Academy Sports and Outdoors, Inc. (Nasdaq: ASO) ("Academy" or the

"Company") today announced its financial results for the first

quarter ended May 4, 2024.

Steve Lawrence, Chief Executive Officer,

commented, "As expected, our first quarter results reflect that our

customers remain under pressure in the current economic

environment. We will navigate through the remainder of the year by

continuing to lean into our position as the value leader in our

space, while also inspiring customers to shop through introductions

and expansions of new and innovative products. We will also

continue making strategic investments in our long-range growth

initiatives. We are pleased that we drove a positive comp in our

new stores and omnichannel business. Academy has the right elements

in place to achieve our long-range goals: a well-established

business model, an experienced leadership team and a strong balance

sheet."

|

First Quarter Operating Results($ in

millions, except per share data) |

Thirteen Weeks Ended |

Change |

|

May 4, 2024 |

April 29, 2023 |

% |

|

Net sales |

$ |

1,364.2 |

|

|

$ |

1,383.6 |

|

|

(1.4 |

) |

% |

|

Comparable sales(1) |

|

(5.7 |

) |

% |

|

(7.3 |

) |

% |

|

| Income

before income tax |

$ |

97.7 |

|

|

$ |

118.7 |

|

|

(17.7 |

) |

% |

| Net

income |

$ |

76.5 |

|

|

$ |

94.0 |

|

|

(18.6 |

) |

% |

| Adjusted

net income(2) |

$ |

81.6 |

|

|

$ |

103.0 |

|

|

(20.8 |

) |

% |

| Earnings

per common share, diluted |

$ |

1.01 |

|

|

$ |

1.19 |

|

|

(15.1 |

) |

% |

|

Adjusted earnings per common share, diluted(1) |

$ |

1.08 |

|

|

$ |

1.30 |

|

|

(16.9 |

) |

% |

(1) Fiscal 2023 had a 53rd week, so the Company

is using a shifted comp sales calculation which compares weeks 1-13

in Q1 2024 to weeks 2-14 in fiscal 2023.(2) Adjusted net

income and adjusted earnings per common share, diluted are non-GAAP

measures. See "Non-GAAP Measures" and "Reconciliations of GAAP

to Non-GAAP Financial Measures" below for reconciliations of

non-GAAP financial measures to their most directly comparable GAAP

financial measures.

|

|

|

Thirteen Weeks Ended |

Change |

|

Balance Sheet($ in millions) |

May 4, 2024 |

April 29, 2023 |

% |

|

Cash and cash equivalents |

$ |

378.1 |

|

|

$ |

295.5 |

|

|

28.0 |

|

% |

|

Merchandise inventories, net |

$ |

1,356.8 |

|

|

$ |

1,386.5 |

|

|

(2.1 |

) |

% |

|

Long-term debt, net |

$ |

484.1 |

|

|

$ |

584.1 |

|

|

(17.1 |

) |

% |

|

|

Thirteen Weeks Ended |

Change |

|

Capital Allocation($ in

millions) |

May 4, 2024 |

April 29, 2023 |

% |

|

Share repurchases |

$ |

123.5 |

|

|

$ |

50.3 |

|

|

145.5 |

|

% |

|

Dividends paid |

$ |

8.2 |

|

|

$ |

6.9 |

|

|

18.8 |

|

% |

Subsequent to the end of the first quarter, on

June 6, 2024, Academy's Board of Directors declared a quarterly

cash dividend of $0.11 per share of common stock. The dividend is

payable on July 18, 2024, to stockholders of record as of the close

of business on June 20, 2024.

Carl Ford, Chief Financial Officer, said,

"Academy generated $200 million in cash from operations during the

quarter. We believe that investing this cash into the pillars of

our long-range plan will result in long-term, sustainable sales and

profit growth for Academy and our shareholders. To that end, in the

first quarter, we invested $32 million of capital back into the

Company, repurchased $124 million in stock, and paid $8 million in

dividends. We are focused on driving traffic, managing our

inventory to maintain margins, and controlling expenses as we

invest in our growth initiatives."

New Store OpeningsAcademy

opened two new stores during the first quarter. The Company plans

to open 15 to 17 stores in 2024.

2024 OutlookAcademy is

reiterating its previous sales and net income guidance for fiscal

2024, while updating its earnings per share forecast to reflect the

share repurchase activity completed in the first quarter.

|

|

Updated Guidance |

|

Previous Guidance |

|

(in millions, except per share data) |

Low end |

|

High end |

|

Low end |

|

High end |

|

Net sales |

|

no change |

|

|

|

no change |

|

|

$ |

6,070.0 |

|

|

|

$ |

6,350.0 |

|

|

Sales growth |

|

no change |

|

|

|

no change |

|

|

|

(1.5 |

) |

% |

|

|

+3.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comparable sales |

|

no change |

|

|

|

no change |

|

|

|

(4.0 |

) |

% |

|

|

1.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

margin rate |

|

no change |

|

|

|

no change |

|

|

|

34.3 |

% |

|

|

|

34.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP net

income |

|

no change |

|

|

|

no change |

|

|

$ |

455 |

|

|

|

$ |

530 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP

earnings per common share, diluted |

$ |

6.05 |

|

|

$ |

7.05 |

|

|

$ |

5.90 |

|

|

|

$ |

6.90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted

weighted average common shares |

|

~75 |

|

|

|

~75 |

|

|

|

~77 |

|

|

|

|

~77 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital

expenditures |

|

no change |

|

|

|

no change |

|

|

$ |

225 |

|

|

|

$ |

275 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

free cash flow(1) |

|

no change |

|

|

|

no change |

|

|

$ |

290 |

|

|

|

$ |

375 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Adjusted free cash flow is a non-GAAP

measure. We have not reconciled it to the most comparable GAAP

measure because it is not possible to do so without unreasonable

efforts given the uncertainty and potential variability of

reconciling items , which are dependent on future events and often

outside of management's control and could be significant. Because

such items cannot be predicted with the level of precision

required, we are unable to provide an estimate of the most closely

comparable GAAP measure at this time. Note: Fiscal year 2023

included 53 weeks compared to 52 weeks in fiscal 2024.

The earnings per common share guidance reflects

a tax rate of approximately 22.0% and does not include any

potential future share repurchases.

Conference Call InfoAcademy

will host a conference call today at 10:00 a.m. Eastern Time to

discuss its financial results. The call will be webcast at

investors.academy.com. The following information is provided for

those who would like to participate in the conference call:

|

U.S. callers |

1-877-407-3982 |

|

International callers |

1-201-493-6780 |

|

Passcode |

13746678 |

| |

|

A replay of the conference call will be

available for approximately 30 days on the Company's website.

About Academy Sports +

OutdoorsAcademy is a leading full-line sporting goods and

outdoor recreation retailer in the United States. Originally

founded in 1938 as a family business in Texas, Academy has grown to

284 stores across 18 states as of the end of the quarter. Academy’s

mission is to provide “Fun for All” and Academy fulfills this

mission with a localized merchandising strategy and value

proposition that strongly connects with a broad range of consumers.

Academy’s product assortment focuses on key categories of outdoor,

apparel, footwear and sports & recreation through both leading

national brands and a portfolio of private label brands.

Non-GAAP MeasuresAdjusted

EBITDA, Adjusted EBIT, Adjusted Net Income, Adjusted Earnings per

Common Share, and Adjusted Free Cash Flow have been presented in

this press release as supplemental measures of financial

performance that are not required by, or presented in accordance

with, generally accepted accounting principles (“GAAP”). The

Company believes that the presentation of these non-GAAP measures

is useful to investors as it provides additional information on

comparisons between periods by excluding certain items that affect

overall comparability. The Company uses these non-GAAP financial

measures for business planning purposes, to consider underlying

trends of its business, and in measuring its performance relative

to others in the market, and believes presenting these measures

also provides information to investors and others for understanding

and evaluating trends in the Company’s operating results or

measuring performance in the same manner as the Company’s

management. Non-GAAP financial measures should be considered in

addition to, and not as an alternative for, the Company’s reported

results prepared in accordance with GAAP. The calculation of these

non-GAAP financial measures may differ from similar measures

reported by other companies and may not be comparable to other

similarly titled measures. For additional information on these

non-GAAP financial measures, please see our Annual Report for the

fiscal year ended February 3, 2024 (the "Annual Report"), and our

Quarterly Report for the thirteen weeks ended May 4, 2024 (the

"Quarterly Report"), which may be updated from time to time in our

periodic filings with the Securities and Exchange Commission (the

"SEC"), which are accessible on the SEC's website at

www.sec.gov.

See “Reconciliations of GAAP to Non-GAAP

Financial Measures” below for reconciliations of non-GAAP financial

measures used in this press release to their most directly

comparable GAAP financial measures.

Forward Looking StatementsThis

press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements are based on Academy’s current

expectations and are not guarantees of future performance.

Forward-looking statements may incorporate words such as “believe,”

“expect,” “forward,” “ahead,” “opportunities,” “plans,”

“priorities,” “goals,” “future,” “short/long term,” “will,”

“should,” or the negative version of these words or other

comparable words. The forward-looking statements include, among

other things, statements regarding the Company’s fiscal 2024

outlook, the Company’s strategic plans and financial objectives,

growth of the Company’s business and operations, the Company’s

payment of dividends and declaration of future dividends, including

the timing and amount thereof, share repurchases by the Company,

the Company's expectations regarding its future performance, and

future financial condition, and other such matters, and are subject

to various risks, uncertainties, assumptions, or changes in

circumstances that are difficult to predict or quantify. Actual

results may differ materially from these expectations due to

changes in global, regional, or local economic, business,

competitive, market, regulatory and other factors that could affect

overall consumer spending or our industry, including the possible

effects of ongoing macroeconomic challenges, inflation and

increases in interest rates, or changes to the financial health of

our customers, many of which are beyond Academy's control. These

and other important factors that could cause actual results to

differ materially from those in the forward-looking statements are

set forth in Academy's filings with the SEC, including the Annual

Report and the Quarterly Report, under the caption "Risk Factors,"

as may be updated from time to time in our periodic filings with

the SEC. Any forward-looking statement in this press release speaks

only as of the date of this release. Academy undertakes no

obligation to publicly update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as may be required by any

applicable securities laws.

|

Investor Contact |

Media

Contact |

| Matt Hodges |

Allan Rojas |

| VP, Investor Relations |

Director, Communications |

| 281-646-5362 |

281-944-6048 |

| matt.hodges@academy.com |

allan.rojas@academy.com |

|

ACADEMY SPORTS AND OUTDOORS,

INC.CONSOLIDATED STATEMENTS OF

INCOME(Unaudited)(Amounts in

thousands, except per share data) |

| |

| |

Thirteen Weeks Ended |

| |

May 4, 2024 |

|

Percentage of Sales(1) |

|

April 29, 2023 |

|

Percentage of Sales(1) |

|

Net sales |

$ |

1,364,220 |

|

|

100.0 |

|

% |

|

$ |

1,383,609 |

|

|

100.0 |

|

% |

| Cost of goods sold |

|

908,427 |

|

|

66.6 |

|

% |

|

|

916,494 |

|

|

66.2 |

|

% |

|

Gross margin |

|

455,793 |

|

|

33.4 |

|

% |

|

|

467,115 |

|

|

33.8 |

|

% |

| Selling, general and

administrative expenses |

|

353,410 |

|

|

25.9 |

|

% |

|

|

340,919 |

|

|

24.6 |

|

% |

|

Operating income |

|

102,383 |

|

|

7.5 |

|

% |

|

|

126,196 |

|

|

9.1 |

|

% |

| Interest expense, net |

|

9,486 |

|

|

0.7 |

|

% |

|

|

11,230 |

|

|

0.8 |

|

% |

| Write off of deferred loan

costs |

|

449 |

|

|

0.0 |

|

% |

|

|

— |

|

|

0.0 |

|

% |

| Other (income), net |

|

(5,204 |

) |

|

(0.4 |

) |

% |

|

|

(3,713 |

) |

|

(0.3 |

) |

% |

|

Income before income taxes |

|

97,652 |

|

|

7.2 |

|

% |

|

|

118,679 |

|

|

8.6 |

|

% |

| Income tax expense |

|

21,187 |

|

|

1.6 |

|

% |

|

|

24,709 |

|

|

1.8 |

|

% |

|

Net income |

$ |

76,465 |

|

|

5.6 |

|

% |

|

$ |

93,970 |

|

|

6.8 |

|

% |

| |

|

|

|

|

|

|

|

| Earnings Per Common

Share: |

|

|

|

|

|

|

|

|

Basic |

$ |

1.03 |

|

|

|

|

$ |

1.22 |

|

|

|

|

Diluted |

$ |

1.01 |

|

|

|

|

$ |

1.19 |

|

|

|

| |

|

|

|

|

|

|

|

| Weighted Average Common Shares

Outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

73,993 |

|

|

|

|

|

76,862 |

|

|

|

|

Diluted |

|

75,798 |

|

|

|

|

|

79,288 |

|

|

|

(1) Column may not add due to rounding

|

ACADEMY SPORTS AND OUTDOORS,

INC.CONSOLIDATED BALANCE

SHEETS(Unaudited)(Amounts in

thousands, except per share data) |

| |

| |

May 4, 2024 |

|

February 3, 2024 |

|

April 29, 2023 |

|

ASSETS |

|

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

378,145 |

|

|

$ |

347,920 |

|

|

$ |

295,536 |

|

|

Accounts receivable - less allowance for doubtful accounts of

$1,817, $2,217 and $2,286, respectively |

|

13,700 |

|

|

|

19,371 |

|

|

|

10,412 |

|

|

Merchandise inventories, net |

|

1,356,811 |

|

|

|

1,194,159 |

|

|

|

1,386,457 |

|

|

Prepaid expenses and other current assets |

|

68,320 |

|

|

|

83,450 |

|

|

|

34,622 |

|

|

Assets held for sale |

|

— |

|

|

|

— |

|

|

|

1,763 |

|

|

Total current assets |

|

1,816,976 |

|

|

|

1,644,900 |

|

|

|

1,728,790 |

|

| |

|

|

|

|

|

| PROPERTY AND

EQUIPMENT, NET |

|

456,594 |

|

|

|

445,209 |

|

|

|

365,024 |

|

| RIGHT-OF-USE

ASSETS |

|

1,116,222 |

|

|

|

1,111,237 |

|

|

|

1,087,854 |

|

| TRADE

NAME |

|

578,364 |

|

|

|

578,236 |

|

|

|

577,799 |

|

| GOODWILL |

|

861,920 |

|

|

|

861,920 |

|

|

|

861,920 |

|

| DEFERRED TAX

ASSETS |

|

— |

|

|

|

— |

|

|

|

— |

|

| OTHER NONCURRENT

ASSETS |

|

43,803 |

|

|

|

35,211 |

|

|

|

20,547 |

|

|

Total assets |

$ |

4,873,879 |

|

|

$ |

4,676,713 |

|

|

$ |

4,641,934 |

|

| |

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

Accounts payable |

$ |

735,563 |

|

|

$ |

541,077 |

|

|

$ |

712,643 |

|

|

Accrued expenses and other current liabilities |

|

262,048 |

|

|

|

217,932 |

|

|

|

221,388 |

|

|

Current lease liabilities |

|

121,465 |

|

|

|

117,849 |

|

|

|

112,333 |

|

|

Current maturities of long-term debt |

|

3,000 |

|

|

|

3,000 |

|

|

|

3,000 |

|

|

Total current liabilities |

|

1,122,076 |

|

|

|

879,858 |

|

|

|

1,049,364 |

|

| |

|

|

|

|

|

| LONG-TERM DEBT,

NET |

|

484,084 |

|

|

|

484,551 |

|

|

|

584,093 |

|

| LONG-TERM LEASE

LIABILITIES |

|

1,098,799 |

|

|

|

1,091,294 |

|

|

|

1,058,869 |

|

| DEFERRED TAX

LIABILITIES, NET |

|

253,069 |

|

|

|

254,796 |

|

|

|

257,120 |

|

| OTHER LONG-TERM

LIABILITIES |

|

10,330 |

|

|

|

11,564 |

|

|

|

11,526 |

|

|

Total liabilities |

|

2,968,358 |

|

|

|

2,722,063 |

|

|

|

2,960,972 |

|

| |

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

| |

|

|

|

|

|

| STOCKHOLDERS'

EQUITY: |

|

|

|

|

|

|

Preferred stock, $0.01 par value, authorized 50,000,000 shares;

none issued and outstanding |

|

— |

|

|

|

— |

|

|

|

— |

|

|

Common stock, $0.01 par value, authorized 300,000,000 shares;

72,590,530; 74,349,927 and 76,439,594 issued and outstanding as of

May 4, 2024, February 3, 2024, and April 29, 2023,

respectively. |

|

726 |

|

|

|

743 |

|

|

|

764 |

|

|

Additional paid-in capital |

|

240,559 |

|

|

|

242,098 |

|

|

|

229,633 |

|

|

Retained earnings |

|

1,664,236 |

|

|

|

1,711,809 |

|

|

|

1,450,565 |

|

|

Stockholders' equity |

|

1,905,521 |

|

|

|

1,954,650 |

|

|

|

1,680,962 |

|

|

Total liabilities and stockholders' equity |

$ |

4,873,879 |

|

|

$ |

4,676,713 |

|

|

$ |

4,641,934 |

|

|

ACADEMY SPORTS AND OUTDOORS,

INC.CONSOLIDATED STATEMENTS OF CASH

FLOWS(Unaudited)(Amounts in

thousands) |

| |

| |

Thirteen Weeks Ended |

| |

May 4, 2024 |

|

April 29, 2023 |

| CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

|

|

|

Net income |

$ |

76,465 |

|

|

$ |

93,970 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

|

28,853 |

|

|

|

26,261 |

|

|

Non-cash lease expense |

|

6,137 |

|

|

|

2,165 |

|

|

Equity compensation |

|

6,138 |

|

|

|

11,382 |

|

|

Amortization of deferred loan and other costs |

|

624 |

|

|

|

674 |

|

|

Deferred income taxes |

|

(1,726 |

) |

|

|

(1,923 |

) |

|

Write off of deferred loan costs |

|

449 |

|

|

|

— |

|

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable, net |

|

5,671 |

|

|

|

6,091 |

|

|

Merchandise inventories, net |

|

(162,652 |

) |

|

|

(102,940 |

) |

|

Prepaid expenses and other current assets |

|

15,129 |

|

|

|

13,125 |

|

|

Other noncurrent assets |

|

(3,392 |

) |

|

|

(3,215 |

) |

|

Accounts payable |

|

186,475 |

|

|

|

26,776 |

|

|

Accrued expenses and other current liabilities |

|

20,819 |

|

|

|

(31,673 |

) |

|

Income taxes payable |

|

21,922 |

|

|

|

12,642 |

|

|

Other long-term liabilities |

|

(1,235 |

) |

|

|

(1,200 |

) |

|

Net cash provided by operating activities |

|

199,677 |

|

|

|

52,135 |

|

| |

|

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

Capital expenditures |

|

(32,227 |

) |

|

|

(40,464 |

) |

|

Purchases of intangible assets |

|

(128 |

) |

|

|

(83 |

) |

|

Net cash used in investing activities |

|

(32,355 |

) |

|

|

(40,547 |

) |

| |

|

|

|

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

Proceeds from Revolving Credit Facilities |

|

3,900 |

|

|

|

— |

|

|

Repayment of Revolving Credit Facilities |

|

(3,900 |

) |

|

|

— |

|

|

Repayment of Term Loan |

|

(750 |

) |

|

|

(750 |

) |

|

Debt issuance fees |

|

(5,690 |

) |

|

|

— |

|

|

Repurchase of common stock for retirement |

|

(122,425 |

) |

|

|

(50,015 |

) |

|

Proceeds from exercise of stock options |

|

2,789 |

|

|

|

7,090 |

|

|

Taxes paid related to net share settlement of equity awards |

|

(2,839 |

) |

|

|

(2,593 |

) |

|

Dividends paid |

|

(8,182 |

) |

|

|

(6,929 |

) |

|

Net cash used in financing activities |

|

(137,097 |

) |

|

|

(53,197 |

) |

| |

|

|

|

| NET INCREASE

(DECREASE) IN CASH AND CASH EQUIVALENTS |

|

30,225 |

|

|

|

(41,609 |

) |

| CASH AND CASH

EQUIVALENTS AT BEGINNING OF PERIOD |

|

347,920 |

|

|

|

337,145 |

|

| CASH AND CASH

EQUIVALENTS AT END OF PERIOD |

$ |

378,145 |

|

|

$ |

295,536 |

|

|

ACADEMY SPORTS AND OUTDOORS,

INC.RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL

MEASURES(Unaudited) |

|

|

Adjusted EBITDA and Adjusted

EBIT

We define “Adjusted EBITDA” as net income (loss)

before interest expense, net, income tax expense and depreciation,

amortization, and impairment, and other adjustments included in the

table below. We define “Adjusted EBIT” as Adjusted EBITDA less

depreciation and amortization. We describe these adjustments

reconciling net income (loss) to Adjusted EBITDA and Adjusted EBIT

in the following table (amounts in thousands):

| |

Thirteen Weeks Ended |

| |

May 4, 2024 |

|

April 29, 2023 |

|

Net income |

$ |

76,465 |

|

|

$ |

93,970 |

|

| Interest expense,

net |

|

9,486 |

|

|

|

11,230 |

|

| Income tax

expense |

|

21,187 |

|

|

|

24,709 |

|

| Depreciation and

amortization |

|

28,853 |

|

|

|

26,261 |

|

| Equity

compensation (a) |

|

6,138 |

|

|

|

11,382 |

|

| Write off of

deferred loan costs |

|

449 |

|

|

|

— |

|

|

Adjusted EBITDA (b) |

$ |

142,578 |

|

|

$ |

167,552 |

|

| Less: Depreciation

and amortization |

|

(28,853 |

) |

|

|

(26,261 |

) |

|

Adjusted EBIT (b) |

$ |

113,725 |

|

|

$ |

141,291 |

|

| |

|

|

|

|

|

| (a) Represents

non-cash charges related to equity-based compensation, which vary

from period to period depending on certain factors such as timing

and valuation of awards, achievement of performance targets and

equity award forfeitures. |

| (b) Effective

January 28, 2023, we no longer exclude pre-opening expenses from

our computations of Adjusted EBITDA and Adjusted EBIT. Adjusted

EBITDA and Adjusted EBIT for the thirteen weeks ended April 29,

2023 have been revised to the current period computation

methodology. |

Adjusted Net Income and Adjusted

Earnings Per Common Share

We define “Adjusted Net Income” as net income

(loss) plus other adjustments included in the table below, less the

tax effect of these adjustments. We define “Adjusted Earnings per

Common Share, Basic” as Adjusted Net Income divided by the basic

weighted average common shares outstanding during the period and

“Adjusted Earnings per Common Share, Diluted” as Adjusted Net

Income divided by the diluted weighted average common shares

outstanding during the period. We describe these adjustments

reconciling net income (loss) to Adjusted Net Income, and Adjusted

Earnings Per Common Share in the following table (amounts in

thousands, except per share data):

| |

Thirteen Weeks Ended |

| |

May 4, 2024 |

|

April 29, 2023 |

|

Net income |

$ |

76,465 |

|

|

$ |

93,970 |

|

| Equity compensation (a) |

|

6,138 |

|

|

|

11,382 |

|

| Write off of deferred loan

costs |

|

449 |

|

|

|

— |

|

| Tax effects of these

adjustments (b) |

|

(1,432 |

) |

|

|

(2,370 |

) |

|

Adjusted Net Income (c) |

$ |

81,620 |

|

|

$ |

102,982 |

|

| |

|

|

|

| Earnings per common

share: |

|

|

|

|

Basic |

$ |

1.03 |

|

|

$ |

1.22 |

|

|

Diluted |

$ |

1.01 |

|

|

$ |

1.19 |

|

| Adjusted earnings per common

share: |

|

|

|

|

Basic |

$ |

1.10 |

|

|

$ |

1.34 |

|

|

Diluted |

$ |

1.08 |

|

|

$ |

1.30 |

|

| Weighted average common shares

outstanding: |

|

|

|

|

Basic |

|

73,993 |

|

|

|

76,862 |

|

|

Diluted |

|

75,798 |

|

|

|

79,288 |

|

| |

|

|

|

| |

| (a) Represents

non-cash charges related to equity-based compensation, which vary

from period to period depending on certain factors such as timing

and valuation of awards, achievement of performance targets and

equity award forfeitures. |

| (b) For the thirteen

weeks ended May 4, 2024 and April 29, 2023, this represents the

estimated tax effect (by using the projected full year tax rates

for the respective years) of the total adjustments made to arrive

at Adjusted Net Income. |

| (c ) Effective

January 28, 2023, we no longer exclude pre-opening expenses from

our computations of Adjusted Net Income. |

Adjusted Free Cash Flow

We define “Adjusted Free Cash Flow” as net cash

provided by (used in) operating activities less net cash used in

investing activities. We describe these adjustments reconciling net

cash provided by operating activities to Adjusted Free Cash Flow in

the following table (amounts in thousands):

| |

Thirteen Weeks Ended |

| |

May 4, 2024 |

|

April 29, 2023 |

|

Net cash provided by operating activities |

$ |

199,677 |

|

|

$ |

52,135 |

|

| Net cash used in investing

activities |

|

(32,355 |

) |

|

|

(40,547 |

) |

|

Adjusted Free Cash Flow |

$ |

167,322 |

|

|

$ |

11,588 |

|

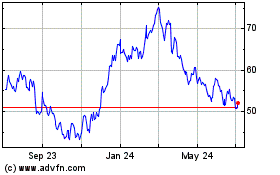

Academy Sports and Outdo... (NASDAQ:ASO)

Historical Stock Chart

From Dec 2024 to Jan 2025

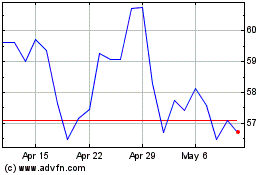

Academy Sports and Outdo... (NASDAQ:ASO)

Historical Stock Chart

From Jan 2024 to Jan 2025