0001141284

false

0001141284

2023-11-14

2023-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (Date of earliest event reported):

November 14, 2023

Actelis Networks, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41375 |

|

52-2160309 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

4039 Clipper Court, Fremont, CA 94538

(Address of principal executive offices)

(510) 545-1045

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instructions A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

ASNS |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation

FD Disclosures.

On

November 14, 2023, Actelis Networks, Inc. (the "Company") issued a press release titled “Actelis Networks Reports Third

Quarter 2023.” A copy of the Company’s press release containing such business update is attached hereto as Exhibit 99.1 The

information set forth in the press release is incorporated by reference into this Item 7.01 of this Current Report on Form 8-K.

This Current Report on Form 8-K and Exhibit 99.1

contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are based on current

expectations and are not guarantees of future performance. Further, the forward-looking statements are subject to the limitations listed

in Exhibit 99.1 and in the other reports of the Company filed with the United States Securities and Exchange Commission (the "SEC"),

including that actual events or results may differ materially from those in the forward-looking statements.

Investors and others should note that the Company

may announce material information about its finances, product development, clinical trials and other matters to its investors using its

website (https://actelis.com/) in addition to SEC filings, press releases, public conference calls and webcasts. The Company uses these

channels to communicate with the Company’s shareholders and the public about the Company and other issues. It is possible that the

information the Company posts on these channels could be deemed to be material information. Therefore, the Company encourages investors,

the media, and others interested in the Company to review the information it posts on the Company’s website (referenced above) in

addition to following its press releases, SEC filings, public conference calls, and webcasts.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ACTELIS NETWORKS, INC. |

| |

|

| Dated: November 15, 2023 |

By: |

/s/ Yoav Efron |

| |

Name: |

Yoav Efron |

| |

Title: |

Chief Financial Officer |

2

Exhibit

99.1

Actelis

Networks Reports Third Quarter 2023

FREMONT,

CA., November 14, 2023 — Actelis Networks, Inc. (NASDAQ: ASNS) (“Actelis” or the “Company”), a market

leader in cyber-hardened, rapid deployment Hybrid-Fiber networking solutions for wide area IoT applications, today reported financial

results for the fiscal third quarter and nine months ended September 30, 2023.

“During

the third quarter of 2023 we have seen a good level of interest in our newly launched products, that are providing solutions for rapid

deployment, cost effective and secure networking for critical infrastructure for our IoT and Federal customers. We have also seen interest

from several large network operators in our new solutions aiming at connecting millions of buildings and customers in multi-tenant-building

(MDU)”, said Tuvia Barlev, Chairman and CEO of Actelis. “Those products are expected to start selling in 2024, following

successful trials and commercial agreements”.

“In

Q3 of 2023 we experienced delays in closing and converting some large opportunities to Revenues due to seasonality during summertime,

slow processing of tenders by customers and some orders received too late in the quarter to be delivered before quarter end. We expect

to catch up on those delays in the fourth quarter of 2023 and the following quarters. Our target markets, now including new offerings

such as our Gigaline 900 for the MDU market and our new federal cyber-safety (FIPS) certification for military application, now enable

additional important opportunities for large expansion, and we remain excited about our growth opportunities.”

“While

we continue to reach new markets and customers, we continue to implement cost-saving measures as discussed in our second quarter report.

It is our goal to reach more than 20% reduction in Operating Expenses in 2024 compared to 2023. Cost savings can be realized as internal

projects are coming to completion and freeing up resources, and as operational and commercial activities are relying more on outsourcing

and reducing fixed costs. Additionally, we have continued to align our business to make sure we are most effective in our markets, and

are focusing resources on the verticals that are most promising. Cyber-Security, Cyber-Aware Networking and Multi-Dwelling/Tenant Unit

buildings continue to be our focus forward,” Barlev added. “Our cost reduction initiatives improve our balance sheet as we

continue to make progress. We are also working to refinance our debt to reduce our restricted cash balance.”

Additionally,

our Net Loss for the nine months ended September 30, 2023 dramatically decreased by 48% to $4.4 million, compared to the nine months

ended September 30, 2022. We continue to aim towards reaching our break-even point.

“We

have not seen impacts to our on-going business from the geo-political conflict in the Middle-East,” Barlev added.

Third

Quarter and nine months of 2023 Financial Highlights:

| ● | Revenues

were $0.85 million for the third quarter of 2023 compared to $1.35 million in the year ago

period, as significant new orders expected to close in the third quarter were delayed to

the fourth quarter of the year. |

| ● | Revenues

were $4.6 million for the nine months ended September 30, 2023, compared to $6.3 million

in the year ago period, as new orders were delayed to the fourth quarter of the year, and

delivery of sales to Telco customers declined 66% compared to the year ago period. This includes

a reduction in software license revenues resulting from a 2 year license revenue received

in 2022 for both 2022 and 2023, which accordingly was not received in 2023 and is expected

to renew in 2024.. New orders for the nine months ended September 30, 2023, consisted of

74% from IoT customers compared to 49% in the year-ago period. |

| ● | Gross

Margin was 34% for the nine months of 2023, compared to 48% for the year ago period driven

by a product-software mix change associated with the focus shift to IoT and the SW license

renewal from 2022 for 2 years, as discussed in the highlights above. This license is expected

to be renewed in 2024. The decline is also driven by the delay of new significant orders

to the fourth quarter resulting in lower volume of sales driving fixed costs higher as percentage

of revenues and periodically reducing gross margin. |

| ● | Operating

expenses for the third quarter 2023 were $2.35 million, flat compared to $2.35 million sequentially

helped by cost reductions implemented during the second quarter of 2023, offset by investments

in sales and marketing. |

| ● | Operating

expenses for the third quarter 2023 decreased to $2.35 million compared to $2.54 million

in the year ago period, due to cost reductions implemented during the second quarter of 2023. |

| ● | Net

Loss is down 46% sequentially to $0.9 million for the third quarter of 2023, compared to

$1.6 million sequentially, and down 60% compared to $2.2 million in the year ago period,

primarily driven by financial income associated with warrant valuation reduction, as well

as foreign exchange rate differences. |

| ● | Net

Loss was down 48% to $4.4 million for the nine months ended September 30, 2023 compared to

$8.5 million in the year ago period, driven primarily by the conversion of the financial

instruments last year and financial income in the third quarter of 2023, as well as foreign

exchange rate differences. |

| ● | Non-GAAP

adjusted EBITDA loss was $1.76 million in the third quarter compared to $1.7 million in the

year ago period driven by the reduction in revenues offset by reduction in operating expenses,

and $4.6 million for the nine months ended September 30, 2023 compared to $2.6 million in

the year ago period driven primarily by the delay in new orders to the fourth quarter and

following quarters, our hardware-software mix, as well as our continued investment in sales

and marketing and as a public company. |

Recent

Company Highlights:

| ● | Actelis

received third party validation for compliance with FIPS Cyber Protection Standard Required

by Government Agencies, testing performed by UL agencies. FIPS uses cryptographic security

and other measures to protect sensitive information. This standard is recognized worldwide

and is also used by organizations outside of the government, such as finance, health care

and manufacturing organizations, as a best practice to ensure optimal security. Completion

of FIPS certification opens up those markets for Actelis. |

| ● | Launched

a new product – GigaLine 900. A Unique, Ultra Low Power In-Building Gigabit Connectivity

Solution for Instant Service Provisioning of Gigabit services to Multi-Tenant Units, making

it very fast to install, simple, and cost effective for providers to connect tenants to high-speed

internet without installing fiber throughout the building) |

| ● | We

recently announced being selected and receiving a first order to provide IoT networking solutions

to European natural gas system operator operating a high-pressure natural gas pipeline network

stretching over thousands of kilometers in a large European country. |

| ● | Hired

2GT – an agency sales team expanding our reach to major territories in Western Europe

including Germany, Scandinavia and more. |

| ● | Hired

Gary Massone, previously Director of Sales at Actelis, coming back to Actelis to help expand

the scale of the Company’s new products including the Gigaline 900 to telecom markets

in the United States. |

| ● | Michael

Golob, former EVP of Operations at Frontier Communications, joins Actelis as an advisor to

help guide Company’s introduction of new products with his vast experience. |

| ● | The

Company continues to work on cost reduction measures with a target to reach 20% reduction

as we enter 2024, to align the efficiency and effectiveness of its operation worldwide. |

| ● | The

war in Israel has not affected the Company’s operations so far, we are keeping a close

look as the situation evolves and preparing for any necessary changes. |

| ● | A

significant portion of the Company’s operations is located in Israel. During the 9

months ended September 30, 2023, the US Dollar strengthened against the Israeli Shekel by

8% driving cost savings. |

Fiscal

Third Quarter and Nine Months of 2023 Financial Results:

Revenues

for the three months ended September 30, 2023 amounted to $0.85 million compared to $1.35 million for the three months ended September

30, 2022. The decrease from the corresponding period was primarily attributable to a decrease of $0.2 million of revenues generated from

North America and a decrease of $0.3 of revenues generated from Asia Pacific and Europe, the Middle East and Africa.

Revenues

for the nine months ended September 30, 2023 amounted to $4.6 compared to $6.3 million for the nine months ended September 30, 2022.

The decrease from the corresponding period was primarily attributable to a decrease of $1.4 million in revenues generated from North

America and a decrease of $0.4 million in revenues generated from Europe, the Middle East and Africa, offset by an increase of $0.1 million

in revenues generated from Asia Pacific.

Cost

of revenues for the three months ended September 30, 2023, amounted to $0.6 million compared to $0.8 million for the three months

ended September 30, 2022. The decrease from the corresponding period was primarily attributable to the decrease in revenues as well as

change in the product mix.

Cost

of revenues for the nine months ended September 30, 2023, amounted to $3.0 million compared to $3.3 million for the nine months ended

September 30, 2022. The decrease from the corresponding period was mainly due to the decrease in revenues as well as change in the product

mix, partially offset by the higher effect of fixed costs as the percent of the lower revenues.

Gross

profit for the three months ended September 30, 2023, amounted to $0.2 million or 27% of revenue, compared to $0.5 million, or 40%

of revenue for the three months ended September 30, 2022. The decrease from the corresponding period was mainly due to change in product

mix, partially offset by the higher effect of fixed costs as the percent of the lower revenues.

Gross

profit for the nine months ended September 30, 2023, amounted to $1.5 million or 34% of revenue, compared to $3.1 million, or 48% of

revenue for the nine months ended September 30, 2022. The decrease from the corresponding period was mainly due to change in product

mix, partially offset by the higher effect of fixed costs as the percent of the lower revenues.

Research

and development expenses for the three months ended September 30, 2023, amounted to $0.7 million compared to $0.7 million for the

three months ended September 30, 2022.

Research

and development expenses for the nine months ended September 30, 2023, amounted to $2.1 million compared to $2.0 million for the nine

months ended September 30, 2022. The increase was mainly due to an increase in professional services related to research and development.

Sales

and marketing expenses for the three months ended September 30, 2023, amounted to $0.7 million compared to $0.8 for the three months

ended September 30, 2022. The decrease was mainly due to a decrease in commission and travel expenses.

Sales

and marketing expenses for the nine months ended September 30, 2023 amounted to $2.3 million compared to $2.4 for the nine months ended

September 30, 2022. The decrease was mainly due to a decrease in commission and travel expenses.

General

and administrative expenses for the three months ended September 30, 2023, amounted to $1.0 million compared to $1.0 million for

the three months ended September 30, 2022. There was a decrease driven by cost reduction measures, offset by one time financing related

expenses.

General

and administrative expenses for the nine months ended September 30, 2023, amounted to $2.8 million compared to $2.7 million for the nine

months ended September 30, 2022.The increase was driven by financing related expenses, partially offset by cost reduction measures.

Operating

loss for the three months ended September 30, 2023, was $2.1 million, compared to an operating loss of $2.0 million for the three

months ended September 30, 2022. The increase was mainly due to the decreases in revenues and gross margin.

Operating

loss for the nine months ended September 30, 2023, was $5.7 million, compared to an operating loss of $4.1 million for the nine months

ended September 30, 2022. The increase was mainly due to the decreases in revenues and gross margin while continuing to invest in Sales

and Marketing.

Other

Financial income, net and interest expenses for the three months ended September 30, 2023, was $1.3 million (including $0.2 million

interest expenses) compared to financial expenses, net of $0.2 million (including $0.2 million interest expenses) for the three months

ended September 30, 2022. The increase in financial income was due to the decrease in fair value of warrants in the amount of $1.3 million,

as well as exchange rate differences in the amount of $0.2 for the three months ended September 30, 2023, compared to $0.05 in the three

months ended September 30, 2022.

Other

Financial income, net and interest expenses for the nine months ended September 30, 2023, was $1.3 million (including $0.5 million interest

expenses) compared to financial expenses, net of $4.4 million (including $0.6 million interest expenses) for the nine months ended September

30, 2022. During the nine months ended September 30, 2023, the Company recorded financial income in connection with a decrease in fair

value of warrants in the amount of $1.7 million, compared to an increase in fair value of various financial instruments prior to the

IPO completed in May 2022, such as a convertible loan, note and warrants in the amount of $4.5 million. In addition, the Company recorded

income in the amount of $0.4 million from exchange rate differences, compared to $0.7 during the nine months ended September 30, 2022.

Net

loss for the three months ended September 30, 2023, was $0.9 million, compared to net loss of $2.2 million for the three months ended

September 30, 2022. This decrease was primarily due to the increase in financial income, net related to the decrease in fair value of

warrants.

Net

loss for the nine months ended September 30, 2023, was $4.4 million, compared to net loss of $8.5 million for the nine months ended September

30, 2022. This decrease was primarily due to the decrease in revenues and gross margin offset by a decrease in financial expenses, net

resulting from the conversion of the financial instruments the Company had such as a convertible loan, note and warrants from the IPO

completed in May 2022.

Adjusted

EBITDA loss, a non-GAAP measurement of operating performance (reconciled below to Net Loss), for the three months ended September

30, 2023, was $1.76 million, compared to $1.7 million in the comparable year-ago period. This was primarily a result of product mix change

which resulted in a decreased gross profit and a decrease in other one-time costs and expenses.

Adjusted

EBITDA loss, a non-GAAP measurement of operating performance (reconciled below to Net Loss), for the nine months ended September 30,

2023, was $4.6 million, compared to $2.6 million in the comparable year-ago period. This was primarily attributed to product mix changes,

as well as expenses associated with being a public company and a decrease in other one-time costs and expenses.

The

Company reported a balance sheet as of September 30, 2023 with $11.2 million of total assets compared to $14.8 million as of December

31, 2022, $10.3 million of total liabilities, commitments and contingencies compared to $11.6 million as of December 31, 2022, and $0.9

million of shareholders’ equity compared to shareholders equity of $3.3 million as of December 31, 2022.

About

Actelis Networks, Inc.

Actelis

Networks, Inc. (NASDAQ: ASNS) is a market leader in cyber-hardened, rapid-deployment networking solutions for wide-area IoT applications

including federal, state and local government, ITS, military, utility, rail, telecom and campus applications. Actelis’ unique portfolio

of hybrid fiber-copper, environmentally hardened aggregation switches, high density Ethernet devices, advanced management software and

cyber-protection capabilities, unlocks the hidden value of essential networks, delivering safer connectivity for rapid, cost-effective

deployment. For more information, please visit www.actelis.com.

Use

of Non-GAAP Financial Information

Non-GAAP

Adjusted EBITDA, and backlog of open orders are Non-GAAP financial measures. In addition to reporting financial results in accordance

with GAAP, we provide Non-GAAP operating results adjusted for certain items, including: financial expenses, which are interest, financial

instrument fair value adjustments, exchange rate differences of assets and liabilities, stock based compensation expenses, depreciation

and amortization expense, tax expense, and impact of development expenses ahead of product launch. We adjust for the items listed above

and show Non-GAAP financial measures in all periods presented, unless the impact is clearly immaterial to our financial statements. When

we calculate the tax effect of the adjustments, we include all current and deferred income tax expense commensurate with the adjusted

measure of pre-tax profitability.

Cautionary

Statement Concerning Forward-Looking Statements

This

press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995 and other securities laws. Words such as “expects,” “anticipates,” “intends,” “plans,”

“believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended

to identify forward-looking statements. Forward-looking statements are not historical facts, and are based upon management’s current

expectations, beliefs and projections, many of which, by their nature, are inherently uncertain. Such expectations, beliefs and projections

are expressed in good faith. However, there can be no assurance that management’s expectations, beliefs and projections will be

achieved, and actual results may differ materially from what is expressed in or indicated by the forward-looking statements. Forward-looking

statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed

in the forward-looking statements. For a more detailed description of the risks and uncertainties affecting the Company, reference is

made to the Company’s reports filed from time to time with the SEC, including, but not limited to, the risks detailed in the Company’s

final prospectus (Registration No. 333-264321), filed with the SEC on May 16, 2022. Investors and security

holders are urged to read these documents free of charge on the SEC’s web site at http://www.sec.gov. Forward-looking statements

speak only as of the date the statements are made. The Company assumes no obligation to update forward-looking statements to reflect

actual results, subsequent events or circumstances, changes in assumptions or changes in other factors affecting forward-looking information

except to the extent required by applicable securities laws. If the Company does update one or more forward-looking statements, no inference

should be drawn that the Company will make additional updates with respect thereto or with respect to other forward-looking statements.

References and links to websites have been provided as a convenience, and the information contained on such websites is not incorporated

by reference into this press release. Actelis is not responsible for the contents of third-party websites.

Investor

Relations Contact:

Kirin

Smith

PCG

Advisory

Ksmith@pcgadvisory.com

-Financial

Tables to Follow-

ACTELIS

NETWORKS, INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(U.

S. dollars in thousands except for share and per share amounts)

| | |

September 30,

2023 | | |

December 31,

2022 | |

| Assets | |

| | |

| |

| CURRENT ASSETS: | |

| | |

| |

| Cash and cash equivalents | |

| 682 | | |

| 3,943 | |

| Short term deposits | |

| 254 | | |

| 1,622 | |

| Restricted bank deposits | |

| 450 | | |

| 451 | |

| Trade receivables, net of allowance for credit losses of $125 as of September 30, 2023, and December 31, 2022. | |

| 715 | | |

| 3,034 | |

| Inventories | |

| 2,698 | | |

| 1,179 | |

| Prepaid expenses and other current assets | |

| 616 | | |

| 678 | |

| TOTAL CURRENT ASSETS | |

| 5,415 | | |

| 10,907 | |

| | |

| | | |

| | |

| NON-CURRENT ASSETS: | |

| | | |

| | |

| Property and equipment, net | |

| 66 | | |

| 80 | |

| Prepaid expenses | |

| 592 | | |

| 492 | |

| Restricted cash | |

| 2,407 | | |

| 336 | |

| Restricted bank deposits | |

| 2,036 | | |

| 2,027 | |

| Severance pay fund | |

| 225 | | |

| 239 | |

| Operating lease right of use assets | |

| 403 | | |

| 726 | |

| Long term deposits | |

| 14 | | |

| 12 | |

| TOTAL NON-CURRENT ASSETS | |

| 5,743 | | |

| 3,912 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

| 11,158 | | |

| 14,819 | |

ACTELIS

NETWORKS, INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS (continued)

UNAUDITED

(U.

S. dollars in thousands except for share and per share amounts)

| | |

September 30,

2023 | | |

December 31,

2022 | |

| Liabilities and redeemable convertible preferred stock, warrants to placement agent and shareholders’ equity | |

| | |

| |

| CURRENT LIABILITIES: | |

| | |

| |

| Current maturities of long-term loans | |

| 1,229 | | |

| 553 | |

| Warrants | |

| 8 | | |

| 8 | |

| Trade payables | |

| 2,192 | | |

| 1,781 | |

| Deferred revenues | |

| 386 | | |

| 484 | |

| Employee and employee-related obligations | |

| 732 | | |

| 793 | |

| Accrued royalties | |

| 924 | | |

| 900 | |

| Current maturities of operating lease liabilities | |

| 255 | | |

| 445 | |

| Other accrued liabilities | |

| 905 | | |

| 1,238 | |

| TOTAL CURRENT LIABILITIES | |

| 6,631 | | |

| 6,202 | |

| | |

| | | |

| | |

| NON-CURRENT LIABILITIES: | |

| | | |

| | |

| Long-term loan, net of current maturities | |

| 3,175 | | |

| 4,625 | |

| Deferred revenues | |

| — | | |

| 164 | |

| Operating lease liabilities | |

| 129 | | |

| 237 | |

| Accrued severance | |

| 256 | | |

| 278 | |

| Other long-term liabilities | |

| 25 | | |

| 48 | |

| TOTAL NON-CURRENT LIABILITIES | |

| 3,585 | | |

| 5,352 | |

| TOTAL LIABILITIES | |

| 10,216 | | |

| 11,554 | |

| COMMITMENTS AND CONTINGENCIES (Note 10) | |

| | | |

| | |

| REDEEMABLE CONVERTIBLE PREFERRED STOCK: | |

| | | |

| | |

| Redeemable convertible preferred stock - $0.0001 par value, 10,000,000 authorized as of September 30, 2023, December 31, 2022. None issued and outstanding as of September 30, 2023, December 31, 2022. | |

| — | | |

| — | |

| | |

| | | |

| | |

| WARRANTS TO PLACEMENT AGENT (Note 11(e)) | |

| 104 | | |

| — | |

| SHAREHOLDERS’ EQUITY (**): | |

| | | |

| | |

| Common stock, $0.0001 par value: 30,000,000 shares authorized as of September 30, 2023, and December 31, 2022; 2,694,179 and 1,737,986 shares issued and outstanding as of September 30,2023 and December 31, 2022, respectively | |

| 1 | | |

| 1 | |

| Non-voting common stock, $0.0001 par value: 2,803,774 shares authorized as of September 30, 2023, and December 31, 2022, None issued and outstanding as of September 30, 2023, and December 31, 2022. | |

| — | | |

| — | |

| Additional paid-in capital | |

| 38,594 | | |

| 36,666 | |

| Accumulated deficit | |

| (37,757 | ) | |

| (33,402 | ) |

| TOTAL SHAREHOLDERS’ EQUITY | |

| 838 | | |

| 3,265 | |

| TOTAL LIABILITIES AND REDEEMABLE CONVERTIBLE PREFERRED STOCK WARRANTS TO PLACEMENT AGENT AND SHAREHOLDERS’ EQUITY | |

| 11,158 | | |

| 14,819 | |

| |

(**) |

Adjusted to reflect reverse

stock split, see note 3(f). |

The

accompanying notes are an integral part of these condensed consolidated financial statements (Unaudited).

ACTELIS

NETWORKS, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(UNAUDITED)

(U.

S. dollars in thousands except for share and per share amounts)

| | |

Three months ended

September 30, | | |

Nine months ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| REVENUES | |

| 845 | | |

| 1,348 | | |

| 4,589 | | |

| 6,297 | |

| COST OF REVENUES | |

| 619 | | |

| 813 | | |

| 3,043 | | |

| 3,258 | |

| GROSS PROFIT | |

| 226 | | |

| 535 | | |

| 1,546 | | |

| 3,039 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES: | |

| | | |

| | | |

| | | |

| | |

| Research and development expenses, net | |

| 691 | | |

| 723 | | |

| 2,117 | | |

| 2,049 | |

| Sales and marketing expenses, net | |

| 691 | | |

| 790 | | |

| 2,332 | | |

| 2,357 | |

| General and administrative expenses, net | |

| 971 | | |

| 1,028 | | |

| 2,805 | | |

| 2,730 | |

| TOTAL OPERATING EXPENSES | |

| 2,353 | | |

| 2,541 | | |

| 7,254 | | |

| 7,136 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING LOSS | |

| (2,127 | ) | |

| (2,006 | ) | |

| (5,708 | ) | |

| (4,097 | ) |

| Interest expense | |

| (161 | ) | |

| (198 | ) | |

| (512 | ) | |

| (622 | ) |

| Other Financial income (expenses), net | |

| 1,421 | | |

| (3 | ) | |

| 1,865 | | |

| (3,781 | ) |

| NET COMPREHENSIVE LOSS FOR THE PERIOD | |

| (867 | ) | |

| (2,207 | ) | |

| (4,355 | ) | |

| (8,500 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share attributable to common shareholders – basic and diluted | |

$ | (0.32 | ) | |

$ | (*) (1.27 | ) | |

$ | (*) (1.93 | ) | |

$ | (*) (8.77 | ) |

| Weighted average number of common stocks used in computing net loss per share – basic and diluted | |

| 2,685,626 | | |

| (*) 1,731,753 | | |

| (*) 2,254,235 | | |

| (*) 968,721 | |

| (*) |

Adjusted to reflect reverse

stock split, see note 3(f). |

The

accompanying notes are an integral part of these condensed consolidated financial statements (Unaudited).

Non-GAAP

Financial Measures

| (U.S. dollars in thousands) | |

Three months Ended

September 30,

2023 | | |

Three months Ended

September 30,

2022 | | |

Nine months Ended

September 30,

2023 | | |

Nine months Ended

September 30,

2022 | |

| Revenues | |

$ | 845 | | |

$ | 1,348 | | |

$ | 4,589 | | |

$ | 6,297 | |

| GAAP net loss | |

| (867 | ) | |

| (2,207 | ) | |

| (4,355 | ) | |

| (8,500 | ) |

| Interest Expense | |

| 161 | | |

| 198 | | |

| 512 | | |

| 622 | |

| Other Financial expenses (income), net | |

| (1,421 | ) | |

| 3 | | |

| (1,865 | ) | |

| 3,781 | |

| Tax Expense | |

| 18 | | |

| 28 | | |

| 58 | | |

| 102 | |

| Fixed asset depreciation expense | |

| 7 | | |

| 9 | | |

| 20 | | |

| 29 | |

| Stock based compensation | |

| 106 | | |

| 13 | | |

| 298 | | |

| 41 | |

| Research and development, capitalization | |

| 113 | | |

| 143 | | |

| 371 | | |

| 423 | |

| Other one-time costs and expenses | |

| 120 | | |

| 115 | | |

| 343 | | |

| 916 | |

| Non-GAAP Adjusted EBITDA | |

| (1,763 | ) | |

| (1,698 | ) | |

| (4,618 | ) | |

| (2,586 | ) |

| GAAP net loss margin | |

| (102.60 | )% | |

| (163.72 | )% | |

| (94.90 | )% | |

| (134.98 | )% |

| Adjusted EBITDA margin | |

| (208.64 | )% | |

| (125.96 | )% | |

| (100.63 | )% | |

| (41.07 | )% |

| | |

For the three months ended

September 30 | | |

For the nine months ended

September 30 | |

| (U.S. dollars in thousands) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

$ | 845 | | |

$ | 1,348 | | |

$ | 4,589 | | |

$ | 6,297 | |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP Adjusted EBITDA | |

| (1,763 | ) | |

| (1,698 | ) | |

| (4,618 | ) | |

| (2,586 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| As a percentage of revenues | |

| (208.64 | )% | |

| (125.96 | )% | |

| (100.63 | )% | |

| (41.07 | )% |

ACTELIS

NETWORKS, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

Nine months ended

September 30, | |

| | |

2023 | | |

2022 | |

| | |

U.S. dollars in thousands | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | |

| |

| Net loss for the period | |

| (4,355 | ) | |

| (8,500 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation | |

| 20 | | |

| 29 | |

| Changes in fair value related to warrants to lenders and investors | |

| (1,658 | ) | |

| 1,068 | |

| Warrant issuance costs | |

| 223 | | |

| — | |

| Inventories write-downs | |

| 132 | | |

| 106 | |

| Exchange rate differences | |

| (365 | ) | |

| (798 | ) |

| Share-based compensation | |

| 298 | | |

| 41 | |

| Changes in fair value related to convertible loan | |

| — | | |

| 1,648 | |

| Changes in fair value related to convertible note | |

| — | | |

| 1,753 | |

| Financial income from short and long term bank deposit | |

| (78 | ) | |

| — | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Trade receivables | |

| 2,319 | | |

| 37 | |

| Net change in operating lease assets and liabilities | |

| 25 | | |

| (62 | ) |

| Inventories | |

| (1,651 | ) | |

| (271 | ) |

| Prepaid expenses and other current assets | |

| 62 | | |

| (251 | ) |

| Long term prepaid expenses | |

| (100 | ) | |

| (245 | ) |

| Trade payables | |

| 411 | | |

| (1,067 | ) |

| Deferred revenues | |

| (262 | ) | |

| 145 | |

| Other current liabilities | |

| (185 | ) | |

| 406 | |

| Other long-term liabilities | |

| (30 | ) | |

| 185 | |

| Net cash used in operating activities | |

| (5,194 | ) | |

| (5,776 | ) |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Short term deposits | |

| 1,363 | | |

| (68 | ) |

| Long term Restricted bank deposits | |

| 75 | | |

| — | |

| Long term deposits | |

| (2 | ) | |

| — | |

| Purchase of property and equipment | |

| (6 | ) | |

| (34 | ) |

| Net cash provided by (used in) investing activities | |

| 1,430 | | |

| (102 | ) |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Proceeds from exercise of options | |

| 10 | | |

| * | |

| Proceeds from issuance of common stocks, pre-funded warrants and warrants (see Note 11d) | |

| 3,500 | | |

| — | |

| Proceeds from initial public offering and private placement | |

| — | | |

| 18,712 | |

| Underwriting discounts and commissions and other offering costs | |

| (291 | ) | |

| (2,175 | ) |

| Repurchase of common stock | |

| (50 | ) | |

| — | |

| Repayment of long-term loan | |

| (583 | ) | |

| (509 | ) |

| Net cash provided by financing activities | |

| 2,586 | | |

| 16,028 | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS AND RESTRICTED CASH | |

| (12 | ) | |

| 46 | |

| | |

| | | |

| | |

| INCREASE (DECREASE) IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | |

| (1,190 | ) | |

| 10,150 | |

| BALANCE OF CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF THE PERIOD | |

| 4,279 | | |

| 795 | |

| BALANCE OF CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT END OF THE PERIOD | |

| 3,089 | | |

| 10,945 | |

| * |

Represents an amount less

than $1 thousands. |

The

accompanying notes are an integral part of these condensed consolidated financial statements (Unaudited).

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

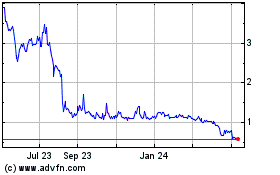

Actelis Networks (NASDAQ:ASNS)

Historical Stock Chart

From Apr 2024 to May 2024

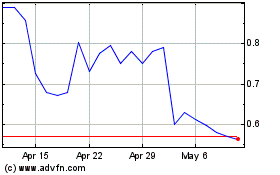

Actelis Networks (NASDAQ:ASNS)

Historical Stock Chart

From May 2023 to May 2024