CECO Environmental Announces Expiration of Tender Offer Period for Outstanding Shares of Profire Energy

03 January 2025 - 12:29AM

CECO Environmental Corp. (Nasdaq: CECO) (together with its

consolidated subsidiaries and affiliates, “CECO”), a leading

environmentally focused, diversified industrial company whose

solutions protect people, the environment and industrial equipment,

today announced the successful completion of the previously

announced tender offer (the “Offer”) to acquire all of the issued

and outstanding shares (the “Shares”) of Profire Energy, Inc.

(Nasdaq: PFIE) (“PFIE” or the “Company”) at a price per share of

$2.55, in cash, without interest and less applicable withholding

taxes, by CECO’s wholly owned subsidiary, Combustion Merger Sub,

Inc. (“Purchaser”). The Offer expired at one minute after 11:59

P.M. New York City time on December 31, 2024 (the “Expiration

Time”). The Offer was made pursuant to the agreement and plan of

merger (the “Merger Agreement”) executed on October 28, 2024 and

announced by CECO and PFIE on October 29, 2024, pursuant to which

Purchaser agreed to acquire PFIE in a transaction valued at

approximately $125 million.

The depositary and paying agent for the Offer has advised CECO

that, as of the Expiration Time, a total of 39,688,706 Shares had

been validly tendered and not validly withdrawn pursuant to the

Offer, and it has received commitments to tender 337,815 additional

Shares under the guaranteed delivery procedures described in the

Offer, representing in the aggregate approximately 86.31% of the

outstanding Shares. As of the Expiration Time, the number of Shares

validly tendered and not validly withdrawn pursuant to the Offer

satisfied the minimum tender condition, and all other conditions to

the Offer described in the Offer to Purchase relating to the Offer

were satisfied or waived. CECO irrevocably accepted for payment all

Shares validly tendered and not validly withdrawn, including Shares

validly tendered pursuant to the guaranteed delivery procedures,

and will promptly pay for all such tendered Shares in accordance

with the terms of the Offer.

Following the acceptance for payment of the tendered Shares,

CECO intends to promptly complete its acquisition of PFIE through

the merger of Purchaser with and into PFIE, in which each Share

issued and outstanding that is not irrevocably accepted for payment

in the Offer will be cancelled and converted into the right to

receive $2.55 per share, in cash, without interest and less any

required withholding taxes. As a result of the merger, PFIE will

become a wholly owned subsidiary of CECO. In addition, the Shares

will cease to trade on and be delisted from the Nasdaq Capital

Market.

ABOUT CECO ENVIRONMENTAL

CECO Environmental is a leading environmentally focused,

diversified industrial company, serving a broad landscape of

industrial air, industrial water, and energy transition markets

across the globe through its key business segments: Engineered

Systems and Industrial Process Solutions. Providing innovative

technology and application expertise, CECO helps companies grow

their business with safe, clean, and more efficient solutions that

help protect people, the environment and industrial equipment. In

regions around the world, CECO works to improve air quality,

optimize the energy value chain, and provide custom solutions for

applications including power generation, petrochemical processing,

general industrial, refining, midstream oil and gas, electric

vehicle production, polysilicon fabrication, battery recycling,

beverage can, and water/wastewater treatment along with a wide

range of other applications. CECO is listed on Nasdaq under the

ticker symbol “CECO.” Incorporated in 1966, CECO’s global

headquarters is in Addison, Texas. For more information, please

visit www.cecoenviro.com.

SAFE HARBOR STATEMENT

Certain statements in this communication are forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934,

both as amended, which are intended to be covered by the safe

harbor for “forward-looking statements” provided by the Private

Securities Litigation Reform Act of 1995. Any statements contained

in this communication, other than statements of historical fact,

including statements about management’s beliefs and expectations,

are forward-looking statements and should be evaluated as such.

These statements are made on the basis of management’s views and

assumptions regarding future events and business performance. We

use words such as “believe,” “expect,” “anticipate,” “intends,”

“estimate,” “forecast,” “project,” “will,” “plan,” “should” and

similar expressions to identify forward-looking statements.

Forward-looking statements involve risks and uncertainties that may

cause actual results to differ materially from any future results,

performance or achievements expressed or implied by such

statements. Potential risks and uncertainties, among others, that

could cause actual results to differ materially are discussed under

“Item 1A. Risk Factors” of CECO’s Quarterly Reports on Form 10-Q

and in CECO’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, and include, but are not limited to:

- the parties’ ability to complete the proposed transactions

contemplated by the Merger Agreement in the anticipated timeframe

or at all;

- the effect of the announcement or pendency of the proposed

transactions on business relationships, operating results, and

business generally;

- risks that the proposed transactions disrupt current plans and

operations and potential difficulties in employee retention as a

result of the proposed transactions;

- risks related to diverting management’s attention from ongoing

business operations;

- the outcome of any legal proceedings that have been or may be

instituted related to the proposed transactions;

- the amount of the costs, fees, expenses and other charges

related to the proposed transactions;

- the sensitivity of CECO’s business to economic and financial

market conditions generally and economic conditions in CECO’s

service areas;

- dependence on fixed price contracts and the risks associated

therewith, including actual costs exceeding estimates and method of

accounting for revenue;

- the effect of growth on CECO’s infrastructure, resources and

existing sales;

- the ability to expand operations in both new and existing

markets;

- the potential for contract delay or cancellation as a result of

on-going or worsening supply chain challenges;

- liabilities arising from faulty services or products that could

result in significant professional or product liability, warranty

or other claims;

- changes in or developments with respect to any litigation or

investigation;

- failure to meet timely completion or performance standards that

could result in higher cost and reduced profits or, in some cases,

losses on projects;

- the potential for fluctuations in prices for manufactured

components and raw materials, including as a result of tariffs and

surcharges, and rising energy costs;

- inflationary pressures relating to rising raw material costs

and the cost of labor;

- the substantial amount of debt incurred in connection with

CECO’s strategic transactions and its ability to repay or refinance

it or incur additional debt in the future;

- the impact of federal, state or local government

regulations;

- CECO’s ability to repurchase shares of its common stock and the

amounts and timing of repurchases;

- CECO’s ability to successfully realize the expected benefits of

its restructuring program;

- economic and political conditions generally;

- CECO’s ability to optimize its business portfolio by

identifying acquisition targets, executing upon any strategic

acquisitions or divestitures, integrating acquired businesses and

realizing the synergies from strategic transactions; and

- unpredictability and severity of catastrophic events, including

cybersecurity threats, acts of terrorism or outbreak of war or

hostilities or public health crises, as well as management’s

response to any of the aforementioned factors.

Many of these risks are beyond management’s ability to control

or predict. Should one or more of these risks or uncertainties

materialize, or should any related assumptions prove incorrect,

actual results may vary in material aspects from those currently

anticipated. Investors are cautioned not to place undue reliance on

such forward-looking statements as they speak only to CECO’s views

as of the date the statement is made. Furthermore, the

forward-looking statements speak only as of the date they are made.

Except as required under the federal securities laws or the rules

and regulations of the Securities and Exchange Commission, CECO

undertakes no obligation to update or review any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Company Contact:Peter JohanssonChief Financial

and Strategy Officer888-990-6670

Investor Relations Contact:Steven Hooser and

Jean Marie YoungThree Part

Advisors214-872-2710Investor.Relations@OneCECO.com

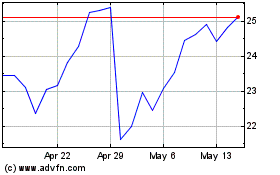

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Dec 2024 to Jan 2025

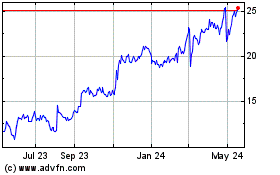

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Jan 2024 to Jan 2025