Asia Pacific Wire & Cable Corporation Limited (NASDAQ: APWC)

("APWC" or the "Company"), a leading manufacturer of wire and cable

products for the telecommunications and electric-power industries

in the Asia-Pacific region, today announced that on April 29, 2024,

it filed its annual report on Form 20-F (the "Form 20-F") for the

year ended December 31, 2023 with the U.S. Securities and

Exchange Commission and reported its financial results for the

twelve months ended December 31, 2023. Unless otherwise

indicated, all data are reported in U.S. Dollars at the exchange

rate prevailing on the date of the event or result reported.

|

Full Year 2023 Financial Results (Ended December 31, 2023)

and 2022 comparative results: |

|

|

|

|

Full Year 2023 |

Full Year 2022 |

CHANGE |

|

Revenues |

$ |

425.8 million |

$ |

433.9 million |

(1.9)% |

|

Operating Profit |

$ |

1.5

million |

$ |

8.1

million |

(80.8)% |

| Net

Income |

$ |

3.9

million |

$ |

3.9

million |

(0.2)% |

| EPS

(1) |

$ |

0.19 |

$ |

0.19 |

—% |

|

|

|

|

|

|

|

| (1)

The calculation of the earnings per share is based on 20,616,227

and 20,020,364 basic and diluted weighted average common shares

issued and outstanding for the twelve months ended December 31,

2023 and 2022, respectively. |

|

|

Full Year 2023 Results

Revenues for the twelve months ended December 31, 2023 were

$425.8 million, a decrease of 1.9% from $433.9 million for the

twelve months ended December 31, 2022. The decrease was

primarily attributable to revenue decreases across the Company’s

Thailand and North Asia regions. Net revenue in the Company’s

Thailand region decreased by $4.9 million or 2.9% from $171.8

million in 2022 to $166.9 million in 2023. The decrease was due to

the decrease in government spending on infrastructure and delay in

government projects. Revenues in the Company's North Asia region

decreased by $18.7 million, or 24.2%, from $77.3 million in 2022 to

$58.6 million in 2023. The decrease was attributable to decreased

sales volume primarily due to increased competition and the

Sino-American trade war. These factors contributed to a sluggish

market, resulting in a decline in sales compared with the previous

period. Revenues in the Company's Rest of World (“ROW”) region

increased by $15.5 million, or 8.4%, from $184.7 million in 2022 to

$200.2 million in 2023. The increase of $1.9 million, or 12%, was

due to strong demand in the construction sector in Australia, and

the increase of $13.6 million, or 88%, was attributable to the

completion of public sector projects in Singapore. The Company's

North Asia region includes China, Hong Kong and Taiwan; the

Thailand region consists of operations and sales within Thailand;

the ROW region includes Singapore, Australia and the other markets

where APWC has operations or sales outside of the Thailand region

and North Asia region.

Operating profit for the twelve months ended December 31,

2023 was $1.5 million, a decrease of $6.5 million, or 80.8% from

operating profit of $8.1 million for the twelve months ended

December 31, 2022. Operating profit margin decreased from a

profit of 1.86% in 2022 to a profit of 0.36% in 2023. In the

Thailand region, the operating profit margin decreased from 1.53%

in 2022 to (1.27)% in 2023. The decrease in operating profit was

due to a decline in higher-margin Thai government projects,

decreased sales volume in enameled wire as well as loss from

onerous contracts. In the North Asia region, the operating profit

margin increased from 0.31% in 2022 to 3.06% in 2023. The increase

in operating profit was the result of the increase in the

manufacturing productivity, or overall equipment effectiveness

("OEE"), which lowered the cost of our products. The ROW region’s

operating profit margin increased from 4.21% in 2022 to 4.31% in

2023. The operating profit margin of 2023 remained consistent

compared to that of 2022. The decrease in the operating profit is

also attributable to the impairment loss on financial and contract

assets, which increased by $4.1 million, due to the increased loss

allowance provided for the delinquent accounts.

Selling, general and administrative, research and development

expenses for the twelve months ended December 31, 2023 were

$24.5 million, compared to $25.0 million reported for the twelve

months ended December 31, 2022. Net profit attributable to

APWC shareholders was $3.9 million for the twelve months ended

December 31, 2023, compared to a net profit of $3.9 million

for the twelve months ended December 31, 2022. The

weighted average number of shares issued and outstanding was 20.62

million and 20.02 million for the twelve months ended

December 31, 2023 and 2022, respectively.

Financial Condition

APWC reported $38.0 million in cash and cash equivalents as of

December 31, 2023, compared to cash and cash equivalents of

$54.0 million as of December 31, 2022.

Current assets totaled $295.0 million as of December 31,

2023, compared to $299.5 million as of December 31, 2022.

Working capital was $154.4 million as of December 31, 2023,

compared to $165.9 million as of December 31, 2022. Short-term

bank loans were $53.7 million at December 31, 2023, an

increase of 17.9% from $45.6 million at December 31, 2022. The

Company had $— million in long-term debt outstanding at

December 31, 2023, compared to $12.2 million in long-term debt

as of December 31, 2022. The decrease was due to the

reclassification of the long-term back loan as a current portion.

Shareholder's equity attributable to APWC was $157.1 million as of

December 31, 2023, compared to $151.6 million as of

December 31, 2022.

APWC reported cash used in operating activities of $6.1 million

during the twelve months ended December 31, 2023, compared to

cash provided by operating activities in the amount of $6.6 million

in the same period in 2022. The cash outflow from operating

activities was primarily due to several factors, including

decreased net profit, and increased trade receivables. The Company

reported $4.9 million in cash outflows from investing activities

during the twelve months ended December 31, 2023, compared to

$2.7 million in cash outflows in the same period of 2022. The

increase in cash used in investing activities in the twelve months

of 2023 was primarily attributable to the increase in purchases of

property, plant in 2023. APWC reported $5.5 million in cash

outflows from financing activities during the twelve months of

2023, compared to $9.6 million in cash inflows from financing

activities in the same period of 2022. The cash used in 2023 was

primarily attributable to the repayment of borrowings.

We encourage shareholders to review our Annual

Report for the year ended December 31, 2023, which has been

filed with the Securities and Exchange Commission, and to visit the

Company's website for further information (www.apwcc.com).

Information on the Company's website or any other website does not

constitute a portion of this release.

About Asia Pacific Wire & Cable

Corporation Limited

Asia Pacific Wire & Cable Corporation Limited is a holding

company incorporated in Bermuda with principal executive offices in

Taiwan that operates its business through operating subsidiaries.

Through its subsidiaries, the Company is principally engaged in the

manufacture and distribution of enameled wire, power cable, and

telecommunications products in Thailand, Singapore, Australia, the

People’s Republic of China, Hong Kong and certain other markets in

the Asia Pacific region. The Company also engages in the

distribution of certain wire and cable products manufactured by its

controlling shareholder, Pacific Electric Wire & Cable Co.,

Ltd., and certain third parties. The Company also provides project

engineering services in the supply, delivery and installation of

power cable. The Company’s major customers include appliance

component manufacturers, electrical contracting firms, state owned

entities, and wire and cable dealers and factories.

Safe Harbor Statement

This release contains certain “forward-looking statements”

relating to the Company, its business, and its subsidiary

companies. These forward-looking statements are often identified by

the use of forward-looking terminology such as “believes”,

“anticipates”, “expects”, “estimates”, “intends”, “plans” or

similar expressions. Such forward-looking statements involve known

and unknown risks and uncertainties that may cause actual results

to be materially different from those described herein as believed,

anticipated, expected, estimated, intended or planned. Investors

should not place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

The Company’s actual results could differ materially from those

anticipated in these forward-looking statements as a result of a

variety of factors, including those discussed in the Company’s

reports that are filed with the Securities and Exchange Commission

and available on its website (www.sec.gov). All forward-looking

statements attributable to the Company or to persons acting on its

behalf are expressly qualified in their entirety by these factors

other than as required under the securities laws. The Company does

not assume a duty to update these forward-looking statements.

| Contact:Investor Relations

Contact: Pacific Holdings Group2901 Dallas Parkway, Suite 360Plano,

TX 75093Attn: Paul WeberPhone: (469) 797-7191Email:

pweber@pusa.com |

|

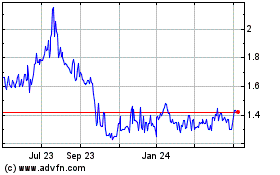

Asia Pacific Wire and Ca... (NASDAQ:APWC)

Historical Stock Chart

From Dec 2024 to Jan 2025

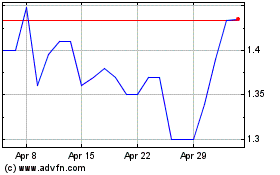

Asia Pacific Wire and Ca... (NASDAQ:APWC)

Historical Stock Chart

From Jan 2024 to Jan 2025