ANI Pharmaceuticals, Inc. Closes $316.25 Million Convertible Senior Notes Offering Including Full Exercise of Initial Purchasers’ Option to Purchase Additional Notes

14 August 2024 - 6:05AM

ANI Pharmaceuticals, Inc. (ANI or the Company) (Nasdaq: ANIP) today

announced the closing of its offering of $316,250,000 aggregate

principal amount of 2.25% convertible senior notes due 2029 (the

“notes”) in a private offering to qualified institutional buyers

pursuant to Rule 144A under the Securities Act of 1933, as amended

(the “Securities Act”). In response to investor demand, ANI upsized

the initial offering of $250,000,000 aggregate principal amount of

notes to $275,000,000 and the initial purchasers fully exercised

their option to purchase an additional $41,250,000 aggregate

principal amount of the notes. The notes were issued pursuant to,

and are governed by, an indenture, dated as of August 13, 2024,

between the Company and U.S. Bank Trust Company, National

Association, as trustee.

The net proceeds from the offering are

approximately $306.8 million, after deducting the initial

purchasers’ discounts and commissions but before deducting ANI’s

estimated offering expenses. ANI intends to use approximately $40.6

million of the net proceeds to fund the cost of entering into the

capped call transactions described below. ANI intends to use the

remainder of the net proceeds from the offering, together with cash

on hand, to repay in full ANI’s existing senior secured term loan

facility. Substantially concurrently with repayment of the existing

senior secured term loan facility, the commitments under the

existing senior secured credit agreement (which includes the senior

secured term loan facility and a revolving facility) were

terminated and the Company entered into a new senior secured credit

agreement consisting of a $325,000,000 delayed draw term loan

facility and a $75,000,000 revolving facility.

In connection with the pricing of the notes and

the exercise by the initial purchasers of their option to purchase

additional notes, ANI entered into privately negotiated capped call

transactions with certain financial institutions. The capped call

transactions cover, subject to anti-dilution adjustments

substantially similar to those applicable to the notes, the number

of shares of ANI’s common stock underlying the notes. The cap

price of the capped call transactions is initially $114.02 per

share, which represents a premium of 100% over the last reported

sale price of ANI’s common stock of $57.01 per share on the date

the notes offering was priced, and is subject to certain

adjustments under the terms of the capped call transactions.

The capped call transactions are expected generally to reduce the

potential dilution to ANI’s common stock upon any conversion of the

notes and/or offset any potential cash payments ANI is required to

make in excess of the principal amount of converted notes, as the

case may be, upon conversion of the notes. If, however, the market

price per share of ANI’s common stock, as measured under the terms

of the capped call transactions, exceeds the cap price of the

capped call transactions, there would nevertheless be dilution

and/or there would not be an offset of such potential cash

payments, in each case, to the extent that such market price

exceeds the cap price of the capped call transactions.

The notes were only offered and sold to persons reasonably

believed to be qualified institutional buyers pursuant to Rule 144A

under the Securities Act. The offer and sale of the notes and any

shares of common stock issuable upon conversion of the notes have

not been, and will not be, registered under the Securities Act or

any other securities laws, and the notes and any such shares cannot

be offered or sold except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and any other applicable securities laws. This press

release does not constitute an offer to sell, or the solicitation

of an offer to buy, the notes or any shares of common stock

issuable upon conversion of the notes, nor will there be any sale

of the notes or any such shares, in any state or other jurisdiction

in which such offer, sale or solicitation would be unlawful.

About ANI Pharmaceuticals,

Inc.

ANI Pharmaceuticals, Inc. (Nasdaq: ANIP) is a

diversified biopharmaceutical company serving patients in need by

developing, manufacturing, and marketing high-quality branded and

generic prescription pharmaceutical products, including for

diseases with high unmet medical need. ANI is focused on delivering

sustainable growth by scaling up its Rare Disease business through

its lead asset Purified Cortrophin® Gel, strengthening its Generics

business with enhanced research and development capabilities,

delivering innovation in Established Brands, and leveraging its

U.S. based manufacturing footprint.

Forward-Looking Statements

This press release contains forward-looking statements. All

statements other than statements of historical facts contained

herein, including, without limitation, statements regarding the

effects of entering into the capped call transactions described

above, are forward-looking statements reflecting the current

beliefs and expectations of management made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. Such forward-looking statements involve known and unknown

risks, uncertainties, and other important factors that may cause

ANI’s actual results, performance, or achievements to be materially

different from any future results, performance, or achievements

expressed or implied by the forward-looking statements. Such risks

and uncertainties include, among others, the risks and

uncertainties related to market conditions and satisfaction of

customary closing conditions related to the offering and risks

relating to ANI’s business, including those described in periodic

reports that ANI files from time to time with the SEC. ANI may not

consummate the offering described in this press release and, if the

offering is consummated, cannot provide any assurances regarding

its ability to effectively apply the net proceeds as described

above. Any risks and uncertainties could materially and adversely

affect ANI’s results of operations, which would, in turn, have a

significant and adverse impact on ANI’s stock price. Any

forward-looking statements contained in this press release speak

only as of the date hereof, and ANI specifically disclaims any

obligation to update any forward-looking statement, whether as a

result of new information, future events or otherwise.

Investor Relations:Lisa M.

Wilson, In-Site Communications, Inc.T: 212-452-2793E:

lwilson@insitecony.com

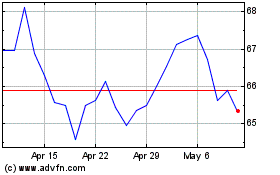

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Dec 2024 to Jan 2025

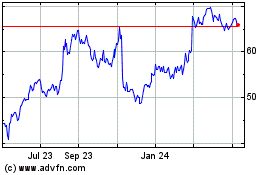

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Jan 2024 to Jan 2025