Filed Pursuant to Rule 424(b)(3)

Registration No. 333-269911

PROSPECTUS SUPPLEMENT NO. 2

(to Prospectus dated September 22, 2023)

FREIGHTOS LIMITED

UP TO 14,850,000 ORDINARY SHARES

UP TO 40,639,421 ORDINARY SHARES BY THE SELLING SECURITYHOLDERS

UP TO 8,550,549 WARRANTS BY THE SELLING SECURITYHOLDERS

This prospectus supplement

updates, amends, and supplements the prospectus dated September 22, 2023 (as amended and supplemented, the “Prospectus”),

which forms a part of our Post-Effective Amendment No. 1 to Registration Statement on Form F-1 (Registration No. 333-269911).

Capitalized terms used in this Prospectus Supplement No. 2 and not otherwise defined herein have the meanings specified in the Prospectus.

This prospectus supplement

is being filed to update, amend, and supplement the information in the Prospectus with the information contained in our Report on Form 6-K

filed with the Securities and Exchange Commission on November 21, 2023 (the “Report”). Accordingly, we have

attached the Report to this prospectus supplement.

This prospectus supplement

is not complete without the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, which is to be delivered

with this prospectus supplement, and is qualified by reference thereto, except to the extent that the information in this prospectus supplement

updates or supersedes the information contained in the Prospectus. Please keep this prospectus supplement with your Prospectus for future

reference.

The Freightos Ordinary Shares

and Freightos Warrants are listed on The Nasdaq Stock Market LLC under the symbols “CRGO” and “CRGOW,” respectively.

On November 20, 2023, the last reported sales price of the Freightos Ordinary Shares was $3.11 per share, and on November 20,

2023, the last reported sales price of the Freightos Warrants was $0.0382 per warrant.

We are both an “emerging

growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and a “foreign private issuer”

as defined under the U.S. federal securities laws and, as such, have elected to comply with certain reduced public company disclosure

and reporting requirements. See “Summary of the Prospectus — Emerging Growth Company” and “Summary of

the Prospectus — Foreign Private Issuer” in the Prospectus for additional information.

Investing in our securities

involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors”

beginning on page 13 of the prospectus, and under similar headings in any amendment or supplements to the prospectus.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy

or adequacy of the Prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is November

21, 2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-41604

Freightos Limited

(Translation of registrant's name into English)

Technology Park Building 2

1 Derech Agudat Sport HaPo’el

Jerusalem, Israel 9695102

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

FREIGHTOS LIMITED

FORM 6-K

Freightos Limited (the “Company”) is furnishing under the

cover of Form 6-K the following:

Press Release

Updated Risk Factor

In light of recent events, the

Company is updating one of the risk factors that was previously included in its Annual Report on Form 20-F and other filings with the

Securities and Exchange Commission:

Risks Related to our Operations in Jerusalem and Ramallah

Relations

between Israel and the other jurisdictions in which we operate, and geopolitical issues in the various jurisdictions in which our employees

and users reside, could materially affect our business.

Many

of our employees, including most of our management team, operate from our offices that are located in Jerusalem, Israel. In addition,

several of our directors are residents of Israel. Accordingly, political, economic and military conditions in Israel and the surrounding

region may directly affect our business and operations. Since October 7, 2023, Israel has been in a state of war with Hamas in the Gaza

Strip. Hamas also launched, and continues to launch, extensive rocket attacks on Israeli population and industrial centers located in

Israel. Israel is also engaged in armed conflicts with Hezbollah, an Islamist terrorist group that controls large portions of southern

Lebanon, and with Iranian-backed military forces in Syria. Iranian-backed Houthi rebels in Yemen have also launched missiles at Israel.

The intensity and duration of Israel’s current war against Hamas and armed conflicts with other terror groups, as well as the war’s

impact on the Company’s employees and operations, and global geopolitical stability, are difficult to predict. Any hostilities involving

Israel or the interruption or curtailment of trade between Israel and its trading partners could adversely affect our operations and results

of operations.

Many

Israeli citizens are obligated to perform annual military reserve duty each year for periods ranging from several days to several weeks

until they reach the age of 40 (or older, for reservists who are military officers or who have certain occupations) and, in the event

of a military conflict, may be called to active duty. Since October 7, 2023, the Israel Defense Force (the “IDF”) has

called up more than 350,000 of its reserve forces to serve. One management employee and several non-management employees are currently

subject to military service in the IDF and have been called to serve. In addition, the family members of many of our Israeli team members

are currently serving in the IDF. Shelter-in-place and work-from-home measures, government-imposed restrictions on movement and travel

and other precautions taken to address the ongoing conflict may temporarily disrupt our management and employees’ ability to effectively

perform their daily tasks. It is also possible that there will be further military reserve duty call-ups in the future, which may affect

our business due to a shortage of skilled labor and loss of institutional knowledge, and necessary mitigation measures we may take to

respond to a decrease in labor availability may have unintended negative effects and adversely impact our results of operations, liquidity

or cash flows.

Many of our employees,

including members of our product, research and development and customer support teams, operate from our offices that are located within

the West Bank, in Ramallah and Nablus. From time to time, there have been violent clashes between Israelis and Palestinians living in

the West Bank. The current violence in the region has caused tension between our teams in Ramallah and Jerusalem. If the war with Hamas

spreads to the West Bank, our team in Ramallah would likely be severely impacted. The Palestinian Authority, which governs the areas where

the Ramallah and Nablus offices are, has recently called several general strikes during which our teams did not perform their duties.

Should our teams in Ramallah be unable or unwilling to continue to perform their functions, whether due to violence, strikes or otherwise,

the Company will suffer significant negative effects that could adversely impact our results of operations, liquidity and cash flows.

Our commercial insurance

does not cover losses that may occur as a result of events associated with war and terrorism. Although the Israeli government currently

covers certain damages that are caused by terrorist attacks or acts of war, we cannot assure you that this government coverage will be

maintained or that it will sufficiently cover our potential damages. Any losses or damages incurred by us could have a material adverse

effect on our business. Any armed conflicts or political instability in the region would likely negatively affect business conditions

and could harm our results of operations.

Further, the State of

Israel and Israeli companies have been, from time to time, subjected to economic boycotts. Several countries still restrict business with

the State of Israel and with Israeli companies. These restrictive laws and policies may have an adverse impact on our results of operations,

financial condition or the expansion of our business. A campaign of boycotts, divestment, and sanctions has been undertaken against Israel,

which could also adversely affect our business. Actual or perceived political instability in Israel or any negative changes in the political

environment, may individually or in the aggregate adversely affect the Israeli economy and, in turn, our business, financial condition,

results of operations, and prospects.

It is currently not possible

to predict the duration or severity of the ongoing conflict or its effects on our business, operations and financial conditions. The ongoing

conflict is rapidly evolving and developing, and could disrupt our business and operations, interrupt our sources and availability of

supply and hamper our ability to raise additional funds or sell our securities, among others.

Incorporation by Reference

The unaudited consolidated balance sheets, unaudited consolidated

statements of operations, unaudited consolidated statements of cash flows, reconciliation of IFRS to non-IFRS gross profit and gross margin,

reconciliation of IFRS operating loss to adjusted EBITDA, and reconciliation of IFRS loss to non-IFRS loss and loss per share contained

in the press release attached as Exhibit 99.1 to this report on Form 6-K and the updated risk factor above are hereby incorporated

by reference into the Company’s registration statement on Form S-8 (File No. 333-270303), to be a part thereof from the

date on which this report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

FREIGHTOS LIMITED |

| Date: November 21, 2023 |

|

| |

/s/ Michael Oberlander |

| |

Name: |

Michael Oberlander |

| |

Title: |

General Counsel |

Exhibit 99.1

Freightos Reports Third Quarter Results with

Revenue Growth and Progress Toward Profitability

●

Sustained growth in Transactions and in number of Buyer Users reflects continued marketplace growth dynamic

● Operational efficiency plan yields better than expected results enhancing the Company’s financial standing

November 21, 2023 – Jerusalem /PRNewswire/ - Freightos Limited

(NASDAQ: CRGO), a leading vendor-neutral digital booking and payment platform for the international freight industry, today reported financial

results for the quarter ended September 30, 2023.

“We are pleased with our third quarter results, marking the 15th

straight quarter of robust growth in the number of transactions. This is a clear indicator of how strongly our value proposition is resonating,

despite the current industry downturn.” said Zvi Schreiber, founder and CEO of Freightos. “On a macro level, we are encouraged

to see that global trade volumes continue to grow, and look forward to more indications of recovery in the global freight market.”

“During the quarter, we enhanced our offerings with key features

and expanded our network of buyers and sellers. Even with this growth, we are only scratching the surface of digitizing the international

freight market, and we're excited about the opportunities we have as leaders in this ongoing digital transformation.“

“We're encouraged by the progress toward profitability in the

third quarter, which confirms the effectiveness of our operational efficiency plan launched in July,” said Ran Shalev, CFO of Freightos.

“The third quarter’s results are a testament to our strategic balance of driving growth and managing expenses. This trend

together with our solid cash position, keeps us on course to reach profitability with the capital on hand.”

Third Quarter 2023 financial highlights

| |

● |

Revenue of $5.1 million for the third quarter of 2023, an increase of 9% compared to the third quarter of 2022, or 7% on a constant currency basis. |

| |

● |

IFRS Gross Margin of 54.9%, the same as for the third quarter of 2022. Non-IFRS Gross Margin of 69.5%, compared to 63.5% for the third quarter of 2022. |

| |

● |

IFRS operating loss of $9.3 million, compared to $5.3 million in the third quarter of 2022. |

| |

● |

Adjusted EBITDA in the third quarter of 2023 of negative $4.1 million, compared to negative $3.4 million in the third quarter of 2022. |

| |

● |

Cash and cash equivalents and short term deposits and investments balance at the end of September 2023 of $55.2 million. |

Recent business highlights

| |

● |

Transaction Growth: Freightos achieved a record 269 thousand Transactions in the third quarter of 2023, up 40% year over year, for the first time exceeding a run rate of a million transactions per year. This growth was achieved while overall global air cargo volumes were flat compared to the third quarter of 2022 and still remain below 2019 levels, based on IATA data. At the same time global ocean container shipping volumes increased 5% from the third quarter of 2022, according to Container Trades Statistics. |

| |

● |

Gross Booking Value Growth: Gross Booking Value (GBV) was $160.7 million in the third quarter, up 1% compared to the third quarter of 2022, reflecting strong Transactions growth but lower average freight prices. |

| |

● |

Unique Buyer Users: The number of unique buyer users digitally booking freight services across the Freightos Platform grew 16% compared to the third quarter of 2022, reaching 17,312. |

| |

● |

Revenue growth: Revenue of $5.1 reflects growth from increased use of platforms and solutions by forwarders and carriers, offset by reduced direct engagement from small to mid-sized importers/exporters compared to the previous year, in line with the company’s expectations when it implemented its operational efficiency plan. Total Platform revenue in the third quarter was $1.8 million, at the same level as the third quarter last year, and Solutions revenue was $3.3 million, up 14% year over year. |

| |

● |

Carrier Growth: Carriers selling on the Platform, primarily on WebCargo, increased to 39 as of the end of the third quarter of 2023. In Q3 the WebCargo platform welcomed new airlines Norse Atlantic Airways and aircraft charter company Chapman Freeborn, more Global Sales Agents (GSAs) offered capacity - including CargoJet and InXpress, while other existing airline sellers expanded available capacity to and from the Americas, Europe, Asia and the Caribbean, and expanded availability of specialized air cargo services for pharma. |

| |

● |

WebCargo Solutions and Platform Advances: Freightos Solutions for freight forwarders, sold under the WebCargo brand, continued to improve with a range of new features in Q3, including new integrations for air cargo data handling and visibility, enhanced carrier integration and language solutions, and booking and payment solutions for ocean shipments. |

Financial outlook

| |

|

Management Expectations |

| |

|

Q4 2023 |

|

FY 2023 |

| # Transactions |

|

273,000 - 284,000 |

|

1,010,500 - 1,021,500 |

| Year over Year Growth |

|

30% - 35% |

|

51% - 53% |

| GBV ($m) |

|

$ 163.5 - $ 175.0 |

|

$ 647.5 - $ 659.0 |

| Year over Year Growth |

|

(4)% - 3% |

|

6% - 8% |

| Revenue ($m) |

|

$ 5.1 - $ 5.3 |

|

$ 20.1 - $ 20.3 |

| Year over Year Growth |

|

4% - 10% |

|

5% - 7% |

| Adjusted EBITDA ($m) |

|

$ (4.7) - $ (4.4) |

|

(19.9) – (19.6) |

This outlook assumes currency exchange rates, freight price levels

and freight volumes as of November 15, 2023.

Earnings Webcast

Freightos’ management will host a webcast and conference call

to discuss the results today, November 21, 2023 at 8:30 a.m. EST.

To participate in the call, please register at the following link:

https://freightos.zoom.us/webinar/register/WN_vt-BkyB0Qw6Qhj0g32vKUg#/registration

Following registration, you will be sent the link to the conference

call which is accessible either via the Zoom app, or alternatively from a dial-in telephone number.

Questions may be submitted in advance to ir@freightos.com or via Zoom

during the call.

A replay of the webcast will be available on Freightos’ Investor

Relations website following the call, as well as the call’s transcript.

Forward-Looking Statements

This press release includes “forward-looking statements”

within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,”

“forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,”

“seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not

statements of historical matters. These statements, which include the financial outlook of Freightos, are based on various assumptions,

whether or not identified in this press release, and on the current expectations of Freightos and are not predictions of actual performance.

These forward-looking statements are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance,

a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict

and will differ from assumptions. Many actual events and circumstances are beyond the control of Freightos. These forward-looking statements

are subject to a number of risks and uncertainties, including the ongoing military conflict in the Middle East; Freightos’ ability

to effectively execute the previously announced operational efficiency and cost reduction plan without undue disruption to its business;

competition and the ability of Freightos to build and maintain relationships with carriers, freight forwarders and importers/exporters

and retain its management and key employees; changes in applicable laws or regulations; any downturn or volatility in economic conditions

whether related to inflation, armed conflict or otherwise; changes in the competitive environment affecting Freightos or its users, including

Freightos’ inability to introduce new products or technologies; risks to Freightos’ ability to protect its intellectual property

and avoid infringement by others, or claims of infringement against Freightos; and those factors discussed in Freightos’ annual

report on Form 20-F filed with the SEC on March 30, 2023, under the heading “Risk Factors,” and any other risk factors Freightos

includes in any subsequent reports on Form 6-K furnished to the SEC. If any of these risks materialize or our assumptions prove incorrect,

actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that

Freightos does not presently know or that Freightos currently believes are immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. In addition, forward-looking statements reflect Freightos’ expectations, plans

or forecasts of future events and views as of the date of this press release. Freightos anticipates that subsequent events and developments

will cause Freightos’ assessments to change. However, while Freightos may elect to update these forward-looking statements at some

point in the future, Freightos specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon

as representing Freightos’ assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance

should not be placed upon the forward-looking statements.

Financial Information; Non-IFRS Financial Measures

While certain financial figures included in this press release have

been computed in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting

Standards Board, this press release does not contain sufficient information to constitute an interim financial report as defined in International

Accounting Standards 34, “Interim Financial Reporting” nor a financial statement as defined by International Accounting Standards

1 “Presentation of Financial Statements”. Not all of the financial information in this press release has been audited.

This press release includes certain financial measures not presented

in accordance with generally accepted accounting principles (“IFRS”) including, but not limited to, Adjusted EBITDA. These

non-IFRS measures differ from the most directly comparable measures determined under IFRS, but we have not presented a reconciliation

to the most directly comparable IFRS measures, because the non-IFRS measures are forward-looking and a reconciliation cannot be prepared

without unreasonable effort. These measures should not be considered in isolation or as an alternative to revenue, net income, cash flows

from operations or other measures of profitability, liquidity or performance under IFRS. You should be aware that the presentation of

these measures may not be comparable to similarly-titled measures used by other companies. In addition, this press release discloses revenue

on a constant currency basis, which is not presented in accordance with IFRS. Freightos believes that revenue on a constant currency basis,

Adjusted EBITDA and other non-IFRS measures provide useful information to investors and others in understanding and evaluating Freightos’

operating results because they provide supplemental measures of our core operating performance and offers consistency and comparability

with both past financial performance and with financial information of peer companies. Certain monetary amounts, percentages and other

figures included in this press release have been subject to rounding adjustments. Certain other amounts that appear in this press release

may not sum due to rounding.

Definitions

| |

● |

Carriers: Number of unique air and ocean carriers who have been sellers of transactions. For airlines, we count booking carriers, which include separate airlines within the same carrier group. We do not count dozens of other airlines that operate individual segments of air cargo transactions as we do not have a direct booking relationship with them. Carriers include ocean less-than-container load (LCL) consolidators. In addition, we only count carriers when more than five bookings were placed with them over the course of a quarter. |

| |

● |

Unique buyer users: Unique buyer users represent the number of individual users placing bookings, typically counted based on unique email logins. The number of buyers, which counts unique customer businesses, does not reflect the fact that some buyers are large multinational organizations while others are small or midsize businesses. Therefore, we find it more useful to monitor the number of unique buyer users than the number of buyer businesses. |

| |

● |

Constant Currency: Comparative information calculated by translating Freightos’ current period financial results using the prior period’s monthly exchange rates (or other applicable rates, as indicated). |

| |

● |

GBV: Total value of transactions on the Freightos platform, which is the monetary value of freight and related services contracted between buyers and sellers on the Freightos platform, plus related fees charged to buyers and sellers, and pass-through payments such as duties. GBV is converted to U.S. dollars at the time of each transaction on the Freightos platform. This metric may be similar to what others call gross merchandise value (GMV) or gross services volume (GSV). We believe that this metric reflects the scale of the Freightos platform and our opportunities to generate platform revenue. |

| |

● |

#Transactions: Number of bookings for freight services, and related services, placed by buyers across the Freightos platform with third-party sellers and with Clearit. Beginning in the third quarter of 2022, #Transactions include trucking bookings, which were added to the Freightos platform following the acquisition of 7LFreight. The number of transactions booked on the Freightos platform in any given time period is net of transactions canceled during the same time period. |

| |

● |

Adjusted EBITDA: Adjusted EBITDA represents net loss before income taxes, finance income, finance expense, share-based compensation expense, depreciation and amortization, changes in the fair value of contingent consideration, operating expense settled by issuance of shares, redomicile costs, share listing expense, change in fair value of warrants, transaction-related costs, non-recurring expenses associated with the business combination with Gesher I Acquisition Corp and reorganization expenses. |

| |

● |

Platform Revenue: Platform revenue reflects fees charged to buyers and sellers in relation to transactions executed on the Freightos platform. For bookings conducted by importers/exporters, our fees are typically structured as a percentage of booking value, depending on the mode and nature of the service. When freight forwarders book with carriers, the sellers often pay a pre-negotiated flat fee per transaction. When sellers transact with a buyer who is a new customer to the seller, we may charge a percentage of the booking value as a fee. |

| |

● |

Solutions Revenue: Solutions revenue is primarily subscription-based SaaS and data. It is typically priced per user or per site, per time period, with larger customers such as multinational freight forwarders often negotiating flat all- inclusive subscriptions. Revenue from our Solutions segment includes certain non-recurring revenue from services ancillary to our SaaS products, such as engineering, customization, configuration and go-live fees, and data services for digitizing offline data. |

Contacts

Media:

Tali Aronsky

press@freightos.com

Investors:

Anat Earon-Heilborn

ir@freightos.com

About Freightos Limited

Freightos® operates a leading, vendor-neutral booking and payment

platform for international freight. Freightos’ platform supports supply chain efficiency and agility by enabling real-time procurement

of ocean and air shipping across more than ten thousand importers/exporters, thousands of forwarders, and dozens of airlines and ocean

carriers.

Freightos.com is a premier digital international freight marketplace

for importers and exporters for instant pricing, booking, and shipment management. Thousands of SMBs and enterprises have sourced shipping

services via Freightos across dozens of logistics service providers.

WebCargo® by Freightos is a leading global freight platform connecting

carriers and forwarders. In particular, it is the largest air cargo eBooking platform, enabling simple and efficient freight pricing and

booking between thousands of freight forwarders, including the top twenty global freight forwarders, and hundreds of airlines, ocean liners

and trucking carriers. Airlines on the platform represent over a third of global air cargo capacity. WebCargo also offers software as

a service for forwarders to facilitate digital freight rate management, quoting, and online sales.

Freightos Data calculates the Freightos Baltic Index, the industry’s

key daily benchmark of container shipping prices, the Freightos Air Index, as well as other market intelligence products that improve

supply chain decision-making, planning, and pricing transparency.

Freightos

is a widely recognized logistics technology leader with a worldwide presence and a broad customer network. Incorporated in the Cayman

Islands with offices around the world, Freightos is a Nasdaq-listed company trading under Nasdaq:CRGO. More information is available at

freightos.com/investors.

CONSOLIDATED BALANCE

SHEETS

(In thousands)

| | |

September 30,

2023 | | |

December 31,

2022 | |

| | |

(unaudited) | | |

(audited) | |

| Assets | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 5,076 | | |

$ | 6,492 | |

| User funds | |

| 4,722 | | |

| 3,328 | |

| Trade receivables, net | |

| 2,258 | | |

| 1,936 | |

| Short-term bank deposit | |

| 20,000 | | |

| - | |

| Short-term investments | |

| 30,097 | | |

| - | |

| Other receivables and prepaid expenses | |

| 2,524 | | |

| 1,215 | |

| | |

| 64,677 | | |

| 12,971 | |

| | |

| | | |

| | |

| Non-current Assets: | |

| | | |

| | |

| Property and equipment, net | |

| 643 | | |

| 767 | |

| Right-of-use assets, net | |

| 1,115 | | |

| 1,384 | |

| Intangible assets, net | |

| 8,088 | | |

| 9,465 | |

| Goodwill | |

| 15,628 | | |

| 15,628 | |

| Deferred taxes | |

| 618 | | |

| 573 | |

| Other long-term assets | |

| 1,585 | | |

| 1,018 | |

| | |

| 27,677 | | |

| 28,835 | |

| | |

| | | |

| | |

| Total assets | |

$ | 92,354 | | |

$ | 41,806 | |

| | |

| | | |

| | |

| Liabilities and Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Short-term bank loan and credit | |

$ | - | | |

$ | 2,505 | |

| Trade payables | |

| 3,248 | | |

| 3,234 | |

| User accounts | |

| 4,722 | | |

| 3,328 | |

| Current maturity of lease liabilities | |

| 652 | | |

| 613 | |

| Accrued expenses and other payables | |

| 5,876 | | |

| 7,400 | |

| | |

| 14,498 | | |

| 17,080 | |

| | |

| | | |

| | |

| Long Term Liabilities: | |

| | | |

| | |

| Lease liabilities | |

| 193 | | |

| 395 | |

| Employee benefit liabilities, net | |

| 1,064 | | |

| 1,294 | |

| Warrants liability | |

| 1,944 | | |

| - | |

| Other long-term liabilities | |

| 440 | | |

| 1,377 | |

| | |

| 3,641 | | |

| 3,066 | |

| | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Share capital | |

| * | ) | |

| * | ) |

| Share premium | |

| 254,942 | | |

| 140,229 | |

| Reserve from remeasurement of defined benefit plans | |

| 137 | | |

| 137 | |

| Accumulated deficit | |

| (180,864 | ) | |

| (118,706 | ) |

| Total equity | |

| 74,215 | | |

| 21,660 | |

| | |

| | | |

| | |

| Total liabilities and equity | |

$ | 92,354 | | |

$ | 41,806 | |

*) Represents an amount lower than $1.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| | |

(unaudited) | | |

(unaudited) | |

| Revenue | |

$ | 5,107 | | |

$ | 4,688 | | |

$ | 15,023 | | |

$ | 14,236 | |

| Cost of revenue | |

| 2,305 | | |

| 2,113 | | |

| 6,493 | | |

| 5,881 | |

| Gross profit | |

| 2,802 | | |

| 2,575 | | |

| 8,530 | | |

| 8,355 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 2,992 | | |

| 2,526 | | |

| 9,006 | | |

| 7,645 | |

| Selling and marketing | |

| 3,944 | | |

| 2,437 | | |

| 11,025 | | |

| 7,338 | |

| General and administrative | |

| 4,274 | | |

| 2,200 | | |

| 10,353 | | |

| 7,197 | |

| Reorganization | |

| 884 | | |

| - | | |

| 884 | | |

| - | |

| Transaction-related costs | |

| - | | |

| 741 | | |

| 3,703 | | |

| 1,553 | |

| Share listing expense (1) | |

| - | | |

| - | | |

| 46,717 | | |

| - | |

| Total operating expenses | |

| 12,094 | | |

| 7,904 | | |

| 81,688 | | |

| 23,733 | |

| Operating loss | |

| (9,292 | ) | |

| (5,329 | ) | |

| (73,158 | ) | |

| (15,378 | ) |

| Change in fair value of warrants | |

| 1,577 | | |

| - | | |

| 8,981 | | |

| - | |

| Finance income | |

| 677 | | |

| 91 | | |

| 2,367 | | |

| 262 | |

| Finance expenses | |

| (64 | ) | |

| (95 | ) | |

| (287 | ) | |

| (401 | ) |

| Financing income (expenses), net | |

| 613 | | |

| (4 | ) | |

| 2,080 | | |

| (139 | ) |

| Loss before taxes on income | |

| (7,102 | ) | |

| (5,333 | ) | |

| (62,097 | ) | |

| (15,517 | ) |

| Income taxes | |

| 58 | | |

| 53 | | |

| 61 | | |

| 91 | |

| Loss | |

$ | (7,160 | ) | |

$ | (5,386 | ) | |

$ | (62,158 | ) | |

$ | (15,608 | ) |

| Other comprehensive income (net of tax effect): | |

| | | |

| | | |

| | | |

| | |

| Remeasurement gain from defined benefit plans | |

| - | | |

| - | | |

| - | | |

| 225 | |

| Total components that will not be reclassified subsequently to profit or loss | |

| - | | |

| - | | |

| - | | |

| 225 | |

| Total comprehensive loss | |

$ | (7,160 | ) | |

$ | (5,386 | ) | |

$ | (62,158 | ) | |

$ | (15,383 | ) |

| Basic and diluted loss per Ordinary share | |

$ | (0.15 | ) | |

$ | (0.95 | ) | |

$ | (1.43 | ) | |

$ | (2.84 | ) |

| Weighted average number of shares outstanding used to compute basic and diluted loss per share | |

| 47,591,775 | | |

| 8,112,059 | | |

| 43,839,445 | | |

| 7,844,521 | |

(1) Represents non-recurring, non-cash

share-based listing expense incurred in connection with the business combination with Gesher I Acquisition Corp.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| | |

(unaudited) | | |

(unaudited) | |

| Cash flows from operating activities: | |

| | | |

| | | |

| | | |

| | |

| Loss | |

$ | (7,160 | ) | |

$ | (5,386 | ) | |

$ | (62,158 | ) | |

$ | (15,608 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | | |

| | | |

| | |

| Adjustments to profit or loss items: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 719 | | |

| 640 | | |

| 2,081 | | |

| 1,769 | |

| Operating expense settled by issuance of shares | |

| 184 | | |

| - | | |

| 184 | | |

| - | |

| Share listing expense | |

| - | | |

| - | | |

| 46,717 | | |

| - | |

| Change in fair value of warrants | |

| (1,577 | ) | |

| - | | |

| (8,981 | ) | |

| - | |

| Changes in the fair value of contingent consideration | |

| 109 | | |

| (96 | ) | |

| (794 | ) | |

| (225 | ) |

| Share-based compensation | |

| 3,375 | | |

| 635 | | |

| 4,503 | | |

| 1,367 | |

| Finance expenses (income), net | |

| (722 | ) | |

| 99 | | |

| (1,928 | ) | |

| 363 | |

| Income taxes | |

| 58 | | |

| 53 | | |

| 61 | | |

| 91 | |

| | |

| 2,146 | | |

| 1,331 | | |

| 41,843 | | |

| 3,365 | |

| Changes in asset and liability items: | |

| | | |

| | | |

| | | |

| | |

| Decrease (increase) in user funds | |

| (1,207 | ) | |

| 546 | | |

| (1,396 | ) | |

| 3,237 | |

| Increase (decrease) in user accounts | |

| 1,207 | | |

| (546 | ) | |

| 1,396 | | |

| (3,237 | ) |

| Decrease (increase) in other receivables and prepaid expenses | |

| 749 | | |

| (128 | ) | |

| (336 | ) | |

| (292 | ) |

| Decrease (increase) in trade receivables | |

| (98 | ) | |

| 69 | | |

| (337 | ) | |

| (259 | ) |

| Increase (decrease) in trade payables | |

| (245 | ) | |

| 906 | | |

| 64 | | |

| 1,679 | |

| Increase (decrease) in accrued severance pay, net | |

| (204 | ) | |

| (7 | ) | |

| (216 | ) | |

| 78 | |

| Increase (decrease) in accrued expenses and other payables | |

| (494 | ) | |

| 530 | | |

| (3,396 | ) | |

| 1,554 | |

| | |

| (292 | ) | |

| 1,370 | | |

| (4,221 | ) | |

| 2,760 | |

| Cash received (paid) during the year for: | |

| | | |

| | | |

| | | |

| | |

| Interest received, net | |

| 48 | | |

| 17 | | |

| 523 | | |

| (144 | ) |

| Taxes paid | |

| (37 | ) | |

| (65 | ) | |

| (91 | ) | |

| (109 | ) |

| | |

| 11 | | |

| (48 | ) | |

| 432 | | |

| (253 | ) |

| Net cash used in operating activities | |

| (5,295 | ) | |

| (2,733 | ) | |

| (24,104 | ) | |

| (9,736 | ) |

| Cash flows from investing activities: | |

| | | |

| | | |

| | | |

| | |

| Purchase of property and equipment | |

| (6 | ) | |

| (44 | ) | |

| (74 | ) | |

| (213 | ) |

| Proceeds from sale of property and equipment | |

| 7 | | |

| 1 | | |

| 8 | | |

| 1 | |

| Acquisition of a subsidiary, net of cash acquired (a) | |

| - | | |

| - | | |

| - | | |

| (4,183 | ) |

| Payment of payables for previous acquisition of a subsidiary | |

| - | | |

| - | | |

| (136 | ) | |

| (156 | ) |

| Investment in long-term assets | |

| (29 | ) | |

| (13 | ) | |

| (376 | ) | |

| (494 | ) |

| Withdrawal of a deposit | |

| 3 | | |

| - | | |

| 3 | | |

| - | |

| Withdrawal of (investment in) short term investments, net | |

| 1,250 | | |

| - | | |

| (29,670 | ) | |

| - | |

| Investment in short-term bank deposit | |

| - | | |

| - | | |

| (20,000 | ) | |

| - | |

| Net cash provided by (used in) investing activities | |

| 1,225 | | |

| (56 | ) | |

| (50,245 | ) | |

| (5,045 | ) |

| Cash flows from financing activities: | |

| | | |

| | | |

| | | |

| | |

| Proceeds from the issuance of share capital and warrants net of transaction costs | |

| - | | |

| - | | |

| 76,044 | | |

| - | |

| Repayment of lease liabilities | |

| (86 | ) | |

| (136 | ) | |

| (373 | ) | |

| (448 | ) |

| Repayment of short-term bank loan and credit | |

| - | | |

| - | | |

| (2,504 | ) | |

| - | |

| Exercise of options | |

| 32 | | |

| 22 | | |

| 51 | | |

| 53 | |

| Net cash provided by (used in) financing activities | |

| (54 | ) | |

| (114 | ) | |

| 73,218 | | |

| (395 | ) |

| Exchange differences on balances of cash and cash equivalents | |

| (94 | ) | |

| (179 | ) | |

| (285 | ) | |

| (550 | ) |

| Decrease in cash and cash equivalents | |

| (4,218 | ) | |

| (3,082 | ) | |

| (1,416 | ) | |

| (15,726 | ) |

| Cash and cash equivalents at the beginning of the period | |

| 9,294 | | |

| 12,435 | | |

| 6,492 | | |

| 25,079 | |

| Cash and cash equivalents at the end of the period | |

$ | 5,076 | | |

$ | 9,353 | | |

$ | 5,076 | | |

$ | 9,353 | |

| (a) Acquisition of an initially consolidated subsidiary: | |

| | | |

| | | |

| | | |

| | |

| Working capital (excluding cash and cash equivalents) | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | (992 | ) |

| Other receivables | |

| - | | |

| - | | |

| - | | |

| 163.00 | |

| Property and equipment | |

| - | | |

| - | | |

| - | | |

| 12 | |

| Intangible assets | |

| - | | |

| - | | |

| - | | |

| 5,734 | |

| Goodwill | |

| - | | |

| - | | |

| - | | |

| 7,607 | |

| Shares issued | |

| - | | |

| - | | |

| - | | |

| (6,573 | ) |

| Contingent consideration | |

| - | | |

| - | | |

| - | | |

| (1,768 | ) |

| Acquisition of a subsidiary, net of cash acquired | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 4,183 | |

| (b) Significant non-cash transactions: | |

| | | |

| | | |

| | | |

| | |

| Right-of-use asset recognized with corresponding lease liability | |

$ | 78 | | |

$ | - | | |

$ | 239 | | |

$ | 74 | |

| Issuance of shares for previous acquisition of a subsidiary | |

$ | - | | |

$ | - | | |

$ | 113 | | |

$ | - | |

RECONCILIATION OF IFRS TO NON-IFRS GROSS PROFIT

AND GROSS MARGIN

(in thousands, except gross margin data)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| | |

(unaudited) | | |

(unaudited) | |

| IFRS gross profit | |

$ | 2,802 | | |

$ | 2,575 | | |

$ | 8,530 | | |

$ | 8,355 | |

| Add: | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation | |

| 432 | | |

| 144 | | |

| 591 | | |

| 209 | |

| Depreciation & Amortization | |

| 315 | | |

| 256 | | |

| 871 | | |

| 683 | |

| Non-IFRS gross profit | |

$ | 3,549 | | |

$ | 2,975 | | |

$ | 9,992 | | |

$ | 9,247 | |

| IFRS gross margin | |

| 54.9 | % | |

| 54.9 | % | |

| 56.8 | % | |

| 58.7 | % |

| Non-IFRS gross margin | |

| 69.5 | % | |

| 63.5 | % | |

| 66.5 | % | |

| 65.0 | % |

RECONCILIATION OF IFRS OPERATING LOSS TO ADJUSTED

EBITDA

(in thousands)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| | |

(unaudited) | | |

(unaudited) | |

| Operating loss | |

$ | (9,292 | ) | |

$ | (5,329 | ) | |

$ | (73,158 | ) | |

$ | (15,378 | ) |

| Add: | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation | |

| 3,375 | | |

| 635 | | |

| 4,503 | | |

| 1,367 | |

| Depreciation & Amortization | |

| 719 | | |

| 640 | | |

| 2,081 | | |

| 1,769 | |

| Share listing expense | |

| - | | |

| - | | |

| 46,717 | | |

| - | |

| Non-recurring expenses | |

| - | | |

| - | | |

| 499 | | |

| - | |

| Redomicile costs | |

| - | | |

| 109 | | |

| - | | |

| 625 | |

| Transaction-related costs | |

| - | | |

| 741 | | |

| 3,703 | | |

| 1,553 | |

| Changes in the fair value of contingent consideration | |

| - | | |

| (225 | ) | |

| (642 | ) | |

| (225 | ) |

| Reorganization | |

| 884 | | |

| - | | |

| 884 | | |

| - | |

| Operating expense settled by issuance of shares | |

| 184 | | |

| - | | |

| 184 | | |

| - | |

| Adjusted EBITDA | |

$ | (4,130 | ) | |

$ | (3,429 | ) | |

$ | (15,229 | ) | |

$ | (10,289 | ) |

| Adjusted EBITDA margins | |

| -81 | % | |

| -73 | % | |

| -101 | % | |

| -72 | % |

RECONCILIATION OF IFRS LOSS TO NON-IFRS LOSS AND

LOSS PER SHARE

(in thousands, except share and per share data)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| | |

(unaudited) | | |

(unaudited) | |

| IFRS loss attributable to ordinary shareholders | |

$ | (7,160 | ) | |

$ | (5,386 | ) | |

$ | (62,158 | ) | |

$ | (15,608 | ) |

| Add: | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation | |

| 3,375 | | |

| 635 | | |

| 4,503 | | |

| 1,367 | |

| Depreciation & Amortization | |

| 719 | | |

| 640 | | |

| 2,081 | | |

| 1,769 | |

| Share listing expense | |

| - | | |

| - | | |

| 46,717 | | |

| - | |

| Non-recurring expenses | |

| - | | |

| - | | |

| 499 | | |

| - | |

| Redomicile costs | |

| - | | |

| 109 | | |

| - | | |

| 625 | |

| Transaction-related costs | |

| - | | |

| 741 | | |

| 3,703 | | |

| 1,553 | |

| Changes in the fair value of contingent consideration | |

| 109 | | |

| (96 | ) | |

| (794 | ) | |

| (225 | ) |

| Reorganization | |

| 884 | | |

| - | | |

| 884 | | |

| - | |

| Operating expense settled by issuance of shares | |

| 184 | | |

| - | | |

| 184 | | |

| - | |

| Change in fair value of warrants | |

| (1,577 | ) | |

| - | | |

| (8,981 | ) | |

| - | |

| Non IFRS loss | |

$ | (3,466 | ) | |

$ | (3,357 | ) | |

$ | (13,362 | ) | |

$ | (10,519 | ) |

| Non IFRS basic and diluted loss per Ordinary share | |

$ | (0.07 | ) | |

$ | (0.70 | ) | |

$ | (0.32 | ) | |

$ | (2.20 | ) |

| Weighted average number of shares outstanding used to compute basic and diluted loss per share | |

| 47,591,775 | | |

| 8,112,059 | | |

| 43,839,445 | | |

| 7,844,521 | |

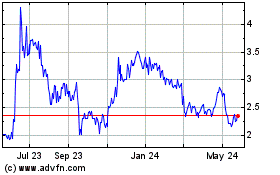

Freightos (NASDAQ:CRGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

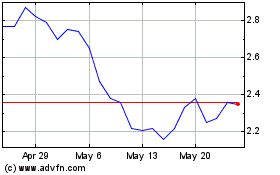

Freightos (NASDAQ:CRGO)

Historical Stock Chart

From Dec 2023 to Dec 2024