UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-12

| | | | | | | | | | | | | | |

AVALO THERAPEUTICS, INC. |

(Name of Registrant as Specified In Its Charter) |

| | | | |

| N/A |

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box)

þ No fee required.

¨ Fee paid previously with preliminary materials.

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

540 Gaither Road, Suite 400

Rockville, Maryland 20850

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 14, 2022

Dear Stockholder of Avalo Therapeutics, Inc.:

You are cordially invited to attend the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Avalo Therapeutics, Inc., a Delaware corporation (the “Company”), which will be held on Tuesday, June 14, 2022, at 9:30 a.m. Eastern Time. The Annual Meeting will be a virtual stockholder meeting via live audio webcast, with no physical in-person meeting. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/AVTX2022. You will also be able to vote your shares electronically at the Annual Meeting.

At the Annual Meeting, stockholders will vote:

1.To elect the seven directors nominated by our board of directors (the “Board”) and named herein to hold office for a one-year term until the 2023 Annual Meeting of Stockholders;

2.To approve an amendment to our Certificate of Incorporation to effect a reverse stock split of the Company’s common stock at a ratio of between 1-for-5 and 1-for-20 as determined by our Board;

3.To approve, on a nonbinding advisory basis, a “Say-on-Pay” resolution regarding the compensation of our named executive officers;

4.To approve, on a nonbinding advisory basis, the frequency of future advisory votes on “Say-on-Pay” resolutions regarding the Company’s executive compensation;

5.To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022; and

6.To conduct any other business properly brought before the Annual Meeting.

This Notice and the Proxy Statement will serve as your guide to the business to be conducted at the Annual Meeting and provide detail on the virtual meeting format.

The record date for the Annual Meeting is April 20, 2022. Only stockholders of record at the close of business on that date are entitled to receive notice of and vote at the Annual Meeting or any adjournment or postponement thereof.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope that you will vote as soon as possible. Please review the instructions on each of your voting options described in the Important Notice Regarding Availability of Proxy Materials. Additional instructions on how to vote can be found on pages 1 through 6 of the Proxy Statement.

| | | | | | | | | | | | | | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Stockholders’ Meeting to Be Held on June 14, 2022 at 9:30 a.m. Eastern Time.

The 2022 Notice of Annual Meeting of Stockholders, Proxy Statement and 2021 Annual Report to Stockholders are available at www.proxyvote.com.

|

| | |

By Order of the Board of Directors, |

| /s/ Garry Neil, M.D. |

Garry Neil, M.D. |

Chief Executive Officer |

Rockville, Maryland

April 25, 2022

You are cordially invited to attend the virtual Annual Meeting. Whether or not you expect to attend the Annual Meeting, please complete, date, sign and return the proxy mailed to you, or vote by Internet as instructed in these materials, as promptly as possible in order to ensure your representation at the Annual Meeting. A return envelope (which is postage prepaid if mailed in the United States) has been provided for your convenience. Even if you have voted by proxy, you may still vote over the Internet during the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder. You may revoke your proxy in the manner described in the Proxy Statement at any time before it has been voted at the Annual Meeting.

TABLE OF CONTENTS

AVALO THERAPEUTICS, INC.

540 Gaither Road, Suite 400

Rockville, Maryland 20850

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

June 14, 2022

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a notice regarding the availability of proxy materials on the Internet?

Pursuant to rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because the board of directors (the “Board”) of Avalo Therapeutics, Inc. (sometimes referred to as the “Company” or “Avalo”) is soliciting your proxy to vote at the 2022 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements of the Annual Meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about April 28, 2022 to all stockholders of record entitled to vote at the Annual Meeting.

How do I attend the Annual Meeting?

The Annual Meeting will be held on Tuesday, June 14, 2022 at 9:30 a.m. Eastern Time. The 2022 Annual Meeting of Stockholders will be a virtual stockholder meeting via live audio webcast, with no physical in-person meeting. The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/AVTX2022 on June 14, 2022, using the 16-digit control number included on the proxy card mailed to you. We recommend that you log in a few minutes before the Annual Meeting begins to ensure you are logged in when the meeting starts. Online check-in will begin at 9:15 a.m. Eastern Time. Information on how to vote in person at the Annual Meeting is discussed below.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 20, 2022 (the “Record Date”) will be entitled to vote at the Annual Meeting. On the record date, there were 112,794,203 shares of the Company’s common stock, par value $0.001 per share, outstanding and entitled to vote.

Can I ask questions at the Annual Meeting?

If you would like to submit a question, you may do so by joining the virtual Annual Meeting at www.virtualshareholdermeeting.com/AVTX2022 and typing your question in the box in the Annual Meeting portal.

What if I need technical assistance accessing or participating in the virtual Annual Meeting?

If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Stockholder Meeting log in page. Technical support will be available starting at 9:00 a.m. Eastern Time on Tuesday, June 14, 2022.

What am I voting on?

There are five matters scheduled for a vote at the Annual Meeting:

1.Election of the seven directors nominated by the Board and named herein to hold office for a one-year term until the 2023 Annual Meeting of Stockholders;

2.Approval of an amendment to our Certificate of Incorporation to effect a reverse stock split of the Company’s common stock at a ratio of between 1-for-5 and 1-for-20 as determined by our Board;

3.Approval, on a nonbinding advisory basis, a “Say-on-Pay” resolution regarding the compensation of our named executive officers;

4.Approval, on a nonbinding advisory basis, the frequency of future advisory votes on “Say-on-Pay” resolutions regarding the Company’s executive compensation; and

5.Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022.

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” the nominees to the Board or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting.

Stockholder of Record: Shares Registered in Your Name

If on April 20, 2022, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. If you are a stockholder of record on the Record Date, there are four ways that you can vote your shares:

•Over the Internet (before the Annual Meeting). To vote over the Internet, access the proxy materials on the secured website www.proxyvote.com and follow the voting instructions on that website. Your Internet vote must be received by 11:59 p.m., Eastern Time on June 13, 2022 to be counted.

•By telephone. To vote over the telephone, dial toll-free 1-800-690-6903, using a touch-tone phone and follow the recorded instructions. You will be asked to provide the Company number and control number from the Notice. Your telephone vote must be received by 11:59 p.m., Eastern Time on June 13, 2022 to be counted.

•By mail. To vote using a requested proxy card, simply complete, sign and date the proxy card that is delivered to you and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. For your mailed proxy card to be counted, we must receive it before 9:30 a.m. Eastern Time on Tuesday, June 14, 2022.

•Over the Internet (during the Annual Meeting). Attend, or have your personal representative with a valid legal proxy attend, the virtual Annual Meeting by logging into www.virtualshareholdermeeting.com/AVTX2022 on June 14, 2022, using the 16-digit control number included on the proxy card that was mailed to you.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 20, 2022, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you must direct your broker or other agent regarding how to vote the shares in your account, or they will not be voted. You are also invited to attend the Annual Meeting. To vote your shares at the Annual Meeting, you must obtain a valid proxy from your broker, bank, dealer or other agent. Follow the instructions from your broker, bank, dealer or other agent included with these proxy materials, or contact your broker, bank, dealer or other agent to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned at the close of business on April 20, 2022.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by Internet, either prior to or at the Annual Meeting, by telephone or by completing and mailing your proxy card, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

Proposal 2 and Proposal 5 are deemed to be “routine” matters. Therefore, if you are a beneficial owner of shares registered in the name of your broker or other nominee and you fail to provide instructions to your broker or nominee as to how to vote your shares on the proposal, your broker or nominee will have the discretion to vote your shares on such proposal. Accordingly, if you fail to provide voting instructions to your broker or nominee, your broker or nominee can vote your shares on the proposal in a manner that is contrary to what you intend. For example, if you are against the approval of Proposal 2 but you do not provide any voting instructions to your broker, your broker can nonetheless vote your shares “For” Proposal 2.

Proposal 1, Proposal 3, and Proposal 4 are deemed to be “non-routine” matters, and as a result, your broker or nominee may not vote your shares on Proposal 1, Proposal 3 or Proposal 4 in the absence of your instruction. See the discussion above for the impact in the event that you fail to instruct your broker to vote. If you are a beneficial owner of shares registered in the name of your broker or other nominee, we strongly encourage you to provide voting instructions to the broker or nominee that holds your shares to ensure that your shares are voted in the manner in which you want them to be voted.

If you hold shares in “street name” and want to vote over the Internet during the Annual Meeting, you will need to ask your broker, bank, dealer or other agent to provide you with a valid legal proxy. Please note that if you request a legal proxy from your broker, bank, dealer or other agent, any previously executed proxy will be revoked and your vote will not be counted unless you vote over the Internet during the Annual Meeting or appoint another valid legal proxy to vote on your behalf.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted “For” Proposals 1, 2, 3, 5 and “For” three years for Proposal 4. If any other matter is properly presented at the Annual Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each Notice to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways before the final vote at the Annual Meeting:

•You may grant a subsequent proxy by Internet;

•You may submit a subsequent proxy by telephone;

•You may submit another properly completed proxy card with a later date;

•You may send a timely written notice that you are revoking your proxy to our Corporate Secretary at 540 Gaither Road, Suite 400, Rockville, Maryland 20850; or

•You may vote over the Internet during the Annual Meeting (or have a personal representative with a valid proxy vote), although simply attending the Annual Meeting will not, by itself, revoke your proxy.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank or dealer as a nominee or agent, you should follow the instructions provided by your broker, bank or dealer.

When are stockholder proposals and director nominations due for next year’s Annual Meeting?

Any proposals that a stockholder intends to present at our 2023 Annual Meeting pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), must be received by us no later than 5:00 p.m., Eastern Time, on December 27, 2022. Any such proposals also must comply with Rule 14a-8 regarding the inclusion of stockholder proposals in the Company’s proxy materials. Proposals should be addressed to the Corporate Secretary, Avalo Therapeutics, Inc., 540 Gaither Road, Suite 400, Rockville, Maryland 20850.

If you wish to submit a proposal (including a director nomination) at the 2023 Annual Meeting that is not to be included in next year’s proxy materials, your proposal or director nomination must be submitted in writing between February 14, 2023 and March 16, 2023, to the Corporate Secretary, Avalo Therapeutics, Inc., 540 Gaither Road, Suite 400, Rockville, Maryland 20850. Director nominations must include the information required by our bylaws, including, among other things: the full name, address and age of the proposed nominee; the proposed nominee’s principal occupation or employment; the class and number of shares of capital stock of the Company owned of record and beneficially by such proposed nominee; the date or dates on which such shares were acquired and the investment intent of such acquisition; and such other information concerning such nominee as would be required to be disclosed in a proxy statement soliciting proxies for the election of such nominee as a director in an election contest (even if an election contest is not involved). You may contact our Corporate Secretary at the address above to obtain a copy of the relevant bylaw provisions regarding the requirements for making stockholder nominations.

How are votes counted?

Votes will be counted by the Inspector of Election appointed for the Annual Meeting, who will separately count, for Proposal 1, votes “For,” “Withheld” and broker non-votes and, with respect to Proposal 2, Proposal 3, Proposal 4, and Proposal 5 votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Abstentions will be counted toward the vote total for Proposal 2, Proposal 3, Proposal 4, and Proposal 5 and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for Proposals 1, 3, 4 and 5.

What are “broker non-votes”?

When a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as broker non-votes.

How many votes are needed to approve each proposal?

The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Proposal Number | | Proposal Description | | Vote Required for Approval | | Effect of Abstentions | | Effect of Broker Non-Votes |

| 1. | | Election of the seven directors nominated by the Board | | Nominees receiving the most “For” votes | | “Withheld” votes will have no effect | | None |

| 2. | | Approval of a reverse stock split of the Company’s common stock | | Majority of shares outstanding and entitled to vote | | Counted “against” | | Shares may be voted by brokers in their discretion, but any non-votes will be a vote against |

| 3. | | Nonbinding advisory stockholder vote on the compensation of our named executive officers | | Majority of shares present and entitled to vote | | Counted “against” | | None |

| 4. | | Nonbinding advisory stockholder vote regarding the frequency submission of stockholders Say-on-Pay advisory vote | | Majority of shares present and entitled to vote | | Counted “against” | | None |

| 5. | | Ratification of the appointment of independent registered public accounting firm | | Majority of shares present and entitled to vote | | Counted “against” | | Shares may be voted by brokers in their discretion, but any non-votes have no effect |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding a majority of the outstanding shares entitled to vote are present at the Annual Meeting or represented by proxy. At the close of business on the Record Date, there were 112,794,203 shares outstanding and entitled to vote. Abstentions and broker non-votes (discussed above) are included in determining whether a quorum is present. Thus, the holders of 56,397,103 shares must be present in person or represented by proxy at the meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy by Internet, telephone, or proxy card (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote over the Internet during the Annual Meeting. Abstentions will be counted towards the quorum requirement. If there is no quorum, the chairman of the Annual Meeting or the holders of a majority of shares present at the Annual Meeting or represented by proxy may adjourn the Annual Meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting. In addition, we will publish final voting results in a Current Report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8‑K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

IMPORTANT INFORMATION IF YOU PLAN TO VIRTUALLY ATTEND THE ANNUAL MEETING

You must be able to show that you owned Avalo common stock on the Record Date, April 20, 2022, in order to gain admission to the Annual Meeting. When you log in to www.virtualshareholdermeeting.com/AVTX2022, you will be required to enter the 16-digit control number contained on your proxy card that evidences that you are a stockholder of record. Registration for the Annual Meeting will begin at 9:15 a.m. Eastern Time on June 14, 2022.

INFORMATION REGARDING THE BOARD AND CORPORATE GOVERNANCE

INDEPENDENCE OF THE BOARD

After review of all relevant identified transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent auditors, the Board has affirmatively determined that the following directors are independent directors within the meaning of the applicable Nasdaq listing standards and the independence criteria set forth in our Corporate Governance Guidelines: Dr. Almenoff, Mr. Boyd, Mr. Chan, Dr. Kaplan, Dr. Maher, and Dr. Persson. The Board also affirmatively determined former directors, Dr. Sol Barer, Dr. Suzanne Bruhn, and Mr. Phil Gutry, who served as Company directors in 2021, were independent directors within the meaning of applicable Nasdaq listing standards and the independence criteria set forth in our Corporate Governance Guidelines. In making this determination, the Board found that none of these directors or nominees for director had a material or other disqualifying relationship with the Company.

In making those independence determinations, the Board took into account certain relationships and transactions that occurred in the ordinary course of business between the Company and entities with which some of its directors are or have been affiliated. The Board considered all relationships and transactions that occurred during any 12-month period within the last three fiscal years, including the participation by our directors and entities affiliated with our directors in various financing transactions with the Company, and determined that there were no relationships that would interfere with their exercise of independent judgment in carrying out their responsibilities as directors.

In making its independence determination with respect to Mr. Boyd and Dr. Maher, the Board considered that Mr. Boyd and Dr. Maher are each managing members of Armistice Capital LLC (an affiliate of Armistice Capital Master Fund Ltd. and collectively, “Armistice”). Armistice is a long-short equity hedge fund focused on the health care and consumer sectors and is the Company’s largest shareholder. As of the Record Date, Armistice beneficially owned approximately 44% of our outstanding common stock. In particular, the Board considered Armistice’s right to designate two directors to our Board based on its current beneficial ownership of our common stock (as discussed in more detail in “Proposal 1 – Election of Directors”). After considering each of Mr. Boyd’s and Dr. Maher’s relationship with Armistice, the Board concluded that it did not interfere with either Mr. Boyd’s or Dr. Maher’s ability to exercise independent judgment in carrying out his responsibilities as a member of the Board and, in the case of Mr. Boyd, as a member of the Nominating and Corporate Governance Committee.

Joseph Miller is not an independent director within the meaning of applicable Nasdaq listing standards and the independence criteria set forth in our Corporate Governance Guidelines because of his prior employment with the Company, which ended in April 2020. Similarly, Director Nominee, Garry Neil, will not qualify as an independent director within the meaning of applicable Nasdaq listing standards and the independence criteria set forth in our Corporate Governance Guidelines because of his employment with the Company, which began in February 2020.

BOARD LEADERSHIP STRUCTURE

The Company’s Board is currently chaired by Mr. Boyd who was appointed Chairman of the Board in December 2021. Currently, the role of Chairman of the Board is separated from the role of Chief Executive Officer. We believe that separating these positions allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to, and independent oversight of management. While our bylaws and our corporate governance guidelines do not require that our Chairman and Chief Executive Officer positions be separate, our Board believes that having separate positions is the appropriate leadership structure for us at this time, and intends to maintain this separation where appropriate and practicable and demonstrates our commitment to good corporate governance. The Board appointed Dr. Magnus Persson as the lead independent director in November of 2021. The lead independent director is empowered to, among other duties and responsibilities, approve agendas and meeting schedules for regular Board meetings, preside over and establish the agendas for meetings of the independent directors, preside over any portions of Board meetings at which the evaluation of the Board is presented or discussed, coordinate the activities of the other independent directors and perform such other duties that the Board may establish or delegate.

In addition, it is the responsibility of the lead independent director to coordinate between the Board and management with regard to the determination and implementation of responses to any problematic risk management issues. We believe our leadership structure is appropriate given the size of our Company (in terms of number of employees) and the historical experience and understanding of our Company and industry.

Our independent directors meet alone in executive session no less than two times per year. The Chairman of the Board may call additional executive sessions of the independent directors at any time, and the Chairman of the Board shall call an executive session at the request of a majority of the independent directors. The purpose of these executive sessions is to promote open and candid discussion among non-employee directors.

ROLE OF THE BOARD IN RISK OVERSIGHT

Our Board believes that risk management is an important part of establishing, updating and executing the Company’s business strategy. Our Board, as a whole and at the committee level, has oversight responsibility relating to risks that could affect the corporate strategy, business objectives, compliance, operations, and the financial condition and performance of the Company. Our Board focuses its oversight on the most significant risks facing the Company and its processes to identify, prioritize, assess, manage and mitigate those risks. Our Board and its committees receive regular reports from members of the Company’s senior management on areas of material risk to the Company, including strategic, operational, financial, legal and regulatory risks. While our Board has an oversight role, management is principally tasked with direct responsibility for management and assessment of risks and the implementation of processes and controls to mitigate their effects on the Company.

The Audit Committee of the Board, as part of its responsibilities, oversees the management of financial risks, including accounting matters, corporate tax positions, insurance coverage and cash investment strategy and results. The Audit Committee is also responsible for overseeing the management of risks relating to the performance of the Company’s internal audit function, if required, and its independent registered public accounting firm, as well as our systems of internal controls and disclosure controls and procedures. The Compensation Committee of the Board is responsible for overseeing the management of risks relating to our executive compensation and overall compensation and benefit strategies, plans, arrangements, practices and policies. The Nominating and Corporate Governance Committee of the Board oversees the management of risks associated with our overall compliance and corporate governance practices, and the independence and composition of our Board. These committees provide regular reports to the full Board.

MEETINGS OF THE BOARD

The Board met thirteen times during 2021. All directors attended at least 75% of the aggregate number of meetings of the Board and of the committees on which he or she served, held during the portion of 2021 for which he or she was a director or committee member, respectively.

It is the Company’s policy to invite directors and nominees for director to attend the Annual Meeting. All of our directors then holding office attended the 2021 Annual Meeting of Stockholders.

INFORMATION REGARDING COMMITTEES OF THE BOARD

The Board has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides the current membership for each of the Board committees:

| | | | | | | | | | | | | | | | | | | | |

Name | | Audit | | Compensation | | Nominating and Corporate Governance |

Steven Boyd | | | | | | X |

| June Almenoff, M.D., Ph.D. | | X | | | | X |

Mitchell Chan | | X* | | X | | |

Gilla Kaplan, Ph.D. | | | | X | | |

| Keith Maher, M.D. | | | | | | |

Joseph Miller | | | | | | |

Magnus Persson, M.D., Ph.D. | | X | | X* | | X* |

| | | | | | |

* Committee Chairperson | | | | | | |

Sol Barer, Ph.D. served as the Company’s Chairman of the Board until his resignation from the Board effective June 15, 2021.

Michael Cola served on the Board at all times during the year ended December 31, 2021 and until February 16, 2022. He served as the Company’s Chairman of the Board from June 16, 2021 until December 14, 2021.

Suzanne Bruhn, Ph.D. served on the Board until November 10, 2021. Dr. Bruhn served as a member of the Audit Committee and a member of the Compensation Committee until November 10, 2021.

Phil Gutry served on the Board until December 1, 2021. Mr. Gutry served as the Chairman of the Audit Committee, Chairman of the Nominating and Corporate Governance Committee and a member of the Compensation Committee until December 1, 2021.

Below is a description of each committee of the Board. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities.

Audit Committee

The Audit Committee assists the Board in its oversight of the integrity of the Company’s financial statements, the qualifications and independence of our independent auditors, and our internal financial and accounting controls. The Audit Committee has direct responsibility for the appointment, compensation, retention (including termination) and oversight of our independent auditors, and our independent auditors report directly to the Audit Committee. The Audit Committee also prepares the audit committee report that the SEC requires to be included in our annual proxy statement.

The Audit Committee is currently composed of three directors: Mr. Chan (Chair), Dr. Almenoff and Dr. Persson. Mr. Gutry served as Chairman of our Audit Committee until December 1, 2021. Dr. Bruhn served on our Audit Committee until November 10, 2021.

The Board reviews the Nasdaq Listing Rules definition of independence for Audit Committee members on an annual basis and has determined that all members of the Audit Committee are independent as defined in Rule 5605(c)(2)(A)(i) and (ii) of the Nasdaq Listing Rules. The Board has also determined that Mr. Chan qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. The Board made qualitative assessments of Mr. Chan’s level of knowledge and experience based on a number of factors, including formal education and experience.

The Audit Committee met nine times during 2021. The Board has adopted a written Audit Committee charter that is available to stockholders under the heading “Corporate Governance” on the Company’s website at ir.avalotx.com.

Report of the Audit Committee of the Board

The Company maintains an independent Audit Committee that operates under a written charter adopted by the Board. The Audit Committee’s charter is available on our website at ir.avalotx.com. All of the members of the Audit Committee are independent as defined in Rule 5605(c)(2)(A)(i) and (ii) of the Nasdaq Listing Rules.

The Audit Committee reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2021 with management of the Company. The Audit Committee has discussed with the Company’s independent registered public accounting firm, Ernst & Young LLP, the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. The Audit Committee has also received the written disclosures and the letter from Ernst & Young LLP required by applicable requirements of the PCAOB regarding Ernst & Young LLP’s communications with the Audit Committee concerning independence and has discussed with Ernst & Young LLP its independence. Based on the foregoing, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 for filing with the SEC.

Submitted by the Audit Committee:

Mr. Mitchell Chan, Chair

Dr. June Almenoff

Dr. Magnus Persson

Compensation Committee

The Compensation Committee approves the compensation objectives for the Company, approves the compensation of the principal executive officer and approves or recommends to our Board for approval the compensation of other executives. The Compensation Committee reviews all compensation components, including base salary, bonus, benefits and other perquisites.

The Compensation Committee is currently composed of three directors: Dr. Persson (Chair), Mr. Chan and Dr. Kaplan. Dr. Bruhn and Mr. Gutry served on our Compensation Committee until November 10, 2021 and December 1, 2021, respectively. All members of the Compensation Committee during 2021 are independent as defined in Rule 5605(d)(2) of the Nasdaq Listing Rules and each is a non-employee member of our Board as defined in Rule 16b-3 under the Exchange Act.

The Compensation Committee met six times during 2021. The Board has adopted a written Compensation Committee charter that is available to stockholders under the heading “Corporate Governance” on the Company’s website at ir.avalotx.com.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board is responsible for making recommendations to our Board regarding candidates for directorships and the structure and composition of our Board and the Board committees. In addition, the Nominating and Corporate Governance Committee is responsible for maintaining and recommending to our Board corporate governance guidelines applicable to the Company and advising our Board on corporate governance matters.

The Nominating and Corporate Governance Committee is currently composed of three directors: Dr. Persson (Chair), Mr. Boyd and Dr. Almenoff. Mr. Gutry served as Chairman of our Nominating and Corporate Governance Committee until December 1, 2021. The Board has determined that all members of the Nominating and Corporate Governance Committee during 2021 are independent as defined in Rule 5605(a)(2) of the Nasdaq Listing Rules.

In accordance with Rule 5605(e)(1)(A) of the Nasdaq Listing Rules, even though we maintain a standing nominating committee, a majority of the independent directors of the Board recommend director nominees. Our non-independent directors do not participate in the recommendation of director nominees.

The Nominating and Corporate Governance Committee met two times during 2021. The Board has adopted a written Nominating and Corporate Governance Committee charter that is available to stockholders under the heading “Corporate Governance” on the Company’s website at ir.avalotx.com.

Other Board Committees

Science and Technology Advisory Committee

The Science and Technology Advisory Committee (“SATAC”) is responsible for periodically reviewing, and advising management on, matters relating to the Company’s strategic direction and investment in research, development and technology, and periodically advising and reporting to the Board on such matters. In addition, the SATAC also advises management and the Board on matters relating to identifying and evaluating significant emerging trends and issues in science and technology and considering the potential impact of such on the Company. The SATAC is currently composed of three directors: Dr. Kaplan (Chair), Dr. Almenoff and Dr. Persson. Dr. Barer and Dr. Bruhn served on our SATAC until June 15, 2021 and November 10, 2021, respectively.

Transaction Committee

The Transaction Committee of the Board is responsible for assisting and advising management in its review, consideration and evaluation of proposed business development, financing and other strategic transactions. In addition, the Transaction Committee reviews, considers and evaluates proposed product or business acquisitions or divestitures, licensing, distribution, promotion, collaboration and other commercial agreements and arrangements, joint ventures, and any other business development transactions. The Transaction Committee is currently composed of three directors: Mr. Chan (Chair), Mr. Boyd and Mr. Miller.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD

Stockholders who wish to communicate with members of our Board, including the independent directors individually or as a group, may send correspondence to them in care of our Corporate Secretary at our principal executive offices at 540 Gaither Road, Suite 400, Rockville, Maryland 20850. Such communication will be forwarded to the intended recipient(s). We currently do not intend to have our Corporate Secretary screen this correspondence, but we may change this policy if directed by the Board due to the nature or volume of the correspondence.

CODE OF ETHICS

The Company has adopted the Avalo Therapeutics, Inc. Code of Business Conduct and Ethics that applies to all officers, directors and employees. The Code of Business Conduct and Ethics is available under the heading “Corporate Governance” on the Company’s website at ir.avalotx.com. If the Company makes any substantive amendments to the Code of Business Conduct and Ethics or grants any waiver from a provision of the Code to any executive officer or director, the Company will promptly disclose the nature of the amendment or waiver on its website.

CORPORATE GOVERNANCE GUIDELINES

In June 2015, the Board documented the governance practices followed by the Company by adopting Corporate Governance Guidelines (the “Guidelines”) to assure that the Board will have the necessary authority and practices in place to review and evaluate the Company’s business operations as needed and to make decisions that are independent of the Company’s management. The Guidelines were amended by the Board in August 2019.

The Guidelines are also intended to align the interests of directors and management with those of the Company’s stockholders. The Guidelines set forth the practices the Board intends to follow with respect to Board composition and selection, the role of the Board, director orientation and education, Board meetings and involvement of senior management, Chief Executive Officer performance evaluation and succession planning and Board committees and compensation. The Guidelines, as well as the charters for each committee of the Board, may be viewed under the heading “Corporate Governance” at ir.avalotx.com.

Additionally, our insider trading policy strongly discourages employees, consultants, officers and directors from engaging in short sales, transactions in put or call options, hedging transactions, margin accounts or other inherently speculative transactions with respect to the Company’s stock at any time.

Board Diversity

We are committed to fostering an environment of diversity and inclusion, including among the members of our board of directors. Therefore, while the Board has not adopted a formal diversity policy, in considering director nominees, the Nominating and Corporate Governance Committee considers candidates who represent a mix of backgrounds and a diversity of gender, race, ethnicity, age, background, professional experience and perspectives that enhance the quality of deliberations and decisions of our Board, in the context of both the perceived needs of the structure of our Board and the Company’s business and structure at that point in time.

| | | | | | | | | | | | | | |

| BOARD DIVERSITY MATRIX (as of April 20, 2022) |

| Total Number of Directors | 7 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity |

| Directors | 2 | 3 | — | 2 |

| Part II: Demographic Background |

| African American or Black | — | — | — | — |

| Alaskan Native or Native American | — | — | — | — |

| Asian | — | — | — | — |

| Hispanic or Latinx | — | — | — | — |

| Native Hawaiian or Pacific Islander | — | — | — | — |

| White | 2 | 3 | — | — |

| Two or More Races or Ethnicities | — | — | — | — |

| LGBTQ+ | — | — | — | — |

| Did Not Disclose Demographic Background | 2 |

PROPOSAL 1

ELECTION OF DIRECTORS

The Board currently consists of seven members, each of which serves for a one-year term or until a successor has been elected and qualified. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors in office. A director elected by the Board to fill a vacancy, including vacancies created by an increase in the number of directors, shall serve for the remainder of the year term and until the director’s successor is duly elected and qualified.

Process for Selecting and Nominating Directors

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also considers such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management; having sufficient time to devote to the affairs of the Company; demonstrating excellence in his or her field; having the ability to exercise sound business judgment; and having the commitment to rigorously represent the long-term interests of the Company’s stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee typically considers diversity, age, skills and such other factors as it deems appropriate, given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability. While the Nominating and Corporate Governance Committee does not have a specific policy concerning diversity, it does consider potential benefits that may be achieved through diversity in viewpoint, professional experience, education and skills. The Board and the Nominating and Corporate Governance Committee assess the effectiveness of the Board’s diversity efforts as part of the annual Board evaluation process.

In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also considers whether the nominee would be an independent director under the Company’s Corporate Governance Guidelines, Nasdaq listing standards and applicable law. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, an executive search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote.

The Nominating and Corporate Governance Committee will also consider director candidates recommended by stockholders to be included in next year’s proxy materials pursuant to SEC Rule 14a-8. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board at the 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”) may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: Corporate Secretary, Avalo Therapeutics, Inc., 540 Gaither Road, Suite 400, Rockville, Maryland 20850. The Corporate Secretary must receive the stockholder nominations no later than 5:00 p.m., Eastern Time, on December 27, 2022 to be included in the proxy materials for, and considered for candidacy at, the 2023 Annual Meeting.

Our bylaws also permit stockholders to nominate director candidates for consideration at the 2023 Annual Meeting, but not to have the nomination considered for inclusion in the proxy materials for that meeting. Stockholders wishing to nominate director candidates can do so by writing to Corporate Secretary, Avalo Therapeutics, Inc., 540 Gaither Road, Suite 400, Rockville, Maryland 20850, giving the information required in our bylaws, including, among other things (i) the full name, address and age of the proposed nominee, (ii) the proposed nominee’s principal occupation or employment, (iii) the class and number of shares of capital stock of the Company owned of record and beneficially by such proposed nominee, (iv) the date or dates on which such shares were acquired and the investment intent of such acquisition and (v) such other information concerning such nominee as would be required to be disclosed in a proxy statement soliciting proxies for the election of such nominee as a director in an election contest (even if an election contest is not involved). You may contact our Corporate Secretary at the address above to obtain a copy of the relevant bylaw provisions regarding the requirements for making stockholder nominations. The Corporate Secretary must receive stockholder nominations between February 14, 2023 and March 16, 2023 to be considered for candidacy at the 2023 Annual Meeting.

In connection with the Securities Purchase Agreement dated April 27, 2017, between the Company and Armistice, the Company agreed that as long as Armistice maintains beneficial ownership of at least 13% of our outstanding common stock, Armistice, exclusively and as a separate class, has the right to designate two directors to our Board, and as long as Armistice maintains beneficial ownership of at least 10% of our outstanding common stock, Armistice, exclusively and as a separate class, has the right to designate one director. As of the Record Date, Armistice beneficially owned approximately 44% of our outstanding common stock.

The Company intends to nominate each of the individuals named below to serve as directors on our Board until their successor is duly elected and qualified at the 2023 Annual Meeting of Stockholder or, if earlier, his or her death, resignation, or removal. Each of the proposed nominees has consented to stand for election as a member of our Board, and the Company’s management has no reason to believe that any nominee will be unable to serve. Each of the nominees, with the exception of Dr. Neil, are currently a director of the Company. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by our Board.

The following sets forth certain information regarding the proposed nominees, including each director’s specific experience, skills and qualifications. The Board believes that the combination of the various experiences, skills and qualifications represented contributes to an effective and well-functioning Board and that the nominees possess the qualifications to provide meaningful oversight of the Company’s business and strategy.

Directors Nominated for Election at the Annual Meeting:

| | | | | | | | | | | | | | | | | | | | |

Name | | Age | | Director Since | | Position(s) with Avalo |

Steven Boyd | | 41 | | May 2017 | | Chairman of the Board of Directors and Director |

June Almenoff, M.D., Ph.D. | | 65 | | November 2021 | | Director |

Mitchell Chan | | 41 | | December 2021 | | Director |

| Gilla Kaplan, Ph.D. | | 75 | | October 2020 | | Director |

| Keith Maher, M.D. | | 54 | | October 2021 | | Director |

Garry Neil, M.D. | | 68 | | New Nominee | | President, Chief Executive Officer |

Magnus Persson, M.D., Ph.D. | | 61 | | April 2012 | | Director |

The following is a brief biography of each director nominated for election:

Steven Boyd. Mr. Boyd has served on our Board since May 2017 and was appointed Chairman of the Board in December 2021. He has served as the Chief Investment Officer of Armistice Capital, a long-short equity hedge fund focused on the health care and consumer sectors, since 2012. From 2005 to 2012, Mr. Boyd was a research analyst at Senator Investment Group, York Capital, and SAB Capital Management, where he focused on healthcare. Mr. Boyd began his career at McKinsey & Company. Mr. Boyd currently serves as a member of the board of directors of Tenax Therapeutics, Inc. (Nasdaq: TENX). Mr. Boyd previously served as a member of the boards of directors of Aytu BioScience, Inc. (Nasdaq: AYTU), Vaxart, Inc. (Nasdaq: VXRT), and Kiora Pharmaceuticals Inc. (Nasdaq: KPRX).

Mr. Boyd received a B.S. in Economics and a B.A. in Political Science from The Wharton School of the University of Pennsylvania. Our Board believes that Mr. Boyd’s experience in the capital markets and strategic transactions, and his focus on the healthcare industry makes him a valuable member of our Board.

June Almenoff, M.D., Ph.D. Dr. Almenoff has served on our Board since November 2021. Dr. Almenoff is currently the Chief Medical Officer at RedHill Biopharma Ltd (Nasdaq: RDHL), a specialty biopharmaceutical company, primarily focused on gastrointestinal and infectious diseases. From March 2010 to October 2014, Dr. Almenoff served as President and Chief Medical Officer and a member of the board of directors of Furiex Pharmaceuticals, Inc. (previously Nasdaq: FURX) (“Furiex”), a drug development collaboration company that was acquired by Actavis plc (now AbbVie, Inc.) for $1.2 billion in July 2014. Prior to joining Furiex, Dr. Almenoff was at GlaxoSmithKline plc (NYSE: GSK) for twelve years, where she held various positions of increasing responsibility, most recently Vice President in the Clinical Safety organization. Dr. Almenoff is on the investment advisory board of the Harrington Discovery Institute, a private venture philanthropy. She serves as a Board Director to Brainstorm Therapeutics, Inc. (Nasdaq: BCLI) and Tenax Therapeutics, Inc. (Nasdaq: TENX). She previously served as a member of the board of directors of Tigenix NV (acquired by Takeda Pharmaceutical Company Limited in August 2018), Kurome Therapeutics, Inc., and as chair of the board of directors of RDD Pharma, Ltd. (now 9 Meters Biopharma, Inc.). Dr. Almenoff received her B.A. cum laude from Smith College and graduated with AOA honors from the M.D.-Ph.D. program at the Icahn (Mt. Sinai) School of Medicine. She completed post-graduate medical training at Stanford University Medical Center and served on the faculty of Duke University School of Medicine. She is an adjunct Professor at Duke, a Fellow of the American College of Physicians (FACP) and has authored over 60 publications. Our Board believes that Dr. Almenoff’s close to 25 years of leadership experience as a biopharma executive and her expertise in research and development and commercialization makes her a valuable member of our Board.

Mitchell Chan. Mr. Chan has served on our Board since December 2021. Mr. Chan is currently the Operating Partner at Catalio Capital Management, LP, a venture capital fund focused on investments in biomedical technology companies. From September 2018 to March 2021, Mr. Chan was at Viela Bio, Inc. (“Viela”), a clinical-stage biotechnology company, and most recently served as the Chief Financial Officer and oversaw the acquisition of Viela by Horizon Therapeutics plc for $3.1 billion. Prior to Viela, Mr. Chan served as the Director of Investor Relations for AstraZeneca, North America (Nasdaq: AZN), a multinational pharmaceutical and biotechnology company. Mr. Chan also held several roles of increasing responsibility within the Roche Group, at Genetech and F. Hoffmann-La Roche AG, including in biooncology commercial finance, research and development finance, and mergers and acquisitions. Mr. Chan is the recipient of Executive Certifications from Stanford University, University of California (Haas), and University of Pennsylvania (Wharton) and earned his B.S. in Biochemistry, M.S. in Medial Biophysics, and MBA from the University of Toronto (Rotman School of Management). Our Board believes that Mr. Chan’s more than 15 years of leadership experience in the finance and investor relation functions at successful life science companies makes him a valuable member of our Board.

Gilla Kaplan, Ph.D. Dr. Kaplan has served on our Board since October 2020. She has spent her career as an academic research scientist leading her laboratory in investigations focusing on human disease, and exploring novel experimental medicine approaches that modulate the immune response for disease control. Dr. Kaplan’s work has encompassed developing a deep understanding of the cellular immune response and how to harness it for host adjunctive therapies. She is the co-founder and currently serves as the Chief Research Officer of Gilrose Pharmaceuticals. She was the Director of the Global Health Program, Tuberculosis, at the Bill and Melinda Gates Foundation (“BMGF”) from January 2014 until April 2018. Building on her 20-year research experience at Rockefeller University in New York City and then 10-year research experience at the Public Health Research Institute Center at the University of Medicine and Dentistry of New Jersey, she led the reshaping of the tuberculosis program at BMGF. Dr. Kaplan is the recipient of multiple grants from the U.S. National Institutes of Health-National Institute of Allergy and Infectious Diseases and other funding organizations for her research. Dr. Kaplan currently serves as a member of the board of directors of Tyra Biosciences, Inc. (Nasdaq: TYRA) and previously served as a member of the board of directors of Celgene Corporation (previously Nasdaq: CELG). Dr. Kaplan received her B.S. from Hebrew University, Jerusalem, Israel and her M.S. Ph.D. in Cellular Immunology from the University of Tromso, Norway. Our Board believes that Dr. Kaplan’s academic and industry experience in immunology and rare diseases makes her a valuable member of Board.

Keith Maher, M.D. Dr. Maher has served on our Board since October 2021. Dr. Maher has served as a Managing Director at Armistice Capital, a long-short equity hedge fund focused on the health care and consumer sectors, since 2018. From 2013 through 2018, Dr. Maher served as the North American healthcare analyst for Schroder Investment Management Ltd. From 2007 to 2013, Dr. Maher held senior roles at Omega Advisors, Inc. and Gracie Capital L.P.. Prior to that, he founded Valesco Healthcare Partners, a global healthcare fund, in partnership with Paramount Bio Capital.

Earlier in his career, Dr. Maher has also worked as a Managing Director at Weiss, Peck & Greer Investments Inc., which he joined from Lehman Brothers, where he was an equity research analyst covering medical device and technology companies. Dr. Maher currently serves as a member of the board of directors of Tenax Therapeutics, Inc. (Nasdaq: TENX). He previously served as a member of the boards of directors of Vaxart, Inc. (Nasdaq: VXRT), Tetraphase Pharmaceuticals, Inc., and Kiora Pharmaceuticals Inc. (Nasdaq: KPRX). Dr. Maher received his M.D. from Albany Medical College and completed his clinical training at the Mount Sinai Medical Center in the Department of Medicine. Dr. Maher holds an MBA from Northwestern University’s Kellogg Graduate School of Management as well as a B.A. from Boston University. Our Board believes that Dr. Maher’s medical training combined with his experience in the capital markets and strategic transactions makes him a valuable member of our Board.

Garry Neil, M.D. Dr. Neil has served as the President and Chief Executive Officer of the Company since February 2022. From March 2020 to February 2022, Dr. Neil served as the Chief Scientific Officer of the Company. Dr. Neil joined the Company as Chief Medical Officer in February 2020, when Aevi Genomic Medicine, Inc. (“Aevi”) was acquired by the Company (the “Aevi Merger”). Dr. Neil served as Chief Scientific Officer of Aevi from September 2013 until the Aevi Merger closed in February 2020. From September 2012 to September 2013, Dr. Neil was a Partner at Apple Tree Partners, a life sciences private equity fund. From July 2002 to August 2012, he held a number of senior positions at Johnson & Johnson, including Corporate VP of Science & Technology from November 2007 to August 2012, and Group President at Johnson & Johnson Pharmaceutical Research and Development from September 2005 to November 2007. Prior to joining Johnson & Johnson, he held senior positions at AstraZeneca, EMD Pharmaceuticals Inc. and Merck KGaA. Under his leadership, a number of important new medicines for the treatment of cancer, anemia, infections, central nervous system and psychiatric disorders, pain, and genitourinary and gastrointestinal diseases gained initial or expanded approvals. Dr. Neil served on the board of directors of Arena Pharmaceuticals, Inc. (Nasdaq: ARNA) until it was acquired by Pfizer Inc. (NYSE: PFE) in March 2022. Dr. Neil previously served as a member of the board of directors of GTx, Inc. (previously Nasdaq: GTXI). Dr. Neil also serves on the Board of Directors of the Reagan Udall Foundation and the Center for Discovery and Innovation. He is a past Chairman of the Pharmaceutical Research and Manufacturers Association (“PhRMA”) Science and Regulatory Executive Committee and the PhRMA Foundation Board, as well as a past member of the Foundation for the U.S. National Institutes of Health (“NIH”) and the Science Management Review Board of the NIH. Dr. Neil holds a B.S. from the University of Saskatchewan and an M.D. from the University of Saskatchewan College of Medicine. He completed postdoctoral clinical training in internal medicine and gastroenterology at the University of Toronto. Dr. Neil also completed a postdoctoral research fellowship at the Research Institute of Scripps Clinic. Our Board believes that Dr. Neil’s wealth of scientific and medical training combined with his substantial leadership skills and board experience will make him a valuable member of our Board.

Magnus Persson, M.D., Ph.D. Dr. Persson has served on our Board since August 2012 and currently serves as Lead Independent Director of the Board. Dr. Persson currently serves as Founding Partner and Chairman of the Board of Eir Venture Partners AB, a Nordics-focused life science venture capital fund, and associated companies. Previously, he was Chief Executive Officer of Karolinska Institutet Holding AB in Stockholm, Sweden. Dr. Persson has served as an Associate Professor in Physiology at the Karolinska Institutet since September 1994. Dr. Persson has served as a practicing pediatrician at CityAkuten and Barnsjukhuset Martina in Stockholm, Sweden since December 2012. Previously, Dr. Persson served as a Partner at HealthCap, a Swedish-based venture capital firm, from January 1996 to December 2009, and as a Managing Partner at The Column Group, a San Francisco-based venture capital firm, from January 2010 through November 2011. Dr. Persson co-founded Aerocrine AB, a medical technology company in 1994. Dr. Persson has also served on the board of directors of Galecto Biotech AB, Gyros Protein Technologies AB, ADDI Medical AB, and Immunicum AB (STO: IMMU). Dr. Persson is a board member of Attgeno AB, Trailhead Biosystems Inc, Cantargia AB (STO: CANTA) and Initiator Pharma AS (STO: INIT). Dr. Persson received his M.D. and Ph.D. in physiology from the Karolinska Institutet. Our Board believes that Dr. Persson’s extensive experience in medicine, life sciences and biotechnology financing and his experience founding and leading public biotechnology and medical technology companies make him a valuable member of our Board.

The Board of Directors unanimously recommends that stockholders vote “FOR” each of the nominees listed above.

DIRECTOR COMPENSATION

Our Board approved a compensation policy for our non-employee directors that became effective upon the closing of our initial public offering. After consultation with an independent, external compensation consultant, Radford, an Aon Company (“Aon Radford”), the policy was most recently amended in 2021 and further amended in January 2022 to fix clerical errors. The policy provides for the following compensation to our non-employee directors:

•The chair of our Board (if not an employee director) receives an annual fee of $70,000 and each other non-employee director receives $40,000;

•The chair of our Audit Committee receives an annual fee of $15,000 and each other member receives $7,500;

•The chair of our Compensation Committee receives an annual fee of $10,000 and each other member receives $5,000;

•The chair of our Nominating and Corporate Governance Committee receives an annual fee of $8,000 and each other member receives $4,000;

•The chair of our Science and Technology Advisory Committee receives an annual fee of $15,000 and each other member receives $7,500; and

•Each non-employee director is entitled to (i) an initial grant of stock options to purchase 80,000 shares of our common stock and (ii) an annual grant of options to purchase 40,000 shares of our common stock under the Third Amended and Restated 2016 Equity Incentive Plan (the “2016 Amended Plan”). The initial grant vests in three substantially equal annual installments over three years commencing on the first anniversary of the grant date. Each annual grant vests in full on the first anniversary of the grant date, in each case, subject to continued service from the date of grant until the applicable vesting dates.

Each non-employee director may make an election to receive all or a part of his or her annual cash compensation in the form of stock options to purchase shares of the Company’s common stock. Elections must be made in multiples of 5% of an Eligible Director’s (as defined in the 2016 Amended Plan) aggregate cash retainer. The stock options will be granted on the date on which the cash would have otherwise been paid, with an exercise price per share equal to the last reported sale price of the common stock on the Nasdaq Capital Market on the date of grant or, if such grant date is not a trading date, on the last trading date prior to the grant date, and with a term of ten years from the date of grant (subject to earlier termination in connection with a termination of service). The actual number of shares subject to the stock options will be determined so that the options have a “fair value” on the date of grant, using a Black-Scholes or binomial valuation model consistent with the methodology.

All fees under the director compensation policy are paid on a quarterly basis and no per meeting fees are paid. The Company reimburses non-employee directors for reasonable expenses incurred in connection with attending Board and committee meetings.

The following table sets forth information regarding the total compensation paid to the Company’s non-employee directors in 2021. The compensation amounts presented in the table below are historical and are not indicative of the amounts the Company may pay directors in the future. Directors who are also Company employees receive no additional compensation for their services as directors and are not included in the table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Fees

Earned or Paid in Cash(1) ($) | | Option

Awards(2) ($) | | Other Compensation ($) | | Total ($) | | Option Awards Held at December 31, 2021

(#) |

Current Non-Employee Directors: |

Steven Boyd(3) | | $— | | $— | | $— | | $— | | — |

June Almenoff, M.D., Ph.D.(4) | | $7,440 | | $130,650 | | $— | | $138,090 | | 80,737 |

Mitchell Chan(5) | | $4,945 | | $106,359 | | $— | | $111,304 | | 80,000 |

| Gilla Kaplan, Ph.D. | | $— | | $153,984 | | $— | | $153,984 | | 133,527 |

Keith Maher, M.D.(6) | | $— | | $— | | $— | | $— | | — |

Joseph Miller(7) | | $— | | $138,421 | | $— | | $138,421 | | 386,894 |

Magnus Persson, M.D., Ph.D. | | $34,780 | | $133,201 | | $— | | $167,981 | | 283,325 |

Former Non-Employee Directors: |

Sol Barer, Ph.D.(8) | | $35,521 | | $98,421 | | $— | | $133,942 | | 1,577,500 |

Suzanne Bruhn, Ph.D.(9) | | $29,093 | | $120,921 | | $8,407 | | $158,421 | | 121,884 |

Phil Gutry(10) | | $41,996 | | $118,821 | | $5,604 | | $166,421 | | 225,599 |

(1) The amounts shown in this column reflect cash fees earned for services rendered in fiscal year 2021.

(2) The amounts shown in this column represent the aggregate grant date fair value of stock options granted in fiscal year 2021 computed in accordance with ASC 718, Compensation—Stock Compensation. The assumptions used in valuing these options are described under the caption “Stock-Based Compensation” in Note 2 to our consolidated financial statements included in our Annual Report on Form 10-K, for the year ended December 31, 2021.

(3) Mr. Boyd elected to forego board compensation.

(4) Dr. Almenoff was appointed to the Board on November 10, 2021.

(5) Mr. Chan was appointed to the Board on December 1, 2021.

(6) Dr. Maher was appointed to the Board on October 15, 2021. Dr. Maher elected to forego board compensation.

(7) Mr. Miller served as Chief Financial Officer of the Company from July 2018 until April 24, 2020. Simultaneously with his resignation as an executive officer of the Company, Mr. Miller was appointed to serve on the Board. As of December 31, 2021, 280,000 of his outstanding stock options relate to stock options granted in his capacity as an executive of the Company and 106,894 relate to stock options granted in his capacity as a non-employee director. In addition, Mr. Miller held 11,250 unvested restricted stock units as of December 31, 2021, which were granted in his capacity as an executive of the Company.

(8) Dr. Barer served on the Board as its Chairman until June 15, 2021. Effective June 16, 2021, the Company and the Dr. Barer entered into an agreement for him to serve as a strategic advisor to the Board and the Company, including serving on the Company’s Scientific Advisory Board, for a period of at least one year. As consideration for these services, the Company modified his outstanding stock options to allow them to continue to vest during the term during which he serves as a strategic advisor and to treat Dr. Barer’s advisor services, when taken together with his prior Board service, as an uninterrupted period of continuous service.

(9) Dr. Bruhn served on the Board until November 10, 2021. In connection with her resignation and pursuant to the Cooperation Agreement the Company entered into with Armistice, the Company accelerated the vesting of her outstanding stock options as if Dr. Bruhn had served her full board term and extended the exercise period of her options until the second anniversary of her resignation. Additionally, Dr. Bruhn will receive compensation as if she had served the full board term, which compensation in 2021 is shown in the “Other Compensation” column.

(10) Mr. Gutry served on the Board until December 1, 2021. In connection with his resignation and pursuant to a Cooperation Agreement the Company entered into with Armistice, the Company accelerated the vesting of his outstanding stock options as if Mr. Gutry had served his full board term and extended the exercise period of his options until the second anniversary of his resignation. Additionally, Mr. Gutry will receive compensation as if he had served the full board term, which compensation in 2021 is shown in the “Other Compensation” column.

PROPOSAL 2

APPROVAL OF REVERSE STOCK SPLIT

The Board of Directors deems it advisable and in the best interest of the Company that the Board be granted the discretionary authority to amend the Company’s Amended and Restated Certificate of Incorporation, as amended (the “Charter”), to effect a reverse stock split of the Company’s issued and outstanding common stock as described below (the “Reverse Stock Split Amendment”). The form of Reverse Stock Split Amendment to be filed with the Delaware Secretary of State is set forth in Annex A.

Approval of the proposal would permit (but not require) our Board of Directors to effect a reverse stock split of our issued and outstanding common stock by a ratio of not less than one-for-five and not more than one-for-twenty (the “Reverse Stock Split”), with the exact ratio to be set at a number within this range as determined by our Board in its sole discretion, provided that the Company effects the Reverse Stock Split no later than one year following the approval of this proposal by stockholders. We believe that enabling our Board to set the ratio within the stated range will provide us with the flexibility to implement the Reverse Stock Split in a manner designed to maximize the anticipated benefits for our Company and our stockholders. In determining a ratio, if any, our Board may consider a variety of factors.

Our Board of Directors reserves the right to elect to abandon the Reverse Stock Split, including any proposed Reverse Stock Split ratio, if it determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of our Company and our stockholders.

Depending on the ratio for the Reverse Stock Split determined by our Board of Directors, no less than five (5) and no more than twenty (20) shares of outstanding common stock, as determined by our Board, will be combined into one share of common stock. Our Board has determined that if the Reverse Stock Split is effected, those stockholders entitled to receive fractional shares would receive, in lieu of any fractional share, the number of shares rounded up to the next whole number.

Reasons for the Reverse Stock Split; Potential Consequences of the Reverse Stock Split

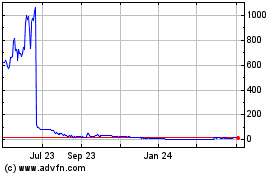

The Company’s primary reasons for approving and recommending the Reverse Stock Split are to increase the per share price and bid price of our common stock to help the Company regain compliance with the continued listing requirements of Nasdaq Listing Rules.

On March 17, 2022, we received a letter from the Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that for the last 30 consecutive business days the bid price for the Company’s common stock had closed below the minimum $1.00 per share requirement for continued inclusion on the Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”). The Nasdaq letter had no immediate effect on the listing of the Company’s common stock on the Nasdaq Capital Market.

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has a compliance period of 180 calendar days, or until September 13, 2022, to regain compliance with the Bid Price Rule. If at any time before September 13, 2022, the bid price of the Company's common stock closes at $1.00 per share or more for a minimum of ten consecutive trading days, Nasdaq will provide the Company with a written confirmation of compliance with the Bid Price Rule. Even in such event, our Board may determine it is in the best interests of our Company and our stockholders to effect the Reverse Stock Split.

Reducing the number of outstanding shares of common stock should, absent other factors, generally increase the per share market price of our common stock. Although the intent of the Reverse Stock Split is to increase the price of our common stock, there can be no assurance, however, even if the Reverse Stock Split is effected, that the bid price of the Company’s common stock will be sufficient for the Company to regain compliance with the Bid Price Rule.

In addition, the Company believes the Reverse Stock Split will make our common stock more attractive to a broader range of investors, as it believes that the current market price of our common stock may deter or even prevent certain institutional investors, professional investors and other members of the investing public from purchasing our stock.

The Company believes that the Reverse Stock Split will make our common stock a more attractive and cost-effective investment for many investors, which in turn would enhance the liquidity of the holders of our common stock.

There can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the market price of our common stock will increase following the Reverse Stock Split, that as a result of the Reverse Stock Split we will be able to meet or maintain a bid price over the minimum bid price requirement of Nasdaq or that the market price of our common stock will not decrease in the future.

Procedure for Implementing the Reverse Stock Split