Blue Star Foods Reports $3.5 Million Revenue for First Half 2023 Ended June 30, 2023

22 August 2023 - 11:22PM

Blue Star Foods Corp., (“Blue Star,” the “Company,” “we,” “our” or

“us”) (NASDAQ:

BSFC), an

integrated Environmental, Social, and Governance (“ESG”)

sustainable seafood company with a focus on Recirculatory

Aquaculture Systems (“RAS”), announced unaudited financial and

operational results for the three and six months ended June 30,

2023.

Key Financial Highlights for the Three

Months Ended June

30,

2023

- Revenue of $1.7 million

- RAS revenues increased to $0.5 million

- Gross profit of $0.1 million

- Operating loss of $1.1 million

- Net loss of $1.5 million (included $0.4 million of non-cash

loss on settlement of stock, amortization of debt note and one-time

non-recurring expenses)

- Adjusted EBITDA loss of $0.7 million

- Inventory and RAS biomass of $3.2 million at June 30, 2023

Key Financial Highlights for the Six Months Ended June

30, 2023

- Revenue of $3.6 million

- RAS revenues increased to $1.1 million

- Gross profit of $0.4 million

- Operating loss of $2.0 million

- Net loss of $3.4 million (included $1.5 million of non-cash

loss on settlement of stock, amortization of debt note and one-time

non-recurring expenses)

- Adjusted EBITDA loss of $0.5 million

Business Highlights for the

Three Months Ended

June 30,

2023

- Regained compliance with NASDAQ minimum bid price

requirement

- Granted option to purchase land for RAS expansion in South

Carolina

- Strengthened balance sheet by paying off $5 million asset based

line of credit to zero

- Entered into a supply agreement for $1 million annually with

Bloomin’ Brands

- Included in two most prominent sustainability reporting

standards

- Ramped shipments to Just Food For Dogs under its supply

agreement for up to $4 million annually

Management Commentary

John Keeler, Chairman and CEO of Blue Star,

commented, “While our first half of 2023 revenue performance was

not as high as expected, we have taken necessary steps to reduce

our cash burn and improve the liabilities portion of our balance

sheet. We are pleased to report progress on the RAS side of our

business, highlighted by our option to purchase land in South

Carolina for our expansion. New business from prominent national

retail brands such as Bloomin’ Brands and Just Food For Dogs are

gaining traction as we seek to recover our decline in revenue over

the next twelve months. We look forward to the remainder of 2023

and look forward to providing updates on our progress.”

Financial Results for the

Three Months

Ended June

30,

2023

- Revenue for the three months ended

June 30, 2023, decreased by $1.3 million, or 44%, to $1.7 million

compared to $3.0 million for the three months ended June 30, 2022.

The decrease in revenue was primarily due to a decrease in poundage

sold during the three months ended June 30, 2023.

- Gross profit for the three months

ended June 30, 2023, decreased by $0.3 million, or 76%, to $0.1

million compared to $0.3 million for the three months ended June

30, 2022. This decrease is attributable to a decrease in revenue.

The resulting gross margin was 4.9%, compared with 11.4% for the

three months ended June 30, 2022.

- Operating loss for the three months

ended June 30, 2023, decreased by $0.1 million, or 5%, to $1.1

million, compared to $1.1 million for the three months ended June

30, 2022. Operating loss for the three months ended June 30, 2023

included non-cash or one-time non-recurring operating expenses of

$0.4 million, comprised of non-cash items of $0.03 million in

depreciation and amortization, $0.3 million of loss on settlement

of stock, $0.2 million accrued portion of convertible debt and

$0.03 million in non-cash stock compensation.

- Net loss for the three months June

30, 2023, increased by $0.0 million, or 1%, to $1.5 million,

compared to $1.4 million for the three months ended June 30, 2022.

The increase in net loss is primarily attributable to increases of

loss on settlement of debt.

- Adjusted EBITDA loss for the three

months ended June 30, 2023, decreased by $0.3 million, or 30% to

$0.7 million, compared to $1.0 million for the three months ended

June 30, 2022.

Financial Results for the Six

Months Ended

June 30,

2023

- Revenue for the six months ended

June 30, 2023, decreased by $4.7 million, or 57%, to $3.6 million

compared to $8.3 million for the six months ended June 30, 2022.

The decrease in revenue was primarily due to a decrease in poundage

sold during the six months ended June 30, 2023.

- Gross profit for the six months

ended June 30, 2023, decreased by $0.5 million, or 56%, to $0.4

million compared to $0.8 million for the six months ended June 30,

2022. This decrease is attributable to a decrease in revenue. The

resulting gross margin was 10.3%, compared with 10.0% for the six

months ended June 30, 2022.

- Operating loss for the six months

ended June 30, 2023, increased by $0.0 million, or 2%, to $2.0

million, compared to $2.0 million for the six months ended June 30,

2022. Operating loss for the six months ended June 30, 2023

included non-cash or one-time non-recurring operating expenses of

$1.5 million, comprised of non-cash items of $0.03 million in

depreciation and amortization, $0.83 million of loss on settlement

of stock, $0.5 million accrued portion of convertible debt and

$0.08 million in non-cash stock compensation.

- Net loss for the six months June

30, 2023, increased by $0.9 million, or 37%, to $3.4 million,

compared to $2.5 million for the six months ended June 30, 2022.

The increase in net loss is primarily attributable to increases of

loss on settlement of debt and interest expense related to Lind

notes amortization.

- Adjusted EBITDA loss for the six

months ended June 30, 2023, decreased by $0.8 million, or 62% to

$0.5 million, compared to $1.3 million for the six months ended

June 30, 2022.

About Blue Star Foods Corp. (NASDAQ:

BSFC)Blue Star Foods Corp. is an integrated ESG seafood

company that processes, packages and sells high-value seafood

products. The Company believes it utilizes best-in-class

technology, in both resource sustainability management and

traceability, and ecological packaging. The Company also owns and

operates the oldest continuously operating RAS full grow-out salmon

farm in North America. The Company is based in Miami, Florida, and

its corporate website is: https://bluestarfoods.com

Forward-Looking Statements:

The foregoing material may contain

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, each as amended. Forward-looking statements

include all statements that do not relate solely to historical or

current facts, including without limitation statements regarding

the Company’s product development and business prospects, and can

be identified by the use of words such as “may,” “will,” “expect,”

“project,” “estimate,” “anticipate,” “plan,” “believe,”

“potential,” “should,” “continue” or the negative versions of those

words or other comparable words. Forward-looking statements are not

guarantees of future actions or performance. These forward-looking

statements are based on information currently available to the

Company and its current plans or expectations and are subject to a

number of risks and uncertainties that could significantly affect

current plans. Risks concerning the Company’s business are

described in detail in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2022, and other periodic and current

reports filed with the Securities and Exchange Commission. The

Company is under no obligation, and expressly disclaims any such

obligation to, update or alter its forward-looking statements,

whether as a result of new information, future events or

otherwise.

Investor Contact:Investors@bluestarfoods.com

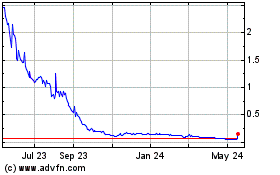

Blue Star Foods (NASDAQ:BSFC)

Historical Stock Chart

From Dec 2024 to Jan 2025

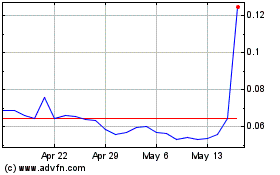

Blue Star Foods (NASDAQ:BSFC)

Historical Stock Chart

From Jan 2024 to Jan 2025