As

filed with the Securities and Exchange Commission on January 8, 2025

Registration

Statement No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

ASPIRA

WOMEN’S HEALTH INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

2835 |

|

33-0595156 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

12117

Bee Caves Road, Building III, Suite 100

Austin,

Texas 78738

(512) 519-0400

(Address,

including zip code and telephone number, including area code of registrant’s principal executive offices)

Sandra

Milligan

Interim

Chief Executive Officer

Aspira

Women’s Health Inc.

12117

Bee Caves Road, Building III, Suite 100

Austin,

Texas 78738

(512) 519-0400

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Jeffrey

J. Fessler, Esq.

Nazia

J. Khan, Esq.

Sheppard,

Mullin, Richter & Hampton LLP

30

Rockefeller Plaza

New

York, NY 10112-0015

Tel.:

(212) 653-8700 |

|

Lawrence

Metelitsa, Esq.

Lucosky

Brookman LLP

101

Wood Avenue South, 5th Floor

Woodbridge,

NJ 08830

Tel.:

(732) 395-4400 |

Approximate

date of commencement of proposed sale to the public:

As

soon as practicable after the date this registration statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

|

|

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective

on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The

information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

JANUARY 8, 2025 |

Up

to 16,000,000 Shares of Common Stock

Up

to 16,000,000 Pre-Funded Warrants to purchase up to 16,000,000 Shares of Common Stock

Aspira

Women’s Health Inc.

We

are offering up to 16,000,000 shares of our common stock at an assumed public offering price of $0.75 per share, the last

reported sale price of our common stock as reported on The Nasdaq Capital Market on January 7, 2025. The actual public offering

price per share of common stock will be determined between us and the underwriters at the time of pricing and may be at a discount to

this assumed offering price. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the

final offering price.

We

are also offering up to 16,000,000 pre-funded warrants (each a “Pre-funded Warrant”) to purchase up to 16,000,000

shares of our common stock, exercisable at an exercise price of $0.001 per share, to those purchasers whose purchase of common

stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially

owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following

the consummation of this offering. The purchase price of each Pre-funded Warrant is equal to the price per share of common stock being

sold to the public in this offering, minus $0.001. The Pre-funded Warrants will be immediately exercisable and may be exercised

at any time until all of the Pre-funded Warrants are exercised in full. For each Pre-funded Warrant we sell, the number of shares

of common stock that we are offering will be decreased on a one-for-one basis.

Our

common stock is listed on The Nasdaq Capital Market under the symbol “AWH”. On January 7, 2025, the closing price of our

common stock on The Nasdaq Capital Market was $0.75. There is no established trading market for the Pre-funded Warrants and we do

not intend to list the Pre-funded Warrants on any securities exchange or nationally recognized trading system.

We

are a “smaller reporting company” as defined in the federal securities laws and will be subject to reduced public company

reporting requirements. See “Prospectus Summary — Implications of Being a Smaller Reporting Company.”

You

should read this prospectus, together with the additional information described under the headings “Where You Can Find More Information”

and “Incorporation of Documents by Reference,” carefully before you invest in any of our securities.

Investing

in our common stock is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page

13 of this prospectus for a discussion of information that should be considered in connection with an investment in our common

stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per

Share | | |

Per

Pre-funded Warrant | | |

Total | |

| Public offering price | |

$ | | | |

$ | | | |

$ | | |

| Underwriting discounts and

commissions (1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds to us, before expenses | |

$ | | | |

$ | | | |

$ | | |

| (1) |

Underwriting

discounts and commissions do not include a non-accountable expense allowance equal to 1.0% of the public offering price payable to

the representative of the underwriters. See “Underwriting” beginning on page 38 for additional information

regarding underwriters’ compensation. |

We

have granted a 45-day option to the underwriters to purchase up to 2,400,000 additional shares of common stock and/or up to 2,400,000 Pre-funded Warrants solely to cover over-allotments, if any.

The

underwriters expect to deliver the securities to purchasers on or about ,

2025.

ThinkEquity

The

date of this prospectus is , 2025

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

We

incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without

charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus

as well as additional information described under “Incorporation of Documents by Reference” before deciding to invest in

our securities.

Neither

we nor the underwriters have authorized anyone to provide you with additional information or information different from that contained

or incorporated by reference in this prospectus filed with the Securities and Exchange Commission (the “SEC”). We take no

responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The underwriters

are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The information

contained in this prospectus, or any document incorporated by reference in this prospectus, is accurate only as of the date of those

respective documents, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition,

results of operations and prospects may have changed since that date.

The

information incorporated by reference or provided in this prospectus contains estimates and other statistical data made by independent

parties and by us relating to market size and growth and other data about our industry. We obtained the industry and market data in this

prospectus from our own research as well as from industry and general publications, surveys and studies conducted by third parties. This

data involves a number of assumptions and limitations and contains projections and estimates of the future performance of the industry

in which we operate that are subject to a high degree of uncertainty, including those discussed in “Risk Factors.” We caution

you not to give undue weight to such projections, assumptions, and estimates. Further, industry and general publications, studies and

surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy

or completeness of such information. While we believe that these publications, studies, and surveys are reliable, we have not independently

verified the data contained in them. In addition, while we believe that the results and estimates from our internal research are reliable,

such results and estimates have not been verified by any independent source.

For

investors outside the United States (“U.S.”): We and the underwriters have not done anything that would permit this offering

or the possession or distribution of this prospectus in any jurisdiction where action for those purposes is required, other than in the

U.S. Persons outside the U.S. who come into possession of this prospectus must inform themselves about, and observe any restrictions

relating to, the offering of the securities and the distribution of this prospectus outside of the U.S.

INFORMATION

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Exchange Act of 1934, as amended (the “Exchange Act”) that involve risks and uncertainties.

You should not place undue reliance on these forward-looking statements. All statements other than statements of historical facts contained

in this prospectus are forward-looking statements. The forward-looking statements in this prospectus are only predictions. We have based

these forward-looking statements largely on our current expectations and projections about future events and financial trends that we

believe may affect our business, financial condition, and results of operations. In some cases, you can identify these forward-looking

statements by terms such as “anticipate,” “believe,” “continue,” “could,” “depends,”

“estimate,” “expects,” “intend,” “may,” “ongoing,” “plan,” “potential,”

“predict,” “project,” “should,” “will,” “would” or the negative of those

terms or other similar expressions, although not all forward-looking statements contain those words. We have based these forward-looking

statements on our current expectations and projections about future events and trends that we believe may affect our financial condition,

results of operations, strategy, short- and long-term business operations and objectives, and financial needs. These forward-looking

statements include, but are not limited to, statements concerning the following:

| ● |

projections

or expectations regarding our future test volumes, revenue, average unit price, cost of revenue, operating expenses, research and

development expenses, gross profit margin, cash flow, results of operations and financial condition; |

| ● |

the

ability to maintain the listing of our common stock and public warrants on The Nasdaq Capital Market; |

| ● |

our

plan to broaden our commercial focus from ovarian cancer to differential diagnosis of women with a range of gynecological diseases,

including additional pelvic disease conditions such as endometriosis and benign pelvic mass monitoring; |

| ● |

our

planned business strategy and the anticipated effects thereof, including partnerships such as those based on our Aspira Synergy platform,

specimen or research collaborations, licensing arrangements, commercial collaborations and distribution agreements; |

| ● |

plans

to expand our current or future products to markets outside of the United States through distribution collaborations or out-licensing; |

| ● |

plans

to develop new algorithms, molecular diagnostic tests, products and tools and otherwise expand our product offerings; |

| ● |

plans

to develop, launch and establish payer coverage and secure contracts for current and new products, including ENDOinform (formerly

EndoMDx) and OVAinform (formerly OvaMDx); |

| ● |

expectations

regarding local and/or national coverage under Novitas, our Medicare Administrative Carrier; |

| ● |

anticipated

efficacy of our products, product development activities and product innovations, including our ability to improve sensitivity and

specificity over traditional diagnostics; |

| ● |

expected

competition in the markets in which we operate; |

| ● |

plans

with respect to Aspira Labs, Inc. (“Aspira Labs”), including plans to expand Aspira Labs’ testing capabilities,

specifically molecular lab capabilities; |

| ● |

expectations

regarding continuing future services provided by Quest Diagnostics Incorporated; |

| ● |

expectations

regarding continuing future services provided by BioReference Health, LLC; |

| ● |

plans

to develop informatics products as laboratory developed tests (“LDTs”) and potential Food and Drug Administration (“FDA”)

oversight changes of LDTs; |

| ● |

expectations

regarding existing and future collaborations and partnerships for our products, including plans to enter into decentralized arrangements

for our Aspira Synergy platform and to provide and expand access to our risk assessment tests; |

| ● |

plans

regarding future publications and presentations; |

| ● |

expectations

regarding potential collaborations with governments, legislative bodies and advocacy groups to enhance awareness and drive policies

to provide broader access to our tests; |

| ● |

our

ability to continue to comply with applicable governmental regulations, including regulations applicable to the operation of our

clinical lab, expectations regarding pending regulatory submissions and plans to seek regulatory approvals for our tests within the

United States and internationally, as applicable; |

| ● |

our

continued ability to expand and protect our intellectual property portfolio; |

| ● |

anticipated

liquidity and capital requirements; |

| ● |

anticipated

future losses and our ability to continue as a going concern; |

| ● |

expectations

regarding raising capital and the amount of financing anticipated to be required to fund our planned operations; |

| ● |

expectations

regarding attrition and recruitment of top talent; |

| ● |

expectations

regarding the results of our clinical research studies and our ability to recruit patients to participate in such studies; |

| ● |

our

ability to use our net operating loss carryforwards and anticipated future tax liability under U.S. federal and state income tax

legislation; |

| ● |

expected

market adoption of our current and prospective diagnostic tests, including Ova1, Overa, Ova1Plus, OvaWatch, ENDOinform and OVAinform,

as well as our Aspira Synergy platform; |

| ● |

expectations

regarding our ability to launch new products we develop, license, co-market or acquire; |

| ● |

expectations

regarding the size of the markets for our products; |

| ● |

expectations

regarding reimbursement for our products, and our ability to obtain such reimbursement, from third-party payers such as private insurance

companies and government insurance plans; |

| ● |

potential

plans to pursue clearance designation with the FDA with respect to OvaWatch, ENDOinform and OVAinform; |

| ● |

expected

potential target launch timing for future products; |

| ● |

expectations

regarding compliance with federal and state laws and regulations relating to billing arrangements conducted in coordination with

laboratories; |

| ● |

plans

to advocate for legislation and professional society guidelines to broaden access to our products and services; |

| ● |

ability

to protect and safeguard against cybersecurity risks and breaches; and |

| ● |

expectations

regarding the results of our academic research agreements. |

These

forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk

Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is

not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which

any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements

we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus

may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You

should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events

and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, except as required by law, neither

we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation

to update publicly any forward-looking statements for any reason after the date of this prospectus to conform these statements to actual

results or to changes in our expectations.

You

should read this prospectus and the documents that we reference in this prospectus and have filed with the SEC as exhibits to the registration

statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and

events and circumstances may be materially different from what we expect.

PROSPECTUS

SUMMARY

The

following summary highlights selected information contained elsewhere in this prospectus and is qualified in its entirety by the more

detailed information and financial statements included elsewhere in this prospectus and the information incorporated by reference

herein. It does not contain all the information that may be important to you and your investment decision. You should carefully read

this entire prospectus, including the matters set forth under “Risk Factors,” included elsewhere in this prospectus and our

financial statements and related notes incorporated by reference herein. In this prospectus, unless context requires otherwise, references

to “we,” “us,” “our,” “Aspira,” or “the Company” refer to Aspira Women’s

Health Inc., a Delaware corporation, and its subsidiaries, unless the context otherwise requires.

Corporate

Vision

Aspira

Women’s Health Inc. is dedicated to pioneering the discovery, development, and commercialization of non-invasive diagnostic tests

enabled by artificial intelligence (“AI”) and machine learning algorithms. Our goal is to transform the way gynecologic

diseases, including ovarian cancer and endometriosis, are diagnosed, by providing advanced, AI-enabled tools that improve

accuracy in the diagnosis of gynecologic diseases.

We

plan to broaden our focus to the differential diagnosis of other gynecologic diseases that typically cannot be assessed through traditional

non-invasive clinical procedures. We will continue to increase the market penetration of our existing and new technology through our

direct sales force, channel partners, and our decentralized technology transfer service platform, Aspira Synergy. We also intend to continue

to raise public awareness regarding the higher sensitivity and negative predictive value for ovarian malignancy of Ova 1 as compared

to cancer antigen 125 (“CA-125”) on its own for women with adnexal masses planned for surgery, as well

as the performance of our machine learning algorithms in detecting ovarian cancer risk in different racial and ethnic populations. We

plan to continue to expand payor coverage for commercial and Federal payors, including Medicaid, as part of our corporate mission to

make the best care available to all women. We will also continue to focus on advocacy for legislation and the adoption of our technology

in professional society guidelines to provide broad access to our products and services.

We

continue to focus on three key initiatives: growth, innovation, and operational excellence.

Growth

As a revenue-generating diagnostics company focused exclusively on gynecologic disease, our commercial capabilities are one of our most

important differentiators. We expect our extensive experience with gynecologists and healthcare providers, along with the historical

adoption of our OvaSuite tests, to drive growth as we introduce new products.

During

2023, we conducted a comprehensive review of our commercial programs to identify people, processes, and technology enhancements and to

refine our product messaging for greater impact and reach. As a result of the findings of that review, we implemented a revised commercial

strategy in the second half of 2023. In the first quarter of 2024, we completed the successful implementation of the revised commercial

strategy including eliminating unprofitable territories, enhancing our sales training program, establishing a remote sales team to support

the field sales team, and expanding sales analytics capabilities, and expect to leverage these enhancements as we continue to focus

on growth through the improved profitability, efficiency, and effectiveness of the sales and marketing teams.

The

average number of field sales representatives during the nine months ended September 30, 2024, was 17 (13 as of January 7, 2025),

compared with 20 representatives in the nine months ended September 30, 2023. The average OvaSuite volume per field sales representative

increased from 917 tests per representative in the nine months ended September 30, 2023, to 1,109 tests per representative in the nine

months ended September 30, 2024, nearly a 21% increase.

Innovation

We believe our ability to successfully develop novel AI-enabled assays is superior to others based on our knowledge and extensive experience

in designing and successfully launching FDA-cleared and laboratory developed blood tests to aid in the diagnosis of ovarian cancer. Our

history of successfully collaborating with world-class research and academic institutions allows us to leverage additional specimen collections

to continue our product innovation. Moreover, we own and operate Aspira Labs, Inc., a research and commercial CLIA laboratory in Texas.

We have an extensive biospecimen repository from ovarian malignancy risk patients with samples from nearly 500 ovarian malignancies from

all stages, and representative controls, which permits the development of new algorithms that incorporate unique features, and supports

extensive analytical testing of current and new diagnostic tests.

Our

product pipeline is focused on two areas: ovarian cancer and endometriosis.

For

ovarian cancer, in the second quarter of 2024, we published a study in the journal of the Society of Gynecologic Oncology (“SGO”),

supporting the repeated use of our OvaWatch test for the monitoring of an adnexal mass. This successful expansion of the OvaWatch mass

monitoring feature resulted in a tenfold increase in the addressable market for our tests when compared to the addressable market for

Ova1Plus of approximately 200,000 to 400,000 based on patients identified for surgery.

Further,

our OVAinform development program continues to progress which increases our indication to include Familial and Germline risk for ovarian

cancer which we believe will fulfill a major clinical need and result in an increase of our addressable market from 2 to 4 million. OVAinform

is a multi-marker test that combines serum proteins, clinical data (metadata), and miRNA for assessing the risk of ovarian cancer in

women with an adnexal mass.

In

endometriosis, we are developing and intend to introduce a new non-invasive test to aid in the diagnosis of this debilitating disease

that impacts millions of women worldwide. We completed the design of a protein-based non-invasive blood test to aid the detection of

endometrioma, one of the most common forms of endometriosis. The algorithm was confirmed with three independent cohorts and is an important

input for our ENDOinform program focused on developing a multi-marker test that combines serum proteins, clinical data (metadata) and

miRNA for the identification of endometriosis.

Our

endometriosis portfolio addresses an even larger addressable market. According to the U.S. Department of Health and Human Services, endometriosis

affects more than 6.5 million women in the United States. We believe the proliferation of commercially available and in-development therapeutics

for the treatment of endometriosis will create a significant demand for a non-invasive diagnostic.

In

the second quarter of 2024, we completed a comprehensive analysis of our biobank and identified up to 70,000 serum, plasma, and whole

blood samples that are available for our continued product research and development.

Our

Business and Products

We

currently commercialize the following blood test products and related services:

(1)

the Ova1Plus workflow, which uses Ova1 as the primary test and Overa as a reflex for Ova1 intermediate range results. Ova1 is a qualitative

serum test intended as an aid to further assess the likelihood of malignancy in women with an ovarian adnexal mass for which surgery

is planned when the physician’s independent clinical and radiological evaluation does not indicate malignancy. Overa is a second-generation

biomarker test intended to maintain Ova1’s high sensitivity while improving specificity. The Ova1Plus workflow leverages the strengths

of Ova1’s MIA sensitivity and Overa’s (MIA2G) specificity to increase performance; and

(2)

OvaWatch, which is intended to assist in the initial and periodic clinical assessment of malignancy risk in all women thought to have

an indeterminate or benign adnexal mass.

Our

products are distributed through our own national sales force, including field and inside sales, through our proprietary decentralized

testing platform and cloud service, marketed as Aspira Synergy, and through marketing and distribution agreements with labs, including

BioReference Health, LLC (“BioReference”) and ARUP Laboratories. In November of 2024, we expanded our distribution agreement

with BioReference to include OvaWatch. This timing aligns with our approval from New York State and increases our ability to market OvaWatch

in New York. This important addition will allow providers who currently order Ova1 through BioReference to also order Aspira’s

products for any woman with a mass within their existing BioReference workflows.

Our

Ova1 test received FDA de novo classification in September 2009. Ova1 comprises instruments, assays, reagents, and the

OvaCalc software, which includes a proprietary algorithm that produces a risk score. Our Overa test, which includes an updated version

of OvaCalc, received FDA 510(k) clearance in March 2016. Ova1, Overa and OvaWatch each use the Roche Cobas 4000, 6000 and 8000 platforms

for analysis of proteins.

In

2021, we began entering into decentralized arrangements with large healthcare networks and physician practices for our Aspira Synergy

platform, our decentralized testing platform and cloud service for decentralized global access of protein biomarker testing. Ova1, Overa,

and the Ova1Plus workflow continue to be available through the Aspira Synergy platform. As of December 31, 2024, we had two active Aspira

Synergy contracts, Women’s Care Florida and Hi-Precision Laboratories.

OvaWatch

has been developed and is validated for use in Aspira’s CLIA-certified lab as a non-invasive blood-based risk assessment test for

use in conjunction with clinical assessment and imaging to determine ovarian cancer risk for patients with an adnexal mass whose adnexal

mass has been determined by an initial clinical assessment as indeterminate or benign. OvaWatch is the only commercially available blood

test available for assessment of the risk of ovarian cancer in women diagnosed with an adnexal mass considered indeterminate or benign

by a physician’s preliminary clinical assessment.

We

collected clinical data to support the utility of OvaWatch to aid in surgical referral and as a longitudinal monitoring test, resulting

in two manuscripts that were peer reviewed and published in Frontiers and SGO Journals in May 2024. In addition, an abstract highlighting

data evaluating the use of OvaWatch to assess ovarian cancer risk in pre- and post-menopausal women was accepted for a poster presentation

at the Annual Meeting of The Menopause Society in September 2024.

Outside

of the United States, we sponsored studies in the Philippines aimed at validating Overa and Ova1 in specific populations. In February

2024, we signed an exclusive license agreement with Hi-Precision Laboratories to offer OvaSuite tests in the Philippines. In November

2024, Hi-Precision Laboratories communicated the completion of all laboratory and regulatory processes required for it to offer Ova1Plus

commercially to patients in the Philippines under the terms of our licensing agreement. Accordingly, it began marketing the test to physicians

through its existing sales and marketing channels at that time. We continue to assist Hi-Precision in the design and execution of its

commercialization and physician adoption strategy. Building on the successful launch of Ova1Plus in the Philippines, we have created

a process roadmap for future global expansion efforts utilizing the Aspira Synergy platform.

We

own and operate Aspira Labs, based in Austin, Texas, a Clinical Chemistry and Endocrinology Laboratory accredited by the College of American

Pathologists, which specializes in applying biomarker-based technologies to address critical needs in the management of gynecologic cancers

and disease. Aspira Labs provides expert diagnostic services using a state-of-the-art biomarker-based risk assessment to aid in clinical

decision making and to advance personalized treatment plans. The lab currently performs our Ova1Plus workflow and OvaWatch testing, and

we plan to expand the testing to other gynecologic conditions with high unmet need. Aspira’s Labs holds a CLIA Certificate of Accreditation

and a state laboratory license in California, Maryland, New York, Pennsylvania and Rhode Island. The Centers for Medicare & Medicaid

Services issued a supplier number to Aspira Labs in 2015. Aspira Labs also holds a current ISO 13485 certification which is the most

accepted standard worldwide for medical devices.

In

the United States, revenue for diagnostic tests comes from several sources, including third-party payers such as insurance companies,

government healthcare programs, such as Medicare and Medicaid, client bill accounts and patients. Novitas Solutions, a Medicare Administrative

Carrier, covers and reimburses for Ova1 tests performed in certain states, including Texas. Due to our billed Ova1 tests being performed

exclusively at Aspira Labs in Texas, the Local Coverage Determination (“LCD”) from Novitas Solutions essentially provides

national coverage for patients enrolled in Medicare as well as Medicare Advantage health plans. We have applied for an LCD for OvaWatch,

which is currently under review.

In

November 2016, the American College of Obstetricians and Gynecologists (“ACOG”) issued Practice Bulletin Number 174 which

included Ova1, defined as the “Multivariate Index Assay,” outlining ACOG’s clinical management guidelines for adnexal

mass management. Practice Bulletin Number 174 recommends that obstetricians and gynecologists evaluating women with adnexal masses who

do not meet Level A criteria of a low-risk transvaginal ultrasound should proceed with Level B clinical guidelines. Level B guidelines

state that the physician may use risk-assessment tools such as existing CA-125 technology or Ova1 (“Multivariate Index Assay”)

as listed in the bulletin. Based on this, Ova1 achieved parity with CA-125 as a Level B clinical recommendation for the management of

adnexal masses.

Practice

Bulletins summarize current information on techniques and clinical management issues for the practice of obstetrics and gynecology. Practice

Bulletins are evidence-based documents, and recommendations are based on the evidence. This is also the only clinical management tool

used for adnexal masses. Although there are Practice Bulletins, guidelines do not exist for adnexal masses. ACOG guidelines do exist,

however, for ovarian cancer management.

Product

Pipeline

We

aim to introduce new gynecologic diagnostic products and to expand our product offerings to additional women’s gynecologic health

diseases by adding additional gynecologic bio-analytic solutions involving biomarkers, clinical risk factors and patient data to aid

diagnosis and risk stratification. Future product expansions will be accelerated by the development of lab developed testing in a CLIA

environment, relationships with strategic research and development partners, and access to specimens in our biobank.

| ● | OVAinform

(formerly OvaMDX) is a multi-marker test that combines serum proteins, clinical data

(metadata), and miRNA for assessing the risk of ovarian cancer in women with an adnexal mass.

The test is being developed in collaboration with Harvard’s Dana-Farber Cancer Institute

(providing clinical and trial design expertise), Brigham & Women’s Hospital (providing

miRNA technical expertise), and Medical University of Lodz (providing miRNA biomarker and

bioinformatics analytic support). |

The

miRNAs used in the OVAinform test were the subject of a 2017 paper, “Diagnostic potential for a serum miRNA neural network for

detection of ovarian cancer” published in the peer-reviewed journal Cancer Biology. In October 2023, a poster entitled “Improving

the diagnostic accuracy of an ovarian cancer triage test using a joint miRNA-protein model,” was presented at the AACR Special

Conference in Cancer Research: Ovarian Cancer by senior author, Dr. Kevin Elias M.D., Director, Gynecologic Oncology Laboratory at Brigham

and Women’s Hospital and Assistant Professor of Obstetrics, Gynecology and Reproductive Biology at Harvard Medical School. The

poster highlighted data from a study that combined serum protein and patient clinical information (metadata) from Aspira’s ovarian

cancer registry studies with miRNA determined by the Elias laboratory. The data showed that using miRNA in combination with serum proteins,

provided superior performance over existing ovarian cancer risk assessment blood tests.

We

have tested our entire set of selected miRNA biomarkers and, based on their performance, we are refining the features on our droplet

digital PCR commercial platform. As a next step, we intend to increase our patient sample testing to refine the algorithm.

| ● | ENDOinform

(formerly EndoMDx) is a multi-marker test program that combines serum proteins,

clinical data (metadata), and miRNA for the identification of endometriosis. The test is

being developed in collaboration with a consortium of academic and clinical partners led

by Dana Farber Cancer Institute. We are currently in the process of analyzing the first 100

patient samples to verify protein and miRNA biomarkers for their analytical properties on

our droplet digital PCR commercial platform. This is a critical step in evaluating the strength

of algorithms that incorporate miRNAs. |

Business

Updates

On

May 7, 2024, we announced the publication of two peer-reviewed manuscripts. The first manuscript, entitled “Ovarian Cancer Surgical

Consideration is Markedly Improved by the Neural Network Powered-MIA3G Multivariate Index Assay” was published in the peer-reviewed

journal Frontiers of Medicine on May 2, 2024. The findings of this study demonstrate that use of OvaWatch to stratify risk in patients

with an adnexal mass might help to reduce surgical backlogs and unnecessary surgical referrals. The second manuscript, entitled “Neural

Network-derived Multivariate Index Assay Demonstrates Effective Clinical Performance in Longitudinal Monitoring of Ovarian Cancer Risk”

was published in the journal Gynecologic Oncology on May 3, 2024. The findings of this study demonstrate that OvaWatch could be an effective

tool for the monitoring of ovarian cancer risk over time in women with indeterminate or low risk adnexal masses. Based on common practice

for adnexal mass management and consistent with the study, OvaWatch can be drawn by the provider every three to six months for active

surveillance of an adnexal mass.

A

publication entitled Serum miRNA improves the accuracy of a multivariate index assay for triage of an adnexal mass was

published in the journal Gynecologic Oncology, in August 2024 from the laboratory of our collaborator Dr. Kevin Elias

at the Brigham and Women’s Hospital. The paper describes the novel combination of microRNAs (miRNAs) and serum proteins to

achieve increased performance in the assessment of malignancy risk in patients with an adnexal mass. The miRNAs, discovered by Dr

Elias’ team, in combination with serum proteins from Aspira’s proprietary multivariate index assays Ova1 and Overa showed

increased sensitivity for detection of malignancy and broader detection of diverse ovarian cancer subtypes. This publication establishes

the feasibility of improved tests using multi-omic information. (Webber JW, Wollborn L, Mishra S, Vitonis AF, Cramer DW, Phan RT,

Pappas TC, Stawiski K, Fendler W, Chowdhury D, Elias KM. Serum miRNA improves the accuracy of a multivariate index assay for triage of

an adnexal mass. Gynecol Oncol. 2024 Aug 23;190:124-130.)

An

abstract entitled “Application of a Deep Neural Network-Based Algorithm to Provide Additional Information in the Assessment

of Adnexal Masses Classified as Indeterminate by Imaging” was presented as a poster at the Annual Meeting of The Menopause

Society in September 2024. This presentation highlighted data evaluating the use of OvaWatch to assess ovarian cancer risk in pre- and

post-menopausal women. The data demonstrated that in women with an adnexal mass and an indeterminate ultrasound imaging result, the OvaWatch

result indicated low malignant potential of the mass in more than 70% of patients. The use of OvaWatch could provide additional information

to reduce surgical referrals.

An

EndoCheck-related abstract entitled “Association of the Endometriosis Health Profile-5 (EHP-5) with Non-Invasive Biomarkers

in Patients with Suspected Endometriosis” was presented as a poster at the 27th Annual National Association

of Nurse Practitioner’s in Women’s Health Women’s Healthcare Conference in September 2024. This poster examined the

association of biomarkers for ovarian endometriosis (endometrioma) with quality-of-life survey responses before and after surgical intervention.

There was no association between endometrioma biomarkers and self-reported patient quality of life either prior to or after surgery,

and this was consistent with other research.

An

EndoCheck-related virtual poster entitled “A Proprietary Protein-Based Algorithm May Increase Sensitivity of Endometrioma Detection

When Combined with Imaging” was presented at the annual meeting of the American Association of Gynecologic Laparoscopists in

November 2024. This poster summarizes a preliminary study on the performance of imaging combined with a protein biomarker-based algorithm.

The combination of these diagnostic tools resulted in increased sensitivity of detection of endometrioma and could be effective in risk

assessment and surgical planning for this condition.

On

October 15, 2024, the Company announced that it had received approval from the New York State Department of Health’s Clinical Laboratory

Evaluation Program for OvaWatch. This approval is required for all lab developed tests to ensure compliance with New York State’s

clinical laboratory regulatory standards. The comprehensive review process includes an assessment of procedures for maintaining quality,

traceability, and risk management.

On

October 23, 2024, First Lady Dr. Jill Biden announced that we had been selected by the Advanced Research Projects Agency for Health (“ARPA-H”)

as an awardee of the Sprint for Women’s Health, an initiative to address critical unmet challenges in women’s health, champion

transformative innovations, and tackle health conditions that uniquely or disproportionately affect women. Under this initiative, we

will receive up to $10.0 million in milestone-based funding over two years to develop our multi-marker blood test to aid in the detection

of endometriosis. Our test will rely on a powerful, AI-enabled algorithm that combines protein and microRNA biomarkers and patient data,

and leverage technology that we pioneered for our ovarian cancer risk assessment blood tests.

The

award also provides for access to a team of world-class subject matter experts and advisors to support the successful completion and

commercial launch of the test before the end of the two-year contract term. We will work with an ARPA-H Program Manager and the ARPA-H

Investor Catalyst Hub in the design, development, and commercial launch of this first-of-its kind endometriosis diagnostic test.

In

December 2024, we met our first ARPA-H milestone and received a milestone payment of $2 million.

Market

Access and Reimbursement

We

continue to gain momentum in our activities to increase coverage and reimbursement of OvaSuite products by contracting with payers and

gaining OvaWatch reimbursement. The volume of Northeast Anthem claims, contracted in August 2024, is increasing and expected to improve

the reimbursement per test in upcoming quarters. We further expect additional Anthem regions to complete contracting in the Anthem Central

and Virginia geographic regions in the first quarter of 2025, adding an additional 16 million lives.

In

the third quarter of 2024, we completed a comprehensive analysis of select national, regional and Integrated Delivery Network payers

with the assistance of an experienced third-party consultant. The project provided additional insights regarding evidence requirements

for broad support and reimbursement of OvaWatch. The findings of the analysis are being incorporated into a clinical utility study which

is currently under development, the timing of which will depend on working capital available for its completion. While this project was

focused on OvaWatch, we believe the output will help us advocate for expanded coverage for Ova1 and inform future market access strategies

for future product launches.

Additionally,

we met with numerous Medical Directors from Laboratory Benefit Management organizations and regional payers and have a further understanding

of their requirements for OvaSuite medical necessity.

We

also initiated an audit of our commercial payer contracts to ensure appropriate reimbursement. With this we have engaged in discussions

that could improve the average unit price for OvaSuite tests. Additionally, we continue to monitor the state biomarker laws, which are

increasingly mandating insurance coverage for biomarker testing in oncology. This trend is driven by the growing recognition

of the importance of precision medicine and the need to ensure that patients have access to the most appropriate treatments. While these

laws are a significant step forward, challenges remain, including inconsistencies across states, difficulties in defining “medically

necessary,” and the requirement to demonstrate clinical utility utilizing real world evidence as a benchmark.

Nasdaq

Listing

On

July 1, 2024, we received written notice (the “Notice”) from the Listing Qualifications Staff (the “Staff”) of

the Nasdaq Stock Market, LLC (“Nasdaq”) notifying us that for the 30 consecutive business days preceding the date of the

Notice, our Market Value of Listed Securities was below the minimum of $35 million required for continued listing on The Nasdaq Capital

Market pursuant to Nasdaq Listing Rule 5550(b)(2) (the “MVLS Requirement”). In accordance with Nasdaq Listing Rule 5810(c)(3)(C),

Nasdaq provided us with 180 calendar days, or until December 30, 2024 (the “Compliance Date”), to regain compliance with

the MVLS Requirement. On December 31, 2024, we received written notice from the Staff of Nasdaq notifying us that we failed to regain

compliance with the MVLS Requirement by the Compliance Date. As of the date of this prospectus, we have requested an appeal of Nasdaq’s

determination to delist our common stock and paid Nasdaq a hearing fee of $20,000. The request for an appeal will stay the delisting

of our common stock pending Nasdaq’s decision. Although we have requested an appeal of Nasdaq’s determination to delist our

common stock, no assurance can be provided that we will be successful in our appeal and that our common stock will continue to be listed

on The Nasdaq Capital Market.

Furthermore,

on October 17, 2024, we received written notice from Nasdaq that we were not in compliance with Nasdaq Listing Rule 5550(a)(2), as the

minimum bid price of our common stock had been below $1.00 per share for 30 consecutive business days. In accordance with Nasdaq

Listing Rule 5810, and assuming our common stock is not delisted for our failure to satisfy the MVLS Requirement by the MVLS Compliance

Date, we will have a period of 180 calendar days, or until April 15, 2025, to regain compliance with the minimum bid price requirement.

To regain compliance with the Nasdaq bid price requirement, the closing bid price of our common stock must meet or exceed $1.00 per share

for at least ten consecutive business days during this 180- calendar day period. In the event we do not regain compliance by April 15,

2025, we may be eligible for an additional 180 calendar day grace period.

Corporate

Information

We

were incorporated in 1993. Our principal executive offices are located at 12117 Bee Caves Road, Building III, Suite 100, Austin,

Texas 78738, and our telephone number is (512) 519-0400. We maintain a website at www.aspirawh.com where general information about

us is available. The information contained on our website is not incorporated by reference into this prospectus, and you should not consider

any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase

our securities.

Implications

of Being a Smaller Reporting Company

We

are a “smaller reporting company,” meaning that the market value of our shares held by non-affiliates is less than $700 million

and our annual revenue was less than $100 million during the most recently completed fiscal year. We have elected to rely on exemptions

from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company,

we may choose to present only the two most recent fiscal years of audited financial statements in this prospectus and have reduced disclosure

obligations regarding executive compensation.

The

Offering

| Shares

of common stock being offered |

|

Up

to 16,000,000 shares of common stock at an assumed public offering price of $0.75 per share, the last

reported sale price of our common stock as reported on The Nasdaq Capital Market on January 7, 2025. |

| |

|

|

| Pre-funded

Warrants being offered |

|

We

are also offering up to 16,000,000 Pre-funded Warrants to purchase up to 16,000,000

shares of our common stock, exercisable at an exercise price of $0.001

per share, to those purchasers whose purchase of common stock in this offering would otherwise

result in the purchaser, together with its affiliates and certain related parties, beneficially

owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common

stock immediately following the consummation of this offering. The purchase price of each

Pre-funded Warrant is equal to the price per share of common stock being sold to the public

in this offering minus $0.001. The Pre-funded Warrants will be immediately exercisable

and may be exercised at any time until exercised in full.

This

prospectus also relates to the offering of common stock issuable upon exercise of the Pre-funded Warrants.

For

each Pre-funded Warrant we sell, the number of shares of common stock that we are offering will be decreased on a one-for-one basis.

For

additional information regarding the terms of the Pre-funded Warrants, see “Description of Securities We Are Offering.” |

| |

|

|

| Underwriters’

over-allotment option |

|

We

have granted the underwriters a 45 day option from the date of this prospectus, exercisable one or more times in whole or in part,

to purchase up to an additional 2,400,000 shares of common stock and/or up to an additional 2,400,000 Pre-funded Warrants

(15% of the total number of shares of common stock and/or Pre-funded Warrants to be offered by us in the offering), solely

to cover over-allotments, if any. |

| |

|

|

| Number

of shares of common stock to be outstanding after this offering (1) |

|

33,529,793 shares,

(or 35,929,793 shares if the underwriters exercise the option to purchase additional shares in full, assuming no sale

of the Pre-funded Warrants). |

| |

|

|

| Use

of proceeds |

|

We

expect to receive net proceeds, after deducting underwriting discounts and estimated expenses payable by us, of approximately $10.6

million (or approximately $12.3 million if the underwriters exercise their option to purchase additional shares and/or

Pre-funded Warrants in full), assuming a public offering price of $0.75 per share, the last reported sale price of

our common stock on The Nasdaq Capital Market on January 7, 2025, after deducting underwriting discounts and commissions

and other estimated offering expenses payable by us, and assuming no sale of any Pre-funded Warrants. We intend to use the

net proceeds from this offering for working capital and general corporate purposes. We may also use a portion of the net proceeds

to in-license, acquire or invest in complementary businesses, technologies or products, however, we have no current commitments or

obligations to do so. See “Use of Proceeds,” for a more complete description of the intended use of proceeds from

this offering. |

| |

|

|

| Lock

Up Agreements |

|

We

and our executive officers, directors and

certain of our stockholders have agreed with the underwriters not to sell, transfer or dispose of any shares or similar securities

for a period of three months from the date of this prospectus. For additional information regarding our arrangement with the

underwriters, please see “Underwriting.” |

| Risk

factors |

|

Investing

in our securities is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page

13 of this prospectus, and the other information included in this prospectus for a discussion of factors you should

consider carefully before deciding to invest in our securities. |

| |

|

|

| Nasdaq

Capital Market Listing |

|

Our

common stock is listed on The Nasdaq Capital Market under the symbol “AWH”. There is no established trading market

for the Pre-funded Warrants, and we do not expect a trading market to develop. We do not intend to list the Pre-funded Warrants on

any securities exchange or nationally recognized trading system. |

(1)

The number of shares of our common stock to be outstanding after this offering is based on 17,529,793 shares of our common stock

outstanding as of January 7, 2025, and excludes:

| |

● |

4,475,068

shares of common stock issuable upon exercise of warrants with a weighted average exercise price of $2.90; |

| |

● |

853,862

shares of common stock issuable upon exercise

of options with a weighted average exercise price of $6.10; |

| |

● |

134,060

shares of common stock issuable upon vesting

of outstanding restricted stock units; |

| |

● |

553,000

shares of common stock reserved for future issuance

under our existing stock incentive plan; |

| |

● |

800,000 shares

of common stock (or 920,000 shares if the underwriters exercise their over-allotment option in full) issuable

upon exercise of warrants to be issued to the representative of the underwriters as part of this offering at an exercise price of

$0.9375 (assuming a public offering price of $0.75 per share, the last reported sale price of our common stock as reported

on The Nasdaq Capital Market on January 7, 2025. |

Unless

otherwise indicated, all information in this prospectus assumes:

| ● | no

exercise of the warrants or options described above; and |

| ● | no

exercise by the underwriters of their option to purchase an additional 2,400,000 shares

of common stock and/or Pre-funded Warrants to cover over-allotments, if any. |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Prior to making a decision about investing in our securities, you should

carefully consider the risk factors described below and the risk factors discussed in the sections entitled “Risk Factors”

contained in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, as may be amended, supplemented or superseded

from time to time by other reports we file with the SEC and incorporated by reference in this prospectus, together with all of the other

information contained in this prospectus. Additional risks and uncertainties not presently known to us, or that we currently view as

immaterial, may also impair our business. If any of the risks or uncertainties described in our SEC filings or this prospectus or any

additional risks and uncertainties actually occur, our business, financial condition and results of operations could be materially and

adversely affected. In that case, the trading price of our common stock could decline, and you might lose all or part of your investment.

Risks

Related to this Offering and Our Common Stock

Our

stock price has been, and may continue to be, highly volatile.

The

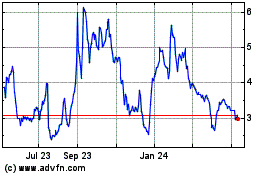

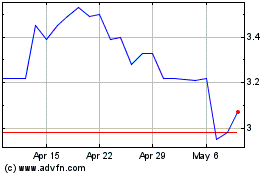

trading price of our common stock has been highly volatile. During the 12 months ended December 31, 2023, the closing trading price of

our common stock ranged from a high of $8.70 per share to a low of $2.40 per share. Between January 1, 2024, and December 31,

2024, the closing trading price of our common stock ranged from $5.63 to $0.70. The trading price of our common stock could continue

to be subject to wide fluctuations in price in response to various factors, many of which are beyond our control, including:

| ● | failure

to significantly increase revenue and volumes of OvaSuite or Aspira Synergy; |

| ● | actual

or anticipated period-to-period fluctuations in financial results; |

| ● | failure

to achieve, or changes in, financial estimates by securities analysts; |

| ● | announcements

or introductions of new products or services or technological innovations by us or our competitors; |

| ● | failure

to complete clinical studies that validate clinical utility sufficiently to increase positive

medical policy among payers at large; |

| ● | publicity

regarding actual or potential discoveries of biomarkers by others; |

| ● | comments

or opinions by securities analysts or stockholders; |

| ● | the

ability to maintain the listing of our common stock and public warrants on The Nasdaq Capital

Market; |

| ● | conditions

or trends in the pharmaceutical, biotechnology or life science industries; |

| ● | announcements

by us of significant acquisitions and divestitures, strategic partnerships, joint ventures

or capital commitments; |

| ● | developments

regarding our patents or other intellectual property or that of our competitors; |

| ● | litigation

or threat of litigation; |

| ● | additions

or departures of key personnel; |

| ● | limited

daily trading volume; |

| ● | our

ability to continue as a going concern; |

| ● | economic

and other external factors, disasters or crises; and |

| ● | our

announcement of future fundraisings. |

In

addition, the stock market in general and the market for diagnostic technology companies, in particular, have experienced significant

price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies. These

broad market and industry factors may adversely affect the market price of our common stock, regardless of our operating performance.

In the past, following periods of volatility in the market price of a company’s securities, securities class action litigation

has often been instituted. A securities class action suit against us could result in substantial costs, potential liabilities and the

diversion of our attention and our resources.

Management

will have broad discretion as to the use of the net proceeds from this offering, and we may not use the proceeds effectively.

Our

management will have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other

than those contemplated at the time of this offering. Our stockholders may not agree with the manner in which our management chooses

to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not have a

positive impact on our results of operations or increase the market value of our common stock. Our failure to apply these funds effectively

could have a material adverse effect on our business, delay the development of our products and/or cause the price of our common stock

to decline.

You

may experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase in the offering.

The

offering price per share in this offering may exceed the net tangible book value per share of our common stock outstanding prior to this

offering. After giving effect to the sale by us of 16,000,000 shares of common stock at an assumed public offering

price of $0.75 per share, the last reported sale price of our common stock as reported on The Nasdaq Capital Market on January 7, 2025 after deducting commissions and estimated offering expenses payable by us and assuming no sale of any Pre-funded Warrants,

you will experience immediate dilution of $0.480 per share, representing the difference between our net tangible book value per

share as of September 30, 2024 after giving effect to this offering and the offering price. The exercise of outstanding warrants and

stock options may also result in further dilution of your investment. See the section entitled “Dilution” on page 17 below for a more detailed illustration of the dilution you may incur if you participate in this offering.

If

we raise additional capital in the future, your ownership in us could be diluted.

In

order to raise additional capital, we may offer additional shares of common stock or other securities convertible into or exchangeable

for our common stock. We may sell shares or other securities in any other offering at a price per share that is less than the price per

share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior

to existing stockholders, including investors who purchase common stock in this offering. The price per share at which we sell additional

shares of common stock or securities convertible into common stock in future transactions may be higher or lower than the price per share

in this offering.

Until

such time, if ever, as we can generate substantial revenue from our operations, we anticipate financing our cash needs through a combination

of equity offerings, debt financings and license agreements. To the extent that we raise additional capital through the further sale

of equity securities or convertible debt securities, your ownership interest will be diluted.

Sales

of a substantial number of our shares of common stock in the public market could cause our stock price to fall.

We

may issue and sell additional shares of common stock in the public markets. Sales of a substantial number of shares of our common stock

in the public markets or the perception that such sales could occur could depress the market price of our common stock and impair our

ability to raise capital through the sale of additional equity securities.

Because

we do not currently intend to declare cash dividends on our shares of common stock in the foreseeable future, stockholders must rely

on appreciation of the value of our common stock for any return on their investment.

We

have never declared or paid cash dividends on our capital stock. We currently intend to retain all of our future earnings, if any, to

finance the operation, development and growth of our business. Furthermore, any future debt agreements may also preclude us from paying

or place restrictions on our ability to pay dividends. As a result, capital appreciation, if any, of our common stock will be your sole

source of gain with respect to your investment for the foreseeable future.

The

exercise of our outstanding options and warrants will dilute stockholders and could decrease our stock price.

The

exercise of our outstanding options and warrants may adversely affect our stock price due to sales of a large number of shares or the

perception that such sales could occur. These factors also could make it more difficult to raise funds through future offerings of our

securities, and could adversely impact the terms under which we could obtain additional equity capital. Exercise of outstanding options

and warrants or any future issuance of additional shares of common stock or other equity securities, including, but not limited to, options,

warrants, restricted stock units or other derivative securities convertible into our common stock, may result in significant dilution

to our stockholders and may decrease our stock price.

If

we fail to comply with the continued listing requirements of The Nasdaq Capital Market, our common stock may be delisted and the price

of our common stock and our ability to access the capital markets could be negatively impacted.

Our

common stock is currently listed on The Nasdaq Capital Market and the continued listing of our common stock on The Nasdaq Capital Market

is contingent on our continued compliance with a number of listing requirements. If we are unable to comply with the continued listing

requirements of The Nasdaq Capital Market, our common stock would be delisted from The Nasdaq Capital Market, which would limit investors’

ability to effect transactions in our common stock and subject us to additional trading restrictions. In order to maintain our listing,

we must maintain certain share prices, financial and share distribution targets, including maintaining a minimum amount of stockholders’

equity and a minimum number of public stockholders, as well as satisfying other listing requirements of The Nasdaq Capital Market. In

addition to these objective standards, The Nasdaq Capital Market may delist the securities of any issuer for other reasons involving

the judgment of The Nasdaq Capital Market.

On

July 1, 2024, we received a deficiency letter (the “Notice”) from the Listing Qualifications Department of The Nasdaq Stock

Market, LLC (“Nasdaq”) stating that for the 30 consecutive business days prior to the date of the Notice, our Market

Value of Listed Securities was below the minimum of $35 million required for continued listing on Nasdaq pursuant to Nasdaq Listing

Rule 5550(b)(2) (the “MVLS Requirement”). To regain compliance with the MVLS Requirement, the market value of our common

stock must have met or exceeded $35.0 million for a minimum of 10 consecutive business days during the 180-day grace period

ending on December 30, 2024 (the “MVLS Compliance Date”), unless the Staff of Nasdaq exercises its discretion to extend this

10 consecutive business day period. As of the date of this prospectus, we were unable to regain compliance by the MVLS Compliance Date.

As such, on December 31, 2024, Nasdaq notified us that our securities are subject to delisting. While we have requested an appeal

of Nasdaq’s delisting determination, no assurance can be provided that we will be successful in appealing such determination

and maintaining the listing of our common stock on The Nasdaq Capital Market.

Furthermore,

on October 17, 2024, we received written notice from Nasdaq that we were not in compliance with Nasdaq Listing Rule 5550(a)(2), as the

minimum bid price of our common stock had been below $1.00 per share for 30 consecutive business days. In accordance with Nasdaq

Listing Rule 5810, and assuming our common stock is not delisted for our failure to satisfy the MVLS Requirement by the MVLS Compliance

Date, we will have a period of 180 calendar days, or until April 15, 2025, to regain compliance with the minimum bid price requirement

and market value of common stock requirement. To regain compliance with the Nasdaq bid price requirement, the closing bid price of our

common stock must meet or exceed $1.00 per share for at least 10 consecutive business days during this 180- calendar day period. In the

event we do not regain compliance by April 15, 2025, we may be eligible for an additional 180 calendar day grace period.

There

is no assurance that we will be able to maintain compliance with The Nasdaq Capital Market continued listing standards and/or continue

our listing on The Nasdaq Capital Market in the future.

If

The Nasdaq Capital Market delists our common stock from trading on its exchange and we are not able to list our securities on another

national securities exchange, we expect our common stock would qualify to be quoted on an over-the-counter market. If this were to occur,

we could face significant material adverse consequences, including:

| ● | a

limited availability of market quotations for our securities; |

| ● | reduced

liquidity for our securities; |

| ● | substantially

impair our ability to raise additional funds; |

| ● | the

loss of institutional investor interest and a decreased ability to issue additional securities

or obtain additional financing in the future; |

| ● | a

determination that our common stock is a “penny stock,” which will require brokers

trading in our common stock to adhere to more stringent rules and possibly result in a reduced

level of trading activity in the secondary trading market for our securities; |

| ● | a

limited amount of news and analyst coverage; and |

| ● | potential

breaches of representations or covenants of our agreements pursuant to which we made representations

or covenants relating to our compliance with applicable listing requirements, which, regardless

of merit, could result in costly litigation, significant liabilities and diversion of our

management’s time and attention and could have a material adverse effect on our financial

condition, business and results of operations. |

There

is no established public trading market for the Pre-funded Warrants being offered in this offering, and we do not expect a market to

develop for the Pre-funded Warrants.

There

is no established public trading market for the Pre-funded Warrants being offered in this offering, and we do not expect a market to

develop. In addition, we do not intend to apply to list the Pre-funded Warrants on any national securities exchange or other nationally

recognized trading system. Without an active market, the liquidity of the Pre-funded Warrants will be limited. Further, the existence

of the Pre-funded Warrants may act to reduce both the trading volume and the trading price of our common stock.

The

Pre-funded Warrants are speculative in nature.

Except

as otherwise provided in the Pre-funded Warrants, until holders of Pre-funded Warrants acquire our common stock upon exercise of the

Pre-funded Warrants, holders of Pre-funded Warrants will have no rights with respect to our common stock underlying such Pre-funded Warrants.

Upon exercise of the Pre-funded Warrants, the holders will be entitled to exercise the rights of a stockholder of our common stock only

as to matters for which the record date occurs after the exercise date.

Moreover,

following this offering, the market value of the Pre-funded Warrants is uncertain. There can be no assurance that the market price of

our common stock will ever equal or exceed the price of the Pre-funded Warrants, and, consequently, whether it will ever be profitable

for investors to exercise their Pre-funded Warrants.

USE

OF PROCEEDS

We

estimate that the net proceeds from our issuance and sale of shares of our common stock and Pre-funded Warrants in this offering will

be approximately $10.6 million, or approximately $12.3 million if the underwriters exercise their option to purchase additional

securities in full, based on an assumed public offering price of $0.75 per share, which was the closing price of shares of

our common stock on The Nasdaq Capital Market on January 7, 2025, after deducting estimated underwriting discounts

and commissions and estimated offering expenses payable by us assuming no sale of the Pre-funded Warrants.

We

intend to use the net proceeds from this offering for working capital and general corporate purposes. We may also use a portion of the

net proceeds to in-license, acquire or invest in complementary businesses, technologies or products, however, we have no current commitments

or obligations to do so.

A

$0.25 increase or decrease in the assumed public offering price of $0.75 per share would increase or decrease the net proceeds

from this offering by approximately $4.0 million, assuming that the number of shares offered by us, as set forth on the cover

page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions. An increase (decrease)

of 5,000,000 shares in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase (decrease)

the net proceeds from this offering by approximately $3.8 million, assuming no change in the assumed public offering price per

share and after deducting estimated underwriting discounts and commissions.

Although

we have identified some potential uses of the net proceeds to be received from this offering, we cannot specify these uses with certainty.

Our management will have broad discretion in the application of the net proceeds from this offering and could use them for purposes other

than those contemplated at the time of this offering. Our stockholders may not agree with the manner in which our management chooses

to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not positively

impact our results of operations or increase the market value of our common stock.

Pending

any use, as described above, we plan to deposit the net proceeds in money market accounts with our primary bank or otherwise invest the

net proceeds in high-quality, short-term, interest-bearing securities.

DILUTION

If

you invest in our common stock in this offering, your ownership interest will be diluted to the extent of the difference between the

offering price per share of our common stock and the as adjusted net tangible book value per share of our common stock immediately after

the offering. Historical net tangible book value per share represents the amount of our total tangible assets less total liabilities,

divided by the number of shares of our common stock outstanding.

The

historical net tangible book value of our common stock as of September 30, 2024 was approximately ($2.5 million) or ($0.155) per share

based on 16,284,381 shares of common stock outstanding on such date. Historical net tangible book value per share represents the