0001897982false00018979822023-11-062023-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 06, 2023

ASPEN TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-41400 | | 87-3100817 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 20 Crosby Drive, | Bedford, | MA | | 01730 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (781) 221-6400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common stock, $0.0001 par value per share | | AZPN | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company □

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

On November 6, 2023, we issued a press release announcing financial results for the first quarter of fiscal year 2024, ended September 30, 2023. The full text of the press release issued in connection with this announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934 except as expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| 99.1 | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | ASPEN TECHNOLOGY, INC. |

| | |

| | | |

Date: November 6, 2023 | By: | /s/ Chantelle Breithaupt |

| | | Chantelle Breithaupt |

| | | Senior Vice President, Chief Financial Officer and Treasurer |

| | (Principal Financial Officer) |

Exhibit 99.1

Contacts:

| | | | | | | | |

| Media Contact | | Investor Contact |

| Len Dieterle | | Brian Denyeau |

| Aspen Technology | | ICR for Aspen Technology |

| +1 781-221-4291 | | +1 646-277-1251 |

| len.dieterle@aspentech.com | | ir@aspentech.com |

Aspen Technology Announces Financial Results for the

First Quarter of Fiscal 2024

Bedford, Mass. – November 6, 2023 - Aspen Technology, Inc. (AspenTech) (NASDAQ: AZPN), a global leader in industrial software, today announced financial results for its first quarter in fiscal 2024, ended September 30, 2023.

“We delivered solid results in the first quarter, once again achieving double-digit ACV growth on strong demand across most markets,” said Antonio Pietri, President and Chief Executive Officer of AspenTech. “While our first year as new AspenTech was centered on building the foundation, our focus in fiscal 2024 is on execution and expansion. Our work in these areas is off to a strong start, and we remain committed to helping our customers to run their assets safer, greener, longer, and faster through our expanded portfolio and greater market reach.”

Pietri continued, “AspenTech solutions are mission-critical to customers around the world. We are seeing numerous opportunities to help asset-intensive companies better meet their profitability and sustainability objectives as well as promising signs of growth across many different sustainability pathways. We remain confident in our business outlook and are reiterating our guidance for fiscal 2024.”

First Quarter Fiscal Year 2024 Recent Business Highlights

•Annual contract value1 (“ACV”) was $897.6 million at the end of the first quarter of fiscal 2024, increasing 10.9% year over year and 1.4% quarter over quarter.

•Operating cash flow was $17.0 million for the first quarter of fiscal 2024, compared to $5.1 million in the first quarter of fiscal 2023.

•Free cash flow2 was $16.0 million for the first quarter of fiscal 2024, compared to $3.7 million in the first quarter of fiscal 2023.

Summary of First Quarter Fiscal Year 2024 Financial Results

AspenTech’s total revenue was $249.3 million in the first quarter of fiscal 2024 and included the following:

•License and solutions revenue, which represents the portion of a term license agreement allocated to the initial license and Open Systems International, Inc. (OSI) revenue where software, hardware and professional services are recognized as one performance obligation, was $148.6 million in the first quarter of fiscal 2024, compared to $160.2 million in the first quarter of fiscal 2023.

•Maintenance revenue, which represents the portion of customer agreements related to ongoing support and the right to future product enhancements, was $85.0 million in the first quarter of fiscal 2024, compared to $78.4 million in the first quarter of fiscal 2023.

•Services and other revenue, which represents the portion of customer agreements related to professional services and training services, was $15.7 million in the first quarter of fiscal 2024, compared to $12.2 million in the first quarter of fiscal 2023.

Loss from operations was $60.2 million in the first quarter of fiscal 2024, compared to loss from operations of $51.2 million in the first quarter of fiscal 2023. Non-GAAP income from operations was $77.8 million in the first quarter of fiscal 2024, compared to $92.6 million in the first quarter of fiscal 2023. A reconciliation of GAAP to non-GAAP results is presented in the financial tables included in this press release.

Net loss was $34.5 million, or $0.54 per diluted share, in the first quarter of fiscal 2024, compared to a net loss of $11.2 million, or $0.17 per diluted share, in the first quarter of fiscal 2023. AspenTech has increased amortization of intangible assets following the close of its transaction with Emerson Electric Co. As a result, AspenTech expects its amortization of intangible assets to remain at higher levels for the next several years as the related asset balance is amortized over the respective expected useful lives of the intangible assets.

Non-GAAP net income was $74.9 million, or $1.16 per share, in the first quarter of fiscal 2024, compared to non-GAAP net income of $142.0 million, or $2.20 per share, in the first quarter of fiscal 2023. The year-over-year decrease in non-GAAP net income was mainly due to the lower benefit from income taxes in the first quarter of fiscal 2024, following AspenTech's change in approach to computing its tax provision, which initially occurred in the second quarter of fiscal 2023.

AspenTech had cash and cash equivalents of $120.5 million as of September 30, 2023, compared to $241.2 million as of June 30, 2023. The decrease in cash and cash equivalents was due to the impact of share repurchase activity under AspenTech’s $300.0 million share repurchase authorization in the first quarter of fiscal 2024. AspenTech had no borrowings and $197.7 million available under its revolving credit facility as of September 30, 2023.

AspenTech generated $17.0 million in cash flow from operations and $16.0 million in free cash flow2 in the first quarter of fiscal 2024, compared to $5.1 million in cash flow from operations and $3.7 million in free cash flow in the first quarter of fiscal 2023. Free cash flow is a non-GAAP metric that is calculated as net cash provided by operating activities adjusted for the net impact of purchases of property, equipment and leasehold improvements and payments for capitalized computer software development costs.

Recent Developments

Chief Financial Officer Transition

On October 19, 2023, AspenTech announced that Chantelle Breithaupt had informed the Company that she plans to step down as Chief Financial Officer for another opportunity. Ms. Breithaupt will continue in her role through December 31, 2023. Christopher Stagno, who currently serves as SVP, Chief Accounting Officer, will assume the role of Interim CFO, effective January 1, 2024, should a permanent CFO not have been named.

Share Repurchase Programs Update

AspenTech settled its $100 million accelerated share repurchase program in the first quarter of fiscal 2024, which resulted in the delivery of an additional 107,045 shares of AspenTech common stock, for a total of 594,671 shares delivered under the program. Upon completion of the accelerated share repurchase program, AspenTech began purchasing shares pursuant to its $300.0 million share repurchase authorization announced on August 1, 2023. During the first quarter of fiscal 2024, AspenTech repurchased 579,798 shares for $114.2 million under the share repurchase authorization. The total value remaining under the share repurchase authorization as of September 30, 2023, was $185.8 million, which AspenTech expects to utilize in the remainder of fiscal 2024.

Fiscal Year 2024 Business Outlook

Based on information as of today, November 6, 2023, AspenTech is issuing the following guidance for fiscal 2024.

•ACV1 growth of at least 11.5% year-over-year

•GAAP operating cash flow of at least $378 million

•Free cash flow2 of at least $360 million

•Total bookings of at least $1.04 billion

•Total revenue of at least $1.12 billion

•GAAP total expense of approximately $1.22 billion

•Non-GAAP total expense of approximately $675 million

•GAAP operating loss at or better than $100 million

•Non-GAAP operating income of at least $445 million

•GAAP net loss at or better than $7 million

•Non-GAAP net income of at least $424 million

•GAAP net loss per share at or better than $0.11

•Non-GAAP net income per share of at least $6.57

These statements are forward-looking and actual results may differ materially. Refer to the Forward-Looking Statements safe harbor below for information on the factors that could cause AspenTech’s actual results to differ materially from these forward-looking statements.

Conference Call and Webcast

AspenTech will host a conference call and webcast presentation on Monday, November 6, 2023, at 4:30 p.m. ET to discuss its financial results, business outlook, and related corporate and financial matters. A live webcast of the call will be available on AspenTech's Investor Relations website, ir.aspentech.com, via its “Webcasts” page. To access the call by phone, please use the following registration link. To avoid delays, we encourage participants to dial into the conference call fifteen minutes ahead of the scheduled start time. A replay of the webcast also will be available for a limited time at http://ir.aspentech.com/.

AspenTech has provided an earnings presentation for its first quarter of fiscal 2024. The Company asks that shareholders refer to this presentation in conjunction with today’s conference call, which can be found at ir.aspentech.com.

Footnotes

1.AspenTech defines ACV as the estimate of the annual value of our portfolio of term license and software maintenance and support, or SMS, contracts, the annual value of SMS agreements purchased with perpetual licenses and the annual value of standalone SMS agreements purchased with certain legacy term license agreements, which have become an immaterial part of our business.

2.Effective January 1, 2023, we no longer exclude acquisition and integration planning related payments from our computation of free cash flow. Free cash flow for all prior periods presented has been revised to the current period computation.

About AspenTech

Aspen Technology, Inc. (NASDAQ: AZPN) is a global software leader helping industries at the forefront of the world’s dual challenge meet the increasing demand for resources from a rapidly growing population in a profitable and sustainable manner. AspenTech solutions address complex environments where it is critical to optimize the asset design, operation and maintenance lifecycle. Through our unique combination of deep domain expertise and innovation, customers in capital-intensive industries can run their assets safer, greener, longer and faster to improve their operational excellence. To learn more, visit AspenTech.com.

Forward-Looking Statements

Statements in this press release that are not strictly historical may be “forward-looking” statements for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, which involve risks and uncertainties, and AspenTech undertakes no obligation to update any such statements to reflect later developments. These forward-looking statements include, but are not limited to, our guidance for fiscal 2024, our expectations regarding cash collections and completion of our share repurchase authorization. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “strategy,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “opportunity” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These risks and uncertainties include, without limitation: the failure to realize the anticipated benefits of our transaction with Emerson Electric Co.; risks resulting from our status as a controlled company; the scope, duration and ultimate impacts of the Russia-Ukraine war, and the Israeli-Hamas conflict; as well as economic and currency conditions, market demand (including related to the pandemic and adverse changes in the process or other capital-intensive industries such as materially reduced spending budgets due to oil and gas price declines and volatility), pricing, protection of intellectual property, cybersecurity, natural disasters, tariffs, sanctions, competitive and technological factors, and inflation; and others, as set forth in AspenTech’s most recent Annual Report on Form 10-K and

subsequent reports filed with the Securities and Exchange Commission. The outlook contained herein represents AspenTech’s expectation for its consolidated results, other than as noted herein.

© 2023 Aspen Technology, Inc. AspenTech, aspenONE, asset optimization and the Aspen leaf logo are trademarks of Aspen Technology, Inc. All rights reserved. All other trademarks not owned by AspenTech are property of their respective owners.

Use of Non-GAAP Financial Measures

This press release contains “non-GAAP financial measures” under the rules of the U.S. Securities and Exchange Commission. Non-GAAP financial measures are not based on a comprehensive set of accounting rules or principles. This non-GAAP information supplements, and is not intended to represent a measure of performance in accordance with, disclosures required by generally accepted accounting principles, or GAAP. Non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in accordance with GAAP. A reconciliation of GAAP to non-GAAP results is included in the financial tables included in this press release.

Management considers both GAAP and non-GAAP financial results in managing AspenTech’s business. As the result of adoption of new licensing models, management believes that a number of AspenTech’s performance indicators based on GAAP, including revenue, gross profit, operating income and net income, should be viewed in conjunction with certain non-GAAP and other business measures in assessing AspenTech’s performance, growth and financial condition. Accordingly, management utilizes a number of non-GAAP and other business metrics, including the non-GAAP metrics set forth in this press release, to track AspenTech’s business performance. None of these non-GAAP metrics should be considered as an alternative to any measure of financial performance calculated in accordance with GAAP.

| | | | | | | | | | | | | | | |

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) |

| | | | | | | |

| Three Months Ended September 30, | | |

| 2023 | | 2022 | | | | |

| (Dollars and Shares in Thousands, Except per share data) |

| Revenue: | | | | | | | |

| License and solutions | $ | 148,648 | | | $ | 160,224 | | | | | |

| Maintenance | 84,968 | | | 78,366 | | | | | |

| Services and other | 15,692 | | | 12,229 | | | | | |

| Total revenue | 249,308 | | | 250,819 | | | | | |

| Cost of revenue: | | | | | | | |

| License and solutions | 71,578 | | | 69,513 | | | | | |

| Maintenance | 10,200 | | | 9,217 | | | | | |

| Services and other | 16,282 | | | 12,400 | | | | | |

| Total cost of revenue | 98,060 | | | 91,130 | | | | | |

| Gross profit | 151,248 | | | 159,689 | | | | | |

| Operating expenses: | | | | | | | |

| Selling and marketing | 122,378 | | | 118,274 | | | | | |

| Research and development | 53,676 | | | 49,740 | | | | | |

| General and administrative | 35,405 | | | 42,848 | | | | | |

| Restructuring costs | — | | | 9 | | | | | |

| Total operating expenses | 211,459 | | | 210,871 | | | | | |

| Loss from operations | (60,211) | | | (51,182) | | | | | |

| Other expense, net | (5,830) | | | (58,632) | | | | | |

| Interest income, net | 14,049 | | | 5,023 | | | | | |

| Loss before benefit for income taxes | (51,992) | | | (104,791) | | | | | |

| Benefit for income taxes | (17,467) | | | (93,547) | | | | | |

| Net loss | $ | (34,525) | | | $ | (11,244) | | | | | |

| Net loss per common share: | | | | | | | |

| Basic | $ | (0.54) | | | $ | (0.17) | | | | | |

| Diluted | $ | (0.54) | | | $ | (0.17) | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 64,319 | | | 64,454 | | | | | |

| Diluted | 64,319 | | | 64,454 | | | | | |

| | | | | | | | | | | |

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) |

| | | |

| September 30, 2023 | | June 30, 2023 |

| (Dollars in Thousands, Except Share and Per Share Data) |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 120,540 | | | $ | 241,209 | |

| Accounts receivable, net | 87,977 | | | 122,789 | |

| Current contract assets, net | 369,019 | | | 367,539 | |

| Prepaid expenses and other current assets | 32,010 | | | 27,728 | |

| Receivables from related parties | 59,458 | | | 62,375 | |

| Prepaid income taxes | 15,319 | | | 11,424 | |

| Total current assets | 684,323 | | | 833,064 | |

| Property, equipment and leasehold improvements, net | 17,484 | | | 18,670 | |

| Goodwill | 8,328,192 | | | 8,330,811 | |

| Intangible assets, net | 4,549,858 | | | 4,659,657 | |

| Non-current contract assets, net | 547,617 | | | 536,104 | |

| Contract costs | 17,138 | | | 15,992 | |

| Operating lease right-of-use assets | 64,322 | | | 67,642 | |

| Deferred income tax assets | 12,019 | | | 10,638 | |

| Other non-current assets | 19,721 | | | 13,474 | |

| Total assets | $ | 14,240,674 | | | $ | 14,486,052 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 15,301 | | | $ | 20,299 | |

| Accrued expenses and other current liabilities | 79,536 | | | 99,526 | |

| Due to related parties | 29,253 | | | 22,019 | |

| Current operating lease liabilities | 12,570 | | | 12,928 | |

| Income taxes payable | 48,461 | | | 46,205 | |

| Current contract liabilities | 117,110 | | | 151,450 | |

| Total current liabilities | 302,231 | | | 352,427 | |

| Non-current contract liabilities | 27,671 | | | 30,103 | |

| Deferred income tax liabilities | 911,967 | | | 957,911 | |

| Non-current operating lease liabilities | 52,485 | | | 55,442 | |

| Other non-current liabilities | 19,401 | | | 19,240 | |

| Stockholders’ equity: | | | |

Common stock, $0.0001 par value

Authorized—600,000,000 shares

Issued— 65,030,408 and 64,952,868 shares

Outstanding— 63,855,939 and 64,465,242 shares | 6 | | | 6 | |

| Additional paid-in capital | 13,230,178 | | | 13,194,028 | |

| Accumulated deficit | (75,916) | | | (41,391) | |

| Accumulated other comprehensive (loss) income | (8,765) | | | 2,436 | |

| Treasury stock, at cost — 1,174,469 and 487,626 shares of common stock | (218,584) | | | (84,150) | |

| Total stockholders’ equity | 12,926,919 | | | 13,070,929 | |

| Total liabilities and stockholders’ equity | $ | 14,240,674 | | | $ | 14,486,052 | |

| | | | | | | | | | | | | | | |

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) |

| | | | | | | |

| Three Months Ended September 30, | | |

| 2023 | | 2022 | | | | |

| (Dollars in Thousands) | | | | |

| Cash flows from operating activities: | | | | | | | |

| Net loss | $ | (34,525) | | | $ | (11,244) | | | | | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | 123,219 | | | 122,546 | | | | | |

| Reduction in the carrying amount of right-of-use assets | 3,562 | | | 3,291 | | | | | |

| Net foreign currency losses | 5,894 | | | 8,332 | | | | | |

| Stock-based compensation | 16,699 | | | 17,736 | | | | | |

| Deferred income taxes | (51,080) | | | (70,438) | | | | | |

| Provision for uncollectible receivables | 1,788 | | | 3,609 | | | | | |

| Other non-cash operating activities | 19 | | | 3,225 | | | | | |

| Changes in assets and liabilities: | | | | | | | |

| Accounts receivable | 29,417 | | | 8,009 | | | | | |

| Contract assets | (24,062) | | | (68,357) | | | | | |

| Contract costs | (1,163) | | | (3,451) | | | | | |

| Lease liabilities | (3,770) | | | (1,659) | | | | | |

| Prepaid expenses, prepaid income taxes, and other assets | (17,022) | | | (47,004) | | | | | |

| Liability from foreign currency forward contract | — | | | 50,259 | | | | | |

| Accounts payable, accrued expenses, income taxes payable and other liabilities | 4,735 | | | (13,476) | | | | | |

| Contract liabilities | (36,730) | | | 3,699 | | | | | |

| Net cash provided by operating activities | 16,981 | | | 5,077 | | | | | |

| Cash flows from investing activities: | | | | | | | |

| Purchases of property, equipment and leasehold improvements | (937) | | | (1,321) | | | | | |

| Payments for business acquisitions, net of cash acquired | (8,273) | | | (74,947) | | | | | |

| Payments for equity method investments | (98) | | | — | | | | | |

| Payments for capitalized computer software development costs | — | | | (99) | | | | | |

| Payments for asset acquisitions | (12,500) | | | — | | | | | |

| | | | | | | |

| Net cash used in investing activities | (21,808) | | | (76,367) | | | | | |

| Cash flows from financing activities: | | | | | | | |

| Issuance of shares of common stock | 3,285 | | | 8,470 | | | | | |

| Repurchases of common stock | (114,224) | | | — | | | | | |

| Payment of tax withholding obligations related to restricted stock | (1,938) | | | (3,422) | | | | | |

| Deferred business acquisition payments | — | | | (1,363) | | | | | |

| Repayments of amounts borrowed under term loan | — | | | (6,000) | | | | | |

| Net transfers from Parent Company | 3,890 | | | 12,446 | | | | | |

| Payments of debt issuance costs | — | | | (2,375) | | | | | |

| Net cash (used in) provided by financing activities | (108,987) | | | 7,756 | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | (6,855) | | | (3,733) | | | | | |

| Decrease in cash and cash equivalents | (120,669) | | | (67,267) | | | | | |

| Cash and cash equivalents, beginning of period | 241,209 | | | 449,725 | | | | | |

| Cash and cash equivalents, end of period | $ | 120,540 | | | $ | 382,458 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | |

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES Reconciliation of GAAP to Non-GAAP Results of Operations and Cash Flows (Unaudited Dollars in Thousands, Except per Share Data) |

| | | | | | | | |

| | Three Months Ended September 30, | | |

| | 2023 | | 2022 | | | | |

| Total expenses | | | | | | | | |

| GAAP total expenses (a) | | $ | 309,519 | | | $ | 302,001 | | | | | |

| Less: | | | | | | | | |

| Stock-based compensation (b) | | (16,699) | | | (17,736) | | | | | |

| Amortization of intangibles (c) | | (121,587) | | | (121,160) | | | | | |

| Acquisition and integration planning related fees | | 255 | | | (4,858) | | | | | |

| | | | | | | | |

| Non-GAAP total expenses | | $ | 171,488 | | | $ | 158,247 | | | | | |

| | | | | | | | |

| (Loss) income from operations | | | | | | | | |

| GAAP loss from operations | | $ | (60,211) | | | $ | (51,182) | | | | | |

| Plus: | | | | | | | | |

| Stock-based compensation (b) | | 16,699 | | | 17,736 | | | | | |

| Amortization of intangibles (c) | | 121,587 | | | 121,160 | | | | | |

| Acquisition and integration planning related fees | | (255) | | | 4,858 | | | | | |

| | | | | | | | |

| Non-GAAP income from operations | | $ | 77,820 | | | $ | 92,572 | | | | | |

| | | | | | | | |

| Net (loss) income | | | | | | | | |

| GAAP net loss | | $ | (34,525) | | | $ | (11,244) | | | | | |

| Plus: | | | | | | | | |

| Stock-based compensation (b) | | 16,699 | | | 17,736 | | | | | |

| Amortization of intangibles (c) | | 121,587 | | | 121,160 | | | | | |

| Acquisition and integration planning related fees | | (255) | | | 4,858 | | | | | |

| Unrealized loss on foreign currency forward contract | | — | | | 50,259 | | | | | |

| Less: | | | | | | | | |

| Income tax effect on Non-GAAP items (d) | | (28,621) | | | (40,730) | | | | | |

| | | | | | | | |

| Non-GAAP net income | | $ | 74,885 | | | $ | 142,039 | | | | | |

| | | | | | | | |

| Diluted (loss) income per share | | | | | | | | |

| GAAP diluted loss per share | | $ | (0.54) | | | $ | (0.17) | | | | | |

| Plus: | | | | | | | | |

| Stock-based compensation (b) | | 0.26 | | | 0.28 | | | | | |

| Amortization of intangibles (c) | | 1.88 | | | 1.88 | | | | | |

| Acquisition and integration planning related fees | | — | | | 0.07 | | | | | |

| Unrealized loss on foreign currency forward contract | | — | | | 0.77 | | | | | |

| Less: | | | | | | | | |

| Income tax effect on Non-GAAP items (d) | | (0.44) | | | (0.63) | | | | | |

| | | | | | | | |

| Non-GAAP diluted income per share | | $ | 1.16 | | | $ | 2.20 | | | | | |

| | | | | | | | |

| Shares used in computing Non-GAAP diluted income per share | | 64,658 | | | 64,454 | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | |

| | 2023 | | 2022 | | | | |

Free Cash Flow (2) | | | | | | | | |

| Net cash provided by operating activities (GAAP) | | $ | 16,981 | | | $ | 5,077 | | | | | |

| Purchases of property, equipment and leasehold improvements | | (937) | | | (1,321) | | | | | |

| Payments for capitalized computer software development costs | | — | | | (99) | | | | | |

| Free cash flow (non-GAAP) | | $ | 16,044 | | | $ | 3,657 | | | | | |

| | | | | | | | |

| (a) GAAP total expenses | | | | | | | | |

| | Three Months Ended September 30, | | |

| | 2023 | | 2022 | | | | |

| Total costs of revenue | | $ | 98,060 | | | $ | 91,130 | | | | | |

| Total operating expenses | | 211,459 | | | 210,871 | | | | | |

| GAAP total expenses | | $ | 309,519 | | | $ | 302,001 | | | | | |

| | | | | | | | |

| (b) Stock-based compensation expense was as follows: | | | | | | | | |

| | Three Months Ended September 30, | | |

| | 2023 | | 2022 | | | | |

| Cost of license and solutions | | $ | 680 | | | $ | 742 | | | | | |

| Cost of maintenance | | 488 | | | 561 | | | | | |

| Cost of services and other | | 498 | | | 408 | | | | | |

| Selling and marketing | | 2,942 | | | 3,347 | | | | | |

| Research and development | | 4,553 | | | 3,611 | | | | | |

| General and administrative | | 7,538 | | | 9,067 | | | | | |

| Total stock-based compensation | | $ | 16,699 | | | $ | 17,736 | | | | | |

| | | | | | | | |

| (c) Amortization of intangible assets was as follows: | | | | | | | | |

| | Three Months Ended September 30, | | | | |

| | 2023 | | 2022 | | | | |

| Cost of license and solutions | | $ | 48,035 | | | $ | 47,670 | | | | | |

| Selling and marketing | | 73,552 | | | 73,490 | | | | | |

| Total amortization of intangible assets | | $ | 121,587 | | | $ | 121,160 | | | | | |

| | | | | | | | |

(d) The income tax effect on non-GAAP items for the three months ended September 30, 2023 and 2022, respectively, is calculated utilizing the Company's combined US federal and state statutory tax rate as following: | | | | |

| | | |

| | Three Months Ended September 30, | | | | |

| | 2023 | | 2022 | | | | |

| U.S. Statutory Rate | | 21.79 | % | | 21.79 | % | | | | |

| | | | | | | | | | | | | | |

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES Reconciliation of Forward-Looking Guidance (Unaudited Dollars in Thousands, Except per Share Data) |

| | | | | | |

| Twelve Months Ended June 30, 2024 (3) |

| | | | | | |

| Guidance - Total expenses | | | | | | |

| GAAP expectation - total expenses | $ | 1,220,000 | | | | | | |

| Less: | | | | | | |

| Stock-based compensation | (59,000) | | | | | | |

| Amortization of intangible assets | (486,000) | | | | | | |

| | | | | | |

| Non-GAAP expectation - total expenses | $ | 675,000 | | | | | | |

| | | | | | |

| Guidance - (Loss) income from operations | | | | | | |

| GAAP expectation - loss from operations | $ | (100,000) | | | | | | |

| Plus: | | | | | | |

| Stock-based compensation | 59,000 | | | | | | |

| Amortization of intangible assets | 486,000 | | | | | | |

| | | | | | |

| Non-GAAP expectation - income from operations | $ | 445,000 | | | | | | |

| | | | | | |

| Guidance - Net (loss) income and diluted (loss) income per share | | | | | | |

| GAAP expectation - net loss and diluted loss per share | $ | (7,000) | | | $ | (0.11) | | | | |

| Plus: | | | | | | |

| Stock-based compensation | 59,000 | | | | | | |

| Amortization of intangible assets | 486,000 | | | | | | |

| Less: | | | | | | |

Income tax effect on Non-GAAP items (4) | (114,000) | | | | | | |

| | | | | | |

| Non-GAAP expectation - net income and diluted income per share | $ | 424,000 | | | $ | 6.57 | | | | |

| | | | | | |

| Shares used in computing guidance for Non-GAAP diluted income per share | 64,560 | | | | | |

| | | | | | |

Guidance - Free Cash Flow (5) | | | | | | |

| GAAP expectation - Net cash provided by operating activities | $ | 378,000 | | | | | | |

| Less: | | | | | | |

| Purchases of property, equipment and leasehold improvements | (17,500) | | | | | | |

| Payments for capitalized computer software development costs | (500) | | | | | | |

| | | | | | |

| Free cash flow expectation (non-GAAP) | $ | 360,000 | | | | | | |

| __________ | | | | | | |

(3) Rounded amount used, except per share data. | | | | | | |

(4) The income tax effect on non-GAAP items for the twelve months ended June 30, 2024 is calculated utilizing the Company's statutory tax rate of 21.79 percent. |

(5) Free cash flow guidance has been updated to reflect a change in methodology to calculate free cash flow and does not represent a change in management's expectations. Effective January 1, 2023, we no longer exclude acquisition and integration planning related payments from our computation of free cash flow. We have updated our guidance computation for free cash flow to reflect that such payments are no longer excluded from free cash flow. |

Cover Page

|

Nov. 06, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 06, 2023

|

| Entity Registrant Name |

ASPEN TECHNOLOGY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-41400

|

| Entity Tax Identification Number |

87-3100817

|

| Entity Address, Address Line One |

20 Crosby Drive,

|

| Entity Address, City or Town |

Bedford,

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

01730

|

| City Area Code |

781

|

| Local Phone Number |

221-6400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.0001 par value per share

|

| Trading Symbol |

AZPN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001897982

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

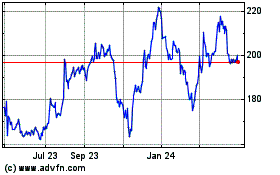

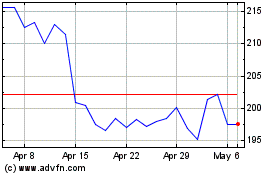

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Apr 2023 to Apr 2024