UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

_________________________________________________________________

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| o | Definitive Proxy Statement |

| |

| ý | Definitive Additional Materials |

| |

| o | Soliciting Material Pursuant to §240.14a-12 |

AXONICS, INC.

_________________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

_________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | | | | |

| ý | | No fee required. |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| | |

| o | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

| | | | |

| | | | |

EXPLANATORY NOTE

As previously disclosed, on January 8, 2024, Axonics, Inc. (“Axonics”), Boston Scientific Corporation (“Boston Scientific”), and Sadie Merger Sub, Inc., a wholly owned subsidiary of Boston Scientific (“Merger Sub”), entered into the Agreement and Plan of Merger (such agreement, as it may be amended, modified or supplemented from time to time, the “Merger Agreement”) providing for the acquisition of Axonics by Boston Scientific. Upon the terms and subject to the conditions of the Merger Agreement, Boston Scientific will acquire Axonics via the merger of Merger Sub with and into Axonics, with the separate corporate existence of Merger Sub thereupon ceasing and Axonics continuing as the surviving company and a wholly owned subsidiary of Boston Scientific (the “Merger”).

Following the filing of the preliminary proxy statement filed by Axonics with the U.S. Securities and Exchange Commission (“SEC”) on February 7, 2024 (the “Preliminary Proxy Statement”) and as of March 6, 2024, three (3) lawsuits have been filed, and thirteen (13) demand letters, have been received by Axonics, by purported stockholders of Axonics challenging disclosures made in the Preliminary Proxy Statement or the definitive proxy statement filed by Axonics with the SEC on February 22, 2024, and sent by Axonics to its stockholders commencing on February 22, 2024 (the “Proxy Statement”).

Axonics and the other named defendants deny that they have violated any laws or breached any duties to Axonics’ stockholders and believe that the disclosures in the Proxy Statement comply fully with applicable law. However, solely to eliminate the burden and expense of litigation and to avoid any possible disruption to the Merger, Axonics is providing the supplemental information set forth in this Schedule 14A. Axonics is also providing additional supplemental disclosures regarding the waiting period applicable to the consummation of the Merger under the HSR Act.

This Schedule 14A is being filed to amend and supplement the information in the Proxy Statement. The information contained in this Schedule 14A is incorporated by reference into the Proxy Statement. All page references in this Schedule 14A are to pages in the Proxy Statement. Terms used in this Schedule 14A, but not otherwise defined herein, have the meanings ascribed to such terms in the Proxy Statement.

To the extent that information in this Schedule 14A differs from, or updates information contained in, the Proxy Statement, the information in this Schedule 14A shall supersede or supplement the information in the Proxy Statement. Except as otherwise described in this Schedule 14A or the documents referred to, contained in or incorporated by reference in this Schedule 14A, the Proxy Statement, the annexes to the Proxy Statement and the documents referred to, contained in or incorporated by reference in the Proxy Statement are not otherwise modified, supplemented or amended.

The supplemental information herein should be read in conjunction with the Proxy Statement, which we urge you to read in its entirety. Nothing in this Schedule 14A shall be deemed an admission of the legal necessity or materiality of any of the disclosures set forth herein.

If you have not already submitted a proxy for use at the Special Meeting, you are urged to do so promptly. This Schedule 14A does not affect the validity of any proxy card or voting instructions that Axonics stockholders may have previously received or delivered. No action is required by any Axonics stockholder who has previously delivered a proxy or voting instructions and who does not wish to revoke or change such proxy or voting instructions.

SUPPLEMENTAL DISCLOSURES TO THE PROXY STATEMENT

1. The following disclosures replace the disclosures that previously appeared in the second paragraph under the section entitled “Regulatory Approvals Required for the Merger” on page 9 of the Proxy Statement. The modified text is bolded and underlined (where added) below.

Axonics and Boston Scientific have agreed to use reasonable best efforts to obtain all regulatory approvals that may be or become necessary to consummate the Merger and the other Transactions contemplated by the Merger Agreement, subject to certain limitations as set forth in the Merger Agreement. Axonics and Boston Scientific filed notification and report forms under the HSR Act with the DOJ and the FTC on January 30, 2024. Pursuant to applicable rules, the HSR Act notification was refiled on March 4, 2024.

2. The following disclosures replace the disclosures that previously appeared in the first two paragraphs under the section entitled “Legal Proceedings Regarding the Merger” on page 12 of the Proxy Statement. The modified text is bolded and underlined (where added) and struck-through (where deleted) below.

As of February 21 March 6, 2024, Axonics has received two thirteen Demand Letters, which generally allege that the preliminary proxy statement filed on February 7, 2024 or this proxy statement contains disclosure deficiencies in violation of Sections 14(a) and 20(a) of the Exchange Act, and Rule 14a-9 promulgated thereunder. The Demand Letters seek corrective disclosures in the this proxy statement in advance of the Special Meeting. As of March 6, 2024, three complaints have been filed by purported stockholders relating to the Merger. The first complaint was filed on February 28, 2024 in the Superior Court of the State of California in Orange County and is captioned Zalvin v. Axonics, Inc., et al, Case No. 30-2024-01382886 (the “California Complaint”). The second complaint was filed on March 4, 2024 in the United States District Court for the District of Delaware and is captioned Smith v. Axonics, Inc. et al, Case No. 1:24-cv-00284-UNA (the “Smith Complaint”). The third complaint was filed on March 6, 2024 in the United States District Court for the District of Delaware and is captioned Taylor v. Axonics, Inc. et al, Case No. 1:24-cv-00298-UNA (together with the Smith Complaint, the “Federal Complaints”).

The California Complaint names as defendants Axonics and each member of the Board of Directors (collectively, the “Axonics Defendants”) as well as Boston Scientific. The California Complaint alleges violations of California Corporations Code § 25401, and negligent misrepresentation and concealment and negligence under California common law. The California Complaint seeks, among other relief (i) declarations that the Axonics Defendants and Boston Scientific have violated California Corporations Code § 25401 and negligently misrepresented and omitted material facts in this proxy statement, (ii) enjoinder of the Special Meeting or, alternatively, rescission of the Axonics Stockholder Approval in the event the Merger is consummated, (iii) an order directing the Axonics Defendants to issue a Schedule 14A that does not contain any untrue statements of material fact and that states all material facts required to be included in it or necessary to make the statements contained therein not misleading, (iv) an award of compensatory damages as allowed by law, (v) an award of plaintiff’s costs and disbursements of the action, including reasonable attorneys’ and expert fees and expenses, and (vi) other and further equitable relief as the court may deem just and proper. On March 6, 2024, Axonics filed a notice of removal of the California Complaint to the United States District Court for the Central District of California (Case No. 8:24-cv-00482).

The Federal Complaints allege violations of Section 14(a) of the Exchange Act and Rule 14a-9 promulgated thereunder against all Axonics Defendants and alleges violations of Section 20(a) of the Exchange Act against the members of the Board of Directors in connection with the disclosures made in this proxy statement related to the Merger. The Federal Complaints allege that this proxy statement omitted or misrepresented material information herein. The Federal Complaints seek, among other relief (i) injunctive relief preventing the consummation of the Merger, unless and until certain information, as requested in the Federal Complaints, is disclosed, (ii) rescission and/or rescissory damages in the event the Merger is consummated, (iii) declarations that the Axonics Defendants violated Section 14(a) and or 20(a) of the Exchange Act, (iv) an award of plaintiff’s costs and disbursements of the action, including reasonable attorneys’ and expert fees and expenses, and (v) other and further equitable relief as the court may deem just and proper.

Axonics believes that the disclosures in this proxy statement comply fully with applicable law. It is possible that additional or similar demand letters may be received by Axonics, the Board of Directors, and/or Boston Scientific and/or that additional complaints may be filed alleging similar or additional disclosure deficiencies between March 6, 2024 the date of this proxy statement and consummation of the Merger. If any such additional demand letters are received or any additional complaints are filed, absent new or different allegations that are material, Axonics and/or Boston Scientific will not necessarily disclose such demand letters or complaints.

3. The following disclosures replace the disclosures that previously appeared as the answer to the question entitled “When do you expect the Merger to be completed?” on page 19 of the Proxy Statement. The modified text is bolded and underlined (where added) below.

We are working toward completing the Merger as promptly as possible. In order to complete the Merger, Axonics must obtain the Axonics Stockholder Approval described in this proxy statement, and the other conditions to Closing under the Merger Agreement must be satisfied or waived, including but not limited to (i) the expiration or termination of any waiting period (and any extension thereof) applicable to the consummation of the Merger under the HSR Act or any voluntary agreement with a governmental authority not to consummate the Merger and (ii) consents, approvals, non-disapprovals and other authorizations of governmental authorities under certain foreign antitrust or competition laws must be obtained. Axonics and Boston Scientific filed notification and report forms under the HSR Act with the DOJ and the FTC on January 30, 2024. Pursuant to applicable rules, the HSR Act notification was refiled on March 4, 2024. Since the Merger is subject to a number of conditions, the exact timing of the Merger cannot be determined at this time. For more information, please see the section of this proxy captioned “The Merger—Regulatory Approvals Required for the Merger.”

4. The following disclosures replace the disclosures that previously appeared in the first paragraph under the section entitled “Anticipated Date of Completion of the Merger” on page 27 of the Proxy Statement. The modified text is bolded and underlined (where added) below.

We are working toward completing the Merger as promptly as possible. In order to complete the Merger, Axonics must obtain the Axonics Stockholder Approval described in this proxy statement, and the other closing conditions under the Merger Agreement must be satisfied or waived, including but not limited to (i) the expiration or termination of any waiting period (and any extension thereof) applicable to the consummation of the Merger under the HSR Act or any voluntary agreement with the DOJ or FTC not to consummate the Transactions and (ii) consents, approvals, non-disapprovals and other authorizations of governmental authorities under certain foreign antitrust or competition laws must be obtained. Axonics and Boston Scientific filed notification and report forms under the HSR Act with the DOJ and the FTC on January 30, 2024. Pursuant to applicable rules, the HSR Act notification was refiled on March 4, 2024. Since the Merger is subject to a number of conditions, the exact timing of the Merger cannot be determined at this time. For more information, please see the section of this proxy captioned “The Merger—Regulatory Approvals Required for the Merger.”

5. The following disclosures replace the disclosures that previously appeared in the first paragraph under the section entitled “Regulatory Approvals Required for the Merger” on page 59 of the Proxy Statement. The modified text is bolded and underlined (where added) below.

The Merger is subject to the provisions of the HSR Act and cannot be completed until each of Axonics and Boston Scientific file a notification and report form with the DOJ and the FTC under the HSR Act and the applicable waiting period has expired or been terminated and any voluntary agreement with the DOJ or FTC not to consummate the Transactions has expired or been terminated. Axonics and Boston Scientific filed notification and report forms under the HSR Act with the DOJ and the FTC on January 30, 2024. Pursuant to applicable rules, the HSR Act notification was refiled on March 4, 2024. Under the HSR Act, certain acquisitions may not be completed until information has been furnished to the DOJ and the FTC, and the applicable HSR Act waiting period requirements have been satisfied. The waiting period under the HSR Act applicable to the Merger is 30 calendar days, unless the waiting period is terminated earlier (provided, however, that the FTC has temporarily suspended granting early termination other than in narrow circumstances that do not apply during the initial 30-day waiting period), extended by a request for additional information and documentary materials (which we refer to as a “Second Request”), or restarted if Boston Scientific voluntarily withdraws and refiles, which commences a new 30 -calendar-day waiting period. If the DOJ or FTC issues a Second Request, the parties must observe a separate 30-day waiting period, which would begin to run only after both parties have complied with such Second Request, unless the waiting period is terminated earlier.

6. The following disclosures replace the disclosures that previously appeared in the first two paragraphs under the section entitled “Legal Proceedings Regarding the Merger” on page 60 of the Proxy Statement. The modified text is bolded and underlined (where added) and struck-through (where deleted) below.

As of February 21 March 6, 2024, Axonics has received two thirteen Demand Letters, which generally allege that the preliminary proxy statement filed on February 7, 2024 or this proxy statement contains disclosure deficiencies in violation of Sections 14(a) and 20(a) of the Exchange Act, and Rule 14a-9 promulgated thereunder. The Demand Letters seek corrective disclosures in the this proxy statement in advance of the Special Meeting. As of March 6, 2024, three complaints have been filed by purported stockholders relating to the Merger. The California Complaint was filed on February 28, 2024 in the Superior Court of the State of California in Orange County and is captioned Zalvin v. Axonics, Inc., et al, Case No. 30-2024-01382886. The Federal Complaints are captioned Smith v. Axonics, Inc. et al, Case No. 1:24-cv-00284-UNA and Taylor v. Axonics, Inc. et al, Case No. 1:24-cv-00298-UNA, and were filed on March 4th and 6th, 2024, respectively, in the United States District Court for the District of Delaware.

The California Complaint names as defendants Axonics and each member of the Board of Directors as well as Boston Scientific. The California Complaint alleges violations of California Corporations Code § 25401, and negligent misrepresentation and concealment and negligence under California common law. The California Complaint seeks, among other relief (i) declarations that the Axonics Defendants and Boston Scientific have violated California

Corporations Code § 25401 and negligently misrepresented and omitted material facts in this proxy statement, (ii) enjoinder of the Special Meeting or, alternatively, rescission of the Axonics Stockholder Approval in the event the Merger is consummated, (iii) an order directing the Axonics Defendants to issue a Schedule 14A that does not contain any untrue statements of material fact and that states all material facts required to be included in it or necessary to make the statements contained therein not misleading, (iv) an award of compensatory damages as allowed by law, (v) an award of plaintiff’s costs and disbursements of the action, including reasonable attorneys’ and expert fees and expenses, and (vi) other and further equitable relief as the court may deem just and proper. On March 6, 2024, Axonics filed a notice of removal of the California Complaint to the United States District Court for the Central District of California (Case No. 8:24-cv-00482).

The Federal Complaints allege violations of Section 14(a) of the Exchange Act and Rule 14a-9 promulgated thereunder against all Axonics Defendants and allege violations of Section 20(a) of the Exchange Act against the members of the Board of Directors in connection with the disclosures made in this proxy statement related to the Merger. The Federal Complaints allege that this proxy statement omitted or misrepresented material information herein. The Federal Complaints seek, among other relief (i) injunctive relief preventing the consummation of the Merger, unless and until certain information, as requested in the Federal Complaints, is disclosed, (ii) rescission and/or rescissory damages in the event the Merger is consummated, (iii) declarations that the Axonics Defendants violated Section 14(a) and or 20(a) of the Exchange Act, (iv) an award of plaintiff’s costs and disbursements of the action, including reasonable attorneys’ and expert fees and expenses, and (v) other and further equitable relief as the court may deem just and proper.

Axonics believes that the disclosures in this proxy statement comply fully with applicable law. It is possible that additional or similar demand letters may be received by Axonics, the Board of Directors, and/or Boston Scientific and/or that additional complaints may be filed alleging similar or additional disclosure deficiencies between March 6, 2024 the date of this proxy statement and consummation of the Merger. If any such additional demand letters are received or any additional complaints are filed, absent new or different allegations that are material, Axonics and/or Boston Scientific will not necessarily disclose such demand letters or complaints.

7. The following disclosures replace the disclosures that previously appeared in the first paragraph following the sub-heading “Public Trading Multiples,” on pages 43 and 44 of the Proxy Statement. The modified text is bolded and underlined (where added) and struck-through (where deleted) below.

Public Trading Multiples. Using publicly available information, J.P. Morgan compared selected financial data of Axonics with similar data for selected publicly traded companies engaged in businesses which J.P. Morgan judged to be sufficiently analogous to Axonics. The following table lists the companies selected by J.P. Morgan and sets forth the firm value (“FV”)/2024E Revenue Multiple for each company were as follows:

| | | | | |

| Selected Company | FV / 2024E |

| Revenue

Multiple |

| Insulet Corporation | 7.4x |

| Penumbra, Inc. | 7.1x |

| Shockwave Medical, Inc. | 8.3x |

| Inspire Medical Systems, Inc. | 6.3x |

| Inari Medical, Inc. | 6.4x |

| Irhythm Technologies, Inc. | 5.9x |

| Alphatec Holdings, Inc. | 4.3x |

| Vericel Corp. | 6.3x |

| Paragon 28, Inc. | 4.5x |

| Median | 6.3x |

8. The following disclosures replace the disclosures that previously appeared in the second paragraph under the sub-heading “Selected Transaction Analysis,” on page 44 of the Proxy Statement. The modified text is bolded and underlined (where added) and struck-through (where deleted) below.

Specifically, J.P. Morgan reviewed the following transactions:

| | | | | | | | | | | | | | |

| Announcement Month and Year | Target | Acquiror | FV/LTM

Revenue | FV/NTM

Revenue |

| July 2023 | Kerecis LLC | Coloplast AS | 10.7x | 8.2x |

| October 2021 | Baylis Medical Company Inc. | Boston Scientific Corporation | 10.6x | 8.8x |

| August 2021 | Intersect ENT, Inc. | Medtronic, PLC | 10.8x | 8.6x |

| March 2021 | Lumenis Ltd. | Boston Scientific Corporation | 7.2x | 5.4x |

| November 2020 | BioTelemetry, Inc. | Koninklijke Philips N.V. | 6.0x | 5.3x |

| August 2018 | K2M Group Holdings, Inc. | Stryker Corp | 4.9x | 4.3x |

| June 2017 | The Spectranetics Corporation | Koninklijke Philips NV | 7.8x | 6.6x |

| February 2017 | ZELTIQ Aesthetics, Inc | Allergan plc | 6.8xx | 5.6x |

| June 2016 | LDR Holding Corporation | Zimmer Biomet Holdings, Inc. | 6.1x | 5.1x |

| April 2013 | Conceptus, Inc. | Bayer HealthCare LLC | 7.6x | 6.7x |

| | Median | 6.8x | 5.4x |

9. The following disclosures replace the disclosures that previously appeared in the first paragraph under the sub-heading “Discounted Cash Flow Analysis,” on page 45 of the Proxy Statement. The modified text is bolded and underlined (where added) and struck-through (where deleted) below.

Discounted Cash Flow Analysis. J.P. Morgan conducted a discounted cash flow analysis for the purpose of determining an implied fully diluted equity value per Share. J.P. Morgan calculated the unlevered free cash flows (less stock-based compensation) that Axonics is expected to generate during fiscal years December 31, 2023 through December 31, 2028 as provided in the Forecasts through the years ending December 31, 2028 and the present value of certain net operating losses and other tax benefits of Axonics, based on the Forecasts (as set forth in the section captioned “The Merger—Certain Unaudited Financial Projections”, which were discussed with, and approved by, the Board of Directors for use by J.P. Morgan in connection with its financial analyses). J.P. Morgan also calculated a range of terminal values of Axonics at the end of this period by applying a perpetual growth rate ranging from 4.25% to 5.75%, based on guidance provided by Axonics’ management and other factors J.P. Morgan considered appropriate based on its professional judgment and experience, to estimates of the unlevered terminal free cash flows for Axonics at the end of calendar year 2028, as provided in the Forecasts. J.P. Morgan then discounted the unlevered free cash flow estimates and the range of terminal values were then discounted to present value as of December 31, 2023 using discount rates ranging from 9.5% to 11.0% for Axonics, which range was chosen by J.P. Morgan based upon an analysis of the weighted average cost of capital of Axonics, taking into account macro-economic assumptions, estimates of risk, Axonics’ capital structure, and other factors that J.P. Morgan considered appropriate based on its professional judgment and experience. The present value of the unlevered free cash flow estimates and the range of terminal values were then adjusted to include Axonics’ estimated 2023 year-end cash as provided in the Forecasts, and present value of the net operating losses and other tax assets.

10. The following disclosures replace the disclosures that previously appeared in the paragraph under the sub-heading “Arrangements with Boston Scientific and Executive Officers,” on page 47 of the Proxy Statement. The modified text is bolded and underlined (where added) below.

As of the date of this proxy statement March 6, 2024, none of our executive officers has entered into any agreement with Boston Scientific or any of its affiliates regarding service with, or the right to purchase or participate in the equity of, the Surviving Corporation or one or more of its affiliates. Moreover, as of March 6, 2024, no discussions have been held between our executive officers or directors and Boston Scientific or any of its affiliates with respect to any such agreement, arrangement or understanding. Prior to and following the Closing, however, certain of our executive officers may have discussions and may enter into agreements with Boston Scientific or the Surviving Corporation, their subsidiaries or their respective affiliates regarding service with, or the right to purchase or participate in the equity of, the Surviving Corporation or one or more of its affiliates. The potential terms of any new arrangements are currently expected to be discussed and entered into after completion of the Merger.

Additional Information and Where to Find It

This filing is being made in connection with the contemplated Merger. In connection with the Merger, Axonics filed on February 22, 2024 with the SEC the Proxy Statement. The Proxy Statement was mailed to Axonics’ stockholders on or about February 22, 2024. Axonics may also file other documents with the SEC regarding the contemplated Merger. This document is not a substitute for the Proxy Statement or any other document that Axonics has filed or may file with the SEC in connection with the contemplated Merger. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF AXONICS ARE URGED TO READ THE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS THERETO, INCLUDING THIS SCHEDULE 14A, ANY OTHER SOLICITING MATERIALS AND ANY OTHER DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC IN CONNECTION WITH THE CONTEMPLATED MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT BECAUSE THEY CONTAIN OR WILL CONTAIN, AS APPLICABLE, IMPORTANT INFORMATION ABOUT AXONICS, BOSTON SCIENTIFIC AND THE CONTEMPLATED MERGER. Investors and security holders may obtain free copies of the Proxy Statement, this Schedule 14A and other filings containing important information about Axonics on the SEC’s website at www.sec.gov, on Axonics’ website at www.axonics.com or by contacting Axonics’ Investor Relations department via email at IR@axonics.com.

Participants in the Solicitation

Axonics and its directors and executive officers may, under SEC rules, be deemed participants in the solicitation of proxies from the stockholders of Axonics in connection with the contemplated Merger. Information regarding the identity of potential participants in the solicitation of proxies in connection with the proposed Merger, and their direct or indirect interests, by security holdings or otherwise, is included in the Proxy Statement. Additional information regarding Axonics’ directors and executive officers is contained in the Proxy Statement, Axonics’ Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, which was filed with the SEC on May 1, 2023 (and specifically, the following sections: “Security Ownership of Certain Beneficial Owners, Executive Officers and Directors”, “Certain Relationships and Related-Party Transactions”, “Executive Officers”, “Proposal 1–Election of Directors”, “Director Compensation”, and “Executive Compensation”) and in Axonics’ Current Report on Form 8-K, which was filed with the SEC on October 4, 2023. To the extent holdings of Axonics’ securities by the directors or executive officers have changed since the amounts set forth in the Proxy Statement, such changes have been or will be reflected on Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC, which are available at EDGAR Search Results (sec.gov). These documents (when available) are available free of charge as described in the preceding section. Cautionary Statement Regarding Forward-Looking Statements

This filing contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words like “may,” “will,” “likely,” “should,” “expect,” “anticipate,” “future,” “plan,” “believe,” “intend,” “goal,” “seek,” “endeavor,” “estimate,” “project,” “continue,” and variations of such words and similar expressions. These forward-looking statements are not guarantees of future performance and involve risks, assumptions, and uncertainties, including, but not limited to, risks related to: Axonics’ ability to consummate the transactions contemplated by the Merger Agreement in a timely manner or at all; the risk that the Merger Agreement may be terminated in circumstances requiring the payment by Axonics of a termination fee; the satisfaction (or waiver) of the conditions to the closing of the Merger; potential delays in consummating the Merger; the occurrence of any event, change or other circumstance or condition that could give rise to termination of the Merger Agreement; Axonics’ ability to timely and successfully realize the anticipated benefits of the Merger; the ability to successfully integrate the businesses of Axonics and Boston Scientific; the effect of the announcement or pendency of the Merger on Axonics’ current plans, business relationships, operating results and business generally; the effect of limitations placed on Axonics’ business under the Merger Agreement; significant transaction costs and unknown liabilities; litigation or regulatory actions related to the Merger Agreement or Merger; FDA or other U.S. or foreign regulatory or legal actions or changes affecting Axonics or Axonics’ industry; the results of any ongoing or future legal proceedings, including the litigation with Medtronic, Inc., Medtronic Puerto Rico Operations Co., Medtronic Logistics LLC and Medtronic USA, Inc. (the “Medtronic Litigation”); any termination or loss of intellectual property rights, including as a result of the Medtronic Litigation; introductions and announcements of new technologies by Axonics, any commercialization partners or Axonics’ competitors, and the timing of these introductions and announcements; changes in macroeconomic and market conditions and volatility, including the risk of recession, inflation, supply chain constraints or disruptions and rising interest rates; and economic and market conditions in general and in the medical technology industry specifically, including the size and growth, if any, of Axonics’ markets, and risks related to other factors described under “Risk Factors” in other reports and statements filed with the SEC, including Axonics’ most recent Annual Report on Form 10-K, which is available on the investor relations section of Axonics’ website at www.axonics.com and on the SEC’s website at www.sec.gov. Should one or more of these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

The forward-looking statements included in this filing are made only as of the date hereof, and except as otherwise required by federal securities law, Axonics does not assume any obligation nor does it intend to publicly update or revise any forward-looking statements to reflect new information, changed circumstances or unanticipated events.

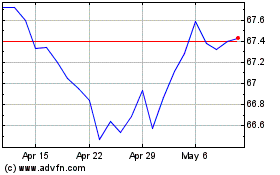

Axonics (NASDAQ:AXNX)

Historical Stock Chart

From Mar 2024 to Apr 2024

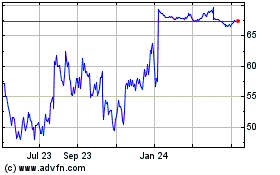

Axonics (NASDAQ:AXNX)

Historical Stock Chart

From Apr 2023 to Apr 2024