SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-163

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of December 2023

Alterity

Therapeutics Limited

(Name

of Registrant)

Level 14, 350 Collins Street,

Melbourne, Victoria 3000 Australia

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

This

Form 6-K is being incorporated by reference into our Registration Statement on Form S-8 (Files No. 333-251073, 333-248980

and 333-228671) and our

Registration Statements on Form F-3 (Files No. 333-274816, 333-251647, 333-231417

and 333-250076)

ALTERITY

THERAPEUTICS LIMITED

(a

development stage enterprise)

The

following exhibits are submitted:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Alterity Therapeutics Limited |

| |

|

| |

By: |

/s/ Geoffrey P. Kempler |

| |

|

Geoffrey P. Kempler |

| |

|

Chairman |

Date:

December 29, 2023

2

Exhibit 99.1

ALTERITY THERAPEUTICS

LIMITED

[ACN 080 699 065]

(“the Company”)

PROSPECTUS

An offer for the issue of:

| ● | up to an aggregate of

571,428,571 fully paid ordinary shares (SPP Shares) at an issue price of $0.0035 (0.35 cents) per SPP Share; and |

| ● | one (1) free-attaching

option for each SPP Share issued, each option having an exercise price of $0.007 (0.7 cents), expiring on 31 August 2024 and which upon

exercise entitle the holder to one (1) fully paid ordinary share in the Company (Short Dated Options); and |

| ● | one (1) free-attaching

option for every three (3) SPP Shares issued, each option having an exercise price of $0.01 (1 Australian cent), expiring on 31 August

2026 and which upon exercise entitle the holder to one (1) fully paid ordinary share in the Company) (Long Dated Options). Fractional

entitlements to Long Dated Options will be rounded down, |

to Eligible Shareholders under a security

purchase plan to raise up to $2 million before costs (SPP Offer). Each Eligible Shareholder may apply for up to a maximum of 8,571,429

SPP Shares ($30,000) (together with free-attaching Short Dated Options and Long Dated Options) under the SPP Offer.

The SPP Offer opens at 9am on (Melbourne

time) on Wednesday, 10 January 2024 and closes at 5pm (Melbourne time) on Thursday, 25 January 2024, which dates may change without notice.

This document is

important and should be read in its entirety

It is important that you read this Prospectus

carefully before deciding to accept the SPP Offer described in this Prospectus. If you do not understand its contents you should consult

your stockbroker, accountant or other professional adviser.

The

securities offered under this Prospectus are considered speculative

CORPORATE

DIRECTORY

ALTERITY THERAPEUTICS LIMITED

[ACN 080 699 065]

Directors

Geoffrey Kempler - Non-Executive Chairman

Lawrence Gozlan - Non-Executive Director

Peter Marks - Non-Executive Director

Brian Meltzer - Non-Executive Director

Chief Executive Officer

David Stamler

Chief Financial Officer

Kathryn Andrews^

Company Secretary

Phillip Hains

Registered Office

Level 3, 62 Lygon Street

Carlton Victoria 3053

Tel: +61 3 9824 5254

Share Registrar

Computershare Investor Services Pty Ltd

Yarra Falls, 452 Johnston Street

Abbotsford Victoria 3067

ASX Code

ATH

Company Web Site

www.alteritytherapeutics.com

Offer Web Site

www.computersharecas.com.au/ATHSPP

To view annual reports, shareholder and company

information, news announcements, background information on the Company’s business and historical information, visit https://alteritytherapeutics.com.

| ^ | Ms Andrews’ resignation as Chief Financial Officer and

the appointment of the Company Secretary, Mr Phillip Hains both with effect at 31 January 2024 was announced to ASX on 21 December 2023. |

IMPORTANT NOTICES

This prospectus (Prospectus) is dated 29

December 2023. A copy of this Prospectus was lodged with the Australian Securities & Investments Commission (ASIC) on the same

date. Neither ASIC nor ASX Limited (ASX) nor their respective officers take any responsibility as to the contents of this Prospectus.

The SPP Offer under this Prospectus close at 5pm

(Melbourne time) on Thursday, 25 January 2024, which date may change without notice. Subject to the Corporations Act, the ASX Listing

Rules and other applicable laws, the Company reserves the right to close the SPP Offer early, to extend the Closing Date and/or any other

dates, or not to proceed with the SPP Offer described in this Prospectus.

This Prospectus is for an offer of continuously

quoted securities (being the SPP Shares) and options over continuously quoted securities (being the Short Dated Options and the Long Dated

Options) and accordingly is not required by the Corporations Act to contain all the information normally required to be set out in a document

of this type. The Prospectus contains and applies to the offer of SPP Shares, Short Dated Options and Long Dated Options under the SPP

Offer.

This Prospectus incorporates by reference certain

information contained in documents lodged with ASIC. A document incorporated by reference in this Prospectus in this manner may be obtained

free of charge from the Company during the application period.

The Company has adopted a target market determinations

(TMD) under which the Company identifies the target market for the offer of Short Dated Options and Long Dated Options under this

Prospectus. The Company will only distribute this Prospectus to those investors who fall within the target market as set out in the TMD

available on the website of the Company (www.alteritytherapeutics.com.au).

By making an application under the SPP Offer,

an investor warrants they have read and understood the TMD and that they fall within the target market set out in the TMD.

No person is authorised to give any information

or make any representation in connection with this Prospectus that is not contained in this Prospectus. Any information or representation

not so contained may not be relied on as having been authorised by the Company in connection with the SPP Offer of SPP Shares.

This Prospectus does not constitute an offer in

any place in which, or to any person to whom, it would not be lawful to make such an offer. Persons resident in countries outside Australia

and New Zealand should consult their professional advisers as to whether any governmental or other consents are required or whether formalities

need to be observed to enable them to acquire securities and observe such restrictions and requirements. Any failure to comply with such

restrictions may constitute a violation of applicable securities laws. Payment by BPAY®1

or EFT or return of a duly completed personalised application form will be taken by the Company to constitute a representation that there

has been no breach of such requirements.

No action has been taken to register or qualify

the SPP Offer or the SPP Shares, Short Dated Options and Long Dated Options, or otherwise to permit a public offering of the SPP Shares,

Short Dated Options and/or Long Dated Options, in any jurisdiction outside Australia. The SPP Shares, Short Dated Options and/or Long

Dated Options have not been, and will not be, registered under the United States Securities Act of 1933 and should not be offered or sold

within the USA.

No count has been taken of particular

objectives, financial situation or needs of recipients of this Prospectus. Recipients of this Prospectus should have regard to their own

objectives, financial situation and needs. Recipients of this Prospectus should make their own independent investigation and assessment

of the Company, its business, assets and liabilities, prospects and profits and losses, and risks associated with investing. Independent

expert advice should be sought before any decision is made to apply for SPP Shares, Short Dated Options and/or Long Dated Options.

All monetary amounts in this Prospectus are in

Australian dollars unless otherwise stated.

All dates and times are dates and times in Melbourne,

Victoria, Australia unless otherwise stated.

The securities offered under this Prospectus are

considered highly speculative.

| 1 ® | Registered to Bpay Pty Ltd ABN 69 079 137 518 |

TIMETABLE

| Record Date identifying Eligible Shareholders |

7.00 pm on 21 November 2023 |

| Lodgement of Prospectus |

29 December 2023 |

| Opening Date and Prospectus dispatched to Eligible Shareholders |

10 January 2024 |

| Closing Date |

5.00 pm on 25 January 2024 |

| Notice of results of the SPP Offer given to ASX |

2 February 2024 |

| Proposed issue date of SPP Shares |

Before noon 2 February 2024 |

The above dates should be regarded as indicative

only and may change without notice. All dates and times are Melbourne, Victoria, Australia time. Subject to the Corporations Act 2001

(Cth), the ASX Listing Rules and other applicable laws, the Company reserves the right to change the above dates, close the SPP Offer

before the date stated above, extend the Closing Date and subsequent dates or not proceed with the SPP Offer. The Company reserves the

right to extend the Closing Date by making an announcement of the extension to ASX. No securities will be issued on the basis of this

Prospectus after 29 January 2025, being the expiry date of this Prospectus.

CONTENTS

| 1. |

Details of the SPP Offer |

10 |

| 2. |

Purpose of the SPP Offer |

13 |

| 3. |

Financial effect of the SPP Offer |

14 |

| 4. |

Effect on Control and the Capital Structure of the Company |

16 |

| 5. |

Risks |

18 |

| 6. |

Acceptance Instructions |

21 |

| 7. |

Continuous Disclosure Obligations |

24 |

| 8. |

ASX Announcements |

25 |

| 9. |

Terms of securities offered |

26 |

| 10. |

Director’s interests |

29 |

| 11. |

Taxation |

30 |

| 12. |

Overseas Investors |

30 |

| 13. |

Privacy |

31 |

| 14. |

Electronic Prospectus |

31 |

| 15. |

Investment Decisions |

32 |

| 16. |

Future Performance |

32 |

| 17. |

Consents |

32 |

| 18. |

Enquiries |

32 |

KEY INVESTMENT RISKS – SUMMARY

Please read and consider this Prospectus in full

and in conjunction with matters which have or may be referred to in the Company’s ASX announcements before applying for securities

under the SPP Offer. Section 5 of this Prospectus contains an overview of some of the key risks associated with investment in the Company,

including risks associated with the SPP Offer as set out below:

| ● | Value of securities and share market conditions

including liquidity risk. |

| ● | Potential taxation consequences. |

| ● | Dilution risks arising from the issue of SPP

Shares (and, if applicable, the exercise of Short Dated Options and/or Long Dated Options into Shares). |

| ● | There being no guarantee that the share price

of the Company will be greater than the exercise price of Short Dated Options and/or Long Dated Options prior to their respective expiry

dates. |

The Company provided detailed disclosure of business

risk factors in its item 3.D of its 2023 Annual Report for the reporting period ended 30 June 2023 that was released to ASX on 31 August

2023. The 2023 Annual Report has been lodged with ASIC and item 3.D of the 2023 Annual Report is incorporated by reference into this Prospectus

in accordance with Section 712 of the Corporations Act. A copy of the 2023 Annual Report including item 3.D is available at www2.asx.com.au

(search code “ATH”) and can be obtained from the Company upon request.

A selection of risk factors as described in item

3.D of the 2023 Annual Report are set out below:

| (a) | The Company has a history of operating losses. |

| (b) | The Company relies on research institutions to conduct its

clinical trials and may not be able to secure and maintain research institutions to conduct future trials. The institutions that the

Company works with have their own limits and procedures that influence or limit the Company’s ability to conduct research and development

and conduct of clinical trials. The Company’s reliance on these research institutions provides it with less control over the timing

and cost of clinical trials, clinical study management personnel and the ability to recruit subjects. |

| (c) | If the Company does not obtain the necessary governmental approvals,

it will be unable to develop or commercialise its pharmaceutical products. |

| (d) | The Company’s success depends upon its ability to protect

its intellectual property and its proprietary technology, to operate without infringing the proprietary rights of third parties and to

obtain marketing exclusivity for its products and technologies. |

| (e) | The Company consider proprietary trade secrets and/or confidential

know-how and unpatented know-how to be important to its business. |

| (f) | The Company’s research and development efforts will be

seriously jeopardised if it is unable to retain key personnel and cultivate key academic and scientific collaborations. |

| (g) | The testing, marketing and sale of human health care products

also entails an inherent risk of product liability. |

| (h) | The biotechnology and pharmaceutical industries are subject

to rapid and significant technological change. The Company’s competitors are numerous and include major pharmaceutical companies,

biotechnology firms, universities and other research institutions. |

Further details of the above risk factors, as

well as information regarding additional business risk factors that may impact upon the Company, are set out in item 3.D of the 2023 Annual

Report as described above.

ABOUT THE SPP OFFER - SUMMARY

The following summary provides only a limited

overview of the SPP Offer being made by the Company. Further detail is set out in this Prospectus. Please read and consider this Prospectus

in full before making any decision regarding applying under the SPP Offer or otherwise investing in the Company.

| Topic |

Summary |

For more information see: |

| What is the SPP Offer? |

The SPP Offer is an offer of:

● up to 571,428,571 SPP Shares; and

● one

(1) Short Dated Option for every one (1) SPP Share issued; and

● one (1) Long Dated Option for every three (3) SPP Shares issued (with

fractional entitlements to Long Dated Options rounded down),

to Eligible Shareholders pursuant to

a security purchase plan to raise up to $2 million before costs (SPP). The issue of securities under the SPP was approved by shareholders

at the general meeting of the Company held on 29 December 2023 (Meeting).

|

Section 1.1 |

| What are the terms of SPP Shares? |

SPP Shares are fully paid ordinary shares that have the same terms as, and rank equally with, the existing fully paid ordinary shares in the capital of the Company. |

Section 9.1 |

|

What is the issue price of SPP Shares?

|

$0.0035 (0.35 cents) per SPP Share. |

Section 1.1 and 1.2 |

|

What are the terms of Short Dated Options?

|

Short Dated Options are unlisted and each have

an exercise price of A$0.007 (0.7 Australian cents), expire of 31 August 2024 and, upon exercise, entitle the holder to one Share.

The full terms of Short Dated Options are set

out in Section 9.2.

|

Section 9.2 |

|

What are the terms of Long Dated Options?

|

Long Dated Options each have an exercise price

of A$0.01 (1 Australian cent), expire of 31 August 2026 and, upon exercise, entitle the holder to one Share.

The full terms of Long Dated Options are set out

in Section 9.3.

|

Section 9.3 |

| Am I an Eligible Shareholder? |

Eligible Shareholders for the SPP Offer under this Prospectus are shareholders with addresses in Australia and New Zealand as recorded in the register of members of the Company on the Record Date. |

Section 1.1 |

| Record Date |

The Record Date was 7:00 pm on 21 November 2023, being the business day before the date on which details of the security purchase plan were first announced to ASX. |

Section 1.1 |

| What is my maximum entitlement? |

Each Eligible Shareholder is entitled to apply for and receive a parcel of up to 8,571,429 SPP Shares ($30,000), being the maximum entitlement of an Eligible Shareholder (subject to scale back as described in Section 1.9) together with free-attaching Short Dated Options and Long Dated Options as described in Section 1.1 (Entitlement). |

Sections 1.1, 1.2, 1.5, 1.6 and 1.9 |

| Topic |

Summary |

For more information see: |

|

What if I am not an Eligible Shareholder?

|

If you are not an Eligible Shareholder then the SPP Offer is not being made to you and consequently you cannot apply for and receive SPP Shares under the SPP Offer in this Prospectus. |

Section 1.7 |

| Is there a minimum or maximum subscription? |

Eligible Shareholders will only be able to apply

for and receive SPP Shares in the following parcels:

$1,000 – 285,714 Shares (min) $17,500 – 5,000,000 Shares

$2,500 – 714,286 Shares $20,000 – 5,714,286 Shares

$5,000 – 1,428,571 Shares $22,500 – 6,428,571 Shares

$7,500 – 2,142,857 Shares $25,000 – 7,142,857 Shares

$10,000 – 2,857,143 Shares $27,500 – 7,857,143 Shares

$12,500 –3,571,429 Shares $30,000 – 8,571,429 Shares

(max)

$15,000 – 4,285,714 Shares

|

Sections 1.2, 1.4 and 1.5 |

|

Can I trade my Entitlement?

|

No, you cannot trade your Entitlement to apply

for and receive SPP Shares.

|

Section 1.3 |

|

Is the SPP Offer underwritten?

|

No, the SPP Offer is not underwritten. |

Section 1.6 |

|

How much will be raised from the SPP Offer?

|

Up to $2 million before costs will

be raised from the SPP Offer. There is no minimum amount that may be raised under the SPP Offer.

|

Section 1.1 |

|

What is the use of funds raised under the SPP Offer?

|

Funds raised under the SPP Offer will be applied towards funding clinical trials, including providing ongoing funding of Alterity’s Phase 2 clinical trials in MSA, ATH434-201 and ATH434-202 and planning for a potential Phase 3 clinical trial in MSA, continuing discovery and research efforts in neurodegenerative diseases, including Parkinson’s Disease, and for general working capital purposes including meeting costs of the SPP Offer. |

Section 2 |

|

What can I do with my Entitlement?

|

You can do any of the following:

●

take up all of your Entitlement (by accepting the SPP Offer in full);

●

take up part of your Entitlement (by accepting part of the SPP Offer)

and allow the balance to lapse (and the balance will form part of the Shortfall); or

●

do nothing, in which case all your Entitlement will lapse and form part

of the Shortfall.

|

Sections 1.6 and 6.1 |

| Topic |

Summary |

For more information see: |

|

What will happen if I do not take up my Entitlement?

|

If you do not take up all of your Entitlement

by the Closing Date the SPP Shares to which you were entitled will form part of the Shortfall. Your interest in the Company may also be

diluted.

|

Sections 1.11 and 4.3 |

|

What will happen if the SPP Offer is oversubscribed?

|

If total

applications exceed the maximum amount to be raised, the Company may scale back (reduce) the number of SPP Shares issued in response to

an application. If a scale back is necessary, the scale back will be applied on a pro rata basis based on the size of an applicant’s

shareholding as at the Record Date. The Company will refund to the applicant the difference between the application monies received by

the Company and application monies payable for the number of SPP Shares actually issued to the applicant. Refunds will be paid to the

applicant either by EFT (if bank account details are held by the Share Registry) or cheque. No interest shall be paid on refunded

application monies.

|

Section 1.9 |

|

What will happen if the SPP Offer is not fully subscribed?

|

SPP Shares (and free-attaching Short Dated Options

and Long Dated Options) not taken up will form part of the Shortfall. The Company may, but is not obliged to, choose place the

Shortfall to professional, sophisticated and other exempt investors who are eligible and are invited to participate by the Company in

its discretion, subject to the recipient being a person eligible to receive SPP Shares and the free attaching Short Dated Options and

Long Dated Options under the conditions of the shareholder approval obtained at the Meeting (including, pursuant to the waiver granted

by ASX announced on 11 December 2023 that shareholders who voted on the resolution are not eligible to subscribe for Shortfall securities)

and satisfaction of regulatory requirements. The issue of any securities from the Shortfall which is not in accordance with the above

would use the placement capacity available to the Company under the ASX Listing Rules.

The Company has engaged MST Financial Services

Pty Ltd (MST) to assist the Company with placement of the Shortfall (if any). The Company has agreed to pay MST a fee of 5% of

amounts for which written commitments to subscribe for shares from the Shortfall are received prior to the opening of the SPP Offer from

investors identified by MST who are eligible. The amount of commitments may exceed the Shortfall (if any), in which case the amounts allocated

to the investors will be adjusted in consultation with MST, with the fee remaining payable on the total committed.

|

Section 1.11 |

|

How do I accept the SPP Offer?

|

If you wish to take up (accept the offer for)

all or part of your Entitlement under the SPP Offer you must pay by BPAY® or for NZ holders who are unable to pay via BPAY you may

pay via EFT in accordance with the details included in the personalised application form online which accompanies this Prospectus using

the applicable reference number set out in Section 2 of the personalised application form and online at www.computersharecas.com.au/ATHSPP,

so payment is received by no later than 5:00 pm (Melbourne time) on the Closing Date.

$30,000 is payable if you are taking up your Entitlement

in full, as set out in the personalised application form. If taking up less than your full Entitlement, the amount payable is dependent

on the parcel applied for as outlined in the table contained in section 1.2 of this Prospectus.

|

Sections 1.2 and 6 |

| Are there risks associated with investment in the Company? |

There are risks associated with investment in

the Company. These include risks relating to the SPP Offer, SPP Shares, Short Dated Options and Long Dated Options, risks relating to

the Company and risks associated with financial investment generally.

|

Section 5 |

| Topic |

Summary |

For more information see: |

| |

Please carefully consider the risks and the information

contained in this Prospectus in conjunction with any specific matters which have or may be referred to in the Company’s ASX announcements

before deciding to apply under the SPP Offer or otherwise making an investment in the Company. |

|

|

What are the taxation implications of participating in the SPP Offer?

|

Taxation implications will vary depending upon the specific circumstances of the investor. You should obtain professional advice as to the taxation treatment applicable to you. |

Section 11 |

| Where can I find more information about the Company? |

For more information on the Company please see the Company’s website (www.alteritytherapeutics.com.au) or refer to the Company’s ASX announcements (available on the ASX’s website www2.asx.com.au, search code “ATH”). or at the Offer website www.computersharecas.com.au/ATHSPP |

Section 18 |

|

What if I have questions about the SPP Offer or how to apply?

|

You should consult your stockbroker, accountant, solicitor or other professional adviser before making any decision regarding applying for securities under the SPP Offer. Questions concerning the SPP Offer can also be directed to the Company by email to we-aualteritytherapeutics@we-worldwide.com. |

Section 18 |

| 1. | Details of the SPP Offer |

The SPP Offer is an offer of:

| ● | up to and aggregate of 571,428,571 SPP Shares

at an issue price of 0.35 cents ($0.0035) per SPP Share (total maximum subscription of $30,000) pursuant to a security purchase plan;

and |

| ● | one (1) free-attaching Short Dated Option for

each one (1) SPP Share issued; and |

| ● | one (1) free-attaching Long Dated Option for

every three (3) SPP Shares issued, |

to Eligible Shareholders under a security purchase

plan to raise up to $2 million before costs. Under the SPP Offer, each Eligible Shareholder may apply for up to a maximum of 8,571,429

SPP Shares ($30,000). Details of the parcels of SPP Shares (including free-attaching Short Dated Options and Long Dated Options) is set

out in Section 1.2. There is no minimum subscription under the SPP Offer.

The issue of SPP Shares, Short Dated Options and

Long Dated Options under the SPP was approved by shareholders of the Company at the General Meeting held on 29 December 2023.

The SPP Offer closes at 5.00 pm (Melbourne time)

on the Closing Date of Thursday, 25 January 2024 (unless closed earlier or extended).

| 1.2 | Applications for parcels of SPP Shares |

Eligible Shareholders may apply for up to their

full entitlement for SPP Shares (with free attaching Short Dated Options and Long Dated Options) under the SPP Offer. Alternatively, an

Eligible Shareholder may apply for a parcel of SPP Shares that is less than their full entitlement.

The parcels of SPP Shares available to be applied

for under the SPP Offer are set out below:

| $ |

Number of SPP Shares |

Number of Short Dated Options |

Number of Long Dated Options |

| $1,000 |

285,714 |

285,714 |

95,238 |

| $2,500 |

714,286 |

714,286 |

238,095 |

| $5,000 |

1,428,571 |

1,428,571 |

476,190 |

| $7,500 |

2,142,857 |

2,142,857 |

714,285 |

| $10,000 |

2,857,143 |

2,857,143 |

952,380 |

| $12,500 |

3,571,429 |

3,571,429 |

1,190,467 |

| $15,000 |

4,285,714 |

4,285,714 |

1,428,571 |

| $17,500 |

5,000,000 |

5,000,000 |

1,666,666 |

| $20,000 |

5,714,286 |

5,714,286 |

1,904,761 |

| $22,500 |

6,428,571 |

6,428,571 |

2,142,857 |

| $25,000 |

7,142,857 |

7,142,857 |

2,380,952 |

| $27,500 |

7,857,143 |

7,857,143 |

2,619,048 |

| $30,000 |

8,571,429 |

8,571,429 |

2,857,142 |

Eligible Shareholders that choose to apply for

any of their entitlement under the SPP Offer will need to pay the required amount by BPAY® or EFT in accordance with the instructions,

and using the personalised payment details, in the personalised application form which accompanied a copy of this Prospectus.

If an Eligible Shareholder applies for a parcel

of SPP Shares in an amount other than as set out in the above table the Board may, at its discretion, accept such application and issue

the number of SPP Shares equal to the amount paid divided by the issue price of SPP Shares ($0.0035), provided that an Eligible Shareholder

must not be issued more than 8,571,429 SPP Shares ($30,000) pursuant to the SPP Offer.

An application for a parcel of SPP Shares will

be treated as an application to also be issued the Short Dated Options and Long Dated Options as described in the table above and in the

personalised application form.

Entitlements under the SPP Offer are subject to

potential scale back as described in Section 1.9.

| 1.3 | No Entitlement Trading |

Entitlements to apply for and receive SPP Shares

and free-attaching Short Dated Options and Long Dated Options under the SPP Offer are not renounceable and, accordingly, there is no ability

to trade rights on ASX or elsewhere.

There is no minimum subscription

amount for the SPP Offer to proceed. Eligible Shareholders will only be able to apply for and receive SPP Shares and free-attaching Short

Dated Options and Long Dated Options. The minimum parcel under the SPP Offer per Eligible Shareholder is $1,000 (285,714 SPP Shares) as

set out in section 1.2.

The SPP Offer is to raise up

to $2 million before costs, through the issue of up to 571,428,571 SPP Shares at the issue price of 0.0035 cents ($0.35) per SPP Share.

If applications are received

from Eligible Shareholders under the SPP Offer for more than the maximum under the SPP Offer, the Company will scale back applications

under the SPP Offer as set out in Section 1.9. Each Eligible Shareholder may only apply for up to $30,000 of SPP Shares (8,571,429 SPP

Shares).

Joint holders are counted as

a single shareholder for the purposes of determining entitlements. A joint holder who receives more than one personalised application

form under the SPP Offer due to multiple registered holdings (including both sole and joint holdings) may only apply for up to $30,000

of shares in total.

The SPP Offer is not underwritten.

| 1.7 | Non-eligible Foreign Shareholders |

Only Eligible Shareholders, being shareholders

with addresses in Australia or New Zealand in the register of members of the Company as at the Record Date, are eligible to participate

in the SPP Offer under this Prospectus. The Company has decided that it is unreasonable to make the SPP Offer outside Australia and New

Zealand having regard to the:

| ● | number of holders in places where the SPP Offer

would be made; |

| ● | number and value of securities those holders

would be offered; and |

| ● | cost of complying with the legal and regulatory

requirements in those other jurisdictions. |

SPP Shares

The Company’s Appendix

3B released to ASX on 22 November 2023 in respect of the SPP included an application to ASX for admission of the SPP Shares to official

quotation. The fact that ASX may grant official quotation of the SPP Shares is not to be taken in any way as an indication of the merits

of the Company or those securities.

If ASX does not grant permission

for the Official Quotation of SPP Shares within 3 months after the date of issue of this Prospectus (or such period as is permitted by

the Corporations Act), the Company, in its absolute discretion, will either repay the application monies to applicants without interest

or (subject to any necessary ASIC or ASX waivers or consents being obtained) issue a supplementary or replacement Prospectus and allow

applicants one month to withdraw their application and be repaid their application monies without interest.

Short Dated Options

The Short Dated Options will not be quoted (listed).

Nothing set out in this Prospectus is to be construed as stating or implying that the Short Dated Options will be quoted at any particular

time, or at all. It is expressly not stated or implied that permission will be sought or obtained for the official quotation of the Short

Dated Options or that official quotation of the Short Dated Options will be granted within three (3) months (or any other period) of the

date of this Prospectus.

Long Dated Options

The Company proposes seeking

quotation (listing) of Long Dated Options. The Long Dated Options that are issued will be unquoted (unlisted) until such time as the Company

satisfies the quotation requirements of ASX, which will include:

| ● | There being at least 100,000 Long Dated Options

on issue; and |

| ● | The Long Dated Options being held by at least

50 holders with a marketable parcel (being if all options held by the holder are exercised in full, the underlying ordinary shares would

be a parcel of not less than $500 based on the trading price of shares or the exercise price if underlying ordinary shares are unquoted). |

If official quotation of Long

Dated Options is not granted, Long Dated Options will be unlisted securities and will not be tradeable on ASX. The fact that ASX may grant

official quotation of Long Dated Options is not to be taken as an indication of the merits of the Company or the Long Dated Options. The

Company’s Appendix 3B released to ASX on 22 November 2023 in respect of the SPP included an application for quotation if the quotation

requirements of ASX are satisfied.

The SPP Offer will raise up to $2 million before

costs (571,428,571 SPP Shares at the issue price of 0.35 cents ($0.0035) per SPP Share). If applications are received from Eligible Shareholders

under the SPP Offer for more than the maximum under the SPP Offer, the Company will scale back applications under the SPP Offer on a pro

rata basis based on the size of the shareholding of each applicant under the SPP Offer as at the Record Date.

The Company will refund applicants

(without interest) the difference between the application monies received by the Company and the application monies payable for the number

of SPP Shares actually issued to the applicant.

No applications for SPP Shares above the maximum

subscription of 8,571,429 SPP Shares, representing a maximum subscription sum of $30,000, will be accepted from any Eligible Shareholder.

In addition, the Company will not issue SPP Shares

if such issue would result in the relevant interest of a shareholder (and its associates) exceeding 20% of the issued capital of the Company

unless doing so is permitted under the Corporations Act without requiring any further action by the Company or shareholder.

| 1.10 | Issue of securities after Closing Date |

The Board reserves the right

to issue SPP Shares and free-attaching Short Dated Options and Long Dated Options in response to valid applications received after the

Closing Date.

Any part of your entitlement to SPP Shares and

free-attaching Short Dated Options and Long Dated Options under the SPP Offer not taken up will form part of the Shortfall.

The Company may, subject to regulatory requirements,

seek to place the securities forming the Shortfall of the Offer with professional, sophisticated and other exempt investors who are eligible

and are invited to participate in the shortfall of the SPP Offer by the Company in its discretion, subject to the recipient being a person

eligible to receive SPP Shares and the free attaching Short Dated Options and Long Dated Options under the conditions of the shareholder

approval obtained at the Meeting (including, pursuant to the waiver granted by ASX announced on 11 December 2023 that shareholders who

voted on the resolution are not eligible to subscribe for Shortfall securities) and satisfaction of regulatory requirements. The issue

of any securities from the Shortfall which is not in accordance with the above would use the placement capacity available to the Company

under the ASX Listing Rules

The Company has engaged MST Financial Services

Pty Ltd (MST) to assist the Company with placement of the Shortfall (if any). The Company has agreed to pay MST a fee of 5% of

amounts for which written commitments to subscribe for shares from the Shortfall are received prior to the opening of the SPP Offer from

investors identified by MST who are eligible. The amount of commitments may exceed the Shortfall (if any), in which case the amounts allocated

to the investors will be adjusted in consultation with MST, with the fee remaining payable on the total committed.

In addition, the Company will not issue SPP Shares

under the Shortfall if that would result in the relevant interest of an investor (and its associates) exceeding 20% of the issued capital

of the Company.

On 22 November 2023, the Company announced it

had received binding commitments for a capital raising of A$4.8 million before costs via a two tranche placement (Placement) of

fully paid ordinary shares (Shares in this Section 1.12) at an issue price of A$0.0035 (0.35 Australian cents) per Share.

Participants in the Placement

were sophisticated, professional and other investors exempt from the disclosure requirements of Ch 6D of the Corporations Act who are

clients of MST Financial Services Pty Ltd or other brokers including institutional investors, or which were identified by the Company

as part of its investor relations program.

The Placement was conducted

over two tranches:

| ● | Tranche one: 362,462,762 Shares under the existing

available placement capacity under Listing Rule 7.1 to raise approximately $1.3 million. Shares under tranche one were issued on 29 November

2023. |

| ● | Tranche two: 1,008,965,809 Shares, the issue

of which was subject to shareholder approval which was obtained at the Meeting. Shares under tranche two are to be issued prior to the

Closing Date. Tranche two also included an issue of Shares (and, consequently, an entitlement to receive free-attaching options as described

below) to related parties (or their nominee(s)). |

Every one (1) Share under the

Placement are to be accompanied by one (1) Short Dated Option and every three (3) Shares are to be accompanied by one (1) Long Dated Option.

The issue of Short Dated Options and Long Dated Options as free-attaching to Shares under the Placement was approved by shareholders at

the Meeting.

Further details with respect

to the Placement are set out in the Notice of Extraordinary General Meeting released to ASX on 30 November 2023 that convened the Meeting.

This Prospectus has been prepared on the basis

that all securities under the Placement will have been issued prior to the opening of the SPP Offer. Details of the issue of securities

under the Placement will be released to ASX as and when such issue of securities under the Placement occurs.

| 2. | Purpose of the SPP Offer |

The purpose of the SPP Offer is to raise up to

$2 million before costs. The SPP Offer is also being made to allow Eligible Shareholders to participate in the capital raising of the

Company by subscribing for SPP Shares and free-attaching Short Dated Options and Long Dated Options on the same basis as investors under

the Placement.

Funds raised under the SPP Offer will be applied

towards funding clinical trials, including providing ongoing funding of Alterity’s Phase 2 clinical trials in MSA, ATH434-201 and

ATH434-202 and planning for a potential Phase 3 clinical trial in MSA, continuing discovery and research efforts in neurodegenerative

diseases, including Parkinson’s Disease, and for general working capital purposes including meeting costs of the SPP Offer.

| 3. | Financial effect of the SPP Offer |

As noted above, $2 million before costs is proposed

to be raised under the SPP Offer. Funds raised under the SPP Offer are to be applied as set out in Section 2.

The anticipated maximum costs of the SPP Offer are set out in the table

below:

| Particulars |

Amount ($) |

| Legal, secretarial, registry, printing and postage |

$90,000 |

| ASIC & ASX fees* |

$21,000 |

| TOTAL |

$111,000 |

| * | assumes quotation of the SPP Shares and Long Dated Options

– see section 1.8. |

As described in Section 1.11, the Company has

..agreed to pay MST a fee of 5% of amounts for which written commitments to subscribe for shares from the Shortfall are received prior

to the opening of the SPP Offer. If commitments were received for the entire $2 million sought to be raised, the above estimated costs

would increase by approximately $100,000.

The costs of the SPP Offer will be less if less

than the full subscription under the SPP Offer is raised.

If the SPP Offer is fully subscribed, then the

cash reserves of the Company are anticipated to increase by approximately $1.89 million, being $2 million less the anticipated costs of

the SPP Offer above.

A pro forma statement of financial position on

the basis of the audited financial statements of the Company for the financial reporting period ended 30 June 2023 as released to ASX

on 31 August 2023 is set out below:

This section contains a summary of the historical

financial information for the Company as at 30 June 2023 (Historical Financial Information) and a pro-forma historical statement of the

financial position as at 30 June 2023 (Pro Forma Historical Financial Information) (collectively, Financial Information).

The Financial Information has been prepared to

illustrate the effect of the Placement and SPP Offer (assuming the maximum amount is raised under the SPP Offer):

| |

Actual |

Placement Tranche 1 |

Placement Tranche 2 |

SPP |

Proforma |

| |

30 June

2023 |

November

2023 |

January

2024 |

February

2024^ |

30 June

2023^ |

| Assets |

|

|

|

|

|

| Current Assets |

|

|

|

|

|

| Cash and cash equivalents |

15,773,783 |

1,174,628 |

3,249,992 |

1,889,000 |

22,087,403 |

| Trade and other receivables |

8,665,704 |

|

|

|

8,665,704 |

| Other current assets |

2,609,286 |

|

|

|

2,609,286 |

| Total Current Assets |

27,048,773 |

1,174,628 |

3,249,992 |

1,889,000 |

33,362,393 |

| Non-Current Assets |

|

|

|

|

|

| Property and equipment |

61,776 |

|

|

|

61,776 |

| Right-of-use assets |

207,087 |

|

|

|

207,087 |

| Total Non-Current Assets |

268,863 |

0 |

0 |

0 |

268,863 |

| Total Assets |

27,317,636 |

1,174,628 |

3,249,992 |

1,889,000 |

33,631,256 |

| |

Actual |

Placement Tranche 1 |

Placement Tranche 2 |

SPP |

Proforma |

| |

30 June

2023 |

November

2023 |

January

2024 |

February

2024^ |

30 June

2023^ |

|

Liabilities |

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

| Trade and other payables |

3,517,708 |

|

|

|

3,517,708 |

| Provisions |

729,202 |

|

|

|

729,202 |

| Lease liabilities |

107,177 |

|

|

|

107,177 |

| Current tax liabilities |

27,930 |

|

|

|

27,930 |

| Total Current Liabilities |

4,382,017 |

0 |

0 |

0 |

4,382,017 |

| Non-Current Liabilities |

|

|

|

|

|

| Provisions |

19,503 |

|

|

|

19,503 |

| Lease liabilities |

103,207 |

|

|

|

103,207 |

| Total Non-Current Liabilities |

122,710 |

0 |

0 |

0 |

122,710 |

| Total Liabilities |

4,504,727 |

0 |

0 |

0 |

4,504,727 |

| Net Assets |

22,812,909 |

1,174,628 |

3,249,992 |

1,889,000 |

29,126,529 |

|

Equity |

|

|

|

|

|

| Issued capital |

213,971,323 |

1,268,620 |

3,531,380 |

2,000,000 |

220,771,323 |

| Reserves |

3,972,475 |

(93,992) |

(281,388) |

(111,000) |

3,486,095 |

| Accumulated deficit |

(195,130,889) |

|

|

|

(195,130,889) |

| Total Equity |

22,812,909 |

1,174,628 |

3,249,992 |

1,889,000 |

29,126,529 |

| ^ | If, as referred to above, written commitments to subscribe for

shares from the Shortfall are received prior to the opening of the SPP Offer for the entire $2 million sought to be raised, the cash

and cash equivalents (and consequently total assets, net assets, issued capital and total equity) in the above table would decrease by

approximately $100,000. |

Basis of preparation of financial information

The stated basis of preparation for the Historical

Financial Information is in accordance with the recognition and measurement principles of the Australian Accounting Standards.

The stated basis of preparation for the Pro Forma

Historical Financial Information is in a manner consistent with the recognition and measurement principles of the Australian Accounting

Standards applied to the Historical Financial Information and the events or transactions to which the pro forma adjustments relate, as

described in the Options Prospectus dated 29 December 2023 and this section of the Prospectus, as if those events or transactions had

occurred as at 30 June 2023.

Pro-forma adjustments to consolidated balance

sheet

The Pro Forma Historical Financial Information

has been derived from the Historical Financial Information and has been prepared on the basis that the following significant transactions

occurred as at 30 June 2023:

| (a) | The issue on 29 November 2023 of 362,462,762 New Shares under tranche one of the Placement, which raised

gross proceeds of $1,268,620 less estimated offer costs of $93,992. |

| (b) | The anticipated issue of 1,008,965,809 New Shares under tranche two of the Placement, anticipated to raise

gross proceeds of $3,531,380 less estimated offer costs of $281,388. |

| (c) | The anticipated issue of 571,428,571 New Shares under the SPP Offer, anticipated to raise gross proceeds

of $2,000,000 less estimated offer costs of $111,000. This represents the maximum amount that may be raised under the SPP Offer. If less

than the maximum is raised, the financial impact of the SPP Offer on the Company will be reduced. |

| (d) | No existing options or options to be issued under the Placement or SPP Offer are included as having been

exercised in the Financial Information. |

Due to the nature of the pro forma adjustments,

they do not represent the actual or prospective financial position of the Company.

| 4. | Effect on Control and the Capital Structure of the Company |

The tables below set out the capital structure

of the Company as at the date of this Prospectus and assume the issue of all securities under the Placement as described in Section 1.12,

which is anticipated to occur prior to the opening of the SPP Offer. Except as otherwise stated, it is assumed that no further securities

are issued by the Company other than as provided for under the SPP Offer and that no existing or proposed convertible securities (including

Short Dated Options and/or Long Dated Options) are exercised into Shares.

SHARES

The below tables demonstrates

the impact of the issue of SPP Shares under the SPP Offer on the basis that the SPP Offer is 50% subscribed or 100% subscribed. The Impact

of the issue of SPP Shares under the SPP Offer on the issued share capital of the Company will differ if the SPP Offer is subscribed to

a different amount. In accordance with Section 1.12, the below tables also assume the issue of the Shares forming tranche two of the Placement

prior to the SPP Offer opening.

SPP 50% Subscribed

| |

Number |

% |

| Current Shares on issue |

2,802,360,380 |

68% |

| Shares under Tranche 2 of the Placement |

1,008,965,809 |

25% |

| Shares prior to opening of the SPP Offer |

3,811,326,189 |

93% |

| SPP Shares (50% subscription under SPP Offer) |

285,714,286 |

7% |

| Total (if SPP 50% subscribed) |

4,097,040,475 |

100% |

SPP 100% Subscribed

| |

Number |

% |

| Current Shares on issue |

2,802,360,380 |

64% |

| Shares under Tranche 2 of the Placement |

1,008,965,809 |

23% |

| Shares prior to opening of the SPP Offer |

3,811,326,189 |

87% |

| SPP Shares (100% subscription under SPP Offer) |

571,428,571 |

13% |

| Total (if SPP fully subscribed) |

4,382,754,760 |

100% |

| * | all percentages are subject to rounding |

OPTIONS

The existing and proposed options

of the Company are set out in the table below. All options are presently unlisted however the Company proposes seeking quotation (listing)

of the Long Dated Options. The quotation (listing) of the Long Dated Options is not a condition of the SPP Offer:

| Number of options |

Expiry Date |

Exercise price |

| 19,250,000 |

29 November 2026 |

$0.0375 (3.75 cents) |

| 12,000,000 |

31 July 2024 |

$0.07 (7 cents) |

| 11,900,000 |

29 November 2026 |

$0.0238 (2.38 cents) |

| 35,000,000 |

17 September 2025 |

$0.09 (9 cents) |

| 91,392,720 |

06 January 2026 |

$0.032 (3.2 cents) |

| 1,371,428,571 (Short Dated Options under the Placement) |

31 August 2024 |

$0.007 (0.7 cents) |

| 457,142,857 (Long Dated Options under the Placement) |

31 August 2026 |

$0.01 (1 cent) |

| 571,428,571 (maximum Short Dated Options under the SPP Offer) |

31 August 2024 |

$0.007 (0.7 cents) |

| 190,476,191 (maximum Long Dated Options under the SPP Offer) |

31 August 2026 |

$0.01 (1 cent) |

| 4.2 | Substantial shareholder |

As at lodgement of the Prospectus,

the Company has received notification of one substantial (5%+) shareholder being the Bank of New York Mellon Corporation and each Group

Entity that together form the BNYMC Group, which holds a relevant interest in 1,588,872,148 Shares (approximately 56.70% at the date of

this Prospectus, prior to issue of the Shares under tranche two of the Placement) in the Company.

The relevant interest arises

from the BNYMC Group having the limited power to dispose of, or control exercise of power to dispose of, securities deposited with or

held by BNYMC (or its custodian or agent) in its capacity as depositary administering an American depository receipts (ADR) program for

the Company.

BNYMC Group is not an Eligible

Shareholder and is accordingly not eligible to participate in the SPP Offer. Accordingly the issue of SPP Shares under the SPP Offer will

dilute the relevant interest of the BNYMC Group. Examples of the dilution to the BNYMC Group as a result of the issue of SPP Shares (both

if the SPP Offer is 50% subscribed or 100% subscribed) is set out in the tables below:

| Shares held |

% at open of SPP Offer |

% if SPP Offer 50% subscribed |

% if SPP Offer 100% subscribed |

| 1,588,872,148 |

41.69% |

38.78% |

36.25% |

Notes

to Tables:

| ● | All

percentages are rounded to two decimal places. |

| ● | It is assumed that BNYMC Group does not acquire

or dispose of shares. |

| ● | Assumes the issue of all securities under

the Placement as described in Section 1.12, which is anticipated to occur prior to the opening of the SPP Offer. |

The

potential dilutive effect of the issue of SPP Shares under the SPP Offer will have on the control of the Company is as follows:

| ● | The dilutive impact on Eligible Shareholders

who take up their entitlement pursuant to the SPP Offer (whether in part or in full) is dependent upon the current shareholding in the

Company of that Eligible Shareholder, the quantum of the Eligible Shareholders investment under the SPP Offer and the extent to which

the SPP Offer is subscribed; and |

| ● | An Eligible Shareholder who does not take up

any part of their entitlement pursuant to the SPP Offer will have their percentage shareholding in the Company diluted as a result of

the SPP Offer. The extent of the dilution is dependent on the extent to which the SPP Offer is subscribed; and |

| ● | Shareholders who are not Eligible Shareholders

will be diluted as a result of the SPP Offer. The extent of the dilution is dependent on the extent to which the SPP Offer is subscribed. |

The

below table shows the example impact of the SPP Offer on shareholders who either do not subscribe for SPP Shares or who are not Eligible

Shareholders, both where the SPP Offer is either 50% subscribed (285,714,286 SPP Shares issued) or fully subscribed (571,428,571 SPP Shares

issued). The below tables assume all Shares under the Placement have been issued prior to opening of the SPP Offer:

| Shareholder (example) |

Holding |

% |

% of shares if SPP Offer 50% subscribed and

example Shareholder does not take up entitlement

(4,097,040,475 Shares)

|

% of total Shares if all SPP Shares are issued

where example Shareholder does not take up entitlement

(4,382,754,760 Shares)

|

| A |

5,000,000 |

0.13% |

0.12% |

0.11% |

| B |

10,000,000 |

0.26% |

0.24% |

0.23% |

| C |

20,000,000 |

0.52% |

0.49% |

0.46% |

| D |

50,000,000 |

1.31% |

1.22% |

1.14% |

| E |

100,000,000 |

2.62% |

2.44% |

2.28% |

Notes

to Tables:

| ● | All percentages are rounded to two decimal

places. |

| ● | It is assumed the notional Eligible Shareholders

in the example above do not acquire or dispose of shares. |

| ● | Does not take into account the dilutive impact

of the conversion of convertible securities. |

| ● | Assumes the issue of all securities under

the Placement as described in Section 1.12, which is anticipated to occur prior to the opening of the SPP Offer. |

The securities offered under this Prospectus

are considered highly speculative. An investment in the Company carries risk. The Directors strongly recommend potential investors consider

the risk factors described below, together with information contained elsewhere in the Prospectus.

This section identifies circumstances

the Directors regard as risks associated with investment in the Company and which may have a material adverse impact on the financial

performance of the Company if they were to arise.

Specifically:

| ● | the SPP Offer (including

securities under the SPP Offer) are subject to specific risks (refer to Section 5.1); and |

| ● | the business, assets and

operations of the Company are subject to further risk factors. The Company provided detailed disclosure of business risk factors in item

3.D of its 2023 Annual Report for the reporting period ended 30 June 2023 that was released to ASX on 31 August 2023. The 2023 Annual

Report has been lodged with ASIC and item 3.D of 2023 Annual Report is incorporated by reference into this Prospectus in accordance with

Section 712 of the Corporations Act. A copy of item 3.D of the 2023 Annual Report is available at www2.asx.com.au (search code “ATH”)

and can be obtained from the Company upon request. A selection of the risk factors as contained in item 3.D of the 2023 Annual Report

are set out in Section 5.2. |

Where possible, the Directors aim to

manage these risks by carefully planning the Company’s activities and implementing risk control measures. However, some of the risks

identified are highly unpredictable or are out of the control of the Company and the Company is therefore limited to the extent it can

effectively manage them.

These risk factors are not intended

to be an exhaustive list of risks to which the Company is, or will be, exposed.

| 5.1 | Risks associated with the SPP Offer |

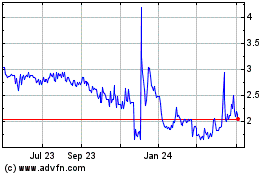

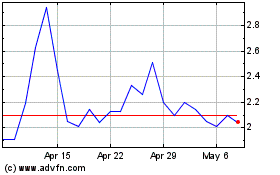

| (a) | Value of securities, liquidity and share market conditions |

The market price of the Company’s ordinary

shares are subject to varied and unpredictable influences on the market for equities in general. Market conditions and lack of liquidity

may affect the value of the Company’s ordinary shares regardless of the performance of the Company. No assurance is given that there

will be, or continue to be, an active market for the SPP Shares or if an active market will be established for the Long Dated Options

if quoted (listed). The trading price of Shares may fall as well as rise.

Participation in the SPP Offer may have taxation

consequences depending on the particular circumstances of the recipient. You should seek your own professional advice before investing

in the Company.

The issue of the SPP Shares (and Shares issued

on exercise of Short Dated Options and/or Long Dated Options, if any) will result in holders who do not subscribe under the SPP Offer

being diluted. The number of SPP Shares to be subscribed for any an Eligible Shareholder to not be diluted is dependent upon their current

shareholding and the total number of SPP Shares ultimately issued under the SPP Offer.

The issue of Short Dated Options and Long Dated

Options will not dilute shareholders unless and until Shares are issued on exercise of Short Dated Options and/or Long Dated Options.

There is no guarantee that a certain number of Short Dated Options and/or Long Dated Options will be exercised, or any at all.

| (d) | Exercise price of securities |

There is no guarantee that the share price will

be greater than the exercise price up to the expiry date (31 August 2024 for Short Dated Options and 31 August 2026 for Long Dated Options).

Accordingly, there is a risk that securities will be out of the money during the exercise period, which will affect the value of the securities.

| 5.2 | Company Specific Risks |

As noted above, the below represent a selection

of the risk factors contained in item 3.D of the 2023 Annual Report released to ASX on 31 August 2023 which is available at www2.asx.com.au

(search code “ATH”) and can be obtained from the Company upon request:

| (a) | The Company has a history of operating losses. The Company will need additional funding to complete its

clinical trials and to operate its business; such funding may not be available or, if it is available, such financing is likely to be

dilutive to existing shareholders. |

| (b) | The Company relies on research institutions to conduct its clinical trials and may not be able to secure

and maintain research institutions to conduct future trials. The institutions that the Company works with have their own limits and procedures

that influence or limit the Company’s ability to conduct research and development and conduct of clinical trials. The Company’s

reliance on these research institutions provides it with less control over the timing and cost of clinical trials, clinical study management

personnel and the ability to recruit subjects. |

| (c) | If the Company does not obtain the necessary governmental approvals, it will be unable to develop or commercialise

its pharmaceutical products. The pharmaceutical and biotechnology industries are subject to extensive regulation, and from time to time

legislative bodies and governmental agencies consider changes to such regulations that could have significant impact on industry participants. |

| (d) | The Company’s success depends upon its ability to protect its intellectual property and its proprietary

technology, to operate without infringing the proprietary rights of third parties and to obtain marketing exclusivity for its products

and technologies. Patent matters in biotechnology are highly uncertain and involve complex legal and factual questions. Accordingly, the

availability and breadth of claims allowed in biotechnology and pharmaceutical patents cannot be predicted. |

| (e) | The Company consider proprietary trade secrets and/or confidential know-how and unpatented know-how to

be important to its business. The Company may rely on trade secrets and/or confidential know-how to protect its technology, especially

where patent protection is believed by the Company to be of limited value. However, trade secrets and/or confidential know-how can be

difficult to maintain as confidential. |

| (f) | The Company’s research and development efforts will be seriously jeopardised if it is unable to

retain key personnel and cultivate key academic and scientific collaborations. |

| (g) | The testing, marketing and sale of human health care products also entails an inherent risk of product

liability. The Company may incur substantial liabilities or be required to limit development or commercialisation of its candidate products

if it cannot successfully defend itself against product liability claims. |

| (h) | The biotechnology and pharmaceutical industries are subject to rapid and significant technological change.

The Company’s competitors are numerous and include major pharmaceutical companies, biotechnology firms, universities and other research

institutions. These competitors may develop technologies and products that are more effective than any that the Company is developing,

or which would render its technology and products obsolete or non-competitive. Many of these competitors have greater financial and technical

resistance and manufacturing and marketing capabilities than the Company does. In addition, many of the Company’s competitors have

much more experience than it does in pre-clinical testing and human clinical trials of new or improved drugs, as well as in obtaining

regulatory approvals. |

| 5.3 | Investment Speculative |

The above list of risk factors ought

not to be taken as an exhaustive list of the risks faced by the Company or in connection with an investment in the Company. The above

risk factors, and other risk factors not specifically referred to above, may materially affect the future financial performance of the

Company and the value of the securities offered under this Prospectus. SPP Shares and Shares issued on exercise of Short Dated Options

and/or Long Dated Options (if any) carry no guarantee with respect to the payment of dividends, returns of capital or market value. The

Company does not expect to declare any dividends for the foreseeable future.

Potential investors should consider that the investment

in the Company is highly speculative.

| 6. | Acceptance Instructions |

| 6.1 | Choices available under the SPP Offer |

Eligible Shareholders may:

| ● | exercise their rights to participate in the SPP

Offer and accept their entitlement in full (i.e. for the subscription sum of $30,000); or |

| ● | exercise their rights to participate in the SPP

Offer and accept in part by applying for a parcel of SPP Shares and free-attaching Short Dated Options and Long Dated Options as set out

in the personalised application form and in Section 1.2; or |

| ● | take no action under the SPP Offer, and allow

the SPP Offer made to them to lapse. |

Depending on the level of applications received,

applications may be scaled back as described in Section 1.9.

| 6.2 | Applying under the SPP Offer |

To apply under the SPP Offer, please make your

payment via BPAY® or by EFT for NZ holders who are unable to pay via BPAY for one of the designated parcels of SPP Shares and free-attaching

Short Dated Options and Long Dated Options as set out in the personalised application form (and set out in Section 1.2) using the applicable

reference number set out online in the personalised application form which accompanies this Prospectus. Applications can only be made

using the personalised application form which formed part of or was accompanied by a copy of this Prospectus.

There is no requirement to return the personalised

application form if you are paying by BPAY® or EFT for NZ holders who are unable to pay via BPAY.

You can only make a payment by BPAY® if you

are the holder of an account with an Australian financial institution. EFT payments from banks in New Zealand must allow for exchange

rates and bank fees so that the Registrar receives the correct amount in Australian dollars. If less than the required amount is received,

your application may be rejected or you may receive fewer securities than you apply for under the SPP Offer.

If applying and paying by BPAY® or EFT for

NZ holders who are unable to pay via BPAY, you need to ensure your payment of application monies is received in the Share Registrar’s

specified bank account in clear and immediately available funds by no later than 5:00pm Melbourne time on the Closing Date. Applicants

should be aware that their own financial institution may implement early cut off times for processing BPAY® and EFT payments, and/or

may impose daily limits. It is important that you make your payment in time and according to any limits so that payment for the full number

of securities you wish to apply for is received on time and in full. Late application monies received after the specified time will not

be accepted, unless the Company otherwise agrees. Neither the Company nor the Share Registrar accepts any liability for lost, delayed

or misdelivered application forms or application monies.

By making payment for SPP Shares under the SPP

Offer by BPAY® or EFT for NZ holders who are unable to pay via BPAY, the applicant confirms that it is an Eligible Shareholder, certifies

the matters set out in the application form, and agrees to be bound by the constitution of the Company (Constitution) and by the

terms and conditions set out in this Prospectus and the application form. Receipt by the Company’s Share Registrar of payment under

the SPP Offer by BPAY® or EFT constitutes an irrevocable and unconditional acceptance of the SPP Offer in accordance with the terms

and conditions set out in this Prospectus and the application form by the applicant.

Applications can only be made in one of the designated

amounts set out in the application form. The Company reserves the right to waive this requirement, or to accept the application for the

number of SPP Shares (together with free-attaching Short Dated Options and Long Dated Options) for which payment is received.

The Company reserves the right to reject an application

received, and/or may refuse to issue securities under the SPP Offer, if the Company believes that acceptance of the application or issue

of the shares may be contrary to any applicable Listing Rule or law, the terms of the ASIC Instrument to the extent they apply for the

purposes of the ASX Listing Rules, or the terms and conditions of the SPP Offer.

The Company may amend or complete any application

received, waive strict compliance with or vary any term or condition of the SPP Offer or resolve in any manner any anomaly, inconsistency,

uncertainty or dispute if such amendment, waiver, variation or resolution would assist or permit the Company to issue and/or the applicant

to receive securities under the SPP Offer, provided no amendment, waiver, variation or resolution shall result in the number of securities

to be issued exceeding the number which may be issued at the SPP Offer price represented by the application monies received.

If payment of application monies is not honoured,

the Company may at its sole discretion issue securities in response to the application and recover the application monies as a debt due

or reject the application.

Effect of receipt

In addition to any acknowledgment noted or provided

for herein or in the application form, receipt in the Share Registrar’s bank account of payment under the SPP Offer by BPAY®

or EFT:

| ● | constitutes an irrevocable and unconditional

acceptance of the SPP Offer in accordance with the terms and conditions set out in this Prospectus and the application form by the applicant; |

| ● | represents an acknowledgment that the applicant

is lawfully permitted to accept the SPP Offer, to acquire the SPP Shares and free-attached Short Dated Options and Long Dated Options

under the SPP Offer and to participate in the SPP Offer in accordance with the applicable laws in Australia and any other applicable laws

in the jurisdiction in which the applicant and/or the beneficial owner is situated; |

| ● | represents an acknowledgement that the applicant

accepts the risk that the market price of the SPP Shares may fall between the date on which the Application is submitted and the date

the SPP Shares are allocated and/or issued; |

| ● | represents an acknowledgement by the applicant

that the Company is not liable for any exercise of its or its Share Registrar’s discretion provided for in the terms and conditions

in this Prospectus or the application form; and |

| ● | represents an agreement that the applicant has

read and understood the TMD and fit within the target market described in the TMD. |

| 6.3 | Maximum Application under SPP Offer |

Each Eligible Shareholder may only apply for up

to $30,000 of SPP Shares (8,571,429 SPP Shares) under the SPP Offer. If an Eligible Shareholder receives more than one offer under the

SPP Offer (for example, due to multiple registered holdings, including joint holdings), it may only apply for up to $30,000 of SPP Shares

in total.

Applicants certify by making payment by BPAY®

or EFT that the aggregate of the payment(s) paid by the applicant for:

| ● | the parcel of SPP Shares indicated on the application

form or by the BPAY® or EFT payment; and |

| ● | any other SPP Shares applied for by the applicant

in the 12 months prior to making payment by BPAY® or EFT does not exceed $30,000. |

Joint holders are counted as a single shareholder

for the purposes of determining entitlements. A joint holder who receives more than one offer under the SPP Offer due to multiple registered

holdings (including both sole and joint holdings) may only apply for up to $30,000 of SPP Shares in total.

If it appears to the Company or the Share Registry

that any applications may result in the $30,000 of SPP Shares limit being exceeded, the Company or the Share Registry on behalf of the

Company has discretion to determine as to which application(s) may be accepted and which (if any) may be accepted.

SPP Shares shall be issued together with free-attaching

Short Dated Options and Long Dated Options as described in Section 1.1.

A shareholder who alone or with its associates

would obtain an interest in more than 20% of the issued voting shares of the Company may be ineligible to receive participate in the SPP

Offer. The Company reserves the right to refuse an application if the applicant (alone or with its associates) would obtain an interest

in more than 20% of the issued voting shares of the Company.

The Company may amend any application received

(including where the application is constituted by payment of application monies by BPAY® or EFT) so that the applicant’s interest

alone or with its associates is no more than 20% of the issued voting shares of the Company. In the event that an application is adjusted,

the Company will refund to the applicant without interest the difference between the application monies received by the Company and application

monies payable for the number of SPP Shares actually issued to the applicant.

Only shareholders whose address in the Company’s

register of members is in Australia and New Zealand at the Record Date are Eligible Shareholders for the SPP Offer in this Prospectus.

Regardless of their address in the register, applicants resident in countries outside Australia and New Zealand should consult their professional

advisers as to whether any governmental or other consent are required or whether formalities need to be observed to enable them to apply

for and receive SPP Shares, Short Dated Options and Long Dated Options under the SPP Offer.

Accordingly, this document and any application

form do not constitute an offer of shares in any place in which, or to any person to whom, it would not be lawful to make such an offer.

Payment of application monies will be taken by the Company to constitute a representation by the applicant that there has been no breach

of such requirements.

No brokerage is payable by applicants in respect

of applications or the issues of securities under SPP Offer.

If you have any questions about the SPP Offer,

please contact the Company by email to we-aualteritytherapeutics@we-worldwide.com. Alternatively, contact your stockbroker or other professional

adviser.

The issue of any securities is expected to occur

after the SPP Offer has closed on or before the dates set out in the timetable on page 5 of this Prospectus (which date may change without

notice). Thereafter statements of holdings relating to any issued SPP Shares and free-attaching Short Dated Options and Long Dated Options

will be despatched. It is the responsibility of recipients to determine their allocation prior to trading in securities. Recipients trading

SPP Shares (and, if listed, Long Dated Options) before they receive their statements do so at their own risk.

The Company may reject an application where payment

of the application amount is not received or a cheque is not honoured, or without prejudice to its rights, issue SPP Shares and free-attaching

Short Dated Options and Long Dated Options in response to the application and recover outstanding application amount from the recipient.

If your personalised application form is returned but is not completed correctly it may still be treated as a valid application. The Directors’

decision whether to treat a form as valid and how to construe, amend or complete the form is final. The Company accepts no responsibility

for failure by your stockbroker or other third parties to carry out your instructions.

This Prospectus does not constitute an offer in

any place in which, or to any person to whom, it would not be lawful to make such an offer. Persons resident in countries outside Australia

and New Zealand should consult their professional advisers as to whether governmental or other consent are required or whether formalities

need to be observed for them to acquire securities under the SPP Offer. Return of an application form and/or payment under the SPP Offer

will be taken by the Company to constitute a representation that there has been no breach of such requirements.

No account has been taken of the particular objectives,

financial situation or needs of recipients of this Prospectus. Because of this, recipients of this Prospectus should have regard to their

own objectives, financial situation and needs.

Recipients of this Prospectus should make their

own independent investigations and assessment of the Company, its business, assets and liabilities, prospects and profits and losses,

and the risks associated with investing in the Company. Independent expert advice should be sought before any decision is made to accept

the SPP Offer, or to acquire SPP Shares or other securities of the Company.

| 7. | Continuous Disclosure Obligations |