UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment No.

)

Filed by the Registrant x

Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Cracker Barrel

Old Country Store, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. |

| |

|

| ¨ |

Fee paid previously with preliminary materials. |

| |

|

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On

November 18, 2024, Cracker Barrel Old Country Store, Inc. (the “Company”) issued the following press release. The

press release was also posted by the Company to the campaign website at www.crackerbarrelshareholders.com (the “Campaign

Website”).

Cracker Barrel’s Board Urges Shareholders

to Vote the WHITE Card “FOR ONLY” Cracker Barrel’s

10 Recommended Director Nominees in Advance of Company’s Annual Meeting This Week

The Company’s Strategic Transformation

Plan Is Taking Hold and Showing Results

Carl Berquist and Meg Crofton Have Been Change

Agents and

Bring Valuable Experience and Skillsets to Cracker Barrel’s Board

Election of Sardar Biglari and Milena Albert-Perez

Would Jeopardize the Company’s Momentum

2024

Annual Meeting of Shareholders Scheduled for November 21, 2024; For Additional Information on

How to Vote Visit CrackerBarrelShareholders.com

LEBANON,

Tenn. – November 18, 2024 – Cracker Barrel Old Country Store, Inc. (“Cracker Barrel” or the

“Company”) (Nasdaq: CBRL) today reminds all shareholders to vote the universal WHITE proxy card “FOR ONLY”

Cracker Barrel’s 10 Recommended Director Nominees to protect the value of their investment; continue the momentum of the

Company’s strategic transformation plan; and ensure Cracker Barrel remains a beloved and relevant restaurant brand for many years

to come.

In casting your vote, Cracker Barrel reminds you

that:

Cracker

Barrel’s strategic transformation plan is building momentum across operations as demonstrated by our preliminary first quarter FY

2025 results and reaffirmation of our FY 2025 outlook. Fiscal 2025 is off to a strong start, with early favorable results on

our strategic initiatives and comparable store sales and traffic results that outperformed the Casual Dining industry.

The Board

and management team continue to act with urgency in implementing our long-term strategic transformation plan designed to return Cracker

Barrel to growth and profitability. We are carefully pacing the investments that are part of the plan by methodically testing

initiatives and scaling the initiatives with the highest demonstrated returns.

Sardar

Biglari continues to misrepresent Cracker Barrel’s capital spending plan. We are NOT spending $600-700 million on store

remodels over the next three years as Mr. Biglari falsely claims. Our strategic plan contemplates spending $225 - $325 million in

incremental capital (i.e., over and above our normal rates of capital spending). Store remodels are only a part of this incremental amount.

Other investments include improvements to our technology and highly successful loyalty program in order to drive traffic.

Carl Berquist

and Meg Crofton are change agents for the Board and the business, while also serving as important sources of stability and institutional

knowledge. With Mr. Berquist’s support and under Ms. Crofton’s leadership as the Chair of the Company’s

Nominating and Corporate Governance Committee, over the past 12 months, all five of Cracker Barrel’s longest tenured directors will

have left the Board; these individuals included the former Board Chair, former Compensation Committee Chair, and former CEO.

Multiple

proxy advisory firms have joined the Company in urging shareholders to “WITHHOLD” support for Sardar Biglari and Milena Alberti-Perez.

ISS, Glass Lewis, and Egan Jones all stressed the extremely poor corporate governance history of Mr. Biglari and did not

support his candidacy. Additionally, ISS and Egan-Jones both found Ms. Alberti-Perez’s ignorance of Cracker Barrel’s

business and her lack of preparation to become a director to be disqualifying, especially given her lack of relevant industry experience.

We are confident the Board’s 10 Recommended

Director Nominees – Carl Berquist, Jody Bilney, Meg Crofton, Gilbert Dávila, John Garratt, Michael Goodwin, Cheryl

Henry, Julie Masino, Gisel Ruiz, and Darryl “Chip” Wade – are the right ones to ensure Cracker Barrel thrives today,

tomorrow and well into the future and that the strategic transformation plan being implemented by the Company’s leadership team

is the right one to deliver value for ALL shareholders. Our recommended director nominees have the right set of skills to drive this change

forward.

The

Annual Meeting of Shareholders will be on November 21, 2024. Shareholders on record as of September 27, 2024, are entitled

to vote at the meeting. For more information on how to vote, or for supporting materials and other important information, shareholders

can refer to CrackerBarrelShareholders.com.

YOUR VOTE IS IMPORTANT. Whether or not

you plan to virtually attend the Annual Meeting, please take a few minutes now to vote by Internet or by telephone by following the instructions

on the WHITE proxy card you have received, or sign, date and return the WHITE proxy card in the postage-paid envelope provided. If you

are a beneficial owner or you hold your shares in “street name,” please follow the voting instructions provided by your bank,

broker or other nominee. Regardless of the number of Company shares you own, your presence by proxy is helpful to establish a quorum and

your vote is important.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE “FOR” ONLY CRACKER BARREL’S 10 RECOMMENDED NOMINEES ON THE WHITE PROXY CARD.

| |

If you have any questions or require any assistance with voting your shares,

please call the Company’s proxy solicitor: |

| OKAPI PARTNERS LLC |

| 1212 Avenue of the Americas, 17th Floor |

| New York, NY 10036 |

| Banks and Brokerage Firms, Please Call: (212) 297-0720 |

| Shareholders and All Others Call Toll-Free: (855) 208-8902 |

| Email: info@okapipartners.com |

| |

Forward Looking Statements

Except for specific historical information, certain

of the matters discussed in this communication may express or imply projections of items such as revenues or expenditures, statements

of plans and objectives or future operations or statements of future economic performance. These and similar statements regarding events

or results that Cracker Barrel Old Country Store, Inc. (“Cracker Barrel” or the “Company”) expects will or

may occur in the future are forward-looking statements concerning matters that involve risks, uncertainties and other factors which may

cause the actual results and performance of the Company to differ materially from those expressed or implied by such forward-looking statements.

All forward-looking information is provided pursuant to the safe harbor established under the Private Securities Litigation Reform Act

of 1995 and should be evaluated in the context of these risks, uncertainties and other factors. Forward-looking statements generally can

be identified by the use of forward-looking terminology such as "trends," "assumptions," "target," "guidance,"

"outlook," "opportunity," "future," "plans," "goals," "objectives," "expectations,"

"near-term," "long-term," "projection," "may," "will," "would," "could,"

"expect," "intend," "estimate," "anticipate," "believe," "potential," "regular,"

"should," "projects," "forecasts," or "continue" (or the negative or other derivatives of each

of these terms) or similar terminology.

The Company believes that the assumptions underlying

any forward-looking statements are reasonable; however, any of the assumptions could be inaccurate, and therefore, actual results may

differ materially from those projected in or implied by the forward-looking statements. In addition to the risks of ordinary business

operations, factors and risks that may result in actual results differing from this forward-looking information include, but are not limited

to risks and uncertainties associated with inflationary conditions with respect to the price of commodities, ingredients, transportation,

distribution and labor; disruptions to the Company’s restaurant or retail supply chain; the Company’s ability to manage retail

inventory and merchandise mix; the Company’s ability to sustain or the effects of plans intended to improve operational or marketing

execution and performance, including the Company’s strategic transformation plan; the effects of increased competition at the Company’s

locations on sales and on labor recruiting, cost, and retention; consumer behavior based on negative publicity or changes in consumer

health or dietary trends or safety aspects of the Company’s food or products or those of the restaurant industry in general, including

concerns about outbreaks of infectious disease; the effects of the Company’s indebtedness and associated restrictions on the Company’s

financial and operating flexibility and ability to execute or pursue its operating plans and objectives; changes in interest rates, increases

in borrowed capital or capital market conditions affecting the Company’s financing costs and ability to refinance its indebtedness,

in whole or in part; the Company’s reliance on a single distribution facility and certain significant vendors, particularly for

foreign-sourced retail products; information technology disruptions and data privacy and information security breaches, whether as a result

of infrastructure failures, employee or vendor errors or actions of third parties; the Company’s compliance with privacy and data

protection laws; changes in or implementation of additional governmental or regulatory rules, regulations and interpretations affecting

tax, health and safety, animal welfare, pensions, insurance or other undeterminable areas; the actual results of pending, future or threatened

litigation or governmental investigations; the Company’s ability to manage the impact of negative social media attention and the

costs and effects of negative publicity; the impact of activist shareholders; the Company’s ability to achieve aspirations, goals

and projections related to its environmental, social and governance initiatives; the Company’s ability to enter successfully into

new geographic markets that may be less familiar to it; changes in land, building materials and construction costs; the availability and

cost of suitable sites for restaurant development and the Company’s ability to identify those sites; the Company’s ability

to retain key personnel; the ability of and cost to the Company to recruit, train, and retain qualified hourly and management employees;

uncertain performance of acquired businesses, strategic investments and other initiatives that the Company may pursue from time to time;

the effects of business trends on the outlook for individual restaurant locations and the effect on the carrying value of those locations;

general or regional economic weakness, business and societal conditions and the weather impact on sales and customer travel; discretionary

income or personal expenditure activity of the Company’s customers; implementation of new or changes in interpretation of existing

accounting principles generally accepted in the United States of America ("GAAP"); and other factors described from time to

time in the Company’s filings with the Securities and Exchange Commission (the “SEC”), press releases, and other communications.

Any forward-looking statement made by the Company herein, or elsewhere, speaks only as of the date on which made. The Company expressly

disclaims any intent, obligation or undertaking to update or revise any forward-looking statements made herein to reflect any change in

the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statements

are based.

Important Additional Information and Where to Find It

On October 9, 2024, Cracker Barrel filed

a definitive proxy statement on Schedule 14A (the “Proxy Statement”) and an accompanying WHITE proxy card in connection with

the solicitation of proxies for the 2024 Annual Meeting of Cracker Barrel shareholders (the “Annual Meeting”). INVESTORS AND

SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND OTHER RELEVANT

DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain

copies of these documents and other documents filed with the SEC by Cracker Barrel for no charge at the SEC’s website at www.sec.gov.

Copies will also be available at no charge in the Investors section of Cracker Barrel’s corporate website at www.crackerbarrel.com.

Participants

Cracker Barrel, its directors and its executive

officers will be participants in the solicitation of proxies from Cracker Barrel shareholders in connection with the matters to be considered

at the Annual Meeting. Information regarding the names of Cracker Barrel’s directors and executive officers and certain other individuals

and their respective interests in Cracker Barrel by security holdings or otherwise is set forth in the Proxy Statement. To the extent

holdings of such participants in Cracker Barrel's securities have changed since the amounts described in the Proxy Statement, such changes

have been reflected on Initial Statements of Beneficial Ownership on Form 3, Statements of Change in Ownership on Forms 4 or Annual

Statement of Changes in Beneficial Ownership of Securities on Forms 5 filed with the SEC. Copies of these documents are or will be available

at no charge and may be obtained as described in the preceding paragraph.

About Cracker Barrel Old Country Store®

Cracker

Barrel Old Country Store, Inc. (Nasdaq: CBRL) is on a mission to bring craveable, delicious homestyle food and unique retail products

to all guests while serving up memorable, distinctive experiences that make everyone feel welcome. Established in 1969 in Lebanon, Tenn.,

Cracker Barrel and its affiliates operate approximately 660 company-owned Cracker Barrel Old Country Store® locations in 44 states

and own the fast-casual Maple Street Biscuit Company. For more information about the company, visit www.crackerbarrel.com.

CBRL-F

Investor Contact:

Adam Hanan

(615) 443-9887

Okapi Partners LLC

(855) 208-8902

Media Contact:

Heidi Pearce

(615) 235-4135

Leigh Parrish, Tim Lynch

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449

On

November 18, 2024, the Company updated the Campaign Website. A copy of the updated website content (other than that previously filed

or filed herewith) can be found below.

###

Forward-Looking Statements

Except for specific historical information, certain

of the matters discussed in this filing may express or imply projections of items such as revenues or expenditures, statements of plans

and objectives or future operations or statements of future economic performance. These and similar statements regarding events or results

that Cracker Barrel Old Country Store, Inc. (“Cracker Barrel” or the “Company”) expects will or may occur

in the future are forward-looking statements concerning matters that involve risks, uncertainties and other factors which may cause the

actual results and performance of the Company to differ materially from those expressed or implied by such forward-looking statements.

All forward-looking information is provided pursuant to the safe harbor established under the Private Securities Litigation Reform Act

of 1995 and should be evaluated in the context of these risks, uncertainties and other factors. Forward-looking statements generally can

be identified by the use of forward-looking terminology such as “trends,” “assumptions,” “target,”

“guidance,” “outlook,” “opportunity,” “future,” “plans,” “goals,”

“objectives,” “expectations,” “near-term,” “long-term,” “projection,” “may,”

“will,” “would,” “could,” “expect,” “intend,” “estimate,” “anticipate,”

“believe,” “potential,” “regular,” “should,” “projects,” “forecasts,”

or “continue” (or the negative or other derivatives of each of these terms) or similar terminology.

The Company believes that the assumptions underlying

any forward-looking statements are reasonable; however, any of the assumptions could be inaccurate, and therefore, actual results may

differ materially from those projected in or implied by the forward-looking statements. In addition to the risks of ordinary business

operations, factors and risks that may result in actual results differing from this forward-looking information include, but are not limited

to risks and uncertainties associated with inflationary conditions with respect to the price of commodities, ingredients, transportation,

distribution and labor; disruptions to the Company’s restaurant or retail supply chain; the Company’s ability to manage retail

inventory and merchandise mix; the Company’s ability to sustain or the effects of plans intended to improve operational or marketing

execution and performance, including the Company’s strategic transformation plan; the effects of increased competition at the Company’s

locations on sales and on labor recruiting, cost, and retention; consumer behavior based on negative publicity or changes in consumer

health or dietary trends or safety aspects of the Company’s food or products or those of the restaurant industry in general, including

concerns about outbreaks of infectious disease; the effects of the Company’s indebtedness and associated restrictions on the Company’s

financial and operating flexibility and ability to execute or pursue its operating plans and objectives; changes in interest rates, increases

in borrowed capital or capital market conditions affecting the Company’s financing costs and ability to refinance its indebtedness,

in whole or in part; the Company’s reliance on a single distribution facility and certain significant vendors, particularly for

foreign-sourced retail products; information technology disruptions and data privacy and information security breaches, whether as a result

of infrastructure failures, employee or vendor errors or actions of third parties; the Company’s compliance with privacy and data

protection laws; changes in or implementation of additional governmental or regulatory rules, regulations and interpretations affecting

tax, health and safety, animal welfare, pensions, insurance or other undeterminable areas; the actual results of pending, future or threatened

litigation or governmental investigations; the Company’s ability to manage the impact of negative social media attention and the

costs and effects of negative publicity; the impact of activist shareholders; the Company’s ability to achieve aspirations, goals

and projections related to its environmental, social and governance initiatives; the Company’s ability to enter successfully into

new geographic markets that may be less familiar to it; changes in land, building materials and construction costs; the availability and

cost of suitable sites for restaurant development and the Company’s ability to identify those sites; the Company’s ability

to retain key personnel; the ability of and cost to the Company to recruit, train, and retain qualified hourly and management employees;

uncertain performance of acquired businesses, strategic investments and other initiatives that the Company may pursue from time to time;

the effects of business trends on the outlook for individual restaurant locations and the effect on the carrying value of those locations;

general or regional economic weakness, business and societal conditions and the weather impact on sales and customer travel; discretionary

income or personal expenditure activity of the Company’s customers; implementation of new or changes in interpretation of existing

accounting principles generally accepted in the United States of America (“GAAP”); and other factors described from time to

time in the Company’s filings with the Securities and Exchange Commission (the “SEC”), press releases, and other communications.

Any forward-looking statement made by the Company herein, or elsewhere, speaks only as of the date on which made. The Company expressly

disclaims any intent, obligation or undertaking to update or revise any forward-looking statements made herein to reflect any change in

the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statements

are based.

Important Additional Information and Where to Find

It

On October 9, 2024, Cracker Barrel filed a definitive

proxy statement on Schedule 14A (the “Proxy Statement”) and an accompanying WHITE proxy card in connection with the solicitation

of proxies for the 2024 Annual Meeting of Cracker Barrel shareholders (the “Annual Meeting”). INVESTORS AND SHAREHOLDERS ARE

STRONGLY ENCOURAGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED WITH

THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain copies of these

documents and other documents filed with the SEC by Cracker Barrel for no charge at the SEC’s website at www.sec.gov. Copies will

also be available at no charge in the Investors section of Cracker Barrel’s corporate website at www. crackerbarrel.com.

Participants in the Solicitation

Cracker Barrel,

its directors and its executive officers will be participants in the solicitation of proxies from Cracker Barrel shareholders in connection

with the matters to be considered at the Annual Meeting. Information regarding the names of Cracker Barrel’s directors and executive

officers and certain other individuals and their respective interests in Cracker Barrel by security holdings or otherwise is set forth

in the Proxy Statement. To the extent holdings of such participants in Cracker Barrel’s securities have changed since the amounts

described in the Proxy Statement, such changes have been reflected on Initial Statements of Beneficial Ownership on Form 3, Statements

of Change in Ownership on Forms 4 or Annual Statement of Changes in Beneficial Ownership of Securities on Forms 5 filed with the SEC.

Copies of these documents are or will be available at no charge and may be obtained as described in the preceding paragraph.

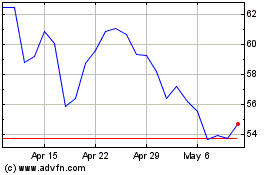

Cracker Barrel Old Count... (NASDAQ:CBRL)

Historical Stock Chart

From Nov 2024 to Dec 2024

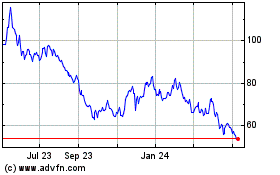

Cracker Barrel Old Count... (NASDAQ:CBRL)

Historical Stock Chart

From Dec 2023 to Dec 2024