UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under Rule 14a-12

Better Home & Finance Holding Company

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary material

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION

Notice of 2024 Annual Meeting of Stockholders

and Proxy Statement

| | | | | | | | | | | | | | |

| | | | |

| Better.com | | 3 World Trade Center, 57th Floor New York, NY 10007 | |

Dear Fellow Stockholders,

On behalf of the Board of Directors of Better Home & Finance Holding Company, I am pleased to invite you to attend the 2024 annual meeting of stockholders of Better Home & Finance Holding Company (the "2024 Annual Meeting"), to be held on Tuesday, June 4, 2024, at 12:00 p.m., Eastern Time. Our 2024 Annual Meeting will be a ‘‘virtual meeting’’ conducted exclusively online via the Internet at www.virtualshareholdermeeting.com/BETR2024.

The Notice of 2024 Annual Meeting of Stockholders and Proxy Statement on the following pages describe the matters to be presented at the 2024 Annual Meeting. Details regarding how to attend the meeting and the business to be conducted at the 2024 Annual Meeting are more fully described in the Notice of 2024 Annual Meeting of Stockholders and Proxy Statement.

Your vote is very important. Whether you plan to attend and participate in the 2024 Annual Meeting, please be sure to vote. Voting instructions can be found on page 38 of the Proxy Statement. On behalf of the Board of Directors and the management team, thank you for your ongoing support of and continued interest in Better Home & Finance.

Sincerely,

[Signature of Harit Talwar]

Harit Talwar

Chairman of the Board of Directors

April [•], 2024

Notice of 2024 Annual Meeting of Stockholders

The board of directors (the "Board") of Better Home & Finance Holding Company ("we", "us", "our", "Better", "Better Home & Finance" or the "Company") is soliciting proxies to be used at the 2024 annual meeting of stockholders (the "2024 Annual Meeting") to be held on the following date, at the following time and to be conducted in a "virtual meeting" format exclusively online, and with the following record date:

Time and Date: Tuesday, June 4, 2024, at 12:00 p.m., Eastern Time

Internet Link: www.virtualshareholdermeeting.com/BETR2024

Record Date: April 8, 2024

The following proposals will be voted on during the 2024 Annual Meeting:

| | | | | |

| Proposals |

| 1 | Election of the seven nominees identified in the accompanying Proxy Statement to serve as directors until the next annual meeting of stockholders |

| 2 | Approval of one or more amendments to the Company's Amended and Restated Certificate of Incorporation to effect one or more reverse stock splits of the Company’s Class A Common Stock, Class B Common Stock and Class C Common Stock at a ratio ranging from any whole number between 1-for-2 and 1-for-100 and in the aggregate not more than 1-for-100, inclusive, as determined by the Board in its discretion, subject to the Board's authority to abandon such amendments |

| 3 | Approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation to permit for officer exculpation to the extent permitted under Delaware law |

| 4 | Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2024 |

| 5 | Transaction of any other business that may properly be brought before the 2024 Annual Meeting |

| | | | | |

| ☑ | The Board of Directors recommends that stockholders vote FOR the election of each of the director nominees and FOR each of Proposals 2, 3 and 4 |

Who Can Vote

Only holders of record of our Class A common stock, par value $0.0001 per share (“Class A Common Stock”), and Class B common stock, par value $0.0001 per share (“Class B Common Stock”), at the close of business on April 8, 2024, will be entitled to vote at the 2024 Annual Meeting. You may vote with respect to the matters described in the Proxy Statement by following the instructions set forth in the Notice of Internet Availability of Proxy Materials (the “Notice”) or through the procedures described in the Proxy Statement.

Date of Mailing

The Proxy Statement and accompanying materials were filed with the U.S. Securities and Exchange Commission on, and we expect to first send the Notice to stockholders on or about, April [•], 2024.

[Signature of Paula Tuffin]

Paula Tuffin

General Counsel, Chief Compliance Officer and Secretary

New York, New York

April [•], 2024

| | | | | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held June 4, 2024 The Notice of the 2024 Annual Meeting and Proxy Statement and the 2023 Annual Report to Stockholders are available at www.proxyvote.com |

Table of Contents

| | | | | | | | |

| Better Home & Finance Holding Company 2024 Proxy Statement | | i |

| | | | | | | | |

| Table of Contents and Defined Terms |

Forward-Looking Statements

This Proxy Statement and the information and documents incorporated by reference herein include “forward-looking statements.” These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements include, without limitation, statements regarding predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this Proxy Statement, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Such forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, the Company disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this Proxy Statement. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the "2023 Annual Report"), as well as the Company’s most recent quarterly report on Form 10-Q.

| | | | | | | | |

ii | | Better Home & Finance Holding Company 2024 Proxy Statement |

Our Company

About Better Home & Finance

Better Home & Finance principally operates a digital-first homeownership company with services including mortgage financing, real estate services, title and homeowners’ insurance. We offer a selection of loan products for home purchase and refinance, including cash-out refinance, debt consolidation and home equity lines of credit, across a range of maturities and interest rates as well as a suite of non-mortgage products, including real estate agent services offered by our network of third-party partner real estate agents and, through our insurance partners, title insurance and settlement services, and homeowners insurance.

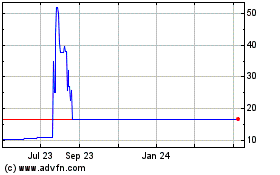

Business Combination

On August 22, 2023, we consummated the transactions contemplated by the Agreement and Plan of Merger, dated as of May 10, 2021 (as amended, the “Merger Agreement”), by and among Aurora Acquisition Corp. (“Aurora”), Better Holdco, Inc. (“Pre-Business Combination Better”), and Aurora Merger Sub I, Inc., formerly a wholly owned subsidiary of Aurora (“Merger Sub”). On that date, Merger Sub merged with and into Pre-Business Combination Better, with Pre-Business Combination Better surviving the merger (the “First Merger”) and Pre-Business Combination Better merged with and into Aurora, with Aurora surviving the merger and changing its name to “Better Home & Finance Holding Company” (referred to as “Better Home & Finance”) (such merger, the “Second Merger,” and together with the First Merger, the “Business Combination” and the completion thereof, the “Closing”). In connection with the Closing of the Business Combination, the Company’s Class A common stock, par value $0.0001 per share (“Class A Common Stock”), and warrants to purchase shares of Class A Common Stock at an exercise price of $11.50 per share ("Warrants") began trading on the Nasdaq Global Market and Nasdaq Capital Market, respectively, under the ticker symbols “BETR” and "BETRW.” On March 13, 2024, the Company’s Class A Common Stock transferred listing from the Nasdaq Global Market to the Nasdaq Capital Market.

Unless otherwise indicated, references to “Better,” “Better Home & Finance,” the “Company,” “we,” “us,” “our” and other similar terms refer to (i) Pre-Business Combination Better and its consolidated subsidiaries prior to the Closing and (ii) Better Home & Finance and its consolidated subsidiaries following the Closing.

| | | | | | | | |

| Better Home & Finance Holding Company 2024 Proxy Statement | | 1 |

Proposal 1 - Election of Directors

Director Nominees

Our Corporate Governance and Nominations Committee and our Board have determined that each of the nominees possesses the right skills, qualifications and experience to oversee our long-term business strategy. Biographical information about each nominee, as well as highlights of certain notable skills, qualifications and experience that contributed to the nominee’s selection as a member of our Board and nomination for re-election at our 2024 Annual Meeting, are set forth below.

| | | | | | | | |

| Name | Principal Occupation | Age |

Harit Talwar | Former Partner, Goldman Sachs and Former President, U.S. Cards, Discover Financial Services | 63 |

| Vishal Garg | Chief Executive Officer, Better Home & Finance | 46 |

Michael Farello | Managing Partner, L Catterton | 59 |

Arnaud Massenet | Managing Partner, NaMa Capital Advisors LLP | 58 |

Prabhu Narasimhan | Managing Partner, NaMa Capital Advisors LLP | 44 |

Steven Sarracino | Founder and Chief Executive Officer, Activant Capital Group, LLC | 47 |

Riaz Valani | General Partner and Founder, Global Asset Capital | 47 |

Harit Talwar, Chairman

Mr. Talwar has served as a member of our board of directors (the "Board") and our Chairman since the Closing. Mr. Talwar served as Chairman of the board of directors of Pre-Business Combination Better (the "Pre-Business Combination Better Board") from May 2022 until the Closing. He was most recently at Goldman Sachs, where he served as Chairman of the Consumer Business from January 2021 through December 2021 and Global Head of the Consumer Business from May 2015 to January 2021, leading the firm’s entry into the consumer space and helping to build Marcus by Goldman Sachs as the division’s head and first employee. Prior to Goldman Sachs, Mr. Talwar was President, U.S. Cards, at Discover Financial Services. He also worked at Citicorp/Citigroup for 15 years in various management roles. Mr. Talwar has served as a member of the board of directors of Mastercard Inc. since April 2022. In addition, Mr. Talwar has served as a member of the board of directors of KPMG U.S. since January 2024, a member of the board of directors of Apexon, a digital engineering services company, since 2022 and a member of the board of directors of Inveniam, a block chain company digitizing assets in private markets, since 2023. Mr. Talwar holds a B.A. in economics from Delhi University and an M.B.A. from the Indian Institute of Management, Ahmedabad. Mr. Talwar was selected to serve on the Board and as Chairman of the Board due to his strong background in direct-to-consumer financial businesses and experience building public companies.

Vishal Garg, Chief Executive Officer

Mr. Garg has served as a member of our Board and Chief Executive Officer of the Company since the Closing. Mr. Garg founded Pre-Business Combination Better and served as Chief Executive Officer of Pre-Business Combination Better from its inception in 2015 until the Closing. Since 1999, Mr. Garg has served as the founding partner of 1/0 Capital, an investment holding company focused on creating and investing in businesses within consumer finance, technology and digital marketing, and which is a significant stockholder of the Company. Before this, Mr. Garg was an entrepreneur in the consumer finance industry. Mr. Garg holds a B.S. in Finance and International Business from New York University. Mr. Garg was selected to serve on the Board due to, among other things, the perspective and experience he brings as our Chief Executive Officer and co-founder of Pre-Business Combination Better.

Michael Farello

Mr. Farello has served as a member of our Board since the Closing. Mr. Farello served as a member of the Pre-Business Combination Better Board from February 2020 until the Closing. He is also a Managing Partner of L Catterton, a private equity firm, focused on its Growth fund, a position he has held since January 2006. Mr. Farello serves as a member of the board of several private companies, and on several of their audit committees and compensation committees. In addition, since July 2015, Mr. Farello has served on the board of directors of Vroom, an e-commerce used vehicle sales platform, including as chair of the compensation committee since July 2015. Mr. Farello holds a B.S. in industrial engineering from Stanford University and an M.B.A. from Harvard Business School. Mr. Farello was selected to serve on the Board due to his strong background in technology and direct-to-consumer businesses, knowledge of growth strategies, and extensive board and committee experience.

Arnaud Massenet

Mr. Massenet has served as a member of our Board since the Closing. Mr. Massenet served as Chief Executive Officer of

| | | | | | | | |

| Better Home & Finance Holding Company 2024 Proxy Statement | | 1 |

| | | | | | | | |

| Proposal 1 - Election of Directors |

Aurora and as an executive officer of Novator Capital Sponsor Ltd., a Cyprus limited liability company (the "Sponsor"), in each case from inception until the Closing. Mr. Massenet is a managing partner of NaMa Capital Advisors LLP (previously Novator Capital). Mr. Massenet holds a Bachelor of Arts from the Lincoln International School of Business in Paris, France and a M.B.A. from the University of North Carolina. Mr. Massenet started his career in 1994 in banking at Morgan Stanley & Co. He became the Head of Morgan Stanley’s derivatives group in London, United Kingdom, in 1998. In 2003, Mr. Massenet started Lehman Brothers Inc.’s corporate derivatives group (Capital Market) before exiting in 2007 to start South West Capital, a hedge fund focused on real asset investments. Mr. Massenet cofounded Net-a-Porter in 1999, which was sold in a 2-step sale in 2010 and 2015 to the Richemont Group. Mr. Massenet is currently a board member of Grip, a subsidiary of Intros.at Ltd., an artificial intelligence company specialized in organizing virtual conferences for corporate and virtual meetings. Mr. Massenet also backed many successful tech companies, including Deliveroo, Care Wish Ltd., Houzz Ltd., Urban Ltd., Highsnobiety Inc., Invincible Ltd., NGM Ltd. and Ozon Ltd., and serves on the board of directors of Design Milk Co., a large interior design platform listed on the Australian stock exchange. Mr. Massenet was selected to serve on our Board due to his experience as a senior executive, his experience in investment, marketing and business development, and his experience serving on the boards of directors of other public and private companies.

Prabhu Narasimhan

Mr. Narasimhan has served as member of our Board since the Closing. Mr. Narasimhan served as Aurora’s Chief Investment Officer and as an executive officer of the Sponsor, in each case from inception until the Closing. Mr. Narasimhan is a managing partner of NaMa Capital Advisors LLP (previously Novator Capital) that Mr. Narasimhan co-founded in 2020 together with Thor Björgólfsson and Chiehmi Chan. Mr. Narasimhan has over 15 years of experience as a lawyer at three leading international law firms, two as partner (Mayer Brown, White & Case and Baker & McKenzie). During his time at White & Case, Mr. Narasimhan held the position of partner and Global Head of Family Offices, advising high net worth family offices on all transactional aspects (mergers and acquisitions, bank finance, tax, structuring and execution) of their investments. Mr. Narasimhan then moved to Baker & McKenzie to found their London headquartered Alternative Capital practice, acting as a senior strategic advisor to multi-billion dollar family offices and private equity funds on multibillion dollar mergers and acquisitions and equity and debt capital markets transactions worldwide. His re-structuring of ATP Media Operations Ltd.’s, or ATP Media, tennis broadcasting rights and his crafting of fiscal stimulus laws in Europe have been widely recognized and commended, particularly by the FT Innovative Lawyers awards. Additionally, in 2020, Mr. Narasimhan was appointed to the board of directors of the media company, Prime Focus World, N.V. Mr. Narasimhan was selected to serve on our Board due to his due to his extensive legal experience as well as his investment and business development experience.

Steven Sarracino

Mr. Sarracino has served as a member of our Board since the Closing. Mr. Sarracino served as a member of the Pre-Business Combination Better Board from August 2019 until the Closing. He also serves as Founder and Chief Executive Officer of Activant Capital Group, LLC, a global investment firm, a position he has held since founding Activant in November 2012 and formally launching in January 2015. Mr. Sarracino has served on the board of over a dozen public and private companies including Upland Software, where he served on the audit committee of the board of directors from December 2013 to April 2016. Mr. Sarracino holds a B.B.A. in Finance from Southern Methodist University and an M.B.A. from the Wharton School at the University of Pennsylvania. Mr. Sarracino was selected to serve on the Board due to his strong background in high-growth company investment, knowledge of technology companies and extensive board experience.

Riaz Valani

Mr. Valani has served as a member of our Board since the Closing. Mr. Valani served as a member of the Pre-Business Combination Better Board from February 2021 until the Closing and previously from December 2015 to October 2017. Mr. Valani is a general partner and founder at Global Asset Capital, a private equity investor with diversified interests in venture capital, structured finance and real estate. He previously served as chairman of Viventures Partners SA, a global venture capital firm, president of IMDI/Sonique and a member of Gruntal & Co.’s asset securitization group. Mr. Valani also serves on the board of Pratham USA, a charity that supports the work of Pratham, an innovative learning organization created to improve the quality of education in India. In addition, Mr. Valani has been a principal investor in many private entities since 2000 and serves as a member of the board of several private companies. Mr. Valani was selected to serve on the Board due to his strong background in high-growth company investment, knowledge of technology companies and extensive knowledge of the Company and its business based on his involvement since our inception.

| | | | | |

| ☑ | The Board of Directors recommends that stockholders vote FOR the election of each of the director nominees. |

| | | | | | | | |

2 | | Better Home & Finance Holding Company 2024 Proxy Statement |

| | | | | | | | |

| Proposal 1 - Election of Directors |

Although our Board does not anticipate that any of the nominees will be unable to stand for election as a director at our 2024 Annual Meeting, if this occurs, proxies will be voted in favor of such other person or persons as may be designated by our Corporate Governance and Nominations Committee and our Board.

How We Evaluate Director Nominees

Upon the recommendation of the Corporate Governance and Nominations Committee, our Board has nominated the seven nominees identified above under "Director Nominees" for election at our 2024 Annual Meeting. If elected, the nominees for election as directors will serve until the next annual meeting and until their successors are elected and qualified or until their death, resignation or removal. All of the nominees are currently directors of the Company. Each of the director nominees was elected during an extraordinary general meeting of stockholders of the Company held on August 11, 2023 (the “2023 Meeting”), in lieu of an annual meeting of stockholders.

The Corporate Governance and Nominations Committee, when making recommendations to the Board regarding director nominations, assesses the overall performance of the Board and its committees, and when re-nominating incumbent Board members or nominating new Board members, evaluates the potential candidate’s ability to make a positive contribution to the Board’s overall function. The Corporate Governance and Nominations Committee considers the actual performance and independence of incumbent Board members over the previous year (or shorter period for directors not serving a full year), as well as whether members of the Board have appropriate experience, skills and other qualifications to support our role as a leading digital homeownership company. The particular experience, independence, qualifications, attributes and skills of the potential candidate are assessed by the Corporate Governance and Nominations Committee to determine whether the potential candidate possesses the professional and personal experiences and expertise necessary to enhance the Board’s mission. After conducting the foregoing analysis, the Corporate Governance and Nominations Committee makes recommendations to the Board regarding director nominees. In its annual assessment of director nominees, the Corporate Governance and Nominations Committee does not take a formulaic approach, but rather considers each prospective nominee’s diversity in viewpoints, personal and professional experiences and background and ability. In making director nominations, the Corporate Governance and Nominations Committee evaluates the Board considering, among other things, the attributes discussed in “Corporate Governance—Board Diversity” below.

The Board also evaluates, from time to time, the size of the Board as well as the structure and membership of its committees. In determining the number of directors, committee membership and structure of the committees, the Board considers several factors, including the attributes and experience of the members of our Board, the oversight responsibilities required for a Company of our size and complexity and the Corporate Governance Requirements of the listing rules of Nasdaq (the "Nasdaq Corporate Governance Rules"). For additional information on the Board selection process see "Corporate Governance" below.

Director Election Standards

The Company maintains a “majority” voting standard for uncontested elections. For a nominee to be elected to our Board, the nominee must receive more “for” than “against” votes. In accordance with our corporate governance guidelines (the "Corporate Governance Guidelines"), each nominee standing for election or re-election as a director must, if the nominee fails to receive a sufficient number of votes contemplated by our bylaws (the "Bylaws"), promptly tender a written offer of resignation to the Board. The Corporate Governance and Nominations Committee will make a recommendation to the Board as to whether to accept or reject the resignation, or whether other action should be taken. In the event of a contested director election, a plurality standard will apply.

| | | | | | | | |

| Better Home & Finance Holding Company 2024 Proxy Statement | | 3 |

Corporate Governance

Our business is managed under the direction of our Board. Our Board is committed to sound corporate governance and promoting the long-term interests of our stockholders by adopting structures, policies and practices that promote responsible oversight of management.

Director Independence

Our Corporate Governance Guidelines require that a majority of our Board consist of directors who are neither officers nor employees of the Company or its subsidiaries (and have not been officers or employees within the previous three years), do not have a relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, and are otherwise “independent directors” under the rules of the Nasdaq Corporate Governance Rules.

Rule 5605 of the Nasdaq Corporate Governance Rules ("Nasdaq Rule 5605") requires that a majority of our Board be independent. An “independent director” is defined generally as a person other than an officer or employee of the company or any other individual having a relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

In accordance with our Corporate Governance Guidelines, the Nasdaq Corporate Governance Rules and the director independence standards adopted by the Board on March 22, 2024, the Board conducted its review of all relationships between the Company and each director and director nominee and has affirmatively determined that, with the exception of Mr. Garg, none of them has a material relationship with the Company or any other relationship that would preclude his independence under Nasdaq Rule 5605. Accordingly, the Board has determined that each of our current directors, other than Mr. Garg, is an independent director under the Nasdaq Corporate Governance Rules.

Board Evaluation Process

The Corporate Governance and Nominations Committee leads the Board in an annual self-evaluation to determine whether it and its committees are functioning effectively. The Corporate Governance and Nominations Committee is responsible for oversight of the evaluation process and reports on the process to the Board.

In addition, each committee of the Board conducts annual evaluations of its performance and reports to the Board on such evaluation. The Corporate Governance and Nominations Committee reviews the evaluations prepared by each Board committee of such committee's performance and determines whether to propose any changes to the Board.

As part of the self-assessment process, each Board and committee member provides feedback on a range of topics relevant to the performance and effectiveness of the Board and the applicable committee. During our first six months as a public company, we conducted a modified evaluation process in connection with our development of a Board candidate vetting process. Below is a summary of the evaluation process utilized in early 2024.

| | | | | |

Step 1 Board and Committee Evaluations | The Board engaged an independent external advisor specializing in corporate board composition and development to coordinate the Board’s self-assessment by its members in support of its candidate pipeline build. The advisor provided a list of topics to each director and then performed one-on-one confidential interviews with each of the directors. |

Step 2 Initial Report | The independent external advisor prepared and presented a report to Mr. Talwar, who serves as Chair of the Corporate Governance and Nominations Committee and Chairman of the Board, that aggregated and summarized the findings of the advisor based on the interviews that were conducted. All responses from directors were kept confidential and anonymous. |

Step 3 Board and Committee Review | The aggregated results were presented to the Corporate Governance and Nominations Committee for its review and discussion, at which time the Committee considered what, if any, actions might be implemented to enhance future performance of the Board as it evaluates the size, structure and composition of the Board, as well as the role, composition and allocation of responsibilities among Board committees. |

Meetings and Committees of the Board

The Pre-Business Combination Better Board held a total of five meetings in 2023 prior to the Business Combination, and the Board held a total of four meetings in 2023 following the Business Combination. Each of the directors (other than Mr. Valani) attended 100% of the meetings of the Pre-Business Combination Better Board and the Board and meetings held by

| | | | | | | | |

4 | | Better Home & Finance Holding Company 2024 Proxy Statement |

committees of the Pre-Business Combination Better Board and the Board on which he served. During 2023, Mr. Valani attended less than 75% of the aggregate of the combined total number of meetings the Pre-Business Combination Better Board and the Board and the total number of meetings held by all committees of the Pre-Business Combination Better Board and the Board on which he served. We do not have a policy regarding directors’ attendance at our annual meeting. Two of the members of our Board, Messrs. Massenet and Narasimhan, attended the 2023 Meeting.

The following table sets forth the current members of our Board who served on Committees in 2023, the standing committees of the Board on which they served, the chairs of the committees and the number of committee meetings held during 2023 following the consummation of the Business Combination:

| | | | | | | | | | | |

Director | Audit Committee | Compensation Committee | Corporate Governance and Nominations Committee |

| Harit Talwar | M | M | C |

| Michael Farello | M | M | |

| Steven Sarracino | C | M | M |

| Riaz Valani | | C | M |

Number of 2023 Meetings after the Business Combination | 5 | 3 | 2 |

C - Chair M - Member

On March 22, 2024, Mr. Valani stepped down as the chair and a member of the Compensation Committee and as a member of the Corporate Governance and Nominations Committee, and the Board, based upon the recommendation of the Governance and Nominations Committee, appointed Mr. Massenet as a member the Corporate Governance and Nominations Committee and Mr. Narasimhan as the chair and as a member of the Compensation Committee.

Roles and Responsibilities of the Board and Committees

Our Board directs the management of the Company’s business and affairs, as provided by Delaware law, and conducts its business through meetings of the Board and standing committees as well as special committees that may be established by the Board from time to time.

Our Board has three standing committees: the audit committee (the "Audit Committee"), the compensation committee (the "Compensation Committee") and the corporate governance and nominations committee (the "Corporate Governance and Nominations Committee"). Each committee has a written charter and each charter is available on the “Investor Relations—Governance—Governance Documents” portion of our website, www.better.com.

Audit Committee

Our Audit Committee is responsible for, among other things:

•appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm;

•discussing with our independent registered public accounting firm their independence from management;

•reviewing, with our independent registered public accounting firm, the scope and results of their audit;

•approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm;

•overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the quarterly and annual financial statements that we file with the U.S. Securities and Exchange Commission ("SEC") as well as certifications required under Section 302 of the Sarbanes-Oxley Act of 2022 (the "Sarbanes-Oxley Act");

•overseeing our internal audit function, financial and accounting controls and compliance with legal and regulatory

| | | | | | | | |

| Better Home & Finance Holding Company 2024 Proxy Statement | | 5 |

requirements;

•reviewing our policies on risk assessment and risk management;

•review, in consultation with the Company's management, independent auditor and internal audit function, the adequacy of the Company's internal control over financial reporting and disclosure processes;

•reviewing related person transactions;

•review and assess the Company's system to monitor compliance with and enforcement of the Code of Conduct and oversee the MECC; and

•establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters.

Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and the Nasdaq Corporate Governance Rules require that our Audit Committee be composed entirely of independent members. Our Board has affirmatively determined that each member of our Audit Committee meets the definition of “independent director” for purposes of serving on the Audit Committee under Rule 10A-3 of the Exchange Act and the Nasdaq Corporate Governance Rules. Each member of our Audit Committee also meets the financial literacy requirements of Nasdaq Corporate Governance Rules. In addition, our Board has determined that Messrs. Sarracino and Talwar each qualify as an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K.

Compensation Committee

Our Compensation Committee is responsible for, among other things:

•reviewing, and recommending for approval by our Board, the compensation of our Chief Executive Officer and other executive officers;

•reviewing and approving or making recommendations to our Board regarding our incentive compensation and equity-based plans, policies and programs and administering equity-based plans;

•reviewing and making recommendations to our Board relating to management succession planning, including for our Chief Executive Officer;

•making recommendations to our Board regarding the compensation of our directors;

•retaining and overseeing any compensation consultants; and

•reviewing our strategies related to human capital management and reviewing and discussing with management our strategies in support of an inclusive and diverse company culture.

Our Board has affirmatively determined that each member of our Compensation Committee meets the definition of “independent director” for purposes of serving on the Compensation Committee under the Nasdaq Corporate Governance Rules and are “non-employee directors” as defined in Rule 16b-3 under the Exchange Act.

Corporate Governance and Nominations Committee

Our Corporate Governance and Nominations Committee is responsible for, among other things:

•identifying individuals qualified to become members of our Board, consistent with criteria approved by our Board;

•recommending to our Board the directors to be appointed to each committee of our Board and periodically reviewing and making recommendations to our Board for changes or rotations of committee members, the creation of additional committees, changes in committee charters or the dissolution of committees;

•periodically reviewing our Board’s leadership structure and recommending any proposed changes to our Board;

•overseeing an annual evaluation of the effectiveness of our Board and its committees; and

| | | | | | | | |

6 | | Better Home & Finance Holding Company 2024 Proxy Statement |

•reviewing and making recommendations to our Board relating to management succession planning, including for our Chief Executive Officer.

Our Board has affirmatively determined that each member of our Corporate Governance and Nominations Committee meets the definition of “independent director” under the Nasdaq Corporate Governance Rules.

Risk Oversight

Our Board works with management to set the strategic objectives of the Company and to monitor progress on those objectives. The Board periodically receives reports from management on the Company's progress with respect to its strategic goals and the risks that could impact the achievement of those goals. The Board oversees risk management in part through its various committees. The Audit Committee focuses on financial risk, including internal controls, and annually reviews with management our guidelines and policies and the commitment of internal audit resources as they relate to risk management. The Audit Committee also oversees cybersecurity risk and other information technology risks to our business.

In addition to the committees of the Board, the Company’s management is involved in risk oversight. The Company’s Enterprise Risk Management Committee was established to consider the Company's day-to-day risk tolerance thresholds, identify risk across all functions, departments and subsidiaries, assess identified risks in terms of both likelihood and impact, mitigate risks that exceed such risk tolerance threshold and ensure employees are trained to make informed decisions about identifying and managing risk. The Enterprise Risk Management Committee consists of members of management and is not a formal Board committee.

The Management, Ethics & Compliance Committee (the "MECC") is separate from the Enterprise Risk Management Committee. It is a committee composed of members of management that was established by the Board to investigate and resolve ethics and compliance violations. The MECC oversees implementation of the Company's Code of Conduct, conducts periodic culture reviews, assesses matters related to ethics and compliance (and reports matters, as necessary, to the Audit Committee) and assists the Board in its oversight of Company matters.

The Enterprise Risk Management Committee and MECC provide the Board with added assurance about the Company’s risk management practices. Our Chief Compliance Officer serves as Chair of each of the Enterprise Risk Management Committee and MECC and reports to the Audit Committee periodically on their activities.

Board Diversity

The Corporate Governance Guidelines and the Corporate Governance and Nominations Committee charter specify that the Corporate Governance and Nominations Committee considers several factors, including diversity, when evaluating or conducting searches for directors. The Corporate Governance and Nominations Committee interprets diversity broadly to include a variety of opinions, perspectives, personal and professional experiences and backgrounds, such as international and multicultural experience and understanding, as well as other differentiating characteristics, including race, ethnicity and gender.

| | | | | | | | | | | | |

Board Diversity Matrix (as of April [19], 2024) | |

Total Number of Directors | 8 | |

| Female | Male | Non-Binary | |

Part I: Gender Identity | | | | |

| Directors | — | 8 | — | |

Part II: Demographic Background | | | | |

Asian | — | 4 | — | |

White | — | 4 | — | |

Director Search

In identifying prospective director candidates for the Board, the Corporate Governance and Nominations Committee may seek referrals from other members of the Board, management, stockholders and other sources. The Corporate Governance and Nominations Committee also may, but need not, retain a professional search firm in order to assist it in these efforts. The Corporate Governance and Nominations Committee and the Board utilize the same criteria for evaluating candidates regardless of the source of the referral.

| | | | | | | | |

| Better Home & Finance Holding Company 2024 Proxy Statement | | 7 |

Corporate Governance Guidelines

The Corporate Governance Guidelines provide that the Corporate Governance and Nominations Committee is responsible for selecting, or recommending for the Board’s selection, the slate of director nominees for election to the Board and for filling vacancies occurring between annual meetings of stockholders. In selecting, or recommending for the Board’s selection, individuals for nomination, the Corporate Governance and Nominations Committee takes into account the following criteria, among others:

•Current knowledge, competency, or subject matter expertise in the Company’s lines of business, industry or other industries relevant to the Company’s business;

•Personal qualities and characteristics, accomplishments and reputation in the business community;

•Ability and willingness to commit adequate time to Board and committee matters;

•The fit of the individual’s skills and experience with those of other directors and potential directors in building a board that is effective, collegial and responsive to the needs of the Company;

•Diversity of viewpoints, background, experience and other demographics (including racial and gender diversity); and

•Tenure of existing directors and potential need to refresh the Board.

The Corporate Governance and Nominations Committee will give appropriate consideration to candidates for Board membership proposed by eligible stockholders and will evaluate such candidates in the same manner as other candidates identified by or submitted to the Corporate Governance and Nominations Committee.

The Corporate Governance Guidelines also contain policies regarding director independence, simultaneous service on other boards and substantial changes relating to a director's position of principal employment. Among other things, the guidelines establish expectations for directors for meeting attendance and participation, loyalty and ethics and confidentiality. Our Corporate Governance Guidelines is available without charge on the “Investor Relations—Governance—Governance Documents” portion of our website, www.better.com.

Our Board Leadership

As indicated in our Corporate Governance Guidelines, the Board believes it is important to retain its flexibility to allocate the responsibilities of the offices of the Chairman of the Board and Chief Executive Officer in a manner that is in the best interests of our Company. The Board believes that the decision as to who should serve as Chairman and Chief Executive Officer, and whether the offices should be combined or separate, should be assessed periodically by the Board and that the Board should not be constrained by a rigid policy mandating the structure of such positions. The Board currently believes that the most effective and efficient leadership structure for our Company is for Mr. Garg to serve as Chief Executive Officer while Mr. Talwar serves as Chairman of our Board.

The Board believes that the current leadership structure is appropriate, benefits the Company by delineating separate roles of management and oversight over management and is recognized as a best corporate governance practice. Our Chief Executive Officer and his management team provide the overall strategy and daily leadership for our Company, and the Board, along with the Chairman, provides oversight and evaluates the performance of management. The Chairman, in consultation with the Chief Executive Officer, has responsibility for chairing and determining the length and frequency of Board meetings as well as setting the agenda for such meetings.

Non-employee members of the Board meet at regularly scheduled executive sessions without management. Executive sessions of the Board are chaired by the Chairman. Each of the committees also meets regularly in executive session without management, and the committee chair presides at the executive sessions.

Limitations on Liability and Indemnification

Our amended and restated certificate of incorporation ("Amended and Restated Certificate of Incorporation") and Bylaws provide indemnification and advancement of expenses for the directors and officers to the fullest extent permitted by the General Corporation Law of the State of Delaware (the "DGCL"), subject to certain limited exceptions. Better Home & Finance entered into indemnification agreements with each of its directors and executive officers. Each indemnification agreement provides for indemnification and advancement by Better Home & Finance of certain expenses and costs relating to claims, suits, or proceedings arising from service to Better Home & Finance or, at its request, service to other entities, as officers or directors to the maximum extent permitted by applicable law.

| | | | | | | | |

8 | | Better Home & Finance Holding Company 2024 Proxy Statement |

These provisions may be held not to be enforceable for violations of the federal securities laws of the United States.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the board of directors or compensation committee (or other committee performing equivalent functions) of any entity that has one or more executive officers serving on our Board or Compensation Committee.

Policy on Trading, Pledging and Hedging of Company Stock

Certain transactions in our securities (such as short sales) create a heightened compliance risk or could create the appearance of misalignment between our management and stockholders. Accordingly, our insider trading policy expressly prohibits members of our Board and executive officers (and their immediate family members, others who reside in their household, others whose transactions in the Company’s securities are subject to their influence or control, and trusts or entities over which they have control) from engaging in hedging or monetization transactions of any type involving the Company’s securities, including the use of collars, forward sale contracts, equity swaps, and exchange funds.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics (the “Code of Conduct”) that applies to our directors, officers and employees. A copy of the Code of Conduct can be found at http://investors.better.com/governance/governance-documents under the link “Code of Business Conduct and Ethics.” In addition, we intend to post on our website all disclosures that are required by law or the Nasdaq Corporate Governance Rules concerning any amendments to, or waivers from, any provision of the Code of Conduct.

| | | | | | | | |

| Better Home & Finance Holding Company 2024 Proxy Statement | | 9 |

Director Compensation

The Company does not currently have a compensation program for its non-employee directors but has occasionally granted awards of restricted stock units ("RSUs") based on shares of Common Stock (as defined herein) and options to purchase shares of Common Stock ("Stock Options"), in each case, pursuant to the Better Holdco, Inc. 2016 Equity Incentive Plan (the "2016 Plan"), the Better Holdco, Inc. 2017 Equity Incentive Plan (the "2017 Plan") or the Better Home & Finance Holding Company 2023 Incentive Equity Plan (the "2023 Plan") to non-employee directors when deemed appropriate. In 2023, Mr. Talwar was compensated pursuant to an agreement with Pre-Business Combination Better, which was assumed by the Company on the closing of the Business Combination and is described below. None of the other non-employee directors received compensation from the Company in 2023 for serving as a member of our Board.

Chairman Agreement with Harit Talwar

Mr. Talwar is party to an agreement with Pre-Business Combination Better, dated as of April 27, 2022 (the "Chairman Agreement"), in connection with his appointment as the Chairman of the Board, commencing on May 1, 2022 (the “Talwar Effective Date”). Pursuant to the terms of the Chairman Agreement, which was assumed by the Company on the Closing of the Business Combination, Mr. Talwar is entitled to $350,000 in cash as an annual retainer in consideration for his services as a member of our Board and an additional sum of $175,000 in cash per year for his service as Chairman of the Board. In addition, Pre-Business Combination Better agreed to pay up to $350,000 per year for Mr. Talwar's reasonable out-of-pocket clerical and other administrative support together with his domestic travel expenses.

Pursuant to the Chairman Agreement with Pre-Business Combination Better, on May 1, 2022, Mr. Talwar received a grant of 1,620,000 Pre-Business Combination Better RSUs, which, in connection with the Business Combination, converted into 4,951,644 RSUs based on Pre-Business Combination Better's outstanding shares and warrants being exchanged for approximately 3.06 shares (the "Exchange Ratio") of the Company’s Common Stock, and otherwise on the same terms and conditions that were in effect with respect to such Pre-Business Combination Better RSUs. 2,475,822 of such RSUs vest in equal installments quarterly over the four years following the Talwar Effective Date and 2,475,822 of such RSUs will vest subject to both (i) Mr. Talwar’s continuous services through the six month anniversary of the Talwar Effective Date and (ii) the achievement of performance conditions which provide that 825,274 RSUs will vest at a $1.7994 post-closing stock price (as adjusted from $5.50 by the Exchange Ratio in connection with the Business Combination), 825,274 RSUs will vest at an $3.5988 post-closing stock price (as adjusted from $11.00 by the Exchange Ratio in connection with the Business Combination) and 825,274 RSUs will vest at a $5.3982 post-closing stock price (as adjusted from $16.50 by the Exchange Ratio in connection with the Business Combination), in each case, measured based on the 45-day trailing average closing stock price. In the event of Mr. Talwar’s death or disability, any unvested time-vesting RSUs will continue to vest until they are settled and any performance-vesting RSUs will continue to vest as to time on the time-vesting date and remain eligible to vest as to performance for the three years after such termination. In the event Mr. Talwar leaves the Board at the Board's or stockholders’ initiative, any performance-vesting RSUs will vest as to time at termination and remain eligible to vest as to performance for two years after termination and (i) if such termination is prior to the second anniversary of the Talwar Effective Date, 50% of any outstanding time-vesting RSUs will vest at termination and (ii) any remaining unvested time-vesting RSUs will be forfeited. In connection with entry into the Chairman Agreement, Mr. Talwar entered into the Company’s standard indemnification agreement and is entitled to coverage under the Company’s directors’ and officers’ liability insurance policy.

2023 Director Compensation Table

The following table sets forth all of the compensation awarded to, earned by or paid to the Company’s non-employee directors during 2023, including before closing of the Business Combination. Other than the awards set forth in the following table, the non-employee directors did not receive cash compensation or equity awards during 2023, and there was no director compensation policy adopted by the Company. The Board may in the future approve and implement a compensation program for the non-employee directors.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name(1) | | Fees Earned or

Paid in Cash

($) | | Stock Awards ($) | | Option Awards

($) | | All Other Compensation(2) ($) | | Total

($) |

| Harit Talwar | | 525,000 | | | — | | | — | | | 50,853 | | | 575,853 | |

(1)All other non-employee directors during 2023 include Michael Farello, Arnaud Massenet, Prabhu Narasimhan, Steven Sarracino and Riaz Valani. Our non-employee directors, other than Mr. Talwar, did not receive any compensation in 2023 and as of December 31, 2023, our non-employee directors held the following equity awards: Mr. Talwar: 4,023,211 RSUs.

(2) Consists of payments and reimbursements for out-of-pocket clerical and other administrative support.

| | | | | | | | |

10 | | Better Home & Finance Holding Company 2024 Proxy Statement |

Proposal 2 - Approval of One or More Amendments to Our Amended and Restated Certificate of Incorporation to Effect One or More Reverse Stock Splits

General

Our Board has adopted and is recommending that our stockholders approve one or more amendments to our Amended and Restated Certificate of Incorporation (such amendments, the “Amendments”) to effect one or more reverse stock splits of our Class A Common Stock, Class B common stock, par value $0.0001 per share (“Class B Common Stock”), and Class C common stock, par value $0.0001 per share ("Class C Common Stock" and together with Class A Common Stock and Class B Common Stock, the "Common Stock"), at a ratio of not less than one-for-two and not more than one-for-100 and in the aggregate at a ratio of not more than one-for-100, inclusive, with the exact ratio for each reverse stock split within such range to be determined by the Board (or any duly constituted committee thereof) in its discretion (any such reverse stock split, the "Reverse Stock Split," and such ratio selected by the Board for a Reverse Stock Split, the "Reverse Split Ratio"). In connection with any Reverse Stock Split, the number of authorized shares of Class A Common Stock, Class B Common Stock and Class C Common Stock will be reduced proportionately with the Reverse Split Ratio and the reduction in outstanding Common Stock. Pursuant to the law of the State of Delaware, our state of incorporation, the Board must adopt an Amendment and submit the Amendment to stockholders for their approval. The proposed Amendment, one or more of which would be filed with the Secretary of State of the State of Delaware (the "Secretary of State"), will be substantially in the form of Appendix A attached to this Proxy Statement.

By approving this proposal, stockholders will approve one or more Amendments pursuant to which a whole number of outstanding shares of our Class A Common Stock, Class B Common Stock and Class C Common Stock between two (2) and 100 and in the aggregate not more than 100, inclusive, would be combined into one share of our Class A Common Stock, Class B Common Stock and Class C Common Stock, respectively. Upon receiving stockholder approval, the Board will have the authority, but not the obligation, in its sole discretion, to elect, without further action on the part of the stockholders, whether to effect any Reverse Stock Split and, if so, to determine the applicable Reverse Split Ratio from among the approved range described above and to effect one or more Reverse Stock Splits by filing one or more Amendments with the Secretary of State. The Board reserves the right to elect not to effect any Reverse Stock Split at any time prior to the effectiveness of the filing of any Amendment with the Secretary of State, if it determines, in its sole discretion, and without further action on the part of the stockholders, that the proposal is no longer in the best interests of the Company and its stockholders.

The Board’s decision as to whether and when to effect any Reverse Stock Split will be based on a number of factors, including market conditions, the historical, existing and expected trading price of our Class A Common Stock, the anticipated impact of such Reverse Stock Split on the trading price and number of holders of our Class A Common Stock, and the continued listing requirements of The Nasdaq Capital Market.

Purpose and Background of the Reverse Stock Split

On March 19, 2024, the Board approved the proposed Amendments to effect one or more Reverse Stock Splits for the following reasons. The Board believes that:

•Effecting one or more Reverse Stock Splits could be an effective means of regaining compliance with the minimum bid price requirement for continued listing of our Class A Common Stock on The Nasdaq Capital Market;

•If we are unable to maintain the listing of our Class A Common Stock on The Nasdaq Capital Market, delisting of our Class A Common Stock would require the Company to redeem the subordinated unsecured 1% convertible note issued in an aggregate principal amount of $528,585,444 pursuant to an indenture (the "Indenture"), dated as of August 22, 2023, between the Company and GLAS Trust Company LLC, as trustee, which is convertible, at the option of the holder into shares of Class A Common Stock (the "Convertible Note"), and failure to do so would have a material adverse effect on our business, financial condition and results of operations;

•Continued listing of our Class A Common Stock on The Nasdaq Capital Market provides overall credibility to an investment in our Common Stock, given the stringent listing and disclosure requirements of The Nasdaq Capital Market. Notably, some trading firms discourage investors from investing in lower priced stocks that are traded in the over-the-counter market because they are not held to the same stringent standards. Increasing visibility of our Common Stock among a larger pool of potential investors could result in higher trading volumes. Such increases in visibility and liquidity could also help facilitate future financings; and

•Continued listing of our Class A Common Stock on The Nasdaq Capital Market and a higher stock price, which may be achieved through one or more Reverse Stock Splits, could help attract, retain, and motivate employees.

| | | | | | | | |

| Better Home & Finance Holding Company 2024 Proxy Statement | | 11 |

| | | | | | | | |

Proposal 2 - Approval of One or More Amendments to Our Amended and Restated Certificate of Incorporation to Effect One or More Reverse Stock Splits |

Nasdaq Requirements for Continued Listing

Our Class A Common Stock is quoted on The Nasdaq Capital Market under the symbol “BETR.” One of the requirements for continued listing on The Nasdaq Capital Market, pursuant to Nasdaq Listing Rule 5550(a)(2), is maintenance of a minimum closing bid price of $1.00. On April 8, 2024, the closing market price per share of our Class A Common Stock was $0.46, as reported by The Nasdaq Capital Market.

On October 12, 2023, the Company received a letter (the “Notice”) from the listing qualifications staff (the “Staff”) of Nasdaq notifying the Company that it is not in compliance with the minimum bid price requirement set forth in Nasdaq Listing Rule 5450(a)(1) (the “Bid Price Rule”) for continued listing. The Bid Price Rule requires listed securities to maintain a minimum bid price of $1.00 per share, and Nasdaq Listing Rule 5810(c)(3)(A) (the “Compliance Period Rule”) provides that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days. In accordance with the Compliance Period Rule, the Company had 180 calendar days, or until April 9, 2024, to regain compliance with the Bid Price Rule. On February 9, 2024, the Company applied to transfer the listing of its Common Stock from The Nasdaq Global Market to The Nasdaq Capital Market in conjunction with requesting an additional 180-calendar day grace period to regain compliance with the Bid Price Rule. On March 7, 2024, the Company received notice from Nasdaq that the transfer was approved, effective March 13, 2024, and, on March 11, 2024, the Company applied for an additional 180-calendar-day period, or until October 6, 2024, to regain compliance with the Bid Price Rule. If, at any time before the end of this 180-day period, the closing bid price of Class A Common Stock closes at or above $1.00 per share for a minimum of 10 consecutive business days, the Staff will provide written notification that the Company has achieved compliance with the Bid Price Rule.

If Nasdaq delists the Class A Common Stock from trading on its exchange for failure to meet the listing standards, the Company and its stockholders could face significant negative consequences including:

•a limited availability of market quotations for our Class A Common Stock;

•reduced liquidity for our Class A Common Stock;

•a determination that the shares of Class A Common Stock are “penny stock” which will require brokers trading in Class A Common Stock to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities;

•a limited amount of news and analyst coverage; and

•a decreased ability to issue additional securities or obtain additional financing in the future.

Furthermore, if our Class A Common Stock ceases to be listed on any of the New York Stock Exchange, the Nasdaq Global Market, the Nasdaq Global Select Market or the Nasdaq Capital Market (or any of their respective successors or related exchanges), such delisting would constitute a fundamental change under the Indenture that would require the Company to redeem the Convertible Note prior to maturity for an amount in cash equal to the principal amount of the Convertible Note plus accrued and unpaid interest to the redemption date. As of December 31, 2023, the Company had cash and cash equivalents, together with short-term investments and restricted cash, of $554 million, compared to $528.6 million principal amount outstanding under the Convertible Note. If the Company is required to redeem the Convertible Note prior to maturity, the Company may not have sufficient available cash and cash equivalents or be able to obtain additional liquidity, on acceptable terms or at all, to enable the Company to redeem or refinance the Convertible Note. Failure to redeem the Convertible Note would be an event of default entitling the noteholder to accelerate the amounts outstanding under the Convertible Note. If the Company is unable to repay or refinance such accelerated debt under the Convertible Note, the Company could become insolvent and seek to file for bankruptcy protection, which would have a material adverse effect on our business, financial condition and results of operations.

Finally, the National Securities Markets Improvement Act of 1996, which is a federal statute, prevents or preempts the states from regulating the sale of certain securities, which are referred to as “covered securities.” Because our Class A Common Stock and Warrants are listed on the Nasdaq Capital Market, our Class A Common Stock and Warrants are covered securities. Although the states are preempted from regulating the sale of our securities for so long as they are covered securities, the federal statute allows states to investigate companies if there is a suspicion of fraud, and, if there is a finding of fraudulent activity, then the states can regulate or bar the sale of covered securities in a particular case. Further, if we were no longer listed on the Nasdaq Capital Market or another national securities exchange, our securities would not be covered securities and we would be subject to regulation in each state in which we offer our securities.

| | | | | | | | |

12 | | Better Home & Finance Holding Company 2024 Proxy Statement |

| | | | | | | | |

Proposal 2 - Approval of One or More Amendments to Our Amended and Restated Certificate of Incorporation to Effect One or More Reverse Stock Splits |

In light of the factors mentioned above, our Board approved the proposed Amendments to effect one or more Reverse Stock Splits as a potential means of increasing and maintaining the price of our Class A Common Stock above $1.00 per share in compliance with the Bid Price Rule for the required time period. If the closing bid price of our Class A Common Stock on The Nasdaq Capital Market reaches a minimum of $1.00 per share and remains at or above that level for a minimum of 10 consecutive trading days (or longer, if required by the Staff), our Board may decide to abandon the filing of the proposed Amendments with the Secretary of State.

Board Discretion to Implement the Reverse Stock Split

The Board believes that stockholder approval of a range of ratios for the Reverse Split Ratio (as opposed to a single Reverse Split Ratio) and to authorize one or more Reverse Stock Split Amendments is in the best interests of our Company and stockholders because it is not possible to predict market conditions at the time that any Reverse Stock Split would be effected. We believe that a range of Reverse Split Ratios provides us with the most flexibility to achieve the desired results of any Reverse Stock Split through one or more Amendments. The Reverse Split Ratio to be determined by our Board (or any duly constituted committee thereof), in its sole discretion, will be a whole number in a range of one-for-two to one-for-100 and in the aggregate not more than one-for-100, inclusive. The Board reserves the right to elect not to effect any Reverse Stock Split at any time prior to the effectiveness of the filing of any Amendment with the Secretary of State, if it determines, in its sole discretion, and without further action on the part of the stockholders, that a Reverse Stock Split is no longer in the best interests of the Company and its stockholders

In determining any applicable Reverse Split Ratio and whether and when to effect any Reverse Stock Split pursuant to one or more Amendments following the receipt of stockholder approval, the Board may consider a number of factors, including, without limitation:

•our ability to maintain the listing of our Class A Common Stock on The Nasdaq Capital Market;

•the historical trading price and trading volume of our Class A Common Stock;

•the number of shares of our Class A Common Stock outstanding immediately before and after the Reverse Stock Split;

•the dilutive impact of any potential exercise of the Company’s outstanding Warrants and the related impact on the trading price of the Company’s Class A Common Stock;

•the then-prevailing trading price and trading volume of our Class A Common Stock and the anticipated impact of a Reverse Stock Split on the trading price and trading volume of our Class A Common Stock in the short- and long-term;

•the anticipated impact of a particular Reverse Split Ratio on the Company’s ability to reduce administrative and transactional costs;

•the anticipated impact of a particular Reverse Split Ratio on the number of holders of our Class A Common Stock; and

•prevailing general market, legal and economic conditions.

We believe that granting the Board (or any duly constituted committee thereof) the authority to elect to implement one or more Reverse Stock Splits through one or more Amendments at various Reverse Split Ratios (subject to the aggregate one-for-100 limitation) is essential because it allows us to take these factors into consideration and to react to changing market, legal and economic conditions. If our Board (or any duly constituted committee thereof) chooses to implement one or more Reverse Stock Splits, we will make a public announcement regarding the determination of each such Reverse Stock Split and the applicable Reverse Split Ratio.

Risks Associated with any Reverse Stock Split

There are risks associated with any Reverse Stock Split, including that a Reverse Stock Split may not result in a sustained increase in the per-share price of our Class A Common Stock. There is no assurance that:

•The market price per share of our Class A Common Stock after any Reverse Stock Split will rise in proportion to the reduction in the number of shares of our Class A Common Stock outstanding as a result of such Reverse Stock Split;

| | | | | | | | |

| Better Home & Finance Holding Company 2024 Proxy Statement | | 13 |

| | | | | | | | |

Proposal 2 - Approval of One or More Amendments to Our Amended and Restated Certificate of Incorporation to Effect One or More Reverse Stock Splits |

•Any Reverse Stock Split will result in a per-share price that will increase the level of investment in our Class A Common Stock by institutional investors or increase analyst and broker interest in our Company;

•Any Reverse Stock Split will result in a per-share price that will increase our ability to attract and retain employees and other service providers; and

•The market price per share will either exceed or remain in excess of the $1.00 minimum bid price as required by the Bid Price Rule, or that we will otherwise meet the requirements of Nasdaq for continued inclusion for trading on The Nasdaq Capital Market.

We expect that, if implemented, each Reverse Stock Split will increase the market price of our Class A Common Stock; however, stockholders should note that the effect of such Reverse Stock Split, if any, upon the market price of our Class A Common Stock cannot be predicted with any certainty, and the outcomes of reverse stock splits for other companies are varied. In particular, we cannot assure you that the per-share price of Class A Common Stock after any Reverse Stock Split will increase in the same proportion as the reduction in the number of shares of our Class A Common Stock outstanding as a result of such Reverse Stock Split. Furthermore, even if the market price of our Class A Common Stock does rise following a Reverse Stock Split, we cannot assure you that such increased per-share price will be maintained for any period of time, including as required to regain compliance with the Nasdaq Listing Rules.

Even if an increased per-share price can be maintained, a Reverse Stock Split may not achieve the desired results that have been outlined above. For example, a Reverse Stock Split may not result in a per-share price that would attract investors who do not trade in lower priced stocks. Although we believe one or more Reverse Stock Splits may enhance the marketability of our Class A Common Stock to certain potential investors, we cannot assure you that, if implemented, our Class A Common Stock will be more attractive to investors, some of which may view a Reverse Stock Split negatively, or increase analyst and broker interest in our Company. We also cannot assure that one or more Reverse Stock Splits will result in a per-share price of Class A Common Stock that will increase our ability to attract and retain employees and other service providers.

Even if we implement one or more Reverse Stock Splits, the market price of Class A Common Stock may decrease due to factors, unrelated to such Reverse Stock Split(s), including our future performance or general market trends. If a Reverse Stock Split is effected and the market price of our Class A Common Stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of a Reverse Stock Split. The total market capitalization of our Class A Common Stock after implementation of a Reverse Stock Split, when and if implemented, may also be lower than the total market capitalization before such Reverse Stock Split.

Furthermore, the liquidity of our Class A Common Stock could be adversely affected by the reduced number of shares that would be outstanding after any Reverse Stock Split, particularly if the per-share price does not increase as expected as a result of such Reverse Stock Split. Additionally, if a Reverse Stock Split is implemented, it will increase the number of our stockholders who own “odd lots” of fewer than 100 shares of Class A Common Stock. Brokerage commissions and other costs of transactions in odd lots are generally higher than the costs of transactions of more than 100 shares of common stock. Accordingly, a Reverse Stock Split may not achieve the desired results of increasing marketability of our Class A Common Stock as described above.

While we expect that one or more Reverse Stock Splits will be sufficient to maintain our listing on The Nasdaq Capital Market, it is possible that, even if such Reverse Stock Split(s) results in a bid price for our Class A Common Stock that exceeds $1.00 per share for the required period of time, we may not be able to continue to satisfy Nasdaq’s other criteria for continued listing of our Class A Common Stock on The Nasdaq Capital Market.

Principal Effects of any Reverse Stock Split

If the proposal to authorize one or more Amendments (the "Reverse Stock Split Proposal") is approved and any Reverse Stock Split is effected, (i) (a) each holder of Class A Common Stock will receive a number of shares of Class A Common Stock equal to (x) the number of shares of Class A Common Stock held immediately before such Reverse Stock Split multiplied by (y) the applicable Reverse Split Ratio, (b) each holder of Class B Common Stock will receive a number of shares of Class B Common Stock equal to (x) the number of shares of Class B Common Stock held immediately before such Reverse Stock Split multiplied by (y) the applicable Reverse Split Ratio and (c) each holder of Class C Common Stock will receive a number of shares of Class C Common Stock equal to (x) the number of shares of Class C Common Stock held immediately before such Reverse Stock Split multiplied by (y) the applicable Reverse Split Ratio and (ii) the number of authorized shares of Class A Common Stock, Class B Common Stock and Class C Common Stock will be reduced proportionately with the applicable Reverse Split Ratio.

| | | | | | | | |

14 | | Better Home & Finance Holding Company 2024 Proxy Statement |

| | | | | | | | |

Proposal 2 - Approval of One or More Amendments to Our Amended and Restated Certificate of Incorporation to Effect One or More Reverse Stock Splits |

Each Reverse Stock Split will be effected simultaneously for all issued and outstanding shares of Class A Common Stock, Class B Common Stock and Class C Common Stock. Each Reverse Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests in the Company, except to the extent that such Reverse Stock Split results in any of our stockholders owning a fractional share that is paid out in cash as further described below. After any such Reverse Stock Split, the shares of our Class A Common Stock, Class B Common Stock and Class C Common Stock will have the same voting rights and rights to dividends and distributions and will be identical in all other respects as now authorized. Common Stock issued pursuant to any Reverse Stock Split will remain fully paid and non-assessable. A Reverse Stock Split will not affect the Company’s periodic reporting requirements under the Exchange Act. The Company has not issued any outstanding certificated shares of Class A Common Stock, Class B Common Stock or Class C Common Stock as of March 13, 2024, and does not expect to issue any certificated shares prior to the effectiveness of any one or more Reverse Stock Splits.

The chart below outlines the capital structure as described in this proposal and prior to and immediately following a possible Reverse Stock Split if such Reverse Stock Split is effected at a ratio of 1-for-5, 1-for-10, 1-for-20, 1-for-50 or 1-for-100 based on share information as of the close of business on March 13, 2024. The below chart does not give effect to the treatment of fractional shares following the Reverse Stock Split and does not give effect to any other changes, including any issuance of securities, after March 13, 2024.

| | | | | | | | | | | | | | | | | | | | |

| Class A |

| Number of shares of Common Stock before Reverse Stock Split | 1-for-5 | 1-for-10 | 1-for-20 | 1-for-50 | 1-for-100 |

| Authorized | 1,800,000,000 | | 360,000,000 | | 180,000,000 | | 90,000,000 | 36,000,000 | | 18,000,000 | |

| Issued and Outstanding | 391,152,585 | | 78,230,517 | | 39,115,258 | | 19,557,629 | 7,823,051 | | 3,911,525 | |

| Issuable under the Warrants | 9,808,405 | | 1,961,681 | | 980,840 | | 490,420 | 196,168 | | 98,084 | |

| Issuable under Outstanding RSUs | 5,181,682 | | 1,036,336 | | 518,168 | | 259,084 | 103,633 | | 51,816 | |

Reserved for Issuance for Incentive Plans(1) | 107,044,293 | | 21,408,858 | | 10,704,429 | | 5,352,214 | 2,140,885 | | 1,070,442 | |

Reserved for Issuance for Convertible Note(2) | 57,454,939 | | 11,490,987 | | 5,745,493 | | 2,872,746 | 1,149,098 | | 574,549 | |

Authorized but Unissued(3) | 1,408,847,415 | | 281,769,483 | | 140,884,741 | | 70,442,370 | 28,176,948 | | 14,088,474 | |

| | | | | | | | | | | | | | | | | | | | |

| Class B |

| Number of shares of Common Stock before Reverse Stock Split | 1-for-5 | 1-for-10 | 1-for-20 | 1-for-50 | 1-for-100 |

| Authorized | 700,000,000 | | 140,000,000 | | 70,000,000 | | 35,000,000 | 14,000,000 | | 7,000,000 | |

| Issued and Outstanding | 292,894,465 | | 58,578,893 | | 29,289,446 | | 14,644,723 | 5,857,889 | | 2,928,944 | |

| Issuable under Outstanding Stock Options | 34,936,027 | | 6,987,205 | | 3,493,602 | | 1,746,801 | 698,720 | | 349,360 | |

| Issuable under Outstanding RSUs | 9,905,635 | | 1,981,127 | | 990,563 | | 495,281 | 198,112 | | 99,056 | |

Authorized but Unissued(4) | N/A | N/A | N/A | N/A | N/A | N/A |

| | | | | | | | | | | | | | | | | | | | |

| Class C |

| Number of shares of Common Stock before Reverse Stock Split | 1-for-5 | 1-for-10 | 1-for-20 | 1-for-50 | 1-for-100 |

| Authorized | 800,000,000 | | 160,000,000 | | 80,000,000 | | 40,000,000 | 16,000,000 | | 8,000,000 | |