Central Garden Kept at Neutral - Analyst Blog

29 November 2011 - 3:09AM

Zacks

Central Garden & Pet Company (CENT) is a

leading producer and marketer of premium and value-oriented

products focused on the lawn and garden as well as pet supplies

markets in the U.S. On the one hand, the company is witnessing

increased sales, but on the other it is reporting dismal

bottom-line results due to rising costs of raw materials that are

weighing upon margins.

Top-Line Sustaining Momentum

The company’s diversified portfolio of brands has helped it to

develop a healthy commercial relationship with giant retailers,

such as Wal-Mart Stores Inc. (WMT), The

Home Depot Inc. (HD) and Lowe’s Companies

Inc. (LOW). This provides a significant upside potential

for the company.

This was quite evident from the company’s top line that

registered a growth of 8.6% to $376.9 million in the fourth quarter

of 2011, reflecting increased sales in the garden products segment.

Moreover, the reported net sales surpassed the Zacks Consensus

Revenue Estimate of $360 million.

Garden Products segment sales jumped 24% to $165.1 million;

however, Pet Products segment sales inched down 1% to $211.8

million.

Bottom-Line Struggling, Margins Under

Pressure

Despite witnessing a growth in the top line, Central Garden

& Pet posted disappointing bottom-line results, battered by

higher input costs and increased sales products carrying lower

margins.

The company’s quarterly loss of 21 cents a share widened from a

loss of 2 cents in the prior-year quarter. The analyst covered by

Zacks had expected the company to incur a loss 6 cents.

During the quarter under review, gross profit dropped 5.1% to

$98.2 million, whereas gross margin contracted 370 basis points to

26.1%. The fall reflected a 14.4% rise in the cost of goods sold.

Total operating loss for the quarter was $4.6 million, indicating a

significant decline from an operating income of $7.4 million in the

year-ago quarter.

Gross margin has portrayed improvement from fiscal 2004 through

fiscal 2010 but shriveled in fiscal 2011. We believe that the sale

of innovative products carrying higher margins, a reasonable price

increase and cost containment efforts may improve gross and

operating margins.

Strategies to Step Up

As Central Garden & Pet enters into fiscal 2012, the

company’s primary focus is on streamlining its cost structure and

increasing operating efficiencies in order to improve its margins.

Management hinted of gross margin improvement and bottom-line

performance to improve in the second half of calendar 2012.

The company’s long-term target is to attain a growth of at least

10% in the top line, and achieve operating margins in the range of

10% to 15%. The company also targets a $30 million yearly savings

in cost as it exits 2012.

The company intends to transform into an integrated, multi-brand

company from a portfolio of stand-alone businesses, by

restructuring and reorganizing operating units and consolidating

manufacturing facilities and logistics centers.

Central Garden & Pet has lowered the count of sales and

logistics warehouses to 27 in fiscal 2011 from 34 in fiscal 2008

and expects to further consolidate about 6 facilities during the

first half of fiscal 2012, and intends to decrease its inventory

level by approximately $60 million by the end of fiscal year in

order to manage working capital effectively. Another significant

area of savings is the SKU rationalization, and the company aims to

lower its total SKU count by at least 30% to 35%.

Let’s Conclude

Given the pros and cons, we prefer to maintain our Neutral

rating on the stock with a price target of $8.25. However, Central

Garden & Pet holds a Zacks #4 Rank that translates into a

short-term Sell rating and well defines the depressed third-quarter

2011 results.

CENTRAL GARDEN (CENT): Free Stock Analysis Report

HOME DEPOT (HD): Free Stock Analysis Report

LOWES COS (LOW): Free Stock Analysis Report

WAL-MART STORES (WMT): Free Stock Analysis Report

Zacks Investment Research

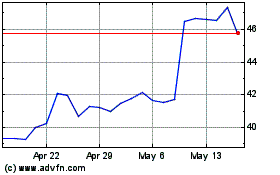

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jun 2024 to Jul 2024

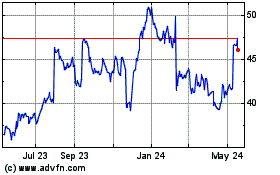

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Jul 2023 to Jul 2024