false

0000727207

0000727207

2023-12-11

2023-12-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported) |

December 11, 2023 |

Accelerate

Diagnostics, Inc.

(Exact name of registrant

as specified in its charter)

Delaware

(State

or other jurisdiction of incorporation)

| 001-31822 |

|

84-1072256 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| 3950

South Country Club Road, Suite 470,

Tucson, Arizona |

|

85714 |

| (Address of principal executive offices) |

|

(Zip Code) |

(520)

365-3100

(Registrant’s

telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which

registered |

| Common

Stock, $0.001 par value per share |

AXDX |

The

Nasdaq Stock Market LLC

(The Nasdaq Capital Market) |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On

December 12, 2023, Accelerate Diagnostics, Inc. (the “Company”) entered into the First Amendment to

Securities Purchase Agreement (the “SPA Amendment”), with the Jack W. Schuler Living Trust (the “Investor”).

The SPA Amendment amends the Securities Purchase Agreement between the Company and the Investor, dated as of June 9, 2023 (the “SPA”). The SPA

Amendment, among other things, extends the date by which the Investor is required to backstop an underwritten offering by the

Company from December 15, 2023 to February 15, 2024. In addition, the SPA Amendment provides that if the Company elects to

conduct a public offering of common stock and other investors purchase at least $10.0 million of shares of common stock by

February 15, 2024, the Investor has agreed to purchase $2.0 million shares of common stock at the public offering price in the

backstopped offering. The previous backstop commitment of $10.0 million has not changed.

Additionally, on December 11,

2023, the Company entered into the First Amendment to the Note Purchase Agreement (the “NPA Amendment”), with the investors

party thereto constituting Majority Investors (as defined in the NPA Amendment). The NPA Amendment amends the Note Purchase Agreement,

dated as of June 9, 2023. Pursuant to the NPA Amendment, the date by which the Company is to consummate the transactions contemplated

by the SPA was extended from December 15, 2023 to February 15, 2024.

Furthermore, on December 11,

2023, the Company entered into the First Amendment to the Note Exchange Agreement (the “NEA Amendment”), with the investors

party thereto constituting Majority Investors (as defined in the NEA Amendment). The NEA Amendment amends the Note Exchange Agreement,

dated as of June 9, 2023. Pursuant to the NEA Amendment, the date by which the Company is to consummate the transactions contemplated

by the SPA was extended from December 15, 2023 to February 15, 2024.

A copy of each of the SPA

Amendment, the NPA Amendment and the NEA Amendment is filed with this Current Report on Form 8-K as Exhibits 10.1, 10.2 and 10.3,

respectively, and is incorporated herein by reference, and the foregoing descriptions of the SPA Amendment, the NPA Amendment and the

NEA Amendment are qualified in their entirety by reference thereto.

Item 7.01. Regulation FD Disclosure.

The Company is providing an

updated corporate presentation to include information regarding the Company’s Accelerate Wave™ system, a copy of which is

attached to this Current Report on Form 8-K as Exhibit 99.1.

This information contained

in this Item 7.01 of this Current Report on Form 8-K and the presentation attached hereto as Exhibit 99.1 are being furnished

to the Securities and Exchange Commission and shall not be deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and such information

shall not be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act or the Exchange Act,

except as expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

The Company is providing the following update on

the Accelerate Wave™ system:

While we will continue to

seek ways to improve the utility of our existing products, the primary focus of our current research and development efforts is our next

generation antibiotic susceptibility testing (“AST”) platform, Accelerate Wave, which is being developed with the goal to

have lower cost, higher throughput, and the capability to test a broader set of sample types when compared to our Accelerate Pheno®

system.

The Accelerate Wave

system, currently in development, performs AST directly from positive blood culture (“PBC”) bottles and bacterial

isolate colonies (“Isolates”) to report minimum inhibitory concentrations (“MICs”) with a goal of delivering

results within 4.5 hours. The fully automated system is based on the principle of digital holographic microscopy, which allows for

simultaneous volumetric imaging of a sample suspension at a high spatial resolution, enabling direct observation of phenotypic

responses of individual bacterial cells in relatively short time periods versus more traditional AST methods. The Accelerate Wave

system uses a time series of holograms to provide microbial quantitation under antimicrobial stress, enabling rapid determination of

minimum inhibitory concentration. Additionally, Accelerate Wave holograms provide morphological information at the level of

individual cells. For some bug-drug combinations morphology is a leading indicator of future MIC.

A key differentiator of the

Accelerate Wave system to current on-market and emerging AST competitors is the system’s ability to process PBC as well as Isolates

AST diagnostics results. Our initial launch of menu items will include a PBC assay that can be run on the Accelerate Wave system. This

will be followed by development of an Isolate assay. Our ability to process Isolates with the Wave system expands our addressable market

today with our Accelerate Pheno system and Accelerate ArcTM Products with PBC samples to include a much larger sample volumes

segment of the market, Isolates within the microbiology testing market. Based on our on-market experience with our Accelerate Pheno

system, we see significant workflow benefits to microbiology labs by offering consolidated PBC and Isolate susceptibility testing on

to a single, rapid, AST diagnostic. Further, recent voice-of-customer interviews highlight the value that Accelerate Wave brings to the

global marketplace with a high percentage of interviewed customers expressing interest in evaluating Wave once available. The Accelerate

Wave system AST modules will be able to test five-to-ten assays per module and can scale to have 5 modules per system which will address

the vast majority of microbiology lab volumes and workflows. Additionally, the cost to produce Accelerate Wave assays will be significantly

lower than our standard costing for the Accelerate PhenoTestTM BC Kit which could improve the Company’s margin profile

as we seek FDA regulatory clearance for the Accelerate Wave system and assays.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

Number |

|

Description |

| |

|

|

| 10.1 |

|

First Amendment to Securities Purchase Agreement, dated December 12, 2023, between the Company and the Jack W. Schuler Living Trust. |

| 10.2 |

|

First Amendment to Note Purchase Agreement, dated December 11, 2023, between the Company and certain investors named therein. |

| 10.3 |

|

First Amendment to Note Exchange Agreement, dated December 11, 2023, between the Company and certain investors named therein. |

| 99.1 |

|

Accelerate Diagnostics, Inc., Investor Presentation, dated December 2023. |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ACCELERATE DIAGNOSTICS, INC. |

| |

(Registrant) |

| Date: December 13, 2023 |

|

| |

/s/ David Patience |

| |

David Patience |

| |

Chief Financial Officer |

Exhibit 10.1

FIRST AMENDMENT TO

SECURITIES PURCHASE AGREEMENT

Accelerate Diagnostics, Inc. and Jack W.

Schuler Living Trust

This amendment (this “Amendment”)

to the Securities Purchase Agreement by and among Accelerate Diagnostics, Inc., a Delaware corporation (the “Company”),

and the Jack W. Schuler Living Trust (including its successors and assigns, the “Investor”) dated as of June 9,

2023 (the “Agreement”), is dated as of December 12, 2023.

WHEREAS, pursuant to Section 6.4

of the Agreement, any provision of the Agreement may be waived or amended if, and only if, such waiver or amendment is in writing and

signed by the Company and the Investor;

WHEREAS the Investor and the

Company wish to extend the Closing Date of the Agreement.

NOW, THEREFORE, IN CONSIDERATION

of the mutual covenants contained in this Agreement, and for other good and valuable consideration the receipt and adequacy of which are

hereby acknowledged, the Company and the Investor agree as follows:

1. Closing

Date. The definition of Closing Date set forth in Section 1.1 of the Agreement is

hereby amended and restated in its entirety as follows:

“Closing Date” means

a date on or prior to February 15, 2024, that is (i) in the case of the purchase of the Securities pursuant to the Fixed Commitment,

the closing date specified by the Company in its request to the Investor pursuant to Section 2.1(a) (which request shall

be made no less than two nor more than 10 Business Days prior to such specified closing date, but no later than 5:00 p.m. Central

Standard Time on February 12, 2024), or (ii) in the case of the purchase of the Securities pursuant to the Backstopped Commitment,

the closing date of the Backstopped Offering.

2. Backstopped

Offering. Sections 2.1(b) and (c) of the Agreement are hereby amended and restated

in its entirety as follows:

(b) Provided

that the Company has not requested the Investor to purchase shares of Common Stock pursuant to the Fixed Commitment set forth in Section 2.1(a),

the Investor shall backstop the underwritten public offering (the “Backstopped Offering”) by the Company of Common

Stock for gross proceeds of a maximum of $10 million in accordance with the following provisions (the “Backstop Commitment”):

(i) If

the Company shall obtain purchase commitments in such Backstopped Offering and the aggregate amount of such commitments total to at

least $10 million by February 15, 2024, then, regardless of the aggregate amount of purchase commitments in such Backstopped

Offering, the Investor shall, pursuant to the Backstop Commitment, be required to purchase, at a price per share equal to the public offering

price for the Backstopped Offering, a number of shares of Common Stock of the Company equal to the quotient obtained by dividing

(x) $2 million, by (y) the public offering price for the Backstopped Offering.

(ii) If

Company shall obtain purchase commitments in such Backstopped Offering and the aggregate of such commitments total to less than $10

million by February 15, 2024, then the Investor shall, pursuant to the Backstop Commitment, be required to purchase, at a price

per share equal to the public offering price for the Backstopped Offering, a number of shares of Common Stock of the Company equal to

the quotient obtained by dividing (x) the difference between $10 million and the aggregate dollar amount of the purchase commitments

that the Company shall have received from investors pursuant to the Backstopped Offering, by (y) the public offering price

for the Backstopped Offering.

(iii) If

the Company shall fail to obtain any purchase commitments pursuant to the Backstopped Offering by February 15, 2024, then the Investor

shall, pursuant to the Backstop Commitment, purchase such shares of Common Stock equal to the quotient obtained by dividing (x) $10

million, by (y) the public offering price for the Backstopped Offering.

The aggregate purchase price paid by

the Investor for shares of Common Stock pursuant to the Backstop Commitment is herein referred to as the “Backstopped Amount.”

(c) In

the event that the Company shall engage in a Backstopped Offering, the Investor shall have the right, but not the obligation, to purchase,

on the Closing Date, at a price per share equal to the public offering price, a number of shares of Common Stock equal to the quotient

obtained by dividing (x) the difference between $10 million and the Backstopped Amount, by (y) the public offering

price for the Backstopped Offering; provided that if the Backstopped Amount is $10 million, then the Investor shall not have any right

to purchase additional shares pursuant to this Section 2.1(c).

3. Termination.

Section 6.5 of the Agreement is hereby amended and restated in its entirety as follows:

Termination. This Agreement may

be terminated prior to the Closing Date by written agreement of the Investor and the Company. In addition, this Agreement shall terminate

effective as of February 13, 2024, if by 5:00 p.m. Central Standard Time on February 12, 2024 the Company shall not have

requested the Investor to purchase Securities or to fulfill its Backstop Commitment in accordance with the provisions of Section 2.1

hereof. Upon a termination in accordance with this Section 6.5, the Company and the Investor shall not have any further obligation

or liability (including as arising from such termination) to the other.

4. Capitalized

terms not defined herein shall have the meeting set forth in the Agreement. Except as expressly amended by this Amendment, the Agreement

shall remain in full force and effect and be enforceable against the parties in accordance with its terms. This Amendment may be executed

in any number of counterparts, each of which shall be an original but all of which together shall constitute one and the same instrument,

binding on all of the parties notwithstanding that all such parties have not signed the same counterpart. Delivery of an executed counterpart

of a signature page to this Agreement by electronic mail transmission of a “.pdf” or other similar data file shall be

effective as delivery of a manually executed counterpart to this Amendment. For clarity, this Amendment shall be governed by all provisions

of the Agreement (other than as the Agreement is specifically amended herein), unless the context otherwise requires, including (but not

limited to) all provisions concerning construction, notices, governing law, jurisdiction, waiver of jury trial and confidentiality, mutatis

mutandis.

(Signature Page Follows)

IN WITNESS WHEREOF, the parties hereto have caused

this First Amendment to be duly executed by their respective authorized signatories as of December 11, 2023.

| |

|

| |

COMPANY: |

| |

|

| |

ACCELERATE DIAGNOSTICS, INC., |

| |

a Delaware corporation |

| |

|

| |

/s/

Jack Phillips |

| |

Name: |

Jack Phillips |

| |

Title: |

President & CEO |

| |

|

| |

INVESTOR: |

| |

|

| |

Jack W. Schuler Living Trust |

| |

|

| |

/s/

Jack W. Schuler |

| |

Name: Jack W. Schuler |

Exhibit 10.2

FIRST AMENDMENT TO

NOTE

Purchase AGREEMENT

This First Amendment to Note

Purchase Agreement (this “Amendment”), dated as of December 11, 2023, is entered into by and between Accelerate

Diagnostics, Inc., a Delaware corporation (the “Company”), and the undersigned investors constituting Majority

Investors.

WHEREAS, reference is made

to that certain Note Purchase Agreement, dated as of June 9, 2023 (as may have been amended, supplemented or otherwise modified and

as may be amended, supplemented or otherwise modified from time to time, the “Note Purchase Agreement”), by and between

the Company and the other parties thereto;

WHEREAS, all capitalized terms

used by not otherwise defined herein shall have the respective meanings ascribed to such terms in the Note Purchase Agreement;

WHEREAS, pursuant to Section 7.8

of the Note Purchase Agreement, any provision of the Note Purchase Agreement may be waived or amended if, and only if, such waiver or

amendment is in writing and signed by the Company and the Majority Investors; and

WHEREAS, the parties desire

to amend the Note Purchase Agreement as set forth herein.

NOW, THEREFORE, in consideration

of the foregoing premises and for other good and valuable consideration, the sufficiency of which is hereby acknowledged, the parties

hereto hereby agree to the following:

1. Defined

Terms. As used in this Amendment, the following terms shall have the respective meanings set forth below.

| (a) | “New Securities Purchase Agreement Amendment” shall mean an amendment to the New Securities

Purchase Agreement (as defined in the RSA), which will (i) change the “Closing Date” under the New Securities Purchase

Agreement to February 15, 2024 and (ii) amend the terms of the Backstopped Offering (as defined in the New Securities Purchase

Agreement) in a manner that is acceptable to the Majority Investors. |

2. New

Securities Purchase Agreement. Section 5.13 of the Note Purchase Agreement is hereby amended and restated as follows:

“New Securities Purchase Agreement.

The Company shall consummate the transactions envisioned by the New Securities Purchase Agreement (as defined in the RSA) with the Jack

W. Schuler Living Trust no later than February 15, 2024, unless such date is amended by the written consent of the Majority Investors.”

3. Conditions

Precedent to Effectiveness. This Amendment shall be effective on the date (the “Amendment Effective Date”) on which

the following conditions shall have been satisfied or waived by the Majority Investors:

| (a) | This Amendment is duly executed by the Company and the Majority Investors. |

| (b) | The Company shall have entered into the New Securities Purchase Agreement Amendment with the Jack W. Schuler

Living Trust in a form and substance acceptable to the Majority Investors. |

4. Effect

of Amendment. Except as expressly amended by this Amendment, the Note Purchase Agreement shall remain in full force and effect and

be enforceable against the Parties in accordance with its terms. This Amendment may be executed in any number of counterparts, each of

which shall be an original but all of which together shall constitute one and the same instrument, binding on all of the Parties notwithstanding

that all such Parties have not signed the same counterpart. Delivery of an executed counterpart of a signature page to this Agreement

by electronic mail transmission of a “.pdf” or other similar data file shall be effective as delivery of a manually executed

counterpart to this Amendment. For clarity, this Amendment shall be governed by all provisions of the Purchase Agreement (other than as

the Note Purchase Agreement is specifically amended herein), unless the context otherwise requires, including (but not limited to) all

provisions concerning construction, notices, governing law, jurisdiction, waiver of jury trial and confidentiality, mutatis mutandis.

(Remainder of page intentionally left blank)

IN WITNESS WHEREOF, each of

undersigned has caused this Amendment to be duly executed as of the date written above.

| |

THE COMPANY: |

| |

|

| |

Accelerate Diagnostics, Inc. |

| |

|

| |

By: |

/s/ Jack Phillips |

| |

|

Jack Phillips |

| |

|

President and Chief Executive Officer |

| |

|

| |

MAJORITY INVESTORS: |

| |

|

| |

Streeterville Capital, LLC |

| |

|

| |

By: |

/s/ John Fife |

| |

|

John Fife |

| |

|

President, Manager, and Secretary |

| |

|

| |

Indaba

Capital Management, L.P. |

| |

|

| |

By: |

/s/ Derek Schrier |

| |

|

Derek Schrier |

| |

|

CIO and Partner |

Signature Page to First Amendment to Note

Purchase Agreement

Exhibit 10.3

FIRST AMENDMENT TO

Note

Exchange AGREEMENT

This First Amendment to Note

Exchange Agreement (this “Amendment”), dated as of December 11, 2023, is entered into by and between Accelerate

Diagnostics, Inc., a Delaware corporation (the “Company”), and the undersigned investors constituting Majority

Investors.

WHEREAS, reference is made

to that certain Note Exchange Agreement, dated as of June 9, 2023 (as may have been amended, supplemented or otherwise modified and

as may be amended, supplemented or otherwise modified from time to time, the “Note Exchange Agreement”), by and between

the Company and the other parties thereto;

WHEREAS, all capitalized terms

used by not otherwise defined herein shall have the respective meanings ascribed to such terms in the Note Exchange Agreement;

WHEREAS, pursuant to Section 7.8

of the Note Exchange Agreement, any provision of the Note Exchange Agreement may be waived or amended if, and only if, such waiver or

amendment is in writing and signed by the Company and the Majority Investors; and

WHEREAS, the parties desire

to amend the Note Exchange Agreement as set forth herein.

NOW, THEREFORE, in consideration

of the foregoing premises and for other good and valuable consideration, the sufficiency of which is hereby acknowledged, the parties

hereto hereby agree to the following:

1. Defined

Terms. As used in this Amendment, the following terms shall have the respective meanings set forth below.

| (a) | “New Securities Purchase Agreement Amendment” shall mean an amendment to the New Securities

Purchase Agreement (as defined in the RSA), which will (i) change the “Closing Date” under the New Securities Purchase

Agreement to February 15, 2024 and (ii) amend the terms of the Backstopped Offering (as defined in the New Securities Purchase

Agreement) in a manner that is acceptable to the Majority Investors. |

2. New

Securities Purchase Agreement. Section 5.13 of the Note Exchange Agreement is hereby amended and restated as follows:

“New Securities Purchase Agreement.

The Company shall consummate the transactions envisioned by the New Securities Purchase Agreement (as defined in the RSA) with the Jack

W. Schuler Living Trust no later than February 15, 2024, unless such date is amended by the written consent of the Majority Investors.”

3. Conditions

Precedent to Effectiveness. This Amendment shall be effective on the date (the “Amendment Effective Date”) on which

the following conditions shall have been satisfied or waived by the Majority Investors:

| (a) | This Amendment is duly executed by the Company and the Majority Investors. |

| (b) | The Company shall have entered into the New Securities Purchase Agreement Amendment with the Jack W. Schuler

Living Trust in a form and substance acceptable to the Majority Investors. |

4. Effect

of Amendment. Except as expressly amended by this Amendment, the Note Exchange Agreement shall remain in full force and effect and

be enforceable against the Parties in accordance with its terms. This Amendment may be executed in any number of counterparts, each of

which shall be an original but all of which together shall constitute one and the same instrument, binding on all of the Parties notwithstanding

that all such Parties have not signed the same counterpart. Delivery of an executed counterpart of a signature page to this Agreement

by electronic mail transmission of a “.pdf” or other similar data file shall be effective as delivery of a manually executed

counterpart to this Amendment. For clarity, this Amendment shall be governed by all provisions of the Note Exchange Agreement (other than

as the Note Exchange Agreement is specifically amended herein), unless the context otherwise requires, including (but not limited to)

all provisions concerning construction, notices, governing law, jurisdiction, waiver of jury trial and confidentiality, mutatis mutandis.

(Remainder of page intentionally left blank)

IN WITNESS WHEREOF, each of

undersigned has caused this Amendment to be duly executed as of the date written above.

| |

THE COMPANY: |

| |

|

| |

Accelerate Diagnostics, Inc. |

| |

|

| |

By: |

/s/

Jack Phillips |

| |

|

Jack Phillips |

| |

|

President and Chief Executive Officer |

| |

|

| |

MAJORITY INVESTORS: |

| |

|

| |

Streeterville Capital, LLC |

| |

|

| |

By: |

/s/ John Fife |

| |

|

John Fife |

| |

|

President, Manager, and Secretary |

| |

|

| |

Indaba

Capital Management, L.P. |

| |

|

| |

By: |

/s/ Derek Schrier |

| |

|

Derek Schrier |

| |

|

CIO and Partner |

Signature Page to First Amendment to Note

Exchange Agreement

Exhibit 99.1

| December 2023

Company Presentation |

| 1

Legal Disclaimer

Forward-Looking Statements

This presentation contains, and the Company’s responses to various questions from investors may include “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Company intends that such forward-looking

statements be subject to the safe harbors created thereby. These forward-looking statements, which can be identified by the use of words such as “may,” “will,” “expect,” “believe,”

“anticipate,” “estimate,” or “continue,” or variations thereon or comparable terminology, include but are not limited to, statements about the Company’s future development plans and

growth strategy, including plans and objectives relating to its future operations, products and performance; financial projections, including the Company’s projected long-term financial model

and forecast; projections as to when certain key business milestones may be achieved; expectations regarding the potential or benefits of the Company’s products and technologies;

projections of future demand for the Company’s products and the growth of the market for its products; the Company’s estimates as to the size of its market opportunity; the Company’s

competitive position and estimates of time reduction to results; the Company’s continued investment in new product development to both enhance its existing products and bring new ones

to market; the Company’s expectations relating to current supply chain impacts and inflationary pressures, including its belief that it currently has sufficient inventory of Accelerate Pheno®

system instruments to limit the impact of cost increases on such devices; the Company’s expectations regarding its commercial partnership with Becton, Dickinson and Company (“BD”),

including anticipated benefits from such collaboration; the Company’s expectations and plans relating to regulatory approvals and submissions, including with respect to the U.S. Food and

Drug Administration (“FDA”) and its Accelerate ArcTM product, WaveTM instrument and Positive Blood Culture (PBC) Gram Negative assay; the Company’s liquidity and capital requirements,

including, without limitation, as to its ability to continue as a going concern; the Company’s plans and expectations relating to the terms and consummation of the restructuring transactions

contemplated by its restructuring support agreement, including, but not limited to, the anticipated issuance of significant amounts of common stock and securities convertible into significant

amounts of common stock and the resulting impact to its capital structure; and the Company's ability to achieve expected future financial performance and results. In addition, all statements

other than statements of historical facts that address activities, events, or developments the Company expects, believes, or anticipates will or may occur in the future, and other such matters,

are forward-looking statements.

The following factors, among others, could cause actual results and financial position and timing of certain events to differ materially from those described in the forward-looking statements:

interest rate movements; local, regional, national and global economic performance and geopolitical factors such as the conflict in Ukraine and instability in Israel and the Middle East;

competitive factors; government policy changes; disruptions in the Company’s supply chain, shipping, logistics or manufacturing processes; the demand for Rapid ID/AST products; the

Company’s ability to drive conversion of the market to rapid/digital testing; quality and performance of the Company’s current and future products; the Company’s ability to complete

development, obtain regulatory approval, and successfully launch the commercialization of its future products; the Company’s ability to convert commercial momentum into sales and

implementations; the Company’s ability to realize the benefits contemplated by its commercial partnership with BD; risks related to the Company’s technology, intellectual property and

infrastructure; any material market changes and trends that could affect the Company's business strategy; and difficulties in resolving the Company’s continuing financial condition and ability

to obtain additional capital to meet its financial obligations, including, without limitation, difficulties in obtaining adequate capital resources to fund its operations and whether it will be

successful in consummating the restructuring transactions contemplated by its restructuring support agreement. For further discussion of factors that could materially affect the outcome of

the Company’s forward-looking statements and its future results and financial condition, see the section entitled “Risk Factors” in the Company’s various filings with the U.S. Securities and

Exchange Commission (the “SEC”), including its most recent Annual Report on Form 10-K. The Company cautions you not to place undue reliance on any forward-looking statements, which

are made as of the date of this investor presentation. The Company undertakes no obligation to update publicly any of these forward-looking statements to reflect actual results, new

information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If the Company

updates one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements. |

| 2

Executive Summary

The Accelerate Pheno® is the first rapid Antimicrobial Susceptibility Testing (AST) platform to receive FDA

approval and has strong IP, thought-leading customers, and dozens of publications proving the high clinical

impact from rapid diagnostic results on patient outcomes

We believe the commercial partnership with Becton Dickinson (BD) has generated increased market

opportunities and shown Pheno® to be the leading Rapid AST platform in the market

Wave™ is designed to address a growing and attractive $2B total estimated market opportunity in AST and we

expect to begin clinical trials in early Q2 2024, followed by platform and GN FDA submission in Q3 2024

Wave™ + Arc™ is designed to bring a novel opportunity for cost effective rapid PBC Identification (ID) + AST,

and the Company has developed a plan of attack for transitioning its existing customer base and increasing

revenues by consolidating PBC and Isolate testing onto the same platform

Wave™ is designed to bring improved consumable platform economics with gross margins of ~90% and ~60%

for PBC and Isolates, respectively, which could result in a material contribution to profitability |

| 3

Existing Paradigms for Management of Bloodstream Infections are Insufficient

Lack of rapid and innovative microbiology diagnostic tools impairs patient care and burden healthcare providers

Cycle begins anew

and antibiotic

options become

more limited

Clinicians overtreat

septic patients until

results are available

Labs take 2-3 days to

deliver results

Microorganisms

develop new ways to

resist antibiotics

Current standard of care adversely impacts patient outcomes and is a financial burden to health systems

$62B

Cost to U.S. healthcare

system in 2019 (1)

2.8M

Antimicrobial

Resistance (AMR)

infections in the U.S.

annually (2)

350K

Sepsis deaths in

the U.S. annually (3)

>300M

Bacterial ID and AST

tests / year (4)

Unmet Clinical Need Represents Significant Opportunity Current Laboratory Diagnostic Methods Delay Clinical Decision Making

(1) Management estimate based on an accumulation of publicly available data sources (https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7017950/)

(2) Solutions to AMR, ‘The Silent Pandemic,’ Remain Out of Reach - Infectious Disease Special Edition (idse.net); August 23, 2023

(3) Centers for Disease Control and Prevention (https://pubmed.ncbi.nlm.nih.gov/37616184/)

(4) Total Available Market based on management estimates |

| 4

Accelerate’s Pheno® Established the Rapid AST Market

Accelerate’s design of the first fully automated, FDA-approved, AST solution provides a foundation for future product development

and commercial success

Achievements in Pioneering the AST Market

Introduced first fully automated, FDA-approved, rapid PBC susceptibility kit to market

Catalyst for Antimicrobial Stewardship best practices with demonstrated

improvements to clinical outcomes

Strong base of existing customers who have adopted Pheno® and established

stewardship and clinical workflow best practices

Significant clinical and workflow outcomes data clearly demonstrating the value of

rapid AST diagnostics on patients and health systems (1)

(1) Based on significant clinical and workflow data which can be found at: https://acceleratediagnostics.com/results/outcomes-data/ |

| 5

Market Learnings with the Accelerate Pheno® System

Wave™ was designed based on lessons from the launch of Pheno® and customer feedback

Limited Menu: Testing only PBC samples, which

is ~3-5% of lab volumes, added additional

instrumentation to lab workflows

Consumable Cost Justification: Launched

premium pricing in 2017 and more recently

revised acquisition options for customers

Lab Fit: System throughput adequate for lower

volumes was challenging to meet large lab

workflow needs

Broader Menu Designed to Enable

Instrument Consolidation: Complete PBC

and isolate AST menu for lab testing while

expanding bug/drug combinations to meet

hospital formulary demands

Improved Economics: Significantly lower

consumable unit costs with potential for

unique isolate AST testing reimbursement

given same-shift results

Fit for All Lab Workflows: ~7.5x Pheno®

capacity with faster time-to-result, scalable

platform with random access for critical

samples

Pheno® On-market Learnings

Wave™ builds on Accelerate’s early innovation and technological leadership in the ID / AST market,

and designed to better support customer needs

WaveTM’s Capabilities Expected to Exceed Expectations |

| 6

WaveTM Expands Potential Addressable Market By Offering Both PBC and Isolates

Accelerate is positioning Wave™ to compete against peers and emerging competitors with a market differentiated solution

+$800M

+$1,000M

+$375M

+$300M

Rapid PBC

Susceptibility

Rapid Isolate

Colony ID

Rapid Isolate

Susceptibility

Rapid PBC /

Myco ID

✓ WaveTM is designed to be a novel, scalable, AST diagnostic combining PBC

and Isolates, compared to existing and emerging competitive landscapes

Competitive Landscape

Large and Growing Testing Market by Indication (1,2)

($ in millions)

Combining PBC & Isolate Markets with WaveTM

($ in millions)

$2B+

Global Total

Addressable Market

(TAM)

~5-6%

Annual Microbiology

Testing Growth Rates

>300M

Global Tests

Performed Annually

Pheno®

Opportunity

WaveTM

Opportunity

+$800M

>$1,800M

Acquired by bioMérieux

Demand for rapid, accurate clinical results is driving

implementation of new ID / AST solutions

Wave TAM

Expansion

(1) TAM Based on management estimates

(2) Microbiology testing growth rates based on management estimates |

| 7

Wave™ is Designed to Advance Rapid Testing with a Decade of Innovation

Unlocking the next generation in antimicrobial susceptibility testing

Wave™ is designed to address the entirety of the AST market

• True same-shift results, improving patient outcomes

• Universal Platform for multiple AST needs

• Enhanced accuracy for complex cases

• Enables cost-effective pricing for both PBC and Isolates

• Scalable instrument design addresses all market segments

Potential Wave™ Technology Benefits

(1) Based on management estimates

Expansion of Addressable Market

• Expands lab testing volumes and lab wallet-share

• Potential to increase addressable market from 8M annual tests in PBC to 133M annual

tests with Isolates and PBC (1)

Designed to Improve System Economics

• Larger customer annuities with multiple revenue streams per platform

• Significantly lower consumable costing resets platform economics with margin

expansion compared to Pheno®

• Modular design affords flexible platform acquisition options |

| 8

+ β-Lactam (filamentation) + Carbapenem (spheroplasts)

Holographic imaging enables enhanced real-time single-cell analysis

3-dimensional environment with enhanced resolution

Pheno® WaveTM Pheno® WaveTM Pheno® WaveTM

Wave™ improves and expedites analysis of antibiotic induced morphological changes

Control Growth |

| 9

Preliminary WaveTM GN PBC Performance (1,2)

Initial data producing quality results in less than 4.5 hours, on average

Data shown for common Enterobacterales organisms:

‒ Citrobacter freundii

‒ Citrobacter koseri

‒ Enterobacter cloacae

‒ Escherichia coli

‒ Klebsiella aerogenes

‒ Klebsiella oxytoca

‒ Klebsiella pneumoniae

96.6%

93.6%

94.5%

97.4%

96.6%

100.0%

96.9%

0% 20% 40% 60% 80% 100%

% Essential Agreement

Avg. % EA by Antibiotic (ABX) Class (1)

Sulfonamides

Penicillins

Monobactams

Fluoroquinolones

Cephalosporins

β-lactams

Aminoglycosides

(1) Based on Accelerate Development data completed to-date

(2) Blood culture bottles were tested between 1-12 hours after positivity |

| 10

Customer Feedback on WaveTM

~90% of existing customers indicated interest in evaluating WaveTM

Universal AST Platform

Ability to run PBC & Isolates together

Fastest AST Results

Delivering same-shift results in less than 4.5 hrs

Budget-Friendly

Cost-effective pricing for PBC & Isolates

Leveraging Existing Pheno® Customers for WaveTM Launch

Existing customer base could kickstart Wave™ launch with ~150 customers

already implementing Rapid PBC results

Pheno® Customer Feedback & Early Marketing Strategy for WaveTM

Review of existing customer feedback and marketing strategy building on WaveTM features and potential benefits for clinical and

laboratory stakeholders

✓ Pheno® customers’ clinical workflows are already setup to utilize rapid AST

✓ ~65% of U.S. customers secured for rapid PBC susceptibility testing through

year-end 2025

✓ Accelerate has established clinical, laboratory, and administrative

relationships at ~500 accounts worldwide

✓ Securing a partnership with a multi-national partner provides potential

access to a global salesforce with well-established market-share in

microbiology

#1

#2

#3

“The size and random-access capability is a real advantage for the laboratory"

“Impressed with < 4.5-hr calls from Enterobacterales training runs”

“Systems that run over ~6 hrs are not rapid since they lose same shift results”

“Ability to price isolate testing competitively with incumbent providers is real

differentiator to emerging competitors”

Top Customer Identified Potential Benefits:

Customer Comments:

~150 Current Pheno® Customers

Multi-national Commercial Partner

further expands new opportunities

Targeting ~500+ Accounts Ready for

Rapid AST at Launch |

| 11

Transitioning Pheno® Customers to Arc™ + Wave™ Creates Powerful Economics (1,2,3,4)

Illustration of converting existing Pheno® customers to WaveTM PBC and Isolate testing

Customer Wallet-Share Highlights

▪ Initial conversion of existing Pheno® PBC

customers to GN WaveTM generates an

estimated margin expansion of ~3.0x per

customer with ~90% margins

▪ Incrementally adding Isolates to GN PBC

testing volumes increases revenues by more

than ~3.0x times and margin contributions

~7.5x compared to current Pheno®

customers with ~60% margins for Isolates

▪ ArcTM, automated sample preparation for

PBC Matrix-assisted Laser Desorption

Ionization time-of-flight (MALDI-ToF) ID,

margins are ~60%

▪ Higher probability of capital instrument sales

with WaveTM given isolate testing already

done in all microbiology labs running

susceptibilities

▪ Significantly reduced consumable costs for

WaveTM assay allows for flexible customer

acquisition options

(1) Per customer sample volumes based on management estimates for GN PBC, GN Isolates, GP Isolates, GN PBC volumes both ID (ARCTM + WaveTM) and AST testing (WaveTM)

(2) Customer annuities and gross margins based on management best estimates of Averaging Selling Prices and Costs of Goods Sold at scale production; estimated capital ASPs shown, reagent rental acquisition options also available

(3) Annuities and Gross Margin shown cumulative of all product line revenues and margin contribution by sequential menu clearance

(4) Sequence of menu roll-out may change based on strategic commercial partner input and directions

Consumable Annuity by Transitioning from Pheno® to Arc™ + Wave™ PBC and Isolates

~$70,000 –

$80,000

~30%

~90%

~75% ~70%

~75%

~$70,000 –

$80,000

~$175,000 –

$185,000

~$235,000 –

$255,000

~$275,000 –

$325,000 |

| 12

4Q 2023

Final system

integration,

complete

Development,

enter Verification

and Validation

2Q 2024

Start Clinical Trial

European Society of

Clinical Microbiology

and Infectious Diseases

and American Society

for Microbiology data

releases on WaveTM

system and

performance

1Q 2024

Pre-clinical trial

completion

3Q 2024

Clinical trial complete

FDA Submission

2Q 2025

FDA Clearance of

Wave system and GN

PBC Menu

Phase II

Identify Wave™ Early

Access Accounts

Target: Early adopting

sites willing to run

investigational use

evaluations

Planned Timeline of Wave™ Launch and Commercialization

Phase III

Identify WaveTM

Commercial Partner

Phase V

IVD Launch & Early

Evidence

Target: Early clinical

evaluations and all

Wave™ opportunities

generated

Phase I

Secure Pheno®

customer base

Target: All Pheno®

customers

2024 2025

Phase IV

Early Access

Target: Early

investigational use

evaluations

Summary of Notable Pre-marketing Efforts and Significant Project Inflection Points |

| 13

Conclusion

1• Novel AST Solution, Supported by Years of Experience and Learnings from Pheno® Launch and BD Partnership

•2 Wave™ Solution Potentially Could Unlock Next Gen Technology and Improved Economic Opportunity

• Growing $2B+ Market Opportunity in AST Remains a Significant Opportunity in Need of the Right

Solution 3

• On Precipice of Meaningful Wave™ and Arc™ Milestones Including Data, FDA Submission, and

Commercialization Plan Finalization 4

• Opportunity for Potential Growth and Improved Profitability Through Next Gen Product Launches and

Opportunity for Commercial Partnerships 5 |

v3.23.3

Cover

|

Dec. 11, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 11, 2023

|

| Entity File Number |

001-31822

|

| Entity Registrant Name |

Accelerate

Diagnostics, Inc.

|

| Entity Central Index Key |

0000727207

|

| Entity Tax Identification Number |

84-1072256

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3950

South Country Club Road

|

| Entity Address, Address Line Two |

Suite 470

|

| Entity Address, City or Town |

Tucson

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85714

|

| City Area Code |

520

|

| Local Phone Number |

365-3100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value per share

|

| Trading Symbol |

AXDX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

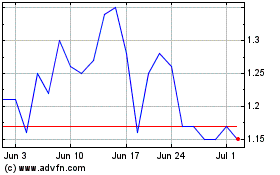

Accelerate Diagnostics (NASDAQ:AXDX)

Historical Stock Chart

From Apr 2024 to May 2024

Accelerate Diagnostics (NASDAQ:AXDX)

Historical Stock Chart

From May 2023 to May 2024