false

0000796505

0000796505

2024-11-25

2024-11-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 25, 2024

Clearfield, Inc.

(Exact name of registrant as specified in charter)

| Minnesota |

|

000-16106 |

|

41-1347235 |

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| 7050 Winnetka Avenue North, Suite 100, Brooklyn Park, MN |

|

55428 |

| (Address of principal executive offices) |

|

(Zip Code) |

| (763) 476-6866 |

| Registrant’s telephone number, including area code |

| Not Applicable |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Common Stock, $0.01 par value

|

CLFD |

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has

elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

|

Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

On November 25, 2024, the Compensation Committee of the Board of Directors

of Clearfield, Inc. (the “Company”) approved and adopted a new form of Performance Stock Unit Award Agreement (the “Award

Agreement”) with respect to the granting of performance-based stock units (“PSUs”) under the Clearfield, Inc. 2022 Stock

Compensation Plan (the “Plan”). The Award Agreement sets forth the standard terms and conditions that apply to grants of PSUs

under the Plan that vest over a multi-year period subject to attainment of one or more performance goals established by the Compensation

Committee. The Award Agreement will be first used for awards of PSUs to executive officers with respect to the fiscal year 2025 performance

period.

The foregoing summary of the Award Agreement does

not purport to be complete and is subject to and qualified in its entirety by reference to the full text of the Award Agreement, a copy

of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| 104 | Cover Page Interactive Data File (included within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

CLEARFIELD, INC. |

| |

|

|

| |

By: |

/s/ Cheryl Beranek |

| Dated: November 26, 2024 |

|

Cheryl Beranek, Chief Executive Officer |

Exhibit 10.1

|

CLEARFIELD, INC.

2022 STOCK COMPENSATION PLAN

PERFORMANCE STOCK UNIT AWARD AGREEMENT |

|

| PARTICIPANT: |

[___________] |

| AWARD DATE: |

[___________] |

| NUMBER OF PERFORMANCE STOCK UNITS (AT TARGET): |

[___________] |

| PERFORMANCE PERIOD: |

[___________]

|

| PERFORMANCE GOAL(S), THRESHOLD, TARGET AND MINIMUM: |

See Exhibit A. |

| VESTING PERCENTAGE: |

The percentage achievement of the Performance Goal(s) for the Performance Period as follows:

|

| |

Performance Goal(s)

Achievement |

Vesting

Percentage |

|

| |

Threshold |

[___]% |

|

| |

Target |

[___]% |

|

| |

Maximum |

[___]% |

|

| |

The Performance Percentage shall be determined by the Committee.

To the extent the Vesting Percentage is less than Threshold, the Vesting Percentage shall be

zero. In no event will the Vesting Percentage exceed [____]% regardless of the achievement of the Performance Goal(s). There is no interpolation

between Vesting Percentages. |

| LAPSE OF RESTRICTIONS: |

The Restricted Stock shall vest and the Restrictions on the Restricted Stock shall lapse as to [___] of the Shares of Restricted Stock on each of the first [___] anniversaries of the Settlement Date (except as otherwise provided in this Agreement). |

THIS PERFORMANCE STOCK UNIT AWARD AGREEMENT

(this “Agreement”) is made as of the Award Date set forth above, by and between Clearfield, Inc., a Minnesota corporation

(the “Company”), and the person named above (“Participant”) setting forth the terms and conditions of an award

of Performance Stock Units granted pursuant to the terms of the Clearfield, Inc. 2022 Stock Compensation Plan (as amended, and as may

be subsequently amended, the “Plan”).

Capitalized terms used herein and not defined shall

have the meaning given such terms in the Plan.

1. Grant

of Performance Stock Units. In accordance with the terms of the Plan and subject to the further terms, conditions and restrictions

contained in this Agreement, the Company hereby grants to Participant the number of Performance Stock Units set forth above. Each Performance

Stock Unit shall represent a contingent right to receive one share of Stock (each, a “Share”) to the extent such Performance

Stock Unit becomes vested and settled pursuant to the terms of this Agreement. As used in this Agreement, “Settlement Date”

means the date of determination and certification by the Committee of the Vesting Percentage with respect to the Performance Goal(s)

for the Performance Period. Until Shares are issued in settlement of the Performance Stock Units on the Settlement Date, Participant

will not be deemed for any purpose to be, or have rights as, a shareholder of the Company, including no right to vote or receive dividends

with respect to the Shares issuable upon settlement of the Performance Stock Units.

2.

Performance Vesting.

(a)

On the Settlement Date, the Performance Stock Units will vest and the Company will issue Participant in settlement of the vested

Performance Stock Units such number of Shares equal to the number of Performance Stock Units covered by this Award multiplied by the Vesting

Percentage, rounded down to the nearest whole Share; provided that two-thirds (2/3) of such Shares (rounded down to the nearest

whole Share) shall be issued as “Restricted Stock” subject to the Restrictions during the Restricted Period as provided in

Section 3. The value of any fractional Share shall be paid to Participant in cash equal to the Fair Market Value of such fractional Share

on the Settlement Date. No Shares will be issued to Participant prior to the Settlement Date and only then to the extent the Performance

Stock Units are vested in accordance with this Section 2(a).

(b)

The Company shall, as soon as practicable after the Settlement Date, deliver to Participant a certificate or cause the Company’s

transfer agent to make appropriate credits to Participant’s book entry account for the Shares (other than Restricted Stock) issued

in settlement of the vested Performance Stock Units; provided that Participant shall be deemed to be the record owner of such Shares

as of the Settlement Date.

(c)

If the Vesting Percentage is less than the Threshold, the Performance Stock Units shall be forfeited to the Company without payment

of any consideration therefor as of the Settlement Date and Participant’s rights under this Agreement will terminate effective as

of the Settlement Date.

3. Restrictions on Restricted Stock. During the period prior to the vesting and lapse of the restrictions as set forth

in Section 4(b) (the “Restriction Period”) and subject to earlier termination of the Restriction Period or forfeiture of the

Restricted Stock, the Restricted Stock and all rights with respect to the Restricted Stock, may not be sold, assigned, transferred, exchanged,

pledged, hypothecated or otherwise encumbered or disposed of, whether such disposition be voluntary or involuntary or by operation of

law by judgment, levy, attachment, garnishment or any other legal or equitable proceedings (including bankruptcy), and any attempted disposition

thereof shall be null and void and of no effect, and shall be subject to the risk of forfeiture contained in Section 4 of this Agreement

(such limitations on transferability and risk of forfeiture being herein referred to as “Restrictions”). When Restricted Stock

is issued in settlement of the Performance Stock Units on the Settlement Date, Participant shall have all other rights of a shareholder

of the Company, including, but not limited to, the right to vote and receive dividends on the Restricted Stock.

4. Forfeiture; Lapse of Restrictions; Change in Control.

(a)

If Participant shall cease to be an employee of the Company for any reason, all Performance Stock Units or Stock that at that time

is Restricted Stock shall thereupon be forfeited by Participant to the Company without payment of any consideration therefor, and neither

Participant, nor any successor, heir, assign or personal representative shall have any right or interest in or to such Performance Stock

Units, Restricted Stock, the certificates evidencing the Restricted Stock, or this Agreement as of the date of such termination.

(b)

Except as otherwise provided in this Section 4, the Restricted Stock shall vest and the Restrictions on the Restricted Stock granted

under this Agreement shall lapse as to the number of Shares of Restricted Stock and on the dates stated above under “Lapse of Restrictions.”

Upon vesting and lapse of the Restrictions in accordance with this Section, the Company shall, as soon as practicable thereafter, deliver

to Participant a certificate or cause the Company’s transfer agent to make appropriate credits to Participant’s book entry

account for the Shares with respect to which such Restrictions have vested and lapsed.

(c)

Notwithstanding any other provision of this Agreement, any outstanding Performance Stock Units shall be vested at the Target Vesting

Percentage (and the Company shall issue Shares in settlement thereof) and any outstanding Restricted Stock shall vest in full and all

restrictions thereon shall lapse upon (1) a termination of Participant’s employment by the Company without Cause or by the Participant

for Good Reason, within twenty-four (24) months following a Change in Control where the Plan is assumed by the successor corporation or

the Company is the surviving entity and the Plan continues, or (2) the occurrence of a Change in Control, if the Plan is not assumed by

the successor corporation.

5. Certificates for Restricted Stock.

(a)

Certificates evidencing the Restricted Stock shall be subject to the control of the Company (either through appropriate entries

in accounts at the Company’s transfer agent or through the Company’s physical control of a certificate relating to the Restricted

Stock) until such Shares are released to Participant or forfeited in accordance with this Agreement. If requested by the Company, Participant

shall, simultaneously with the delivery of any Restricted Stock, deliver to the Company a stock power, in blank, executed by Participant.

If any Restricted Stock is forfeited, the Company shall direct the transfer agent of the Shares to make the appropriate entries in its

records showing the cancellation of the certificate or certificates for such Restricted Stock and the Shares represented thereby shall

have the status as authorized but unissued Shares.

(b)

The Share certificate or certificates evidencing the Restricted Stock issued hereunder shall be endorsed with the following legend

(in addition to any other legend or legends required under applicable Federal and state securities laws):

THE SHARES REPRESENTED BY THIS CERTIFICATE ARE SUBJECT TO CERTAIN RESTRICTIONS

UPON TRANSFER AND RIGHTS OF REPURCHASE AS SET FORTH IN ANY AGREEMENT BETWEEN THE COMPANY AND THE STOCKHOLDERS AND IN THE CLEARFIELD, INC.

2022 STOCK COMPENSATION PLAN, ALL AS MAY BE AMENDED FROM TIME TO TIME. ANY PERSON OR ENTITY TO WHOM SHARES REPRESENTED BY THIS CERTIFICATE,

OR ANY INTEREST THEREIN, ARE TRANSFERRED SHALL BE DEEMED TO AGREE TO AND SHALL BECOME BOUND BY SUCH AGREEMENT. COPIES OF SUCH AGREEMENTS

AND THE PLAN MAY BE OBTAINED UPON WRITTEN REQUEST TO THE SECRETARY OF THE COMPANY.

6.

Non-Transferability. None of the Performance Stock Units, the Restricted Stock or this Agreement nor any interest

therein or in this Award may be alienated, encumbered, sold, pledged, assigned, transferred or subjected to any charge or legal process,

other than by will or the laws of descent and distribution, so long as the Restrictions have not lapsed as to any share of Restricted

Stock and the Shares have not been delivered in accordance with the Plan, and any sale, pledge, assignment or other attempted transfer

shall be null and void.

7.

Successors and Heirs. This Agreement shall be binding upon and inure to the benefit of the Company and its successors

and assigns, and upon any person that is an acquiring person in a Change in Control involving the Company. In the event of Participant’s

death, any Shares to which Participant may become entitled pursuant to this Agreement or the Plan will be delivered to his or her heirs

or personal representative in accordance with the terms of the Plan.

8.

Governing Law. This Agreement and any matter relating to this Award of Performance Stock Units will be construed,

administered and governed in all respects under and by the applicable laws of the State of Minnesota, excluding any conflicts or choice

of law rule or principle that might otherwise refer construction or interpretation of this Agreement, the Plan, or this Award of Performance

Stock Units to the substantive law of another jurisdiction.

9.

Tax Withholding. Participant will be responsible for all tax obligations that arise as a result of the grant, vesting,

settlement and forfeiture of the Performance Stock Units and the Restricted Stock. Participant acknowledges that unless Participant makes

a proper and timely Section 83(b) election as further described below, then at the time of vesting and lapse of the Restrictions on the

Restricted Stock, Participant will be obligated to recognize ordinary income in an amount equal to the Fair Market Value, as of the date

of vesting and lapse of Restrictions, of those Shares issuable to the Participant upon the vesting and lapse of Restrictions. Participant

acknowledges that it is Participant’s sole responsibility to timely file an election under Section 83(b) of the Code. If Participant

makes such an election, Participant must promptly provide the Company with a copy. The Company has no, and shall incur no, liability or

obligation with respect to the Section 83(b) election made, or not made, by the Participant.

As a condition precedent for the delivery by the Company

of Shares in settlement of the Performance Stock Units, of Restricted Stock or upon lapse of Restrictions on the Restricted Stock, or

any other amount or benefit provided under this Agreement, and as further set forth in Section 14(e) of the Plan, Participant agrees to

make adequate provision for federal, state or other tax withholding obligations, if any, which arise upon the grant, vesting or settlement

of the Performance Stock Units or the grant, vesting or lapse of Restrictions on the Restricted Stock, dividend distribution thereon,

whether by withholding, direct payment to the Company, or by surrendering Shares (either directly or by stock attestation) that Participant

previously acquired. The Company shall have the power and the right to deduct or withhold, or require Participant to remit to the Company,

as a condition precedent for the delivery by the Company of Shares or Restricted Stock on the Settlement Date and a condition precedent

for the delivery by the Company of the Shares deliverable upon vesting and lapse of Restrictions, an amount sufficient to satisfy federal,

state and local taxes, domestic or foreign, required by law or regulation to be withheld with respect to any taxable event arising as

a result of the grant, vesting, settlement and forfeiture of the Performance Stock Units, the issuance or forfeiture of Restricted Stock,

the vesting and lapse of the Restrictions, or the issuance of Shares. Unless Participant has made arrangements prior to the date the tax

withholding obligation arises to satisfy such tax withholding amount in cash, Participant acknowledges and agrees that such tax withholding

amount shall be satisfied by the Company retaining the number of Shares from those Shares otherwise issuable to the Participant as the

Company determines to be sufficient to satisfy such tax withholding obligation. Notwithstanding the foregoing, in no event shall payment

of withholding taxes be made by retention of Shares by the Company unless the Company retains only Shares with a Fair Market Value equal

to the minimum amount of taxes required to be withheld. The Company may also deduct from any award under the Plan payment of any other

amounts due by Participant to the Company.

10. Plan Controls. Notwithstanding anything in this Agreement to the contrary, the terms of this Agreement shall be subject

to the terms of the Plan. In accordance with the Plan, all decisions of the Committee shall be final and binding upon Participant and

the Company.

11. Recoupment Policy. The Participant acknowledges and agrees that this Award, the Performance Stock Units and Restricted

Stock shall constitute “Covered Compensation” under the Company’s Compensation Recoupment Policy.

12. Administration

and Compliance with 409A of the Code. This Agreement is intended to comply with Section 409A of the Code or an exemption thereunder

and will be construed, administered and interpreted in accordance with Section 409A of the Code. Notwithstanding any other provision

of this Agreement, payments and settlements provided under this Agreement may only be made upon an event and in a manner that complies

with Section 409A of the Code or an applicable exemption. Any payments under this Agreement that may be excluded from Section 409A of

the Code either as separation pay provided due to an involuntary separation from service or as a short-term deferral will be excluded

from Section 409A to the maximum extent possible. Any payments to be made under this Agreement upon a termination of employment

will only be made upon a “separation from service” under Section 409A of the Code. Notwithstanding the foregoing, the

Company makes no representations that the payments and benefits provided under this Agreement comply with Section 409A of the Code

and in no event will the Company be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred

by Participant on account of non-compliance with Section 409A of the Code. Notwithstanding any other provision of this Agreement,

if any payment or benefit provided to Participant in connection with termination of employment is determined to constitute

“non-qualified deferred compensation” within the meaning of Section 409A of the Code and Participant is determined

to be a “specified employee” at that time as defined in Section 409A of the Code, then such payment or benefit

will not be paid until the first payroll date to occur following the six-month anniversary of the date of termination (the

“Specified Employee Payment Date”) or, if earlier, on Participant’s death. The aggregate of any payments

that would otherwise have been paid before the Specified Employee Payment Date (and interest on such amounts calculated based on the

applicable federal rate published by the Internal Revenue Service for the month in which Participant’s separation from

service occurs) shall be paid to Participant in lump sum on the Specified Employee Payment Date and thereafter,

any remaining payments will be paid without delay in accordance with their original schedule.

13. Black-Out

Periods. Participant acknowledges that, to the extent the vesting or settlement of any Performance Stock Units occur during a

“blackout” period wherein certain employees, including Participant, are precluded from selling Shares, the Committee retains

the right, in its sole discretion, to defer the delivery of the Shares (including Restricted Stock) pursuant to the Performance Stock

Units; provided, however, that the Committee will not exercise its right to defer Participant’s receipt of such Shares if

such Shares are specifically covered by a trading plan of Participant that conforms to the requirements of Rule 10b5-1 of the Exchange

Act and the Company’s policies and procedures with respect to Rule 10b5-1 trading plans and such trading plan causes such Shares

to be exempt from any applicable blackout period then in effect. In the event the receipt of any Shares is deferred hereunder due to

the existence of a regularly scheduled blackout period, such Shares will be issued to Participant on the first business day following

the termination of such regularly scheduled blackout period; provided, however, that in no event will the issuance of such Shares

be deferred subsequent to March 15th of the year following the year in which the Performance Stock Units are vested and settled. In the

event the receipt of any Shares is deferred hereunder due to the existence of a special blackout period, such Shares will be issued to

Participant on the first business day following the termination of such special blackout period as determined by the Company’s

General Counsel or his or her delegatee; provided, however, that in no event will the issuance of such Shares be deferred subsequent

to March 15th of the year following the year in which such Shares vest. Notwithstanding the foregoing, any deferred Shares will be issued

promptly to Participant prior to the termination of the blackout period in the event Participant ceases to be subject to the blackout

period. Participant hereby represents that Participant accepts the effect of any such deferral on Participant’s liability for taxes

or otherwise.

14.

Representations by Participant. The Participant has read this Agreement and is familiar with its terms and provisions.

The Participant has reviewed with personal tax advisors the Federal, state, local and foreign tax consequences of this Award and the transactions

contemplated by this Agreement. The Participant is relying solely on such advisors and not on any statements or representations of the

Company or any of its agents. The Participant understands that he or she (and not the Company) shall be responsible for any tax liability

that may arise as a result of this investment or the transactions contemplated by this Agreement. The Participant hereby agrees to accept

as binding, conclusive and final all decisions or interpretations of the Board (or committee with delegated authority) upon any questions

arising under this Agreement.

IN WITNESS WHEREOF, the Company and Participant

have each executed and delivered this Agreement as of the date first above written.

| |

CLEARFIELD, INC. |

| |

|

|

| |

By: |

|

| |

Its: |

|

| PARTICIPANT: |

|

| |

|

| |

|

| Print Name of Participant |

|

| |

|

|

|

| Signature of Participant |

|

Exhibit A

Performance Goal(s)

The Performance Goal(s) shall be [___________________].

The Performance Goal(s) levels of achievement for the Performance Period shall be as follows:

| Levels |

Performance Goal Achievement |

Vesting Percentage |

| Threshold |

[__________] |

[___]% |

| Target |

[__________] |

[___]% |

| Maximum |

[__________] |

[___]% |

v3.24.3

Cover

|

Nov. 25, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 25, 2024

|

| Entity File Number |

000-16106

|

| Entity Registrant Name |

Clearfield, Inc.

|

| Entity Central Index Key |

0000796505

|

| Entity Tax Identification Number |

41-1347235

|

| Entity Incorporation, State or Country Code |

MN

|

| Entity Address, Address Line One |

7050 Winnetka Avenue North

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Brooklyn Park

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55428

|

| City Area Code |

(763)

|

| Local Phone Number |

476-6866

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

CLFD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

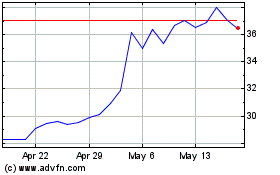

Clearfield (NASDAQ:CLFD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Clearfield (NASDAQ:CLFD)

Historical Stock Chart

From Feb 2024 to Feb 2025