Q3 2023 Net Revenue Increased 175% to $5.8

million

Number of Vehicles Sold Increased by 326% to

298 Vehicles

Gross Profit Margin Increased 4,260 bps to

12.4% from a loss of -30.3%

Average Selling Price Increased by 15.7% to

Approximately $19.2 Thousand

Cenntro Electric Group Limited (NASDAQ: CENN) (“Cenntro”, “we”,

“our”, “us”, or the “Company”), a leading electric vehicle

technology company with advanced, market-validated electric

commercial vehicles (“ECVs”), today announced its financial results

for the third quarter ended September 30, 2023.

Third Quarter 2023 Financial and Operating Highlights

- Net revenue of $5.8 million increased 175% year over year;

- Sales volume increased by 326% year over year and 27%

sequentially quarter over quarter to 298 vehicles;

- Average selling price (“ASP”) increased 15.7% year over year to

approximately $19,200; and

- Adjusted EBITDA for the quarter is a loss of $12.1 million

compared to a loss of $12.0 million for Q3 2022.

Peter Z. Wang, Chief Executive Officer explained, “Our sales

momentum in the third quarter continued to ramp up as distribution

expanded from the second quarter of 2023. Consequentially, we have

sold 298 vehicles in Q3 2023 compared to 235 vehicles in Q2 2023

and 70 in Q3 2022. More importantly, to date the demand for some of

our newly launched vehicle models in Europe such as the LS260® has

outpaced our estimates. We have also experienced positive sales

momentum for our iChassis, having sold 103 units in Q3, though

these 103 units are not inclusive of the number of vehicles sold

because iChassis is not considered a complete vehicle. We continue

to build our sales momentum in 2023 from quarter to quarter to

improve the effectiveness of our sales process, including having

streamlined our North American sales team structure during Q3

2023.

“We built on our second quarter results by expanding our vehicle

lineup to include Avantier and Antric, as well as our assembly

capabilities in the United States, benefitting from our

qualification for government incentives in both the United States

and the European Union. Based on these developments, we are

optimistic that our sales growth momentum will continue even amidst

the current uncertain economic and global political

environment.

“Cenntro’s most recent US assembly and manufacturing facility in

Ontario, California is preparing to scale production in Q4 2023.

The facility has the capability to assemble and distribute the

TeeMak, Metro and Logistar series models with a focus on the

Logistar 400® and future models. We believe Ontario will also

support strategic growth and sales on the west coast and the entire

western region of the United States. California remains a strong

market for EV sales and infrastructure development, as such we

believe dealer and distributor partnerships will strengthen sales

and aftermarket support. In addition, from a supply chain

standpoint, we believe California will serve as a very

cost-effective point of entry for our products from China to serve

our customers on the West Coast.

“Cenntro’s LS400 was also approved for the Commercial Clean

Vehicle Credit, allowing purchasers to apply for a Federal Tax

Credit under IRC 45W. Further, in conjunction with the June 2023

California Air Resources Board (“CARB”) certification for the Metro

and LS400, these models have recently been approved for

Zero-Emission Powertrain Certification (“ZEP”), which moves us

forward in the process for Hybrid and Zero-Emission Truck and Bus

Voucher Inventive Program (“HVIP”) approval. The HVIP program

allows end purchasers to apply for the HVIP vouchers offsetting

their purchase price. Under the standard HVIP approval, customers

may qualify for up to $60,000 of the purchase of the LS400. The

final HVIP approval is anticipated in Q4 2023.

“Our footprint in the European market continues to build in

scale with our EVC customer base looking for competitive products

to complete their local commerce needs and allowing them to

participate in Zero Emission initiatives. We have also determined

that providing a compatible charging solution to our customers that

is available for sale along with our product line is vital. We have

begun to develop relationships that will allow us to provide a

charging solution as part of the sales transaction.

“Looking ahead, we continue to position Cenntro to capture

market share with our diverse and innovative lineup of all-electric

vehicles and an expanded geographic footprint for production,

distribution, and service infrastructure. Combined with our hybrid

EV Center and distribution partner sales model, we continue to gain

traction with customers,” concluded Wang.

Edmond Cheng, Chief Financial Officer added, “Sales volume in

the third quarter of 2023 of our electric commercial vehicles

increased 326% year-over-year to 298 from 70 in the same period of

2022. At the same time, we achieved an increase of net revenue of

175% to approximately $5.8 million for the third quarter of 2023

compared to $2.1 million in the same period of 2022. The increase

in net revenue is mainly attributable to an approximately $3.6

million increase in vehicle revenue. More importantly, we continue

to experience quarter-to-quarter revenue growth in 2023 as third

quarter grew 36% from the second quarter of 2023 to $5.8 million

and second quarter 2023 revenue grew 22% from the first quarter of

2023. We are cautiously optimistic that the growth momentum will

continue in the fourth quarter, reflecting our investment in

expanding our product offerings and strengthening our global

distribution capabilities.

“Our average sales price was approximately $19.2 thousand in the

third quarter of 2023, up 15.7% from approximately $16.6 thousand

in the third quarter of 2022. We continue to benefit from the

transition to an in-country direct sales model and our launch of

new models, particularly the LS260 as mentioned by Peter. Also, our

overall vehicles gross margin for the nine months ended September

30, 2023 and 2022 was approximately 16.3% and -3.6%, respectively.

The increase in our overall gross profit was the result of less

impairment of inventory recognized in the nine months ended

September 30, 2023 compared with the same period in 2022.

“As of September 30, 2023, we had approximately $44.6 million in

cash and cash equivalents on our balance sheet. We also had $4.6

million in accounts receivable, $43.1 million in inventory which

consisted of approximately $28.4 million in finished goods

inventory, and approximately $28.6 million in investments in equity

securities as of September 30, 2023,” concluded Cheng.

Third Quarter 2023 Financial Results

Net Revenue

Net revenue was $5.8 million for the three months ended

September 30, 2023, an increase of 175% from $2.1 million in the

same period of 2022. The increase was primarily due to an increase

in vehicle sales, spare parts sales, including 103 units of the

iChassis, and an improvement in the average selling price.

Gross Profit

Gross Profit for the three months ended September 30, 2023 was

approximately $0.7 million, an increase of approximately $1.4

million from approximately $0.6 million of gross loss for the three

months ended September 30, 2022. For the three months ended

September 30, 2023 and 2022, our overall gross margin was

approximately 12.4% and -30.3%, respectively. Our gross margin of

vehicle sales for the three months ended September 30, 2023 and

2022 was 15.8% and -34.8%, respectively. The increase of our

overall gross profit was caused by less impairment of inventory

recognized in the three months ended September 30, 2023 compared

with the same period in 2022.

Operating Expenses

Total operating expenses were approximately $13.3 million in the

third quarter of 2023, compared with $9.6 million in the third

quarter of 2022.

Selling and marketing expenses for the three months ended

September 30, 2023 were approximately $2.6 million, an increase of

approximately $1.0 million or approximately 60.8% from

approximately $1.6 million for the three months ended September 30,

2022. The increase in selling and marketing expenses in 2023 was

primarily attributed to the increase in salary expenses and

marketing related professional fee of approximately $0.2 million

and $0.8 million, respectively.

General and administrative expenses for the three months ended

September 30, 2023 were approximately $9.1 million, an increase of

approximately $2.9 million or approximately 45.8% from

approximately $6.2 million for the three months ended September 30,

2022. The increase in general and administrative expenses in 2023

was primarily attributed to an increase in salary and social

insurance and legal, share-based compensation and ROU amortization

$1.2 million, $0.8 million and $0.7 million, respectively.

Research and development expenses for the three months ended

September 30, 2023 were approximately $1.6 million, a decrease of

approximately $0.2 million or approximately 9.0% from approximately

$1.8 million for the three months ended September 30, 2022. The

decrease in research and development expenses in 2023 was primarily

attributed to the decrease in design and development expenditures

of approximately $0.5 million, offset by the increase in salary

expense of approximately $0.2 million.

Net Loss

Net loss was approximately $16.1 million in the third quarter of

2023, compared with net loss of $15.1 million in the third quarter

of 2022.

Balance Sheet

Cash and cash equivalents were approximately $44.6 million as of

September 30, 2023, compared with $154.0 million as of December 31,

2022.

Adjusted EBITDA

Adjusted EBITDA was approximately $(12.1) million in the third

quarter of 2023, compared with Adjusted EBITDA of $(12.0) million

in the third quarter of 2022.

We define Adjusted EBITDA as net income (or net loss) before net

interest expense, income tax expense, depreciation and amortization

as further adjusted to exclude the impact of stock-based

compensation expense and other non-recurring expenses including

expenses related to TME Acquisition, expenses related to one-off

payment inherited from the original Naked Brand Group, impairment

of goodwill, convertible bond issuance fee, loss on redemption of

convertible promissory notes, loss on exercise of warrants, and

change in fair value of convertible promissory notes and derivative

liability. We present Adjusted EBITDA because we consider it to be

an important supplemental measure of our performance and believe it

is frequently used by securities analysts, investors, and other

interested parties in the evaluation of companies in our industry.

Our management believes that investors’ understanding of our

performance is enhanced by including this non-GAAP financial

measure as a reasonable basis for comparing our ongoing results of

operations.

US-GAAP NET INCOME (LOSS) TO ADJUSTED EBITDA

RECONCILIATION

Three Months ended

September 30,

Nine Months ended September

30,

2023

2022

2023

2022

(Expressed in U.S. Dollars)

(Unaudited)

(Unaudited)

Net loss

$

(16,103,199

)

$

(15,088,738

)

$

(41,294,342

)

$

(38,143,026

)

Interest expense, net

84,573

110,659

137,726

(176,214

)

Income tax expense

(384

)

(43,366

)

25,084

(92,228

)

Depreciation and amortization

425,218

431,290

1,213,489

916,227

Share-based compensation expense

2,154,710

1,314,446

4,565,001

2,624,302

Loss on redemption of convertible

promissory notes

(966

)

-

(865

)

-

Loss on exercise of warrants

1,134

-

228,749

Convertible bond issuance fee

-

5,589,336

-

5,589,336

Change in fair value of convertible

promissory notes and derivative liability

(15,143

)

(4,280,538

)

(88,568

)

(4,280,538

)

Loss from acquisition of Antric

1,316,772

-

1,316,772

-

Expenses related to TME Acquisition

-

-

--

348,987

Expenses related to one-off payment

inherited from the original Naked Brand Group

-

-

-

8,299,178

Adjusted EBITDA

$

(12,135,425

)

$

(11,966,911

)

$

(33,896,954

)

$

(24,913,976

)

Represents a non-GAAP financial measure.

About Cenntro Electric Group Ltd.

Cenntro Electric Group Ltd. (or "Cenntro") (NASDAQ: CENN) is a

leading designer and manufacturer of electric commercial vehicles.

Cenntro's purpose-built ECVs are designed to serve a variety of

organizations in support of city services, last-mile delivery, and

other commercial applications. Cenntro plans to lead the

transformation in the automotive industry through scalable,

decentralized production, and smart driving solutions empowered by

the Cenntro iChassis. For more information, please visit Cenntro's

website at: www.cenntroauto.com.

Forward-Looking Statements

This communication contains "forward-looking statements" within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include all statements that are not historical facts.

Such statements may be, but need not be, identified by words such

as "may,'' "believe,'' "anticipate,'' "could,'' "should,''

"intend,'' "plan,'' "will,'' "aim(s),'' "can,'' "would,''

"expect(s),'' "estimate(s),'' "project(s),'' "forecast(s)'',

"positioned,'' "approximately,'' "potential,'' "goal,''

"strategy,'' "outlook'' and similar expressions. Examples of

forward-looking statements include, among other things, statements

regarding assembly and distribution capabilities, decentralized

production, and fully digitalized autonomous driving solutions. All

such forward-looking statements are based on management's current

beliefs, expectations, and assumptions, and are subject to risks,

uncertainties and other factors that could cause actual results to

differ materially from the results expressed or implied in this

communication. For additional risks and uncertainties that could

impact Cenntro's forward-looking statements, please see disclosures

contained in Cenntro's public filings with the Securities and

Exchange Commission (the “SEC”), including the "Risk Factors" in

Cenntro's Annual Report on Form 10-K filed with the SEC on June 30,

2023 and which may be viewed at www.sec.gov.

CENNTRO ELECTRIC GROUP

LIMITED

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

September 30,

2023

December 31,

2022

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

44,645,341

$

153,966,777

Restricted cash

198,041

130,024

Accounts receivable, net

4,645,738

565,398

Inventories

43,081,772

31,843,371

Prepayment and other current assets

17,360,617

16,138,330

Deferred cost -current

14,281

-

Amounts due from a related party

210,335

366,936

Total current assets

110,156,125

203,010,836

Non-current assets:

long-term investment, net

3,557,697

5,325,741

Investment in equity securities

28,593,070

29,759,195

Property, plant and equipment, net

20,132,381

14,962,591

Intangible assets, net

6,384,532

4,563,792

Right-of-use assets

20,679,376

8,187,149

Deferred cost - non-current

206,700

-

Other non-current assets, net

2,152,968

2,039,012

Total non-current assets

81,706,724

64,837,480

Total Assets

$

191,862,849

$

267,848,316

LIABILITIES AND EQUITY

LIABILITIES

Current liabilities:

Accounts payable

$

4,842,645

$

3,383,021

Accrued expenses and other current

liabilities

3,663,756

5,048,641

Contractual liabilities

3,084,737

2,388,480

Operating lease liabilities, current

4,548,226

1,313,334

Convertible promissory notes

9,953,562

57,372,827

Deferred government grant, current

52,721

26,533

Amounts due to related parties

37,951

716,372

Total current liabilities

26,183,598

70,249,208

Non-current liabilities:

Deferred government grant, non-current

948,971

497,484

Derivative liability - investor

warrant

12,191,457

14,334,104

Derivative liability - placement agent

warrant

3,455,328

3,456,404

Operating lease liabilities,

non-current

17,074,145

7,421,582

Total non-current liabilities

33,669,901

25,709,574

Total Liabilities

$

59,853,499

$

95,958,782

Commitments and contingencies

EQUITY

Ordinary shares (No par value; 304,449,091

and 300,841,995 shares issued and outstanding as of September 30,

2023 and December 31, 2022, respectively)

-

-

Additional paid in capital

401,672,121

397,497,817

Accumulated deficit

(260,959,274

)

(219,824,176

)

Accumulated other comprehensive loss

(8,701,442

)

(5,306,972

)

Total equity attributable to

shareholders

132,011,405

172,366,669

Non-controlling interests

(2,055

)

(477,135

)

Total Equity

$

132,009,350

$

171,889,534

Total Liabilities and Equity

$

191,862,849

$

267,848,316

CENNTRO ELECTRIC GROUP

LIMITED

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2023

2022

2023

2022

Net revenues

$

5,762,831

$

2,096,590

$

13,470,895

$

7,131,912

Cost of goods sold

(5,045,364

)

(2,730,920

)

(11,411,439

)

(7,234,760

)

Gross profit

717,467

(634,330

)

2,059,456

(102,848

)

OPERATING EXPENSES:

Selling and marketing expenses

(2,626,829

)

(1,633,340

)

(7,238,563

)

(4,259,908

)

General and administrative expenses

(9,071,910

)

(6,220,227

)

(25,715,387

)

(26,446,511

)

Research and development expenses

(1,634,796

)

(1,796,268

)

(5,347,785

)

(3,610,780

)

Total operating expenses

(13,333,535

)

(9,649,835

)

(38,301,735

)

(34,317,199

)

Loss from operations

(12,616,068

)

(10,284,165

)

(36,242,279

)

(34,420,047

)

OTHER EXPENSE:

Interest (expense) income, net

(84,573

)

(110,659

)

(137,726

)

176,214

(Loss) Income from long-term

investment

(107,069

)

36,441

(236,672

)

47,319

Loss from acquisition of Antric Gmbh

(1,316,772

)

-

(1,316,772

)

-

Impairment of long-term investment

(2,668

)

-

(1,157,334

)

-

Gain on redemption of convertible

promissory notes

966

-

865

-

Loss on exercise of warrants

(1,134

)

-

(228,749

)

-

Change in fair value of convertible

promissory notes and derivative liability

15,143

4,280,538

88,568

4,280,538

Convertible bond issuance cost

-

(5,589,336

)

-

(5,589,336

)

Change in fair value of equity

securities

(1,879,593

)

19,052

(1,166,125

)

19,052

Other expense, net

(111,815

)

(3,483,975

)

(873,034

)

(2,748,994

)

Loss before income taxes

(16,103,583

)

(15,132,104

)

(41,269,258

)

(38,235,254

)

Income tax benefit (expense)

384

43,366

(25,084

)

92,228

Net loss

(16,103,199

)

(15,088,738

)

(41,294,342

)

(38,143,026

)

Less: net loss attributable to

non-controlling interests

(534

)

(668,512

)

(159,244

)

(1,339,153

)

Net loss attributable to the Company’s

shareholders

$

(16,102,665

)

$

(14,420,226

)

$

(41,135,098

)

$

(36,803,873

)

OTHER COMPREHENSIVE LOSS

Foreign currency translation

adjustment

(931,345

)

(3,686,137

)

(3,419,038

)

(7,511,222

)

Total comprehensive loss

(17,034,544

)

(18,774,875

)

(44,713,380

)

(45,654,248

)

Less: total comprehensive loss

attributable to non-controlling interests

(534

)

(454,156

)

(183,812

)

(994,960

)

Total comprehensive loss to the

Company’s shareholders

$

(17,034,010

)

$

(18,320,719

)

$

(44,529,568

)

$

(44,659,288

)

CENNTRO ELECTRIC GROUP

LIMITED

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

For the Nine Months Ended

September 30,

2023

2022

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net cash used in operating

activities

$

(45,588,906

)

$

(47,671,865

)

CASH FLOWS FROM INVESTING

ACTIVITIES:

Purchase of equity investment

(680,932

)

(3,616,188

)

Purchase of equity securities

-

(5,000,000

)

Purchase of plant and equipment

(7,329,509

)

(1,479,712

)

Purchase of land use right and

property

(2,183,430

)

(16,764,322

)

Purchase of other intangible assets

(7,502

)

-

Acquisition of CAE’s equity interests

(1,924,557

)

(3,612,717

)

Cash acquired from acquisition of CAE

-

1,118,700

Acquisition of Antric Gmbh’s equity

interests

(1

)

-

Cash acquired from acquisition of Antric

Gmbh

1,376

-

Payment of expense for Acquisition of

CAE’s equity interests

-

(348,987

)

Proceeds from disposal of property, plant

and equipment

842

314

Loans provided to third parties

(790,000

)

(1,276,617

)

Repayment of loans from related

parties

-

281,436

Net cash used in investing

activities

(12,913,713

)

(30,698,093

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Repayment of loans to related parties

-

(1,734,016

)

Repayment of loans to third parties

-

(1,128,070

)

Repayment of bank loans

(602,477

)

-

Purchase of CAE’s loan

-

(13,228,101

)

Reduction of capital

-

(13,930,000

)

Proceed from issuance of convertible

promissory notes

-

54,069,000

Redemption of convertible promissory

notes

(47,534,119

)

-

Proceed from exercise of share-based

awards

-

14,386

Payment of expense for the reverse

recapitalization

-

(904,843

)

Net cash (used in) provided by

financing activities

(48,136,596

)

23,158,356

Effect of exchange rate changes on

cash

(2,614,204

)

(5,456,870

)

Net decrease in cash, cash equivalents and

restricted cash

(109,253,419

)

(60,668,472

)

Cash, cash equivalents and restricted cash

at beginning of period

154,096,801

261,664,962

Cash, cash equivalents and restricted cash

at end of period

$

44,843,382

$

200,996,490

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION:

Interest paid

$

1,200,673

$

371,999

Income tax paid

$

4,829

$

-

SUPPLEMENTAL DISCLOSURE OF NON-CASH

INVESTING AND FINANCING ACTIVITIES:

Convention from debt to equity interest of

HW Electro Co., Ltd.

$

1,000,000

$

-

Cashless exercise of warrants

$

2,168,185

$

-

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231114757150/en/

Investor Relations Contact: MZ North America

CENN@mzgroup.us 949-491-8235

Company Contact: PR@cenntroauto.com

IR@cenntroauto.com

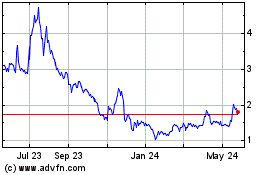

Cenntro (NASDAQ:CENN)

Historical Stock Chart

From Feb 2025 to Mar 2025

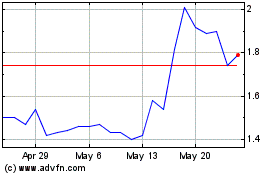

Cenntro (NASDAQ:CENN)

Historical Stock Chart

From Mar 2024 to Mar 2025