UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☑ Definitive Additional Materials

☐ Soliciting Material Under Rule 14a-12

|

AMTECH SYSTEMS, INC. |

(Name of Registrant as Specified in its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☑ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

AMTECH SYSTEMS, INC.

58 S. RIVER DRIVE, #370

TEMPE, ARIZONA 85288

SUPPLEMENT NO. 1 TO PROXY STATEMENT RELATING TO

THE 2025 ANNUAL MEETING OF SHAREHOLDERS

On January 24, 2025, Amtech Systems, Inc., an Arizona corporation (the “Company” or “Amtech”), filed a definitive proxy statement (the “Proxy Statement”) with the Securities and Exchange Commission, which was distributed in connection with the Company’s annual meeting of shareholders to be held on March 5, 2025 at Amtech Systems, Inc., 58 S. River Drive, 3rd Floor Meeting Room, Tempe, Arizona, USA (the “Annual Meeting” or “Meeting”). Capitalized terms not defined in this Supplement shall have the meanings set forth in the Proxy Statement.

This supplement (this “Supplement”), dated February 24, 2025, should be read in conjunction with the Proxy Statement. The purpose of this Supplement is to clarify certain information regarding the voting standards and the effect of broker non-votes and abstentions on the quorum determination and the outcome of the vote on the proposals to be considered at the Annual Meeting. Except as specifically supplemented by the information contained in this Supplement, all information set forth in the Proxy Statement remains unchanged. From and after the date of this Supplement, any references to the “Proxy Statement” are to the Proxy Statement as amended and supplemented by this Supplement. If you have already submitted a proxy and do not wish to change your vote, you need not take any further action. If you have submitted a proxy and wish to change your vote, you may revoke your proxy and/or change your vote at any time before the Annual Meeting by: voting again over the internet or by telephone; signing and delivering a new proxy card bearing a later date; delivering a written notice by mail to our Corporate Secretary at 58 S. River Drive, #370, Tempe, Arizona 85288 stating that the proxy is revoked; or attending the Annual Meeting and voting in-person (note that attendance at the Annual Meeting will not, by itself, revoke a proxy unless you vote again electronically at the Annual Meeting). Please note, however, that if your shares of Common Stock are held through a broker or other nominee and you would like to change your voting instructions, please follow the instructions provided by your broker.

The following sections in the Proxy Statement are amended and restated as follows:

What Constitutes a Quorum

The presence, in person or by proxy, of the holders of a majority of the voting power of the issued and outstanding shares of Common Stock as of the Record Date entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes are included in the number of shares of Common Stock present at the Meeting for purposes of determining a quorum. An abstention is a shareholder’s affirmative choice to decline to vote on a proposal. Under Arizona law, abstentions are counted as shares of Common Stock present and entitled to vote at the Annual Meeting. A broker “non-vote” occurs when a nominee holding shares of Common Stock for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.

What Vote is Required to Approve Each Item

•Proposal 1 – Election of Directors: If a quorum is present, the five nominees who receive a plurality of the votes cast at the Annual Meeting will be elected. Broker non-votes and abstentions will have no effect on the results of the vote for the election of directors.

•Proposal 2 – Ratification of the Independent Registered Public Accountants: If a quorum is present, a majority of votes cast by holders of Common Stock represented and entitled to vote at the Annual Meeting will constitute a ratification of the appointment of KPMG LLP as our independent registered public accountants. An abstention with respect to this proposal will be counted for the

purposes of determining the number of shares of Common Stock entitled to vote that are present in person or by proxy. Accordingly, an abstention will have the effect of an against vote. Broker non-votes will not affect the outcome of this proposal.

•Proposal 3 – Advisory Vote On Named Executive Officer Compensation: If a quorum is present, a majority of votes cast by holders of Common Stock represented and entitled to vote at the Annual Meeting will constitute approval of the advisory vote on the compensation of our named executive officers. Because the vote is advisory, it will not be binding upon the Board. However, the Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements. An abstention with respect to this proposal will be counted for the purposes of determining the number of shares of Common Stock entitled to vote that are present in person or by proxy. Accordingly, an abstention will have the effect of an against vote. Broker non-votes will not affect the outcome of this proposal.

•Proposal 4 – Amendment to the 2022 Equity Incentive Plan: If a quorum is present, a majority of votes cast by holders of Common Stock represented and entitled to vote at the Annual Meeting will constitute approval of the amendment to the 2022 Equity Incentive Plan. An abstention with respect to this proposal will be counted for the purposes of determining the number of shares of Common Stock entitled to vote that are present in person or by proxy. Accordingly, an abstention will have the effect of an against vote. Broker non-votes will not affect the outcome of this proposal.

How Votes are Counted

Inspectors of election will be appointed for the Annual Meeting. The inspectors of election will determine whether or not a quorum is present and will tabulate votes cast by proxy or in person at the Annual Meeting. If you have returned valid proxy instructions or attend the Annual Meeting in person, your Common Stock will be counted for the purpose of determining whether there is a quorum. Abstentions and broker non-votes will be included in the determination of the number of shares of Common Stock represented for a quorum. Generally, broker non-votes occur when a beneficial owner does not provide instructions to their broker with respect to a matter on which the broker is not permitted to vote without instructions from the beneficial owner. In tabulating the voting result for any particular proposal, shares of Common Stock that constitute broker non-votes are not considered entitled to vote on that proposal. Accordingly, broker non-votes will not affect the outcome of any matter being voted on at the Annual Meeting, assuming that a quorum is obtained. If a proposal requires a majority of votes cast, abstentions typically have no effect because they are not considered “votes cast.” If a proposal requires either (i) a majority of shares of Common Stock present at the Annual Meeting or represented by proxy and entitled to vote on the proposal or (ii) a majority of all outstanding shares of Common Stock, abstentions will effectively count as votes against such proposal because they are included in the total number of shares of Common Stock present or outstanding but do not contribute to the affirmative vote count.

The following subsection under “PROPOSAL NO. 1 – ELECTION OF DIRECTORS” in the Proxy Statement is amended and restated as follows:

Vote Required

Assuming a quorum is present, the five nominees receiving the highest number of votes cast at the Annual Meeting will be elected. There is cumulative voting in the election of directors. This means that each holder of Common Stock present at the Annual Meeting, either in person or by proxy, will have an aggregate number of votes in the election of directors equal to five (the number of persons nominated for election as directors) multiplied by the number of shares of Common Stock held by such shareholder on the Record Date. The resulting aggregate number of votes may be cast by the shareholder for the election of any single nominee, or the shareholder may distribute such votes among any number or all of the nominees. In order to exercise cumulative voting, the voting shareholder must complete the proxy card and indicate cumulative voting in accordance with the instructions included on the proxy card. Broker non-votes and abstentions will have no effect on the results of the vote for the election of directors.

The following subsection under “PROPOSAL NO. 2 – TO APPROVE THE RATIFICATION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS” in the Proxy Statement is amended and restated as follows:

Vote Required

Assuming a quorum is present, a majority of votes cast by holders of Common Stock represented and entitled to vote at the Annual Meeting is required to ratify the selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2025. Even if the selection is ratified, however, the Audit Committee may in its discretion select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and of our stockholders. An abstention with respect to this proposal will be counted for the purposes of determining the number of shares of Common Stock entitled to vote that are present in person or by proxy. Accordingly, an abstention will have the effect of an against vote. Broker non-votes will not affect the outcome of this proposal.

The Board of Directors recommends a vote “FOR” the ratification of KPMG LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2025.

The section titled, “PROPOSAL NO. 3 – TO VOTE ON AN ADVISORY (NON-BINDING) RESOLUTION TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION” in the Proxy Statement is amended to include the following new subsection:

Vote Required

Assuming a quorum is present, a majority of votes cast by holders of Common Stock represented and entitled to vote at the Annual Meeting will constitute approval of the advisory vote on the compensation of our named executive officers. An abstention with respect to this proposal will be counted for the purposes of determining the number of shares of Common Stock entitled to vote that are present in person or by proxy. Accordingly, an abstention will have the effect of an against vote. Broker non-votes will not affect the outcome of this proposal.

The following subsection under “PROPOSAL NO. 4 – TO APPROVE THE AMENDMENT OF THE AMTECH SYSTEMS, INC. 2022 EQUITY INCENTIVE PLAN” in the Proxy Statement is amended and restated as follows:

Vote Required

Assuming a quorum is present, a majority of votes cast by holders of Common Stock represented and entitled to vote at the Annual Meeting is required to approve the amendment to the 2022 Equity Incentive Plan. An abstention with respect to this proposal will be counted for the purposes of determining the number of shares of Common Stock entitled to vote that are present in person or by proxy. Accordingly, an abstention will have the effect of an against vote. Broker non-votes will not affect the outcome of this proposal.

The Board of Directors recommends and encourages you to vote “FOR” the approval of the amendment to the Equity Incentive Plan.

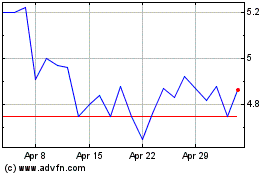

Amtech Systems (NASDAQ:ASYS)

Historical Stock Chart

From Jan 2025 to Feb 2025

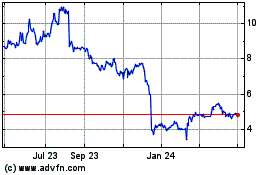

Amtech Systems (NASDAQ:ASYS)

Historical Stock Chart

From Feb 2024 to Feb 2025