false

0001012477

0001012477

2024-03-04

2024-03-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported): March 4, 2024

AVADEL PHARMACEUTICALS PLC

(Exact name of registrant as specified

in its charter)

| Ireland |

001-37977 |

98-1341933 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

10

Earlsfort Terrace

Dublin 2, Ireland, D02

T380 |

Not Applicable |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: +353-1-901-5201

Not applicable

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which

registered |

|

American

Depositary Shares*

Ordinary Shares, nominal value

$0.01 per share** |

AVDL

N/A |

The Nasdaq Global Market |

*American Depositary Shares may be evidenced

by American Depositary Receipts. Each American Depositary Share represents one (1) Ordinary Share.

** Not for trading, but only in connection with the listing

of American Depositary Shares on The Nasdaq Global Market.

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operations and Financial Condition |

On March 4, 2024, Avadel Pharmaceuticals plc (the “Company”)

announced its financial results for the quarter and full year ended December 31, 2023. A copy of the press release is being furnished

as Exhibit 99.1 to this Report on Form 8-K.

The information in this Report on Form 8-K and Exhibit 99.1

attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it

be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or

the Exchange Act, except as expressly set forth by specific reference in such filing.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: March 4, 2024 |

AVADEL PHARMACEUTICALS PLC |

| |

|

| |

By: |

/s/ Jerad G. Seurer |

| |

|

Name: Jerad G. Seurer |

| |

|

Title: General Counsel & Corporate Secretary |

Exhibit 99.1

Avadel Pharmaceuticals

Provides Corporate Update and Reports Fourth Quarter and Full Year 2023 Financial

Results

-- Generated $19.5 million in fourth quarter

and $28.0 million of full year 2023 net revenue from sales of

LUMRYZ™ --

-- As of January 31st, greater

than 2,200 patients enrolled in RYZUPTM and more than 1,200 patients initiated

therapy --

-- Payer coverage now in place for greater than

80% of commercially covered lives for LUMRYZ through new

listings including United Healthcare and Anthem --

-- FDA target action date of September 7,

2024, issued for the Supplemental New Drug Application (sNDA) for

LUMRYZ in pediatric narcolepsy--

-- Management to host a conference call today

at 7:30 a.m. ET --

DUBLIN, Ireland, March 4, 2024 - Avadel Pharmaceuticals

plc (Nasdaq: AVDL), a biopharmaceutical company focused on transforming medicines to transform lives, today provided a corporate update

and announced its financial results for the fourth quarter ended December 31, 2023.

“We are carrying significant momentum into 2024 following the

successful launch of LUMRYZ and are pleased with the strong early launch results we have seen. We have established a strong foundation

with patients, prescribers and payers to build on and advance our mission of transforming the lives of people living with narcolepsy,”

said Greg Divis, Chief Executive Officer of Avadel Pharmaceuticals. “While the launch is still in the early stages, we believe the

meaningful increase in patients initiating therapy with LUMRYZ underscores the significant unmet need for a once-at-bedtime therapy. We

look forward to expanding the LUMRYZ indication for the pediatric narcolepsy population with the anticipated approval decision in September,

initiating our Phase 3 pivotal trial program in idiopathic hypersomnia and continuing our robust commercial execution throughout 2024.”

Fourth Quarter and Recent Company Highlights

LUMRYZ Commercial Updates Through the End

of January 2024:

| · | Greater than 2,200 patients enrolled in Avadel’s RYZUP patient support services: |

| o | More than 1,200 patients initiated therapy. |

| o | The majority of RYZUP enrollments and patients currently being treated with LUMRYZ are patients who switched from first generation

oxybates, with the balance made up of patients who previously tried and discontinued a first generation oxybate and patients who are new

to oxybate treatment. |

| · | Secured payor coverage policies for greater than 80% of commercially covered lives with the inclusion of Anthem and the United Healthcare

national formulary. |

| o | Contracts now established with all 3 PBM-owned GPOs (Ascent/ESI, Zinc/CVS and Emisar/Optum). |

| · | Approximately 1,900 health care providers have completed the LUMRYZ REMS certification process, including both experienced oxybate

prescribers as well as providers who have never previously prescribed an oxybate. |

Pipeline Updates:

| · | U.S. Food and Drug Administration (FDA) accepted the Supplemental New Drug Application (sNDA) for LUMRYZ for treatment of cataplexy

or EDS in the pediatric narcolepsy population. The FDA has assigned a target action date of September 7, 2024, for its approval decision. |

| · | With potential approval in the pediatric population, LUMRYZ could alleviate the burden placed on families and caregivers of children

with narcolepsy who are responsible for waking up in the middle of the night to administer a second dose. |

| · | Pediatric patients currently represent approximately 3-5% of all oxybate treated narcolepsy patients. |

| · | Planning to enroll the first patient in a clinical study for the use of LUMRYZ to treat idiopathic hypersomnia in the second half

of 2024. |

Overview of Fourth Quarter and Full Year

Results

Recognized $19.5 million and $28.0 million

in net product revenue for the quarter and year ended December 31, 2023, respectively. Net product revenue consists of LUMRYZ product

sales, which was launched in the U.S. on June 5, 2023.

R&D expenses for the quarter and year ended December 31, 2023,

were $2.4 million and $13.3 million, respectively, compared to $6.2 million and $20.7 for the same periods in 2022. The

decreases were driven primarily by lower pre-commercial LUMRYZ related costs that were capitalized into inventory beginning in May 2023

upon FDA approval of LUMRYZ.

SG&A expenses for the quarter and year ended December 31,

2023, were $41.3 million and $151.7 million, compared to $17.0 million and $74.5 million for the same periods in 2022. These

increases were driven primarily by higher costs associated with the commercial launch of LUMRYZ, higher compensation costs due to increased

headcount, higher marketing and market research activities, and higher legal fees.

Net losses for the quarter and year ended

December 31, 2023, were $28.8 million, or ($0.32) per diluted share and $160.3 million,

or ($2.00) per diluted share, respectively, compared to net losses of $27.5 million, or ($0.44) per diluted share, and $137.5 million,

or ($2.29) per diluted share, for the same periods in 2022.

Cash, cash equivalents and marketable securities

were $105.1 million as of December 31, 2023.

Conference call details

A live audio webcast of the call can be accessed by visiting the investor

relations section of the Company’s website, www.avadel.com. A replay of the webcast will be archived on Avadel’s website

for 90 days following the event. Participants may register for the conference call here and are advised to do so at least 10 minutes

prior to joining the call.

About LUMRYZ™

(sodium oxybate) for extended-release oral suspension

LUMRYZ, is an extended-release

sodium oxybate medication approved by the FDA on May 1, 2023, as the first and only once-at-bedtime treatment for cataplexy or excessive

daytime sleepiness (EDS) in adults with narcolepsy.

The FDA approval of LUMRYZ was

supported by results from REST-ON, a randomized, double-blind, placebo-controlled, pivotal Phase 3 trial in adults with narcolepsy. LUMRYZ

demonstrated statistically significant and clinically meaningful improvements in the three co-primary endpoints: EDS, clinicians’

overall assessment of patients’ functioning (CGI-I) and cataplexy attacks, for all three evaluated doses when compared to placebo.

With its approval, the FDA also

granted seven years of Orphan Drug Exclusivity to LUMRYZ for the treatment of cataplexy or EDS in adults with narcolepsy due to a finding

of clinical superiority of LUMRYZ relative to currently available oxybate treatments. In particular, the FDA found that LUMRYZ

makes a major contribution to patient care over currently available, twice-nightly oxybate products by providing a once-nightly dosing

regimen that avoids nocturnal arousal to take a second dose.

About Avadel Pharmaceuticals plc

Avadel Pharmaceuticals plc (Nasdaq: AVDL) is a biopharmaceutical company

focused on transforming medicines to transform lives. Our approach includes applying innovative solutions to the development of medications

that address the challenges patients face with current treatment options. Avadel’s commercial product, LUMRYZ, was approved by

the U.S. Food & Drug Administration (FDA) as the first and only once-at-bedtime oxybate for the treatment of cataplexy or excessive

daytime sleepiness (EDS) in adults with narcolepsy. For more information, please visit www.avadel.com.

IMPORTANT SAFETY INFORMATION

|

WARNING: Taking LUMRYZ™ (sodium oxybate) with other central

nervous system (CNS) depressants, such as medicines used to make you fall asleep, including opioid analgesics, benzodiazepines, sedating

antidepressants, antipsychotics, sedating anti-epileptic medicines, general anesthetics, muscle relaxants, alcohol or street drugs, may

cause serious medical problems, including trouble breathing (respiratory depression), low blood pressure (hypotension), changes in alertness

(drowsiness), fainting (syncope) and death.

The active ingredient of LUMRYZ (sodium oxybate) is a form of gamma

hydroxybutyrate (GHB), a controlled substance. Abuse or misuse of illegal GHB alone or with other CNS depressants (drugs that cause changes

in alertness or consciousness) have caused serious side effects. These effects include seizures, trouble breathing (respiratory depression),

changes in alertness (drowsiness), coma and death. Call your doctor right away if you have any of these serious side effects.

Because of these risks, LUMRYZ is available only by prescription

and filled through certified pharmacies in the LUMRYZ REMS. You must be enrolled in the LUMRYZ REMS to receive LUMRYZ. Further information

is available at www.LUMRYZREMS.com or by calling 1-877-453-1029. |

INDICATIONS

LUMRYZ (sodium oxybate) for extended-release oral suspension is

a prescription medicine used to treat the following symptoms in adults with narcolepsy:

| · | sudden onset of weak or paralyzed muscles (cataplexy) |

| · | excessive daytime sleepiness (EDS) |

It is not known if LUMRYZ is safe and effective in people less than

18 years of age.

Do not take LUMRYZ if you take other sleep medicines or sedatives

(medicines that cause sleepiness), drink alcohol or have a rare problem called succinic semialdehyde dehydrogenase deficiency.

Keep LUMRYZ in a safe place to prevent abuse and misuse. Selling or

giving away LUMRYZ may harm others and is against the law. Tell your doctor if you have ever abused or been dependent on alcohol, prescription

medicines or street drugs.

Anyone who takes LUMRYZ should not do anything that requires them to

be fully awake or is dangerous, including driving a car, using heavy machinery or flying an airplane, for at least six (6) hours

after taking LUMRYZ. Those activities should not be done until you know how LUMRYZ affects you.

Falling asleep quickly, including while standing or while getting up

from the bed, has led to falls with injuries that have required some people to be hospitalized.

LUMRYZ can cause serious side effects, including the following:

| · | Breathing problems, including slower breathing, trouble breathing and/or short periods of not breathing while sleeping

(e.g., sleep apnea). People who already have breathing or lung problems have a higher chance of having breathing problems when they take

LUMRYZ. |

| · | Mental health problems, including confusion, seeing or hearing things that are not real (hallucinations), unusual or disturbing

thoughts (abnormal thinking), feeling anxious or upset, depression, thoughts of killing yourself or trying to kill yourself, increased

tiredness, feelings of guilt or worthlessness and difficulty concentrating. Tell your doctor if you have or had depression or have tried

to harm yourself. Call your doctor right away if you have symptoms of mental health problems or a change in weight or appetite. |

| · | Sleepwalking. Sleepwalking can cause injuries. Call your doctor if you start sleepwalking. |

Tell your doctor if you are on a salt-restricted diet or if you have

high blood pressure, heart failure or kidney problems. LUMRYZ contains a lot of sodium (salt) and may not be right for you.

The most common side effects of LUMRYZ in adults include nausea, dizziness,

bedwetting, headache and vomiting. Your side effects may increase when you take higher doses of LUMRYZ. LUMRYZ can cause physical dependence

and craving for the medicine when it is not taken as directed. These are not all the possible side effects of LUMRYZ.

For more information, ask your doctor or pharmacist. Call your doctor

for medical advice about side effects.

You are encouraged to report negative side effects of prescription

drugs to the FDA. Visit www.fda.gov/medwatch, or call 1-800-FDA-1088.

Please see full Prescribing Information, including BOXED Warning.

Cautionary Disclosure Regarding Forward-Looking

Statements

This press release includes “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These

forward-looking statements relate to our future expectations, beliefs, plans, strategies, objectives, results, conditions, financial performance,

prospects or other events. Such forward-looking statements include, but are not limited to, expectations regarding the potential therapeutic

benefit of LUMRYZ; the success of the commercialization of LUMRYZ; the anticipated market availability, demand and sales opportunity of

LUMRYZ; the potential expansion of LUMRYZ into the pediatric narcolepsy population including FDA’s review of the sNDA for such population

and timing related thereto; the Company’s plans and timing to initiate the idiopathic hypersomnia clinical study; the

Company’s anticipated financial condition, expenses, uses of capital and other future financial results. In some cases, forward-looking

statements can be identified by use of words such as “will,” “may,” “could,” “believe,”

“expect,” “look forward,” “on track,” “guidance,” “anticipate,” “estimate,”

“project,” “next steps” and similar expressions and the negatives thereof (if applicable).

The Company’s forward-looking statements are based on estimates

and assumptions that are made within the bounds of our knowledge of our business and operations and that we consider reasonable. However,

the Company’s business and operations are subject to significant risks, and, as a result, there can be no assurance that actual

results and the results of the company’s business and operations will not differ materially from the results contemplated in such

forward-looking statements. Factors that could cause actual results to differ from expectations in the Company’s forward-looking

statements include the risks and uncertainties described in the “Risk Factors” section of Part I, Item 1A of the

Company’s Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the Securities and Exchange

Commission (SEC) on February 29, 2024, and subsequent SEC filings.

Forward-looking statements speak only as of the date they are made

and are not guarantees of future performance. Accordingly, you should not place undue reliance on forward-looking statements. The Company

does not undertake any obligation to publicly update or revise our forward-looking statements, except as required by law.

Investor Contact:

Courtney Mogerley

Stern Investor Relations, Inc.

Courtney.Mogerley@sternir.com

(212) 698-8687

Media Contact:

Lesley Stanley

Real Chemistry

lestanley@realchemistry.com

(609) 273-3162

AVADEL PHARMACEUTICALS PLC

CONDENSED CONSOLIDATED STATEMENTS OF LOSS

(In thousands, except per share data)

(Unaudited)

| | |

Three Months Ended December 31, | | |

Twelve Months Ended December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net product revenue | |

$ | 19,453 | | |

$ | — | | |

$ | 27,963 | | |

$ | — | |

| Cost of products sold | |

| 693 | | |

| — | | |

| 846 | | |

| — | |

| Gross profit | |

| 18,760 | | |

| — | | |

| 27,117 | | |

| — | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development expenses | |

| 2,359 | | |

| 6,235 | | |

| 13,261 | | |

| 20,700 | |

| Selling, general and administrative expenses | |

| 41,301 | | |

| 16,981 | | |

| 151,705 | | |

| 74,516 | |

| Restructuring (income) expense | |

| — | | |

| (178 | ) | |

| — | | |

| 3,345 | |

| Total operating expenses | |

| 43,660 | | |

| 23,038 | | |

| 164,966 | | |

| 98,561 | |

| Operating loss | |

| (24,900 | ) | |

| (23,038 | ) | |

| (137,849 | ) | |

| (98,561 | ) |

| Investment and other (expense) income, net | |

| (1,632 | ) | |

| (1,072 | ) | |

| 87 | | |

| (536 | ) |

| Interest expense | |

| (2,354 | ) | |

| (3,255 | ) | |

| (9,886 | ) | |

| (12,342 | ) |

| Loss on extinguishment of debt | |

| — | | |

| — | | |

| (13,129 | ) | |

| — | |

| Loss before income taxes | |

| (28,886 | ) | |

| (27,365 | ) | |

| (160,777 | ) | |

| (111,439 | ) |

| Income tax (benefit) provision | |

| (100 | ) | |

| 85 | | |

| (501 | ) | |

| 26,025 | |

| Net loss | |

$ | (28,786 | ) | |

$ | (27,450 | ) | |

$ | (160,276 | ) | |

$ | (137,464 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share - basic | |

$ | (0.32 | ) | |

$ | (0.44 | ) | |

$ | (2.00 | ) | |

$ | (2.29 | ) |

| Net loss per share - diluted | |

| (0.32 | ) | |

| (0.44 | ) | |

| (2.00 | ) | |

| (2.29 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding - basic | |

| 89,798 | | |

| 62,276 | | |

| 80,174 | | |

| 60,094 | |

| Weighted average number of shares outstanding - diluted | |

| 89,798 | | |

| 62,276 | | |

| 80,174 | | |

| 60,094 | |

AVADEL PHARMACEUTICALS PLC

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except per share data)

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 31,167 | | |

$ | 73,981 | |

| Marketable securities | |

| 73,944 | | |

| 22,518 | |

| Accounts receivable, net | |

| 12,103 | | |

| — | |

| Inventories | |

| 10,380 | | |

| — | |

| Research and development tax credit receivable | |

| 1,322 | | |

| 2,248 | |

| Prepaid expenses and other current assets | |

| 5,286 | | |

| 2,096 | |

| Total current assets | |

| 134,202 | | |

| 100,843 | |

| Property and equipment, net | |

| 585 | | |

| 839 | |

| Operating lease right-of-use assets | |

| 2,591 | | |

| 1,713 | |

| Goodwill | |

| 16,836 | | |

| 16,836 | |

| Research and development tax credit receivable | |

| 332 | | |

| 1,232 | |

| Other non-current assets | |

| 10,152 | | |

| 11,322 | |

| Total assets | |

$ | 164,698 | | |

$ | 132,785 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT) | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Current portion of long-term debt | |

$ | — | | |

$ | 37,668 | |

| Current portion of operating lease liability | |

| 934 | | |

| 960 | |

| Accounts payable | |

| 11,433 | | |

| 7,890 | |

| Accrued expenses | |

| 24,227 | | |

| 7,334 | |

| Other current liabilities | |

| 261 | | |

| 1,941 | |

| Total current liabilities | |

| 36,855 | | |

| 55,793 | |

| Long-term debt | |

| — | | |

| 91,614 | |

| Long-term operating lease liability | |

| 1,690 | | |

| 780 | |

| Royalty financing obligation | |

| 32,760 | | |

| — | |

| Other non-current liabilities | |

| 5,654 | | |

| 5,743 | |

| Total liabilities | |

| 76,959 | | |

| 153,930 | |

| | |

| | | |

| | |

| Shareholders’ equity (deficit): | |

| | | |

| | |

| Preferred shares, nominal value of $0.01 per share; 50,000 shares authorized; 5,194 issued and outstanding at December 31, 2023 and 488 issued and outstanding at December 31, 2022 | |

| 52 | | |

| 5 | |

| Ordinary shares, nominal value of $0.01 per share; 500,000 shares authorized; 89,825 issued and outstanding at December 31, 2023 and 62,878 issued and outstanding at December 31, 2022 | |

| 898 | | |

| 628 | |

| Additional paid-in capital | |

| 855,452 | | |

| 589,783 | |

| Accumulated deficit | |

| (745,496 | ) | |

| (585,220 | ) |

| Accumulated other comprehensive loss | |

| (23,167 | ) | |

| (26,341 | ) |

| Total shareholders’ equity (deficit) | |

| 87,739 | | |

| (21,145 | ) |

| Total liabilities and shareholders’ equity (deficit) | |

$ | 164,698 | | |

$ | 132,785 | |

AVADEL PHARMACEUTICALS PLC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | |

Twelve Months Ended December 31, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (160,276 | ) | |

$ | (137,464 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 1,766 | | |

| 1,493 | |

| Amortization of debt discount and debt issuance costs | |

| 2,796 | | |

| 6,052 | |

| Changes in deferred taxes | |

| — | | |

| 26,025 | |

| Share-based compensation expense | |

| 15,811 | | |

| 7,013 | |

| Loss on extinguishment of debt | |

| 13,129 | | |

| — | |

| Other adjustments | |

| 1,262 | | |

| 2,042 | |

| Net changes in assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (12,103 | ) | |

| — | |

| Inventories | |

| (9,532 | ) | |

| — | |

| Prepaid expenses and other current assets | |

| (3,127 | ) | |

| 30,815 | |

| Research and development tax credit receivable | |

| 1,884 | | |

| 30 | |

| Accounts payable & other current liabilities | |

| 1,545 | | |

| (3,108 | ) |

| Accrued expenses | |

| 16,892 | | |

| 227 | |

| Other assets and liabilities | |

| 1,442 | | |

| (3,429 | ) |

| Net cash used in operating activities | |

| (128,511 | ) | |

| (70,304 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| — | | |

| (716 | ) |

| Proceeds from sales of marketable securities | |

| 187,136 | | |

| 83,828 | |

| Purchases of marketable securities | |

| (237,229 | ) | |

| (3,414 | ) |

| Net cash (used in) provided by investing activities | |

| (50,093 | ) | |

| 79,698 | |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from April 2023 public offering, net of issuance costs | |

| 134,151 | | |

| — | |

| Payments for February 2023 Notes | |

| (17,500 | ) | |

| (8,653 | ) |

| Payments for October 2023 Notes | |

| (21,165 | ) | |

| — | |

| Payments for debt issuance costs | |

| (4,357 | ) | |

| (4,804 | ) |

| Proceeds from royalty purchase agreement | |

| 30,000 | | |

| — | |

| Proceeds from issuance of shares off the at-the-market offering program | |

| 11,913 | | |

| 25,318 | |

| Proceeds from stock option exercises and employee share purchase plan | |

| 2,293 | | |

| 2,682 | |

| Net cash provided by financing activities | |

| 135,335 | | |

| 14,543 | |

| | |

| | | |

| | |

| Effect of foreign currency exchange rate changes on cash and cash equivalents | |

| 455 | | |

| (664 | ) |

| | |

| | | |

| | |

| Net change in cash and cash equivalents | |

| (42,814 | ) | |

| 23,273 | |

| Cash and cash equivalents at January 1 | |

| 73,981 | | |

| 50,708 | |

| Cash and cash equivalents at December 31 | |

$ | 31,167 | | |

$ | 73,981 | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

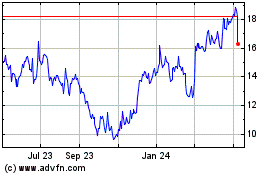

Avadel Pharmaceuticals (NASDAQ:AVDL)

Historical Stock Chart

From Mar 2024 to Apr 2024

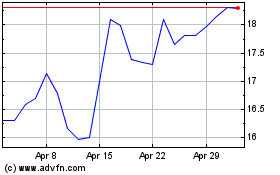

Avadel Pharmaceuticals (NASDAQ:AVDL)

Historical Stock Chart

From Apr 2023 to Apr 2024