Third Quarter 2022 Highlights

- Lower quarterly revenue and earnings due to timing of flight

equipment sales.

- Year-to-date sales up 40.1% to $313.4 million.

- Year-to-date basic EPS up 13.6%; Adjusted basic EPS up

4.1%.

- Year-to-date Adjusted EBITDA up 16.2%

- Third quarter revenue of $51.0 million, compared to $73.3

million in the prior year period.

- Third-quarter GAAP net loss of $9.0 million versus GAAP net

loss of $1.6 million in prior year period.

- Adjusted Net Loss of $1.9 million in the third quarter, versus

Adjusted Net Income of $9.2 million in prior year period.

- Third quarter Adjusted EBITDA of $(0.5) million compared to

Adjusted EBITDA of $13.9 million in the prior year period.

- Flight equipment sales in the third quarter consisted of two

engines compared to three aircraft and one engine in the prior year

quarter.

- Continue to monetize Boeing 757s with one additional AerSale

converted P2F aircraft monetized in October 2022 and up to twelve

additional aircraft to be converted to freighters by third parties

and become available to lease or sell in 2023.

- Reaffirms 2022 guidance: expects revenue in the range of $420 -

$450 million and adjusted EBITDA in the range of $80 - $90

million1.

AerSale Corporation (Nasdaq: ASLE) (the “Company”) today

reported results for the third quarter ended September 30, 2022.

The Company’s revenue for the third quarter of 2022 was $51.0

million compared to $73.3 million in the third quarter of 2021.

Revenue for the third quarter of 2022 included $2.7 million of

flight equipment sales versus $27.4 million of flight equipment

sales in the prior-year period. Flight equipment sales in the third

quarter of 2022 consisted of two engines compared to three aircraft

and one engine in the third quarter of 2021. The pacing of flight

equipment sales led to substantially lower revenue in the third

quarter, primarily due to the sale of a B747 freighter which was

planned to close in the third quarter, but was accelerated into the

second quarter, plus a delay of the sale of the last AerSale

passenger to freighter (P2F) converted B757 aircraft shifting to

the beginning of the fourth quarter.

Excluding flight equipment sales, Asset Management Solutions

(AMS) revenue would have been $17.9 million in the third quarter of

2022 compared to $21.5 million in the prior year period. Revenue

from Used Serviceable Material (USM) declined compared to the same

quarter last year due to extended turnaround times for overhauled

parts. Leasing revenue for the current quarter was similar to the

prior year, as robust demand for engines from widebody freight

operators offset lower revenues from aircraft leasing, with only

one aircraft on lease during the quarter.

TechOps revenue improved during the third quarter compared to

the same quarter in the prior year, driven in part by higher

component MRO and landing gear activities, as well as increased

revenue from AerSale’s Goodyear facility. At the beginning of the

fourth quarter, AerSale transitioned to multiple third-party

providers to perform an additional twelve P2F conversions initially

planned to be completed at Goodyear, enabling the Company to

increase its capacity for third-party work. The allocation of labor

and hangar space to support AerSale’s Boeing 757 P2F conversion

line had reduced available capacity and MRO revenue for third party

work at the Goodyear facility in recent quarters. The increase in

revenue from on airport MRO activities at AerSale’s Goodyear

facility was partially offset by lower revenue from the Company’s

Roswell location due to fewer customer aircraft in storage as

compared to prior periods.

GAAP net loss was $9.0 million in the third quarter of 2022,

compared to a GAAP net loss of $1.6 million in the third quarter of

2021. AerSale recognized a mark-to-market adjustment expense of

$2.0 million related to the private warrant liability, $4.4 million

of stock-based compensation expenses within payroll expenses, $0.4

million in secondary offering costs and $0.4 million in relocation

costs during the third quarter of 2022. In the third quarter of

2021, the mark-to-market adjustment expense related to the private

warrant liability was $2.1 million and stock-based compensation

expenses were $8.7 million. Excluding these non-cash and unusual

items, Adjusted Net Loss was $1.9 million in the third quarter of

2022 versus Adjusted Net Income was $9.2 million in the third

quarter of 2021. Diluted loss per share was $0.17 for the third

quarter of 2022 and $0.04 in the third quarter of 2021. Adjusted

for the non-cash and unusual items noted above, adjusted diluted

loss per share was $0.03 for the third quarter of 2022 compared to

adjusted diluted earnings per share of $0.22 in the third quarter

of 2021. Please see the non-GAAP reconciliation table at the end of

this press release for additional details on adjusted Net (loss)

Income and adjusted diluted (loss) earnings per share.

Adjusted EBITDA in the third quarter of 2022 was $(0.5) million

compared to $13.9 million in the third quarter of 2021. Lower

adjusted EBITDA was a result of lower flight equipment sales, which

typically have higher margins. Please see the non-GAAP

reconciliation table at the end of this press release for

additional details on adjusted EBITDA.

Year-to-date cash used in operating activities was $2.4 million

as of September 30th, 2022 primarily due to applications of a

previously collected deposit related to a flight equipment sale

reflected in cash flows from investing activities during the

period, along with the timing of cash advances to vendors. The

Company ended the quarter with $151.4 million of cash and has an

undrawn $150 million credit facility.

Nicolas Finazzo, AerSale’s Chief Executive Officer, commented,

“As we have noted in the past, our business is expected to be

uneven quarter-to-quarter, which is mainly driven by variations in

flight equipment transactions, which are an important component of

our end-to-end integrated model. This has been the case in 2022,

with significant flight equipment sales closing in the first half,

and the fourth quarter of the year. To underscore this point,

year-to-date flight equipment sales are up 75%, and all planned

flight equipment sales to reach our full-year guidance have been

realized through the end of October giving us confidence to

reiterate our full-year guidance.”

Finazzo added, “Regarding our AerAware product, we have

requested the FAA to schedule our final certification flights,

which we expect to commence in the coming weeks. We anticipate the

FAA will issue a Supplemental Type Certificate (STC) shortly after

the completion of flight testing. We believe this innovative

enhanced flight vision technology may prove to be mandatory

equipment with airline partners over the long-term given its

wide-ranging benefits to safety and efficiency.”

Certification of AerAware will make AerSale the first to certify

a head-wearable display for use on a commercial transport aircraft

as a primary flight display. The superior technology that the

Company’s system will offer is expected to not only improve

passenger safety and airport efficiencies, but greatly reduce the

costs and greenhouse emissions caused by in flight delays,

diversions, and weather related flight cancellations. Integration

of an enhanced flight vision system, such as AerAware, is one of

the key aspirations of the FAA’s next generation air traffic

control system.

Third Quarter 2022 Results of Operations AerSale

reported revenue of $51.0 million in the third quarter of 2022,

which included $2.7 million of flight equipment sales comprising

two engines. The Company’s revenue for the third quarter of 2021

was $73.3 million and included $27.4 million of flight equipment

sales consisting of three aircraft and one engine. Excluding flight

equipment sales, revenue would have been $48.3 million in the third

quarter of 2022 compared to $45.9 million in the prior year period.

The delivery of one Boeing 757 P2F AerSale converted aircraft,

which was initially forecasted to close during the third quarter of

2022, was delivered at the beginning of the fourth quarter. In the

second quarter of 2022, flight equipment sales were $92.5 million

and consisted of three aircraft and three engines, which included

two AerSale converted Boeing 757 freighter aircraft and the early

delivery of one Boeing 747 freighter.

As a reminder to investors, flight equipment sales may

significantly vary quarter-to-quarter, and AerSale believes

full-year analysis, rather than year-over-year quarterly

comparisons is a more appropriate measurement of the Company’s

progress.

AMS revenue decreased 57.9% to $20.6 million in the third

quarter of 2022 primarily due to flight equipment sales of only two

engines and no aircraft. USM parts sales were also lower in the

third quarter of 2022, on account of slower repair turnaround times

for overhauled parts. Leasing revenue for the third quarter of 2022

was close to third quarter of 2021 levels as demand for engines

from widebody freighter operators offset reductions to the aircraft

leasing portfolio. Excluding flight equipment sales, AMS revenue

would have been $17.9 million in the third quarter of 2022 compared

to $21.5 million in the prior year period.

TechOps revenue rose 24.5% during the third quarter of 2022 when

compared to the same quarter in the prior year, based on growing

airport MRO activities at AerSale’s Goodyear facility. At the

beginning of the fourth quarter, AerSale transitioned to a

third-party provider to perform an additional 12 P2F conversions,

which in turn will increase the Company’s capacity for third party

work at its Goodyear facility and generate additional revenue going

forward. In addition, lower revenue from on airport MRO storage

related activities at AerSale’s Roswell facility was offset by

higher revenue from component and landing gear MRO activities.

Gross margin was 30.4% in the third quarter of 2022 compared to

33.6% in the year ago period largely as a result of lower sales mix

of higher margin flight equipment sales.

Selling, general and administrative expenses were $24.0 million

in the third quarter of 2022 compared to $22.8 million in the third

quarter of 2021. The Company also incurred $4.4 million of

stock-based compensation expenses in the third quarter of 2022,

compared to $8.7 million in the third quarter of 2021.

Loss from operations was $8.5 million in the third quarter of

2022 and income from operations was $1.8 million in the third

quarter of 2021.

Income tax benefit was $1.1 million in the third quarter of

2022, while income tax expense was $1.1 million in the third

quarter of 2021.

GAAP net loss for the third quarter of 2022 was $9.0 million,

compared to $1.6 million in the third quarter of 2021. Adjusted for

stock-based compensation, mark-to-market adjustment to the private

warrant liability, secondary offering and relocation costs,

Adjusted Net Loss was $1.9 million in the third quarter of 2022 and

Adjusted Net Income was $9.2 million in the third quarter of 2021.

Diluted loss per share was $0.17 for the third quarter of 2022 and

$0.04 in the third quarter of 2021. Adjusted for the

above-mentioned non-cash and unusual items, adjusted diluted loss

per share was $0.03 for the third quarter of 2022 and adjusted

diluted earnings per share was $0.22 in the third quarter of

2021.

Adjusted EBITDA in the third quarter of 2022 was $(0.5) million,

compared to $13.9 million in the third quarter of 2021. The decline

in adjusted EBITDA was mainly on account of lower revenues from

flight equipment sales, which generally have higher margins.

AerSale did not receive any Payroll Support Program proceeds during

the third quarter of 2021 and 2022.

Martin Garmendia, AerSale’s Chief Financial Officer, said: “We

are pleased and encouraged by the performance of our business

through the third quarter, which included significant flight

equipment sales in the first half of the year. While there were

minimal flight equipment transactions in the third quarter, it is

important to note that underlying demand remained strong, and we

continued to demonstrate growth in the rest of the business. For

the balance of the year, all remaining planned flight equipment

sales have closed and we have clear line of sight through year-end

and into early 2023. We remain confident that the strength of our

purpose-built model and our excellent execution capabilities will

continue drive shareholder value over the long-term.”

2022 Guidance AerSale reaffirmed its guidance for

revenue of $420 - $450 million and adjusted EBITDA of $80 - $90

million in 2022.

Conference Call Information The Company will host a

conference call today, November 8, 2022, at 4:30 pm Eastern Time to

discuss these results. A live webcast will also be available at

https://ir.aersale.com/news-events/events. Participants may access

the call at 1-877-846-2690, international callers may use

1-416-981-9009, and request to join the AerSale Corporation

earnings call.

A telephonic replay will be available shortly after the

conclusion of the call and until November 22, 2022. Participants

may access the replay at 1-844-512-2921, international callers may

use 1-412-317-6671, and enter access code 22021077. An archived

replay of the call will also be available on the Investors portion

of the AerSale website at https://ir.aersale.com/.

Non-GAAP Financial Measures This press release

includes non-GAAP financial measures, including adjusted EBITDA,

adjusted Net Income, and adjusted diluted Earnings per Share.

AerSale defines adjusted EBITDA as net income (loss) after giving

effect to interest expense, depreciation and amortization, income

tax expense (benefit), and other non-recurring or unusual items.

Adjusted Net Income is defined as net income (loss) after giving

effect to mark-to-market adjustments relating to our Private

Warrants, stock-based compensation expense and other non-recurring

or unusual items. Adjusted diluted earnings per share also exclude

these material non-recurring or unusual items.

AerSale believes these non-GAAP measures of financial results

provide useful information to management and investors regarding

certain financial and business trends relating to AerSale’s

financial condition and results of operations. AerSale’s management

uses certain of these non-GAAP measures to compare AerSale’s

performance to that of prior periods for trend analyses and for

budgeting and planning purposes. These non- GAAP measures should

not be construed as an alternative to net income or net income

margin as an indicator of operating performance or as an

alternative to cash flow provided by operating activities as a

measure of liquidity (each as determined in accordance with

GAAP).

You should review AerSale’s audited financial statements, and

not rely on any single financial measure to evaluate AerSale’s

business. Other companies may calculate adjusted EBITDA, adjusted

Net Income, or Adjusted diluted earnings per share differently, and

therefore AerSale’s adjusted EBITDA, adjusted Net Income, or

adjusted diluted earnings per share measures may not be directly

comparable to similarly titled measures of other companies.

Reconciliations of Net Income, the Company’s closest GAAP

measure, to adjusted EBITDA, adjusted Net Income, and adjusted

diluted earnings per share, are outlined in the tables below

following the Company’s condensed consolidated financial

statements.

Third Quarter 2022 Financial Results

AERSALE CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEET

(in thousands, except share

data)

(Unaudited)

September 30,

December 31,

2022

2021

(Unaudited)

Current assets:

Cash and cash equivalents

$

151,378

$

130,188

Accounts receivable, net of allowance for

doubtful accounts of $1,272 and $1,692 as of September 30, 2022 and

December 31, 2021

39,219

42,571

Inventory:

Aircraft, airframes, engines, and parts,

net

107,150

81,759

Advance vendor payments

24,384

14,287

Deposits, prepaid expenses, and other

current assets

3,471

2,724

Total current assets

325,602

271,529

Fixed assets:

Aircraft and engines held for lease,

net

33,118

73,364

Property and equipment, net

11,963

7,350

Inventory:

Aircraft, airframes, engines, and parts,

net

80,435

77,534

Deferred income taxes

12,852

10,013

Deferred financing costs, net

659

999

Deferred customer incentives and other

assets, net

628

598

Goodwill

19,860

19,860

Other intangible assets, net

24,647

26,238

Total assets

$

509,764

$

487,485

Current liabilities:

Accounts payable

$

22,050

$

19,967

Accrued expenses

7,829

8,424

Income tax payable

1,239

3,443

Lessee and customer purchase deposits

10,116

33,212

Deferred revenue

3,524

2,860

Total current liabilities

44,758

67,906

Long-term lease deposits

152

2,053

Maintenance deposit payments and other

liabilities

1,624

3,403

Deferred income taxes, net

1,297

1,113

Warrant liability

6,012

4,131

Total liabilities

53,843

78,606

Commitments and contingencies

Stockholders’ equity:

Common stock, $0.0001 par value.

Authorized 200,000,000 shares; issued and outstanding 51,774,665

and 51,673,099 shares as of September 30, 2022 and December 31,

2021, respectively

5

5

Additional paid-in capital

326,275

313,901

Retained earnings

129,641

94,973

Total stockholders' equity

455,921

408,879

Total liabilities and stockholders’

equity

$

509,764

$

487,485

AERSALE CORPORATION

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

(in thousands, except per share

data)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

Revenue:

Products

$

16,823

$

43,613

$

217,813

$

124,914

Leasing

7,786

8,002

23,342

20,624

Services

26,390

21,683

72,258

78,116

Total revenue

50,999

73,298

313,413

223,654

Cost of sales and operating expenses:

Cost of products

12,755

30,954

133,702

85,147

Cost of leasing

1,818

2,436

6,538

7,667

Cost of services

20,937

15,276

56,001

55,635

Total cost of sales

35,510

48,666

196,241

148,449

Gross profit

15,489

24,632

117,172

75,205

Selling, general, and administrative

expenses

23,983

22,803

71,252

53,079

Payroll support program proceeds

-

-

-

(14,768

)

(Loss) income from operations

(8,494

)

1,829

45,920

36,894

Other income (expenses):

Interest income (expense), net

393

(241

)

15

(750

)

Other income, net

45

9

526

258

Change in fair value of warrant

liability

(2,029

)

(2,104

)

(1,881

)

(2,735

)

Total other expenses

(1,591

)

(2,336

)

(1,340

)

(3,227

)

(Loss) income before income tax

provision

(10,085

)

(507

)

44,580

33,667

Income tax benefit (expense)

1,072

(1,129

)

(9,912

)

(8,737

)

Net (loss) income

$

(9,013

)

$

(1,636

)

$

34,668

$

24,930

(Loss) earnings per share - basic

$

(0.17

)

$

(0.04

)

$

0.67

$

0.59

(Loss) earnings per share - diluted

$

(0.17

)

$

(0.04

)

$

0.64

$

0.59

AERSALE CORPORATION

CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(in thousands)

(Unaudited)

Nine Months Ended September

30,

2022

2021

Cash flows from operating activities:

Net income

$

34,668

$

24,930

Adjustments to reconcile net income to net

cash (used in) provided by operating activities:

Depreciation and amortization

8,589

9,868

Amortization of debt issuance costs

340

366

Inventory reserve

2,010

5,033

Impairment of aircraft held for lease

857

-

Provision for doubtful accounts

(379

)

(122

)

Deferred income taxes

(2,655

)

(988

)

Change in fair value of warrant

liability

1,881

2,735

Share-based compensation

12,029

8,899

Changes in operating assets and

liabilities:

Accounts receivable

3,730

5,279

Inventory

(26,441

)

(44,104

)

Deposits, prepaid expenses, and other

current assets

(747

)

3,628

Deferred customer incentives and other

assets

661

-

Advance vendor payments

(10,097

)

(3,201

)

Accounts payable

2,082

(57

)

Income tax payable

(2,205

)

(987

)

Accrued expenses

(594

)

(2,234

)

Deferred revenue

664

363

Lessee and customer purchase deposits

(24,996

)

16,649

Other liabilities

(1,779

)

327

Net cash (used in) provided by operating

activities

(2,382

)

26,384

Cash flows from investing activities:

Proceeds from sale of assets

37,107

6,995

Acquisition of aircraft and engines held

for lease, including capitalized cost

(6,945

)

(60

)

Purchase of property and equipment

(6,935

)

(1,060

)

Net cash provided by investing

activities

23,227

5,875

Cash flows from financing activities:

Cash paid for employee taxes on

withholding shares

-

(269

)

Proceeds from exercise of warrants

-

545

Proceeds from the issuance of Employee

Stock Purchase Plan shares

345

-

Net cash provided by financing

activities

345

276

Increase in cash and cash equivalents

21,190

32,535

Cash and cash equivalents, beginning of

period

130,188

29,317

Cash and cash equivalents, end of

period

$

151,378

$

61,852

Supplemental disclosure of cash

activities

Income taxes paid

14,637

8,095

Interest paid

856

452

Supplemental disclosure of noncash

investing activities

Reclassification of aircraft and aircraft

engines inventory (from) to equipment held for lease, net

(25,025

)

14,650

Reclassification of customer purchase

deposits to sale of assets

12,500

-

AERSALE CORPORATION

Adjusted EBITDA, Net Income and

Diluted EPS

Reconciliation Table (In ‘000s,

except per share data)

(Unaudited)

Three months ended September

30,

Nine months ended September

30,

2022

% of

Total

Revenue

2021

% of

Total

Revenue

2022

% of

Total

Revenue

2021

% of

Total

Revenue

Reported Net (Loss)/Income

(9,013

)

(17.7

%)

(1,636

)

(2.2

%)

34,668

11.1

%

24,930

11.1

%

Addbacks:

Change in FV of Warrant Liability

2,029

4.0

%

2,104

2.9

%

1,881

0.6

%

2,735

1.2

%

Stock Compensation

4,357

8.5

%

8,749

11.9

%

12,029

3.8

%

8,899

4.0

%

Inventory Write-Off

-

0.0

%

-

0.0

%

1,845

0.6

%

4,776

2.1

%

Impairment in Flight Equipment

-

0.0

%

-

0.0

%

857

0.3

%

-

0.0

%

Secondary Offering Costs

391

0.8

%

-

0.0

%

391

0.1

%

-

0.0

%

Relocation Costs

373

0.7

%

-

0.0

%

373

0.1

%

-

0.0

%

Income Tax Effect of Adjusting Items

(1)

(81

)

(0.2

%)

-

0.0

%

(170

)

(0.1

%)

-

0.0

%

Adjusted Net (Loss)/Income

(1,944

)

(3.9

%)

9,217

12.6

%

51,874

16.5

%

41,340

18.4

%

Interest Expense

(393

)

(0.8

%)

241

0.3

%

(15

)

(0.0

%)

750

0.3

%

Income Tax Expense (Benefit)

(1,072

)

(2.1

%)

1,129

1.5

%

9,912

3.2

%

8,737

3.9

%

Depreciation and Amortization

2,832

5.6

%

3,291

4.5

%

8,589

2.7

%

9,868

4.4

%

Reversal of Income Tax Effect of Adjusting

Items (1)

81

0.2

%

-

0.0

%

170

0.1

%

-

0.0

%

Adjusted EBITDA

(496

)

(1.0

%)

13,878

18.9

%

70,530

22.5

%

60,695

27.0

%

Reported Basic (loss) earnings per

share

(0.17

)

(0.04

)

0.67

0.59

Addbacks:

Change in fair value of warrant

liability

0.04

0.05

0.04

0.06

Stock-based compensation

0.08

0.21

0.23

0.21

Inventory Write-Off

-

-

0.04

0.12

Impairment in Flight Equipment

-

-

0.02

-

Secondary Offering Costs

0.01

-

0.01

-

Relocation Costs

0.01

-

0.01

-

Income Tax Effect of Adjusting Items

(0.00

)

-

(0.00

)

-

Adjusted Basic (loss) earnings per

share

(0.03

)

0.22

1.02

0.98

Reported Diluted (loss) earnings per

share

(0.17

)

(0.04

)

0.64

0.59

Addbacks:

Change in FV of warrant liability

0.04

0.05

0.03

0.06

Stock-based compensation

0.08

0.21

0.22

0.21

Inventory Write-Off

-

-

0.03

0.12

Impairment in Flight Equipment

-

-

0.02

-

Secondary Offering Costs

0.01

-

0.01

-

Relocation Costs

0.01

-

0.01

-

Income Tax Effect of Adjusting Items

(0.00

)

-

(0.00

)

-

Adjusted Diluted (loss) earnings per

share

(0.03

)

0.22

0.96

0.98

(1) The income tax effect of adjusting

items, net is calculated at the Company's effective tax rate for

the applicable period

Forward Looking Statements This press release

includes “forward-looking statements” within the meaning of the

“safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995, including without limitation statements

regarding our anticipated financial performance, including all

statements set forth in the “2022 Guidance” section above such as

expectations of revenue in the range of $420 - $450 million and

adjusted EBITDA in the range of $80 - $90 million; our expectations

that demand for P2F conversions will allow monetization of the

remaining Boeing 757 package in through 2024; anticipations

regarding an increasingly favorable market for feedstock

availability within AerSale’s USM business; our plans to continue

to direct our resources toward the highest generating rates of

return for our shareholders; expectations regarding feedstock as a

cornerstone of our strategy, and our belief that we are extremely

well positioned to take advantage of the current market dynamic;

our belief that our purpose built model continues to generate

strong returns to stakeholders and is supported by best-in-class

execution; our belief that we are very well positioned to take

advantage of asset availability; our growth trajectory; the impact

of investments in our Boeing 757 program on our financial

performance; the expected operating capacity of our MRO facilities

and demand for such services; expectations of increased capacity

for third party work at our Goodyear, AZ facility; the anticipated

receipt from the FAA of an STC for our AerAware product and

expectation of sales; expectations that the AerAware technology may

prove to be mandatory equipment with airline partners; expectation

that our AerAware product will reduce costs and greenhouse gas

emissions caused by flight delays and diversions caused by weather;

and our anticipated revenue split between our two segments.

AerSale’s actual results may differ from their expectations,

estimates and projections and consequently, you should not rely on

these forward-looking statements as predictions of future events.

Words such as “expect,” “estimate,” “project,” “budget,”

“forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,”

“should,” “believes,” “predicts,” “potential,” “continue,” and

similar expressions are intended to identify such forward-looking

statements. Many factors could cause actual future events to differ

materially from the forward-looking statements in this

presentation, including without limitation, the impact of the

COVID-19 pandemic; factors adversely impacting the commercial

aviation industry; events related to the war in Ukraine including

economic and trade sanctions; the fluctuating market value of our

products; our ability to repossess mid-life commercial aircraft and

engines; our ability to comply with stringent government

regulation; the shortage of skilled personnel, including as a

result of work stoppages; the highly competitive nature of the

markets in which we operate; and risks associated with our

international operations, including geopolitical events such as the

Russian invasion of Ukraine. You should carefully consider the

foregoing factors and the other risks and uncertainties described

in the “Risk Factors” section of the Company's most recent Annual

Report on Form 10-K filed with the Securities and Exchange

Commission ("SEC"), and its other filings with the SEC, including

its subsequent quarterly reports on Form 10-Q. These filings

identify and address other important risks and uncertainties that

could cause actual events and results to differ materially from

those contained in the forward-looking statements. Forward-looking

statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements,

and AerSale Corporation assumes no obligation and does not intend

to update or revise these forward-looking statements, whether as a

result of new information, future events, or otherwise, except as

required by law

About AerSale AerSale serves airlines operating

large jets manufactured by Boeing, Airbus and McDonnell Douglas and

is dedicated to providing integrated aftermarket services and

products designed to help aircraft owners and operators to realize

significant savings in the operation, maintenance and monetization

of their aircraft, engines, and components. AerSale’s offerings

include: Aircraft & Component MRO, Aircraft and Engine Sales

and Leasing, Used Serviceable Material sales, and internally

developed ‘Engineered Solutions’ to enhance aircraft performance

and operating economics (e.g. AerSafe™, AerTrak™, and now

AerAware™).

____________________ 1 A reconciliation of

non-GAAP adjusted EBITDA guidance to net (loss) income, the most

directly comparable GAAP (Generally Accepted Accounting Principles)

measure, has not been provided due to the lack of predictability

regarding the various reconciling items such as the provision for

income taxes and depreciation and amortization, which are expected

to have a material impact on these measures and cannot be

reasonably predicted without unreasonable efforts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221108006034/en/

Media Contacts: For more information about AerSale,

please visit our website: www.AerSale.com. Follow us on: LinkedIn |

Twitter | Facebook | Instagram

AerSale: Jackie Carlon Telephone: (305) 764-3200 Email:

media.relations@aersale.com

Investor Contact: AerSale: AersaleIR@icrinc.com

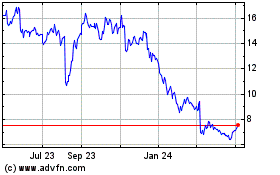

AerSale (NASDAQ:ASLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

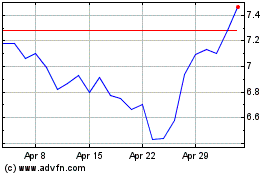

AerSale (NASDAQ:ASLE)

Historical Stock Chart

From Apr 2023 to Apr 2024