0000006845False00000068452024-11-042024-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 4, 2024

APOGEE ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Minnesota | | 0-6365 | | 41-0919654 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | | | | | | | | | | | | | | | | |

4400 West 78th Street, Suite 520 | | Minneapolis | | Minnesota | | 55435 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | | | | | | | | | | |

| Registrant's telephone number, including area code: | (952) 835-1874 | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Exchange Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.33 1/3 Par Value | APOG | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE: This Current Report on Form 8-K/A is being filed solely to correct a technical error that omitted Item 2.03 during the filing process of the Current Report on Form 8-K filed on November 4, 2024 (the “Original Report”). Except as amended by this Amendment, all information set forth in the Original Report and corresponding exhibits remains unchanged.

| | | | | |

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

On November 4, 2024, Apogee Enterprises, Inc. (the “Company”) completed the transaction contemplated by the Membership Interest Purchase Agreement, dated September 23, 2024 (the “Purchase Agreement”) with UW Holdings, LLC (the “Seller”) and UW Interco, LLC (the “Target”).

Pursuant to the terms and conditions of the Purchase Agreement, the Company acquired all of the membership interests of the Target from the Seller in exchange for cash consideration (the “Closing”) in the amount of $242 million (the “Unadjusted Purchase Price”), of which $1.75 million was deposited into escrow in connection with the Purchase Agreement. The Unadjusted Purchase Price is subject to customary adjustments as set forth in the Purchase Agreement, and the $1.75 million escrow will serve as the Company’s sole recourse for any adjustments to the Unadjusted Purchase Price pursuant to the post-closing adjustment process set forth in the Purchase Agreement.

The material terms of the Purchase Agreement were previously reported in Item 1.01 of the Current Report on Form 8-K filed on September 25, 2024 with the U.S. Securities and Exchange Commission (the “SEC”). The foregoing description of the Purchase Agreement and the transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Purchase Agreement, a copy of which was filed with the SEC as Exhibit 2.1 to the Company’s Current Report on Form 8-K on September 25, 2024, and is incorporated into this Item 2.01 by reference.

| | | | | |

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

On November 4, 2024, the Company drew $250 million under its existing $250 million term loan facility pursuant to the terms and conditions of the Credit Agreement, dated July 19, 2024, among the Company, certain material domestic subsidiaries of the Company, Bank of America, N.A., as administrative agent, swingline lender and L/C issuer and the syndicate of lenders party thereto from time to time (as amended from time to time, the “Credit Agreement”) to finance a portion of the Unadjusted Purchase Price referenced in Item 2.01 of this Current Report and for working capital and general corporate purposes.

The material terms of the Credit Agreement were previously reported in Item 1.01 of the Current Report on Form 8-K filed on July 19, 2024 with the SEC. The foregoing description of the Credit Agreement and the transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Credit Agreement, a copy of which was filed with the SEC as Exhibit 10.1 to the Company’s Current Report on Form 8-K on July 19, 2024, and is incorporated into this Item 2.03 by reference.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On November 4, 2024, the Company issued a press release announcing the Closing, a copy of which is filed as Exhibit 99.1 and incorporated into this Item 7.01 by reference.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, unless specifically identified therein as being incorporated therein by reference.

| | | | | |

| Item 9.01 | Financial Statement and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 2.1* | | Membership Interest Purchase Agreement, dated as of September 23, 2024, by and among UW Holdings, LLC, UW Interco, LLC and Apogee Enterprises, Inc. (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K of Apogee Enterprises, Inc., filed with the SEC on September 25, 2024). |

10.1* | | |

| 99.1 | | |

| 104 | | Cover page interactive data file (formatted in inline XBRL). |

* This filing excludes certain schedules and exhibits pursuant to Item 601(a)(5) of Regulation S-K, which the registrant agrees to furnish supplementally to the U.S. Securities and Exchange Commission upon request by the Commission provided, however, that the registrant may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedules or exhibits so furnished. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| APOGEE ENTERPRISES, INC. |

| By: | /s/ Meghan M. Elliott |

| | Meghan M. Elliott |

| | Chief Legal Officer and Secretary |

Date: November 5, 2024

Press Release

FOR RELEASE: November 4, 2024

Apogee Enterprises Completes Acquisition of UW Solutions

MINNEAPOLIS, MN, November 4, 2024 – Apogee Enterprises, Inc. (Nasdaq: APOG) announced today that it has completed the previously announced acquisition of UW Interco, LLC (“UW Solutions”), a vertically integrated manufacturer of high-performance coated substrates used in graphic arts, building products, and other applications, for $242 million in cash.

Ty R. Silberhorn, Apogee’s Chief Executive Officer, said, “I am excited to welcome the UW Solutions team to Apogee. This acquisition expands the capabilities and market opportunity of our Large-Scale Optical segment, leveraging the combined strengths of both businesses to create a new engine for growth.”

In fiscal 2025, the Company expects the acquisition to contribute incremental net sales of approximately $30 million and a decrease in adjusted diluted EPS of approximately $0.10, primarily due to increased interest and amortization expense. In fiscal 2026, the acquisition is expected to be accretive to adjusted diluted EPS, contributing approximately $100 million of revenue with an adjusted EBITDA margin of approximately 20%.

More information regarding the acquisition can be found in the Company’s September 25, 2024, press release announcing the transaction.

About Apogee Enterprises, Inc.

Apogee Enterprises, Inc. (Nasdaq: APOG) is a leading provider of architectural building products and services, as well as high-performance coated materials used in a variety of applications. Headquartered in Minneapolis, MN, our portfolio of industry-leading products and services includes architectural glass, windows, curtainwall, storefront and entrance systems, integrated project management and installation services, and high-performance coatings that provide protection, innovative design, and enhanced performance. For more information, visit www.apog.com.

Apogee Enterprises, Inc. • 4400 West 78th Street • Minneapolis, MN 55435 • (952) 835-1874 • www.apog.com

Apogee Enterprises, Inc.

Page 2

Use of Non-GAAP Financial Measures

This release contains the following non-GAAP measures: adjusted EBITDA (adjusted net earnings before interest, taxes, depreciation, and amortization) margin and adjusted diluted EPS (adjusted net earnings per diluted share). These measures are used by the Company to provide meaningful supplemental information about its operating performance by excluding amounts that are not considered part of core operating results to enhance comparability of results from period to period. Management uses non-GAAP measures to evaluate the Company’s historical and prospective financial performance, measure operational profitability on a consistent basis, as a factor in determining executive compensation, and to provide enhanced transparency to the investment community. Non-GAAP measures should be viewed in addition to, and not as a substitute for, the reported financial results of the Company prepared in accordance with GAAP. Other companies may calculate these measures differently, limiting the usefulness of the measures for comparison with other companies. The Company is not providing reconciliations for these forward-looking non-GAAP financial measures because the Company is unable to predict with reasonable certainty the ultimate outcome of adjusted items without unreasonable efforts. These items are uncertain, depend on various factors and could be material to financial results computed in accordance with GAAP.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “should,” “will” and similar expressions are intended to identify “forward-looking statements.” These statements reflect Apogee management’s expectations or beliefs as of the date of this release. The company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements are subject to significant risks that could cause actual results to differ materially from the expectations reflected in the forward-looking statements. More information concerning potential factors that could affect future financial results is included in the company’s Annual Report on Form 10-K and in subsequent filings with the U.S. Securities and Exchange Commission.

Contact:

Jeff Huebschen

Vice President, Investor Relations & Communications

952.487.7538

ir@apog.com

Apogee Enterprises, Inc. • 4400 West 78th Street • Minneapolis, MN 55435 • (952) 835-1874 • www.apog.com

Cover

|

Nov. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Document Period End Date |

Nov. 04, 2024

|

| Registrant Name |

APOGEE ENTERPRISES, INC.

|

| Entity Address, Address Line One |

4400 West 78th Street,

|

| Entity Address, Address Line Two |

Suite 520

|

| Entity Address, City or Town |

Minneapolis

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55435

|

| City Area Code |

952

|

| Local Phone Number |

835-1874

|

| Entity Incorporation, State or Country Code |

MN

|

| Entity File Number |

0-6365

|

| Entity Tax Identification Number |

41-0919654

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.33 1/3 Par Value

|

| Trading Symbol |

APOG

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Central Index Key |

0000006845

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

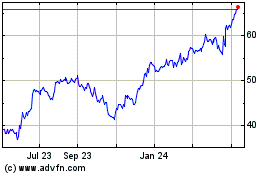

Apogee Enterprises (NASDAQ:APOG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Apogee Enterprises (NASDAQ:APOG)

Historical Stock Chart

From Feb 2024 to Feb 2025