Filed Pursuant to Rule 424(b)(5)

Registration No. 333-274816

PROSPECTUS SUPPLEMENT

(To Prospectus dated October 25, 2023)

| |

ALTERITY THERAPEUTICS LIMITED

US$6,000,000

Ordinary Shares represented by American Depositary

Shares |

|

This prospectus supplement relates to the offer

and sale of ordinary shares from time to time, represented by American Depositary Shares, or ADSs, having an aggregate offering price

of up to US$6,000,000. The ADSs are evidenced by American Depositary Receipts, or ADRs. We have entered into an Sales Agreement, dated

February 15, 2024, which we refer to as the Sales Agreement, with JonesTrading Institutional Services LLC, or the “Agent”.

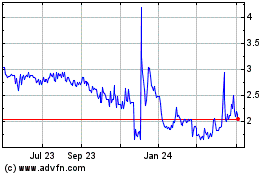

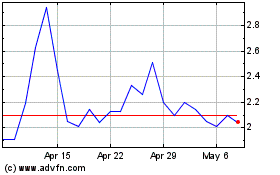

Our ADSs are listed on The NASDAQ Capital Market

under the symbol “ATHE.” On February 14, 2024, the closing price of an ADS of Alterity Therapeutics Limited on The NASDAQ

Capital Market was US$1.98.

Sales of our ADSs under this prospectus supplement

and the accompanying prospectus, if any, may be made in sales deemed to be “at the market offerings” as defined in Rule 415

promulgated under the Securities Act of 1933, as amended, or the Securities Act. The Agent will act as sales agent on a best efforts basis

using commercially reasonable efforts consistent with its normal trading and sales practices. There is no arrangement for funds to be

received in any escrow, trust or similar arrangement.

The Agent will be entitled to compensation at a

fixed commission rate of equal to 3.0% of the gross sales price per share sold. In connection with the sale of ADSs on our behalf, the

Agent will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation of the Agent will

be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to the Agent against

certain liabilities, including liabilities under the Securities Act.

As of the date of this prospectus supplement, the aggregate market

value of our outstanding ordinary shares held by non-affiliates is US$20,989,187, based on 4,382,754,741 ordinary shares outstanding,

represented by 7,304,592 ADSs, of which 4,342,590,393 ordinary shares, represented by 7,237,651 ADSs, are held by non-affiliates, and

a per share price of US$2.90, which was the closing sale price of our common stock as quoted on Nasdaq on December 18, 2023. As of the

date of this prospectus supplement, we have offered and sold US$118,061 of our securities pursuant to General Instruction I.B.5. of Form

F-3 during the prior 12 calendar month period that ends on, and includes, the date of this prospectus supplement. Pursuant to General

Instruction I.B.5 of Form F-3, in no event will we sell our ordinary shares in a public primary offering with a value exceeding more than

one-third of our public float in any 12-month period so long as our public float remains below US$75,000,000.

Investing in the ADSs involves a high degree of

risk. Before buying any securities, you should carefully consider the risk factors described in “Risk Factors” beginning on

page S-3 of this prospectus supplement and on page 2 of the accompanying prospectus.

Neither the Securities and Exchange Commission nor

any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement and the accompanying

prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is February 15, 2024.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

BASE PROSPECTUS

Unless expressly stated otherwise, all references in

this prospectus supplement and the accompanying prospectus to “Alterity” “we,” “us,” “our,”

or similar references mean Alterity Therapeutics Limited and its subsidiaries, unless otherwise indicated.

All references to “U.S. dollars” or “US$”

in this supplement and the accompanying prospectus are to U.S. dollars, and all references to “Australian dollars” or “A$”

are to the currency of Australia.

This document is in two parts. The first part is this

prospectus supplement, which describes the terms of this offering of our ADSs and supplements information contained in the accompanying

prospectus and the documents incorporated by reference into the accompanying prospectus. The second part is the accompanying prospectus,

which gives more general information about us and the ADSs that we may offer from time to time under our shelf registration statement.

To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information

contained in the accompanying prospectus or any document incorporated by reference therein, on the other hand, the information in this

prospectus supplement shall control.

You should read this document together with the

additional information described under the headings “Where You Can Find More Information” and “Incorporation of Certain

Information by Reference” in this prospectus supplement. We have not authorized any dealer, salesperson or other person to give

any information or to make any representation other than those contained or incorporated by reference in this prospectus supplement, the

accompanying prospectus and any related free writing prospectus. You should not rely upon any information or representation not contained

or incorporated by reference in this prospectus supplement, the accompanying prospectus or any free writing prospectus that we may authorize

to be provided to you. This prospectus supplement, the accompanying prospectus and any related free writing prospectus do not constitute

an offer to sell or the solicitation of an offer to buy ADSs, nor does this prospectus supplement, the accompanying prospectus and any

related free writing prospectus constitute an offer to sell or the solicitation of an offer to buy ADSs in any jurisdiction to any person

to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in

this prospectus supplement, the accompanying prospectus and any related free writing prospectus is accurate on any date subsequent to

the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent

to the date of the document incorporated by reference, even though this prospectus supplement, the accompanying prospectus and any related

free writing prospectus is delivered or ADS is sold on a later date.

We further note that the representations, warranties

and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into the accompanying

prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating

risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such

representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and

covenants should not be relied on as accurately representing the current state of our affairs.

FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus

and the documents incorporated in it by reference contain forward-looking statements which involve known and unknown risks and uncertainties.

We include this notice for the express purpose of permitting us to obtain the protections of the safe harbor provided by the Private Securities

Litigation Reform Act of 1995 with respect to all such forward-looking statements. Examples of forward-looking statements include: projections

of capital expenditures, competitive pressures, revenues, growth prospects, product development, financial resources and other financial

matters. You can identify these and other forward-looking statements by the use of words such as “may,” “plans,”

“anticipates,” “believes,” “estimates,” “predicts,” “intends,” “potential”

or the negative of such terms, or other comparable terminology.

Our ability to predict the results of our operations

or the effects of various events on our operating results is inherently uncertain. Therefore, we caution you to consider carefully the

matters described under the caption “Risk Factors” and certain other matters discussed in this prospectus supplement, the

accompanying prospectus, the documents incorporated by reference in the accompanying prospectus, and other publicly available sources.

Such factors and many other factors beyond the control of our management could cause our actual results, performance or achievements to

be materially different from any future results, performance or achievements that may be expressed or implied by the forward-looking statements.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information contained

elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus. The summary may not contain all

the information that you should consider before investing in our ADSs. You should read the entire prospectus supplement and the accompanying

prospectus carefully, including “Risk Factors” contained in this prospectus supplement and the accompanying prospectus and

the documents incorporated by reference in the accompanying prospectus, before making an investment decision. This prospectus supplement

may add to, update or change information in the accompanying prospectus.

Alterity Therapeutics Limited

We were incorporated under the laws of the Commonwealth of Australia on

November 11, 1997 and began limited operations shortly thereafter. Our mission is to develop therapeutic drugs designed to treat neurodegenerative

diseases, currently focusing on Parkinsonian and other movement disorders.

Corporate Information

Our registered office is located at Level 3, 62 Lygon Street, Carlton,

Victoria 3053 Australia and our telephone number is 011-61-3-9824-5254. Our principal executive office is located at Level 14, 350 Collins

Street, Melbourne, Victoria 3052, Australia and our telephone number is 011-61-3-9349-4906. Our address on the internet is www.alteritytherapeutics.com. The

information in our website is not incorporated by reference into this prospectus supplement and should not be considered as part of this

prospectus supplement.

The Offering

|

Securities offered

|

Ordinary shares represented by ADSs having an aggregate offering price of up to US$6,000,000. |

| |

|

| The ADSs |

Each ADS represents six hundred ordinary shares, no par value. The offered ADSs are evidenced by ADRs. |

| |

|

| Depositary |

The Bank of New York Mellon |

| |

|

| Manner of Offering |

“At the market offering” that may be made from time to time through the Agent. See “Plan of Distribution” on page S-6. |

| |

|

| Ordinary Shares outstanding as of February 14, 2024 |

4,382,754,741 ordinary shares (which excludes 2,768,018,796 ordinary

shares issuable upon the exercise of options having exercise prices ranging from A$0.032 to A$0.007 per share). |

| |

|

| Use of proceeds |

We intend to use the net proceeds from this offering for ongoing and future clinical trials, and future research programs into the development of our proprietary compounds, including our lead compound, ATH434, and for working capital purposes. See “Use of Proceeds” on page S-4. |

| |

|

| NASDAQ Capital Market symbol |

“ATHE” |

| |

|

| Risk Factors |

This investment involves a high degree of risk. See “Risk Factors” beginning on page S-3 of this prospectus supplement as well as the other information included in or incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of risks you should consider carefully before making an investment decision. |

Unless otherwise stated, all information contained

in this prospectus supplement reflects the assumed public offering price of US$1.98 per ADS, which was the last reported sale price of

an ADS representing our ordinary shares on The NASDAQ Capital Market on February 14, 2024.

RISK FACTORS

Investing in our securities involves significant risks.

Before making an investment decision, you should carefully consider the risks described under “Risk Factors” in the applicable

prospectus supplement and under Item 3.D. – “Risk Factors” in our most recent Annual Report on Form 20-F, or any updates

in our Reports on Form 6-K, together with all of the other information appearing in this prospectus or incorporated by reference into

this prospectus and any applicable prospectus supplement, in light of your particular investment objectives and financial circumstances.

The risks so described are not the only risks facing us. Additional risks not presently known to us or that we currently deem immaterial

may also impair our business operations. Our business, financial condition and results of operations could be materially adversely affected

by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your

investment. The discussion of risks includes or refers to forward-looking statements; you should read the explanation of the qualifications

and limitations on such forward-looking statements discussed elsewhere in this prospectus.

Risks Relating to the Offering

We have broad discretion in the use of the net proceeds from this

offering.

Our management will have broad discretion in the application of the net

proceeds from this offering and could spend the proceeds in ways with which you may not agree. Accordingly, you will be relying on the

judgment of our management with regard to the use of the net proceeds, and you will not have the opportunity, as part of your investment

decision, to assess whether the proceeds are being used appropriately. It is possible that the net proceeds will be invested or otherwise

used in a way that does not yield a favorable, or any, return for the Company.

Investors in this offering will experience immediate and substantial

dilution in the net tangible book value per ADS they purchase.

Since the price per share of our ordinary shares represented by ADSs being

offered is higher than the net tangible book value per share of our ordinary shares represented by ADSs, you will suffer substantial dilution

in the net tangible book value of the common stock you purchase in this offering. See the section entitled “Dilution” in this

prospectus for a more detailed discussion of the dilution you will incur if you purchase ADSs in this offering. In addition, we have a

significant number of options outstanding. If the holders of these options exercise such options, you may incur further dilution.

Our stockholders may experience significant dilution as a result

of future equity offerings and exercise of outstanding options.

In order to raise additional capital, we may in the future offer additional

ordinary shares represented by ADSs or other securities convertible into or exchangeable for our ordinary shares. We cannot assure you

that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the

price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights

superior to existing stockholders. The price per share at which we sell additional ordinary shares represented by ADSs or other securities

convertible into or exchangeable for our ordinary shares in future transactions may be higher or lower than the price per share in this

offering.

USE OF PROCEEDS

Except as otherwise provided in the applicable prospectus

supplement, we intend to use the net proceeds from the sale of the securities covered by this prospectus for ongoing and future clinical

trials and research programs into the development of our proprietary compounds, including our compound ATH434 for Parkinsonian disorders,

and for working capital purposes. Additional information on the use of net proceeds from the sale of securities covered by this

prospectus may be set forth in the prospectus supplement relating to the specific offering.

DILUTION

If you invest in our securities, your ownership interest

will be immediately diluted to the extent of the difference between the offering price per ordinary share paid by purchasers in this offering

and the pro forma as adjusted net tangible book value per ordinary share after completion of the offering. Dilution results from the fact

that the per ordinary share offering price is substantially in excess of the book value per ordinary share attributable to the existing

holders of our presently outstanding ordinary shares.

Our net tangible book value as of June 30, 2023 was approximately US$15.1

million, or US$0.0062 per ordinary share (US$3.72 per ADS). Net tangible book value per share or per ADS represents the amount of our

total tangible assets less total liabilities divided by the total number of ordinary shares or ADSs outstanding. Each ADS represents 600

ordinary shares.

After giving effect to the placement of 1,942,857,123 shares in placements

on November 29, 2023 (362,462,763 shares), January 8, 2024 (1,008,965,809 shares) and February 2, 2024 (571,428,556 shares), our adjusted

proforma net tangible book value as of June 30, 2023, would have been US$21.92 million or US$0.005 per ordinary share (US$3.00 per ADS).

After giving further effect to the sale of 1,764,705,882 ordinary shares (2,941,176 ADSs) in this offering of US$6,000,000 at an assumed

offering price of US$0.0034 per ordinary share, or US$2.04 per ADS, which was our closing price of our ADSs on the NASDAQ Capital Market

on February 13, 2024 and after deducting estimated offering commissions and other estimated offering expenses, our as-adjusted proforma

net tangible book value as of June 30, 2023 would have been US$27.62 million or US$0.0045 per ordinary share (US$2.70 per ADS). This represents

an immediate dilution in the proforma net tangible book value of US$0.0005 per ordinary share (US$0.31 per ADS) to our existing stockholders

and an increase in proforma net tangible book value of US$0.0011 per ordinary share (US$0.66 per ADS) to new investors.

The following table sets forth the estimated net tangible book value

per ordinary share in US$ after the offering and the dilution to persons purchasing ordinary shares based on the foregoing offering assumptions.

Assumed offering price per ordinary share | |

| | | |

$ | 0.0034 | |

| Adjusted net tangible book value per ordinary share as of June 30,

2023 | |

$ | 0.0050 | | |

| | |

| Dilution per ordinary share attributable to new investors | |

$ | 0.0005 | | |

| | |

| Pro forma as-adjusted net tangible book value per ordinary share after

this offering | |

| | | |

$ | 0.0045 | |

| Increase per share to new investors purchasing shares in this offering | |

| | | |

$ | 0.0011 | |

This discussion of dilution, and the table quantifying it, assumes

no exercise of any outstanding options or warrants over our ordinary shares. The table above contains a translation of net tangible book

value at June 30, 2023 from Australian dollar amounts into U.S. dollar amounts at specified rates solely for the convenience of the reader,

which was A$1 to US$0.663. Thereafter the proforma has been made at the exchange rate of A$1 to US$0.6516, which was the exchange rate

at February 13, 2024.

PLAN OF DISTRIBUTION

We have entered into an Sales Agreement,

dated February 15, 2024, or the Sales Agreement, with JonesTrading Institutional Services LLC, or the Agent, under which we may issue

and sell ADSs for up to $6,000,000 of our ordinary shares from time to time pursuant to this Prospectus Supplement through the Agent.

The Agent may sell the ADSs

by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415 under the Securities Act. The

ADSs are evidenced by ADRs.

Each time that we wish to issue and sell ADSs under

the Sales Agreement, we will provide the Agent with a placement notice describing the number of ADSs to be issued, the time period during

which sales are requested to be made, any limitation on the number of ADSs that may be sold in any one day and any minimum price below

which sales may not be made.

Upon receipt of a placement notice from us, and subject

to the terms and conditions of the Sales Agreement, the Agent has agreed to use its commercially reasonable efforts consistent with its

normal trading and sales practices to sell such ADSs up to the amount specified on such terms. Unless otherwise specified, the settlement

between us and the Agent of our ADSs will occur on the second trading day following the date on which the sale was made. The obligation

of the Agent under the Sales Agreement to sell our ADSs pursuant to a placement notice is subject to a number of conditions. There is

no arrangement for funds to be received in an escrow, trust or similar arrangement.

We will pay the Agent a commission of equal to

3.0% of the gross proceeds of the sales price of all ADSs sold through it as sales agent under the Sales Agreement. Because there is no

minimum offering amount required as a condition to closing this offering, the actual total public offering amount, commissions and proceeds

to us, if any, are not determinable at this time. We estimate that the total expenses for the offering, excluding compensation payable

to the Agent under the terms of the Sales Agreement, will be approximately US$100,000.

In connection with the sale of our ADSs contemplated

in this prospectus supplement, the Agent is an “underwriter” within the meaning of the Securities Act, and the compensation

paid to it will be deemed to be underwriting commissions or discounts. We have agreed to indemnify the Agent against certain civil liabilities,

including liabilities under the Securities Act.

Sales of our ADSs as contemplated in this prospectus

supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and the Agent may agree

upon.

The offering of our ADSs pursuant to this prospectus

supplement will terminate on the earlier of (1) the sale of all of the ordinary shares subject to this prospectus supplement, or (2) termination

of the Sales Agreement by us or the Agent.

This summary

of the material provisions of the Sales Agreement does not purport to be a complete statement of its terms and conditions. A copy of the

Sales Agreement, as amended, was filed with the SEC as an exhibit to a Report on Form 6-K filed under the Securities Exchange Act of 1934,

or the Exchange Act, and is incorporated by reference in this prospectus supplement and the accompanying prospectus.

The Agent and its affiliates have in the past and may

in the future provide various investment banking and other financial services for us, for which services they may in the future receive

customary fees.

LEGAL MATTERS

The validity of the securities offered hereunder will be passed upon

for us by QR Lawyers Pty Ltd., Melbourne, Australia, our Australian counsel. Carter Ledyard & Milburn LLP, New York, New York, will

be passing upon matters of United States law for us with respect to securities offered by this prospectus and any accompanying prospectus

supplement. The Agent is being represented in connection with this offering by Duane Morris LLP, New York, New York.

EXPERTS

The financial statements incorporated in this Prospectus

by reference to the Annual Report on Form 20-F for the year ended June 30, 2023 have been so incorporated in reliance on the report (which

contains an explanatory paragraph relating to the Company's ability to continue as a going concern as described in Note 1 to the financial

statements) of PricewaterhouseCoopers, an independent registered public accounting firm, given on the authority of said firm as experts

in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We filed a registration statement on Form F-3 to register

with the SEC the securities described in this prospectus. This prospectus is part of that registration statement. This prospectus, which

constitutes a part of the registration statement, summarizes material provisions of contracts and other documents that we refer to in

the prospectus. Since this prospectus does not contain all of the information contained in the registration statement, you should read

the registration statement and its exhibits and schedules for further information with respect to us and our ordinary shares and the ADSs.

Our SEC filings, including the registration statement, are also available to you on the SEC’s Web site at http://www.sec.gov.

We are subject to the information reporting requirements

of the Exchange Act that are applicable to foreign private issuers, and under those requirements we file reports with the SEC. As a foreign

private issuer, we are exempt from the rules under the Exchange Act related to the furnishing and content of proxy statements, and our

officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16

of the Exchange Act. In addition, we are not required under the Exchange Act to file annual, quarterly and current reports and financial

statements with the SEC as frequently or as promptly as United States companies whose securities are registered under the Exchange Act.

However, we file with the SEC, within four months after the end of each fiscal year, or such applicable time as required by the SEC, an

annual report on Form 20-F containing financial statements audited by an independent registered public accounting firm, and submit

to the SEC, on Form 6-K, unaudited quarterly financial information for the first three quarters of each fiscal year within 60 days

after the end of each such quarter, or such applicable time as required by the SEC.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference”

information into this prospectus, which means that we can disclose important information to you by referring you to other documents which

we have filed or will file with the SEC. We are incorporating by reference in this prospectus the documents listed below and all amendments

or supplements we may file to such documents, as well as any future filings we may make with the SEC on Form 20-F under the Exchange Act

before the time that all of the securities offered by this prospectus have been sold or de-registered.

| |

● |

Our Annual Report on Form 20-F for the fiscal year ended June 30, 2023, as filed with the Commission on August 31, 2023; |

| |

● |

Our Reports on Form 6-K filed with or furnished to the SEC on August

31, 2023, August 31,

2023, August

31, 2023, September 13,

2023, October 30,

2023, October 31,

2023, November 8,

2023, November 16,

2023, November 20,

2023, November 22,

2023, November 22,

2023, November 22,

2023, November 22,

2023, November 22,

2023, November 27,

2023, November 29,

2023, November 29,

2023, November

29, 2023, November 29,

2023, November 29,

2023, November 29,

2023, November 30,

2023, November 30,

2023, December 4,

2023, December 8, 2023, December

11, December 18, December

21, 2023, December 21,

2023, December 29,

2023, December 29,

2023, January 2, 2024, January

2, 2024, January 2,

2024, January 5, 2024, January

5, 2024, January 8,

2024, January 8, 2024, January

8, 2024, January 8,

2024, January 10, 2024, January

11, 2024, January 11,

2024, January 18, 2024, January

22, 2024, January 31, 2024, February 2, 2024, February 2, 2024, February 2, 2024, and February 6, 2024; |

| |

● |

The description of our ADRs contained in our Form 20-F for the fiscal year ended June 30, 2023. |

In addition, we may incorporate by reference

into this prospectus our reports on Form 6-K filed after the date of this prospectus (and before the time that all of the securities offered

by this prospectus have been sold or de-registered) if we identify in the report that it is being incorporated by reference in this prospectus.

Certain statements in and portions of this prospectus

update and replace information in the above listed documents incorporated by reference. Likewise, statements in or portions of a future

document incorporated by reference in this prospectus may update and replace statements in and portions of this prospectus or the above

listed documents.

We will provide you without charge, upon your written

or oral request, a copy of any of the documents incorporated by reference in this prospectus, other than exhibits to such documents which

are not specifically incorporated by reference into such documents. Please direct your written or telephone requests to:

Alterity Therapeutics Limited

Level 14, 350 Collins Street

Melbourne, Victoria 3000 Australia

Attn.: Phillip Hains, Chief Financial Officer

Telephone number +61-3-9349-4906.

You may also obtain information about us by visiting

our website at http://www.alteritytherapeutics.com. Information contained in our website is not part of this prospectus.

We are an Australian company and are a “foreign

private issuer” as defined in Rule 3b-4 under the Exchange Act. As a result, (1) our proxy solicitations are not subject to the

disclosure and procedural requirements of Regulation 14A under the Exchange Act, (2) transactions in our equity securities by our officers

and directors are exempt from Section 16 of the Exchange Act, and (3) we are not required under the Exchange Act to file periodic reports

and financial statements as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act. We make

all required filings with the SEC electronically, and these filings are available over the Internet at the SEC’s website at http://www.sec.gov.

PROSPECTUS

ALTERITY

THERAPEUTICS LIMITED

$50,000,000

Ordinary Shares represented by American Depositary Shares

Warrants

Units

We

may offer to the public from time to time in one or more series or issuances:

| ● | American

depositary shares, or ADSs, with each ADS representing six hundred ordinary shares; or |

| |

● |

warrants

to purchase ADSs; or |

| |

● |

a

combination of the above as units. |

We

refer to the ordinary shares, ADSs, warrants and units collectively as “securities” in this prospectus.

The

ADSs, are listed on the NASDAQ Capital Market under the symbol “ATHE.” On September 27, 2023, the closing price of an ADS

representing ordinary shares of Alterity Therapeutics Limited on the NASDAQ Capital Market was US$2.51.

The

securities will have a total public offering price not to exceed $50,000,000. This prospectus provides a general description of the securities

we may offer. Each time we sell securities, we will provide specific terms of the securities offered in a supplement to this prospectus.

The prospectus supplement may also add, update, or change information contained in this prospectus. This prospectus may not be used to

consummate a sale of securities unless accompanied by the applicable prospectus supplement. You should read both this prospectus and

any prospectus supplement together with additional information described under the heading “Where You Can Find More Information”

and the documents incorporated or deemed to be incorporated by reference carefully before you make your investment decision.

We

will sell these securities directly to our shareholders or to purchasers or through agents on our behalf or through underwriters or dealers

as designated from time to time. If any agents or underwriters are involved in the sale of any of these securities, the applicable prospectus

supplement will provide the names of the agents or underwriters and any applicable fees, commissions, or discounts. The prospectus supplement

for each offering of securities will describe in detail the plan of distribution for that offering. For general information about the

distribution of securities offered, please see “Plan of Distribution” in this prospectus on page 7.

The

aggregate market value of our outstanding Ordinary Shares held by non-affiliates on 21 September 2023, as calculated in accordance with

General Instruction I.B.5. of Form F-3, was approximately $3.96 million. During the prior 12 calendar month period that ends on, and

includes, the date of this prospectus, we have offered securities with an aggregate market value of approximately $0.12 million pursuant

to General Instruction I.B.5 of Form F-3. Pursuant to General Instruction I.B.5, in no event will we sell securities pursuant to this

prospectus with a value of more than one-third of the aggregate market value of our Ordinary Shares held by non-affiliates in any 12-month

period, so long as the aggregate market value of our Ordinary Shares held by non-affiliates is less than $75,000,000.

INVESTING

IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” BEGINNING ON PAGE 2 AND UNDER SIMILAR HEADINGS IN THE

OTHER DOCUMENTS THAT ARE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS FOR A DISCUSSION OF CERTAIN FACTORS THAT SHOULD BE CONSIDERED

BY PROSPECTIVE PURCHASERS OF THE SECURITIES OFFERED HEREBY.

NEITHER

THE U.S. SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED

UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The

date of this prospectus is October 25, 2023

TABLE

OF CONTENTS

You

should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized any other person

to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on

it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume

that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business,

financial condition, results of operation and prospects may have changed since that date.

In

this prospectus, the terms “we,” “us,” “Alterity and “our” mean Alterity Therapeutics Limited

and its subsidiaries, unless otherwise indicated

All

references to “U.S. dollars” or “US$” in this prospectus are to U.S. dollars, and all references to “Australian

dollars” or “A$” are to the currency of Australia.

SUMMARY

This

prospectus is part of a registration statement on Form F-3 that we filed with the Securities and Exchange Commission, or SEC, using a

“shelf” registration process. Under this process, we may sell from time to time any combination of the securities described

in this prospectus in one or more offerings up to a total U.S. dollar amount of $50,000,000 or the equivalent denominated in foreign

currencies or foreign currency units. This prospectus does not contain all of the information included in the registration statement.

For a more complete understanding of the offering of the securities, you should refer to the registration statement, including its exhibits.

This

prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus

supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or

change information contained in this prospectus, and may also contain information about any material federal income tax considerations

relating to the securities covered by the prospectus supplement. You should read both this prospectus and any prospectus supplement together

with additional information under the headings “Where You Can Find More Information” and “Incorporation of

Certain Information by Reference.”

This

summary may not contain all of the information that may be important to you. You should read this entire prospectus, including the financial

data and related notes incorporated by reference in this prospectus, before making an investment decision. This summary contains forward-looking

statements that involve risks and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking

statements. Factors that might cause or contribute to such differences include those discussed in “Risk Factors” and “Forward-Looking

Statements.”

Alterity

Therapeutics Limited

We

were incorporated under the laws of the Commonwealth of Australia on November 11, 1997 and began limited operations shortly thereafter.

Our mission is to develop therapeutic drugs designed to treat neurodegenerative diseases, currently focusing on Parkinsonian and other

movement disorders.

Corporate

Information

Our

registered office is located at Level 3, 62 Lygon Street, Carlton, Victoria 3053 Australia and our telephone number is 011-61-3-9824-5254.

Our principal executive office is located at Level 14, 350 Collins Street, Melbourne, Victoria 3000, Australia and our telephone number

is 011-61-3-9349-4906. Our address on the internet is www.alteritytherapeutics.com. The information in our website is not incorporated

by reference into this prospectus and should not be considered as part of this prospectus.

RISK

FACTORS

Investing

in our securities involves significant risks. Before making an investment decision, you should carefully consider the risks described

under “Risk Factors” in the applicable prospectus supplement and under Item 3.D. – “Risk Factors” in our

most recent Annual Report on Form 20-F, or any updates in our Reports on Form 6-K, together with all of the other information appearing

in this prospectus or incorporated by reference into this prospectus and any applicable prospectus supplement, in light of your particular

investment objectives and financial circumstances. The risks so described are not the only risks facing us. Additional risks not presently

known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition and results

of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to

any of these risks, and you may lose all or part of your investment. The discussion of risks includes or refers to forward-looking statements;

you should read the explanation of the qualifications and limitations on such forward-looking statements discussed elsewhere in this

prospectus.

FORWARD-LOOKING

STATEMENTS

Some

of the statements contained in this prospectus and the documents incorporated by reference are forward-looking statements. Forward-looking

statements involve risks and uncertainties, such as statements about our plans, objectives, expectations, assumptions or future events.

In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,”

“project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,”

“may,” “should,” “will,” “could” and similar expressions denoting uncertainty or an action

that may, will or is expected to occur in the future. These statements involve estimates, assumptions, known and unknown risks, uncertainties

and other factors that could cause actual results to differ materially from any future results, performances or achievements expressed

or implied by the forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements about:

| ● | statements

of expected future economic performance; |

| ● | the

future impact of pandemics on the economy and our operations; |

| ● | product

and technology development and rapid technological change; |

| ● | the

potential attributes and benefit of our products and their competitive position; |

| ● | our

estimates regarding expenses, future revenues, capital requirements and our need for additional financing; |

| ● | statements

of our plans and objectives; |

| ● | statements

regarding the capabilities of our business operations; |

| ● | statements

regarding competition in our market; and |

| ● | assumptions

underlying statements regarding us or our business. |

Forward-looking

statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations

and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks

and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial

condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these

forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those

indicated in the forward-looking statements include, among others, the following:

Risks

Related to Our Financial Condition

| ● | We

have a history of operating losses and our management has concluded that factors raise substantial

doubt about our ability to continue as a going concern and our auditor has included an explanatory

paragraph relating to our ability to continue as a going concern in its audit report for

the fiscal year ended June 30, 2023. |

| ● | We

will need additional funding to complete our clinical trials and to operate our business;

such funding may not be available or, if it is available, such financing is likely to substantially

dilute our existing shareholders. |

Risks

Related to Our Business

| ● | We

are a development stage company engaged in the development of pharmaceutical products and

our success is uncertain. |

| ● | We

rely on research institutions to conduct our clinical trials and we may not be able to secure

and maintain research institutions to conduct our future trials. The institutions that we

work with have their own limits and procedures that will influence or limit our ability to

conduct research and development and the conduct of clinical trials. |

| ● | We

are faced with uncertainties related to our research. |

| ● | Clinical

trials as they relate to our business are expensive and time consuming and their outcome

is uncertain. |

| ● | We

may experience delays in our clinical trials that could adversely affect our business and

operations. |

| ● | We

may not be able to complete the development of our products candidates or develop other pharmaceutical

products. |

| ● | We

may need to prioritise the development of our most promising candidates at the expense of

the development of other products. |

| ● | Our

research and development efforts will be seriously jeopardised if we are unable to retain

key personnel and cultivate key academic and scientific collaborations. |

| ● | If

we are unable to successfully keep pace with technological change or with the advances of

our competitors, our technology and products may become obsolete or non-competitive. |

| ● | Acceptance

of our products in the marketplace is uncertain and failure to achieve market acceptance

will negatively impact our business and operations. |

| ● | We

have limited large scale manufacturing experience with our product candidates. Delays in

manufacturing sufficient quantities of such materials to the required standards for pre-clinical

and clinical trials may negatively impact our business and operations. |

| ● | The

failure to establish sales, marketing and distribution capability would materially impair

our ability to successfully market and sell our pharmaceutical products. |

| ● | If

healthcare insurers and other organisations do not pay for our products, or impose limits

on reimbursement, our future business may suffer. |

| ● | We

may be exposed to product liability claims, which could harm our business. |

| ● | Breaches

of network or information technology security, natural disasters or terrorist attacks could

have an adverse effect on our business. |

Risks

Related to Government Regulation

| ● | If

we do not obtain the necessary governmental approvals, we will be unable to develop or commercialise

our pharmaceutical products. |

| ● | We

will not be able to commercialise any current or future product candidates if we fail to

adequately demonstrate their safety and efficacy. |

| ● | Positive

results in previous clinical trials of product candidates may not be replicated in future

clinical trials, which could result in development delays or a failure to obtain marketing

approval. |

| ● | Even

if approved, any product candidates that we or our subsidiaries may develop and market may

be later withdrawn from the market or subject to promotional limitations. |

| ● | Healthcare

reform measures and other statutory or regulatory changes could adversely affect our business |

| ● | We

could be adversely affected by violations of the U.S. Foreign Corrupt Practices Act. |

Risks

Related to Intellectual Property

| ● | Our

success depends upon our ability to protect our intellectual property and our proprietary

technology, to operate without infringing the proprietary rights of third parties and to

obtain marketing exclusivity for our products and technologies. |

| ● | We

may face difficulties in certain jurisdictions in protecting our intellectual property rights,

which may diminish the value of our intellectual property rights in those jurisdictions. |

| ● | Intellectual

property rights do not address all potential threats to our competitive advantage. |

| ● | Changes

in patent laws or patent jurisprudence could diminish the value of our patents, thereby impairing

our ability to protect our products or product candidates. |

| ● | Confidentiality

agreements with employees and others may not adequately prevent disclosure of our trade secrets

and protect our other proprietary information. |

Risks

Related to Our Compliance with the Sarbanes-Oxley Act of 2002

| ● | We

may fail to maintain effective internal control over financial reporting in accordance with

Section 404 of the Sarbanes-Oxley Act of 2002, which could adversely affect our operating

results, investor confidence in our reported financial information, and the market price

of our ordinary shares and ADSs. |

| ● | Material

weaknesses in our disclosure controls and procedures could negatively affect shareholder

and customer confidence. |

Risks

Related to Ownership of Our Securities

| ● | Our

stock price may be volatile and the trading markets for our securities is limited. |

| ● | Ownership

interest in our company may be further diluted as a result of additional financings. |

| ● | There

is a substantial risk that we are a passive foreign investment company, or PFIC, to some

U.S. investors which will subject those investors to adverse tax rules |

| ● | We

do not anticipate paying dividends on our ordinary shares. |

| ● | Currency

fluctuations may adversely affect the price of our securities. |

| ● | If

we fail to maintain compliance with NASDAQ’s continued listing requirements, our shares

may be delisted from the NASDAQ Capital Market. |

Risks

Related to Our Location in Australia

| ● | It

may be difficult to enforce a judgment in the United States against us and our officers and

directors or to assert U.S. securities laws claims in Australia or serve process on our officers

and directors. |

| ● | As

a foreign private issuer whose shares are listed on The NASDAQ Capital Market, we may follow

certain home country corporate governance practices instead of certain NASDAQ requirements. |

| ● | We

currently do not have a majority of independent directors serving on our Board of Directors,

which may afford less protection to our shareholders than if our Board of Directors had a

majority of independent directors. |

| ● | Australian

takeovers laws may discourage takeover offers being made for us or may discourage the acquisition

of large numbers of our ordinary shares. |

| ● | Our

Constitution and other Australian laws and regulations applicable to us may adversely affect

our ability to take actions that could be beneficial to our shareholders. |

OFFER

STATISTICS AND EXPECTED TIMETABLE

We

may sell from time to time pursuant to this prospectus (as may be detailed in prospectus supplements) an indeterminate number of securities

as shall have a maximum aggregate offering price of $50,000,000. The actual per share price of the securities that we will

offer pursuant hereto will depend on a number of factors that may be relevant as of the time of offer (see “Plan of Distribution”

below).

CAPITALIZATION

The

table below sets forth our capitalization as of June 30, 2023.

| | |

As of

June 30,

2023 | |

| | |

(In A$, except number of shares) | |

| Ordinary Shares, no par value, 2,439,897,618 shares issued and outstanding (1) | |

| |

| Issued capital | |

| 213,971,323 | |

| Reserves | |

| 3,972,475 | |

| Accumulated deficit | |

| (195,130,889 | ) |

| Total shareholders’ equity | |

| 22,812,909 | |

| (1) | The

number of shares issued and outstanding excludes 844,737,659 ordinary shares issuable upon the exercise of 844,737,659 options, having

exercise prices ranging from $A0.02 to $A0.09 per ordinary share having a weighted average exercise price of $A0.[ ] per ordinary share. |

MARKET

FOR OUR ORDINARY SHARES

Our

ordinary shares have traded on the ASX since our initial public offering on March 29, 2000. Since September 5, 2002 our ADRs have traded

on the NASDAQ Capital Market and since April 8, 2019, when we changed our name to Alterity Therapeutics Limited, under the symbol “ATHE.”

USE

OF PROCEEDS

Except

as otherwise provided in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the securities covered

by this prospectus for ongoing and future clinical trials and research programs into the development of our proprietary compounds, including

our compound ATH434 for Parkinsonian disorders, and for working capital purposes. Additional information on the use of net proceeds

from the sale of securities covered by this prospectus may be set forth in the prospectus supplement relating to the specific offering.

PLAN

OF DISTRIBUTION

We

may sell securities in any of the ways described below, including any combination thereof:

| ● | to

or through underwriters or dealers; |

| ● | through

one or more agents; or |

| ● | directly

to one or more purchasers. |

The

distribution of the securities may be effected from time to time in one or more transactions:

| ● | at

a fixed price, or prices, which may be changed from time to time; |

| ● | at

market prices prevailing at the time of sale; |

| ● | at

prices related to such prevailing market prices; or |

Each

prospectus supplement will describe the method of distribution of the securities and any applicable restrictions. The prospectus supplement

with respect to the securities of a particular series will describe the terms of the offering of the securities, including the following:

| ● | the

name or names of any underwriters, dealers or agents, and the amounts of securities underwritten or purchased by each of them; |

| ● | the

initial public offering price of the securities and the proceeds to us and any discounts, commissions, or concessions allowed or reallowed

or paid to dealers; and |

| ● | any

securities exchanges on which the securities may be listed. |

Any

public offering price and any discounts or concessions allowed or reallowed or paid to dealers may be changed from time to time. In no

event will any underwriter or dealer receive fees, commissions, and markups which, in the aggregate, would exceed 8% of the price of

the shares being registered.

Only

the agents or underwriters named in the prospectus supplement are agents or underwriters in connection with the securities being offered.

We

may authorize underwriters, dealers, or other persons acting as our agents to solicit offers by certain institutions to purchase securities

from us pursuant to delayed delivery contracts providing for payment and delivery on the date stated in the prospectus supplement. Each

contract will be for an amount not less than, and the aggregate amount of securities sold pursuant to such contracts shall not be less

nor more than, the respective amounts stated in the prospectus supplement. Institutions with whom the contracts, when authorized, may

be made include commercial and savings banks, insurance companies, pension funds, investment companies, educational and charitable institutions,

and other institutions, but shall in all cases be subject to our approval. Delayed delivery contracts will be subject only to those conditions

set forth in the prospectus supplement, and the prospectus supplement will set forth any commissions we pay for solicitation of these

contracts.

Agents,

underwriters and other third parties described above may be entitled to indemnification by us against certain civil liabilities, including

liabilities under the Securities Act of 1933, or to contribution with respect to payments which the agents or underwriters may be required

to make in respect thereof. Agents, underwriters and such other third parties may be customers of, engage in transactions with, or perform

services for us in the ordinary course of business.

One

or more firms, referred to as “remarketing firms,” may also offer or sell the securities, if the prospectus supplement so

indicates, in connection with a remarketing arrangement upon their purchase. Remarketing firms will act as principals for their own accounts

or as our agents. These remarketing firms will offer or sell the securities in accordance with the terms of the securities. The prospectus

supplement will identify any remarketing firm and the terms of its agreement, if any, with us and will describe the remarketing firm’s

compensation. Remarketing firms may be deemed to be underwriters in connection with the securities they remarket. Remarketing firms may

be entitled under agreements that may be entered into with us to indemnification by us against certain civil liabilities, including liabilities

under the Securities Act of 1933, and may be customers of, engage in transactions with, or perform services for us in the ordinary course

of business.

Certain

of the underwriters may use this prospectus and the accompanying prospectus supplement for offers and sales related to market making

transactions in the securities. These underwriters may act as principal or agent in these transactions, and the sales will be made at

prices related to prevailing market prices at the time of sale.

The

securities may be new issues of securities and may have no established trading market. The securities may or may not be listed on a national

securities exchange. Underwriters may make a market in these securities, but will not be obligated to do so and may discontinue any market

making at any time without notice. We can make no assurance as to the liquidity of or the existence of trading markets for any of the

securities.

Certain

persons participating in this offering may engage in overallotment, stabilizing transactions, short covering transactions, and penalty

bids in accordance with rules and regulations under the Securities Exchange Act of 1934, or the Exchange Act. Overallotment involves

sales in excess of the offering size, which create a short position. Stabilizing transactions permit bids to purchase the underlying

security so long as the stabilizing bids do not exceed a specified maximum. Short covering transactions involve purchase of the securities

in the open market after the distribution is completed to cover short positions. Penalty bids permit the underwriters to reclaim a selling

concession from a dealer when the securities originally sold by the dealer are purchased in a covering transaction to cover short positions.

Those activities may cause the price of the securities to be higher than it would otherwise be. If commenced, the underwriters may discontinue

any of the activities at any time.

DESCRIPTION

OF OUR SHARE CAPITAL

The

concept of authorized share capital no longer exists in Australia and as a result, our authorized share capital is unlimited. All our

outstanding ordinary shares are validly issued, fully paid and non-assessable. The rights attached to our ordinary shares are as follows:

Dividend

rights. If our board of directors recommends a dividend, registered holders of our ordinary shares may declare a dividend by ordinary

resolution in a general meeting. The dividend, however, cannot exceed the amount recommended by our board of directors. Our board of

directors may declare an interim dividend. No dividend may be paid except out of our profits.

Voting

rights. Holders of ordinary shares have one vote for each ordinary share held on all matters submitted to a vote of shareholders.

Such voting rights may be affected by the grant of any special voting rights to the holders of a class of shares with preferential rights

that may be authorized in the future.

The

quorum required for an ordinary meeting of shareholders consists of at least two shareholders represented in person or by proxy who hold

or represent, in the aggregate, at least one third of the voting rights of the issued share capital. A meeting adjourned for lack of

a quorum generally is adjourned to the same day in the following week at the same time and place or any time and place as the directors

designate in a notice to the shareholders. At the reconvened meeting, the required quorum consists of any two members present in person

or by proxy.

An

ordinary resolution, such as a resolution for the declaration of dividends, requires approval by the holders of a majority of the voting

rights represented at the meeting, in person, by proxy or by written ballot and voting thereon. Under our Constitution, a special resolution,

such as amending our Constitution, approving any change in capitalization, winding-up, authorization of a class of shares with special

rights, or other changes as specified in our Constitution, requires approval of a special majority, representing the holders of no less

than 75% of the voting rights represented at the meeting in person, by proxy or by written ballot, and voting thereon.

Pursuant

to our Constitution, our directors are elected at our annual general meeting of shareholders by a vote of the holders of a majority of

the voting power represented and voting at such meeting.

Rights

in our profits. Our shareholders have the right to share in our profits distributed as a dividend and any other permitted distribution.

Rights

in the event of liquidation. In the event of our liquidation, after satisfaction of liabilities to creditors, our assets will be

distributed to the holders of ordinary shares in proportion to the nominal value of their holdings. This right may be affected by the

grant of preferential dividend or distribution rights to the holders of a class of shares with preferential rights that may be authorized

in the future.

Changing

Rights Attached to Shares

According

to our Constitution, in order to change the rights attached to any class of shares, unless otherwise provided by the terms of the class,

such change must be adopted by a general meeting of the shareholders and by a separate general meeting of the holders of the affected

class with a majority of 75% of the voting power participating in such meeting.

Annual

and Extraordinary Meetings

Our

Board of Directors must convene an annual meeting of shareholders at least once every calendar year, within five months of our last fiscal

year-end balance sheet data. Notice of at least twenty-eight (28) days prior to the date of the meeting is required. An extraordinary

meeting may be convened by the board of directors, if it decides or upon a demand of any directors, or of one or more shareholders holding

in the aggregate at least five percent (5%) of our issued capital. An extraordinary meeting must be called not more than twenty-one (21)

days after the request is made. The meeting must be held not later than two months after requested.

Limitations

on the Rights to Own Securities in Our Company

Neither

our Constitution nor the laws of the Commonwealth of Australia restrict in any way the ownership or voting of our shares.

Changes

in Our Capital

Pursuant

to the Listing Rules of the Australian Securities Exchange, our directors may in their discretion issue securities equal to not more

than 25% of our issued capital within a 12-month period. Issuances of securities in excess of such amount require the approval of our

shareholders by an ordinary resolution, unless made under an exception contained in the Listing Rules of the Australian Securities Exchange

which includes, among other things, a pro rata offer to shareholders, offers or issues made under previously approved employee incentive

schemes and share purchase plans under Australian law involving an offer of up to A$30,000 of shares at the applicable price.

DESCRIPTION

OF OUR AMERICAN DEPOSITARY SHARES

American

Depositary Shares

The

Bank of New York Mellon, as depositary, will register and deliver ADSs. Each ADS represents six hundred ordinary shares (or a right to

receive six hundred ordinary shares) deposited with HSBC Custody Nominees (Australia) Limited, as custodian for the depositary. Each

ADS also represents any other securities, cash or other property which may be held by the depositary. The depositary’s corporate

trust office at which the ADSs are administered is located at 101 Barclay Street, New York, New York 10286. The Bank of New York

Mellon’s principal executive office is located at 240 Greenwich Street, New York, New York 10286.

You

may hold ADSs either (A) directly (i) by having an American depositary receipt, which is a certificate evidencing a specific

number of ADSs, registered in your name, or (ii) by holding ADSs in the Direct Registration System, or (B) indirectly through

your broker or other financial institution. If you hold ADSs directly, you are an ADS holder. This description assumes you hold your

ADSs directly. If you hold the ADSs indirectly, you must rely on the procedures of your broker or other financial institution to assert

the rights of ADR holders described in this section. You should consult with your broker or financial institution to find out what those

procedures are.

The

Direct Registration System is a system administered by DTC pursuant to which the depositary may register the ownership of uncertificated

ADSs, which ownership shall be confirmed by periodic statements issued by the depositary to the ADS holders entitled thereto.

As

an ADS holder, we will not treat you as one of our shareholders and you will not have shareholder rights. Australian law governs shareholder

rights. The depositary will be the holder of the shares underlying your ADSs. As a holder of ADSs, you will have ADS holder rights. A

deposit agreement among us, the depositary and you, as an ADS holder, and the beneficial owners of ADSs set out ADS holder rights as

well as the rights and obligations of the depositary. New York law governs the deposit agreement and the ADSs.

The

following is a summary of the material provisions of the deposit agreement. For more complete information, you should read the entire

deposit agreement and the form of American depositary receipt. Directions on how to obtain copies of those documents are provided under

“Where You Can Find Additional Information.”

Dividends

and Other Distributions

If

We Pay a Dividend or Other Distribution, How Will You Receive Dividends and Other Distributions on the Shares?

In

the event that we pay a cash dividend or make another distribution, the depositary has agreed to pay to you the cash dividends or other

distributions it or the custodian receives on shares or other deposited securities, after deducting its fees and expenses. You will receive

these distributions in proportion to the number of shares your ADSs represent.

| ● | Cash. The

depositary will convert any cash dividend or other cash distribution we pay on the shares into U.S. dollars, if it can do so on

a reasonable basis and can transfer the U.S. dollars to the United States. If that is not possible or if any government approval

is needed and cannot be obtained, the deposit agreement allows the depositary to distribute the foreign currency only to those ADR holders

to whom it is possible to do so. It will hold the foreign currency it cannot convert for the account of the ADS holders who have not

been paid. It will not invest the foreign currency and it will not be liable for any interest. |

Before

making a distribution, any withholding taxes, or other governmental charges that must be paid will be deducted. The depositary will distribute

only whole U.S. dollars and cents and will round fractional cents to the nearest whole cent. If exchange rates fluctuate during

a time when the depositary cannot convert the foreign currency, you may lose some or all of the value of the distribution.

| |

● |

Shares. The

depositary may distribute additional ADSs representing any shares we distribute as a dividend or free distribution. The depositary

will only distribute whole ADSs. It will sell shares which would require it to deliver a fractional ADS and distribute the net proceeds

in the same way as it does with cash. If the depositary does not distribute additional ADSs, the outstanding ADSs will also represent

the new shares. |

| |

● |

Rights

to Purchase Additional Shares. If we offer holders of our securities any rights to subscribe for additional shares or any

other rights, the depositary may make these rights available to you. If the depositary decides it is not legal and practical to make

the rights available but that it is practical to sell the rights, the depositary will use reasonable efforts to sell the rights and

distribute the proceeds in the same way as it does with cash. The depositary will allow rights that are not distributed or sold to

lapse. In that case, you will receive no value for them. |

If

the depositary makes rights available to you, it will exercise the rights and purchase the shares on your behalf. The depositary will

then deposit the shares and deliver ADSs to you. It will only exercise rights if you pay it the exercise price and any other charges

the rights require you to pay.

U.S. securities

laws may restrict transfers and cancellation of the ADSs represented by shares purchased upon exercise of rights. For example, you may

not be able to trade these ADSs freely in the United States. In this case, the depositary may deliver restricted depositary shares that

have the same terms as the ADSs described in this section except for changes needed to put the necessary restrictions in place.

| |

● |

Other

Distributions. The depositary will send to you anything else we distribute on deposited securities by any means

it thinks is legal, fair and practical. If it cannot make the distribution in that way, the depositary has a choice. It may decide

to sell what we distributed and distribute the net proceeds, in the same way as it does with cash. Or, it may decide to hold what

we distributed, in which case ADSs will also represent the newly distributed property. However, the depositary is not required to

distribute any securities (other than ADSs) to you unless it receives satisfactory evidence from us that it is legal to make that

distribution. |

The

depositary is not responsible if it decides that it is unlawful or impractical to make a distribution available to any ADS holders. We

have no obligation to register ADSs, shares, rights or other securities under the Securities Act. We also have no obligation to take

any other action to permit the distribution of ADSs, shares, rights or anything else to ADS holders. This means that you may

not receive the distributions we make on our shares or any value for them if it is illegal or impractical for us to make them available

to you.

Deposit,

Withdrawal and Cancellation

How

Are ADSs Issued?

The

depositary will deliver ADSs if you or your broker deposits shares or evidence of rights to receive shares with the custodian. Upon payment

of its fees and expenses and of any taxes or charges, such as stamp taxes or stock transfer taxes or fees, the depositary will register

the appropriate number of ADSs in the names you request and will deliver the ADSs to or upon the order of the person or persons entitled

thereto.

How

Do ADS Holders Cancel an ADS?

You

may turn in your ADSs at the depositary’s corporate trust office. Upon payment of its fees and expenses and of any taxes or charges,

such as stamp taxes or stock transfer taxes or fees, the depositary will deliver the shares and any other deposited securities underlying

the ADSs to you or a person you designate at the office of the custodian. Or, at your request, risk and expense, the depositary will

deliver the deposited securities at its corporate trust office, if feasible.

How

Do ADS Holders Interchange Between Certificated ADSs and Uncertificated ADSs?

You

may surrender your ADR to the depositary for the purpose of exchanging your ADR for uncertificated ADSs. The depositary will cancel that

ADR and will send you a statement confirming that you are the owner of uncertificated ADSs. Alternatively, upon receipt by the depositary

of a proper instruction from a holder of uncertificated ADSs requesting the exchange of uncertificated ADSs for certificated ADSs, the

depositary will execute and deliver to you an ADR evidencing those ADSs.

Voting

Rights

How

Do You Vote?

You

may instruct the depositary to vote the deposited securities, but only if we ask the depositary to ask for your instructions. Otherwise,

you won’t be able to exercise your right to vote unless you withdraw the shares. However, you may not know about the meeting enough

in advance to withdraw the shares.

If

we ask for your instructions, the depositary will notify you of the upcoming vote and arrange to deliver our voting materials to you.

The materials will (1) describe the matters to be voted on and (2) explain how you may instruct the depositary to vote the

shares or other deposited securities underlying your ADSs as you direct. For instructions to be valid, the depositary must receive them

on or before the date specified. The depositary will try, as far as practical, subject to the laws of Australia and our Constitution,

to vote or to have its agents vote the shares or other deposited securities as you instruct. The depositary will only vote or attempt

to vote as you instruct.

We

cannot assure you that you will receive the voting materials in time to ensure that you can instruct the depositary to vote your shares.

In addition, the depositary and its agents are not responsible for failing to carry out voting instructions or for the manner of carrying

out voting instructions. This means that you may not be able to exercise your right to vote and there may be nothing you can do if

your shares are not voted as you requested.

In

order to give you a reasonable opportunity to instruct the depositary as to the exercise of voting rights relating to deposited securities,

if we request the depositary to act, we will try to give the depositary notice of any such meeting and details concerning the matters

to be voted upon sufficiently in advance of the meeting date.

Fees

and Expenses

| Persons

Depositing or Withdrawing Shares Must Pay: |

|

For: |

| ● US$3.00

(or less) per 100 ADSs (or portion of 100 ADSs) |

|

● Issuance

of ADSs, including issuances resulting from a distribution of shares or rights or other property

● Cancellation

of ADSs for the purpose of withdrawal, including if the deposit agreement terminates |

| |

|

|

| ● US$0.03

(or less) per ADS |

|

● Any

cash distribution to you |

| |

|

|

| ● A

fee equivalent to the fee that would be payable if securities distributed to you had been shares and the shares had been deposited

for issuance of ADSs |

|

● Distribution

of securities distributed to holders of deposited securities which are distributed by the depositary to ADS holders |

| |

|

|

| ● US$1.50

(or less) per ADR |

|

● Transfers,

combination and split-up of ADRs |

| |

|

|

| ● Expenses

of the depositary |

|

● Cable,

telex and facsimile transmissions (when expressly provided in the deposit agreement)

● Converting

foreign currency to U.S. dollars |

| |

|

|

| ● Taxes

and other governmental charges the depositary or the custodian have to pay on any ADS or share underlying an ADS, for example,

stock transfer taxes, stamp duty or withholding taxes |

|

● As

necessary |

| |

|

|

| ● Any

charges incurred by the depositary or its agents for servicing the deposited securities |

|

● As

necessary |

The

Bank of New York Mellon, as depositary, has agreed to reimburse us for expenses we incur that are related to establishment and maintenance

of the ADR program, including investor relations expenses and Nasdaq application and listing fees. There are limits on the amount of

expenses for which the depositary will reimburse us, but the amount of reimbursement available to us is not related to the amount of

fees the depositary collects from investors.

The

depositary collects its fees for issuance and cancellation of ADSs directly from investors depositing shares or surrendering ADSs for

the purpose of withdrawal or from intermediaries acting for them. The depositary collects fees for making distributions to investors

by deducting those fees from the amounts distributed or by selling a portion of distributable property to pay the fees. The depositary