Filed pursuant to Rule 424(b)(4)

File No. 333-276771

PROSPECTUS

BONE

BIOLOGICS CORPORATION

119,000

Shares of Common Stock

662,251

Prefunded Warrants to purchase 662,251

Shares of Common Stock

662,251 Shares of Common Stock underlying

the Prefunded Warrants

781,251

Common Warrants to purchase 781,251

Shares of Common Stock

781,251

Shares of Common Stock underlying the Common

Warrants

46,875

Placement Agent Warrants to Purchase 46,875

Shares of Common Stock

46,875

Shares of Common Stock Underlying the Placement

Agent Warrants

We are

offering 119,000 shares of common stock, par value $0.001 per share (“common stock”), together with warrants to purchase

781,251 shares of common stock, which we refer to as the “warrants,” at a combined public offering price of

$2.56 per share and accompanying warrant. Each share of our common stock is being sold together with one warrant to purchase

one share of common stock. The warrants will have an exercise price of $2.43 per share and will be exercisable upon issuance and

will expire five years from the date of issuance. This prospectus also relates to the offering of the shares of common stock issuable

upon exercise of warrants.

We

are also offering to those investors, whose purchase of shares of our common stock in this offering would result in such investor, together

with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the investor, 9.99%) of

our outstanding common stock following the consummation of this offering, the opportunity to purchase, in lieu of the common stock that

would otherwise result in the investor’s beneficial ownership exceeding 4.99% (or, at the election of the investor, 9.99%), 662,251

pre-funded warrants to purchase 662,251 shares of common stock, at an exercise price of $0.001 per share, which we refer

to as the “pre-funded warrants.” Each pre-funded warrant will be exercisable upon issuance and may be exercised at any time

until all of the pre-funded warrants are exercised in full. Each pre-funded warrant is being sold together with one warrant to purchase

one share of common stock. The public offering price for each pre-funded warrant and the accompanying warrant is equal to the price per

share of common stock and the accompanying warrant being sold to the public in this offering, minus $0.001. This prospectus also relates

to the offering of the shares of common stock issuable upon exercise of the pre-funded warrants.

The shares of common stock and/or pre-funded warrants and the accompanying warrant can only be purchased together in this offering but

will be issued separately and will be immediately separable upon issuance.

This

offering will terminate on May 13, 2024 unless we decide to terminate the offering (which we may do at any time in our discretion)

prior to that date. We will have one closing for all the securities purchased in this offering. The combined public offering price per

share (or pre-funded warrant) and accompanying warrant will be fixed for the duration of this offering.

We

have engaged H.C. Wainwright & Co., LLC, or the placement agent, to act as our exclusive placement agent in connection with

this offering. The placement agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by

this prospectus. The placement agent is not purchasing or selling any of the securities we are offering and the placement agent is not

required to arrange the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay to the placement

agent the placement agent fees set forth in the table below, which assumes that we sell all of the securities offered by this prospectus.

Since we will deliver the securities to be issued in this offering upon our receipt of investor funds, there is no arrangement for funds

to be received in escrow, trust or similar arrangement. There is no minimum offering requirement as a condition of closing of this offering.

Because there is no minimum offering amount required as a condition to closing this offering, we may sell fewer than all of the securities

offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive

a refund in the event that we do not sell an amount of securities sufficient to pursue our business goals described in this prospectus.

In addition, because there is no escrow account and no minimum offering amount, investors could be in a position where they have invested

in our company, but we are unable to fulfill all of our contemplated objectives due to a lack of interest in this offering. Further,

any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we

would be able to use such funds to effectively implement our business plan. See the section entitled “Risk Factors” for more

information. We will bear all costs associated with the offering. See “Plan of Distribution” on page 19 of this prospectus

for more information regarding these arrangements.

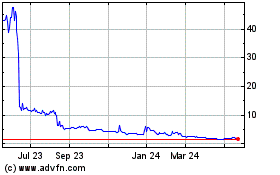

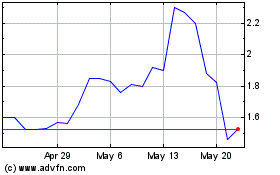

Our

common stock is listed on Nasdaq under the symbol “BBLG.” The last reported sale price of our common stock on Nasdaq on

March 1, 2024 was $2.43. There is no established trading market for the pre-funded warrants or the warrants and we do not expect

an active market to develop. In addition, we do not intend to list the pre-funded warrants or the warrants on any national securities

exchange or other trading market. Without an active trading market, the liquidity of these securities will be limited.

| | |

Per Share and Accompanying Warrant | | |

Per Pre-

Funded

Warrant and

Accompanying

Warrant | | |

Total | |

| Public offering price | |

$ | 2.56 | | |

$ | 2.559 | | |

$ | 1,999,340.31 | |

| Placement Agent fees(1) | |

$ | 0.1792 | | |

$ | 0.1792 | | |

$ | 140,000.18 | |

| Proceeds to us (before expenses)(2) | |

$ | 2.3808 | | |

$ | 2.3798 | | |

$ | 1,859,340.13 | |

| (1) |

We

have agreed to pay the placement agent a cash fee equal to 7.0%. We have also agreed to pay the placement agent a management fee

of 1.0% of the aggregate gross proceeds raised in this offering and to reimburse the placement agent for certain of its offering

related expenses, including reimbursement for non-accountable expenses in an amount up to $10,000, legal fees and expenses

in the amount of up to $100,000, and for its clearing expenses in the amount of $15,950. In addition, we have agreed to issue the

placement agent or its designees warrants to purchase a number of shares of common stock equal to 6.0% of the shares of common stock

sold in this offering (including the shares of common stock issuable upon the exercise of the pre-funded warrants), at an exercise

price of $3.20 per share, which represents 125% of the public offering price per share and accompanying warrant. For a description

of compensation to be received by the placement agent, see “Plan of Distribution” for more information. |

| (2) |

Because

there is no minimum number of securities or amount of proceeds required as a condition to closing in this offering, the actual public

offering amount, placement agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than

the total maximum offering amounts set forth above. For more information, see “Plan of Distribution.” |

You

should read this prospectus, together with additional information described under the headings “Information Incorporated by

Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing

in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 9 of this prospectus

and in the documents incorporated by reference into this prospectus for a discussion of risks that should be considered in connection

with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery

of the securities offered hereby is expected to be made on or about March 6, 2024, subject to satisfaction of customary closing

conditions.

H.C.

Wainwright & Co.

The

date of this prospectus is March 4, 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

We incorporate by reference important information

into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under “Where

You Can Find More Information.” You should carefully read this prospectus as well as additional information described under “Information

Incorporated by Reference,” before deciding to invest in our securities.

We

have not, and the placement agent has not, authorized anyone to provide you with additional information or information different from

that contained in this prospectus or from that contained or incorporated by reference in this prospectus filed with the Securities

and Exchange Commission (the “SEC”). We do not, and the placement agent and its affiliates do not, take any responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell,

and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The information contained in this

prospectus, or any document incorporated by reference in this prospectus, is accurate only as of its date, regardless of the time

of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects

may have changed since that date.

This

prospectus and the information incorporated by reference in this prospectus contain estimates and other statistical data made by independent parties and by us relating to market size and growth

and other data about our industry. We obtained the industry and market data in this prospectus from our own research as well as from

industry and general publications, surveys and studies conducted by third parties. This data involves a number of assumptions and limitations

and contains projections and estimates of the future performance of the industries in which we operate that are subject to a high degree

of uncertainty, including those discussed in “Risk Factors.” We caution you not to give undue weight to such projections,

assumptions and estimates. Further, industry and general publications, studies and surveys generally state that they have been obtained

from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe

that these publications, studies and surveys are reliable, we have not independently verified the data contained in them. In addition,

while we believe that the results and estimates from our internal research are reliable, such results and estimates have not been verified

by any independent source.

Neither

we nor the placement agent have done anything that would permit this offering or the possession or distribution of this prospectus in

any jurisdiction where action for those purposes is required, other than in the United States. Persons outside the United States who

come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities

and the distribution of this prospectus outside of the United States.

CAUTIONARY

NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference herein contain forward-looking statements that involve risks and uncertainties.

You should not place undue reliance on these forward-looking statements. All statements other than statements of historical fact contained

in this prospectus and the documents incorporated by reference herein are forward-looking statements and are only predictions.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial

trends that we believe may affect our business, financial condition and results of operations. In some cases, you can identify these

forward-looking statements by terms such as “anticipate,” “believe,” “continue,” “could,”

“depend,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,”

“potential,” “predict,” “project,” “should,” “will,” “would”

or the negative of those terms or other similar expressions, although not all forward-looking statements contain those words. We have

based these forward-looking statements on our current expectations and projections about future events and trends that we believe may

affect our financial condition, results of operations, strategy, short- and long-term business operations and objectives, and financial

needs. These forward-looking statements include, but are not limited to, statements concerning the following:

| |

● |

our

ability to maintain compliance with the Nasdaq listing standards and remain listed on Nasdaq; |

| |

● |

our

projected financial position and estimated cash burn rate; |

| |

● |

our

estimates regarding expenses, future revenues and capital requirements; |

| |

● |

our

ability to continue as a going concern; |

| |

● |

our

need to raise substantial additional capital to fund our operations; |

| |

● |

the

success, cost and timing of our clinical trials; |

| |

● |

our

dependence on third parties in the conduct of our clinical trials; |

| |

● |

our

ability to obtain the necessary regulatory approvals to market and commercialize our product candidates; |

| |

● |

the

ultimate impact of health pandemics or epidemics on our business, our clinical trials, our research programs, healthcare systems

or the global economy as a whole; |

| |

● |

the

potential that results of preclinical and clinical trials indicate our current product candidate or any future product candidates

we may seek to develop are unsafe or ineffective; |

| |

● |

the

results of market research conducted by us or others; |

| |

● |

our

ability to obtain and maintain intellectual property protection for our current product candidates; |

| |

● |

our

ability to protect our intellectual property rights and the potential for us to incur substantial costs from lawsuits to enforce

or protect our intellectual property rights; |

| |

● |

the

possibility that a third party may claim we or our third-party licensors have infringed, misappropriated or otherwise violated their

intellectual property rights and that we may incur substantial costs and be required to devote substantial time defending against

claims against us; |

| |

● |

our

reliance on third-party suppliers and manufacturers; |

| |

● |

the

success of competing therapies and products that are or become available; |

| |

● |

our

ability to expand our organization to accommodate potential growth and our ability to retain and attract key personnel; |

| |

● |

the

potential for us to incur substantial costs resulting from product liability lawsuits against us and the potential for these product

liability lawsuits to cause us to limit our commercialization of our product candidate; |

| |

● |

market

acceptance of our product candidate, the size and growth of the potential markets for our current product candidate and any future

product candidates we may seek to develop, and our ability to serve those markets; |

| |

● |

the

successful development of our commercialization capabilities, including sales and marketing capabilities; |

| |

● |

our

expectation regarding the number of shares outstanding after this offering; |

| |

● |

our

intention to use the net proceeds of this offering to fund clinical trials, maintain and extend our patent portfolio, and for working

capital and other general corporate purposes; and |

| |

● |

pending

the intended uses described herein, our intention to invest the net proceeds of this offering in short-term, investment grade, interest-bearing

securities. |

These

forward-looking statements are subject to a number of risks, uncertainties and assumptions, including the successful development and

commercialization of our product candidates, market acceptance of our product candidates, our financial performance, including our ability

to fund operations, our ability to maintain compliance with Nasdaq’s continued listing requirements, regulatory approval and regulation

of our product candidates, our expected use of proceeds from this offering, and other factors and risks identified from time to time

in our filings with the SEC, including this prospectus and those described in “Risk Factors.” Moreover, we operate in a very

competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all

risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks,

uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results

could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You

should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events

and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, except as required by law, neither

we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation

to update publicly any forward-looking statements for any reason after the date of this prospectus to conform these statements to actual

results or to changes in our expectations.

You

should read this prospectus and the documents that we reference and that are incorporated by reference in this prospectus and

have filed with the SEC as exhibits to the registration statement of which this prospectus is a part with the understanding that our

actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

Risk

Factors Summary

The

following factors are among the principal factors that make in an investment in this offering speculative or risky. For a more detailed

description of the risks material to our business, see “Risk Factors” beginning on page 9. The following summary should not

be considered an exhaustive summary of the material risks we face and should be read in conjunction with the “Risk Factors”

section and the other information in this prospectus and under similar headings in the other documents that are incorporated by reference

into this prospectus including documents that are filed after the date hereof. These factors include:

| ● | Our

recurring operating losses have raised substantial doubt regarding our ability to continue

as a going concern. |

| | ● | Future

sales and issuance of our common stock or equity-linked securities could result in additional

dilution of the percentage ownership of our stockholder and could cause our share price to

fall. |

| ● | There

is not expected to be an active trading market for the warrants in this offering, and warrant

holders have no rights as stockholders. |

| ● | Our

management will have broad discretion over the use of the proceeds we receive in this offering. |

| ● | We

may be unable to comply with the continued listing standards of Nasdaq. |

| ● | Our

Chief Executive Officer and Chief Financial Officer have contractual rights to participate

in future financings. |

| ● | We

have a limited operating history. |

| ● | We

will require substantial capital to complete studies of our product candidates and, if possible,

achieve FDA approval for the products. |

| ● | Our

product candidates are at an early stage of development and may not be successfully developed

or commercialized. |

| ● | FDA

regulation is costly and time consuming, which may delay or prevent us from commercializing

our product candidates. |

| ● | Our

product candidates may cause unacceptable adverse events. |

| ● | Suspensions

or delays in commencing and completing clinical testing could increase our costs and delay

or prevent us from commercializing our product candidates. |

| ● | We

have limited resources to pursue product candidates and indications. |

| ● | We

may have difficulty recruiting patients for our clinical trials. |

| ● | Any

success in preclinical studies and early clinical trials does not predict the success of

later trials; our product candidates may not have favorable results or receive regulatory

approval. |

| ● | We

may be unable to obtain regulatory approval in non-U.S. jurisdictions. |

| ● | We

may be unable to retain or recruit necessary personnel to advance the development of our

product candidates. |

| ● | We

rely on third parties to supply raw materials for our product candidates and to conduct our

preclinical and clinical trials. |

| ● | We

must comply with our obligations under license agreements or risk losing rights that are

important to our business. |

| ● | We

rely on patents and other intellectual property to protect some of our product candidates. |

| ● | We

could be subject to substantial costs in legal proceedings or other actions relating to intellectual

property rights. |

| ● | We

may not be able to obtain patent protection for our product candidates, or our intellectual

property may not be sufficient to protect our product candidates from competition. |

| ● | Our

commercial success depends upon attaining significant market acceptance of our lead product

candidate and future product candidates, if approved, among physicians, patients, healthcare

payors and treatment centers. |

| ● | Our

product candidates, if approved, may not be covered or adequately reimbursed by third-party

payors. |

| ● | Healthcare

legislative measures aimed at reducing healthcare costs may negatively impact our business. |

| ● | Our

future success depends on the performance and continued service of our officers and directors. |

| ● | We

face substantial competition, which may result in others discovering, developing or commercializing

products before or more successfully than we do. |

| ● | Product

liability lawsuits against us could cause us to incur substantial liabilities and to limit

commercialization of any products that we may develop. |

| ● | The

price of our common stock may fluctuate substantially. |

| ● | We

may be at risk of securities class action litigation. |

| ● | Market

and economic conditions may negatively impact our business, financial condition and share

price. |

| ● | We

do not intend to pay cash dividends on our shares of common stock. |

| ● | Our

governing documents and Delaware law have anti-takeover effects that could discourage, delay

or prevent a change in control. |

PROSPECTUS

SUMMARY

The

following summary highlights selected information contained or incorporated by reference in this prospectus and does not contain

all of the information that may be important to you and your investment decision. Before investing in our securities, you should carefully

read this entire prospectus, including our consolidated financial statements and the related notes and other documents incorporated

by reference herein, as well as the information under the caption “Risk Factors” herein and under similar headings

in the other documents that are incorporated by reference into this prospectus including documents that are filed after the date hereof.

Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Cautionary

Note Concerning Forward-Looking Statements.” In this prospectus, unless context requires otherwise, references to “we,”

“us,” “our,” “BBLG” “Bone Biologics,” or the “Company” refer to Bone Biologics

Corporation and its subsidiary on a consolidated basis.

Company

Overview

We

are a medical device company that is currently focused on bone regeneration in spinal fusion using the recombinant human protein known

as NELL-1. NELL-1 in combination with DBM, demineralized bone matrix, is an osteopromotive recombinant protein that provides target specific

control over bone regeneration. The NELL-1 technology platform has been licensed exclusively for worldwide applications to us through

a technology transfer from the UCLA Technology Development Group on behalf of UC Regents (“UCLA TDG”). UCLA TDG and the Company

received guidance from the Food and Drug Administration (“FDA”) that NELL-1/DBM will be classified as a device/drug combination

product that will require an FDA-approved pre-market approval application (“PMA”) before it can be commercialized in the

United States.

We

were founded by University of California professors in collaboration with an Osaka University professor and a University of Southern

California surgeon in 2004 as a privately-held company with proprietary, patented technology that has been validated in sheep and non-human

primate models to facilitate bone growth. We believe our platform technology has application in delivering improved outcomes in the surgical

specialties of spinal, orthopedic, general orthopedic, plastic reconstruction, neurosurgery, interventional radiology, and sports medicine.

Lead product development and clinical studies are targeted on spinal fusion surgery, one of the larger segments in the orthopedic market.

We

are a development stage entity. The production and marketing of our products and ongoing research and development activities are subject

to extensive regulation by numerous governmental authorities in the United States. Prior to marketing in the United States, any combination

product developed by us must undergo rigorous preclinical (animal) and clinical (human) testing and an extensive regulatory approval

process implemented by the FDA under the Federal Food, Drug, and Cosmetic Act. There can be no assurance that we will not encounter problems

in clinical trials that will cause us or the FDA to delay or suspend the clinical trials.

Our success will depend in part on our ability

to obtain patents and product license rights, maintain trade secrets, and operate without infringing on the proprietary rights of others,

both in the United States and other countries. There can be no assurance that patents issued to or licensed by us will not be challenged,

invalidated, rendered unenforceable, or circumvented, or that the rights granted thereunder will provide proprietary protection or competitive

advantages to us.

Product Candidates

We

have developed a stand-alone platform technology through significant laboratory and small and large animal research over more than ten

years to generate the current applications across broad fields of use.

The platform technology is our recombinant human protein, known as NELL-1, a proprietary skeletal specific growth factor which is a bone

void filler. NELL-1 provides regulation over skeletal tissue formation and stem cell differentiation during bone regeneration. We obtained

the platform technology pursuant to an exclusive license agreement with UCLA TDG which grants us exclusive rights to develop and commercialize

NELL-1 for spinal fusion by local administration, osteoporosis and trauma applications. A major challenge associated with orthopedic

surgery is effective bone regeneration, including challenges related to rapid, uncontrolled bone growth which can cause unsound structure;

cysts and less dense bone formation; unwanted bone formation, and swelling; and intense inflammatory response to current bone regeneration

compounds. We believe NELL-1 will address these unmet clinical challenges for effective bone regeneration, especially in hard healers.

We

are currently focused on bone regeneration in lumbar spinal fusion, in keeping with our exclusive license agreement, using NELL-1 in

combination with DBM, a demineralized bone matrix from Musculoskeletal Transplant Foundation (“MTF”). The NELL-1/DBM medical

device is a combination product which is an osteopromotive recombinant protein that provides target specific control over bone regeneration.

Leveraging the resources of investors and strategic partners, we have successfully surpassed four critical milestones:

| |

● |

Demonstrating

a successful small laboratory scale pilot run for the manufacturing of the recombinant NELL-1 protein in Chinese hamster ovary cells; |

| |

|

|

| |

● |

Validation

of protein dosing and efficacy in established large animal sheep models pilot study; |

| |

|

|

| |

● |

Completed

pivotal animal study; and |

| |

|

|

| |

● |

Initiated

a first-in-man pilot clinical trial in Australia. |

Our

lead product candidate is expected to be purified NELL-1 mixed with 510(k) cleared DBM Demineralized Bone Putty recommended for use in

conjunction with applicable hardware consistent with the indication. The NELL-1/DBM Fusion Device, NB1, will be comprised of a

single dose vial of NELL-1 recombinant protein freeze dried onto DBM. A vial of NELL-1/DBM will be sold in a convenience kit with a diluent

and a syringe of 510(k) cleared demineralized bone (“DBM Putty”) produced by MTF. A delivery device will allow the surgeon

to mix the reconstituted NELL-1 with the appropriate quantity of DBM Putty just prior to implantation.

The

NELL-1/DBM Fusion Device, NB1, is intended for use in lumbar spinal fusion and may have a variety of other spine and orthopedic

applications. While the product is initially targeted at the lumbar spine fusion market, in keeping with our exclusive license agreement,

we believe NELL-1’s novel set of characteristics, target specific mechanism of action, efficacy, safety and affordability position

the product well for application in a variety of procedures including:

| |

Spine

Implants. The global bone graft substitute market presents a $3 billion market opportunity. While use of the patient’s own bone, also referred

to as autograft, to enhance fusion of vertebral segments remains the optimal use for this

type of treatment, complications associated with use of autograft bone including pain, increased

surgical time and infection limit its use.

|

| |

Non-Union

Trauma Cases. While the majority of fractures heal without the need for osteosynthetic products, bone substitutes are used

in complicated breaks where the bone does not mend naturally. Globally an $8 billion market opportunity, management believes that

NELL-1 technology is expected to perform as well as other growth factors in this market. |

| |

|

| |

Osteoporosis.

Globally an $11.2 billion market opportunity, the medical need to find a solution to counter a decrease in bone mass and density

seen in women most frequently after menopause or a similar effect on astronauts in microgravity environments for an extended period

is a major medical challenge. The systemic use of NELL-1 to stimulate bone regeneration throughout the body thereby increasing bone

density could have a very significant impact on the treatment of osteoporosis. |

UCLA’s initial research was funded with

approximately $18 million in resources from UCLA TDG and government grants. Since licensing the exclusive worldwide intellectual property

rights from UCLA TDG, our continued development has been funded through capital raises. Our research and development expenses for the

years ended December 31, 2023 and 2022 were $6,907,824 and $1,579,298, respectively. We anticipate that we will require approximately

$5 million to complete first-in-man studies, and an estimated additional $24 million in scientific expenses to achieve FDA approval,

if possible, for a spine interbody fusion indication. These amounts are estimates based on data currently available to us, and are subject

to many factors including the various risk factors discussed in the section “Risk Factors” included in our Form 10-K

for the fiscal year ended December 31, 2023 (the “2023 Form 10-K”), which is incorporated herein by reference.

NELL-1’s powerful specific bone and cartilage

forming properties are derived from the ability of NELL-1 to only target cells that exhibit an activated “master switch”

to develop into bone or cartilage. NELL-1 is a function specific recombinant human protein that has been proven in laboratory bench models

to recapitulate normal human growth and development to provide control over bone and cartilage regeneration.

NELL-1 was isolated in 1996, and the first NELL-1

patent on bone regeneration was filed in 1999. Subsequent patents and continuations in part describing NELL-1 manufacturing, delivery,

and cartilage regeneration were filed to further strengthen the patent portfolio.

We

have completed two preclinical sheep studies that demonstrated our recombinant NELL-1 (“rhNELL-1”) growth factor effectively

promotes bone formation in a phylogenetically advanced spine model. In addition, rhNELL-1 was shown to be well tolerated and there were

no findings of inflammation. Our pivotal sheep study evaluated the effect of rhNELL-1 combined with DBM on lumbar interbody arthrodesis

in an adult ovine model and demonstrated a 37.5% increased frequency of fusion at 26 weeks from the control.

Our

first-in-man pilot clinical study commenced year-end 2023 and will evaluate the safety and effectiveness of NB1 in adult subjects with

spinal degenerative disc disease at one level from L2-S1, who may also have up to Grade 1 spondylolisthesis or Grade 1 retrolisthesis

at the involved level who undergo transforaminal lumbar interbody fusion. The multi-center, prospective, randomized trial consists of

30 patients in Australia, with the primary end-point being fusion success at 12 months and change from baseline in the Oswestry Disability

Index pain score. We expect completion of the trial 12 months following enrollment of the 30th patient. We intend to use the

pilot clinical trial data from Australia to enable a future larger U.S. pivotal clinical study, prior to submission of a PMA to the FDA.

Our

Business Strategy

Our

business plan is to develop our target-specific growth factor for bone regeneration, based on preclinical and clinical data that has

demonstrated increases in the quantity and quality of bone, and a strong safety profile. Our initial focus on lumbar spinal fusion entails

advancing our target-specific growth factor through clinical studies to achieve FDA approval with comparable efficacy and safety to the

gold standard for spine fusion (autografts). Continued capital funding is critical to facilitate the development of our Nell-1 technology

through the clinical regulatory path.

Intellectual

Property Risks

Our

patent portfolio currently consists of nine patents which expire between 2024 and 2033. We intend to expand our portfolio through

composition of matter, methods of use and methods of production patent applications, as the opportunity arises through the development

of our platform technology. Our success will depend in part on our ability to obtain patents and product license rights, maintain trade

secrets, and operate without infringing on the proprietary rights of others, both in the United States and other countries. There can

be no assurance that patents issued to or licensed by us will not be challenged, invalidated, rendered unenforceable, or circumvented,

or that the rights granted thereunder will provide proprietary protection or competitive advantages to us. The patent positions of medical

device companies are uncertain and involve complex legal and factual questions. We may incur significant expenses in protecting our intellectual

property and defending or assessing claims with respect to intellectual property owned by others. See “Risk Factors” on page

9 and other information included or incorporated by reference in this prospectus for a discussion of intellectual property risks

to consider carefully before deciding to invest in our securities.

Our Management Team

We have two full-time employees. Jeffrey Frelick

has served as our President and Chief Executive Officer since June 2019 and brings more than 25 years of leadership, operational, and

investment experience in the life science industry. Deina Walsh has served as our Chief Financial Officer since November 2014.

Mr. Frelick previously served as our Chief Operating

Officer from 2015 to June 2019. Prior to this Mr. Frelick spent 15 years on Wall Street as a sell-side analyst following the med-tech

industry at investment banks Canaccord Genuity, ThinkEquity and Lazard. He also previously worked at Boston Biomedical Consultants where

he provided strategic planning assistance, market research data and due diligence for diagnostic companies. He began his career at Becton

Dickinson in sales and sales management positions after gaining technical experience as a laboratory technologist with Clinical Pathology

Facility. Mr. Frelick received a B.S. in Biology from University of Pittsburgh and an M.B.A. from Suffolk University’s Sawyer Business

School.

Ms. Walsh is a certified public accountant and

owner/founder of DHW CPA, PLLC, a Public Company Accounting Oversight Board (PCAOB) registered firm since 2014. Prior to forming her

firm, Ms. Walsh spent 13 years at a public accounting firm where, as a partner, she was actively responsible for leading firm audit engagements

of publicly held entities in accordance with PCAOB standards and compliance with SEC regulations, including internal control requirements

under Section 404 of the Sarbanes-Oxley Act. Ms. Walsh had a global client base including entities throughout the United States, Canada

and China. These entities encompass a diverse range of industries including manufacturing, wholesale, life sciences, pharmaceuticals,

and technology. Her experience includes work with start-up companies and well-established operating entities. She has assisted many entities

seeking debt and equity capital. Areas of specialty include mergers, acquisitions, reverse mergers, consolidations, complex equity structures,

foreign currency translations and revenue recognition complexities. Ms. Walsh has an Associates of Science Degree in Business Administration

from Monroe Community College and a Bachelor of Science Degree in Accounting from the State University of New York at Brockport.

We have relied and plan on continuing to rely

on independent organizations, advisors and consultants to perform certain services for us, including handling substantially all aspects

of regulatory approval, clinical management, manufacturing, marketing, and sales. Such services may not always be available to us on

a timely basis or at costs that we can afford. We also have engaged and plan to continue to engage regulatory consultants to advise us

on our dealings with the FDA and other foreign regulatory authorities and have been and will be required to retain additional consultants

and employees.

Our future performance will depend in part on

our ability to successfully integrate newly hired officers into our management team, engage and retain consultants, and to develop an

effective working relationship with our management and consultants. Losing key personnel or failing to recruit necessary additional personnel

would impede our ability to attain our development objectives. Losing key personnel or failing to recruit necessary additional personnel

would impede our ability to attain our development objectives. See “Risk Factors” on page 9 and other information included

or incorporated by reference in this prospectus for a discussion of management risks to consider carefully before deciding to invest

in our securities.

Recent

Developments

November

2023 Offering

On

November 20, 2023 the Company sold and issued, in a registered direct offering (the “Registered Direct Offering”), 142,384

shares of common stock, at an offering price of $5.12 per share to certain institutional investors (the “Purchasers”) pursuant

to a securities purchase agreement (the “Purchase Agreement”). Pursuant to the Purchase Agreement, in a concurrent private

placement (together with the Registered Direct Offering, the “November Offering”), the Company issued to the Purchasers unregistered

warrants (the “November Warrants”) to purchase up to an aggregate of 142,384 shares of common stock, which represent 100%

of the shares of common stock issued and sold in the Registered Direct Offering. The November Warrants are exercisable at an exercise

price of $4.16 per share, were exercisable immediately upon issuance, and will expire five and one-half years from the date of issuance.

In addition, the Company issued the placement agent as compensation in connection with the November Offering, warrants (the “November

Placement Agent Warrants”) to purchase up to an aggregate of 8,543 shares of common stock (equal to 6.0% of the aggregate number

of shares sold in the Registered Direct Offering). The November Placement Agent Warrants have substantially the same terms and conditions

as the November Warrants, except that the November Placement Agent Warrants have a term of five years from the commencement of sales

in the November Offering and an exercise price of $6.40 per share.

Nasdaq

Panel Decision

On

September 27, 2023, the Company received a written notice from the Nasdaq notifying the Company that it was not in compliance with the

$1.00 per share minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) and that Nasdaq’s staff had determined

to delist the Company’s securities. On December 11, 2023, a Nasdaq Hearings Panel granted the Company’s request for continued

listing on Nasdaq subject to the Company demonstrating compliance with the minimum bid price requirement prior to January 12, 2024. The

Company received notice from Nasdaq on January 9, 2024 that it had regained compliance with the minimum bid price requirement. The Company

will remain under a Nasdaq discretionary panel monitor until June 28, 2024.

Litigation

Update

On

January 10, 2024 we entered into a Settlement Agreement and Mutual General Release (the “Agreement”) with Drs. Bessie

(Chia) Soo and Kang (Eric) Ting, on the one hand (the “plaintiffs”), and the Company and Stephen LaNeve on the other

hand (together with the Company, the “defendants”), in settlement of the claims for breach of contract and tortious

interference with contract against the defendants filed in the United States District Court for the District of Massachusetts (the

“Court”). The Agreement is effective as of January 9, 2024. We had certain indemnification obligations to Mr. LaNeve

arising out of actions taken in connection with his service to the Company. Under the Agreement, the Company agreed to pay the

plaintiffs $750,000, and on February 7, 2024, the Company paid $414,989, and the Company’s insurance carrier paid $335,011 for

the total settlement. The parties to the Agreement filed a joint stipulation to dismiss the action with prejudice with the

Court.

Going

Concern

We

have a history of operating losses since inception and expect to incur additional near-term losses. As discussed further in “Management’s

Discussion and Analysis - Liquidity and Capital Resources,” included in our 2023 Form 10-K, which is incorporated herein

by reference, our independent registered public accounting firm, in its audit report to the financial statements included in our

Annual Report on Form 10-K for the year ended December 31, 2023, expressed substantial doubt about our ability to continue as

a going concern. Our consolidated financial statements do not include any adjustments that may result from the outcome of this uncertainty.

Following this offering, we will need to raise additional capital to fund our operations and continue to support our planned development

and commercialization activities. If we cannot secure the financing needed to continue as a viable business, our stockholders may lose

some or all of their investment in us.

Corporate

Information

We

were incorporated under the laws of the State of Delaware on October 18, 2007 as AFH Acquisition X, Inc. Pursuant to a Merger Agreement,

dated September 19, 2014, by and among the Company, its wholly-owned subsidiary, Bone Biologics Acquisition Corp., a Delaware corporation

(“Merger Sub”), and Bone Biologics, Inc., Merger Sub merged with and into Bone Biologics Inc., with Bone Biologics Inc. remaining

as the surviving corporation in the merger. Upon the consummation of the merger, the separate existence of Merger Sub ceased. On September

22, 2014, the Company officially changed its name to “Bone Biologics Corporation” to more accurately reflect the nature of

its business and Bone Biologics, Inc. became a wholly owned subsidiary of the Company. Bone Biologics, Inc. was incorporated in California

on September 9, 2004.

Our

principal executive offices are located at 2 Burlington Woods Drive, Suite 100, Burlington MA 01803 and our telephone number is (781)

552-4452. Our website address is www.bonebiologics.com. The information contained on our website is not incorporated by reference into

this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this

prospectus or in deciding whether to invest in our securities.

THE

OFFERING

The

following summary contains basic information about this offering. The summary is not intended to be complete. You should read the full

text and more specific details contained elsewhere in this prospectus.

| Common

Stock Offered |

|

119,000

shares. |

| |

|

|

| Pre-Funded

Warrants Offered |

|

We

are also offering to those investors, whose purchase of shares of our common stock in this offering would result in such investor,

together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the investor,

9.99%) of our outstanding common stock following the consummation of this offering, the opportunity to purchase, in lieu of the common

stock that would otherwise result in the investor’s beneficial ownership exceeding 4.99% (or, at the election of the investor,

9.99%), 662,251 pre-funded warrants to purchase 662,251 shares of common stock, at an exercise price of $0.001 per share,

which we refer to as the “pre-funded warrants.” Each pre-funded warrant will be exercisable upon issuance and may

be exercised at any time until all of the pre-funded warrants are exercised in full. Each pre-funded warrant is being sold together

with one warrant to purchase one share of common stock. The public offering price for each pre-funded warrant and the accompanying

warrant is equal to the price per share of common stock and the accompanying warrant being sold to the public in this offering, minus

$0.001. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the pre-funded warrants. See

“Description of Securities – Pre-Funded Warrants” for additional information. |

| |

|

|

| Warrants

Offered |

|

Each

share of common stock or pre-funded warrant is being offered together with one warrant to

purchase one share of common stock. The warrants will have an exercise price of $2.43

per share and will be exercisable upon issuance (the “Initial Exercise Date”).

The warrants will expire on the five-year anniversary of the Initial Exercise Date. Each

holder of warrants will be prohibited from exercising its warrant for shares of our common

stock if, as a result of such exercise, the holder, together with its affiliates, would own

more than 4.99% of the total number of shares of our common stock then issued and outstanding.

However, any holder may increase such percentage to any other percentage not in excess of

9.99%. This offering also relates to the offering of the shares of common stock issuable

upon the exercise of the warrants. For more information regarding the warrants, you should

carefully read the section titled “Description of Securities — Warrants”

in this prospectus.

|

| Placement

Agent Warrants |

|

We

have agreed to issue to the placement agent or its designees warrants, or the placement agent warrants, to purchase up to 6.0% of

the shares of common stock sold in this offering (including the shares of common stock issuable upon the exercise of the pre-funded

warrants), at an exercise price of $3.20 per share, which represents 125% of the public offering price per share and accompanying

warrant. For a description of the compensation to be received by the placement agent, see “Plan of Distribution” for

more information. |

| |

|

|

Common

Stock Outstanding Prior

to

This Offering |

|

534,238

shares. |

| |

|

|

| Common

Stock to be Outstanding After this Offering |

|

1,315,489

shares (assuming full exercise of the

pre-funded warrants and no exercise of the warrants offered hereby). |

| |

|

|

| Use

of Proceeds |

|

We

estimate that the net proceeds of this offering assuming no exercise of the warrants, after deducting placement agent fees and estimated

offering expenses, will be approximately $1.5 million, assuming full exercise of the pre-funded warrants and

assuming no exercise of the warrants. We intend to use all of the net proceeds we receive from this offering to fund clinical trials,

maintain and extend our patent portfolio, and for working capital and other general corporate purposes. See “Use of Proceeds.” |

| |

|

|

| Lock-up

Agreements |

|

Our

executive officers and directors have agreed with the placement agent not to sell, transfer or dispose of any shares or similar securities

for a period of 60 days after the date of this prospectus. For additional information regarding our arrangement with the

placement agent, please see “Plan of Distribution.” |

| Nasdaq

Trading Symbol |

|

Our

common stock is listed on the Nasdaq Capital Market under the symbol “BBLG.” We do not intend to list the pre-funded

warrants or warrants offered hereunder on any stock exchange. Without an active trading market, the liquidity of the pre-funded warrants

and warrants will be limited. |

| |

|

|

| Risk

Factors |

|

See

“Risk Factors” on page 9 and other information included or incorporated by reference in this prospectus for a discussion of factors to consider carefully before deciding to invest in our securities. |

The

discussion above is based on 534,238 shares of our common stock outstanding as of March 4, 2024, and excludes as of such date

the following:

| |

● |

74,151

shares of common

stock issuable upon exercise of stock options outstanding at a weighted average exercise price of $107.65 per share. |

| |

|

|

| |

● |

197,844

shares of common

stock issuable upon exercise of outstanding common stock warrants with a weighted average exercise price of $127.86

per share. |

| |

|

|

| |

● |

555,338

shares of common

stock reserved for future grants pursuant to the Bone Biologics Corporation 2015 Equity Incentive Plan (the “2015 Equity Incentive

Plan”). |

| |

|

|

| |

● |

781,251 shares of our common

stock issuable upon the exercise of warrants to be issued in this offering; and |

| |

|

|

| |

● |

46,875

shares of common stock issuable upon the exercise

of the placement agent warrants to be issued to the placement agent or its designees as compensation in connection with this offering

and pursuant to this prospectus. |

Unless

expressly indicated or the context requires otherwise, all information in this prospectus assumes (i) we issue no pre-funded warrants

and (ii) no exercise of the warrants offered hereby.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. You should carefully consider all of the information contained in this prospectus

and other information which may be incorporated by reference in this prospectus as provided under “Information Incorporated by

Reference.” In particular, you should carefully consider the risks described below and elsewhere in this prospectus, which

could materially and adversely affect our business, results of operations or financial condition, together with those under the heading

“Risk Factors” in our most recent Annual Report on Form 10-K, which is incorporated by reference into this prospectus, as

those risk factors are amended or supplemented by our subsequent filings with the SEC. These risks and uncertainties are not the

only risks and uncertainties we face. Additional risks and uncertainties not currently known to us, or that we currently view as immaterial,

may also impair our business. If any of the risks or uncertainties described below or in our SEC filings or any additional risks

and uncertainties actually occur, our business, financial condition, results of operations and cash flow could be materially and adversely

affected. As a result, you could lose all or part of your investment.

Risks

Related to This Offering and Ownership of our Securities

Our

recurring operating losses have raised substantial doubt regarding our ability to continue as a going concern.

Our

recurring operating losses raise substantial doubt about our ability to continue as a going concern. During the year ended December 31,

2023, we incurred a net loss of $8.9 million, and used net cash in operating activities of $9.6 million. Our available

cash is expected to fund our operations through the second quarter of 2024. These factors raise substantial doubt about the Company’s

ability to continue as a going concern within a reasonable period of time, which is considered to be one year from the issuance date

of these financial statements. In addition, our independent registered public accounting firm, in its audit report to the financial statements

included in our Annual Report on Form 10-K for the year ended December 31, 2023, expressed substantial doubt about our ability

to continue as a going concern. Our financial statements incorporated by reference into this prospectus do not include any adjustments

that might result if we are unable to continue as a going concern and, therefore, be required to realize our assets and discharge our

liabilities other than in the normal course of business which could cause investors to suffer the loss of all or a substantial portion

of their investment. In order to have sufficient cash and cash equivalents to fund our operations in the future, we will need to raise

additional equity or debt capital and cannot provide any assurance that we will be successful in doing so. The perception of our ability

to continue as a going concern may make it more difficult for us to obtain financing for the continuation of our operations and could

result in the loss of confidence by investors, suppliers and employees.

The price of our

common stock and public warrants may fluctuate substantially.

You should consider an

investment in our common stock to be risky. Some factors that may cause the market price of our common stock to fluctuate, in addition

to the other risks mentioned in this “Risk Factors” section are:

| |

● |

our ability to meet

the Nasdaq listing requirements; |

| |

● |

volatility and limitations

in trading volumes of our shares of common stock; |

| |

● |

our ability to obtain

financing to conduct and complete research and development activities including, but not limited to, our clinical trials, and other

business activities; |

| |

● |

the timing and success

of our clinical trials and introduction of products to the market; |

| |

● |

changes in the development

status of our product candidate; |

| |

● |

any delays or adverse

developments or perceived adverse developments with respect to the FDA’s review of our planned preclinical and clinical trials; |

| |

● |

safety concerns related

to the use of our product candidate; |

| |

● |

changes in our capital

structure or dividend policy, future issuances of securities, sales of large blocks of common stock by our stockholders; |

| |

● |

our cash position; |

| |

● |

announcements and events

surrounding financing efforts, including debt and equity securities; |

| |

● |

changes in general economic,

political and market conditions in or any of the regions in which we conduct our business; |

| |

● |

analyst research reports,

recommendation and changes in recommendations, price targets, and withdrawals of coverage; |

| |

● |

departures and additions

of key personnel; |

| |

● |

disputes and litigation; |

| |

● |

changes in applicable

laws, rules, regulations, or accounting practices and other dynamics; and |

| |

● |

other events or factors,

many of which may be out of our control. |

In addition, if the market

for stock in our industry or industries related to our industry, or the stock market in general, experiences a loss of investor confidence,

the trading price of our common stock could decline for reasons unrelated to our business, financial condition and results of operations.

If any of the foregoing occurs, it could cause our stock price to fall and may expose us to lawsuits that, even if unsuccessful, could

be costly to defend and a distraction to management.

Future

sales and issuances of our common stock or equity-linked securities could result in additional dilution of the percentage ownership

of our stockholders and could cause our share price to fall.

Following

this offering we expect that significant additional capital will be needed in the future to continue our planned operations, including

increased marketing, hiring new personnel, commercializing our product, and continuing activities as an operating public company. To

the extent we raise additional capital by issuing common stock, or securities convertible into or exchangeable or exercisable for

shares of common stock, our stockholders, including investors who purchase shares of common stock or pre-funded warrants in this

offering, may experience substantial dilution. We may sell common stock, convertible securities or other equity securities in one

or more transactions at prices and in a manner we determine from time to time. We cannot assure you that we will be able to sell shares

or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors

in this offering. If we sell common stock, convertible securities or other equity securities in more than one transaction, investors

may be materially diluted by subsequent sales. Such sales may also result in material dilution to our stockholders, and new investors

could gain rights superior to our existing stockholders, including investors who purchase shares of common stock or pre-funded warrants

in this offering. Moreover, the perceived risk of this potential dilution could cause stockholders to attempt to sell their shares

and investors to short our common stock. These sales also may result in downward pressure on the price of our common stock and

make it more difficult for us to sell equity or equity-related securities in the future at a time and price that we deem reasonable or

appropriate, and may cause you to lose the value of your investment.

The

warrants are speculative in nature.

The

warrants do not confer any rights of common stock ownership on their holders, such as voting rights or the right to receive dividends,

but rather merely represent the right to acquire shares of common stock at a fixed price for a limited time. Moreover, following this

offering the market value of the warrants, if any, will be uncertain and there can be no assurance that the market value of the warrants

will equal or exceed their imputed offering price. The warrants will not be listed or quoted for trading on any market or exchange. There

can be no assurance that the market price of our common stock will ever equal or exceed the exercise price of the warrants, and consequently,

the warrants may expire valueless.

There

is no public market for the pre-funded warrants or warrants offered by us.

There

is no established public trading market for the pre-funded warrants or warrants and we do not expect such a market to develop. In addition,

we do not intend to apply to list the pre-funded warrants or warrants on any national securities exchange or other nationally recognized

trading system. Without an active trading market, the liquidity of the pre-funded warrants and warrants will be limited.

Holders

of the warrants and pre-funded warrants will have no rights as common stockholders until they acquire our common stock.

Until

holders of the warrants or pre-funded warrants acquire shares of our common stock upon exercise of the warrants or pre-funded warrants,

the holders will have no rights with respect to shares of our common stock issuable upon exercise of the warrants or pre-funded warrants.

Upon exercise of the warrants or pre-funded warrants, the holder will be entitled to exercise the rights of a common stockholder as to

the security exercised only as to matters for which the record date occurs after the exercise.

Our

management will have broad discretion over the use of the proceeds we receive in this offering and might not apply the proceeds in ways

that increase the value of your investment.

Our

management will have broad discretion in the application of the net proceeds from this public offering, including for any of the currently

intended purposes described in the section entitled “Use of Proceeds.” Because of the number and variability of factors that

will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended

use. Our management may not apply our cash from this offering in ways that ultimately increase the value of any investment in our securities

or enhance stockholder value. The failure by our management to apply these funds effectively could harm our business. Pending their use,

we may invest the net proceeds from this offering in short-term, investment-grade, interest-bearing securities. These investments may

not yield a favorable return to our stockholders. If we do not invest or apply our cash in ways that enhance stockholder value, we may

fail to achieve expected financial results, which may result in a decline in the price of our shares of common stock, and, therefore,

may negatively impact our ability to raise capital, invest in or expand our business, acquire additional products or licenses, commercialize

our product, or continue our operations.

Purchasers

who purchase our securities in this offering pursuant to a securities purchase agreement may have rights not available to purchasers

that purchase without the benefit of a securities purchase agreement.

In

addition to rights and remedies available to all purchasers in this offering under federal securities and state law, the purchasers that

enter into a securities purchase agreement will also be able to bring claims of breach of contract against us. The ability to pursue

a claim for breach of contract provides those investors with the means to enforce the covenants uniquely available to them under the

securities purchase agreement including: (i) timely delivery of shares; (ii) agreement to not enter into variable rate financings for

one year from closing, subject to certain exceptions; (iii) agreement to not enter into any financings for 60 days from closing;

and (iv) indemnification for breach of contract.

This

is a best efforts offering, with no minimum amount of securities is required to be sold, and we may not raise the amount of capital we

believe is required for our business plans, including our near-term business plans.

The

placement agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The placement

agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar

amount of the securities. There is no required minimum number of securities that must be sold as a condition to completion of this offering.

Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, placement

agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth above.

We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and

investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to support our

continued operations, including our near-term continued operations. Thus, we may not raise the amount of capital we believe is required

for our operations in the short-term and may need to raise additional funds, which may not be available or available on terms acceptable

to us.

Because

there is no minimum required for the offering to close, investors in this offering will not receive a refund in the event that we do

not sell an amount of securities sufficient to pursue the business goals outlined in this prospectus.

We

have not specified a minimum offering amount nor have or will we establish an escrow account in connection with this offering. Because

there is no escrow account and no minimum offering amount, investors could be in a position where they have invested in our company,

but we are unable to fulfill our objectives due to a lack of interest in this offering. Further, because there is no escrow account in

operation and no minimum investment amount, any proceeds from the sale of securities offered by us will be available for our immediate

use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. Investor funds

will not be returned under any circumstances whether during or after the offering.

There

can be no assurance that we will be able to comply with the continued listing standards of Nasdaq, a failure of which could result in

a delisting of our common stock and certain warrants.

Nasdaq

requires that the trading price of listed stock remain above $1.00 in order for the stock to remain listed. If a listed stock trades

below $1.00 for more than 30 consecutive trading days, then it is subject to delisting from the Nasdaq. In addition, to maintain a listing

on Nasdaq, we must satisfy minimum financial and other continued listing standards, including those regarding minimum stockholders’

equity, minimum publicly available shares, director independence and independent committee requirements and other corporate governance

requirements. We recently regained compliance with Nasdaq’s listing standards, and Nasdaq will continue to monitor our compliance

with its requirements including through a Nasdaq discretionary panel monitor until June 28, 2024. If we are unable to satisfy these standards,

we could be subject to delisting, which would have a negative effect on the price of our common stock, impair your ability to sell or

purchase our common stock or warrants when you wish to do so, and potentially cause you to lose the value of your investment in us. In

the event of a delisting, we would expect to take actions to restore our compliance with the listing standards, but we can provide no

assurance that any action we take to restore our compliance would allow our common stock to become listed again, stabilize the market

price or improve the liquidity of our common stock, prevent our common stock from dropping below the minimum bid price requirement, or

prevent future noncompliance with the listing requirements.

If

the Company is delisted from Nasdaq, its common stock may be eligible for trading on an over-the-counter market. If the Company is not

able to obtain a listing on another stock exchange or quotation service for its common stock, it may be extremely difficult or impossible

for stockholders to sell their shares of common stock. Moreover, if the Company is delisted from Nasdaq, but obtains a substitute listing

for its common stock, it will likely be on a market with less liquidity, and therefore experience potentially more price volatility than

experienced on Nasdaq. Stockholders may not be able to sell their shares of common stock on any such substitute market in the quantities,

at the times, or at the prices that could potentially be available on a more liquid trading market. As a result of these factors, if

the Company’s common stock is delisted from Nasdaq, the value and liquidity of the Company’s common stock would likely be

significantly adversely affected. A delisting of the Company’s common stock from Nasdaq could also adversely affect the Company’s

ability to obtain financing for its operations and/or result in a loss of confidence by investors, employees and/or business partners.

We do not intend

to pay cash dividends on our shares of common stock so any returns will be limited to the value of our shares.

We currently anticipate

that we will retain future earnings, if any, for the development, operation and expansion of our business and do not anticipate declaring

or paying any cash dividends for the foreseeable future. Any return to stockholders will therefore be limited to the increase, if any,

of our share price.

The

right of our President and Chief Executive Officer and Chief Financial Officer to participate in future financings of ours could impair

our ability to raise capital.

Jeffrey

Frelick, our President and Chief Executive Officer, and Deina Walsh, our Chief Financial Officer, hold contractual preemptive rights

which allow them to participate, at their option, in all future financings up to an amount necessary to maintain their percentage interest

in our common stock. The existence of such preemptive rights, or the exercise of such rights, may deter potential investors from providing

us needed financing, or may deter investment banks from working with us. This may have a material adverse effect on our ability to raise

capital which, in turn, could have a material adverse effect on our business prospects.

If

our shares of common stock become subject to the penny stock rules, it would become more difficult to trade our shares.

The

SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally

equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or authorized

for quotation on certain automated quotation systems, provided that current price and volume information with respect to transactions

in such securities is provided by the exchange or system. If we do not retain a listing on Nasdaq and if the price of our common stock

is less than $5.00, our common stock will be deemed a penny stock. The penny stock rules require a broker-dealer, before a transaction

in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document containing specified information.

In addition, the penny stock rules require that before effecting any transaction in a penny stock not otherwise exempt from those rules,

a broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive

(i) the purchaser’s written acknowledgment of the receipt of a risk disclosure statement; (ii) a written agreement to transactions

involving penny stocks; and (iii) a signed and dated copy of a written suitability statement. These disclosure requirements may have

the effect of reducing the trading activity in the secondary market for our common stock, and therefore stockholders may have difficulty

selling their shares.

Risks

Relating to Our Financial Position and Capital Needs

Our

limited operating history makes it difficult to evaluate our current business and future prospects.

We

have a limited operating history, and there is a risk that we will be unable to continue as a going concern. We have minimal assets and

no significant financial resources. Our limited operating history makes it difficult to evaluate our current business model and future

prospects. Accordingly, you should consider our prospects in light of the costs, uncertainties, delays and difficulties frequently encountered

by companies in the early stages of development. Potential investors should carefully consider the risks and uncertainties that a company

with a limited operating history will face. In particular, potential investors should consider that there is a significant risk that

we will not be able to, among other things:

| |

● |

implement

or execute our current business plan, which may or may not be sound; |

| |

|

|

| |

● |

maintain

our anticipated management and advisory team; |

| |

|

|

| |

● |

raise

sufficient funds in the capital markets to effectuate our business plan; and |

| |

|

|

| |

● |

utilize

the funds that we do have and/or raise in the future to efficiently execute our business strategy. |

If

we cannot execute any one of the foregoing or similar matters relating to our business, the business may fail, in which case you would

lose the entire amount of your investment in us.

Our

long-term capital requirements are subject to numerous risks.

We