false

0001279704

0001279704

2024-08-20

2024-08-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 20, 2024

Cellectar Biosciences, Inc.

(Exact name of Registrant as Specified in its

Charter)

| Delaware | |

1-36598 | |

04-3321804 |

(State or other jurisdiction

of incorporation) | |

(Commission

File Number) | |

(IRS Employer

Identification No.) |

100

Campus Drive, Florham Park, NJ, 07932

(Address of principal executive offices) (Zip

Code)

Registrant’s telephone number, including

area code: (608) 441-8120

N/A

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.00001 per share |

|

CLRB |

|

The Nasdaq Capital

Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 3.01. |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

On August 20, 2024, the Company received a letter (the “Notice”)

from the Listing Qualifications Staff of The Nasdaq Stock Market, LLC (“Nasdaq”) indicating that the Company is not in compliance

with the periodic financial report filing requirement set forth in Nasdaq Listing Rule 5250(c)(1) as a result of the Company's delay in

filing its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, by the applicable due date.

As previously disclosed, the Company has determined that it is necessary

to re-evaluate the Company’s accounting treatment for the warrants that it issued as part of a financing it completed in October

2022 and expects to restate its previously issued (i) audited consolidated financial statements for the fiscal years ended December 31,

2023 and December 31, 2022, contained in its Annual Reports on Form 10-K and (ii) unaudited interim condensed consolidated financial statements

for the periods ending March 31, 2023, June 30, 2023, September 30, 2023, and March 31, 2024, contained in its Quarterly Reports on Form

10-Q (the “Previously Issued Statements”). Restating and filing the Previously Issued Statements must be completed prior to

filing the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024. The Company expects the process of restating

and filing the Previously Issued Statements will require approximately six weeks to complete, immediately after which it expects to file

its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024.

The Notice has no immediate effect on the continued listing status

of the Company’s common stock, which remains listed on the Nasdaq Capital

Market.

| Item 7.01. |

Results of Operations and Financial Condition. |

On

August 23, 2024, we issued a press release announcing that we will be restating certain historical financial statements and that we received

the Notice from the Nasdaq. A copy of the press release is furnished as Exhibit 99.1 and

is incorporated by reference herein.

| Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CELLECTAR BIOSCIENCES,

INC. |

| |

|

| |

|

| Date: August 23, 2024 |

By: |

/s/ Chad J. Kolean |

| |

Name: |

Chad J. Kolean |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Cellectar to Restate Previously Issued Financial

Statements – Company Announces

Receipt of Expected Delinquency Notification Letter from Nasdaq

FLORHAM PARK, N.J., August 23, 2024 –

Cellectar Biosciences, Inc. (NASDAQ: CLRB), a late-stage clinical biopharmaceutical company focused on the discovery, development,

and commercialization of drugs for the treatment of cancer, today announced that the Company had received an expected delinquency notification

letter (the “Notice”) from the Listing Qualifications Staff of the Nasdaq Stock Market LLC (“Nasdaq”) on August 20,

2024. The Notice indicated that the Company is not in compliance with the periodic financial report filing requirement set forth in Nasdaq

Listing Rule 5250(c)(1) as a result of the Company's delay in filing its Quarterly Report on Form 10-Q for the quarter

ended June 30, 2024 (the “Second Quarter 10-Q”), by the applicable due date.

The delay in filing the Second Quarter 10-Q is

a result of the Company’s need to restate certain previously filed financial statements. As was previously reported on Form 8-K

filed with the U.S. Securities and Exchange Commission (SEC) on August 9, 2024, after engaging Deloitte & Touche LLP as

the Company’s independent registered accounting firm the Company determined that it was necessary to re-evaluate its accounting

treatment for warrants issued as part of a financing completed in October 2022. The financial statement changes are all expected

to be non-cash and non-operating. The Company expects to restate the previously issued (i) audited consolidated financial statements

for the fiscal years ended December 31, 2023 and 2022, contained in its Annual Reports on Form 10-K and (ii) unaudited

interim condensed consolidated financial statements for the periods ending March 31, 2023, June 30, 2023, September 30,

2023, and March 31, 2024, contained in its Quarterly Reports on Form 10-Q (the “Previously Issued Statements”).

Restating and filing the Previously Issued Statements must be completed prior to filing the Second Quarter 10-Q.

The Company has 60 calendar days, or until October 21,

2024, to submit a plan (“Plan”) to Nasdaq to regain compliance. If Nasdaq accepts the Plan, Nasdaq may grant an exception

of up to 180 calendar days from the Form 10-Q’s due date, or until February 17, 2025, to regain compliance. If Nasdaq

does not accept the Plan, the Company will have the opportunity to appeal that decision to a Nasdaq Hearings Panel.

The Notice does not impact the Company’s

listing of its common stock on The Nasdaq Capital Market at this time. The Company expects the process of restating and filing the Previously

Issued Statements will require approximately six weeks to complete, immediately after which it expects to file its Second Quarter 10-Q.

About Cellectar Biosciences, Inc.

Cellectar Biosciences

is a late-stage clinical biopharmaceutical company focused on the discovery and development of proprietary drugs for the treatment of

cancer, independently and through research and development collaborations. The company’s core objective is to leverage its proprietary

Phospholipid Drug Conjugate™ (PDC) delivery platform to develop the next-generation of cancer cell-targeting treatments, delivering

improved efficacy and better safety as a result of fewer off-target effects.

The company’s product

pipeline includes lead asset iopofosine I 131, a small-molecule PDC designed to provide targeted delivery of iodine-131 (radioisotope),

proprietary preclinical PDC chemotherapeutic programs and multiple partnered PDC assets.

For

more information, please visit www.cellectar.com or join the conversation by liking and following us on the company’s

social media channels: Twitter, LinkedIn, and Facebook.

Forward-Looking Statement Disclaimer

This news release contains

forward-looking statements. All statements other than statements of historical fact are statements that could be deemed forward-looking

statements. The Company advises caution in reliance on forward-looking statements. Forward-looking statements include, without limitation:

statements related to the completion of the Company’s review of accounting matters and audits of the Company’s financial statements,

the Company’s plans to restate and file the Previously Issued Statements, and the preparation and filing the Second Quarter 10-Q.

These forward-looking statements are made only as of the date hereof, and we disclaim any obligation to update any such forward-looking

statements.

Contacts

MEDIA:

Claire LaCagnina

Bliss Bio Health

315-765-1462

clacagnina@blissbiohealth.com

INVESTORS:

Chad Kolean

Chief Financial Officer

investors@cellectar.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

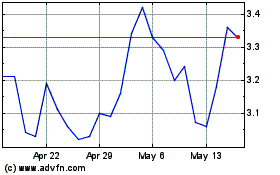

Cellectar Biosciences (NASDAQ:CLRB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cellectar Biosciences (NASDAQ:CLRB)

Historical Stock Chart

From Jan 2024 to Jan 2025