false000160375600016037562024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________________________________

FORM 8-K

_________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2024

_________________________________________________________________

Axonics, Inc.

(Exact name of registrant as specified in its charter)

_________________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-38721 | | 45-4744083 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

26 Technology Drive

Irvine, California 92618

(Address of principal executive offices) (Zip Code)

(949) 396-6322

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of class | Trading symbol | Name of exchange on which registered |

| Common stock, par value $0.0001 per share | AXNX | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 28, 2024, Axonics, Inc. (the Company) issued a press release announcing its financial results for the quarter and fiscal year ended December 31, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | AXONICS, INC. |

| | |

Date: February 28, 2024 | | By: | | /s/ Raymond W. Cohen |

| | | | Raymond W. Cohen |

| | | | Chief Executive Officer |

Exhibit 99.1

Axonics Reports Fourth Quarter and

Fiscal Year 2023 Financial Results

IRVINE, Calif – (BUSINESS WIRE) – Axonics, Inc. (Nasdaq: AXNX), a global medical technology company that is developing and commercializing novel products for the treatment of bladder and bowel dysfunction, today reported financial results for the three months and fiscal year ended December 31, 2023.

“The continued strong performance of Axonics reflects the physician community’s preference and enthusiasm for our incontinence products,” said Raymond W. Cohen, chief executive officer. “Revenue grew 34% in 2023, gross margin expanded to nearly 75% and Axonics generated over $50 million of adjusted EBITDA.”

Mr. Cohen continued, “In 2023, clinicians used Axonics therapies to treat approximately 100,000 incontinence patients globally, a testament to our mission-driven employees and their commitment to quality and teamwork. Our team is looking forward to the global impact we can make as part of Boston Scientific as we endeavor to bring these life-changing therapies to more patients than ever before.”

Fourth Quarter 2023 Financial Results

•Net revenue was $109.7 million in fourth quarter 2023, an increase of 28% compared to the prior year period.

◦Sacral neuromodulation revenue was $88.5 million, of which $86.6 million was generated in the U.S. and the remainder in international markets.

◦Bulkamid revenue was $21.2 million, of which $17.0 million was generated in the U.S. and the remainder in international markets.

•Gross margin was 75.4% in fourth quarter 2023 compared to 73.3% in the prior year period.

•Operating expenses were $81.7 million in fourth quarter 2023 and included $3.5 million of acquisition-related costs. Operating expenses were $66.6 million in the prior year period and included $2.1 million of acquisition-related costs.

•Net income was $6.6 million in fourth quarter 2023 compared to $0.7 million in the prior year period.

•Adjusted EBITDA was $18.9 million in fourth quarter 2023 compared to $10.1 million in the prior year period.

•Cash, cash equivalents, short-term investments and restricted cash were $358 million as of December 31, 2023.

Fiscal Year 2023 Financial Results

•Net revenue was $366.4 million in fiscal year 2023, an increase of 34% compared to the prior year.

◦SNM revenue was $291.8 million, of which $284.8 million was generated in the U.S. and the remainder in international markets.

◦Bulkamid revenue was $74.6 million, of which $59.0 million was generated in the U.S. and the remainder in international markets.

•Gross margin was 74.9% in fiscal year 2023 compared to 72.2% in the prior year.

•Operating expenses were $300.6 million in fiscal year 2023 and included $5.9 million of acquisition-related costs and a $15.4 million charge for acquired in-process research and development. Operating expenses were $262.6 million in the prior year and included $22.6 million of acquisition-related costs.

•Net loss was $6.1 million in fiscal year 2023 compared to net loss of $59.7 million in the prior year.

•Adjusted EBITDA was $52.3 million in fiscal year 2023 compared to $1.6 million in the prior year.

About Axonics

Axonics is a global medical technology company that is developing and commercializing novel products for adults with bladder and bowel dysfunction. Axonics recently ranked No. 2 on the 2023 Financial Times ranking of the fastest growing companies in the Americas after being ranked No. 1 in 2022.

Axonics® sacral neuromodulation systems provide adults with overactive bladder and/or fecal incontinence with long-lived, easy to use, safe, clinically effective therapy. In addition, the company’s best-in-class urethral bulking hydrogel, Bulkamid®, provides safe and durable symptom relief to women with stress urinary incontinence. In the U.S., moderate to severe urinary incontinence affects an estimated 28 million women and fecal incontinence affects an estimated 19 million adults. For more information, visit www.axonics.com.

Use of Non-GAAP Financial Measures

To supplement Axonics’ consolidated financial statements prepared in accordance with generally accepted accounting principles (GAAP), Axonics provides certain non-GAAP financial measures in this release as supplemental financial metrics.

Adjusted EBITDA is calculated as net income (loss) before other income/expense (including interest), income tax expense (benefit), depreciation and amortization expense, stock-based compensation expense, acquisition-related costs, acquired in-process research and development expense, loss on disposal of property and equipment, and expense related to impairment of intangible assets. Management believes that in order to properly understand short-term and long-term financial trends, investors may want to consider the impact of these excluded items in addition to GAAP measures. The excluded items vary in frequency and/or impact on our results of operations and management believes that the excluded items are typically not reflective of our ongoing core business operations and financial condition. Further, management uses adjusted EBITDA for both strategic and annual operating planning. A reconciliation of adjusted EBITDA reported in this release to the most comparable GAAP measure for the respective periods appears in the table captioned “Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA” later in this release.

The non-GAAP financial measures used by Axonics may not be the same or calculated in the same manner as those used and calculated by other companies. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for Axonics’ financial results prepared and reported in accordance with GAAP. We urge investors to review the reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures included in this press release, and not to rely on any single financial measure to evaluate our business.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words like “may,” “will,” “likely,” “should,” “expect,” “anticipate,” “future,” “plan,” “believe,” “intend,” “goal,” “seek,” “endeavor,” “estimate,” “project,” “continue,” and variations of such words and similar expressions. These forward-looking statements are not guarantees of future performance and involve risks, assumptions, and uncertainties, including, but not limited to, risks related to: Axonics’ ability to consummate the transactions contemplated by the Agreement and Plan of Merger, dated January 8, 2024 (the “Merger Agreement”), by and among Axonics, Boston Scientific Corporation (“Boston Scientific”), and Sadie Merger Sub, Inc., a wholly owned subsidiary of Boston Scientific (“Merger Sub”), providing for the merger of Merger Sub with and into Axonics with Axonics continuing as the surviving company and a wholly owned subsidiary of Boston Scientific (the “Merger”), in a timely manner or at all; the risk that the Merger Agreement may be terminated in circumstances requiring the payment by Axonics of a termination fee; the satisfaction (or waiver) of the conditions to the closing of the Merger; potential delays in consummating the Merger; the occurrence of any event, change or other circumstance or condition that could give rise to termination of the Merger Agreement; Axonics’ ability to timely and successfully realize the anticipated benefits of the Merger; the ability to successfully integrate the businesses of Axonics and Boston Scientific; the effect of the announcement or pendency of the Merger on Axonics’ current plans, business relationships, operating results and business generally; the effect of limitations placed on Axonics’ business under the Merger Agreement; significant transaction costs and unknown liabilities; litigation or regulatory actions related to the Merger Agreement or Merger; FDA or other U.S. or foreign regulatory or legal actions or changes affecting Axonics or Axonics’ industry; the results of any ongoing or future legal proceedings, including the litigation with Medtronic, Inc., Medtronic Puerto Rico Operations Co., Medtronic Logistics LLC and Medtronic USA, Inc. (the “Medtronic Litigation”); any termination or loss of intellectual property rights, including as a result of the Medtronic Litigation; introductions and announcements of new technologies by Axonics, any commercialization partners or Axonics’ competitors, and the timing of these introductions and announcements; changes in macroeconomic and market conditions and volatility, including the risk of recession, inflation, supply chain constraints or disruptions and rising interest rates; and economic and market conditions in general and in the medical technology industry specifically, including the size and growth, if any, of Axonics’ markets, and risks related to other factors described under “Risk Factors” in other reports and statements filed with the U.S. Securities and Exchange Commission (“SEC”), including Axonics’ most recent Annual Report on Form 10-K, which is available on the investor relations section of Axonics’ website at www.axonics.com and on the SEC’s website at www.sec.gov. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

The forward-looking statements included in this press release are made only as of the date of this press release, and except as otherwise required by federal securities law, Axonics does not assume any obligation nor does it intend to publicly update or revise any forward-looking statements to reflect new information, changed circumstances or unanticipated events.

Additional Information and Where to Find It

In connection with the contemplated Merger, Axonics filed on February 22, 2024 with the SEC a definitive proxy statement relating to a special meeting of Axonics’ stockholders to be held for the purpose of obtaining stockholder approval of the Merger Agreement and other related matters (the “Proxy Statement”). The Proxy Statement was mailed to Axonics’ stockholders on or about February 22, 2024. Axonics may also file other documents with the SEC regarding the contemplated Merger. This document is not a substitute for the Proxy Statement or any other document that Axonics has filed or may file with the SEC in connection with the contemplated Merger. BEFORE MAKING ANY VOTING DECISION,

INVESTORS AND SECURITY HOLDERS OF AXONICS ARE URGED TO READ THE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS THERETO, ANY OTHER SOLICITING MATERIALS AND ANY OTHER DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC IN CONNECTION WITH THE CONTEMPLATED MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT BECAUSE THEY CONTAIN OR WILL CONTAIN, AS APPLICABLE, IMPORTANT INFORMATION ABOUT AXONICS, BOSTON SCIENTIFIC AND THE CONTEMPLATED MERGER. Investors and security holders may obtain free copies of the Proxy Statement and other filings containing important information about Axonics on the SEC’s website at www.sec.gov, on Axonics’ website at www.axonics.com or by contacting Axonics’ Investor Relations department via email at IR@axonics.com.

Participants in the Solicitation

Axonics and its directors and executive officers may, under SEC rules, be deemed participants in the solicitation of proxies from the stockholders of Axonics in connection with the contemplated Merger. Information regarding the identity of potential participants in the solicitation of proxies in connection with the proposed Merger, and their direct or indirect interests, by security holdings or otherwise, is included in the Proxy Statement. Additional information regarding Axonics’ directors and executive officers is contained in the Proxy Statement, Axonics’ Definitive Proxy Statement on Schedule 14A for Axonics’ 2023 Annual Meeting of Stockholders, which was filed with the SEC on May 1, 2023 (and specifically, the following sections: “Security Ownership of Certain Beneficial Owners, Executive Officers and Directors”, “Certain Relationships and Related-Party Transactions”, “Executive Officers”, “Proposal 1–Election of Directors”, “Director Compensation”, and “Executive Compensation”) and in Axonics’ Current Report on Form 8-K, which was filed with the SEC on October 4, 2023. To the extent holdings of the Company’s securities by the directors or executive officers have changed since the amounts set forth in the Proxy Statement, such changes have been or will be reflected on Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC, which are available at EDGAR Search Results (sec.gov). These documents (when available) are available free of charge as described in the preceding section.

Axonics contact:

Neil Bhalodkar

949-336-5293

IR@axonics.com

Axonics, Inc.

Consolidated Balance Sheets

(in thousands, except share and per share data)

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| (unaudited) | | |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 104,811 | | | $ | 238,846 | |

| Short-term investments | 240,149 | | | 118,365 | |

| Accounts receivable, net of allowance for credit losses of $442 and $321 at December 31, 2023 and 2022, respectively | 57,243 | | | 44,817 | |

| Inventory, net | 79,940 | | | 55,765 | |

| Prepaid expenses and other current assets | 9,279 | | | 7,282 | |

| Total current assets | 491,422 | | | 465,075 | |

| Restricted cash | 12,714 | | | — | |

| Property and equipment, net | 10,760 | | | 6,798 | |

| Intangible assets, net | 81,375 | | | 86,253 | |

| Other assets | 24,235 | | | 6,813 | |

| Goodwill | 99,417 | | | 94,414 | |

| Total assets | $ | 719,923 | | | $ | 659,353 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities | | | |

| Accounts payable | $ | 18,452 | | | $ | 9,070 | |

| Accrued liabilities | 10,527 | | | 6,520 | |

| Accrued compensation and benefits | 15,060 | | | 15,495 | |

| Operating lease liabilities, current portion | 1,777 | | | 1,562 | |

| Other current liabilities | — | | | 32,600 | |

| Total current liabilities | 45,816 | | | 65,247 | |

| Operating lease liabilities, net of current portion | 25,840 | | | 7,555 | |

| | | |

| Deferred tax liabilities, net | 10,703 | | | 16,412 | |

| | | |

| Total liabilities | 82,359 | | | 89,214 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Stockholders’ equity | | | |

| Preferred stock, par value $0.0001 per share; 10,000,000 shares authorized, no shares issued and outstanding at December 31, 2023 and 2022 | — | | | — | |

| Common stock, par value $0.0001 per share, 75,000,000 shares authorized at December 31, 2023 and 2022; 50,770,520 and 49,546,727 shares issued and outstanding at December 31, 2023 and 2022, respectively | 5 | | | 5 | |

| Additional paid-in capital | 1,033,778 | | | 969,545 | |

| | | |

| Accumulated deficit | (380,352) | | | (374,264) | |

| Accumulated other comprehensive loss | (15,867) | | | (25,147) | |

| Total stockholders’ equity | 637,564 | | | 570,139 | |

| Total liabilities and stockholders’ equity | $ | 719,923 | | | $ | 659,353 | |

Axonics, Inc.

Consolidated Statements of Comprehensive Income (Loss)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited) | | (unaudited) | | (unaudited) | | |

| Net revenue | $ | 109,735 | | | $ | 85,918 | | | $ | 366,379 | | | $ | 273,702 | |

| Cost of goods sold | 26,975 | | | 22,951 | | | 91,825 | | | 76,037 | |

| Gross profit | 82,760 | | | 62,967 | | | 274,554 | | | 197,665 | |

| Operating expenses | | | | | | | |

| Research and development | 9,714 | | | 8,103 | | | 34,886 | | | 34,410 | |

| General and administrative | 11,095 | | | 10,264 | | | 45,754 | | | 40,238 | |

| Sales and marketing | 55,094 | | | 43,824 | | | 189,562 | | | 156,019 | |

| Amortization of intangible assets | 2,261 | | | 2,271 | | | 9,064 | | | 9,383 | |

| Acquisition-related costs | 3,530 | | | 2,114 | | | 5,898 | | | 22,561 | |

| Acquired in-process research & development | — | | | — | | | 15,447 | | | — | |

| Total operating expenses | 81,694 | | | 66,576 | | | 300,611 | | | 262,611 | |

| Income (loss) from operations | 1,066 | | | (3,609) | | | (26,057) | | | (64,946) | |

| Other income (expense) | | | | | | | |

| Interest and other income | 4,541 | | | 3,229 | | | 16,690 | | | 5,133 | |

| Loss on disposal of property and equipment | (1) | | | (69) | | | (1) | | | (69) | |

| Interest and other (expense) income | (150) | | | 592 | | | 624 | | | (2,434) | |

| Other income, net | 4,390 | | | 3,752 | | | 17,313 | | | 2,630 | |

| Income (loss) before income tax (benefit) expense | 5,456 | | | 143 | | | (8,744) | | | (62,316) | |

| Income tax benefit | (1,118) | | | (522) | | | (2,656) | | | (2,618) | |

| Net income (loss) | 6,574 | | | 665 | | | (6,088) | | | (59,698) | |

| Foreign currency translation adjustment | 8,644 | | | 11,038 | | | 9,280 | | | (18,587) | |

| Comprehensive income (loss) | $ | 15,218 | | | $ | 11,703 | | | $ | 3,192 | | | $ | (78,285) | |

| | | | | | | |

| Net income (loss) per share, basic | $ | 0.13 | | | $ | 0.01 | | | $ | (0.12) | | | $ | (1.28) | |

| Weighted-average shares used to compute basic net income (loss) per share | 49,402,597 | | | 48,166,003 | | | 49,081,470 | | | 46,684,478 | |

| Net income (loss) per share, diluted | $ | 0.13 | | | $ | 0.01 | | | $ | (0.12) | | | $ | (1.28) | |

| Weighted-average shares used to compute basic net income (loss) per share | 50,941,760 | | | 50,460,039 | | | 49,081,470 | | | 46,684,478 | |

Axonics, Inc.

Net Revenue by Product and Region

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | | Years Ended December 31, | | |

| 2023 | | 2022 | | | | 2023 | | 2022 | | |

| (unaudited) | | (unaudited) | | | | (unaudited) | | | | |

| SNM | | | | | | | | | | | |

| United States | $ | 86,576 | | | $ | 69,068 | | | | | $ | 284,846 | | | $ | 216,861 | | | |

| International | 1,934 | | | 1,236 | | | | | 6,959 | | | 5,130 | | | |

| SNM total | $ | 88,510 | | | $ | 70,304 | | | | | $ | 291,805 | | | $ | 221,991 | | | |

| | | | | | | | | | | |

| Bulkamid | | | | | | | | | | | |

| United States | $ | 17,038 | | | $ | 12,341 | | | | | $ | 59,036 | | | $ | 40,178 | | | |

| International | 4,187 | | | 3,273 | | | | | 15,538 | | | 11,533 | | | |

| Bulkamid total | $ | 21,225 | | | $ | 15,614 | | | | | $ | 74,574 | | | $ | 51,711 | | | |

| Total net revenue | $ | 109,735 | | | $ | 85,918 | | | | | $ | 366,379 | | | $ | 273,702 | | | |

Axonics, Inc.

Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| GAAP Net income (loss) | $ | 6,574 | | | $ | 665 | | | $ | (6,088) | | | $ | (59,698) | |

| Non-GAAP Adjustments: | | | | | | | |

| Interest and other income | (4,541) | | | (3,229) | | | (16,690) | | | (5,133) | |

| Interest and other expense | 150 | | | (592) | | | (624) | | | 2,434 | |

| Income tax benefit | (1,118) | | | (522) | | | (2,656) | | | (2,618) | |

| Depreciation and amortization expense | 3,192 | | | 2,880 | | | 12,487 | | | 11,721 | |

| Stock-based compensation expense | 11,148 | | | 8,757 | | | 44,536 | | | 32,018 | |

| Acquisition-related costs | 3,530 | | | 2,114 | | | 5,898 | | | 22,561 | |

| Acquired in-process research & development | — | | | — | | | 15,447 | | | — | |

| Loss on disposal of property and equipment | 1 | | | 69 | | | 1 | | | 69 | |

| Impairment expense | — | | | — | | | — | | | 287 | |

| Adjusted EBITDA | $ | 18,936 | | | $ | 10,142 | | | $ | 52,311 | | | $ | 1,641 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

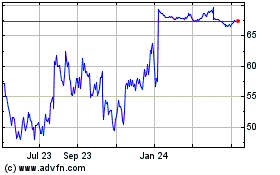

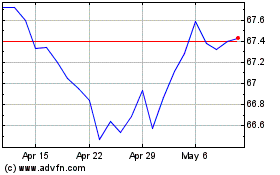

Axonics (NASDAQ:AXNX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Axonics (NASDAQ:AXNX)

Historical Stock Chart

From Apr 2023 to Apr 2024