our website

at www.americanlithiumcorp.com.

Follow us

on Facebook, Twitter and LinkedIn.

On behalf of the Board of Directors of

American Lithium Corp.

“Simon Clarke”

CEO & Director

Tel: 604 428 6128

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release.

Cautionary Statement Regarding Forward

Looking InformationThis news release contains certain

forward-looking information and forward-looking statements

(collectively “forward-looking statements”) within the meaning of

applicable securities legislation. All statements, other than

statements of historical fact, are forward-looking statements.

Forward-looking statements in this news release include, but are

not limited to, statements regarding the business plans,

expectations and objectives of American Lithium. Forward-looking

statements are frequently identified by such words as "may",

"will", "plan", "expect", "anticipate", "estimate", "intend",

“indicate”, “scheduled”, “target”, “goal”, “potential”, “subject”,

“efforts”, “option” and similar words, or the negative connotations

thereof, referring to future events and results. Forward-looking

statements are based on the current opinions and expectations of

management and are not, and cannot be, a guarantee of future

results or events. Although American Lithium believes that the

current opinions and expectations reflected in such forward-looking

statements are reasonable based on information available at the

time, undue reliance should not be placed on forward-looking

statements since American Lithium can provide no assurance that

such opinions and expectations will prove to be correct. All

forward-looking statements are inherently uncertain and subject to

a variety of assumptions, risks and uncertainties, including risks,

uncertainties and assumptions related to: American Lithium’s

ability to achieve its stated goals;, which could have a material

adverse impact on many aspects of American Lithium’s businesses

including but not limited to: the ability to access mineral

properties for indeterminate amounts of time, the health of the

employees or consultants resulting in delays or diminished

capacity, social or political instability in Peru which in turn

could impact American Lithium’s ability to maintain the continuity

of its business operating requirements, may result in the reduced

availability or failures of various local administration and

critical infrastructure, reduced demand for the American Lithium’s

potential products, availability of materials, global travel

restrictions, and the availability of insurance and the associated

costs; the ongoing ability to work cooperatively with stakeholders,

including but not limited to local communities and all levels of

government; the potential for delays in exploration or development

activities; the interpretation of drill results, the geology, grade

and continuity of mineral deposits; the possibility that any future

exploration, development or mining results will not be consistent

with our expectations; risks that permits will not be obtained as

planned or delays in obtaining permits; mining and development

risks, including risks related to accidents, equipment breakdowns,

labour disputes (including work stoppages, strikes and loss of

personnel) or other unanticipated difficulties with or

interruptions in exploration and development; risks related to

commodity price and foreign exchange rate fluctuations; risks

related to foreign operations; the cyclical nature of the industry

in which American Lithium operates; risks related to failure to

obtain adequate financing on a timely basis and on acceptable terms

or delays in obtaining governmental approvals; risks related to

environmental regulation and liability; political and regulatory

risks associated with mining and exploration; risks related to the

uncertain global economic environment and the effects upon the

global market generally, any of which could continue to negatively

affect global financial markets, including the trading price of

American Lithium’s shares and could negatively affect American

Lithium’s ability to raise capital and may also result in

additional and unknown risks or liabilities to American Lithium.

Other risks and uncertainties related to prospects, properties and

business strategy of American Lithium are identified in the “Risk

Factors” section of American Lithium’s Management’s Discussion and

Analysis filed on May 29, 2024, and in recent securities filings

available at www.sedarplus.ca. Actual events or results may differ

materially from those projected in the forward-looking statements.

American Lithium undertakes no obligation to update forward-looking

statements except as required by applicable securities laws.

Investors should not place undue reliance on forward-looking

statements.

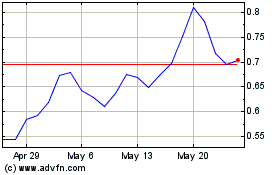

American Lithium (NASDAQ:AMLI)

Historical Stock Chart

From Nov 2024 to Dec 2024

American Lithium (NASDAQ:AMLI)

Historical Stock Chart

From Dec 2023 to Dec 2024