Bankwell Financial Group, Inc. (NASDAQ: BWFG) reported GAAP net

income of $1.1 million, or $0.14 per share for the second quarter

of 2024, versus $8.0 million, or $1.02 per share, for the same

period in 2023. Pre-tax, pre-provision net revenue ("PPNR") was

$9.7 million, or $1.25 per share, for the second quarter of 2024,

versus $12.8 million, or $1.68 per share for the same period in

2023.

The Company's Board of Directors declared a $0.20 per share cash

dividend, payable August 23, 2024 to shareholders of record on

August 12, 2024.

We recommend reading this earnings release in conjunction

with the Second Quarter 2024 Investor Presentation, located at

http://investor.mybankwell.com/Presentations and included as an

exhibit to our July 24, 2024 Current Report on Form 8-K.

Notes Bankwell Financial Group President and CEO, Christopher R.

Gruseke:

"The Company’s core profitability has begun to expand; PPNR

Return on Average Assets grew to 1.22% for the quarter, while the

Net interest margin (“NIM”) has expanded to 2.75%. We continue to

achieve peer-leading operational efficiency with a Noninterest

Expense to Average Assets ratio of 1.55% for the quarter. Going

forward, the Company’s liability sensitive balance sheet is well

positioned for any potential Federal Reserve rate cuts.

Earnings per share for the second quarter were reduced by

approximately $0.66 due to a specific reserve taken on a non-real

estate related commercial credit. The Company announced this

addition to its Allowance for Credit Losses in its 8-K filed on

July 2, 2024. Notwithstanding this idiosyncratic credit event,

other areas of the loan portfolio have experienced improving credit

trends. A significant portion of criticized and classified loans

have demonstrated improved operating results and may be subject to

future credit upgrades if these trends continue. Additional details

regarding the specific reserve as well as other credit metrics can

be found in the accompanying Investor Presentation.

We are also pleased to announce that the Company will host its

first earnings call after third quarter financial results are

released in October 2024. The date and time of that call will be

announced in the coming weeks."

Second Quarter 2024 Highlights:

- PPNR was $9.7 million and PPNR return on average assets was

1.22% for the quarter ended June 30, 2024.

- Net income of $1.1 million for the quarter reflects the impact

of an $8.2 million provision for credit losses.

- $6.6 million of the provision for credit losses is related to a

specific reserve taken against an $8.7 million commercial business

credit1.

- The net interest margin was 2.75% and 2.73% for the quarter and

six months ended June 30, 2024, respectively.

- Noninterest expense to average assets was 1.55% and 1.60% for

the quarter and six months ended June 30, 2024, respectively.

- Total gross loans were $2.7 billion, decreasing $61.4 million,

or 2.3%, compared to December 31, 2023.

- Average yield on total loans was 6.37% for the six months ended

June 30, 2024.

- Deposits were $2.7 billion, decreasing $74.4 million, or 2.7%,

compared to December 31, 2023.

- Brokered deposits decreased $144.2 million compared to December

31, 2023.

- FDIC-insured deposits totaled $1.9 billion and represent 72.9%

of total deposits as of June 30, 2024.

- Return on average assets was 0.14% and 0.31% for the quarter

and six months ended June 30, 2024, respectively.

- Return on average tangible common equity was 1.67% and 3.65%

for the quarter and six months ended June 30, 2024,

respectively.

- Investment securities totaled $138.0 million and represent 4.4%

of total assets.

- The Company repurchased 40,140 shares and 76,320 at the

weighted average prices of $24.55 and $24.94 per share for the

quarter and six months ended June 30, 2024, respectively.

1 - 8-K was filed on July 2, 2024.

Earnings and Performance

Revenues (net interest income plus noninterest income) for the

quarter ended June 30, 2024 were $21.9 million, versus $25.4

million for the quarter ended June 30, 2023. Revenues for the six

months ended June 30, 2024 were $44.0 million, versus $52.5 million

for the six months ended June 30, 2023. The decrease in revenues

for the quarter and six months ended June 30, 2024 was attributable

to an increase in interest expense on deposits and lower gains from

loan sales partially offset by an increase in interest and fees on

loans, given higher loan yields2 and prepayment fees.

Net income for the quarter ended June 30, 2024 was $1.1 million,

versus $8.0 million for the quarter ended June 30, 2023. Net income

for the six months ended June 30, 2024 was $4.9 million, versus

$18.4 million for the six months ended June 30, 2023. The decrease

in net income for the quarter and six months ended 2024 was

primarily due to the aforementioned decrease in revenues and an

increase in provision for credit losses.

Basic and diluted earnings per share were $0.14 and $0.14,

respectively, for the quarter ended June 30, 2024 compared to basic

and diluted earnings per share of $1.02 and $1.02, respectively,

for the quarter ended June 30, 2023. Basic and diluted earnings per

share were $0.62 and $0.62, respectively, for the six months ended

June 30, 2024 compared to basic and diluted earnings per share of

$2.36 and $2.34, respectively, for the six months ended June 30,

2023.

The net interest margin (fully taxable equivalent basis) for the

quarters ended June 30, 2024 and June 30, 2023 was 2.75% and 3.07%,

respectively. The net interest margin (fully taxable equivalent

basis) for the six months ended June 30, 2024 and June 30, 2023 was

2.73% and 3.15%, respectively. The decrease in the net interest

margin was due to an increase in funding costs partially offset by

an increase in interest income on earning assets.

2 - The increase in overall loan yields was 28 bps and 38 bps

for the quarter and six months ended June 30, 2024,

respectively.

Allowance for Credit Losses - Loans ("ACL-Loans")

The ACL-Loans was $36.1 million as of June 30, 2024 compared to

$27.9 million as of December 31, 2023. The ACL-Loans as a

percentage of total loans was 1.36% as of June 30, 2024 compared to

1.03% as of December 31, 2023. Provision for credit losses was $8.2

million for the quarter ended June 30, 2024. The increase in the

provision for credit losses for the quarter was primarily due to an

additional $7.4 million for two loans. Of the $7.4 million, $6.6

million is related to a specific reserve taken against an $8.7

million commercial business credit. The credit had been previously

reported as a non-performing loan as of the fourth quarter of 2023

and had previously carried a $0.4 million specific reserve. The

Company's estimated remaining exposure for the commercial business

credit is $1.7 million. The additional $0.8 million specific

reserve was related to a construction loan.

Financial Condition

Assets totaled $3.1 billion at June 30, 2024, a decrease of

$73.8 million, or 2.3% compared to December 31, 2023. Gross loans

totaled $2.7 billion at June 30, 2024, a decrease of $61.4 million,

or 2.3% compared to December 31, 2023. Deposits totaled $2.7

billion at June 30, 2024, a decrease of $74.4 million, or 2.7%

compared to December 31, 2023.

Capital

Shareholders’ equity totaled $267.0 million as of June 30, 2024,

an increase of $1.2 million compared to December 31, 2023,

primarily a result of net income of $4.9 million for the six months

ended June 30, 2024. The increase was partially offset by dividends

paid of $3.2 million.

About Bankwell Financial Group

Bankwell is a commercial bank that serves the banking needs of

residents and businesses throughout Fairfield and New Haven

Counties, Connecticut. For more information about this press

release, interested parties may contact Christopher R. Gruseke,

President and Chief Executive Officer or Courtney E. Sacchetti,

Executive Vice President and Chief Financial Officer of Bankwell

Financial Group at (203) 652-0166.

For more information, visit www.mybankwell.com.

This press release may contain certain forward-looking

statements about the Company. Forward-looking statements include

statements regarding anticipated future events and can be

identified by the fact that they do not relate strictly to

historical or current facts. They often include words such as

“believe,” “expect,” “anticipate,” “estimate,” and “intend” or

future or conditional verbs such as “will,” “would,” “should,”

“could,” or “may.” Forward-looking statements, by their nature, are

subject to risks and uncertainties. Certain factors that could

cause actual results to differ materially from expected results

include increased competitive pressures, changes in the interest

rate environment, general economic conditions or conditions within

the banking industry or securities markets, and legislative and

regulatory changes that could adversely affect the business in

which the Company and its subsidiaries are engaged.

Non-GAAP Financial Measures

In addition to evaluating the Company's financial performance in

accordance with U.S. generally accepted accounting principles

("GAAP"), management may evaluate certain non-GAAP financial

measures, such as the efficiency ratio. A computation and

reconciliation of certain non-GAAP financial measures used for

these purposes is contained in the accompanying Reconciliation of

GAAP to Non-GAAP Measures tables. We believe that providing certain

non-GAAP financial measures provides investors with information

useful in understanding our financial performance, our performance

trends and financial position. For example, the Company believes

that the efficiency ratio is useful in the assessment of financial

performance, including noninterest expense control. The Company

believes that tangible common equity, tangible assets, tangible

common equity to tangible assets, tangible common shareholders'

equity, fully diluted tangible book value per common share,

adjusted noninterest expense, operating revenue, efficiency ratio,

average tangible common equity, annualized return on average

tangible common equity, return on average assets, return on average

shareholders' equity, pre-tax, pre-provision net revenue, pre-tax,

pre-provision net revenue on average assets, and the dividend

payout ratio are useful to evaluate the relative strength of the

Company's performance and capital position. We utilize these

measures for internal planning and forecasting purposes. These

non-GAAP financial measures should not be considered a substitute

for GAAP basis measures and results, and we strongly encourage

investors to review our consolidated financial statements in their

entirety and not to rely on any single financial measure.

BANKWELL FINANCIAL GROUP, INC.

CONSOLIDATED BALANCE SHEETS

(unaudited)

(Dollars in thousands)

June 30, 2024

March 31, 2024

December 31,

2023

June 30, 2023

ASSETS

Cash and due from banks

$

234,277

$

245,043

$

267,521

$

207,345

Federal funds sold

17,103

2,584

1,636

54,706

Cash and cash equivalents

251,380

247,627

269,157

262,051

Investment securities

Marketable equity securities, at fair

value

2,079

2,069

2,070

2,017

Available for sale investment securities,

at fair value

107,635

108,417

109,736

99,938

Held to maturity investment securities, at

amortized cost

28,286

15,739

15,817

15,884

Total investment securities

138,000

126,225

127,623

117,839

Loans receivable (net of ACL-Loans of

$36,083, $27,991, $27,946, and $30,694 at June 30, 2024, March 31,

2024, December 31, 2023, and June 30, 2023, respectively)

2,616,691

2,646,686

2,685,301

2,736,607

Accrued interest receivable

14,675

15,104

14,863

14,208

Federal Home Loan Bank stock, at cost

5,655

5,655

5,696

5,696

Premises and equipment, net

25,599

26,161

27,018

27,658

Bank-owned life insurance

52,097

51,764

51,435

50,816

Goodwill

2,589

2,589

2,589

2,589

Deferred income taxes, net

11,345

9,137

9,383

10,014

Other assets

23,623

24,326

22,417

25,229

Total assets

$

3,141,654

$

3,155,274

$

3,215,482

$

3,252,707

LIABILITIES AND SHAREHOLDERS’

EQUITY

Liabilities

Deposits

Noninterest bearing deposits

$

328,475

$

376,248

$

346,172

$

367,635

Interest bearing deposits

2,333,900

2,297,274

2,390,585

2,421,228

Total deposits

2,662,375

2,673,522

2,736,757

2,788,863

Advances from the Federal Home Loan

Bank

90,000

90,000

90,000

90,000

Subordinated debentures

69,328

69,266

69,205

69,082

Accrued expenses and other liabilities

52,975

54,454

53,768

55,949

Total liabilities

2,874,678

2,887,242

2,949,730

3,003,894

Shareholders’ equity

Common stock, no par value

118,037

118,401

118,247

116,541

Retained earnings

150,895

151,350

149,169

133,988

Accumulated other comprehensive (loss)

(1,956

)

(1,719

)

(1,664

)

(1,716

)

Total shareholders’ equity

266,976

268,032

265,752

248,813

Total liabilities and shareholders’

equity

$

3,141,654

$

3,155,274

$

3,215,482

$

3,252,707

BANKWELL FINANCIAL GROUP, INC.

CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

(Dollars in thousands, except share

data)

For the Quarter Ended

For the Six Months

Ended

June 30, 2024

March 31, 2024

December 31,

2023

June 30, 2023

June 30, 2024

June 30, 2023

Interest and dividend income

Interest and fees on loans

$

43,060

$

43,325

$

44,122

$

42,482

$

86,385

$

82,205

Interest and dividends on securities

1,190

1,130

1,108

1,002

2,320

2,002

Interest on cash and cash equivalents

3,429

3,826

4,164

3,022

7,255

6,590

Total interest and dividend income

47,679

48,281

49,394

46,506

95,960

90,797

Interest expense

Interest expense on deposits

24,677

25,362

25,307

20,777

50,039

37,810

Interest expense on borrowings

1,783

1,772

1,842

1,738

3,555

3,455

Total interest expense

26,460

27,134

27,149

22,515

53,594

41,265

Net interest income

21,219

21,147

22,245

23,991

42,366

49,532

Provision (credit) for credit

losses

8,183

3,683

(960

)

2,579

11,866

3,405

Net interest income after provision for

credit losses

13,036

17,464

23,205

21,412

30,500

46,127

Noninterest income

Bank owned life insurance

333

329

316

292

662

573

Service charges and fees

495

304

688

361

799

647

Gains and fees from sales of loans

45

321

79

725

366

1,656

Other

(190

)

(39

)

46

23

(229

)

51

Total noninterest income

683

915

1,129

1,401

1,598

2,927

Noninterest expense

Salaries and employee benefits

6,176

6,291

6,088

6,390

12,467

12,471

Occupancy and equipment

2,238

2,322

2,231

2,204

4,561

4,288

Professional services

989

1,065

1,033

692

2,054

2,014

Data processing

755

740

747

729

1,495

1,400

Director fees

306

900

605

453

1,206

845

FDIC insurance

705

930

1,026

1,050

1,635

2,112

Marketing

90

114

139

177

203

328

Other

986

935

995

946

1,921

1,874

Total noninterest expense

12,245

13,297

12,864

12,641

25,542

25,332

Income before income tax

expense

1,474

5,082

11,470

10,172

6,556

23,722

Income tax expense

356

1,319

2,946

2,189

1,675

5,360

Net income

$

1,118

$

3,763

$

8,524

$

7,983

$

4,881

$

18,362

Earnings Per Common Share:

Basic

$

0.14

$

0.48

$

1.09

$

1.02

$

0.62

$

2.36

Diluted

$

0.14

$

0.48

$

1.09

$

1.02

$

0.62

$

2.34

Weighted Average Common Shares

Outstanding:

Basic

7,747,675

7,663,521

7,603,938

7,593,417

7,705,598

7,574,160

Diluted

7,723,888

7,687,679

7,650,451

7,601,562

7,721,880

7,639,828

Dividends per common share

$

0.20

$

0.20

$

0.20

$

0.20

$

0.40

$

0.40

BANKWELL FINANCIAL GROUP, INC.

CONSOLIDATED FINANCIAL HIGHLIGHTS

(unaudited)

For the Quarter Ended

For the Six Months

Ended

June 30, 2024

March 31, 2024

December 31, 2023

June 30, 2023

June 30, 2024

June 30, 2023

Performance ratios:

Return on average assets

0.14

%

0.47

%

1.03

%

0.99

%

0.31

%

1.14

%

Return on average shareholders' equity

1.65

%

5.59

%

12.82

%

12.91

%

3.61

%

15.15

%

Return on average tangible common

equity

1.67

%

5.65

%

12.95

%

13.05

%

3.65

%

15.31

%

Net interest margin

2.75

%

2.71

%

2.81

%

3.07

%

2.73

%

3.15

%

Efficiency ratio(1)

55.9

%

60.3

%

55.0

%

49.8

%

58.1

%

48.3

%

Net loan charge-offs as a % of average

loans

0.01

%

0.11

%

0.01

%

—

%

0.13

%

0.02

%

Dividend payout ratio(2)

142.86

%

41.67

%

18.35

%

19.61

%

64.52

%

17.09

%

(1) Efficiency ratio is defined as

noninterest expense, less other real estate owned expenses and

amortization of intangible assets, divided by our operating

revenue, which is equal to net interest income plus noninterest

income excluding gains and losses on sales of securities and gains

and losses on other real estate owned. In our judgment, the

adjustments made to operating revenue allow investors and analysts

to better assess our operating expenses in relation to our core

operating revenue by removing the volatility that is associated

with certain one-time items and other discrete items that are

unrelated to our core business.

(2) The dividend payout ratio is calculated

by dividing dividends per share by earnings per share.

As of

June 30, 2024

March 31, 2024

December 31, 2023

June 30, 2023

Capital ratios:

Total Common Equity Tier 1 Capital to

Risk-Weighted Assets(1)

11.73

%

11.60

%

11.30

%

10.34

%

Total Capital to Risk-Weighted

Assets(1)

12.98

%

12.63

%

12.32

%

11.41

%

Tier I Capital to Risk-Weighted

Assets(1)

11.73

%

11.60

%

11.30

%

10.34

%

Tier I Capital to Average Assets(1)

10.17

%

10.09

%

9.81

%

9.41

%

Tangible common equity to tangible

assets

8.42

%

8.42

%

8.19

%

7.58

%

Fully diluted tangible book value per

common share

$

33.61

$

33.57

$

33.39

$

31.45

(1) Represents Bank ratios. Current period

capital ratios are preliminary subject to finalization of the FDIC

Call Report.

BANKWELL FINANCIAL GROUP, INC.

ASSET QUALITY (unaudited)

(Dollars in thousands)

For the Quarter Ended

June 30, 2024

March 31, 2024

December 31, 2023

June 30, 2023

ACL-Loans:

Balance at beginning of period

$

27,991

$

27,946

$

29,284

$

27,998

Charge-offs:

Residential real estate

(9

)

(132

)

—

—

Commercial real estate

(522

)

(3,306

)

(824

)

—

Commercial business

—

(197

)

—

—

Consumer

(12

)

(49

)

(15

)

(25

)

Total charge-offs

(543

)

(3,684

)

(839

)

(25

)

Recoveries:

Residential real estate

141

—

—

—

Commercial real estate

113

—

—

—

Commercial business

—

27

464

32

Consumer

13

4

3

10

Total recoveries

267

31

467

42

Net loan (charge-offs) recoveries

(276

)

(3,653

)

(372

)

17

Provision (credit) for credit losses -

loans

8,368

3,698

(966

)

2,679

Balance at end of period

$

36,083

$

27,991

$

27,946

$

30,694

As of

June 30, 2024

March 31, 2024

December 31, 2023

June 30, 2023

Asset quality:

Nonaccrual loans

Residential real estate

$

1,339

$

1,237

$

1,386

$

1,429

Commercial real estate

28,088

19,083

23,009

1,905

Commercial business

17,396

16,841

15,430

2,815

Construction

9,382

9,382

9,382

9,382

Consumer

—

—

—

—

Total nonaccrual loans

56,205

46,543

49,207

15,531

Other real estate owned

—

—

—

—

Total nonperforming assets

$

56,205

$

46,543

$

49,207

$

15,531

Nonperforming loans as a % of total

loans

2.12

%

1.74

%

1.81

%

0.56

%

Nonperforming assets as a % of total

assets

1.79

%

1.48

%

1.53

%

0.48

%

ACL-loans as a % of total loans

1.36

%

1.04

%

1.03

%

1.11

%

ACL-loans as a % of nonperforming

loans

64.20

%

60.14

%

56.79

%

197.63

%

Total past due loans to total loans

0.84

%

1.44

%

0.78

%

1.30

%

Total nonaccrual loans increased $7.0 million to $56.2 million

as of June 30, 2024 when compared to December 31, 2023. The

increase was primarily due to a $13.9 million commercial real

estate non-owner occupied office loan put on nonaccrual during the

six months ended June 30, 2024. This loan represents a 16.5%

participation in a $84.3 million club transaction. The increase was

partially offset by the payoff of two loans totaling $4.4 million

and four loans that were partially charged-off for a total of $4.0

million during the six months ended June 30, 2024.

Nonperforming assets as a percentage of total assets increased

to 1.79% at June 30, 2024 from 1.53% at December 31, 2023. The

ACL-Loans at June 30, 2024 was $36.1 million, representing 1.36% of

total loans.

BANKWELL FINANCIAL GROUP, INC.

LOAN & DEPOSIT PORTFOLIO

(unaudited)

(Dollars in thousands)

Period End Loan Composition

June 30, 2024

March 31, 2024

December 31, 2023

Current QTD %

Change

YTD % Change

Residential Real Estate

$

47,875

$

49,098

$

50,931

(2.5

)%

(6.0

)%

Commercial Real Estate(1)

1,912,701

1,927,636

1,947,648

(0.8

)

(1.8

)

Construction

150,259

151,967

183,414

(1.1

)

(18.1

)

Total Real Estate Loans

2,110,835

2,128,701

2,181,993

(0.8

)

(3.3

)

Commercial Business

503,444

508,912

500,569

(1.1

)

0.6

Consumer

42,906

41,946

36,045

2.3

19.0

Total Loans

$

2,657,185

$

2,679,559

$

2,718,607

(0.8

)%

(2.3

)%

(1) Includes owner occupied commercial

real estate of $0.7 billion at June 30, 2024, March 31, 2024, and

December 31, 2023, respectively.

Gross loans totaled $2.7 billion at June 30, 2024, a decrease of

$61.4 million or 2.3% compared to December 31, 2023.

Period End Deposit Composition

June 30, 2024

March 31, 2024

December 31, 2023

Current QTD %

Change

YTD % Change

Noninterest bearing demand

$

328,475

$

376,248

$

346,172

(12.7

)%

(5.1

)%

NOW

122,112

95,227

90,829

28.2

34.4

Money Market

825,599

818,408

887,352

0.9

(7.0

)

Savings

91,870

92,188

97,331

(0.3

)

(5.6

)

Time

1,294,319

1,291,451

1,315,073

0.2

(1.6

)

Total Deposits

$

2,662,375

$

2,673,522

$

2,736,757

(0.4

)%

(2.7

)%

Total deposits were $2.7 billion at June 30, 2024, a decrease of

$74.4 million, or 2.7%, when compared to December 31, 2023.

Brokered deposits have decreased $144.2 million, when compared to

December 31, 2023.

BANKWELL FINANCIAL GROUP, INC.

NONINTEREST EXPENSE (unaudited)

(Dollars in thousands)

For the Quarter Ended

Noninterest expense

June 30, 2024

March 31, 2024

June 30, 2023

June 24 vs. Mar 24 %

Change

Jun 24 vs. Jun 23 %

Change

Salaries and employee benefits

$

6,176

$

6,291

$

6,390

(1.8

)%

(3.3

)%

Occupancy and equipment

2,238

2,322

2,204

(3.6

)

1.5

Professional services

989

1,065

692

(7.1

)

42.9

Data processing

755

740

729

2.0

3.6

Director fees

306

900

453

(66.0

)

(32.5

)

FDIC insurance

705

930

1,050

(24.2

)

(32.9

)

Marketing

90

114

177

(21.1

)

(49.2

)

Other

986

935

946

5.5

4.2

Total noninterest expense

$

12,245

$

13,297

$

12,641

(7.9

)%

(3.1

)%

Noninterest expense decreased by $0.4 million to $12.2 million

for the quarter ended June 30, 2024 compared to the quarter ended

June 30, 2023. The decrease in noninterest expense was primarily

driven by a decrease in FDIC insurance costs, mainly driven by a

reduction in the Bank's brokered deposits.

For the Six Months

Ended

Noninterest expense

June 30, 2024

June 30, 2023

Jun 24 vs. Jun 23 %

Change

Salaries and employee benefits

$

12,467

$

12,471

—

%

Occupancy and equipment

4,561

4,288

6.4

Professional services

2,054

2,014

2.0

Data processing

1,495

1,400

6.8

Director fees

1,206

845

42.7

FDIC insurance

1,635

2,112

(22.6

)

Marketing

203

328

(38.1

)

Other

1,921

1,874

2.5

Total noninterest expense

$

25,542

$

25,332

0.8

%

Noninterest expense increased by $0.2 million to $25.5 million

for the six months ended June 30, 2024 compared to the six months

ended June 30, 2023. The increase in noninterest expense was

primarily driven by an increase in director fees related to timing

of compensation and accelerated vestings in connection with the

death of a director. The increase was partially offset by a

decrease in FDIC insurance costs, mainly attributable by a

reduction in the Bank's brokered deposits.

BANKWELL FINANCIAL GROUP, INC.

RECONCILIATION OF GAAP TO NON-GAAP

MEASURES (unaudited)

(Dollars in thousands, except share

data)

As of

Computation of Tangible Common Equity

to Tangible Assets

June 30, 2024

March 31, 2024

December 31,

2023

June 30, 2023

Total Equity

$

266,976

$

268,032

$

265,752

$

248,813

Less:

Goodwill

2,589

2,589

2,589

2,589

Other intangibles

—

—

—

—

Tangible Common Equity

$

264,387

$

265,443

$

263,163

$

246,224

Total Assets

$

3,141,654

$

3,155,274

$

3,215,482

$

3,252,707

Less:

Goodwill

2,589

2,589

2,589

2,589

Other intangibles

—

—

—

—

Tangible Assets

$

3,139,065

$

3,152,685

$

3,212,893

$

3,250,118

Tangible Common Equity to Tangible

Assets

8.42

%

8.42

%

8.19

%

7.58

%

As of

Computation of Fully Diluted Tangible

Book Value per Common Share

June 30, 2024

March 31, 2024

December 31, 2023

June 30, 2023

Total shareholders' equity

$

266,976

$

268,032

$

265,752

$

248,813

Less:

Preferred stock

—

—

—

—

Common shareholders' equity

$

266,976

$

268,032

$

265,752

$

248,813

Less:

Goodwill

2,589

2,589

2,589

2,589

Other intangibles

—

—

—

—

Tangible common shareholders'

equity

$

264,387

$

265,443

$

263,163

$

246,224

Common shares issued and outstanding

7,866,499

7,908,180

7,882,616

7,829,950

Fully Diluted Tangible Book Value per

Common Share

$

33.61

$

33.57

$

33.39

$

31.45

For the Quarter Ended

For the Six Months

Ended

Computation of PPNR

June 30, 2024

March 31, 2024

December 31, 2023

June 30, 2023

June 30, 2024

June 30, 2023

Income before income tax expense

$ 1,474

$ 5,082

$ 11,470

$ 10,172

$ 6,556

$ 23,722

Add:

Provision (credit) for credit losses

8,183

3,683

(960)

2,579

11,866

3,405

PPNR

$ 9,657

$ 8,765

$ 10,510

$ 12,751

$ 18,422

$ 27,127

PPNR return on average assets

1.22 %

1.10 %

1.27 %

1.58 %

1.16 %

1.69 %

BANKWELL FINANCIAL GROUP, INC.

EARNINGS PER SHARE ("EPS")

(unaudited)

(Dollars in thousands, except share

data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(In thousands, except per

share data)

Net income

$

1,118

$

7,983

$

4,881

$

18,362

Dividends to participating

securities(1)

(40

)

(41

)

(79

)

(84

)

Undistributed earnings allocated to

participating securities(1)

14

(172

)

(52

)

(403

)

Net income for earnings per share

calculation

$

1,092

$

7,770

$

4,750

$

17,875

Weighted average shares outstanding,

basic

7,748

7,593

7,706

7,574

Effect of dilutive equity-based

awards(2)

(24

)

8

16

66

Weighted average shares outstanding,

diluted

7,724

7,601

7,722

7,640

Net earnings per common share:

Basic earnings per common share

$

0.14

$

1.02

$

0.62

$

2.36

Diluted earnings per common share

$

0.14

$

1.02

$

0.62

$

2.34

(1)

Represents dividends paid and

undistributed earnings allocated to unvested stock-based awards

that contain non-forfeitable rights to dividends.

(2)

Represents the effect of the

assumed exercise of stock options and the vesting of restricted

shares, as applicable, utilizing the treasury stock method.

BANKWELL FINANCIAL GROUP, INC.

NONINTEREST INCOME (unaudited)

(Dollars in thousands)

For the Quarter Ended

Noninterest income

June 30, 2024

March 31, 2024

June 30, 2023

Jun 24 vs. Mar 24 %

Change

Jun 24 vs. Jun 23 %

Change

Bank owned life insurance

$

333

$

329

$

292

1.2

%

14.0

%

Service charges and fees

495

304

361

62.8

37.1

Gains and fees from sales of loans

45

321

725

(86.0

)

(93.8

)

Other

(190

)

(39

)

23

Unfavorable

Unfavorable

Total noninterest income

$

683

$

915

$

1,401

(25.4

)%

(51.2

)%

Noninterest income decreased $0.7 million for the quarter ended

June 30, 2024 compared to the quarter ended June 30, 2023. The

decrease in noninterest income was driven by lower gains as a

result of fewer SBA loan sales for the quarter ended June 30,

2024.

For the Six Months

Ended

Noninterest income

June 30, 2024

June 30, 2023

Jun 24 vs. Jun 23 %

Change

Bank owned life insurance

$

662

$

573

15.5

%

Service charges and fees

799

647

23.5

%

Gains and fees from sales of loans

366

1,656

(77.9

)%

Other

(229

)

51

Unfavorable

Total noninterest income

$

1,598

$

2,927

(45.4

)%

Noninterest income decreased $1.3 million for the six months

ended June 30, 2024 compared to the six months ended June 30, 2023.

The decrease in noninterest income was driven by lower gains as a

result of fewer SBA loan sales for the six months ended June 30,

2024.

BANKWELL FINANCIAL GROUP, INC.

NET INTEREST MARGIN ANALYSIS ON A FULLY

TAX EQUIVALENT BASIS - QTD (unaudited)

(Dollars in thousands)

For the Quarter Ended

June 30, 2024

June 30, 2023

Average Balance

Interest

Yield/ Rate (4)

Average Balance

Interest

Yield/ Rate (4)

Assets:

Cash and Fed funds sold

$

273,301

$

3,429

5.05

%

$

227,777

$

3,023

5.32

%

Securities(1)

137,360

1,139

3.32

128,576

955

2.97

Loans:

Commercial real estate

1,901,189

27,654

5.75

1,935,058

27,099

5.54

Residential real estate

49,046

772

6.30

56,981

643

4.51

Construction

159,184

2,871

7.14

206,844

3,691

7.06

Commercial business

523,382

11,028

8.34

557,482

10,646

7.55

Consumer

42,335

735

6.98

29,326

500

6.84

Total loans

2,675,136

43,060

6.37

2,785,691

42,579

6.05

Federal Home Loan Bank stock

5,655

118

8.42

5,610

98

7.00

Total earning assets

3,091,452

$

47,746

6.11

%

3,147,654

$

46,655

5.86

%

Other assets

95,453

96,603

Total assets

$

3,186,905

$

3,244,257

Liabilities and shareholders' equity:

Interest bearing liabilities:

NOW

$

107,310

$

49

0.18

%

$

98,048

$

42

0.18

%

Money market

833,489

8,552

4.13

902,225

8,083

3.59

Savings

90,987

688

3.04

112,585

860

3.06

Time

1,291,595

15,388

4.79

1,298,170

11,792

3.64

Total interest bearing deposits

2,323,381

24,677

4.27

2,411,028

20,777

3.46

Borrowed Money

159,288

1,783

4.43

163,138

1,738

4.21

Total interest bearing liabilities

2,482,669

$

26,460

4.29

%

2,574,166

$

22,515

3.51

%

Noninterest bearing deposits

368,516

375,514

Other liabilities

63,177

46,565

Total liabilities

2,914,362

2,996,245

Shareholders' equity

272,543

248,012

Total liabilities and shareholders'

equity

$

3,186,905

$

3,244,257

Net interest income(2)

$

21,286

$

24,140

Interest rate spread

1.82

%

2.36

%

Net interest margin(3)

2.75

%

3.07

%

(1)

Average balances and yields for

securities are based on amortized cost.

(2)

The adjustment for securities and

loans taxable equivalency amounted to $67 thousand and $51 thousand

for the quarters ended June 30, 2024 and 2023, respectively.

(3)

Annualized net interest income as

a percentage of earning assets.

(4)

Yields are calculated using the

contractual day count convention for each respective product

type.

BANKWELL FINANCIAL GROUP, INC.

NET INTEREST MARGIN ANALYSIS ON A FULLY

TAX EQUIVALENT BASIS - YTD (unaudited)

(Dollars in thousands)

For the Six Months

Ended

June 30, 2024

June 30, 2023

Average Balance

Interest

Yield/ Rate (4)

Average Balance

Interest

Yield/ Rate (4)

Assets:

Cash and Fed funds sold

$

282,981

$

7,255

5.16

%

$

271,328

$

6,590

4.90

%

Securities(1)

136,049

2,199

3.23

129,225

1,912

2.96

Loans:

Commercial real estate

1,911,896

56,295

5.82

1,926,852

52,125

5.38

Residential real estate

49,624

1,490

6.01

58,207

1,286

4.42

Construction

160,080

5,844

7.22

186,684

6,651

7.09

Commercial business

520,188

21,314

8.10

549,963

21,394

7.74

Consumer

41,150

1,442

7.05

23,971

749

6.30

Total loans

2,682,938

86,385

6.37

2,745,677

82,205

5.95

Federal Home Loan Bank stock

5,678

239

8.44

5,442

193

7.14

Total earning assets

3,107,646

$

96,078

6.12

%

3,151,672

$

90,900

5.74

%

Other assets

93,179

90,427

Total assets

$

3,200,825

$

3,242,099

Liabilities and shareholders' equity:

Interest bearing liabilities:

NOW

$

99,493

$

88

0.18

%

$

95,494

$

81

0.17

%

Money market

858,670

17,698

4.14

905,021

14,468

3.22

Savings

91,979

1,402

3.06

124,387

1,586

2.57

Time

1,304,332

30,851

4.76

1,275,417

21,675

3.43

Total interest bearing deposits

2,354,474

50,039

4.27

2,400,319

37,810

3.18

Borrowed Money

159,257

3,555

4.42

162,215

3,454

4.24

Total interest bearing liabilities

2,513,731

$

53,594

4.29

%

2,562,534

$

41,264

3.25

%

Noninterest bearing deposits

352,768

389,608

Other liabilities

62,775

45,494

Total liabilities

2,929,274

2,997,636

Shareholders' equity

271,551

244,463

Total liabilities and shareholders'

equity

$

3,200,825

$

3,242,099

Net interest income(2)

$

42,484

$

49,636

Interest rate spread

1.83

%

2.49

%

Net interest margin(3)

2.73

%

3.15

%

(1)

Average balances and yields for

securities are based on amortized cost.

(2)

The adjustment for securities and

loans taxable equivalency amounted to $118 thousand and $102

thousand for the six months ended June 30, 2024 and 2023,

respectively.

(3)

Annualized net interest income as

a percentage of earning assets.

(4)

Yields are calculated using the

contractual day count convention for each respective product

type.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724575735/en/

Christopher R. Gruseke President and Chief Executive Officer

(203) 652-0166 or Courtney E. Sacchetti Executive Vice President

and Chief Financial Officer of Bankwell Financial Group (203)

652-0166

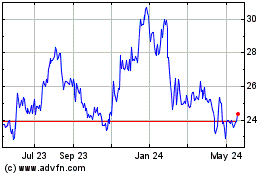

Bankwell Financial (NASDAQ:BWFG)

Historical Stock Chart

From Dec 2024 to Jan 2025

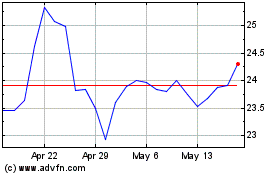

Bankwell Financial (NASDAQ:BWFG)

Historical Stock Chart

From Jan 2024 to Jan 2025