Liberty Broadband Submits Counterproposal to Charter for Proposed Business Combination

24 September 2024 - 6:15AM

Business Wire

Liberty Broadband Corporation (“Liberty Broadband”) (Nasdaq:

LBRDA, LBRDK, LBRDP) announced today that it communicated a

counterproposal to the Special Committee of the Board of Directors

of Charter Communications, Inc. (“Charter”) (the Special Committee

referred to as “Charter Special Committee”) in response to an

initial merger proposal sent by the Charter Special Committee. In

its counterproposal, Liberty Broadband outlined the terms of a

proposed combination of Liberty Broadband with Charter in an

all-stock transaction intended to be tax-free whereby holders of

each series of Liberty Broadband common stock would receive 0.2900

of a share of Charter Class A common stock (Nasdaq: CHTR) in

exchange for each share of Liberty Broadband common stock. The

proposed transaction includes a closing date of June 30, 2027 or

such earlier date as the parties shall mutually agree.

“Liberty’s proposed transaction would rationalize the dual

corporate structure between Charter and Liberty Broadband,

providing enhanced trading liquidity and removing Liberty

Broadband’s existing governance rights. The certainty of a future

transaction would provide clarity to our shareholders and continue

our strong partnership with Charter in the interim. In GCI, Charter

would be acquiring an attractive business that is the leading

connectivity platform in Alaska with significant opportunity for

future value creation. We look forward to reaching a mutually

agreed upon transaction for the benefit of all stakeholders,” said

Greg Maffei, Liberty Broadband President & CEO.

According to the terms of the counterproposal, Charter would

assume or refinance Liberty Broadband’s debt at or prior to closing

as well as Liberty Broadband’s outstanding preferred stock. During

the pendency of the transaction, Liberty Broadband, including GCI,

would operate in the ordinary course of business, subject to the

terms of the definitive transaction agreements. The proposed

transaction would be subject to, among other things, the

negotiation and execution of mutually acceptable definitive

transaction documents, applicable board approvals, the requisite

approval of Liberty Broadband stockholders, and the approval of a

majority of the stockholders of Liberty Broadband unaffiliated with

John Malone and his affiliates. The transaction would also be

subject to customary closing conditions, including the receipt of

requisite regulatory approvals and applicable tax opinions.

Additional information can be found in Liberty Broadband’s

letter to Charter filed as an exhibit to the amendment to Liberty

Broadband’s Schedule 13D filed on September 23, 2024. No further

updates on the proposed transaction will be provided unless and

until definitive documents are executed or discussions between the

parties terminate.

Forward-Looking Statements

This press release includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including certain statements relating to the completion of

the proposed transaction and other matters related to such proposed

transaction. All statements other than statements of historical

fact are “forward-looking statements” for purposes of federal and

state securities laws. These forward-looking statements generally

can be identified by phrases such as “possible,” “potential,”

“intends” or “expects” or other words or phrases of similar import

or future or conditional verbs such as “will,” “may,” “might,”

“should,” “would,” “could,” or similar variations. These

forward-looking statements involve many risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied by such statements, including, without

limitation, the satisfaction of all other conditions to the

proposed transaction. These forward-looking statements speak only

as of the date of this press release, and Liberty Broadband

expressly disclaims any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statement contained

herein to reflect any change in Liberty Broadband’s expectations

with regard thereto or any change in events, conditions or

circumstances on which any such statement is based. Please refer to

the publicly filed documents of Liberty Broadband, including its

most recent Forms 10-K and 10-Q, as such risk factors may be

amended, supplemented or superseded from time to time by other

reports Liberty Broadband subsequently files with the SEC, for

additional information about Liberty Broadband and about the risks

and uncertainties related to Liberty Broadband’s business which may

affect the statements made in this press release.

Additional Information

Nothing in this press release shall constitute a solicitation to

buy or an offer to sell shares of common stock or preferred stock

of Liberty Broadband or Charter. The proposed offer and issuance of

shares of common stock of Charter in the proposed combination will

be made only pursuant to an effective registration statement.

Liberty Broadband stockholders and other investors are urged to

read the registration statement when it is available, together with

all relevant SEC filings regarding the proposed transaction, and

any other relevant documents filed as exhibits therewith, as well

as any amendments or supplements to those documents, because they

will contain important information about the proposed transaction.

Copies of these SEC filings will be available free of charge at the

SEC’s website (http://www.sec.gov). Copies of the filings together

with the materials incorporated by reference therein will also be

available, without charge, by directing a request to Liberty

Broadband Corporation, 12300 Liberty Boulevard, Englewood, Colorado

80112, Attention: Investor Relations, Telephone: (844)

826-8735.

Participants in a Solicitation

Liberty Broadband and Charter and their respective directors and

executive officers and other persons may be deemed to be

participants in a solicitation in respect of any proposals relating

to the proposed transaction. Information regarding the directors

and executive officers of Liberty Broadband and any participants in

a solicitation and a description of their respective direct and

indirect interests, by security holdings or otherwise, will be

available in relevant SEC filings regarding the proposed

transaction to be filed with the SEC. Investors should read

relevant SEC filings regarding the proposed transaction carefully

before making any voting or investment decisions. Free copies of

these materials from Liberty Broadband may be obtained as indicated

above.

About Liberty Broadband

Corporation

Liberty Broadband Corporation (Nasdaq: LBRDA, LBRDK, LBRDP)

operates and owns interests in a range of communications

businesses. Liberty Broadband’s principal assets consist of its

interest in Charter Communications and its subsidiary GCI. GCI is

Alaska’s largest communications provider, providing data, wireless,

video, voice and managed services to consumer and business

customers throughout Alaska and nationwide. GCI has delivered

services over the past 40 years to some of the most remote

communities and in some of the most challenging conditions in North

America.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240923039328/en/

Liberty Broadband Corporation Shane Kleinstein,

720-875-5432

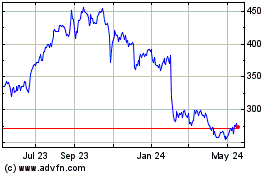

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Dec 2024 to Dec 2024

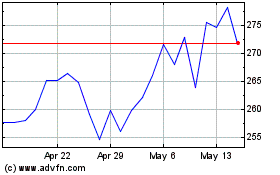

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Dec 2023 to Dec 2024