| Prospectus |

Filed Pursuant to Rule 424(b)(4)

Registration Statement No. 333-274910 |

Nxu, Inc.

86,000,000 Shares of Class A Common Stock

(or Pre-Funded Warrants to Purchase up to 86,000,000

Shares of Class A Common Stock)

_____________________________

We are offering up to 86,000,000 shares (the “Shares”)

of our Class A common stock, $0.0001 par value per share (the “Class A common stock”). We are offering each Share at a public

offering price of $0.035 per Share.

We are also offering to each investor of Shares

that would otherwise result in the investor’s beneficial ownership exceeding 4.99% of our outstanding Class A common stock immediately

following the consummation of this offering the opportunity to invest in pre-funded warrants to purchase shares of Class A common stock

(“Pre-Funded Warrant”) (in lieu of Shares). Subject to limited exceptions, a holder of Pre-Funded Warrants will not have

the right to exercise any portion of its Pre-Funded Warrants if the holder, together with its affiliates, would beneficially own in excess

of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the Class A common stock outstanding immediately

after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one share of Class A common stock. The purchase

price of each Pre-Funded Warrant will be equal to the price per Share, minus $0.0001, and the exercise price of each Pre-Funded Warrant

will equal $0.0001 per Share. The Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership cap) and may

be exercised at any time until all of the Pre-Funded Warrants are exercised in full. For each Pre-Funded Warrant purchased (without regard

to any limitation on exercise set forth therein), the number of Shares we are offering will be decreased on a one-for-one basis. We are

also registering the Class A common stock issuable from time to time upon exercise of the Pre-Funded Warrants offered in lieu of Shares.

The Shares will be offered at a fixed price and

are expected to be issued in a single closing. There is no minimum number of Shares to be sold or minimum aggregate offering proceeds

for this offering to close. We expect this offering to be completed not later than two business days following the commencement of this

offering and we will deliver all securities issued in connection with this offering delivery versus payment (“DVP”)/receipt

versus payment (“RVP”) upon our receipt of investor funds. Accordingly, neither we nor the Placement Agent has made any arrangements

to place investor funds in an escrow account or trust account since the Placement Agent will not receive investor funds in connection

with the sale of securities offered hereunder.

Our Class A common stock is listed on the Nasdaq

Stock Market LLC (“Nasdaq”) under the symbol “NXU.” On October 18, 2023, the last reported sales price of our

Class A common stock as reported on Nasdaq was $0.069 per share.

There is no established public trading market

for the Pre-Funded Warrants and we do not expect markets to develop. Without an active trading market, the liquidity of these securities

will be limited.

We are an “emerging growth company”

as that term is defined under the federal securities laws and, as such, we have elected to comply with certain reduced reporting requirements

for this prospectus and may elect to do so in future filings.

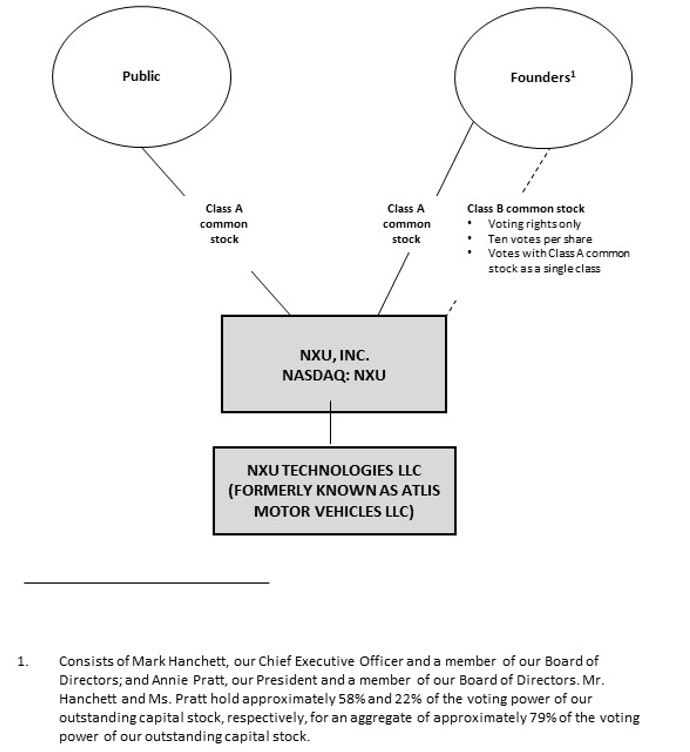

Our Company has a dual class structure. Our Class

A common stock, which is the stock we are offering by means of this prospectus, has one vote per share and our Class B common stock,

$0.0001 par value per share (the “Class B common stock” and together with the Class A common stock, “common stock”),

has no economic rights and has 10 votes per share. See “Risk Factors – The dual class structure of our common stock has the

effect of concentrating voting power with members of our management team, which will limit your ability to influence the outcome of important

transactions, including a change in control” and “Risk Factors – We cannot predict the impact our dual class structure

may have on our stock price” for more information. For more information on our capital stock, see the section titled “Description

of Securities.”

Our Class B common stock is owned solely by our

Chief Executive Officer, Mark Hanchett, and our President, Annie Pratt, who own 25,903,676 and 9,721,696 shares of our Class B common

stock, respectively. Mr. Hanchett and Ms. Pratt hold approximately 58% and 22% of the voting power of our outstanding capital stock, respectively,

for an aggregate of approximately 79% of the voting power of our outstanding capital stock. Upon the closing of this offering, our Chief

Executive Officer and President will collectively hold approximately 68% of the voting power of our outstanding capital stock.

As a result of our Chief Executive Officer’s

ownership of our Class B common stock, we are a “controlled company” within the meaning of the corporate governance standards

of Nasdaq. See “Management – Controlled Company” and “Risk Factors – We are a “controlled company”

within the meaning of the Nasdaq rules and, as a result, qualify for and rely on exemptions from certain corporate governance requirements.

As a result, our stockholders do not have the same protections afforded to stockholders of companies that cannot rely on such exemptions.

Our principal executive offices are located at

1828 N Higley Rd., Suite 116, Mesa, Arizona 85205, and our telephone number at that address is (760) 515-1133.

________________________

You should carefully read this prospectus and any prospectus

supplement or amendment before you invest. See the section entitled “Risk Factors” beginning on page 14. You also should

read the information included throughout this prospectus for information on our business and our financial statements, including information

related to our predecessor.

Neither the Securities and Exchange Commission

(the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

| |

|

Per Share |

|

|

Per Pre-

Funded Warrant |

|

|

Total |

|

| Public offering price(1) |

|

$ |

0.0350 |

|

|

$ |

0.0349 |

|

|

$ |

3,010,000 |

|

| Placement agent fees(2) |

|

$ |

0.0023 |

|

|

$ |

0.0023 |

|

|

$ |

195,650 |

|

| Proceeds, before expenses, to us(3) |

|

$ |

0.0327 |

|

|

$ |

0.0326 |

|

|

$ |

2,814,350 |

|

_____________________

| (1) | The public offering price is $0.350per Share and $0.0349 per Pre-Funded Warrant. |

| (2) | Represents a cash fee equal to six

and a half percent (6.5%) of the aggregate purchase price paid by investors in this offering.

We have also agreed to reimburse the Placement Agent for its out-of-pocket expenses in an

amount up to $50,000. |

| (3) | The amount of offering proceeds to

us presented in this table assumes no Pre-Funded Warrants are issued in lieu of Shares. |

We have engaged Maxim Group LLC to act as our

exclusive placement agent (the “Placement Agent”) to use its reasonable best efforts to solicit offers to purchase our securities

in this offering. The Placement Agent has no obligation to purchase any of the securities from us or to arrange for the purchase or sale

of any specific number or dollar amount of the securities. We have agreed to pay the Placement Agent the placement agent fees set forth

in the table above and to provide certain other compensation to the Placement Agent. See “Plan

of Distribution” for more information regarding these arrangements.

We anticipate that delivery of the securities

against payment therefor will be made on or about October 23, 2023.

Maxim Group LLC

Placement Agent

Prospectus dated October 19, 2023.

TABLE OF CONTENTS

________________________

Please read this prospectus carefully. It describes

our business, our financial condition and our results of operations. We have prepared this prospectus so that you will have the information

necessary to make an informed investment decision. You should rely only on the information contained in this prospectus or to which we

have referred you. We and the Placement Agent have not authorized any person to provide you with additional information or different

information. We and the Placement Agent take no responsibility for, and can provide no assurance as to the reliability of, any information

that others may give you. This prospectus may only be used where it is legal to offer and sell the securities described herein and only

during the effectiveness of the registration statement of which this prospectus forms a part. You should assume the information contained

in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this

prospectus or of any sale of our Class A common stock. Neither the delivery of this prospectus nor any distribution of securities in

accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of

this prospectus.

This prospectus contains forward-looking statements

that are subject to a number of risks and uncertainties, many of which are beyond our control. See “Risk Factors” and “Cautionary

Note Regarding Forward-Looking Statements.”

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

on Form S-1 that we filed with the SEC for this offering by us of Class A common stock.

Neither we nor the Placement Agent has authorized

anyone to provide you with different or additional information, other than that contained in this prospectus or in any free writing prospectus

prepared by or on behalf of us or to which we may have referred you, and neither we nor they take any responsibility for, or provide

any assurance as to the reliability of, any other information that others may give you. Neither we nor the Placement Agent is making

an offer to sell Class A common stock in any jurisdiction where the offer or sale thereof is not permitted. You should not assume

that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus,

regardless of the time of delivery of this prospectus or any sale of our Class A common stock. Our business, financial condition, results

of operations and prospects may have changed since that date.

We may also provide a prospectus supplement or

post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus.

You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement

together with the additional information to which we refer you in the sections of this prospectus titled “Where You Can Find More

Information.”

Unless otherwise indicated, information contained

in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position,

market opportunity and market share, is based on information from our own management estimates and research, as well as from industry

and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly

available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be

reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party

information. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high

degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other

factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Note Regarding

Forward-Looking Statements.”

For investors outside the United States: Neither

we nor the Placement Agent have taken any action to permit the possession or distribution of this prospectus in any jurisdiction other

than the United States where action for that purpose is required. Persons outside the United States who come into possession of

this prospectus must inform themselves about and observe any restrictions relating to the Class A common stock and the distribution

of this prospectus outside the United States.

Unless

otherwise indicated or the context otherwise requires, all references in this prospectus

to the terms “Nxu,” the “Company,” “we,” “our”

or “us” refer to Nxu, Inc., a Delaware corporation, and, immediately prior to

the Reorganization Merger (as defined herein), to its predecessor, Atlis Motor Vehicles Inc.,

a Delaware corporation, either individually or together with its consolidated subsidiaries,

as the context requires.

MARKET AND INDUSTRY DATA

Market and industry data and forecasts used in

this prospectus have been obtained from independent industry sources as well as from research reports prepared for other purposes. We

are responsible for all of the disclosure in this prospectus, and although we believe these third-party sources to be reliable, we have

not independently verified the data obtained from these sources, and we cannot assure you of the accuracy or completeness of the data.

Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties

as the other forward-looking statements in this prospectus.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This document contains references to trademarks,

trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred

to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that

the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names.

We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with,

or endorsement or sponsorship of us by, any other companies.

SUMMARY

OF THE PROSPECTUS

This summary highlights selected information

from this prospectus and does not contain all of the information that is important to you in making an investment decision. You should

read the entire prospectus carefully, including the information under the headings “Risk Factors,” “Cautionary Note

Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” and the financial statements and the notes to those financial statements appearing elsewhere in this prospectus.

Overview

Nxu is a U.S.-based technology company manufacturing

innovative battery cells and battery packs for use in advanced energy storage systems, megawatt charging stations, and mobility products.

We believe that widespread adoption of EVs by the commercial and industrial markets requires high performing battery and pack solutions

that can effectively compete with legacy diesel-based products. Nxu designs, engineers, and plans to build proprietary lithium-ion (“Li-ion”)

battery cells and packs, 1 megawatt plus charging stations, energy storage solutions and a suite of software and services designed to

allow an easy transition from diesel to electric for our target segment.

Our battery technology is expected to offer considerable

advantages in battery capacity, charging rate, safety, and lifespan while keeping costs low. We are confident that these advantages will

be highly beneficial to Original Equipment Manufacturers (“OEMs”) in the automotive and medium to heavy duty equipment segments

as it would encourage customers to transition to electrification. We are designing our Li-ion batteries to fully charge in about 15 minutes

or less, thereby allowing for a more competitive EV experience to match fossil fuel vehicles, something that current EVs using conventional

batteries are unable to achieve. We believe Nxu technology may be used to power medium and super-duty pick-up trucks, last mile delivery

vehicles, garbage trucks, cement trucks, vans, RVs, box trucks, light to heavy-duty equipment and more. In addition, our batteries could

be used for commercial and residential energy storage devices.

In 2023, we introduced our megawatt charging

station and demonstrated its ability to deliver up to 1.1 megawatts of electricity to fast charge compatible batteries. Currently, there

are three types of chargers prevalent in the market:

Level 1 chargers use a standard 120-volt

household outlet and can provide up to 5 miles of range per hour of charging. They are typically used for overnight charging at home

and are the slowest charging option.

Level 2 chargers require a 240-volt electrical

supply and can provide up to 25 miles of range per hour of charging. They are commonly found in public locations like parking garages,

workplaces, and retail spaces.

Level 3 chargers, also known as Direct

Current (DC) fast chargers, are the fastest charging option and can provide approximately 100 to 200+ miles of range in as little as

30 minutes.

Our megawatt chargers, being designed to provide

1,500kW of electricity, represent the next generation of charging solutions needed to expedite the mass adoption of electric vehicles

for individual drivers, commercial fleets, medium-to-heavy duty equipment customers and businesses. To take advantage of the expected

rapid growth in the number of EVs on the road in the United States, the Company plans to deploy and test its chargers for mass rollout

in the near future.

We also believe that energy storage solutions

are important for both consumer and commercial markets as grid stability and resiliency becomes critical to enabling the adoption of

electric vehicles. Stationary energy storage systems are technologically adjacent opportunities which can leverage the modular design

of our battery packs and advanced battery management systems to create solutions that address residential, commercial and utility-scale

needs. Energy storage can also provide backup power during grid outages or emergencies, helping to ensure that critical services like

hospitals and emergency responders remain operational.

Nxu is an early-stage company and has not yet

scaled production of its products or delivered any products to customers. Of the products we intend to bring to market, our proprietary

battery technology is the furthest along in development and closest to mass production. We intend to deliver battery cells and packs

to customers in 2023. Simultaneously, we plan to deploy our megawatt charging stations and energy storage solutions as soon as the next

twelve months and the next twenty-four months respectively. Finally, we plan to continue to develop our vehicle products in the future,

both of which we believe will provide incremental value to our target market in the long run. Scaling to reach high-volume battery production

will require significant effort and capital. Based on our plans, we estimate that the cost to build and completely tool multi-gigawatt

hour facility will range from $200 million to $300 million per gigawatt hour of capacity. Our ability to raise the significant capital

required continues to be a challenge. Additionally, as of the date of this prospectus, we have no actionable plan of operation to commence

sales of our products. As such, Nxu will need to build out detailed go-to-market plans as we get closer to customer deliveries and sales.

Our Target Market

Customers across the commercial and industrial

segments are progressively contemplating EVs for a range of reasons such as improved performance, expansion of the EV charging infrastructure,

significantly reduced environmental impact, and lower costs for maintenance and operation. However, the players in these market segments

face unique barriers to the adoption of EVs due to their high-demand usage patterns and operational requirements. In addition, the use

of conventional Li-ion batteries in heavy-duty vehicles and equipment poses several inherent challenges that limit their adoption. Some

of these challenges include:

| · | Limited

energy density: Conventional batteries have a relatively low energy density, which means

that heavy-duty vehicles and equipment require a large number of batteries to achieve sufficient

range. This can add significant weight to the vehicle and reduce payload capacity. |

| · | Temperature

sensitivity: Conventional Li-ion batteries are sensitive to temperature changes, particularly

at extreme temperatures. This can impact the performance and lifespan of the battery, particularly

in hot or cold environments. |

| · | Charging

time: Charging time for Li-ion batteries can be significant, particularly for larger

batteries. This can impact the operational efficiency of heavy-duty vehicles and equipment,

which may require frequent charging throughout the day. |

| · | High

upfront costs: Electric commercial vehicles can have a higher upfront cost than their

conventional counterparts, which can be a significant barrier for companies that operate

on tight profit margins. |

| · | Limited

range and charging infrastructure: Commercial vehicles often need to travel longer distances

than passenger cars and require more frequent stops for refueling. The limited range of electric

commercial vehicles and the lack of charging infrastructure can make it difficult for fleets

to operate efficiently. |

| · | Payload

capacity: Electric commercial vehicles often have lower payload capacity than their conventional

counterparts due to the weight of the battery, which can limit their utility for certain

applications. |

| · | Vehicle

downtime: Commercial vehicles and equipment are often in use for long hours and may have

limited downtime for charging, which can be a challenge for EVs that require longer charging

times than refueling with gasoline or diesel. |

| · | Uncertainty

about total cost of ownership: Companies may be hesitant to invest in electric commercial

vehicles due to uncertainty about the total cost of ownership, including maintenance, repair,

and replacement costs. |

We believe that effective adoption to electrification

by the commercial and industrial markets requires a unified solution that addresses all concerns simultaneously. A piecemeal solution

where multiple companies independently develop and build pieces of the electrification puzzle while leaving the customer to figure out

the rest may not adequately address all needs and may even drive greater execution risk for the customer. An effective Li-ion battery

technology along with megawatt level charging solution and energy storage solutions to support grid resiliency are critical and foundational

components of a unified solution. Nxu plans to develop these foundational components.

Production Development Phases

In producing its various products and services,

Nxu follows a phased development approach comprised of the stages noted below.

Stage 1: Concept Verification and Test. This

is the concept verification and test phase of development. Product ideas are evaluated to assess viability and whether or not there is

potential to further develop and invest.

Stage 2: Engineering Verification and Test. This

is the engineering verification and test phase of development. Validation of the technology within a product is completed.

Stage 3: Design Verification and Test. This is

the design verification phase of development. The product has reached a final design phase and engineering and production teams are validating

feasibility of the final product.

Stage 4: Production Verification and Test. This

is the production validation phase of development. The product design has been finalized, and the production process is developing and

undergoing verification before being sold to customers.

Principal Products and Services

Nxu plans to address the needs highlighted above

by developing a unified set of products and solutions to support a seamless transition to electrification by the commercial and industrial

industry. Our products start with the Nxu Qcell battery cells that are intended to go into our high-performing Qube battery packs, which

in turn, can be used by OEMs to power their electrified vehicles and equipment. Simultaneously, we plan to build megawatt charging stations

that will enable 15-minute charge time for our batteries. Finally, we plan to build energy storage systems, called Qube+, that will use

our battery packs to augment rising energy demand across residential, commercial and infrastructure customers. Eventually, we plan to

introduce a modular and scalable electric powered platform and an electric pickup truck purposely built to leverage our battery technology

to deliver high performing, all-electric vehicles for our target market.

Our Products

| · | Qcell Cell – Our proprietary battery technology is the foundation of the Nxu ecosystem. The Qcell

is designed to leverage an in-house developed NMC-811 chemistry, combined with a unique, proprietary mechanical construction, to significantly

improve thermal management and reduce electrical resistance. In addition, our battery cell structure eliminates excess volume and space,

thereby providing high energy density. The Qcell, when implemented utilizing our proprietary Qube battery pack technology and our advanced

charging station currently under development–- will be capable of delivering consistent power from 0% to 100% battery pack usable

capacity, while charging from 0% to 100% usable capacity in 15 minutes. This is the same amount of time it normally takes to fill an Internal

Combustion Engine (ICE) vehicle with fuel. Battery cells are currently being produced in low volumes at our facility in Mesa, AZ and production

is not dependent on any currently unknown advances in technology. We are in small-batch, pilot production of our battery cells and expect

to make customer deliveries in late 2023. To ensure we are capable of scaling production output, Nxu will need to continue to make investments

in capital expenses, additional facilities, and team growth for the coming years. Nxu has earmarked capital investment to ramp cell production

throughout 2023. As a byproduct of increased production, Nxu will continue to make significant investments in equipment for the foreseeable

future. |

| · | The

Nxu Qube is a 30 Kilowatt hours (“kWh”) battery pack focused on serving customers

within mobility, equipment, and energy storage and infrastructure applications. The Qube

will utilize our proprietary battery cell, pack design, electronics, and software systems,

all of which are currently in development. Legacy manufacturers of vehicle battery packs

typically utilize Li-ion battery cells in either cylindrical or pouch form factor which are

inherently inefficient due to high thermal and electrical resistance. Our Qube’s competitive

advantage is our direct cell integration approach which minimizes thermal resistance while

maximizing electrical conductivity. Our Qcell is intended to directly integrate into our

Qube. In addition, Nxu is developing the battery pack system with a completely integrated

power management, thermal management, and battery management system. The Qube is in Production

Verification and Test phase of development and completion of the engineering design and production

line is not subject to any currently unknown advances in technology. Our efforts are focused

on target customers that are seeking to deploy packs in 2024. As of February 2023, Nxu announced

it had secured two gigawatt-hours’ worth of battery capacity

demand in the form of non-binding Letters of Intent (LOI), Memoranda of Understanding (MOU),

and Purchase Orders (PO) from multiple customers in the automotive, heavy equipment, and

solar industries. Nxu plans to continue securing MOUs and LOIs for additional battery

packs and will work to expand production output in order to capitalize on that demand and

deliver products as quickly as our facilities and production processes allow. Our ability

to deliver these battery packs to customers at a growing rate is dependent on our ability

to raise capital and leverage that capital into increased production, among other factors. |

| · | Megawatt

charger – Our proprietary megawatt charger is intended to be capable of delivering

up to 1.5 megawatts of continuous power, deployable in standalone charging station or as

a drop-in direct-grid connection solution. The megawatt charger is intended to be a proprietary

charging solution to provide charging capabilities to the XT, the XP, and non-Nxu branded

electric vehicle that are compatible with Combined Charging System 2.0 (“CCS 2.0”).

Recently, the Company successfully demonstrated our one megawatt plus charging capability,

The megawatt charger is still in the research and development phase and is not yet in production.

The charging system is expected to complete the Production Verification and Test phase of

development as early as the end of 2023. Our ability to execute this plan is dependent on

our ability to raise the necessary capital and therefore, if the company is unable to secure

appropriate funding, these timelines are subject to change. Engineering design of the Megawatt

charger is not yet complete. We expect to encounter unforeseen engineering challenges and

may be reliant on unknown advances in technology. |

Future Products for Commercial and Industrial

Markets

| · | Nxu

Platform– The Platform is designed to be a modular vehicle system, or electric skateboard,

providing all technology, software, and mobility technology required to develop a vehicle

by third parties. Intended to be a universal, connected, complete vehicle hardware and mechanical

architecture system, the Platform will utilize our proprietary Qcell battery, electronics

hardware, mechanical, and software technologies to create a vehicle platform for sale to

low-volume vehicle OEMs to develop new EV solutions for niche- and mass-market opportunities.

The Platform has completed the Concept Verification and Test phase of development and Nxu

has produced a functioning concept as demonstrated in 2021 on our social media channels.

We expect that the production intent development of the Platform will follow our successful

commercialization of the Qcell, Qube, Qube+ and megawatt charger. We intend to commercialize

and scale our energy products first and expect the Platform to begin the Design Verification

and Test phase of development as early as 2025. However, our ability to execute is dependent

on our ability to raise the necessary capital and therefore, if the Company is unable to

secure appropriate funding, these timelines are subject to change. |

| · | Nxu pickup truck –

The pickup truck is intended to be our flagship vehicle and a 100% electric full-sized work

truck. The pickup truck is intended to be built on our platform. We intend to provide up

to 500 miles of range, up to 35,000 pounds of towing capacity, and a simplified operational

approach that that utilizes our software and cloud service solutions to provide seamless

fleet connectivity. The pickup truck is still in the research and development phase. Given

ongoing capital constraints and current market sentiment, the Company has decided to focus

its resources on commercializing and scaling energy products at this time. We expect that

the production intent development of the truck will follow the ramp of the Platform. The

pickup truck has completed the Concept Verification and Test phase of development, we expect

to begin the Engineering Verification and Test phase of development as soon as 2026. We expect

to encounter unforeseen engineering challenges and may be reliant on unknown advances in

technology. In addition, our ability to execute is dependent on our ability to raise the

necessary capital and therefore, if the Company is unable to secure appropriate funding,

these timelines are subject to change. |

The execution of our vision is highly dependent

on multiple factors that include our ability to raise the necessary capital required to bring all products and services to market and,

more specifically, our ability to successfully deliver Qubes to customers. Our successful implementation of the Qcell and Qube would

allow us to tackle a key challenge that we face in the industry: the lack of available, adequate, and accessible battery technology.

Thus, we have focused our attention on developing our own battery technology in order to mitigate the external risk created from a lack

of suitable and available battery technology in the market.

We intend to continue development of Q-cells upon

raising additional capital specifically for the battery program as soon as 2024. To do so, Nxu will need to continue to make investments

in capital expenses, additional facilities, and team growth. Nxu will continue to make significant investments in equipment for battery

and charging product development programs for the foreseeable future. In addition to the proceeds from this offering, we will need to

raise funds through other sources to invest in the continued development and deployment of our charging products.

Additionally, our ability to scale high-volume

mobility and energy storage solutions is highly dependent on our success with the Qcell and Qube. As there is a limited supply of these

materials, Qcell and Qube production delays will likely delay high volume mobility and energy storage solutions. Any disruption from

competitors or any disruption to internal material and cell availability could impact the Company’s ability to succeed in any program

that relies on battery cells.

While we remain optimistic in our ability to

bring Qcell and Qube to market, these two programs carry high technical challenges due to the fact that the intellectual property required

for the programs to successfully scale must be developed, as it cannot be purchased nor is it readily available in the market. Nxu appreciates

the importance of overcoming this challenge and the resources needed to do so, and Nxu intends to focus the majority of its efforts on

bringing the Nxu charging technology to market first and refocus on Qcell and Qube products once the needed resources are secured, as

soon as 2024.

We signed an Amended Collaboration Agreement

on July 28, 2022 with an Australian company called Australian Manufactured Vehicles (“AUSEV”) to jointly develop a right-hand

drive version of the pickup truck. Under the terms of the AUSEV agreement, we agreed to supply pickup trucks in limited volume of prototype

and test vehicles in 2024, up to a total of 19,000 production intent pickup trucks beginning in 2026 through 2027, contingent upon production

capacity, funding, and raw material availability. The AUSEV agreement requires the parties to enter into binding definitive supply agreements.

Given our decision to focus our resources on commercializing and scaling energy products at this time, we do not expect to supply pickup

trucks in 2024. AUSEV is supportive of our strategy and we are working closely together and endeavor to deliver pickup trucks to AUSEV

as soon as practicable. The AUSEV agreement has an initial term of five (5) years from August 28, 2021. Upon expiration of the initial

term, the AUSEV agreement will automatically renew for an additional two-year term unless either party notifies the other party in writing

of its intent to terminate, at least 90 days prior to such expiration.

Our People

Beyond our products and solutions in development,

we believe the largest competitive advantage Nxu has is our culture. Our company culture embodies the idea that a transition to electrification

and a sustainable future should not require compromise. We are unwilling to bend in our belief that when a technology does not exist,

we find creative and innovative ways of developing solutions to solve these challenges. Our team is built of a diverse group of individuals

with a singular focus, to power the future of work through an ecosystem of technologies and solutions that provide incremental value

to those who build, dig, grow, and maintain.

Implications of Being an Emerging Growth Company

and Smaller Reporting Company

We qualify as an “emerging growth company”

under the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). As a result, we are permitted to, and

intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be

required to:

| · | have

an auditor report on our internal controls over financial reporting pursuant to Section 404(b)

of the Sarbanes-Oxley Act of 2022, as amended; |

| · | comply

with any requirement that may be adopted by the Public Company Accounting Oversight Board

regarding mandatory audit firm rotation or a supplement to the auditor’s report providing

additional information about the audit and the financial statements (i.e., an auditor discussion

and analysis); |

| · | submit

certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,”

“say-on-frequency” and pay ratio; and |

| · | disclose

certain executive compensation related items such as the correlation between executive compensation

and performance and comparisons of the chief executive officer’s compensation to median

employee compensation. |

In addition, Section 107 of the JOBS Act also

provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities

Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards. In other words, an

emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private

companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore

not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company”

for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues are

$1.07 billion or more, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), which would occur if the market value of our Class A common stock

that are held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter,

or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

We are also a “smaller reporting company”

as defined by Rule 12b-2 of the Exchange Act. We may continue to be a smaller reporting company even after we are no longer an emerging

growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able

to take advantage of these scaled disclosures for so long as the market value of our voting and non-voting Class A common stock held

by non-affiliates is less than $250.0 million measured on the last business day of our second fiscal quarter, or our annual revenue is

less than $100.0 million during the most recently completed fiscal year and the market value of our voting and non-voting Class A common

stock held by non-affiliates is less than $700.0 million measured on the last business day of our second fiscal quarter.

Controlled Company Exemption

Our Chief Executive Officer, Mark Hanchett, beneficially

owns and controls a majority of the combined voting power of our common stock. As a result, we are a “controlled company”

within the meaning of the Nasdaq listing rules. Under these rules, a company of which more than 50% of the voting power is held by an

individual, a group or another company is a “controlled company” and may elect not to comply with certain corporate governance

requirements of Nasdaq. Our stockholders do not have the same protections afforded to stockholders of companies that are subject to such

requirements. Mark Hanchett also serves as the Chairman of the Board of Nxu.

Corporate Information

We were originally incorporated under the laws

of the State of Delaware on November 9, 2016 under the name “Atlis Motor Vehicles Inc.” (the “Predecessor”).

In connection with the Reorganization Merger, Nxu was incorporated under the laws of the State of Delaware on March 10, 2023. Our principal

executive offices are located at 1828 North Higley Road, Mesa, AZ 85205. Our website address is www.nxu.com. The information provided

on or accessible through our website (or any other website referred to in the registration statement, of which this prospectus forms

a part, or the documents incorporated by reference herein) is not part of the registration statement, of which this prospectus forms

a part, and is not incorporated by reference as part of the registration statement, of which this prospectus forms a part.

Recent Developments

Initial Public Offering

On September 27, 2022, we completed our initial

public offering (the “IPO”) under Regulation A of the Securities Act and became listed on the Nasdaq Stock Market.

In our IPO, we sold 1,015,802 shares of our Class A common stock at a weighted-average price of $14.28 per share. We used the proceeds

from the IPO to fund our production and marketing activities.

Following our IPO, trading in our Class A common

stock has been volatile and subject to wide fluctuations from a high price of $243.99 on September 28, 2022 to a low price of $0.069 on

October 18, 2023. These swings in our trading prices are unrelated and disproportionate to our operating performance. As a

startup company, we expect this volatility in our stock price to continue for the foreseeable future. As a result, we determine,

and advise potential investors to determine, the value of our Class A common stock based on the information contained in our public disclosures

and other industry information rather than by reference to its current trading price. See “Risk Factors – The market price

of our Class A common stock has fluctuated, and may continue to fluctuate, significantly, and you may lose all or part of your investment.”

Convertible Notes

On November 3, 2022, we entered into a Securities

Purchase Agreement with certain investors (the “Investors”), as amended on January 5, 2023 (as amended, the “Securities

Purchase Agreement”). Pursuant to the Securities Purchase Agreement, we issued an aggregate of $20.0 million of Senior Secured Original

Issue 10% Discount Convertible Promissory Notes (the “convertible notes”) and 1,711,306 warrants to purchase shares of our

Class A common stock. As of October 19, 2023, there was an aggregate of approximately $1.3 million of convertible notes outstanding, which

are convertible into up to an aggregate of 8,686,667 shares of Class A common stock (assuming conversion at a conversion price equal to

the floor price of $0.15), and 1,711,306 outstanding warrants to purchase 1,711,306 shares of Class A common stock. The Company

does not currently have any other indebtedness outstanding.

Nasdaq Notices

On April 11, 2023, we received a notice of non-compliance from Nasdaq

stating that we are not in compliance with the $1.00 minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) for continued

listing on Nasdaq. On August 29, 2023, we received a notice from Nasdaq stating that the Company’s reported stockholders’

equity no longer meets the minimum stockholders’ equity of $2,500,000 required for continued listing of the Company’s Class

A common stock on Nasdaq under Nasdaq Listing Rule 5550(b)(1). On October 10, 2023, we received a notice from Nasdaq stating that we did

not regain compliance with the minimum bid price requirement within the 180-day period provided and are not eligible for a second 180-day

period because we do not comply with the $5 million initial listing requirement for Nasdaq. As a result, Nasdaq determined that, unless

we timely requested a hearing before the Nasdaq Hearings Panel (the “Panel”), our Class A common stock would be suspended.

We timely requested a hearing, and on October 17, 2023, we received formal notice from Nasdaq that such hearing is scheduled to be held

on December 14, 2023. The delisting action has been stayed, pending a final written decision by the Panel. At the hearing, the Company

will present a plan to the Panel that includes a discussion of the events that it believes will enable it to regain compliance.

We determined that the notices of non-compliance constituted events

of default under our outstanding convertible notes. As a result of the events of default, unless waived by the Investors, the convertible

notes began accruing default interest at a rate of 10% per annum and we are obligated to pay to the Investors 100% of the sum of (x)

the outstanding principal of the notes and (y) accrued and unpaid interest thereon. The Investors have the option to instead convert

the amount due and payable under the event of default, including at an alternative conversion price as described in the convertible notes.

Holding Company Reorganization

On May 12, 2023, the Predecessor completed its

previously announced reorganization merger pursuant to the Agreement and Plan of Merger, dated as of April 16, 2023 (the “Reorganization

Agreement”), by and among the Predecessor, Nxu and Atlis Merger Sub, Inc., a Delaware corporation and, as of immediately prior

to the consummation of such merger, a wholly-owned subsidiary of Nxu (“Merger Sub”). The Reorganization Agreement provided

for the merger of the Predecessor and Merger Sub, with the Predecessor surviving the merger as a wholly-owned subsidiary of Nxu (the

“Reorganization Merger”).

Following the Reorganization Merger, on May 12,

2023, the Predecessor (which, as a result of the Reorganization Merger, became a wholly-owned subsidiary of Nxu) converted from a Delaware

corporation into a Delaware limited liability company named “Atlis Motor Vehicles LLC” (such conversion, together with the

Reorganization Merger, the “Reorganization”). Following the Reorganization, substantially all of the assets of Atlis Motor

Vehicles LLC were distributed, assigned, transferred, conveyed and delivered to, and related liabilities of Atlis Motor Vehicles LLC

were assumed by, Nxu. On May 25, 2023, Atlis Motor Vehicles LLC changed its name to Nxu Technologies, LLC.

The below chart depicts our capital structure

following the Reorganization:

GEM Agreements

On June 25, 2021, the Company entered into a Share Purchase Agreement

(the “Share Purchase Agreement”) with GEM Global Yield LLC SCS (“GEM Global”) and GEM Yield Bahamas Limited (“GYBL”),

pursuant to which the Company will issue and sell to GEM Global, and GEM Global agrees to purchase from the Company, until September

27, 2025, up to the number of shares of Class A common stock having an aggregate value of $300,000,000 (the “Aggregate Limit”),

pursuant to draw down notices (each, a “Draw Down Notice” and each transaction under a Draw Down Notice, a “Draw Down”),

which the Company may deliver to GEM Global in its sole discretion. The Company will also pay GEM Global a commitment fee equal to two

percent (2%) of the Aggregate Limit.

On the effective date of the Share Purchase Agreement, the Company

also issued a warrant to GYBL (the “Common Stock Purchase Warrant”) to purchase a number of shares of Class A common stock

equal to 4.2% of the total number of shares of Class A common stock outstanding immediately after the completion of the Company’s

public listing on September 27, 2022, calculated on a fully diluted basis, which amount equals 340,374 shares. The Common Stock Purchase

Warrant is exercisable at an exercise price per share of $82.12 and expires on September 27, 2025.

In connection with the Share Purchase Agreement,

on June 25, 2021, we entered into the Registration Rights Agreement, pursuant to which we agreed to register all the shares that may be

issuable to GEM Global and GYBL. On September 19, 2023, the Company, GEM Global and GYBL entered into a letter agreement (the “Letter

Agreement”), pursuant to which the parties agreed to register an aggregate of 50,000,000 shares of Class A common stock, comprised of (i)

340,374 shares of Class A common stock issuable to GYBL upon full exercise of the Common Stock Purchase Warrant; (ii) 34,000,000 unrestricted

shares of Class A common stock to be issued to GEM Global immediately upon the effectiveness of the registration statement filed pursuant

to the Registration Rights Agreement (the “GEM S-1”); and (iii) 15,659,626 additional shares of Class A common stock issuable

to GEM Global pursuant to the Share Purchase Agreement. The Company publicly filed the GEM S-1 on September 20, 2023 and it was declared

effective by the SEC on September 29, 2023, at which time the Company issued 34,000,000 unrestricted shares of Class A common stock to

GEM Global.

The Offering

| Issuer |

Nxu, Inc., a Delaware corporation. |

| |

|

| Securities Offered |

Up to 86,000,000 Shares at a public offering

price of $0.035 per Share.

We are also offering to each investor of

Shares that would otherwise result in the investor’s beneficial ownership exceeding 4.99% of our outstanding Class A common

stock immediately following the consummation of this offering the opportunity to invest in Pre-Funded Warrants (in lieu of Shares).

Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded

Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder,

such limit may be increased to up to 9.99%) of the Class A common stock outstanding immediately after giving effect to such exercise.

Each Pre-Funded Warrant will be exercisable for one share of Class A common stock. The purchase price of each Pre-Funded Warrant

will be equal to the price per Share, minus $0.0001, and the exercise price of each Pre-Funded Warrant will equal $0.0001 per Share.

The Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time

until all of the Pre-Funded Warrants are exercised in full. For each Pre-Funded Warrant purchased (without regard to any limitation

on exercise set forth therein), the number of Shares we are offering will be decreased on a one-for-one basis. |

| Class A Common Stock Outstanding Prior to this Offering |

100,701,835 shares. |

| |

|

| Class A Common Stock Outstanding After this Offering |

186,701,835 shares. |

| |

|

| Reasonable Best Efforts |

We have agreed to issue and sell the securities offered hereby to the purchasers through the Placement

Agent. The Placement Agent is not required to buy or sell any specific number or dollar amount of the securities offered hereby,

but they will use their reasonable best efforts to solicit offers to purchase the securities offered by this prospectus. See “Plan

of Distribution” on page 92 of this prospectus. |

| |

|

| Use of Proceeds |

We intend to use the net proceeds of this offering primarily for general corporate

purposes, which may include, but is not limited to, operating expenses, working capital, and the continued development and deployment

of our charging products. The amounts that we actually spend for any specific purpose may vary significantly, and will depend on

a number of factors including, but not limited to, the pace of progress of our product development, market conditions, and our ability

to secure supply of goods and services for both equipment and raw material. See the section titled “Use of Proceeds”

appearing elsewhere in this prospectus for more information and see “Risk Factors” for a discussion of certain risks

that may affect our intended use of the net proceeds from this offering. |

| |

|

| Dividend Policy |

We have never declared or paid any cash dividends on our shares, and we do not anticipate paying

any cash dividends on our shares in the foreseeable future. It is presently intended that we will retain our earnings

for future operations and expansion. |

| Risk Factors |

See “Risk Factors” and the other information included in this prospectus

for a discussion of factors you should carefully consider before deciding to invest in our securities. |

| |

|

| Market Symbol and Trading |

Our shares of Class A common stock are listed on Nasdaq under the symbol “NXU.” There

is no established trading market for the Pre-Funded Warrants, and we do not expect a trading market for those securities to develop.

We do not intend to list the Pre-Funded Warrants on any securities exchange or other trading market. Without a trading market, the

liquidity of those securities will be extremely limited. |

The above discussion is based on 100,701,835

shares of our Class A common stock outstanding as of October 19, 2023 and excludes, as of that date, the following: (a) 37,483,905

shares of Class A common stock issuable upon the exercise of options outstanding prior to this offering at a weighted average exercise

price equal to approximately $7.00; (b) up to an aggregate of 8,686,667 shares of Class A common stock issuable upon the conversion of

our outstanding convertible notes (assuming conversion at a conversion price equal to the floor price of $0.15); and (c) up to an aggregate

of 41,944,714 shares of Class A common stock issuable upon the exercise of our outstanding warrants at a weighted average exercise price

equal to approximately $0.46.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information in this prospectus includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act. All statements, other

than statements of present or historical fact included in this prospectus, regarding Nxu’, strategy, future operations, financial

position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward-looking statements.

When used in this prospectus, including any oral statements made in connection therewith, the words “could,” “should,”

“will,” “may,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on

management’s current expectations and assumptions about future events and are based on currently available information as to the

outcome and timing of future events. Except as otherwise required by applicable law, Nxu disclaims any duty to update any forward-looking

statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date

of this prospectus. Nxu cautions you that these forward-looking statements are subject to all of the risks and uncertainties, most of

which are difficult to predict and many of which are beyond the control of Nxu, incident to the development, production, gathering and

sale of oil, natural gas and natural gas liquids.

In addition, Nxu cautions you that the forward-looking

statements regarding Nxu, which are contained in this prospectus, are subject to the following factors:

| · | the

length, scope and severity of the ongoing coronavirus pandemic (“COVID-19”),

including the effects of related public health concerns and the impact of continued actions

taken by governmental authorities and other third parties in response to the pandemic and

its impact on commodity prices, supply and demand considerations and storage capacity; |

| · | U.S.

and global economic conditions and political and economic developments; |

| · | economic

and competitive conditions; |

| · | the

availability of capital resources; |

| · | capital

expenditures and other contractual obligations; |

| · | the

availability of goods and services; |

| · | legislative,

regulatory or policy changes; |

| · | the

securities or capital markets and related risks such as general credit, liquidity, market

and interest-rate risks. |

Should one or more of the risks or uncertainties

described in this prospectus occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially

from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact the

operations and projections discussed herein can be found in the section entitled “Risk Factors” herein and in Nxu’s

periodic filings with the SEC. Nxu’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

SUMMARY RISK FACTORS

We are providing the following summary of the

risk factors contained in this prospectus to enhance the readability and accessibility of our risk factor disclosures. We encourage you

to carefully review the full risk factors contained under the section entitled “Risk Factors” in this prospectus in their

entirety for additional information regarding the risks and uncertainties that could cause our actual results to vary materially from

recent results or from our anticipated future results.

Risks Related to Our Business

| · | We

are an early-stage company with a limited operating history that has never turned a profit

and there are no assurances that the Company will ever be profitable. |

| · | Uncertainty

exists as to whether we will be able to raise sufficient funds to continue scaling our battery

manufacturing capabilities or deploying our megawatt charging stations and our energy storage

solutions. |

| · | Uncertainty

also exists as to whether we will succeed in eventually developing the vehicle products. |

| · | We

need to raise additional capital to meet our future business requirements and such capital

raising may be costly or difficult to obtain and could dilute current stockholders’

ownership interest. |

| · | We

have losses which we expect to continue into the future. There is no assurance our future

operations will result in a profit. |

| · | We

may not achieve our projected development goals in the time frames we announce and expect

due to unforeseen factors, including scarcity of natural resources and battery raw materials,

increases in costs of raw materials, disruption of supply chain or shortages of materials,

rising interest rates and inflation increasing the cost to do business. |

| · | A

significant interruption of our information technology systems or the loss of confidential

or other sensitive data, including cybersecurity risks, could have a material adverse

impact on our operations and financial results. |

| · | We

are in the development stages of many products and we may experience difficulty scaling up

manufacturing of our products, including cost, technical complexity and regulatory compliance. |

| · | Our

products rely on software and hardware that is highly technical, and if these systems contain

errors, bugs, vulnerabilities, or design defects, or if we are unsuccessful in addressing

or mitigating technical limitations in our systems, our business could be adversely affected. |

| · | The cost and difficulty

of protecting our intellectual property. |

| · | We

may not be able to successfully manage growth. |

| · | Our

growth rate may not meet our expectations. |

| · | We

may face state and federal regulatory challenges, including environmental and safety regulations. |

| · | We

may not be successful in developing an effective direct sales force. |

| · | If

we do not successfully establish and maintain our Company as a highly trusted and respected

name for electric vehicles (“EVs”), we may not achieve future revenue goals,

which could significantly affect our business, financial condition and results of operations. |

Risks Related to the Development and Commercialization

of Our Products

| · | If

our battery cells fail to perform as expected, our ability to develop, market, and license

our technology could be harmed. |

| · | Our

success depends on our ability to manufacture battery cells and packs at volume and with

acceptable performance, yield and costs. |

| · | Our

reliance on complex machinery to scale operations and production involves a significant degree

of risk and uncertainty in terms of operational performance and costs. |

| · | We

may not be able to build and scale our charging stations and energy storage solutions as

expected. |

| · | The

future growth and success of our charging stations is highly correlated with and thus dependent

upon the continuing rapid adoption of EVs. |

| · | We

currently face competition from a number of companies and expect to face significant competition

in the future as the market for EV battery, charging and energy storage solutions develops. |

| · | The

automotive market is highly competitive, and we may not be successful in competing in this

industry. |

| · | We

are dependent on our own suppliers and suppliers to our third-party contract manufacturers

who fabricate our equipment to fulfill orders placed by us. Timely delivery of orders is

needed to meet the requirements of our customers, and a shortage of materials or components,

such as microprocessors, can disrupt the production of our equipment. |

| · | If

there is inadequate access to charging stations, our business will be materially and adversely

affected. |

| · | Our

products will make use of Li-ion battery cells, which, if not appropriately managed and controlled,

have been observed to catch fire or vent smoke and flame. |

| · | We

have minimal experience servicing and repairing our vehicles. If we or our partners are unable

to adequately service our vehicles, our business, prospects, financial condition, results

of operations, and cash flows could be materially and adversely affected. |

| · | The

automotive industry and its technology are rapidly evolving and may be subject to unforeseen

changes which could adversely affect the demand for our vehicles or increase our operating

costs. |

| · | Product

recall could hinder growth and product liability or other claims could have a material adverse

effect on our business. |

Risks Related to Our Management

| · | We

are dependent upon our executives for their services and the loss of personnel may have a

material adverse effect on our business and operations. |

| · | Our

management team does not have experience running a public company. |

| · | Limitations

of director liability and director and officer indemnification. |

| · | Limitations

on remedies; indemnification. |

Risks Related to this Offering, Our Capital

Structure and Ownership of Class A Common Stock

| · | Our

Class A common stock may be delisted from Nasdaq if we do not maintain compliance with Nasdaq’s

continued listing requirements. Delisting could effect the market price and liquidity of

our Class A common stock and our ability to issue additional securities and raise additional

capital would be adversely impacted. |

| · | There

is no public market for the Pre-Funded Warrants. |

| · | The

Pre-Funded Warrants are speculative in nature. |

| · | Holders

of the Pre-Funded Warrants have no rights as stockholders until they acquire our Class A

common stock. |

| · | Management

will have broad discretion in the application of the net proceeds from this offering. |

| · | The

dual class structure of our common stock has the effect of concentrating voting power with

members of our management team, which will limit your ability to influence the outcome of

important transactions, including a change in control. |

| · | We

cannot predict the impact our dual class structure may have on our stock price. |

| · | We are a “controlled company”

within the meaning of the Nasdaq rules and, as a result, qualify for and rely on exemptions

from certain corporate governance requirements. As a result, you do not have the same protections

afforded to stockholders of companies that cannot rely on such exemptions and are subject

to such requirements. |

| · | Our

Chief Executive Officer and majority stockholder may significantly influence matters to be

voted on and their interest may differ from, or be adverse to, the interest of our other

stockholders. |

| · | The

market price of our Class A common stock has fluctuated, and may continue to fluctuate, significantly. |

| · | We

do not anticipate dividends to be paid on our Class A common stock and investors may lose

the entire amount of their investment. |

| · | We

are an emerging growth company and a smaller reporting company within the meaning of the

Securities Act, and if we take advantage of certain exemptions from disclosure requirements

available to emerging growth companies and smaller reporting companies, this could make our

securities less attractive to investors and may make it more difficult to compare our performance

with other public companies. |

| · | We

will incur significant additional costs as a result of being a public company, and our management

will be required to devote substantial time to compliance with our public company responsibilities

and corporate governance practices. |

| · | Our Bylaws include

forum selection provisions, which could limit your ability to obtain a favorable judicial

forum for disputes with us. |

RISK

FACTORS

An investment in our securities involves a

high degree of risk. You should carefully consider the risks described below before making an investment decision. Our business, prospects,

financial condition, or operating results could be harmed by any of these risks, as well as other risks not known to us or that we consider

immaterial as of the date of this prospectus. The trading price of our securities could decline due to any of these risks, and, as a

result, you may lose all or part of your investment. Our actual results may differ materially from any future results expressed or implied

by such forward-looking statements as a result of various factors, including, but not limited to, those discussed in the sections of

this prospectus entitled “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations.”

RISKS RELATED TO OUR BUSINESS

We are an early-stage company that has

never turned a profit and there are no assurances that the Company will ever be profitable.

We are a relatively new company that was originally

incorporated on November 9, 2016 under the name “Atlis Motor Vehicles Inc.” On May 12, 2023, we completed the Reorganization

Merger, pursuant to which Nxu replaced Atlis Motor Vehicles Inc. as the publicly listed corporation. If you are investing in this company,

it is because you think our products are innovative and differentiated and that our business model is a good idea, and we will be able

to successfully grow our business and become profitable. We have yet to fully develop or sell any of our products. We are launching our

Energy business and have yet to start mass manufacturing of battery cells and pack solutions. Currently, our efforts are focused on scaling

our battery pilot production, on building and deploying our megawatt charging stations, primarily for testing our hardware and software,

and on building and deploying our energy storage solutions. In the meantime, other companies could develop successful alternatives. We

have never turned a profit and there is no assurance that we will ever be profitable.

We also have no history in the EV battery, charging,

energy storage or in the automotive industry. Although we have taken significant steps in developing brand awareness, we are a new company

and currently has no experience developing or selling battery technology. As such, it is possible that our lack of history in the industry

may impact our brand, business, financial goals, operation performance, and products.

We should be considered a “Development

Stage Company,” and our operations will be subject to all the risks inherent in the establishment of a new business enterprise,

including, but not limited to, hurdles or barriers to the implementation of our business plans. Further, because there is no history

of operations there is also no operating history from which to evaluate our executive management’s ability to manage our business

and operations and achieve our goals or the likely performance of the Company. Prospective investors should also consider the fact that

our management team has not previously developed or managed similar companies. No assurances can be given that we will be able to achieve

or sustain profitability.

Our limited operating history makes it

difficult for us to evaluate our future business prospects.

We are a company with an extremely limited operating

history and have not generated material revenue from sales of our products and services to date. As we continue to transition from research

and development activities to production and sales, it is difficult, if not impossible, to forecast our future results, and we have limited

insight into trends that may emerge and affect our business. The estimated costs and timelines that we have developed to reach full scale

commercial production are subject to inherent risks and uncertainties involved in the transition from a start-up company focused on research

and development activities to the large-scale manufacture and sale of battery products, charging stations or energy storage solutions.

There can be no assurance that our estimates related to the costs and timing necessary to complete the design and engineering of our

products will prove accurate. These are complex processes that may be subject to delays, cost overruns and other unforeseen issues. In

addition, we have engaged in limited marketing activities to date, so even if we are able to bring our other commercial products to market,

on time and on budget, there can be no assurance that customers will embrace our products in significant numbers at the prices we establish.

Market and geopolitical conditions, many of which are outside of our control and subject to change, including general economic conditions,

the availability and terms of financing, the impacts and ongoing uncertainties created by the COVID-19 pandemic, the conflict in the

Ukraine, fuel and energy prices, regulatory requirements and incentives, competition, and the pace and extent of transition to electrification

generally, will impact demand for our products, and ultimately our success.

Our ability to develop and manufacture

battery and pack technologies, charging stations and energy storage solutions of sufficient quality and appeal to customers on schedule

and on a large scale is unproven.

Our business depends largely on our ability to

develop, manufacture, market, and sell our technology and products. Our production ramp may take longer than originally expected due

to a number of reasons. The cascading impacts of the COVID-19 pandemic, and more recently the conflict in Ukraine, have impacted our

business and operations from facility construction to equipment installation to product component supply.

We have not launched a production-intent product

and do not anticipate making large scale deliveries in the near future. In conjunction with the launch of future products, we may need

to manufacture our batteries and packs in increasingly higher volumes than our present production capabilities. We have no experience

as an organization in high volume manufacturing. The continued development of and the ability to manufacture our products at scale will

be subject to risks, including with respect to:

| · | our

ability to secure necessary funding; |

| · | our

ability to negotiate and execute definitive agreements, and maintain arrangements on reasonable

terms, with our various suppliers for raw materials, hardware, software, or services necessary

to engineer or manufacture parts or components; |

| · | securing

necessary components, services, or licenses on acceptable terms and in a timely manner; |

| · | delays

by us in delivering final component designs to our suppliers; |

| · | our

ability to accurately manufacture our products within specified design tolerances; |

| · | quality

controls, including within our manufacturing operations, that prove to be ineffective or

inefficient; |

| · | defects

in design and/or manufacture that cause our batteries not to perform as expected or that

require repair, field actions, including product recalls, and design changes; |

| · | delays,

disruptions, or increased costs in our supply chain, including raw material supplies; |

| · | other

delays, backlog in manufacturing and research and development of new models, and cost overruns; |

| · | obtaining

required regulatory approvals and certifications; |

| · | compliance with

environmental, safety, and similar regulations; and |

| · | our ability to

attract, recruit, hire, retain, and train skilled employees. |

Our ability to develop, manufacture, and obtain

required regulatory approvals for products of sufficient quality and appeal to customers on schedule and on a large scale is unproven.

Our battery products, charging stations, and energy storage solutions may not meet customer expectations and may not be commercially

viable. To date, we have limited experience, as a company, designing, testing, manufacturing, marketing, and selling any of our products,

including vehicles, and therefore cannot assure you that we will be able to meet customer expectations. Any of the foregoing could have

a material adverse effect on our business, prospects, financial condition, results of operations, and cash flows.

There is substantial doubt about our ability

to continue as a going concern.

There is substantial doubt about our ability

to continue as a going concern, as described in the notes to the financial statements. We plan to continue considering

all avenues available to us in order to obtain the necessary capital to be able to continue as a going concern and to execute on our