false

0001518461

0001518461

2025-01-17

2025-01-17

0001518461

AMPG:CommonStockParValue0.001PerShareMember

2025-01-17

2025-01-17

0001518461

AMPG:WarrantsToPurchaseCommonStockMember

2025-01-17

2025-01-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): January 17, 2025

| AmpliTech

Group, Inc. |

| (Exact

Name of Registrant as Specified in its Charter) |

| Nevada |

|

001-40069 |

|

27-4566352 |

(State

of

incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

155

Plant Avenue,

Hauppauge,

NY |

|

11788 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(631)-521-7831

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

Name or former address if changed from last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

AMPG |

|

The

Nasdaq Stock Market LLC |

| Warrants

to Purchase Common Stock |

|

AMPGW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

January 20, 2025,

AmpliTech Group, Inc., a Nevada corporation (the “Company”), entered into a standard form of director agreement (the “Director

Agreement”) with each of the foregoing independent directors: Mr. Andrew Lee, Mr. Daniel Mazziota and Mr. Shailesh “Sonny”

Modi. The Director Agreement provides for a one (1) year term unless terminated earlier upon certain events set forth in the Director

Agreement, which includes among other things, resignation or removal. In addition, the Director Agreement also provides, among other

things, reimbursement of expenses for attending meetings, indemnification and annual compensation of 15,000 Restricted Stock Units pursuant

to the Company’s Amended and Restated 2020 Equity Incentive Plan for services.

The

foregoing description of the Director Agreement does not purport to be complete and is qualified in its entirety by reference to the

full text of such document, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

(a)

On January 17, 2025, Mr. Matthew Kappers resigned as a director of the Company, including his positions as the chairman of the

Nominating and Corporate Governance Committee, and as a member of the Audit Committee and the Compensation Committee, effective

immediately. Mr. Kappers’ resignation is for personal reasons and not due to any disagreement with the Company’s

management team or the Company’s board on any matter relating to the operations, policies or practices of the Company or any

issues regarding the Company’s accounting policies or practices.

(d)

On January 17, 2025, the Board appointed Mr. Shailesh “Sonny” Modi as a director of the Board of Directors of the

Company to fill the vacancy resulting from Mr. Kappers’ resignation. The Board appointed Mr. Modi to serve as the chairman of

the Nominating and Corporate Governance Committee, and a member of the Audit Committee and the Compensation Committee, effective

immediately.

Below

is the summary of Mr. Modi’s business experience:

Shailesh

“Sonny” Modi, age 62, Mr. Modi has served as chief financial officer and treasurer of ShelterPoint Life Insurance

Company (“ShelterPoint”) since December 2015 and was instrumental in leading the successful sale of ShelterPoint to Protective

Life Insurance Company in 2024. Prior to ShelterPoint, Mr. Modi served as senior vice president of Global Insurance Strategic Planning

& Analysis at Aspen Insurance Holdings from April 2014 to June 2015. Earlier in his career, he spent 10 years at Deloitte & Touche

LLP, focusing on financial services and participating in initial public offerings. Mr. Modi holds a B.S. in Accounting and an MBA in

Finance & Computer Systems from New York University. He has served on various boards, including InRoads and the Insurance Accounting

and Systems Association (IASA), and has been involved in volunteer organizations such as the Boy Scouts of America.

As

disclosed in Item 1.01 above, on January 20, 2025,

in connection with the appointment, the Company entered into the Director Agreement with Mr. Modi. Pursuant to the terms of the Director

Agreement, the Company agreed to an annual compensation of 15,000 Restricted Stock Units (“RSUs”) pursuant to the Amended

and Restated 2020 Equity Incentive Plan, which will be settled in 15,000 shares of common stock of the Company. The term of Director

Agreement will be for a period of one (1) year, unless earlier terminated under circumstances specified in the Director Agreement.

Except

as disclosed in this Current Report on Form 8-K, there are no arrangements or understandings with any other person pursuant to which

Mr. Modi was appointed as a director of the Company. There are also no family relationships between Mr. Modi and any of the Company’s

directors or executive officers. Except as disclosed in this Current Report on Form 8-K, Mr. Modi has no direct or indirect material

interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Item

8.01. Other Events.

On

January 21, 2025,

the Company issued a press release announcing the appointment of Mr. Shailesh “Sonny” Modi as the Company’s independence

director. The press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated into this Item 8.01 by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AMPLITECH

GROUP INC. |

| |

|

|

| Date:

January 21, 2025 |

By: |

/s/ Fawad

Maqbool |

| |

Name: |

Fawad

Maqbool |

| |

Title: |

Chief

Executive Officer |

Exhibit 10.1

DIRECTOR

AGREEMENT

This

Director Agreement, dated as of [______________] (the “Effective Date”), is by and between Amplitech Group, Inc.,

a Nevada corporation (the “Company”), and [DIRECTOR] (the “Director”).

W

I T N E S S E T H:

WHEREAS,

the Company wishes to engage the Director and the Director is willing to accept such engagement upon the terms and conditions hereinafter

set forth.

NOW,

THEREFORE, in consideration of the mutual covenants set forth herein and other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the parties hereto hereby agree as follows:

1. Services.

Upon the terms and subject to the conditions of this Agreement and with effect from the Effective Date, the Company hereby engages the

Director to act as a Member of the Board of Directors of the Company (the “Board”), the [BLANK] Committee Chairman

and member of committee(s) of the Board (upon appointment by the Board), and to provide services on the terms and conditions provided

in this Agreement. The Director agrees to devote appropriate time and attention to the execution of the services to be provided by the

Director hereunder; to perform such tasks as may be necessary to fulfill Director’s obligations as a member of the Board and its

committees and to serve as a director, which shall include the services listed on Exhibit A; or such other services as the Company

and the Director may reasonably agree (hereinafter the services to be provided by the Director hereunder are referred to as the “Services”).

Director agrees to provide such Services so long as he is duly appointed or elected and qualified in accordance with the applicable provisions

of the Company’s Articles of Incorporation, as amended and Bylaws, as amended (collectively, the “Charter”)

and any necessary approval by the Company’s stockholders and/or Board, and until such time as he resigns, fails to stand for election,

fails to be elected by the stockholders of the Company or is removed from his position. Director may at any time and for any reason resign

or be removed from such position consistent with the Charter (subject to any other contractual obligation or other obligation imposed

by operation of law) and the Nevada Revised Statutes, in which event the Company shall have no obligation under this Agreement to provide

the Services under this Agreement. Director acknowledges that his appointment hereunder is contingent upon the Board’s determination

that he is “independent” with respect to the Company, in accordance with the listing requirements of the Nasdaq and that

his appointment may be terminated by the Company in the event that the Director does not maintain such independence standard.

2. Term

of Engagement. The term of the Director’s engagement by the Company under this Agreement shall commence on the Effective Date

and be effective for one (1) year from the Effective Date, unless terminated earlier upon the earliest occurrence of any of the following

(the “Termination Date” and such period from the Effective Date to the Termination Date, referred to herein as the

“Contract Period.”):

(a) Termination

By Permanent Disability. If at any time, the Company reasonably determines that the Director has been or will be unable, as a result

of physical or mental illness or incapacity, to perform his duties hereunder.

(b) Termination

By Reason of Death. Upon the date of the Director’s death.

(c) Termination

Upon Agreement. The termination of the Director from his membership on the Board by the mutual agreement of the Company and the Director.

(d) Removal,

Resignation, and Failure to Stand for Election. If the Director fails to stand for election, fails to be elected by the stockholders

of the Company, resigns or is removed from his position pursuant to the Charters and Nevada Revised Statutes.

3. Independent

Contractor. The Director is an independent contractor, not an employee or agent of the Company. All payments and other consideration

made or provided to the Director under this Section 3 shall be made or provided without withholding or deduction of any kind, and the

Director shall assume sole responsibility for discharging all tax or other obligations associated therewith.

4. Compensation.

(a) Restricted

Stock Units. As compensation for the Services rendered for one (1) year, the Director shall be issued up to 15,000 restricted stock

units (“RSU’s”), pursuant to the Company’s Amended and Restated 2020 Equity Incentive Plan.

(b) Benefits.

The Director shall not receive or be eligible to participate in the Company’s benefit programs in effect for the employees of the

Company as in effect from time to time.

(c) Expenses.

The Company shall reimburse the Director for all reasonable expenses relating to meeting attendance, and business travel expenses previously

authorized in writing by the Company and reasonably and necessarily incurred by the Director in the performance of his duties, responsibilities,

and authorities hereunder.

5. Termination

Provisions. The Director’s engagement with the Company shall terminate on the Termination Date, as set forth in Section 2.

6. Covenants

of the Director.

(a) Non-solicitation

of Employees of the Company, Directors of the Company or Customers or Suppliers of the Company. During the Contract Period and for

three (3) year following the Contract Period (the “Subject Period”), the Director shall not, directly or indirectly

on behalf of any business, firm, corporation, partnership, person, proprietorship or other entity, incorporated or otherwise, and shall

use his best efforts to cause each business, firm, corporation, partnership, person, proprietorship and other entity with which he is

or shall become associated in any capacity not to, (i) solicit for employment, employ or otherwise engage any employee or Director of

the Company, without the written consent of the Company, or (ii) except in connection with the performance of his duties hereunder and

in accordance herewith, solicit, interfere with, endeavor to entice away from the Company or communicate with regarding the business

of the Company any customer or supplier of the Company. The Director acknowledges and agrees in connection with the foregoing that the

identities of the Company’s employees, Directors, customers, suppliers and clients and other information gained during his period

of employment with the Company with respect thereto is Confidential Information (as more fully defined in paragraph (b) below) of the

Company.

(b) Confidentiality.

During the Subject Period and at all times thereafter, the Director agrees and acknowledges that the Confidential Information (as defined

below) of the Company is valuable, special and unique to its business; that such business depends on such Confidential Information; and

that the Company wishes to protect such Confidential Information by keeping it confidential for the exclusive use and benefit of the

Company. The Director further acknowledges that any use by him of the Confidential Information other than in strict accordance with the

terms of this Agreement would be wrongful and would cause the Company irreparable injury. Based upon the foregoing, with respect to such

Confidential Information, the Director agrees:

(i) to

keep any and all Confidential Information in trust for the sole use and benefit of the Company;

(ii) to

not use the Confidential Information for his own benefit or the benefit of any other person or entity, except as may be specifically

permitted in this Agreement. Director will immediately give notice to the Company of any unauthorized use or disclosure by or through

him, or of which he becomes aware, of the Confidential Information;

(iii) except

as required by applicable law or as required in furtherance of the business of the Company in accordance with the terms hereof, not to

use or disclose or reproduce, directly or indirectly, any Confidential Information of the Company;

(iv) to

take all steps necessary or reasonably requested by the Company to ensure that all Confidential Information is kept confidential for

the sole use and benefit of the Company; and

(v) in

the event the Director’s services with the Company terminates for any reason whatsoever or at any time that the Company may in

writing request, to deliver promptly to the Company all materials constituting Confidential Information (including all written, graphic,

facsimile, encoded or recorded copies or duplicates thereof or notes regarding the same) of the Company that are in his possession or

under his control without making or retaining any written graphic, facsimile, encoded or recorded copy or extract from such materials.

For

purposes of this Section 6, “Confidential Information” means any and all information developed by or for or possessed

by the Company prior to or during the Contract Period that is (A) not generally known in any industry in which the Company does business

as of the date hereof or during the Contract Period or (B) not publicly available (including for this purpose information that is publicly

available because of a breach by the Director of the provisions hereof). Confidential Information includes, but is not limited to, the

information identified in Section 6(a) above (including, without limitation, personnel records and applications, employment and other

Director agreements, medical records, Director appraisals, reviews and evaluations, general wage and salary rates and individual salaries

and bonuses and plans and records relating thereto, numbers of Directors in departments and divisions, Director benefit plans and incentive

plans), and any and all other information developed by or for or possessed by the Company concerning information technology, marketing

and sales methods, concepts, materials, products, processes, procedures, formulae, compounds, formulations, models, innovations, discoveries,

improvements, inventions, protocols, computer programs, records, data, know-how, techniques, designs, machinery, devices, research and

development projects, data, preparations, business forms, strategies, plans for development of products, services or expansion into new

areas or markets, internal operations, product price lists, forecasts, projections, financial information (including the revenues, costs

or profits associated with the products of the Company) and any other trade secrets and proprietary information of any type owned by

or pertaining to the Company, together with all written, graphic, facsimile, encoded, recorded and other materials relating to all or

any part of the same.

(c) Noncompetition,

etc. During the Contract Period and the extension thereof, the Director shall not, directly or indirectly, engage in or be associated

with, whether as a director, officer, employee, agent, Director, shareholder, partner, owner, independent contractor or otherwise, any

business, firm, corporation, partnership, person, proprietorship or other entity, incorporated or otherwise (other than the Company),

which is conducting, or plans to conduct, any business which competes with or will compete with, in the United States, (i) the business

of the Company as constituted during the Contract Period, or (ii) the products of the Company manufactured, sold or under development

by the Company during the Contract Period; provided, however, nothing herein shall prohibit the Director from being a shareholder

in any entity that competes with the Company so long as the Director does not control such entity and does not hold more than a five

percent (5%) equity interest therein.

(d) Compliance

With Laws. In performing his duties hereunder the Director agrees to comply with all applicable governmental laws, rules and regulations

and all applicable policies and procedures of the Company.

(e) Return

of Company Property. All materials furnished to Director by the Company, whether delivered to Director by the Company or made by

Director in the performance of Director Services under this Agreement (the “Company Property”), are the sole and exclusive

property of the Company. Director agrees to promptly deliver the original and any copies of the Company Property to the Company at any

time upon the Company’s request. Upon termination of this Agreement by either party for any reason, Director agrees to promptly

deliver to the Company or destroy, at the Company’s option, the original and any copies of the Company Property. Director agrees

to certify in writing that Director has so returned or destroyed all such Company Property.

(f) Insider

Trading Guidelines. Director acknowledges and agrees that the Director may have access to “material non-public information”

for purposes of the federal securities laws (“Insider Information”) and that the Director will abide by all securities

laws relating to the handling of and acting upon such Insider Information. Upon request by the Company, Director will be asked to executed

the Company’s Insider Trading and Section 16 Compliance Policy upon adoption by the Company.

(g) Survival.

The provisions of this Section 6 shall survive any termination of the Contract Term, and the existence of any claim or cause of action

by the Director against the Company, whether predicated on this Agreement or otherwise, shall not constitute a defense to the enforcement

by the Company of the covenants and agreements of this Section 6.

(h) Miscellaneous.

For purposes of Section 6 hereof, the term “Director” shall include the Director’s affiliates and advisors.

7. Representations

and Warranties.

(a) The

Company. The Company hereby represents and warrants to the Director as follows:

(i) the

Company is duly incorporated, validly existing and in good standing under the laws of the State of Nevada; and

(ii)

this Agreement has been duly authorized, executed and delivered by the Company.

(b) The

Director. The Director hereby represents and warrants to the Company as follows:

(i) the

Director has full legal capacity to enter into this Agreement;

(ii) the

execution, delivery and performance by the Director of this Agreement will not conflict with or result in a breach of any of the terms,

conditions or provisions of, or constitute (with due notice or lapse of time or both) a default under, any agreement or instrument to

which the Director is a party or by which he is bound;

(iii) this

Agreement has been duly executed and delivered by the Director; and

(iv) the

Director has made such investigations of the business and properties of the Company as he deems necessary or appropriate before entering

into this Agreement and has been given a sufficient amount of time to review this Agreement with counsel and other professionals of his

choice and has done so to the extent he desires.

Without

limiting clause (ii) above, the Director hereby represents and warrants that he is not bound by the terms of any agreement with any other

party to refrain from using or disclosing any trade secret or confidential or proprietary information in the course of his employment

with the Company or to refrain from competing, directly or indirectly, with the business of such other party. The Director further represents

and warrants that his performance of all the terms of this Agreement and as a Director of the Company does not and will not breach any

agreement to keep in confidence proprietary information, knowledge or data acquired by him in confidence or in trust prior to his employment

with the Company.

8. Director

and Officer Insurance. The Company shall make all commercially reasonable efforts to procure suitable director and officer insurance

for a company of substantially similar size and position. Such insurance shall cover and include the Director.

9. Indemnification.

The Company shall indemnify the Director and each of his agents against any loss, liability, claim, damage, or expense arising from the

actions or inactions of the Company (or any of its officers and directors), including, but not limited to, any and all out of pocket

expense and reasonable attorneys’ fees whatsoever reasonably incurred in investigating, preparing, or defending against any litigation,

commenced or threatened, or any third party claim whatsoever), to which the Director may become subject arising out of or based on any

actions or inactions or operations of the Company (or any of its officers and directors), to the fullest extent permitted by the Nevada

Revised Statutes. Such indemnification does not include any claims resulting from the gross negligence or wilful misconduct of the Director.

The indemnification provided for in this paragraph shall survive the Termination Date.

10. Successors;

Assignment.

(a) The

Company. This Agreement shall be binding upon and inure to the benefit of the Company and its successors and permitted assigns.

(b) The

Director. Neither this Agreement, nor any right, obligation or interest hereunder, may be assigned by the Director, his beneficiaries,

or his legal representatives without the prior written consent of the Company; provided, however, that nothing in this

paragraph (b) shall preclude (i) the Director from designating a beneficiary to receive any benefit payable hereunder upon his death,

or (ii) the executors, administrators, or other legal representatives of the Director or his estate from assigning any such rights hereunder

to distributees, legatees, beneficiaries, testamentary trustees or other legal heirs of the Director. Subject to the foregoing, this

Agreement shall be binding upon and inure to the benefit of the Director and his executors and administrators.

11. Waiver

of Breach. The waiver by the Company or the Director of a breach of any provision of this Agreement by the other party shall not

be construed as a waiver of any continuing or subsequent breach of the same provision or of any other provision of this Agreement. It

is also understood and agreed that no failure or delay by the Company in exercising any right, power or privilege hereunder shall operate

as a waiver thereof, nor shall any single or partial exercise thereof preclude any other or future exercise thereof or the exercise of

any other right, power or privilege hereunder.

12. Notices.

All notices and other communications hereunder shall be in writing and shall be deemed to have been given when delivered by hand or courier

service, or mailed by first-class certified mail, postage prepaid and return receipt requested, addressed as follows:

If

to the Company:

Amplitech

Group, Inc.

Attn:

Fawad Maqbool

155 Plant Avenue

Hauppauge,

NY 11788

If

to the Director, to the address set forth on in signature page hereto.

or,

in each case, at such other address as may from time to time be specified to the other party in a notice similarly given.

13. Governing

Law; Litigation.

(a) Governing

Law. This Agreement shall be governed by end construed in accordance with the internal laws of the State of New York applicable to

agreements made and to be performed entirely within such State.

(b) Litigation.

Each of the Company and the Director hereby agrees that the courts of the State of New York shall have jurisdiction to hear and determine

any claims or disputes pertaining to this Agreement or to any matter arising therefrom. Each of the Company and the Director expressly

submits and consents in advance to such jurisdiction in any action commenced in such courts, hereby waiving personal service of the summons

and complaint or other process or papers issued therein, and agreeing that service of such summons and complaint, or other process or

papers, may be made in any manner permitted by the laws of the State of New York including if permissible the same manner as notices

hereunder may be given pursuant to Section 10. The choice of forum set forth in this paragraph (b) shall not be exclusive nor shall it

preclude the enforcement of any judgment obtained in such forum or the taking of any action under this Agreement to enforce such judgment

in any appropriate jurisdiction.

14. Expenses.

All costs and expenses (including attorneys’ fees) incurred in connection with the negotiation and preparation of, or any claim,

dispute or litigation pertaining to, this Agreement shall be paid by the party incurring such expenses.

15. Entire

Agreement. This Agreement contains the entire agreement of the parties and their affiliates relating to the subject matter hereof

and thereof and supersedes all prior agreements, representations, warranties and understandings, written or oral, with respect thereto.

16. Severability.

(a) Generally.

If any term or provision of this Agreement or the application thereof to any person, property or circumstance shall to any extent be

invalid or unenforceable, the remainder of this Agreement, or the application of such term or provision to persons, property or circumstances

other than those as to which it is invalid or unenforceable, shall not be affected thereby, and each term and provision of this Agreement

shall be valid and enforceable to the fullest extent permitted by law.

(b) Duration

and Scope of Certain Covenants. Without limiting paragraph (a) above, if any court determines that any of the covenants contained

in Section 6, or any part of such covenants, is unenforceable because of the duration or scope of such covenant or provision, such court

shall have the power to and is hereby requested to reduce the duration or scope of such covenant or provision, as the case may be, to

the extent necessary to make such covenant or provision enforceable, and in its reduced form, such covenant or provision shall then be

enforceable.

17. Remedies.

(a) Injunctive

Relief. The Director acknowledges and agrees that the covenants and obligations of the Director contained in Section 6 relate to

special, unique and extraordinary matters and are reasonable and necessary to protect the legitimate interests of the Company and that

a breach of any of the terms of such covenants and obligations will cause the Company irreparable injury for which adequate remedies

at law are not available. Therefore, the Director agrees that the Company shall be entitled to an injunction, restraining order, or other

equitable relief from any court of competent jurisdiction restraining the Director from any such breach.

(b) Remedies

Cumulative. The Company’s rights and remedies under this Section 15 are cumulative and are in addition to any other rights

and remedies the Company may have at law or in equity. In connection with paragraph (a) of this Section 15, the Director represents that

his economic means and circumstances are such that such provisions will not prevent him from providing for himself and his family on

a basis satisfactory to him.

18. Waiver

of Statute of Limitations. The Director hereby waives for the longest period permitted by applicable law the limitation of any statute

for the presentation of any claim arising under any provision of Section 6 hereof.

19. Withholding

Taxes. The Company shall deduct any foreign, federal, state or local withholding or other taxes from any payments to be made by the

Company hereunder in such amounts which the Company reasonably determines are required to be deducted under applicable law.

20. Amendments,

Miscellaneous, etc. Neither this Agreement, nor any term hereof, may be changed, waived, discharged or terminated except by an instrument

in writing signed by the party against which such change, waiver, discharge or termination is sought to be enforced. This Agreement may

be executed in one or more counterparts, each of which shall be deemed an original, and all of which together shall constitute one and

the same instrument. The headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning

or interpretation of this Agreement.

IN

WITNESS WHEREOF, the parties hereto have duly executed and delivered this Agreement as of the date first written above.

| |

AMPLITECH GROUP, INC. |

| |

|

| |

By: |

|

| |

Name: |

Fawad Maqbool |

| |

Title: |

Chief Executive Officer |

EXHIBIT

A

| ● | The

Company is retaining the services of the Director as described in the Audit Committee Charter,

Nominating Committee Charter and the Compensation Committee Charter. |

Exhibit

99.1

AmpliTech

Group Announces Appointment Of Shailesh “Sonny” Modi To Its Board Of Directors

Hauppauge,

NY, January 21, 2025 – AmpliTech Group, Inc. (Nasdaq: AMPG, AMPGW, “AmpliTech”), a designer, developer, and

manufacturer of state-of-the-art signal processing components for satellite, Public and Private 5G, and other communications networks,

including the design of complete 5G/6G systems and a global distributor of packages and lids for integrated circuits assembly, today

is pleased to announce the appointment of Shailesh “Sonny” Modi to its Board of Directors. Mr. Modi is a seasoned senior

financial and business professional with nearly 40 years of experience. Mr. Modi will serve on the Audit, Nominating and Governance Committees.

AmpliTech looks forward to leveraging his experience, knowledge and guidance to further its abilities to achieve corporate goals.

Mr.

Modi’s experience spans into various sectors and disciplines, including managerial, finance, auditing and strategy. He spent the

first 10 years of his career with Deloitte & Touche LLP, serving various clients in the financial services industry and participating

in initial public offerings. For the past 30-plus years, Mr. Modi has worked in the private sector in various senior executive roles.

For the past 9 years, Mr. Modi has continued to serve in the role of chief financial officer and treasurer at ShelterPoint Life Insurance

Company (“ShelterPoint”). In 2024, Mr. Modi was instrumental in leading the efforts of the successful sale of ShelterPoint

to Protective Life Insurance Company. Mr. Modi holds his BS in Accounting and MBA in Finance & Computer Systems from New York University.

He has served on various Boards including InRoads and IASA, and been involved in various volunteer organizations, including the Boy Scouts

of America.

About

AmpliTech Group

AmpliTech

Group, Inc., its subsidiary, AmpliTech Inc., and the Company’s divisions, Specialty Microwave, Spectrum Semiconductor Materials,

AmpliTech Group Microwave Design Center, and AmpliTech Group True G Speed Services—is a leading designer, developer, manufacturer,

and distributor of cutting-edge radio frequency (RF) microwave components and 5G network solutions. Serving global markets including

satellite communications, telecommunications (5G & IoT), space exploration, defense, and quantum computing, AmpliTech Group is committed

to advancing technology and innovation. For more information, please visit www.amplitechgroup.com.

Safe

Harbor Statement

This

release contains statements that constitute forward-looking statements. These statements appear in several places in this release and

include all statements that are not statements of historical fact regarding the intent, belief or current expectations of the Company,

its directors or its officers with respect to, among other things, that this company’s expected receipt of patents in the

near future, will lead to immediate or near future orders and to further penetrate Quantum Computing and Public and Private 5G markets.

The words “may” “would” “will” “expect” “estimate” “anticipate”

“believe” “intend” and similar expressions and variations thereof are intended to identify forward-looking statements.

Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties,

many of which are beyond the Company’s ability to control, and that actual results may differ materially from those projected in

the forward-looking statements because of various factors. Other risks are identified and described in more detail in the “Risk

Factors” section of the Company’s filings with the SEC, which are available on our website. We undertake no obligation

to update, and we do not have a policy of updating or revising these forward-looking statements, except as required by applicable law.

Contacts:

Corporate

Social Media

X/Twitter:

@AmpliTechAMPG

Instagram:

@AmpliTechAMPG

Facebook:

AmpliTechInc

Linked

In: @AmpliTech Group Inc

Investor

Social Media

Twitter:

@AMPG_IR

StockTwits:

@AMPG_IR

Company

Contact:

Jorge

Flores

Tel:

(631)-521-7831

investors@amplitechgroup.com

v3.24.4

Cover

|

Jan. 17, 2025 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 17, 2025

|

| Entity File Number |

001-40069

|

| Entity Registrant Name |

AmpliTech

Group, Inc.

|

| Entity Central Index Key |

0001518461

|

| Entity Tax Identification Number |

27-4566352

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

155

Plant Avenue

|

| Entity Address, City or Town |

Hauppauge

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

11788

|

| City Area Code |

(631)

|

| Local Phone Number |

521-7831

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.001 per share |

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

AMPG

|

| Security Exchange Name |

NASDAQ

|

| Warrants to Purchase Common Stock |

|

| Title of 12(b) Security |

Warrants

to Purchase Common Stock

|

| Trading Symbol |

AMPGW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AMPG_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AMPG_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

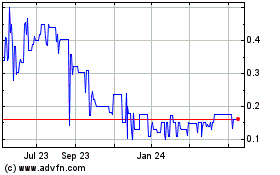

Amplitech (NASDAQ:AMPGW)

Historical Stock Chart

From Dec 2024 to Jan 2025

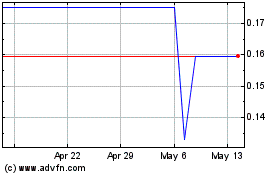

Amplitech (NASDAQ:AMPGW)

Historical Stock Chart

From Jan 2024 to Jan 2025