UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

————————

FORM 20-F/A

(Amendment No. 2)

————————

(Mark One)

| ☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| OR |

| |

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| For the fiscal year ended December 31, 2022 |

| |

| OR |

| |

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| For the transition period from: _____________ to _____________ |

| |

| OR |

| |

| ☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| Date of event requiring shell company report ___________ |

Commission

file number: 0-26046

CHINA

NATURAL RESOURCES, INC.

(Exact name of Registrant as specified in

its charter)

Not Applicable

(Translation of Registrant’s name into

English)

British Virgin Islands

(Jurisdiction of incorporation or organization)

Room 2205, 22/F, West Tower, Shun Tak Centre,

168-200 Connaught Road Central, Sheung Wan, Hong

Kong

(Address of principal executive offices)

Zhu Youyi, Chief Financial Officer

Room 2205, 22/F, West Tower, Shun Tak Centre,

168-200 Connaught Road Central, Sheung Wan, Hong

Kong

01185228107205

zhuyouyi@chnr.net

(Name, telephone number, e-mail and/or facsimile

number and address of company contact person)

Securities registered or to be registered

pursuant to Section 12(b) of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| Common Shares, without par value |

CHNR |

Nasdaq Capital Market |

Securities registered or to be registered pursuant

to Section 12(g) of the Act: None

Securities for which there is a reporting obligation

pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each

of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. 40,948,082 common

shares as of December 31, 2022. (8,197,897 common shares following a five-to-one share combination

as of April 3, 2023).

Indicate by check mark if the issuer is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐ No

☒

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934.

Yes

☐ No

☒

Note – Checking the box above will not

relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their

obligations under those Sections.

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Yes

☒ No

☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (•232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes

☒ No

☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large

accelerated filer,” “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange

Act. (Check one):

| Large Accelerated Filer ☐ |

|

Accelerated Filer ☐ |

|

| Non-Accelerated Filer ☒ |

|

Emerging Growth Company ☐ |

|

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by checkmark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards†

provided pursuant to Section 13(a) of the Exchange Act.

☐

† The term “new or revised

financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards

Codification after April 5, 2012.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of

its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public

accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting

the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ |

|

International Financial Reporting Standards as issued |

|

Other ☐ |

| |

|

By the International Accounting Standards Board ☒ |

|

|

If “Other” has been checked in response

to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item

17 ☐ Item

18 ☐

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐ No

☒

EXPLANATORY NOTE

This Amendment No. 2 (this “Amendment”)

to the Annual Report on Form 20-F of China Natural Resources, Inc. (the “Company”) for the year ended December 31,

2022 filed on May 15, 2023 (as amended by Amendment No. 1 to the Annual report on Form 20-F of the Company, the “Original Filing”)

is being filed solely to amend and restate in its entirety Item 16I, “Disclosure Regarding Foreign Jurisdictions that Prevent Inspections”

in order to provide the documentation required under Item 16I(a) of Form 20-F and to provide the disclosures required under Item 16I(b)

of Form 20-F.

Except as noted above, this Amendment

does not update or modify any disclosures in the Original Filing or reflect any events occurring after the filing of the Original Filing.

Accordingly, this Amendment should be read in conjunction with the Original Filing.

As required by Rule 12b-15 of

the Securities and Exchange Act of 1934, as amended, the Company is filing or furnishing the certifications required under Section

302 and Section 906 of the Sarbanes-Oxley Act of 2002 as exhibits to this Amendment No. 2.

| |

ITEM 16I. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

In June 2022, we were

conclusively listed by the SEC as a “Commission-Identified Issuer” under the HFCAA following the filing of our annual report

on Form 20-F for the fiscal year ended December 31, 2021. Our auditor, a registered public accounting firm that the PCAOB was unable to

inspect or investigate completely in 2021, issued the audit report for us for the fiscal year ended December 31, 2021. On December 15,

2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list

of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. For this reason, we do not

expect to be identified as a Commission-Identified Issuer under the HFCAA after we filed the Original Filing and the filing of this Amendment.

As of the date of the Original

Filing, Guangzhou Ruiyi Environmental Protection Technology Co., Ltd., and Shaoguan Wujiang Runheng Municipal & Rural Development

Investment Co., Ltd. each owns 20% of the registered capital of Shaoguan Angrui Environmental Technology Development Co., Limited (“Shaoguan

Angrui”), a company organized in the PRC and a 55%-owned subsidiary of Shanghai Onway Environmental Development Co., Limited

(“Shanghai Onway”). Shanghai Onway was a 51%-owned subsidiary of Shenzhen Qianhai Feishang Environmental Investment

Co., Limited (“Shenzhen Qianhai”), a company organized in the PRC and an indirect wholly-owned subsidiary of the Company

as of the date of the Original Filing. Each of Guangzhou Ruiyi Environmental Protection Technology Co., Ltd., and Shaoguan Wujiang Runheng

Municipal & Rural Development Investment Co., Ltd. is a PRC state-owned enterprise. On July 28, 2023, the Company entered into a Sale

and Purchase Agreement with Feishang Group Limited (“Feishang”) for the sale of Precise Space-Time Technology Limited.

Feishang is the Company’s largest shareholder and a British Virgin Islands company wholly owned by Mr. LI Feilie, the principal

beneficial owner of the Company and its former Chairman and CEO. After the completion of the sale, subsidiaries of Precise Space-Time

Technology Limited, including Shanghai Onway, Zhejiang Xinyu Environmental Technology Co., Limited (“Zhejiang Xinyu”)

and Shaoguan Angrui are no longer our consolidated foreign operating entities.

Except as disclosed above, based

on an examination of the Company’s register of members, public filings made by its shareholders, as of the date of the Original

Filing, governmental entities in the BVI, Hong Kong or the PRC do not have a controlling financial interest in us or any of our consolidated

foreign operating entities.

As of the date of the Original

Filing, none of the currently effective memorandum and articles of association (or equivalent organizing document) of the Company or any

of our consolidated foreign operating entities contains any charter of the Chinese Communist Party.

As of the date of the Original

Filing, the directors and officers of the Company consist of: Wong Wah On Edward, Tam Cheuk Ho, Zhu Youyi, Zou Yu, Peng Wenlie, Lam Kwan

Sing, Ng Kin Sing, Yip Wing Hang and Li Feilie. None of the Company’s directors or officers are representatives of any government

entity in the PRC.

None of the members of the board

of directors of the Company or any of our consolidated foreign entities is an official of the Chinese Communist Party, except for the

following:

| |

1. |

Zheng Lei is a director of Shanghai Onway, a director of Bayannaoer City Feishang Mining Company Limited (“Bayannaoer Mining”), and a supervisor of Yunnan Feishang Mining Co., Limited, Shenzhen Feishang Management and Consulting Co., Limited, and Shenzhen Qianhai. Zheng Lei is a member of the Chinese Communist Party. |

| |

2. |

Ding Daohua, a director of Bayannaoer Mining, is a retired civil servant in the PRC. |

| |

3. |

Zhang Huachun, a director of Yangpu Shuanghu Industrial Development Co., Limited, is a member of the Chinese Communist Party. |

| |

4. |

Qiu Jiangping, a director of Shanghai Onway, is a member of the Chinese Communist Party. |

| |

5. |

Zhang Zhengshi is a director of Zhejiang Xinyu and a director of Shaoguan Angrui. Zhang Zhengshi is a member of the Chinese Communist Party. |

| |

6. |

Peng Wenjie, a director of Shanghai Onway, is a member of the Chinese Communist Party. |

|

For

information supporting our assertion that governmental entities in the BVI, Hong Kong or the PRC do not have a controlling financial

interest in us or any of our consolidated foreign operating entities, please see the Supplemental Submission pursuant to Item 16I(a)

of Form 20-F furnished as Exhibit 99.1 to this Amendment. |

SIGNATURES

The registrant hereby certifies that it meets

all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this Annual Report

on its behalf.

| |

CHINA NATURAL RESOURCES, INC. |

| |

|

|

|

| Date: September 28, 2023 |

By: |

/s/ Wong Wah On Edward |

|

| |

|

Wong Wah On Edward, CEO |

|

Exhibit 12.1

CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT

TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Wong Wah On Edward, certify that:

| |

1. |

I have reviewed this annual report on Form 20-F of China Natural Resources, Inc.; |

| |

2. |

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| |

3. |

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| |

4. |

The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

a) Designed such disclosure controls

and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information

relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly

during the period in which this report is being prepared;

b) Designed such internal control

over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable

assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance

with generally accepted accounting principles;

c) Evaluated the effectiveness of the

registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure

controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d) Disclosed in this report any change

in the registrant’s internal control over financial reporting that occurred during the period covered by the annual report that

has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting;

and

| |

5. |

The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

a) All significant deficiencies and

material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect

the registrant’s ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material,

that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

September 28, 2023

/s/ Wong Wah On Edward

Wong Wah On Edward

Chief Executive Officer

(Principal Executive Officer)

Exhibit 12.2

CERTIFICATION OF CHIEF FINANCIAL OFFICER PURSUANT

TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

CERTIFICATION

I, Zhu

Youyi, certify that:

| |

1. |

I have reviewed this annual report on Form 20-F of China Natural Resources, Inc.; |

| |

2. |

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| |

3. |

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| |

4. |

The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

a) Designed such disclosure controls

and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information

relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly

during the period in which this report is being prepared;

b) Designed such internal control

over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable

assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance

with generally accepted accounting principles;

c) Evaluated the effectiveness of the

registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure

controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d) Disclosed in this report any change

in the registrant’s internal control over financial reporting that occurred during the period covered by the annual report that

has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting;

and

| |

5. |

The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

a) All significant deficiencies and

material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect

the registrant’s ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material,

that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

September 28, 2023

/s/ Zhu Youyi

Zhu Youyi

Chief Financial Officer

(Principal Financial Officer)

Exhibit 13.1

CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO SECTION 906 OF THE

SARBANES-OXLEY ACT OF 2002

In connection with the

Annual Report on Form 20-F of China Natural Resources, Inc. (the “Company”) for the fiscal year ended December 31,

2022 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Wong Wah On Edward, Chief

Executive Officer of the Company, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley

Act of 2002, that:

(1) The Report fully complies with the requirements

of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended; and

(2) The information contained in the Report

fairly presents, in all material respects, the financial condition and results of operations of the Company.

/s/ Wong Wah On Edward

Wong Wah On Edward

Chief Executive Officer

(Principal Executive Officer)

September 28, 2023

Exhibit 13.2

CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO SECTION 906 OF THE

SARBANES-OXLEY ACT OF 2002

In connection with the

Annual Report on Form 20-F of China Natural Resources, Inc. (the “Company”) for the fiscal year ended December 31, 2022

as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Zhu

Youyi, Chief Financial Officer of the Company, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section

906 of the Sarbanes-Oxley Act of 2002, that:

(1) The Report fully complies with the requirements

of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended; and

(2) The information contained in the Report

fairly presents, in all material respects, the financial condition and results of operations of the Company.

/s/ Zhu

Youyi

Zhu Youyi

Chief Financial Officer

(Principal Financial Officer)

September 28, 2023

Exhibit 99.1

Supplemental Submission

Pursuant to Item 16I(a) of Form 20-F

China Natural Resources Inc. (the

“Company”) is submitting via EDGAR the following information as required under Item 16I(a) of Form 20-F in relation to the

Staff Statement on the Holding Foreign Companies Accountable Act and the Consolidated Appropriate Act, 2023 (the “HFCAA”).

During its fiscal year 2022, the

Company was conclusively identified by the U.S. Securities and Exchange Commission (the “SEC”) as a Commission-Identified

Issuer pursuant to the HFCAA because it filed an annual report on Form 20-F for the year ended December 31, 2021 with the SEC with an

audit report issued by Our auditor, a registered public accounting firm that the Public Company Accounting Oversight Board (the “PCAOB”)

was unable to inspect or investigate completely in 2021. On December 15, 2022, the PCAOB issued a report that vacated its December 16,

2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate

completely registered public accounting firms.

Ownership and/or controlling financial interest

held by governmental entities with respect to the Company

In response to Item 16I(a) of

Form 20-F, the Company believes that the following information establishes that it is not owned or controlled by a governmental entity

in the People’s Republic of China (the “PRC”), the British Virgin Islands (the “BVI”) or Hong Kong Special

Administrative Region (“Hong Kong”).

In connection with the required

submission under paragraph (a) and the required disclosure under (b)(3) of Item 16I, the Company relied on an examination of

the Company’s register of members, Schedules 13D, Schedules 13G and other filings made by its shareholders. Because major shareholders

of the Company are legally obligated to file beneficial ownership schedules with the SEC, the Company believes such reliance is reasonable

and sufficient. Based on the examination of the Company’s register of members and the public filings, nothing comes to the attention

of the Company that makes the Company believe that any such major shareholder was owned or controlled by a governmental entity of the

PRC, the BVI, or Hong Kong. In particular, the Company’s largest beneficial owner was Mr. LI Feilie, who directly and indirectly

through Feishang Group Limited, a British Virgin Islands company wholly owned by Mr. LI, held 5,371,553 common shares or 65.52% of the

Company’s aggregate voting power. Mr. LI was the former Chairman and CEO of the Company. Mr. LI served as the sole shareholder,

director and officer of Feishang Group Limited.

Furthermore, as of the date of

the Original Filing, the directors and officers of the Company consist of: Wong Wah On Edward, Tam Cheuk Ho, Zhu Youyi, Zou Yu, Peng Wenlie,

Lam Kwan Sing, Ng Kin Sing, Yip Wing Hang and Li Feilie. None of the Company’s directors or officers are representatives of any

government entity in the PRC, the BVI, or Hong Kong.

Based on the foregoing, the Company

believes that it is not owned or controlled by a governmental entity of the PRC, the BVI, or Hong Kong and that the governmental entities

in the PRC, the BVI, or Hong Kong do not have a controlling financial interest in the Company.

In connection with the required

disclosure under paragraph (b)(2) of Item 16I, the Company respectfully submits that, based on its register of members as of May

7, 2023, the record holders of its common shares included: (i) Feishang Group Limited and Mr. LI Feilie, (ii) Cede & Co,

(iii) certain other institutional investors that beneficially own common shares that in aggregate amount to approximately 2.64% of the

Company’s total outstanding common shares as of May 7, 2023, (iv) certain directors and officers of the Company that beneficially

own common shares that in aggregate amount to approximately 1.67% of the Company’s total outstanding common shares as of May 7,

2023, and (v) certain other natural person shareholders that beneficially own common shares that in aggregate amount to approximately

0.01% of the Company’s total outstanding common shares as of May 7, 2023. Cede & Co is the nominee of DTC. It would present

an undue hardship for the Company to identify each public market shareholder due to the large number of such holders. The Company could

only rely on the Schedules 13D, Schedules 13G and the amendments thereto filed by the beneficial owners of 5% or more of the Company’s

shares who hold shares through Cede & Co. Based on such public filings, none of the holders who own 5% or more of the Company’s

shares is a governmental entity in the PRC, the BVI, or Hong Kong. Based on the examination of publicly available information, such as

company registry information of the institutional shareholders and address information of the individual shareholders, as of the date

of the Original Filing, to the best of the Company’s knowledge, no governmental entity in the PRC, the BVI, or Hong Kong owns any

share of any of the Company’s institutional shareholders.

Therefore, to the best of the

Company’s knowledge, no governmental entity in in the PRC, the BVI, or Hong Kong owns any share of the Company.

The Company respectfully submits

that it did not rely upon any legal opinions or third party certifications such as affidavits as the basis of its submission.

Ownership and/or controlling financial interest

held by governmental entities with respect to the Company’s consolidated foreign entities

In connection with the required

disclosures under paragraphs (b)(2) and (b)(3) of Item 16I with respect to the Company’s consolidated foreign entities, the Company

respectfully submits that the jurisdictions in which the Company’s consolidated foreign entities are incorporated in the PRC, the

BVI, and Hong Kong.

As of the date of the Original

Filing, the Company holds 100% equity interests in such consolidated foreign entities except (i) Silver Moon Technologies Limited, a company

organized in the BVI; (ii) Shanghai Onway Environmental Development Co., Limited (“Shanghai Onway”), a company organized in

the PRC; and (iii) Shaoguan Angrui Environmental Technology Development Co., Limited (“Shaoguan Angrui”), a company organized

in the PRC.

| • | As of the date of the Original Filing, the Company directly held 80% equity interest of Silver Moon Technologies

Limited, a company organized in the BVI. Silver Moon is currently inactive. |

| • | As of the date of the Original Filing, the Company indirectly held 51% equity interest of Shanghai Onway.

Shanghai Onway was a 51%-owned subsidiary of Shenzhen Qianhai Feishang Environmental Investment Co., Limited (“Shenzhen Qianhai”),

a company organized in the PRC and an indirect wholly-owned subsidiary of the Company as of the date of the Original Filing. As of the

date of the Original Filing, Anxon Envirotech Pte. Ltd (a direct wholly owned subsidiary of AnnAik Limited, which is listed on the Singapore

Stock Exchange under ticker “A52”) owned 25% equity interest of Shanghai Onway and Shanghai Xingyu Environment Engineering

Co., Ltd. owned 24% equity interest of Shanghai Onway. |

| o | Based on the annual report of AnnAik Limited for the fiscal year 2022 dated April 10, 2023, no governmental

entity in the PRC, the BVI or Hong Kong owns any shares of AnnAik Limited. |

| o | Based on the examination of shareholder information which are mandated to be made publicly available,

all equity interest of Shanghai Xingyu Environment Engineering Co., Ltd. is owned by six individuals and no governmental entity in the

PRC, the BVI or Hong Kong owns shares of Shanghai Xingyu Environment Engineering Co., Ltd. |

| • | As of the date of the Original Filing, the Company indirectly held 28.05% equity interest of Shaoguan

Angrui. Shaoguan Angrui was a 55%-owned subsidiary of Shanghai Onway, which in turn was a 51%-owned subsidiary of Shenzhen Qianhai, an

indirect wholly-owned subsidiary of the Company as of the date of the Original Filing. As of the date of the Original Filing, each of

Guangzhou Ruiyi Environmental Protection Technology Co., Ltd., and Shaoguan Wujiang Runheng Municipal & Rural Development Investment

Co., Ltd. owned 20% equity interest of Shaoguan Angrui. Each of Guangzhou Ruiyi Environmental Protection Technology Co., Ltd., and Shaoguan

Wujiang Runheng Municipal & Rural Development Investment Co., Ltd. is a PRC state-owned enterprise. |

On July 28, 2023, the Company

entered into a Sale and Purchase Agreement with Feishang Group Limited for the sale of Precise Space-Time Technology Limited. After the

completion of the sale, subsidiaries of Precise Space-Time Technology Limited, including Shanghai Onway, Zhejiang Xinyu Environmental

Technology Co., Limited and Shaoguan Angrui were no longer our consolidated foreign operating entities.

Based on the examination of publicly

available information on the composition of the remaining shareholders of the Company’s consolidated foreign entities, except as

described above, (i) no governmental entity in the PRC, the BVI or Hong Kong owns any share of any of the Company’s consolidated

foreign entities, and (ii) no governmental entity in the PRC, the BVI or Hong Kong has a controlling financial interest in any of the

Company’s consolidated foreign entities.

Dated: September 28, 2023

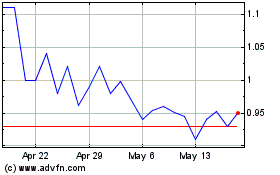

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

From Apr 2023 to Apr 2024