Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

02 February 2023 - 8:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2023

Commission File Number: 001-39978

CN ENERGY GROUP. INC.

Building 2-B, Room 206, No. 268 Shiniu Road

Liandu District, Lishui City, Zhejiang Province

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Explanatory Note

On January 30, 2023, CN Energy

Group. Inc., a company incorporated under the laws of the British Virgin Islands (the “Company”), entered into an underwriting

agreement (the “Underwriting Agreement”) with Aegis Capital Corp. (the “Underwriter”), pursuant to which the

Company agreed to sell to the Underwriter in a firm commitment public offering (the “Offering”) (i) 10,396,974 units, each

consisting of one Class A ordinary share, no par value (collectively, the “Class A ordinary shares”) and one warrant, each

exercisable to purchase one Class A ordinary share at an exercise price of $0.55 per share (collectively, the “warrants”),

at an offering price of $0.55 per unit; and (ii) 7,786,300 units, each consisting of one pre-funded warrant, each exercisable to purchase

one Class A ordinary share at an exercise price of $0.0001 per share (collectively, the “Pre-funded Warrants”), and one warrant,

at an offering price of $0.5499 per unit (together with the Class A ordinary shares and the warrants, the “Offered Securities”),

to those purchasers whose purchase of Class A ordinary shares in the Offering would otherwise result in the purchaser, together with

its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the holder, 9.99%) of the Company’s

outstanding ordinary shares immediately following the consummation of the Offering. In addition, the Company has granted the Underwriter

in the Offering a 45-day option to purchase up to an additional 2,727,491 Class A ordinary shares and/or 2,727,491 warrants at the public

offering price, less underwriting discounts, to cover over-allotments in connection with the offering. The components of the units were

issued separately and are immediately separable upon issuance. The Company expects to receive approximately $10 million in gross proceeds

from the Offering, before deducting underwriting discounts and other related offering expenses.

The Pre-funded Warrants are

exercisable immediately (subject to the beneficial ownership cap) and may be exercised at any time in perpetuity until all of the Pre-funded

Warrants are exercised in full. The warrants are exercisable immediately and expire five years after their issuance date.

The Company issued press

releases on January 27, 2023 to announce the proposed offering, on January 30, 2023 in connection with the pricing of the Offering, and

on February 1, 2023 in connection with the closing of the Offering. Copy of all press releases are furnished herewith as Exhibit 99.1,

Exhibit 99.2, and Exhibit 99.3, respectively.

The Offered Securities were

offered under the Company’s registration statement on Form F-3 (File No. 333-264579), initially filed with the U.S. Securities

and Exchange Commission on April 29, 2022 and was declared effective on June 13, 2022 (the “Registration Statement”). A prospectus

supplement to the Registration Statement in connection with the Offering was filed with the U.S. Securities and Exchange Commission on

January 31, 2023.

The foregoing description

of the Underwriting Agreement, warrant, and Pre-funded Warrant does not purport to be complete and is qualified in its entirety by reference

to the full text of the Underwriting Agreement, warrant, and Pre-funded Warrant copies of which are attached hereto as Exhibits 1.1,

4.1, and 4.2, respectively. A copy of the opinion of Carey Olsen Singapore LLP, as special counsel in the British Virgin Islands to the

Company, regarding the legality of the issuance and sale of Offered Securities is attached hereto as Exhibit 5.1.

This report shall not constitute

an offer to sell or the solicitation to buy nor shall there be any sale of the securities in any state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

This current report on form

6-K is incorporated by reference into the Company’s registration statements on Form F-3 (File No. 333-264579).

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: February 1, 2023

| |

CN Energy Group. Inc. |

| |

|

|

| |

By: |

/s/ Kangbin

Zheng |

| |

Name: |

Kangbin Zheng |

| |

Title: |

Chief Executive Officer |

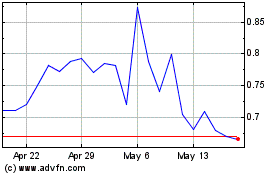

CN Energy (NASDAQ:CNEY)

Historical Stock Chart

From Jan 2025 to Feb 2025

CN Energy (NASDAQ:CNEY)

Historical Stock Chart

From Feb 2024 to Feb 2025