UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

(Amendment No. 1)*

(Rule 13d-101)

Information

to be included in statements filed pursuant

to §

240.13d-1(a) and amendments thereto filed

pursuant

to § 240.13d-2(a)

Under the Securities Exchange Act of 1934

Atara Biotherapeutics, Inc.

(Name of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

046513107

(CUSIP Number)

Gregory A. Ciongoli

Adiumentum Capital Fund I LP

c/o Cadwalader, Wickersham & Taft LLP

200 Liberty Street

New York, NY 10281

(212) 504-6000

with a copy to

Richard M. Brand

Erica L. Hogan

Cadwalader, Wickersham & Taft LLP

200 Liberty Street

New York, NY 10281

(212) 504-6000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September 3, 2024

(Date of Event which Requires Filing of this

Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ¨

| * | The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page. |

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act

of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

| |

| |

1. |

Names of Reporting Persons

Adiumentum Capital Fund I LP |

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

x |

| |

|

(b) |

¨ |

| |

3. |

SEC

Use Only |

| |

4. |

Source of Funds (See Instructions)

OO |

| |

5. |

Check

Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

6. |

Citizenship or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,134,322(1) |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,134,322(1) |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,134,322(1) |

| |

12. |

Check

Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent of Class Represented by Amount in Row (11)

19.99%(2) |

| |

14. |

Type of Reporting Person (See Instructions)

IA |

| |

|

|

|

|

|

(1) Adiumentum Capital Fund I LP’s

beneficial ownership of the reported securities is comprised of 1,133,823 shares of Common Stock (as defined below) and 499

Pre-Funded Warrants (as defined below) which may be exercised as of the date hereof without exceeding the Beneficial Ownership

Limitation (as defined below). The reported securities may also be deemed beneficially owned by Adiumentum Capital Fund I GP LLC and

Gregory A. Ciongoli, each of which or whom disclaim beneficial ownership of these shares, except to the extent of its or his

pecuniary interest in such shares, if any. Subject to the Beneficial Ownership Blocker (as defined below), Adiumentum Capital Fund I

LP may also be deemed to beneficially own 150,193 shares of Common Stock issuable upon exercise of certain Pre-Funded Warrants.

Pursuant to the terms of the Pre-Funded Warrants, the Issuer may not effect any exercise of any Pre-Funded Warrant, and a holder of

a Pre-Funded Warrant does not have the right to exercise any portion of the Pre-Funded Warrant held by such holder, to the extent

that, after giving effect to the attempted exercise set forth in a notice of exercise, such holder, together with such

holder’s affiliates and any other person whose beneficial ownership of Common Stock would be aggregated with such

holder’s for the purposes of Section 13(d) of the Act, and the applicable regulations of the U.S. Securities and Exchange

Commission (the “SEC”), including any “group” of which such holder is a member, would beneficially own a

number of shares of Common Stock in excess of the Beneficial Ownership Limitation (the “Beneficial Ownership Blocker”).

The “Beneficial Ownership Limitation” is 19.99% of the shares of Common Stock then issued and outstanding, which

percentage may be changed at a holder’s election upon 61 days’ notice to the Issuer. The 1,133,823 shares of Common

Stock and 499 Pre-Funded Warrants reported as beneficially owned by Adiumentum Capital Fund I LP in this Schedule 13D represents

19.99% of the outstanding shares of Common Stock (calculated in accordance with footnote (2) below).

(2) All percentage calculations set forth

herein are based upon the aggregate of 4,915,049 shares of Common Stock (as defined below) outstanding as of August 6, 2024, as

reported in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on August 12, 2024 (as adjusted to account

for the one-for-twenty-five reverse stock split of the Issuer, effective as of June 20, 2024, as reported by the Issuer in its

Quarterly Report on Form 10-Q filed on August 12, 2024 (the “Reverse Stock Split”)), and 758,900 shares

of Common Stock and 499 Pre-Funded Warrants issued to Adiumentum Capital Fund I LP in the Registered Offering (as defined

below).

| |

| |

1. |

Names of Reporting Persons

Adiumentum Capital Fund I GP LLC |

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

x |

| |

|

(b) |

¨ |

| |

3. |

SEC

Use Only |

| |

4. |

Source of Funds (See Instructions)

OO |

| |

5. |

Check

Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

6. |

Citizenship or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,134,322(1) |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,134,322(1) |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,134,322(1) |

| |

12. |

Check

Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent of Class Represented by Amount in Row (11)

19.99%(2) |

| |

14. |

Type of Reporting Person (See Instructions)

IA |

| |

|

|

|

|

|

(1) Adiumentum Capital Fund I GP LLC’s

beneficial ownership of the reported securities is comprised of 1,133,823 shares of Common Stock and 499 Pre-Funded Warrants which

may be exercised as of the date hereof without exceeding the Beneficial Ownership Limitation. The reported securities may also be

deemed beneficially owned by Adiumentum Capital Fund I LP and Gregory A. Ciongoli, each of which or whom disclaim beneficial

ownership of these shares, except to the extent of its or his pecuniary interest in such shares, if any. Subject to the Beneficial

Ownership Blocker, Adiumentum Capital Fund I GP LLC may also be deemed to beneficially own 150,193 shares of Common Stock issuable

upon exercise of certain Pre-Funded Warrants. Pursuant to the terms of the Pre-Funded Warrants, the Issuer may not effect any

exercise of any Pre-Funded Warrant, and a holder of a Pre-Funded Warrant does not have the right to exercise any portion of the

Pre-Funded Warrant held by such holder, if the Beneficial Ownership Blocker applies. The 1,133,823 shares of Common Stock and 499

Pre-Funded Warrants reported as beneficially owned by Adiumentum Capital Fund I GP LLC in this Schedule 13D represents 19.99% of the

outstanding shares of Common Stock (calculated in accordance with footnote (2) below).

(2) All percentage calculations set forth

herein are based upon the aggregate of 4,915,049 shares of Common Stock outstanding as of August 6, 2024, as reported in the

Issuer’s Quarterly Report on Form 10-Q filed with the SEC on August 12, 2024 (as adjusted to account for the Reverse

Stock Split), and 758,900 shares of Common Stock and 499 Pre-Funded Warrants issued to Adiumentum Capital Fund I LP issued in the

Registered Offering.

| |

| |

1. |

Names of Reporting Persons

Gregory A. Ciongoli |

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

x |

| |

|

(b) |

¨ |

| |

3. |

SEC

Use Only |

| |

4. |

Source of Funds (See Instructions)

OO |

| |

5. |

Check

Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

6. |

Citizenship or Place of Organization

United States |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,134,322(1) |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,134,322(1) |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,134,322(1) |

| |

12. |

Check

Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent of Class Represented by Amount in Row (11)

19.98%(2) |

| |

14. |

Type of Reporting Person (See Instructions)

IN |

| |

|

|

|

|

|

(1) Mr. Ciongoli’s beneficial

ownership of the reported securities is comprised of 1,133,823 shares of Common Stock and 499 Pre-Funded Warrants which may be

exercised as of the date hereof without exceeding the Beneficial Ownership Limitation. The reported securities may also be deemed

beneficially owned by Adiumentum Capital Fund I LP and Adiumentum Capital Fund I GP LLC, each of which disclaim beneficial ownership

of these shares, except to the extent of its pecuniary interest in such shares, if any. Subject to the Beneficial Ownership Blocker,

Mr. Ciongoli may also be deemed to beneficially own 150,193 shares of Common Stock issuable upon exercise of certain Pre-Funded

Warrants. Pursuant to the terms of the Pre-Funded Warrants, the Issuer may not effect any exercise of any Pre-Funded Warrant, and a

holder of a Pre-Funded Warrant does not have the right to exercise any portion of the Pre-Funded Warrant held by such holder, if the

Beneficial Ownership Blocker applies. The 1,133,823 shares of Common Stock and 499 Pre-Funded Warrants reported as beneficially

owned by Mr. Ciongoli in this Schedule 13D represents 19.99% of the outstanding shares of Common Stock (calculated in accordance

with footnote (2) below).

(2) All percentage calculations set forth

herein are based upon the aggregate of 4,915,049 shares of Common Stock outstanding as of August 6, 2024, as reported in the

Issuer’s Quarterly Report on Form 10-Q filed with the SEC on August 12, 2024 (as adjusted to account for the Reverse

Stock Split), and 758,900 shares of Common Stock and 499 Pre-Funded Warrants issued to Adiumentum Capital Fund I LP in the

Registered Offering.

This Amendment No. 1 to

Schedule 13D (this “Amendment No. 1”) relates to the Schedule 13D filed with the SEC on May 22, 2024 (the

“Initial 13D” and, as amended and supplemented through the date of this Amendment No. 1, collectively, the “Schedule

13D”) by the Reporting Persons, relating to the common stock, par value $0.0001 per share (the “Common Stock”),

of Atara Biotherapeutics, Inc., a Delaware corporation (the “Issuer”). Except to the extent set forth in this

Amendment No. 1, all information disclosed in the Initial 13D remains unchanged. Capitalized terms used but not otherwise defined

in this Amendment No. 1 have the meaning ascribed to them in the Initial 13D.

Percentage beneficial

ownership reported herein is based on 4,915,049 shares of Common Stock outstanding as of August 6, 2024, as reported on the

Issuer’s Quarterly Report on Form 10-Q filed with the SEC on August 12, 2024 (as adjusted to account for the Reverse

Stock Split), and 758,900 shares of Common Stock and 499 Pre-Funded Warrants issued to Adiumentum Capital Fund I LP in the

Registered Offering.

This Amendment No. 1 amends

Items 3, 4, 5, 6 and 7 as set forth below:

| Item 3. |

Source and Amount of Funds or Other Consideration. |

Item 3 of the Initial 13D is

hereby amended and restated in its entirety as follows:

The Responses to Item 4, 5 and

6 of this Schedule 13D are incorporated herein by reference.

The investment costs

(including commissions, if any) of the Common Stock and the Pre-Funded Warrants directly owned by Adiumentum is approximately

$13,796,448.29. The source of funding for such transactions was derived from the capital of Adiumentum.

| Item 4. |

Purpose of Transaction. |

Item 4 of the Initial 13D is

hereby amended and supplemented to add the following information:

On September 3, 2024, the

Issuer entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain purchasers including Adiumentum

(the “Purchasers”), pursuant to which the Issuer agreed to issue and sell to the Purchasers in a registered direct

offering (the “Registered Offering”) an aggregate of (i) 758,900 shares (the “Shares”) of the

Issuer’s common stock, par value $0.0001 per share (the “Common Stock”), and (ii) pre-funded warrants (each,

a “Pre-Funded Warrant”, and together, the “Pre-Funded Warrants”) to purchase up to 3,604,780 shares

of Common Stock, at a purchase price of $8.25 per share of Common Stock and $8.2499 per share of Common Stock issuable upon exercise of

the Pre-Funded Warrants. The exercise price of each Pre-Funded Warrant is equal to $0.0001 per share, subject to adjustment as provided

therein, and the Pre-Funded Warrants will be exercisable immediately and have no expiration date. The Pre-Funded Warrants may be exercised

by means of cash or the holder may elect to receive upon such exercise the net number of shares of Common Stock determined according to

a formula set forth in the Pre-Funded Warrants.

The aggregate gross proceeds

to the Issuer from the Registered Offering are expected to be approximately $36.0 million, before deducting estimated offering expenses

payable by the Issuer. Adiumentum is purchasing 758,900 shares of Common Stock and Pre-Funded Warrants to purchase up to 150,193 shares

of Common Stock in the Registered Offering at an aggregate purchase price of $7.5 million. The Registered Offering is being made pursuant

to an effective shelf registration statement on Form S-3 (File No. 333-275256) that was filed with the SEC on November 1,

2023 and declared effective by the SEC on November 13, 2023 and prospectus supplement to be filed with the SEC. The Registered Offering

closed on September 5, 2024 (the “Closing Date”), subject to the satisfaction or waiver of customary

closing conditions, including the appointment of Mr. Gregory A. Ciongoli to the Board of Directors of the Issuer (the “Board”).

The Board appointed, effective as of and contingent upon the Closing Date, Mr. Ciongoli to serve as a

member of the Board.

Pursuant to the Purchase Agreement,

the Issuer has agreed to certain restrictions on the issuance and sale of shares of the Issuer’s securities for a period of 30 days

following the Closing Date, subject to certain exceptions.

The Purchase Agreement contains

customary representations, warranties, covenants and agreements by the Issuer, customary conditions to closing, indemnification obligations,

other obligations of the parties and termination provisions. The representations, warranties and covenants contained in the Purchase Agreement

were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to such agreement and

may be subject to limitations agreed upon by the contracting parties. The foregoing is only a summary of the terms of the Purchase Agreement

and the Pre-Funded Warrants issued under the Purchase Agreement, and does not purport to be complete and is qualified in its entirety

by reference to the full text of (i) the form of Purchase Agreement, a copy of which is filed as Exhibit 99.3 hereto

and (ii) the form of Pre-Funded Warrant, a copy of which is filed as Exhibit 99.4 hereto.

| Item 5. |

Interest in Securities of the Issuer. |

Items 5(a), (b) and (c) of

the Initial 13D are hereby amended and restated in their entirety to read as follows:

(a),

(b) The Reporting Persons each beneficially owns an aggregate of 1,133,823 shares of

Common Stock (the “Subject Shares”). The Subject Shares represent approximately 19.98% of the outstanding shares

of Common Stock, based on 4,915,049 shares of Common Stock outstanding as of August 6, 2024, as reported in the Issuer’s

Quarterly Report on Form 10-Q filed with the SEC on August 12, 2024 (as adjusted to account for the Reverse Stock Split),

and 758,900 shares of Common Stock and 499 Pre-Funded Warrants issued to Adiumentum Capital Fund I LP issued in the Registered

Offering.

Adiumentum may be deemed to

have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) all of the Subject

Shares. Adiumentum GP, as the general partner of Adiumentum may be deemed to have the shared power to vote or direct the vote of (and

the shared power to dispose or direct the disposition of) all the Subject Shares. Mr. Ciongoli, as the managing partner of Adiumentum,

and as the managing member of Adiumentum GP, may be deemed to have the shared power to vote or direct the vote of (and the shared power

to dispose or direct the disposition of) all the Subject Shares.

(c) Other than as

disclosed in Item 4 of this Amendment No.1, no reportable transactions were effected by any Reporting Person during the past sixty

days.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Item 6 of the Initial 13D is

hereby amended and supplemented to add the following information:

On September 3, 2024, Adiumentum

and the Issuer entered into the Purchase Agreement and the Issuer issued Pre-Funded Warrants to Adiumentum, each of which are described

in Item 4 above and forms of each of which are filed as Exhibit 99.3 and Exhibit 99.4, respectively, to this Amendment

No. 1. Item 4 to this Amendment No. 1 is incorporated herein by reference.

| Item 7. |

Material to be Filed as Exhibits. |

Item 7 of the Initial 13D is

hereby amended and supplemented to add the following exhibits:

SIGNATURES

After reasonable inquiry and

to the best of my knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and

correct.

| Date: September 5, 2024 |

ADIUMENTUM CAPITAL FUND I LP |

| |

|

| |

By: |

Adiumentum Capital Fund I GP LLC, its general partner |

| |

By: |

/s/ Gregory A. Ciongoli |

| |

|

Name: Gregory A. Ciongoli |

| |

|

Title: Managing Member |

| Date: September 5, 2024 |

ADIUMENTUM CAPITAL FUND I GP LLC |

| |

|

| |

By: |

/s/ Gregory A. Ciongoli |

| |

|

Name: Gregory A. Ciongoli |

| |

|

Title: Managing Member |

| |

|

| Date: September 5, 2024 |

GREGORY A. CIONGOLI |

| |

|

| |

By: |

/s/ Gregory A. Ciongoli |

| |

|

Gregory A. Ciongoli |

Index

to Exhibits

*Previously filed.

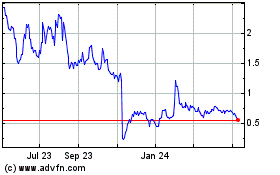

Atara Biotherapeutics (NASDAQ:ATRA)

Historical Stock Chart

From Jan 2025 to Feb 2025

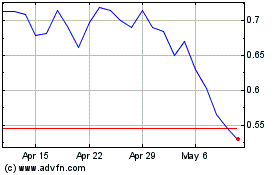

Atara Biotherapeutics (NASDAQ:ATRA)

Historical Stock Chart

From Feb 2024 to Feb 2025