UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

Cactus Acquisition Corp. 1 Limited

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

On October 30, 2023, Cactus Acquisition Corp. 1

Limited (the “Company”) filed a Current Report on Form 8-K that reported several actions

being undertaken by the Company or its affiliates (including contributions by the Company’s sponsor, Cactus Healthcare Management

LP, or its designees into the Company’s trust account) in connection with the Company’s upcoming extraordinary general

meeting to be held at 9:00 a.m. Eastern Time/3:00 p.m. local (Israel) time on November 2, 2023, as described below:

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 30, 2023

CACTUS ACQUISITION CORP. 1 LIMITED

(Exact Name of Registrant as Specified in its Charter)

| Cayman Islands |

|

001-40981 |

|

N/A |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(I.R.S. Employer |

| of incorporation) |

|

|

|

Identification No.) |

| 4B Cedar Brook Drive |

|

|

| Cranbury, NJ |

|

08512 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(609) 495-2222

Registrant’s telephone number, including

area code

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one Class A ordinary share and one-half redeemable warrant |

|

CCTSU |

|

The Nasdaq Stock Market LLC |

| Class A ordinary shares, par value $0.0001 per share |

|

CCTS |

|

The Nasdaq Stock Market LLC |

| Redeemable warrants, each warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

CCTSW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

Sponsor Contributions and Additional

Actions in Connection with Extraordinary General Meeting

As

previously disclosed, Cactus Acquisition Corp. 1 Limited, a Cayman Islands exempted company (“Cactus” or the “Company”)

has called an extraordinary general meeting of the Company to be held at 9:00 a.m. Eastern Time/3:00 p.m. local (Israel) time on November

2, 2023 (the “Meeting”) for the purpose of considering and voting on, among other proposals, a proposal

to approve, by way of special resolution, an amendment to Cactus’ Amended and Restated Memorandum and Articles of Association (the

“Articles”) to extend the date by which Cactus has to consummate a business combination (the “Extension”)

from November 2, 2023 to November 2, 2024 (the “Extension Date”), or such earlier date as may be determined by Cactus’

board of directors in its sole discretion (the “Articles Extension Proposal”).

On October 30, 2023, the

Company issued a press release announcing the following additional actions being undertaken in anticipation of the Meeting:

Sponsor Contributions to Trust Account

If the Extension is approved

at the Meeting and implemented, the Company’s sponsor, Cactus Healthcare Management LP (the “Sponsor”) or its

designees will deposit into the Company’s trust account as a loan (a “Contribution”, and the Sponsor or its designee

making such Contribution, a “Contributor”), on the 15th day of each calendar month beginning with November

2023, until (but not including) November 2024, the lesser of (x) $20,000 and (y) $0.01 per publicly-held Class A ordinary share multiplied

by the number of publicly-held Class A ordinary shares outstanding on such applicable date, for maximum aggregate Contributions over the

course of the twelve-month Extension period of $240,000 (each such date on which a Contribution is to be deposited into the Company’s

trust account, a “Contribution Date”).

If a Contributor fails

to make a Contribution by an applicable Contribution Date (subject to a three business day grace period), the Company will liquidate and

dissolve as soon as practicable after such date and in accordance with the Company’s Articles. The Contributions will be evidenced

by a non-interest bearing, unsecured promissory note and will be repayable by the Company upon consummation of an initial business combination.

If the Company does not consummate an initial business combination by the Extension Date, any such promissory notes will be repaid only

from funds held outside of the Company’s trust account or will be forfeited, eliminated or otherwise forgiven. Any Contribution

is conditioned on the approval of Proposals No. 1 and 2 (which provide for the Extension) at the Meeting and the implementation of the

Extension. No Contribution will occur if such proposals are not approved or the Extension is not implemented. If the Company has consummated

an initial business combination or announced its intention to wind up prior to any Contribution Date, any undertaking by the Contributors

to make Contributions will terminate.

Trust Funds Will Not Be Withdrawn to Pay

Excise Taxes

On August 16, 2022, the

Inflation Reduction Act of 2022 (the “IR Act”) was signed into federal law. The IR Act provides for, among other things,

a new U.S. federal 1% excise tax on certain repurchases (including redemptions) of stock by publicly traded U.S. domestic corporations

and certain U.S. domestic subsidiaries of publicly traded foreign corporations occurring on or after January 1, 2023. Any redemptions

of public shares on or after January 1, 2023, including in connection with the Extension, may be subject to such excise tax. The Company

confirms that if the Extension is implemented, it will not withdraw any funds from its trust account, including interest earned on the

funds held in the trust account, to pay for the 1% excise tax that may become due under the IR Act.

Trust Funds to Be Held in Interest-Bearing

Account, if Liquidated

If the Extension is implemented

and the Company thereafter determines to liquidate the U.S. government treasury obligations or money market funds held in the Company’s

trust account, the Company intends to maintain the funds in the trust account in cash in an interest-bearing demand deposit account at

a national bank. Interest on such deposit account currently yields approximately 5.25% per annum, but such deposit account carries a variable

rate and the Company cannot assure investors that such rate will not decrease or increase significantly.

Forward Looking Statements

This Current Report on

Form 8-K includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private

Securities Litigation Reform Act of 1995. Certain of these forward-looking statements can be identified by the use of words such as “believes,”

“expects,” “intends,” “plans,” “estimates,” “assumes,” “may,”

“should,” “will,” “seeks,” or other similar expressions. Such statements may include, but are not

limited to, statements regarding the approval of certain proposals at the Meeting, implementation of the Extension or any Contributions

to the trust account, any excise tax liabilities of the Company under the IR Act, liquidation of any securities held in the trust account,

placement of funds held in the trust account in an interest-bearing demand deposit account being permitted by the trustee of the trust

account or current or future interest rates on funds held in the trust account. These statements are based on current expectations on

the date of this Current Report on Form 8-K and involve a number of risks and uncertainties that may cause actual results to differ significantly,

including those risks set forth in the definitive proxy statement related to the Meeting filed by the Company with the Securities and

Exchange Commission (the “SEC”) on October 27, 2023 (the “Definitive Proxy Statement”), the Company’s

most recent Annual Report on Form 10-K and other documents filed by the Company with the SEC. Copies of such filings are available at

the SEC’s website at www.sec.gov. The Company does not assume any obligation to update or revise any such forward-looking statements,

whether as the result of new developments or otherwise. Readers are cautioned not to put undue reliance on forward-looking statements.

Additional Information and Where to Find

It

Further information related

to attendance, voting and the proposals to be considered and voted on at the Meeting is provided in the Definitive Proxy Statement, which

has been mailed to the Company’s shareholders of record as of the record date for the Meeting (October 19, 2023). Investors and

security holders of the Company are advised to read the Definitive Proxy Statement because it contains important information about the

Meeting and the Company. Investors and security holders of the Company may also obtain a copy of the Definitive Proxy Statement, as well

as other relevant documents that have been or will be filed by the Company with the SEC, without charge and once available, at the SEC’s

website at www.sec.gov or by directing a request to: Stephen T. Wills, Chief Financial Officer, c/o Cactus Acquisition Corp. 1 Limited,

4B Cedar Brook Drive, Cranbury, NJ 08512, email: swills@cactususac1.com; telephone: (609) 495-2222.

Participants in the Solicitation

The Company and certain

of its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from the Company’s

shareholders in respect of the proposals to be considered and voted on at the Meeting. Information concerning the interests of the directors

and executive officers of the Company is set forth in the Definitive Proxy Statement, which may be obtained free of charge from the sources

indicated above.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: October 30, 2023

| |

CACTUS ACQUISITION CORP. 1 LIMITED |

| |

|

|

| |

By: |

/s/ Stephen T. Wills |

| |

Name: |

Stephen T. Wills |

| |

Title: |

Chief Financial Officer |

3

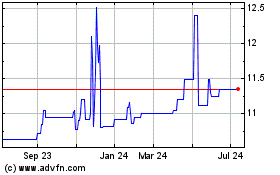

Cactus Acquisition Corp 1 (NASDAQ:CCTSU)

Historical Stock Chart

From Apr 2024 to May 2024

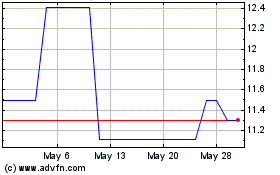

Cactus Acquisition Corp 1 (NASDAQ:CCTSU)

Historical Stock Chart

From May 2023 to May 2024