UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

(RULE

14C-101)

Information

Statement Pursuant to Section 14(c) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☒ |

Preliminary

Information Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

|

| ☐ |

Definitive

Information Statement |

American

Rebel Holdings, Inc.

(Name

of Registrant as Specified in Its Charter)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| ☐ |

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| |

1) |

Title

of each class of securities to which transaction applies: |

| |

|

| |

|

|

| |

2) |

Aggregate

number of securities to which transaction applies: |

| |

|

| |

|

|

| |

3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

| |

|

|

| |

4) |

Proposed

maximum aggregate value of transaction: |

| |

|

| |

|

|

| |

5) |

Total

fee paid: |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

(1) |

Amount

Previously Paid: |

| |

|

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

| |

|

|

| |

(4) |

Date

Filed: |

| |

|

AMERICAN

REBEL HOLDINGS, INC.

909

18th Avenue South, Suite A

Nashville,

Tennessee 37212

INFORMATION

STATEMENT IN LIEU OF ANNUAL MEETING OF STOCKHOLDERS

Dear

American Rebel Holdings, Inc. Stockholder:

The

purpose of this letter and the enclosed Information Statement is to inform you that stockholders holding shares of Series A Convertible

Preferred Stock (the “Series A Preferred”) and shares of Common Stock, representing in excess of a majority of the

outstanding shares of Common Stock of American Rebel Holdings, Inc. (“American Rebel”) have executed a written consent

dated February 13, 2024 (the “Written Consent”) in lieu of a special or annual meeting to effectuate the following

(the “Actions”):

| |

1. |

To

elect a new board of directors for American Rebel to hold office until the next annual stockholder’s meeting, (the current

nominees are Charles A. Ross, Jr., Corey Lambrecht, Larry Sinks, Michael Dean Smith and C. Stephen Cochennet); |

| |

|

|

| |

2. |

To

(i) authorize up to a 1-for-10 reverse stock split of American Rebel’s Common Stock (the “Reverse Stock Split”),

(ii) in connection therewith, approve an amendment to American Rebel’s Articles of Incorporation to effectuate the Reverse

Stock Split, and (iii) authorize any other action deemed necessary to effectuate the Reverse Stock Split, without further approval

or authorization of American Rebel stockholders, at any time within 12 months of the approval of this Action; and |

| |

|

|

| |

3. |

To

reaffirm the appointment of BF Borgers CPA, PC as American Rebel’s independent auditors for the next year. |

The

required consent of at least a majority of the votes allocated to our voting shares was given for each of the actions listed above.

The

Board believes it would not be in the best interests of our company and our stockholders to incur the costs of holding a special meeting

or of soliciting proxies or consents from additional stockholders in connection with these actions. Based on the foregoing, the Board

has determined not to call a special meeting of stockholders to authorize these actions.

A

copy of the form of amendment to the Articles of Incorporation to effectuate the Reverse Stock Split is attached hereto as Appendix

A.

Pursuant

to Rule 14c-2 of the Exchange Act, the Actions will become effective on or after March __, 2024, which is 20 calendar days following

the date American Rebel first mailed the Information Statement to its stockholders.

The

accompanying Information Statement is being furnished to American Rebel stockholders for informational purposes only, pursuant to Section

14(c) of the Exchange Act and the rules and regulations prescribed thereunder. As described in this Information Statement, the Actions

have been approved by stockholders representing more than a majority of the voting power of American Rebel outstanding Common Stock.

American Rebel is not soliciting your proxy or consent in connection with the matters discussed above. You are urged to read the Information

Statement in its entirety for a description of the Actions approved by certain stockholders holding more than a majority of the voting

power of American Rebel’s outstanding Common Stock.

The

Information Statement is being mailed on or about March __, 2024 to stockholders of record as of February __, 2024.

THIS

IS FOR YOUR INFORMATION ONLY. YOU DO NOT NEED TO DO ANYTHING IN RESPONSE TO THIS INFORMATION STATEMENT. THIS IS NOT A NOTICE OF A MEETING

OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

| |

Yours

truly, |

| |

|

| |

/s/

Charles A. Ross, Jr. |

| |

Charles

A. Ross, Jr. |

| |

Chairman |

| Nashville,

Tennessee |

|

| March

__, 2024 |

|

AMERICAN

REBEL HOLDINGS, INC.

909

18th Avenue South, Suite A

Nashville,

Tennessee 37212

INFORMATION

STATEMENT

(Dated

February __, 2024)

NO

VOTE OR OTHER ACTION OF AMERICAN REBEL’S STOCKHOLDERS IS REQUIRED IN

CONNECTION WITH THIS INFORMATION STATEMENT.

AMERICAN

REBEL IS NOT ASKING YOU FOR A PROXY AND

YOU

ARE REQUESTED NOT TO SEND AMERICAN REBEL A PROXY.

American

Rebel Holdings, Inc., a Nevada corporation (“American Rebel”) is furnishing this information statement (the “Information

Statement”) to its stockholders in full satisfaction of any notice requirements American Rebel may have under the Securities

and Exchange Act of 1934, as amended (the “Exchange Act”), and applicable Nevada law (the “NRS”).

No additional action will be undertaken by American Rebel with respect to the receipt of written consents, and no dissenters’ rights

with respect to the receipt of the written consents, and no dissenters’ rights under the NRS, are afforded to American Rebel’s

stockholders as a result of the adoption of the actions contemplated herein.

The

Information Statement is being mailed on or about March __, 2024 to the holders of record at the close of business on February __, 2024

(the “Record Date”), of the Common Stock of American Rebel in connection with actions approved by written consent

dated February 13, 2024 (the “Written Consent”) in lieu of an annual meeting to effectuate the following (the “Actions”):

| |

● |

To

elect a new board of directors for American Rebel to hold office until the next annual stockholder’s meeting, (the current

nominees are Charles A. Ross, Jr., Corey Lambrecht, Larry Sinks, Michael Dean Smith and C. Stephen Cochennet); |

| |

|

|

| |

● |

To

(i) authorize up to a 1-for-10 reverse stock split of American Rebel’s Common Stock (the “Reverse Stock Split”),

(ii) in connection therewith, approve an amendment to American Rebel’s Articles of Incorporation to effectuate the Reverse

Stock Split, and (iii) authorize any other action deemed necessary to effectuate the Reverse Stock Split, without further approval

or authorization of American Rebel stockholders, at any time within 12 months of the approval of this Action; and |

| |

|

|

| |

● |

To

reaffirm the appointment of BF Borgers CPA, PC as American Rebel’s independent auditors for the next year. |

This

Information Statement is being mailed on or about February __, 2024 to American Rebel’s stockholders of record as of the Record

Date.

The

entire cost of furnishing this Information Statement will be borne by American Rebel. American Rebel will request brokerage houses, nominees,

custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of its Common Stock held

of record by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

The

corporate offices of American Rebel are located at 909 18th Avenue South, Suite A, Nashville, Tennessee 37212 and American

Rebel’s telephone number is (833) 267-3235.

Except

as otherwise described herein, no director, executive officer, associate of any director or executive officer, or any other person has

any substantial interest, direct or indirect, by security holdings or otherwise, in the Actions, which is not shared by all other holders

of American Rebel’s Common Stock.

Once

American Rebel’s board of directors (the “Board”) decides to implement the Reverse Stock Split, it would become

effective on the date of filing of a Certificate of Amendment to American Rebel’s Articles of Incorporation with the office of

the Secretary of State of the State of Nevada. Additionally, the Certificate of Amendment may not be filed until at least 20 calendar

days after the mailing of this Information Statement.

The

Second Amended Articles will be effective when filed with the Nevada Secretary of State. American Rebel will not make such filing until

on or after March __, 2024, a date that is 20 calendar days after this Information Statement is first sent to its stockholders.

Under

the NRS, American Rebel stockholders are not entitled to dissenters’ rights with respect to the Actions.

No

security holders have transmitted any proposals to be acted upon by American Rebel.

VOTE

REQUIRED AND INFORMATION ON VOTING STOCKHOLDERS

American

Rebel is not seeking consents, authorizations or proxies from you.

As

of the date of the Written Consent, American Rebel had 5,947,643 shares of Common Stock issued and outstanding and entitled to vote,

which for voting purposes are entitled to one vote per share. On February 13, 2024, the following consenting Voting Stockholders owning

a total of 95,624 shares of Common Stock and 125,000 shares of Series A Preferred, whereby each share is entitled to cast one thousand

(1,000) votes for each share held of the Series A Preferred on all matters presented to the stockholders of American Rebel for stockholder

vote, thereby allowing such Common Stock and Series A Preferred to cast votes totaling 125,095,624 shares of Common Stock, delivered

the executed Written Consent authorizing the Actions described herein. The consenting Voting Stockholders’ names, affiliation with

American Rebel and holdings are as follows:

| Name | |

Affiliation | |

Number of

Voting Shares | | |

% of Total

Voting Shares(4) | |

| Charles A. Ross, Jr. | |

Director, Chief Executive Officer, Treasurer | |

| 50,051,716 | (1) | |

| 38.22 | % |

| Doug Grau | |

President | |

| 50,035,276 | (2) | |

| 38.21 | % |

| Corey Lambrecht | |

Director, Chief Operating Officer | |

| 25,008,632 | (3) | |

| 19.10 | % |

| Total | |

| |

| 125,095,624 | | |

| 95.53 | % |

| (1) |

Includes 50,000 shares of Series A Preferred with equivalent of 50,000,000 shares of Common Stock voting power and 51,716 shares of Common Stock beneficially owned by Mr. Ross. |

| |

|

| (2) |

Includes 50,000 shares of Series A Preferred with equivalent of 50,000,000 shares of Common Stock voting power and 35,276 shares of Common Stock beneficially owned by Mr. Grau. |

| |

|

| (3) |

Includes 25,000 shares of Series A Preferred with equivalent of 25,000,000 shares of Common Stock voting power and 8,632 shares of Common Stock beneficially owned by Mr. Lambrecht. |

| |

|

| (4) |

Percentage is based upon 5,947,643 shares of Common Stock authorized and outstanding and adjusted by the 125,000,000 votes attributable to the Series A Preferred, for a total of 130,947,643 total voting shares. Figures are rounded to the nearest hundredth of a percent. |

Pursuant

to American Rebel’s existing Bylaws and the NRS, the holders of the issued and outstanding shares of Common Stock, or Preferred

Stock voting rights, representing a majority of voting power may approve and authorize the Actions by written consent as if such Actions

were undertaken at a duly called and held meeting of stockholders. In order to significantly reduce the costs and management time involved

in soliciting and obtaining proxies to approve the Actions, and in order to effectuate the Actions as early as possible, the Board elected

to utilize, and did in fact obtain, the Written Consent of the Voting Stockholders. The Written Consent satisfies the stockholder approval

requirement for the Actions. Accordingly, under the NRS and the Bylaws, no other approval by the Board or stockholders of American Rebel

is required in order to effectuate the Actions.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information concerning the number of shares of American Rebel’s Common Stock owned beneficially

as of February 13, 2024, or exercisable within the next 60 days thereafter, by: (i) American Rebel’s directors; (ii) American Rebel’s

named executive officers; and (iii) each person or group known by American Rebel to beneficially own more than 5% of American Rebel’s

outstanding shares of Common Stock. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes

voting or investment power with respect to securities. Except as indicated by footnote, the persons named in the table below have sole

voting power and investment power with respect to all shares of Common Stock shown as beneficially owned by them.

| Name and Address of Beneficial Owner(1) | |

Amount and Nature of Beneficial Ownership | | |

Percentage of Common Stock Outstanding(2) | |

| Named Executive Officers: | |

| | | |

| | |

| Charles A. Ross, Jr., CEO, principal executive officer, Chairman, and treasurer(3) | |

| 5,051,716 | | |

| 46.14 | % |

| | |

| | | |

| | |

| Doug Grau, President, interim principal financial officer and interim principal accounting officer(3) | |

| 5,035,276 | | |

| 45.99 | % |

| | |

| | | |

| | |

| Corey Lambrecht, COO and Director(4) | |

| 6,258,632 | | |

| 51.31 | % |

| | |

| | | |

| | |

| Directors: | |

| | | |

| | |

| Larry Sinks, Director | |

| 0 | | |

| * | % |

| | |

| | | |

| | |

| Michael Dean Smith, Director | |

| 8,132 | | |

| 0.14 | % |

| | |

| | | |

| | |

| C. Stephen Cochennet, Director | |

| 2,203 | | |

| 0.04 | % |

| | |

| | | |

| | |

| Officers and Directors as a group (6 Persons) | |

| 16,355,959 | | |

| 73.69 | % |

*

Less than 0.01%.

| (1) |

Unless

otherwise noted above, the address of the persons and entities listed in the table is c/o American Rebel Holdings, Inc., 909 18th

Avenue South, Suite A, Nashville, Tennessee 37212. |

| |

|

| (2) |

Percentage

is based upon 5,947,643 shares of Common Stock authorized and outstanding and adjusted as needed for derivative securities held by

such stockholders. Figures are rounded to the nearest hundredth of a percent. |

| |

|

| (3) |

Includes

10,000 shares of Series A Preferred Stock, which is currently convertible into 5,000,000 shares of Common Stock at the option of

the holder. Does not include an additional 40,000 shares of Series A Preferred stock, which are convertible, equally every year starting

on January 1, 2025 and for three additional years, into shares of Common Stock at a rate of 500 to 1. Further, each share of Series

A Preferred Stock is entitled to cast one thousand (1,000) votes for each share held of the Series A Preferred stock on all matters

presented to the stockholders of the Company for a vote. |

| |

|

| (4) |

Includes

12,500 shares of Series A Preferred Stock, which is currently convertible into 6,250,000 shares of Common Stock at the option of

the holder. Does not include an additional 12,500 shares of Series A Preferred stock, which are convertible, equally every year starting

on January 1, 2025 and for two additional years, into shares of Common Stock at a rate of 500 to 1. Further, each share of Series

A Preferred Stock is entitled to cast one thousand (1,000) votes for each share held of the Series A Preferred stock on all matters

presented to the stockholders of the Company for a vote.

|

ACTION

1. ELECTION OF DIRECTORS

In

accordance with the Written Consent, stockholders holding the Series A Preferred stock and shares of common stock, representing more

than a majority of American Rebel’s outstanding shares of common stock, voted to elect Charles A. Ross, Jr., Corey Lambrecht, Larry

Sinks, Michael Dean Smith and C. Stephen Cochennet as board members.

Directors

and Executive Officers

The

following table sets forth certain information regarding the executive officers and directors of American Rebel Holdings, Inc. as of

December 31, 2023.

All

directors of the Company hold office until the next annual meeting of the security holders or until their successors have been elected

and qualified. Officers of the Company are appointed by our Board and hold office until their death, resignation or removal from office.

Our directors and executive officers, their ages, positions held, and duration as such, are as follows:

| Name |

|

Positions

Held with the Company |

|

Age |

|

Date

First Elected

or Appointed |

| Executive

Officers |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Charles

A. Ross, Jr. |

|

Chief

Executive Officer and Director (Principal Executive Officer) |

|

57 |

|

June

9, 2016 |

| |

|

|

|

|

|

|

| Doug

E. Grau |

|

President,

(Interim Principal Accounting Officer) |

|

61 |

|

February

12, 2020 |

| |

|

|

|

|

|

|

| Corey

Lambrecht |

|

Chief

Operating Officer and Director |

|

54 |

|

February

12, 2020 |

| |

|

|

|

|

|

|

| Non-Employee

Directors |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Michael

Dean Smith |

|

Director |

|

53 |

|

February

8, 2022 |

| |

|

|

|

|

|

|

| C.

Stephen Cochennet |

|

Director |

|

66

|

|

May

9, 2023 |

| |

|

|

|

|

|

|

| Larry

Sinks |

|

Director |

|

60 |

|

November

20, 2023 |

Executive

Officers

Charles

A. Ross, Jr., Chief Executive Officer and Director

Mr.

Ross is currently the Company’s CEO and a Director. He has held these positions since June 20, 2016. He is responsible for all

duties required of a corporate officer and the development of the business. From December 15, 2014 through April 9, 2021, Mr. Ross served

as the sole officer and director of American Rebel, Inc. He now serves as Secretary/Treasurer and a director. American Rebel, Inc. has

developed a product line of concealed carry products that officially launched at the 2017 NRA Convention April 27 – 30 in Atlanta,

GA. Prior to founding American Rebel, Inc. Mr. Ross founded many companies including Digital Ally, Inc. (NASDAQ: DGLY), which he established

in 2004. In addition to his entrepreneurial accomplishments, Mr. Ross served as host for ten years of his own television show, Maximum

Archery World Tour, where he bowhunted all over the world including traditional hunts and some of the world’s most dangerous

game. Maximum Archery World Tour evolved into his new show, American Rebel, which featured Mr. Ross’s music, patriotism,

his support of the 2nd Amendment and celebrated the “American Rebel Spirit” in all of us. Mr. Ross has released

three CDs and his song “American Rebel” has become the theme song for American Rebel.

Doug

E. Grau, President and Interim Principal Accounting Officer

Mr.

Grau is currently our president and interim principal accounting officer. Mr. Grau served as a director from February of 2020 through

November of 2023. From 2014 through present he has also served as a director of American Rebel, Inc., our wholly-owned operating subsidiary.

Mr. Grau has produced Chief Executive Officer Andy Ross’s three CDs and has worked with Andy in various capacities for fifteen

years. Mr. Grau worked as an executive at Warner Bros. Records in Nashville for fifteen years, developing the talents of Travis Tritt,

Little Texas, David Ball, Jeff Foxworthy, Bill Engvall, Larry the Cable Guy, Ron White, and others. Mr. Grau graduated from Belmont University

in Nashville, TN in 1985 with a Bachelor’s degree in Business Administration.

Corey

Lambrecht, Chief Operating Officer and Director

Mr.

Lambrecht has served as a director since February of 2020 and was appointed as our Chief Operating Officer in November of 2023. Mr. Lambrecht

is a 20+ year public company executive with broad experience in strategic acquisitions, corporate turnarounds, new business development,

pioneering consumer products, corporate licensing, interactive technology services in addition to holding public company executive roles

with responsibilities including day-to-day business operations, management, raising capital, board communication and investor relations.

He is a Certified Director from the UCLA Anderson Graduate School of Management accredited Directors program. From 2007 through 2023,

he was an independent director and committee member of Orbital Infrastructure Group, Inc., a former NASDAQ listed company. Mr. Lambrecht

served on the Board of HippoFi, Inc. (OTC: ORHB) from July 2016 through December 2019. On January 17, 2020, Mr. Lambrecht was appointed

to serve as the Chief Financial Officer for Singlepoint Inc. (CBOE: SING) and he previously served as a Board Member for Lifestyle Wireless,

Inc. which, in 2012 merged into Singlepoint. In December 2011 he joined the Board of Guardian 8 Holdings, a leading non-lethal security

product company, serving until early 2016. He most recently served as the President and Chief Operating Officer at Earth911 Inc., a subsidiary

of Infinity Resources Holdings Company (OTC: IRHC) from January 2010 to July 2013.

Non-Employee

Directors

Michael

Dean Smith, Director

Mr.

Smith has been an independent director since February 2022 and has, since 2017, been Vice President of Industrial Maintenance, Inc. From

1997-2017, Mr. Smith served in various positions with Payless Shoe Source. Mr. Smith holds B.S. in Business Administration and Accounting

from the University of Kansas, and MBA from Washburn University.

C.

Stephen Cochennet, Director

Mr.

Cochennet has served as CEO/President, of Kansas Resource Development Company, a private oil and gas exploration company since 2011.

In addition, from 2018 through 2023, Mr. Cochennet served as an independent board and committee member of Orbital Infrastructure Group,

Inc., a former Nasdaq listed company. From 2011 through 2015 he was also the CEO and president of Guardian 8 Corporation. From 2005 to

2010, Mr. Cochennet was the Chairman, President, and Chief Executive Officer of EnerJex Resources, Inc., a publicly traded Commission

registered Oil and Gas Company. Prior to joining EnerJex, Mr. Cochennet was President of CSC Group, LLC in which he supported several

Fortune 500 corporations, international companies, and natural gas/electric utilities as well as various startup organizations. The services

provided included strategic planning, capital formation, corporate development, executive networking and transaction structuring. From

1985 to 2002, he held several executive positions with UtiliCorp United Inc. (Aquila) in Kansas City, Missouri. His responsibilities

included finance, administration, operations, human resources, corporate development, natural gas/energy marketing, and managing several

new startup operations. Prior to his experience at Aquila Mr. Cochennet served 6 years with the Federal Reserve System managing problem

and failed banking institutions primarily within the oil and gas markets.

Mr.

Cochennet graduated from the University of Nebraska with a B.A. in Finance and Economics.

Larry

Sinks, Director

Mr.

Sinks was appointed as a director in November of 2023. Since 2005, Mr. Sinks has been in the screen printing and embroidering business

on a freelance basis. In addition, since 2016, Mr. Sinks has been a consultant for Team Image Marketing, a company specializing in high-end

corrugated grocery store displays. Further, from 2021 through present, Mr. Sinks has been consulting for Champion Building Solutions,

a private company in Kansas City, Missouri specializing in general remodels of homes. Mr. Sinks real passion is in motorsports and making

introductions to people in the auto racing business. Along these lines, Mr. Sinks was instrumental in introducing us to Tony Stewart

Racing.

CORPORATE

GOVERNANCE

Concurrent

with our February 2022 public offering, we made significant corporate governance changes, which are set forth below.

Director

Independence

The

Board has reviewed the independence of our directors based on the listing standards of the Nasdaq Capital Market. Based on this review,

the Board has determined that each of Larry Sinks, Michael Dean Smith and C. Stephen Cochennet are independent within the meaning of

the Nasdaq Capital Market rules. In making this determination, our Board considered the relationships that each of these non-employee

directors has with us and all other facts and circumstances our Board deemed relevant in determining their independence. As required

under applicable Nasdaq Capital Market rules, we anticipate that our independent directors will meet in regularly scheduled executive

sessions at which only independent directors are present.

Board

Committees

Our

Board has established the following four standing committees: an audit committee; a compensation committee; a nominating and governance

committee; and mergers and acquisitions committee. Our Board has adopted written charters for each of these committees. Copies of their

charters are available on our website . Our Board may establish other committees as it deems necessary or appropriate from time to time.

The

following table identifies the independent and non-independent current Board and committee members through the date of this filing:

| Name |

|

Audit |

|

Compensation |

|

Nominating

and Corporate Governance |

|

Mergers

and Acquisitions |

|

Independent |

| Charles

A. Ross, Jr. |

|

|

|

|

|

|

|

X

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Corey

Lambrecht |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Larry

Sinks |

|

X |

|

X |

|

X |

|

X |

|

X |

| |

|

|

|

|

|

|

|

|

|

|

| Michael

Dean Smith |

|

X |

|

X |

|

X |

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

| C.

Stephen Cochennet |

|

X |

|

X |

|

X |

|

X |

|

X |

Audit

Committee

Our

Board established the audit committee for the purpose of overseeing the accounting and financial reporting process and audits of our

financial statements. The audit committee is responsible for, among other matters:

| |

● |

appointing,

compensating, retaining, evaluating, terminating, and overseeing our independent registered public accounting firm; |

| |

|

|

| |

● |

discussing

with our independent registered public accounting firm the independence of its members from its management; |

| |

|

|

| |

● |

reviewing

with our independent registered public accounting firm the scope and results of their audit; |

| |

|

|

| |

● |

approving

all audit and permissible non-audit services to be performed by our independent registered public accounting firm; |

| |

|

|

| |

● |

overseeing

the financial reporting process and discussing with management and our independent registered public accounting firm the interim

and annual financial statements that we file with the Commission; |

| |

|

|

| |

● |

reviewing

and monitoring our accounting principles, accounting policies, financial and accounting controls, and compliance with legal and regulatory

requirements; |

| |

|

|

| |

● |

coordinating

the oversight by our Board of our code of business conduct and our disclosure controls and procedures; |

| |

|

|

| |

● |

establishing

procedures for the confidential and/or anonymous submission of concerns regarding accounting, internal controls or auditing matters;

and |

| |

|

|

| |

● |

reviewing

and approving related-person transactions. |

Our

audit committee consists of Larry Sinks, Michael Dean Smith and C. Stephen Cochennet. Mr. Cochennet serves as the chairman. Our Board

has affirmatively determined that each of the members; Larry Sinks, Michael Dean Smith and C. Stephen Cochennet qualify as an “audit

committee financial expert,” as defined by Item 407(d)(5) of Regulation S-K.

Our

Board has affirmatively determined that each of the members; Larry Sinks, Michael Dean Smith and C. Stephen Cochennet meet the definition

of an “independent director” for purposes of serving on the audit committee under Rule 10A-3 of the Exchange Act and the

Nasdaq Capital Market rules and requirements.

Compensation

Committee

Our

Board has established the compensation committee for the purpose of reviewing, recommending and approving our compensation policies and

benefits, including the compensation of all of our executive officers and directors. The compensation committee is responsible for, among

other matters:

| |

● |

reviewing

key employee compensation goals, policies, plans and programs; |

| |

|

|

| |

● |

reviewing

and approving the compensation of our directors and executive officers; |

| |

|

|

| |

● |

reviewing

and approving employment agreements and other similar arrangements between us and our executive officers; and |

| |

|

|

| |

● |

appointing

and overseeing any compensation consultants or advisors. |

Our

compensation committee consists of Larry Sinks, Michael Dean Smith and C. Stephen Cochennet. Larry Sinks serves as the chairman. In determining

that each of the members; Larry Sinks, Michael Dean Smith and C. Stephen Cochennet qualify as an “independent director” pursuant

to Rule 10A-3 of the Exchange Act, the Board also considered all factors required by Rule 5605(d)(2)(A) and any and all other applicable

regulations or rules promulgated by the Commission and the Nasdaq Capital Market rules relating to the compensation committee composition.

Nominating

and Corporate Governance Committee

Our

Board has established the nominating and corporate governance committee for the purpose of assisting the board in identifying qualified

individuals to become board members, in determining the composition of the board and in monitoring the process to assess board effectiveness.

Our nominating committee consists of Michael Dean Smith, C. Stephen Cochennet, and Larry Sinks. Michael Dean Smith serves as the chairman.

Mergers

and Acquisitions Committee

Our

Board has established the mergers and acquisitions committee for the purpose of assisting the board in identifying and analyzing potential

mergers or acquisitions for the Company. Our mergers and acquisitions committee consists of Charles A. Ross, Jr., C. Stephen Cochennet,

and Larry Sinks. Mr. Sinks serves as the chairman.

Board

Leadership Structure

Our

Board has not adopted a formal policy regarding the separation of the offices of Chief Executive Officer and Chairman of the Board. Rather,

the Board believes that different leadership structures may be appropriate for the Company at a different time and under different circumstances,

and it prefers the flexibility in making this decision based on its evaluation of the relevant facts at any given time.

In

December 2014, Mr. Ross was appointed as Chief Executive Officer and became Executive Chairman of the Board. Under our current Board

leadership structure, the Chief Executive Officer is responsible for the day-to-day leadership and performance of the Company. Mr. Grau,

our President and Interim Principal Accounting Officer, focuses on the allocation of resources and the financial reporting and operational

and internal controls necessary to provide accurate and timely financials.

Risk

Oversight

Our

board of directors will oversee a company-wide approach to risk management. Our board of directors will determine the appropriate risk

level for us generally, assess the specific risks faced by us and review the steps taken by management to manage those risks. While our

board of directors will have ultimate oversight responsibility for the risk management process, its committees will oversee risk in certain

specified areas.

Specifically,

our compensation committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements,

and the incentives created by the compensation awards it administers. Our audit committee oversees management of enterprise risks and

financial risks, as well as potential conflicts of interests. Our board of directors is responsible for overseeing the management of

risks associated with the independence of our board of directors.

Code

of Business Conduct and Ethics

Our

board of directors adopted a Code of Business Conduct and Ethics that applies to our directors, officers and employees. A copy of this

code will be available on our website. We intend to disclose on our website any amendments to the Code of Business Conduct and Ethics

and any waivers of the Code of Business Conduct and Ethics that apply to our principal executive officer, principal financial officer,

principal accounting officer, controller, or persons performing similar functions.

Family

Relationships

There

are no family relationships among our directors and/or executive officers.

Involvement

in Certain Legal Proceedings

To

the best of our knowledge, none of our directors or executive officers has, during the past 10 years, been involved in any legal proceedings

described in subparagraph (f) of Item 401 of Regulation S-K.

Board

Diversity

While

we do not have a formal policy on diversity, our Board considers diversity to include the skill set, background, reputation, type and

length of business experience of our Board members as well as a particular nominee’s contributions to that mix. Our Board believes

that diversity promotes a variety of ideas, judgments and considerations to the benefit of our Company and stockholders. Although there

are many other factors, the Board primarily focuses on public company board experience, knowledge of the safes and concealed self-defense

products industry, or background in finance or technology, and experience operating growing businesses.

| Board

Diversity Matrix (As of November 30, 2023) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

Number of Directors |

|

5 |

|

| |

|

Female |

|

|

Male |

|

|

Non-Binary |

|

|

Did

Not

Disclose

Gender |

|

| Part

I: Gender Identity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Directors |

|

|

- |

|

|

|

5 |

|

|

|

- |

|

|

|

- |

|

| Part

II: Demographic Background |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| African

American or Black |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Alaskan

Native or Native American |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Asian |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Hispanic

or Latinx |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Native

Hawaiian or Pacific Islander |

|

|

- |

|

|

|

1 |

|

|

|

- |

|

|

|

- |

|

| White |

|

|

- |

|

|

|

5 |

|

|

|

- |

|

|

|

- |

|

| Two

or More Ethnicities |

|

|

- |

|

|

|

1 |

|

|

|

- |

|

|

|

- |

|

| LGBTQ+ |

|

|

- |

|

| Did

Not Disclose Demographic Background |

|

|

- |

|

Communication

with our Board

Although

the Company does not have a formal policy regarding communications with the Board, stockholders may communicate with the Board by writing

to us at American Rebel Holdings, Inc., at 909 18th Avenue South, Suite A, Nashville, TN, 37212, Attention: Corporate Secretary. Stockholders

who would like their submission directed to a member of the Board may so specify, and the communication will be forwarded, as appropriate.

Nominations

to the Board

Our

directors take a critical role in guiding our strategic direction and oversee the management of the Company. Board candidates are considered

based upon various criteria, such as their broad-based business and professional skills and experiences, a global business and social

perspective, concern for the long-term interests of the stockholders, diversity, and personal integrity and judgment.

In

addition, directors must have the time available to devote to Board activities and to enhance their knowledge in the growing of our business.

Accordingly, we have sought to attract and retain highly qualified independent directors who have the sufficient time to attend to their

substantial duties and responsibilities to the Company.

Director

Nominations

As

of December 31, 2022, we did not make any material changes to the procedures by which our stockholders may recommend nominees to our

Board. In January of 2023, the Company and its stockholders approved the election and continuation of the then current board members

until the next annual stockholders meeting. In April of 2023, Ken Yonika resigned as a member of the Board and its committees. In May

of 2023, this vacancy on the Board was filled by the appointment of C. Stephen Cochennet as a member of the Board and its committees.

In November of 2023, Doug Grau resigned as a member of the Board and this vacancy was filled by the appointment of Larry Sinks as a member

of the Board and its committees.

Compensation

Committee Interlocks and Insider Participation

No

interlocking relationship exists between our Board and the Board or the compensation committee of any other company, nor has any interlocking

relationship existed in the past.

EXECUTIVE

COMPENSATION

General

Philosophy

During

fiscal 2021, our board was solely responsible for establishing and administering our executive and director compensation plans. During

2022, the compensation committee of the Board was solely responsible for establishing and administering our executive and director compensation

plans.

Executive

Compensation

The

following table sets forth the compensation we paid to our current executive officer(s) during the fiscal years ended December 31, 2022

and 2021, respectively:

| SUMMARY COMPENSATION TABLE |

| Name and | |

| | |

Salary | | |

Bonus | | |

Stock Awards | | |

All Other Compensation | | |

Total | |

| principal position | |

Year | | |

($) | | |

($) | | |

($) | | |

($) | | |

($) | |

| (a) | |

(b) | | |

(c) | | |

(d) | | |

(i) | | |

(e) | | |

(j) | |

| Charles A. Ross, Jr. (1) | |

| 2022 | | |

| 200,000 | | |

| 481,400 | | |

| 20,766 | (2) | |

| - | | |

| 702,166 | |

| Chief Executive Officer | |

| 2021 | | |

| 200,000 | | |

| - | | |

| 393,490 | (3) | |

| - | | |

| 593,490 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Doug E. Grau(4) | |

| 2022 | | |

| 120,000 | | |

| 293,381 | | |

| 11,182 | (5) | |

| - | | |

| 424,563 | |

| President | |

| 2021 | | |

| 120,000 | | |

| - | | |

| 393,490 | (3) | |

| - | | |

| 513,490 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ronald A. Smith(6) | |

| 2022 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Chief Operating Officer | |

| 2021 | | |

| - | | |

| - | | |

| 247,000 | (6) | |

| - | | |

| 247,000 | |

| |

(1) |

On

January 1, 2021, the Company entered into a five-year employment agreement with Mr. Ross, with a base annual salary of $180,000. |

| |

(2) |

Deemed

value of 103,829 shares of Common Stock authorized for issuance on December 27, 2022 pursuant to the LTIP. |

| |

(3) |

Deemed

value of 26,813 shares of Common Stock issued on March 24, 2021 pursuant to the LTIP, 50,000 shares of preferred stock issued on

April 9, 2021 pursuant to an employment agreement, and 9,416 shares of Common Stock issued on August 3, 2021 pursuant to the LTIP. |

| |

|

Represents

cash compensation paid to the named executive officer. |

| |

(4) |

On

January 1, 2021, the Company entered into a five-year employment agreement with Mr. Grau, with a base annual salary of $120,000. |

| |

(5) |

Deemed

value of 55,908 shares of Common Stock authorized for issuance on December 27, 2022 pursuant to the LTIP. |

| |

(6) |

Mr.

Smith was appointed as Chief Operating Officer and the Company entered into a two-year employment agreement with Mr. Smith on April

9, 2021, with no cash salary; however, Mr. Smith was issued 59,375 shares of Common Stock, with a deemed value of $247,000, pursuant

to the employment agreement. |

Employment

Agreements

Effective

January 1, 2021, the Company entered into employment agreements with Charles A. Ross, Jr., its Chief Executive Officer, and Doug E. Grau,

its President. These agreements were amended in April of 2021.

Charles

A. Ross, Jr. Employment Agreement and Amendments

In

general, Mr. Ross’ employment agreement contains provisions concerning terms of employment, voluntary and involuntary termination,

indemnification, severance payments, and other termination benefits, in addition to a non-compete clause and certain other perquisites.

The

term of Mr. Ross’ employment agreement, as amended, runs from January 1, 2021 until December 31, 2026.

Mr.

Ross’ employment agreement provides for an initial annual base salary of $180,000, which may be adjusted by the Board of the Company.

As of the date of this offering circular Mr. Ross’ annual base salary is $325,000.

In

addition, Mr. Ross is eligible to receive annual short term incentive bonuses as determined by a review at the discretion of the Company’s

Board.

Further,

the Company granted and issued Mr. Ross 50,000 shares of Series A - Super Voting Convertible preferred stock. Pursuant to the amendment

to his employment agreement, the Company issued 50,000 shares of Common Stock to Mr. Ross.

In

the event of a termination of employment with the Company by the Company without “cause” or by Mr. Ross for “Good Reason”

(as defined in the employment agreement), Mr. Ross would receive: (i) a lump sum payment equal to all earned but unpaid base salary through

the date of termination of employment; (ii) a lump sum payment equal to 12-months base salary; and (iii) immediate vesting of all equity

awards (including but not limited to stock options and restricted shares).

In

the event of a termination of employment with the Company by the Company for “cause” (as defined in the employment agreement),

by reason of incapacity, disability or death, Mr. Ross, or his estate, would receive a lump sum payment equal to all earned but unpaid

base salary through the date of termination of employment, disability or death.

In

the event of a termination of Mr. Ross’ employment with the Company by reason of change in control (as defined in the employment

agreement), Mr. Ross, would receive: (i) a lump sum payment equal to all earned but unpaid base salary through the date of termination

of employment; (ii) a lump sum payment equal to twelve (12) months Salary plus 100% of his prior year’s Bonus; and (iii) and immediate

vesting of all equity awards (including but not limited to stock options and restricted shares).

The

above description of Mr. Ross’ employment agreement is qualified in its entirety by reference to the full text of that agreement,

a copy of which was attached as Exhibit 10.2 to the Form 8-K filed on March 2, 2021. A copy of the first amendment to Mr. Ross’

employment agreement was attached as Exhibit 10.42 to the Form 10-K filed on May 17, 2021. A copy of the second amendment to Mr. Ross’

employment agreement was attached as Exhibit 10.3 to the Form 8-K filed on November 24, 2023.

Doug

E. Grau Employment Agreement and Amendments

In

general, Mr. Grau’s employment agreement contains provisions concerning terms of employment, voluntary and involuntary termination,

indemnification, severance payments, and other termination benefits, in addition to a non-compete clause and certain other perquisites.

The

term of Mr. Grau’s employment agreement, as amended, runs from January 1, 2021 until December 31, 2026.

Mr.

Grau’s employment agreement provides for an initial annual base salary of $120,000, which may be adjusted by the Board of the Company.

As of the date of this offering circular Mr. Grau’s annual base salary is $260,000.

In

addition, Mr. Grau is eligible to receive annual short term incentive bonuses as determined by a review at the discretion of the Company’s

Board.

Further,

the Company granted and issued Mr. Grau 50,000 shares of Series A - Super Voting Convertible preferred stock. Pursuant to the amendment

to his employment agreement, the Company issued 50,000 shares of Common Stock to Mr. Grau.

In

the event of a termination of employment with the Company by the Company without “cause” or by Mr. Grau for “Good Reason”

(as defined in the employment agreement), Mr. Grau would receive: (i) a lump sum payment equal to all earned but unpaid base salary through

the date of termination of employment; (ii) a lump sum payment equal to 12-months base salary; and (iii) immediate vesting of all equity

awards (including but not limited to stock options and restricted shares).

In

the event of a termination of employment with the Company by the Company for “cause” (as defined in the employment agreement),

by reason of incapacity, disability or death, Mr. Grau, or his estate, would receive a lump sum payment equal to all earned but unpaid

base salary through the date of termination of employment, disability or death.

In

the event of a termination of Mr. Grau’s employment with the Company by reason of change in control (as defined in the employment

agreement), Mr. Grau, would receive: (i) a lump sum payment equal to all earned but unpaid base salary through the date of termination

of employment; (ii) a lump sum payment equal to twelve (12) months Salary plus 100% of his prior year’s Bonus; and (iii) and immediate

vesting of all equity awards (including but not limited to stock options and restricted shares).

The

above description of Mr. Grau’s employment agreement is qualified in its entirety by reference to the full text of that agreement,

a copy of which was attached as Exhibit 10.2 to the Form 8-K filed on March 2, 2021. A copy of the first amendment to Mr. Grau’s

employment agreement was attached as Exhibit 10.43 to the Form 10-K filed on May 17, 2021. A copy of the second amendment to Mr. Grau’s

employment agreement was attached as Exhibit 10.4 to the Form 8-K filed on November 24, 2023.

Corey

Lambrecht Employment Agreement -

In

general, Mr. Lambrecht’s employment agreement contains provisions concerning terms of employment, voluntary and involuntary termination,

indemnification, severance payments, and other termination benefits, in addition to a non-compete clause and certain other perquisites.

The

original term of Mr. Lambrecht’s employment agreement runs from November 20, 2023 until December 31, 2026.

Mr.

Lambrecht’s employment agreement provides for an initial annual base salary of $260,000, which may be adjusted by the board of

directors of the Registrant.

In

addition, Mr. Lambrecht is eligible to receive annual short term incentive bonuses as determined by a review at the discretion of our

board of directors.

Further,

we granted and issued Mr. Lambrecht 25,000 shares of Series A - Super Voting Convertible Preferred Stock. Conversion of the Series A

– Super Voting Convertible Preferred Stock shall vest as follows: Twenty-five percent (25%) shall vest and be convertible into

shares of common stock immediately, the remainder shall vest and be convertible into shares of common stock equally on January 1, 2024,

January 1, 2025 and January 1, 2026.

In

the event of a termination of employment with the Registrant by the Registrant without “cause” or by Mr. Lambrecht for “Good

Reason” (as defined in the employment agreement), Mr. Lambrecht would receive: (i) a lump sum payment equal to all earned but unpaid

base salary through the date of termination of employment; (ii) a lump sum payment equal to 12-months base salary; and (iii) immediate

vesting of all equity awards (including but not limited to stock options and restricted shares).

In

the event of a termination of employment with the Registrant by the Registrant for “cause” (as defined in the employment

agreement), by reason of incapacity, disability or death, Mr. Lambrecht, or his estate, would receive a lump sum payment equal to all

earned but unpaid base salary through the date of termination of employment, disability or death.

In

the event of a termination of Mr. Lambrecht’ employment with the Registrant by reason of change in control (as defined in the employment

agreement), Mr. Lambrecht, would receive: (i) a lump sum payment equal to all earned but unpaid base salary through the date of termination

of employment; (ii) a lump sum payment equal to twelve (12) months Salary plus 100% of his prior year’s Bonus; and (iii) and immediate

vesting of all equity awards (including but not limited to stock options and restricted shares).

The

above description of Mr. Lambrecht’s employment agreement is qualified in its entirety by reference to the full text of that agreement,

a copy of which was attached as Exhibit 10.2 to the Form 8-K filed on November 24, 2023.

Options

Exercised and Stock Vested Table

None

of the named executive officers exercised any stock options, nor were there any restricted stock units held by our named executive officers

vested, during the fiscal years ended December 31, 2022 and December 31, 2021.

Outstanding

Equity Awards at Fiscal Year-end Table

None

of the named executive officers held any unexercised options and unvested stock awards previously awarded as of December 31, 2022.

Potential

Payments upon Termination or Change-in-Control

Commission

regulations state that we must disclose information regarding agreements, plans or arrangements that provide for payments or benefits

to our executive officers in connection with any termination of employment or change in control of the company. On January 1, 2021 we

entered into employment agreements with Charles A. Ross, Jr. and Doug E. Grau. These agreements provide for certain payments to be made

in the event of a termination of their employment agreements by reason of change in control (as defined in the employment agreements).

Each of them would receive: (i) a lump sum payment equal to all earned but unpaid base salary through the date of termination of employment

(not applicable to Smith as he receives no salary); (ii) a lump sum payment equal to twelve (12) months Salary plus 100% of his prior

year’s bonus; and (iii) and immediate vesting of all equity awards (including but not limited to stock options and restricted shares).

No changes were made to these agreements for the year ended December 31, 2022.

Retirement

Plans

We

do not offer any annuity, pension, or retirement benefits to be paid to any of our officers, directors, or employees in the event of

retirement.

Compensation

of Directors

During

the year ended December 31, 2021, we did not have a standard arrangement for compensation of our directors for services provided as a

director, including services for committee participation or for special assignments. In March of 2022, our Board adopted compensation

specific to and for non-employee directors. Non-employee directors are entitled to receive compensation of $60,000 per year for their

service, payable in restricted shares of the Company’s Common Stock at a price determined by the average monthly closing price

for each month in service, and are to be paid nominal cash fees and reimbursement of costs for director and committee meetings.

The

following table sets forth summary compensation information for the year ended December 31, 2022 for each of our non-employee directors.

| Name | |

Fees

Earned or

Paid in Cash

$ | | |

Stock

Awards

$ | | |

Option

Awards

$ | | |

All Other

Compensation

$ | | |

Total

$ | |

| Corey Lambrecht | |

$ | 63,000 | | |

$ | 54,194 | (1) | |

$ | - | | |

$ | 122,000 | | |

$ | 239,194 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Michael Dean Smith | |

$ | - | | |

$ | 54,194 | (1) | |

$ | - | | |

$ | - | | |

$ | 54,194 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ken Yonika(2) | |

$ | 30,500 | | |

$ | 54,194 | (1) | |

$ | - | | |

$ | - | | |

$ | 84,694 | |

| (1) |

Effective

February 7, 2022, our non-employee directors were eligible for the payment of $60,000 per year as a non-employee director fee for

their services, which is payable in shares of our Common Stock. The value is pro-rated for the partial year ended December 31, 2022.

Each non-employee director was issued 3,920 shares of Common Stock for their services for fiscal 2022. |

| |

|

| (2) |

Effective

April 4, 2023, Mr. Yonika resigned from the board and its committees. |

ACTION

2. APPROVAL OF REVERSE STOCK SPLIT

The

Board recommended and the Voting Stockholders approved an amendment to American Rebel’s Articles of Incorporation to effectuate

a Reverse Stock Split at an exchange ratio of up to one-for-10 (or more plainly stated, up to every ten existing shares would be exchanged

for one new share) as the Board may determine.

The

Reverse Stock Split will have no effect on the par value of American Rebel’s Common Stock. No fractional shares will be issued

in connection with the Reverse Stock Split. The proposed form of amendment to American Rebel’s Articles of Incorporation to implement

the Reverse Stock Split is attached to this Information Statement as Appendix A.

American

Rebel’s Common Stock is currently quoted on the Nasdaq Capital Market under the symbol “AREB”.

The

Board may elect not to implement the approved Reverse Stock Split at its sole discretion. The Board has the maximum flexibility to react

to current market conditions and to therefore achieve the purposes of the Reverse Stock Split, if implemented, and to act in the best

interests of American Rebel and its stockholders.

American

Rebel’s Board intends to effectuate the Reverse Stock Split in order to maintain its listing on Nasdaq as described below or at

any time within the following twelve months (the “Effective Time”).

Purpose

of the Reverse Stock Split

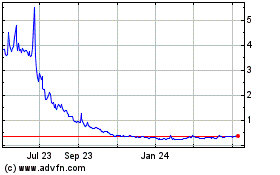

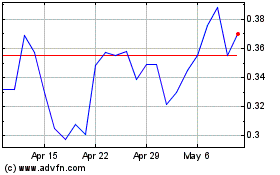

The

primary purpose of implementing the reverse stock split would be to raise the per share trading price of our common stock. In particular,

this will help us to maintain the listing of our common stock on the Nasdaq Capital Market.

Our

common stock is listed on the Nasdaq Capital Market, which has as one of its continued listing requirements a minimum bid price of at

least $1.00 per share. Recently our common stock has traded significantly below $1.00 per share. On October 23, 2023, we received a letter

from The Nasdaq Stock Market LLC indicating that we failed to comply with the minimum bid price requirement, and that we have been provided

with a 180-day grace period (which expires on April 22, 2024) to regain compliance. If we are not in compliance by April 22, 2024, we

may be afforded a second 180-day period to regain compliance. We will regain compliance if the bid price of our common stock closes at

$1.00 per share or more for a minimum of ten consecutive trading days. The reverse stock split proposal is intended primarily to increase

our per share bid price and satisfy the Nasdaq Capital Market continued listing requirement. Reducing the number of outstanding shares

of our common stock should, absent other factors, increase the per share market price of our common stock, although we cannot provide

any assurance that we will be able to meet or maintain a bid price over the minimum bid price requirement for continued listing on the

Nasdaq Capital Market or any other exchange.

Delisting

from the Nasdaq Capital Market may adversely affect our ability to raise additional financing through the public or private sale of equity

securities, may significantly affect the ability of investors to trade our securities and may negatively affect the value and liquidity

of our common stock. Delisting also could have other negative results, including the potential loss of employee confidence, the loss

of institutional investors or interest in business development opportunities.

If

we are delisted from the Nasdaq Capital Market and we are not able to list our common stock on another exchange, our common stock could

be quoted on the OTC Bulletin Board or in the “pink sheets.” As a result, we could face significant adverse consequences

including, among others:

| ● | a

limited availability of market quotations for our securities; |

| ● | a

determination that our common stock is a “penny stock” which will require brokers

trading in our common stock to adhere to more stringent rules and possibly result in a reduced

level of trading activity in the secondary trading market for our securities; |

| ● | a

limited amount of news and little or no analyst coverage of our company; |

| ● | we

would no longer qualify for exemptions from state securities registration requirements, which

may require us to comply with applicable state securities laws; and |

| ● | a

decreased ability to issue additional securities (including pursuant to short-form registration

statements on Form S-3) or obtain additional financing in the future. |

In

addition, an increase in the per share trading value of our common stock would be beneficial because it would:

| ● | improve

the perception of our common stock as an investment security; |

| ● | reset

our stock price to more normalized trading levels in the face of potentially extended market

dislocations; |

| ● | assist

with future potential capital raises; |

| ● | appeal

to a broader range of investors to generate greater investor interest in us; and |

| ● | reduce

stockholder transaction costs because investors would pay lower commission to trade a fixed

dollar amount of our stock if our stock price were higher than they would if our stock price

were lower. |

You

should consider that, although our Board believes that a reverse stock split will in fact increase the trading price of our common stock,

in many cases, because of variables outside of our control (such as market volatility, investor response to the news of a proposed reverse

stock split and the general economic environment), the market price of our Common Stock may in fact decline in value after effecting

the Reverse Stock Split. You should also keep in mind that the implementation of a reverse stock split does not have an effect on the

actual or intrinsic value of our business or a stockholder’s proportional ownership in our company. However, should the overall

value of our Common Stock decline after the proposed Reverse Stock Split, then the actual or intrinsic value of the shares of our Common

Stock held by you will also proportionately decrease as a result of the overall decline in value.

Effects

of the Reverse Stock Split

Reduction

of Shares Held by Individual Stockholders. After the Effective Date each Common Stockholder will own fewer shares of American Rebel’s

Common Stock. However, the Reverse Stock Split will affect all of the Common Stockholders uniformly and will not affect any Common Stockholder’s

percentage ownership interests in American Rebel, except to the extent that the Reverse Stock Split results in any of its stockholders

owning a fractional share as described below. Any fractional share shall be rounded up to the nearest whole share. Further, at the

option of the Board on the Effective Date the Board may choose to implement a provision that provides any stockholder as of

the Effective Date who owns at least 100 shares will not own less than 100 shares as a result of the Reverse Stock Split.

Change

in Number and Exercise Price of Employee and Equity Awards. The Reverse Stock Split will reduce the number of shares of Common Stock

available for issuance under American Rebel’s equity compensation arrangements in proportion to the split ratio. Under the terms

of its outstanding equity and option awards, the Reverse Stock Split will cause a reduction in the number of shares of Common Stock issuable

upon exercise or vesting of such awards in proportion to the split ratio of the Reverse Stock Split which is ultimately approved by the

Board and will cause a proportionate increase in the exercise price of such awards to the extent they are stock options. The number of

shares of Common Stock issuable upon exercise or vesting of stock option awards will be rounded to the nearest whole share and no cash

payment will be made in respect of such rounding. Warrant and other convertible security holders, if any, will also see a similar reduction

of the number of shares such instruments are convertible into stock option holders described above.

Authorized

Shares of Common Stock. The Reverse Stock Split, if implemented, would not change the number of authorized shares of the Common Stock

as designated by American Rebel’s Articles of Incorporation. Therefore, because the number of issued and outstanding shares of

Common Stock would decrease, the number of shares remaining available for issuance under American Rebel’s authorized shares of

Common Stock would increase.

The

additional shares of Common Stock that would become available for issuance if the Reverse Stock Split is implemented could also be used

by American Rebel’s management to oppose a hostile takeover attempt or delay or prevent changes of control or changes in or removal

of management, including transactions that are favored by a majority of the stockholders or in which the stockholders might otherwise

receive a premium for their shares over then-current market prices or benefit in some other manner. Although the proposed Reverse Stock

Split has been prompted by business and financial considerations, stockholders nevertheless should be aware that this action could facilitate

future efforts by American Rebel’s management to deter or prevent a change in control.

American

Rebel has no current specific plans for the issuance of the Common Stock, which would become newly available as a result of the Reverse

Stock Split. Any future issuance will have the effect of diluting the percentage of stock ownership and voting rights of the present

holders of American Rebel’s Common Stock.

Other

Effects on Outstanding Shares. If the Reverse Stock Split is implemented, the rights and preferences of the outstanding shares of

the Common Stock would remain the same after the Reverse Stock Split. Each share of Common Stock issued pursuant to the Reverse Stock

Split would be fully paid and non-assessable.

No

Effect on Series A Preferred Stock Voting and Conversion. The voting and conversion rights attributed to the Series A Preferred shall

remain unaffected by the Reverse Stock Split, if implemented, (each share of Series A Preferred shall continue to have 1,000:1 voting

rights and 500:1 conversion rights).

No

Effect on Series C Preferred Stock Conversion. The conversion rights attributed to the Series C Preferred shall remain unaffected

by the Reverse Stock Split, if implemented, (each share of Series C Preferred shall continue to have 5:1 conversion rights).

Regulatory

Effects. American Rebel’s Common Stock is currently registered under Section 12(b) of the Exchange Act, and is subject to the

periodic reporting and other requirements of the Exchange Act. The Reverse Stock Split will not affect the registration of the Common

Stock under the Exchange Act or American Rebel’s obligation to publicly file financial and other information with the SEC. If the

Reverse Stock Split is implemented in order to maintain its Nasdaq listing, American Rebel’s Common Stock will continue to trade

on the Nasdaq Capital Market.

In

addition to the above, the Reverse Stock Split will have the following effects upon American Rebel’s Common Stock:

| ● |

The

number of shares owned by each holder of Common Stock will be reduced; however, at the option of the Board on the Effective Date

the Board may choose to implement a provision that provides that no current owner of 100 or more shares will be reduced to less

than 100 shares; |

| |

|

| ● |

The

per share loss and net book value of American Rebel’s Common Stock will be increased because there will be a lesser number

of shares of its Common Stock outstanding; |

| |

|

| ● |

The

par value of the Common Stock will remain $0.001 per share; |

| |

|

| ● |

The

stated capital on American Rebel’s balance sheet attributable to the Common Stock will be decreased and the additional paid-in

capital account will be credited with the amount by which the stated capital is decreased; and |

| |

|

| ● |

All

outstanding options, warrants, and convertible securities entitling the holders thereof to purchase shares of Common Stock, if any,

will enable such holders to purchase, upon exercise thereof, fewer of the number of shares of Common Stock which such holders would

have been able to purchase upon exercise thereof immediately preceding the Reverse Stock Split, at the same total price (but a higher

per share price) required to be paid upon exercise thereof immediately preceding the Reverse Stock Split. |

Shares

of Common Stock after the Reverse Stock Split will be fully paid and non-assessable. The amendment will not change any of the other the

terms of American Rebel’s Common Stock or Preferred Stock. The shares of Common Stock after the Reverse Stock Split will have the

same voting rights and rights to dividends and distributions and will be identical in all other respects to the shares of Common Stock

prior to the Reverse Stock Split.

Once

American Rebel implements the Reverse Stock Split, the share certificates representing the shares will continue to be valid. In the future,

new share certificates will be issued reflecting the Reverse Stock Split, but this in no way will affect the validity of your current

share certificates. The Reverse Stock Split will occur without any further action on the part of American Rebel’s stockholders.

After the Effective Date each share certificate representing the shares prior to the Reverse Stock Split will be deemed to represent

a smaller number of shares than the number presently shown on the certificate.

The

actual number of outstanding shares of American Rebel’s Common Stock after giving effect to the Reverse Stock Split, if and when

effected will depend on the number of issued and outstanding shares at the time the Reverse Stock Split is effected and the Reverse Stock

Split ratio that is ultimately determined by the Board. The table below shows the Reverse Stock Split ratio and the approximate number

of authorized shares of Common Stock to be outstanding for various reverse split ratios:

| Reverse Stock Split Ratio | |

Outstanding Shares Before Reverse Stock Split(1) | | |

Outstanding Shares After Reverse Stock Split(2) | |

| 1-for-2 | |

| 5,947,643 | | |

| 2,973,822 | |

| 1-for-5 | |

| 5,947,643 | | |

| 1,189,529 | |

| 1-for-8 | |

| 5,947,643 | | |

| 743,456 | |

| 1-for-10 | |

| 5,947,643 | | |

| 594,765 | |

| |

(1) |

Does

not account for the additional issuance of shares of Common Stock after the date hereof as the result of future financings, conversion

of outstanding derivative securities or other issuances, which may be substantial. |

| |

|

|

| |

(2) |

Does

not account for fractional share rounding or the potential qualification, to be determined by the Board in its sole discretion,

that a stockholder who owns at least 100 shares will continue to own at least 100 shares. Such amount of shares would

be material, for example, in the Company’s June 2023 25:1 reverse stock split, the Company issued 1,488,615 shares of common

stock as a result of this rounding provision. |

Certificates

representing the shares after the Reverse Stock Split will be issued in due course as share certificates representing shares prior to

the Reverse Stock Split are tendered for exchange or transfer to American Rebel’s transfer agent. American Rebel request that

stockholders do not send in any of their stock certificates at this time.

As

applicable, new share certificates evidencing new shares following the Reverse Stock Split that are issued in exchange for share certificates

issued prior to the Reverse Stock Split representing old shares that are restricted shares will contain the same restrictive legend as

on the old certificates. Also, for purposes of determining the term of the restrictive period applicable to the new shares after the

Reverse Stock Split, the time period during which a stockholder has held their existing pre-Reverse Stock Split old shares will be included

in the total holding period.

Procedure

for Implementing the Reverse Stock Split

The

Reverse Stock Split will become effective upon the filing of the amendment to the Articles of Incorporation with the Nevada Secretary

of State. The timing of the filing of the amendment that will effectuate the Reverse Stock Split will be determined by the Board, at

any time within 12 months, based on its evaluation as to when such action will be the most advantageous to American Rebel and its stockholders.

In addition, the Board reserves the right, notwithstanding stockholder approval and without further action by the stockholders, to elect

not to proceed with the Reverse Stock Split if, at any time prior to filing the amendment, the Board, in its sole discretion, determines

that it is no longer in American Rebel’s best interest and the best interests of its stockholders to proceed with the Reverse Stock