0000799850 False 0000799850 2023-08-29 2023-08-29 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 29, 2023

_______________________________

America's Car-Mart Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Texas | 0-14939 | 63-0851141 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1805 North 2nd Street, Suite 401

Rogers, Arkansas 72756

(Address of Principal Executive Offices) (Zip Code)

(479) 464-9944

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | CRMT | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On September 5, 2023, America’s Car-Mart, Inc. (the “Company”) issued a press release announcing its operating results for the first fiscal quarter of the fiscal year ending April 30, 2024. The press release contains certain financial, operating and other information for the period ended July 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

In accordance with General Instruction B.2., the information contained in Item 2.02 of this Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act. The Company undertakes no obligation to update or revise this information.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 29, 2023, the Board of Directors of the Company (the “Board”) approved the promotion of the Company’s current President, Douglas W. Campbell, to Chief Executive Officer (“CEO”) of the Company effective October 1, 2023. Mr. Campbell will continue to serve as President of the Company upon his appointment as CEO.

Mr. Campbell, age 47, has served as President of the Company since October 2022. Prior to joining the Company, Mr. Campbell was Senior Vice President, Head of Fleet Services for the Americas, at Avis Budget Group (“Avis”) since June 2022 and previously served as Head of Fleet Services for the Americas since June 2021 and Vice President, Remarketing for the Americas, from March 2018 to June 2021. Prior to joining Avis, Mr. Campbell held management positions at AutoNation from September 2014 to March 2018 serving as Used Vehicle Director, Eastern Region, in AutoNation’s corporate office and later as General Manager of its Honda Dulles dealership. Preceding AutoNation, Mr. Campbell served fifteen years with Coral Springs Auto Mall, most recently serving as Executive General Manager.

Upon Mr. Campbell’s promotion to CEO, the Company’s current CEO, Jeffrey A. Williams, will serve as CEO Emeritus and an advisor to senior management effective October 1, 2023, for the remainder of fiscal year 2024. Mr. Williams will continue to serve as a director of the Company.

In accordance with the Amended and Restated Bylaws of the Company, on August 29, 2023, the Board also approved increasing the number of directors serving on the Board to eight directors and appointed Mr. Campbell to serve as a director effective October 1, 2023.

Item 7.01. Regulation FD Disclosure.

On September 5, 2023, the Company issued a press release announcing the appointment of Douglas Campbell as CEO of the Company effective October 1, 2023. A copy of the press release is attached as Exhibit 99.2 to this Form 8-K and is incorporated herein by reference.

In accordance with General Instruction B.2., the information contained in Item 7.01 of this Form 8-K, including Exhibit 99.2 attached hereto, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act. The Company undertakes no obligation to update or revise this information.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | America's Car-Mart Inc. |

| | | |

| | | |

| Date: September 5, 2023 | By: | /s/ Vickie D. Judy |

| | | Vickie D. Judy |

| | | Chief Financial Officer (Principal Financial Officer) |

| | | |

EXHIBIT 99.1

America’s Car-Mart Reports First Quarter Fiscal 2024 Earnings

ROGERS, Ark., Sept. 05, 2023 (GLOBE NEWSWIRE) -- America’s Car-Mart, Inc. (NASDAQ: CRMT) (“we,” “Car-Mart” or the “Company”) today reported strong revenue growth in the first quarter of fiscal year 2024, with net income negatively impacted by credit results. Diluted earnings per share were $0.63 on revenue of $368.0 million for the quarter.

Also today, the Company announced that current President Doug Campbell will succeed Jeff Williams as Chief Executive Officer and join the Board of Directors, effective October 1, 2023. Williams will remain a Board Member and serve as CEO Emeritus and an advisor to the Company. See associated press release America’s Car-Mart Names Doug Campbell CEO & Board Member.

Highlights First Quarter 2024

The following are the key highlights from the first quarter. All comparisons are based on the first quarter of fiscal year 2024 vs. the first quarter of fiscal year 2023, unless otherwise noted.

- Revenues of $368.0 million, up 8.6%.

- Total retail unit sales increased 2.4%. Same store retail revenue growth was 8.2%.

- Sales volume productivity per store per month was 34.2 vs. 33.6, an increase of 1.8%.

- Gross profit per car sold was $6,768 compared to $6,5241.

- Provision for credit losses as a percentage of sales was 30.9% compared to 25.9%1. Net charge-offs as a percentage of average finance receivables for the quarter were 5.8% compared to 5.1%1.

- Interest income was up 27.3% to $56.5 million, compared to $44.3 million.

- SG&A as a percentage of sales was relatively flat at 14.9% vs. 14.7%. SG&A was up $3.2 million and up $0.7 million, sequentially. Excluding stock-based compensation, SG&A was down $0.6 million sequentially. SG&A per average customer was $449 vs. $450.

- Interest expense was $14.3 million, compared to $7.3 million.

- Total debt to finance receivables was 49.3% up from 46.5% at April 30, 2023 and total debt, net of cash, to finance receivables (non-GAAP), was 42.9%2 at the end of the first quarter, up from 41.5%2 at April 30, 2023.

- Customer count increased 8.1% to 104,734 active customers. Customers served per dealership was 680, compared to 629.

- Diluted EPS was $0.63 vs. $2.071.

CEO Commentary

“In the first quarter, improvements in many areas of the business - unit sales, gross margin, repair costs, diminishing wholesale losses, online credit application activity, working capital management and closing underperforming stores were overshadowed by the increase in the provision for loan losses during the period. The major drivers behind higher loan losses related to post-stimulus normalization of charge-offs, additional provisioning resulting from increased contract term, and a higher average interest rate for the portfolio. Said in a different way, we are experiencing the same credit results on the portfolio as we have historically, but the contract length has changed,” commented CEO Jeff Williams. “We anticipate this dynamic will reverse in the future leading to a more normalized reserve provision. In effect, the current principal collected, as a percentage of finance receivables, has been lower, creating a higher allowance for losses rather than being reported in earnings and equity. We continue to increase our allowance for credit losses, providing $14.8 million more than charge-offs during the period. Our loan origination system is now being utilized in all our stores for customer pre-approvals, improving our ability to maximize deal structures according to the risk each customer presents, and positioning us well for long-term success. While our competition is struggling with access to capital, we are not. Our healthy increase in sales volumes and scale, not to mention our on-going business investments, are giving us ever-increasing advantages in the marketplace.”

Sales

Continued strength in the growth of online credit applications drove a 2.4% increase in unit volumes versus the prior year’s first quarter. We are converting approximately 13.0% of online credit applications to sales and growth in applications remained robust at 19.0% for the quarter, increasing our market share. Our dealership volume productivity averaged 34.2 sales per month, up from 33.6 last year in a challenging environment for used car sales.

Our average retail sales price rose by 4.1% to $18,799 versus the prior year’s first quarter. Approximately half of the price increase was related to the vehicle and half was related to ancillary product pricing. We strongly believe that affordability will improve and that many potential customers will come off the sidelines. Publicly traded dealership groups continue to report double-digit decreases in overall used unit volumes, citing affordability as the main reason. In addition, recent wholesale market price decreases are expected to result in lower retail prices, and more affordable consumer prices in the future. As a reminder, dealership and wholesale pricing are a reliable leading indicator for our market. We are on target to reach our goal of selling 40-50 vehicles per month per dealership and eventually support an average of 1,000 or more active customers per store.

Gross profits

Last quarter we committed to recovering 260 bps of gross margin to 36.0%. We are very pleased with our progress and now expect our future gross margins to be higher than previously communicated. The gross margin improvement is a direct result of Doug Campbell’s expertise in improving purchasing and disposition business practices and the hard work of our team, under his leadership. We are excited about the investments we have been making and continue to make, and believe we are in the early innings of realizing the benefits. Total gross profit dollars were $107.7 million versus $101.4 million in the prior year’s first quarter. Unit gross profits were $6,768 versus $6,5241 last year and versus $6,354 sequentially. Inventory is 19.0% lower than the end of the first quarter of fiscal 2023. Annualized inventory turns for the first quarter were 7.2, an improvement compared to the prior year’s first quarter turns of 5.9. Gross margin was up 120 basis points sequentially and 20 basis points compared to the prior year’s first quarter. The biggest driver of the sequential quarterly gross margin improvement was an 11.0% reduction in the cost of repairing vehicles. In addition, wholesale losses continue to diminish and are now lower than they were in 2018 as a result of improvements to both the purchasing and the disposition of vehicles.

Credit and Interest Income

Net charge-offs as a percentage of average finance receivables were 5.8% compared to 5.1%1 during the prior year quarter and 6.3% during the sequential quarter. The prior 5-year and 10-year averages for first quarters were 5.0%1 and 5.6%1, respectively. The provision for credit losses was 30.9% compared to 25.9%1 versus the prior year’s first quarter and 30.4% sequentially. Our reserve increased during the quarter by $14.8 million or 15.0%. Our realized recoveries were constant at 27.0% of gross charge-offs. Structural changes to our portfolio driven by higher vehicle costs and longer term lengths continue to drive an increase in the provision for credit losses. For example, had term lengths and consumer payment behavior remained the same as the first quarter of fiscal 2020 (pre-pandemic), principal collections as a percentage of average Finance Receivables, would have exceeded 13.0% versus the 8% that we realized. This would equate to approximately $80 million more in principal collected, resulting in credit losses being approximately $19 million lower. Each quarter, we provide initial reserves for new finance receivables as well as re-evaluate reserves related to existing finance receivables. As vehicle prices level off, and potentially decrease over time, credit losses are expected to decline significantly. We do not believe that our business fundamentals have changed: credit fundamentals will normalize. Approximately 57.0% of the higher provision for the fiscal year relates to the increase in finance receivables, net of deferred revenue. The growth in the provision was driven by the increase in vehicle sales prices resulting in a longer average contract term, and changes in consumer payment behavior related to both the absence of government stimulus payments and added inflationary pressures.

Interest income was $56.5 million in the quarter compared to $44.3 million during the prior year’s first quarter. The 27.3% increase in interest income was driven by a combination of higher average finance receivables and our decision in December 2022 to increase our consumer contract interest rate to 18.0% from 16.5% in all states except Arkansas (Illinois dealerships originate at 19.5% to 21.5%). There is a usury cap of 17.0% in Arkansas, which accounts for approximately 28.0% of our revenues.

SG&A

SG&A was $46.5 million, 14.9% of sales, compared to $45.8 million during the sequential quarter. Excluding stock-based compensation expense, SG&A was down approximately $0.6 million sequentially. Approximately 70.0% of our SG&A is people related. Our full-time headcount at July 31, 2023 and 2022, was 2,200 and 2,100, respectively. SG&A per average account, a key metric that is part of management’s short-term incentive plan, was $449 compared to $451 during the prior year’s first quarter and $454 sequentially. We expect our business investments, capital expenditures and technology investments to provide SG&A cost leveraging opportunities as we move forward.

Leverage and liquidity

Interest expense was $14.3 million, compared to $7.3 million during the prior year’s first quarter, due to higher borrowing levels and increased interest rates. Access to capital, with our $600 million revolving credit facility and our successful securitization program, gives us distinct advantages over many competitors. Many competitors may experience even more pressure in accessing capital in the future. Our non-recourse securitized funding represents the bulk of our funding, and our cost of funds fluctuates with the level of interest rates and credit spreads.

Debt to finance receivable and debt, net of cash to finance receivables (non-GAAP) 2 were 49.3% and 42.9%, compared to 43.2% and 39.7%, respectively, at the end of the prior year’s first quarter (sequentially 46.5% and 41.5%, respectively). During the current quarter, we grew net finance receivables by $53 million and increased inventory by $8 million, with a $48 million increase in debt, net of cash.

Acquisitions & Dispositions

As significant disruptions in the competitive landscape continue, we are building a pipeline of acquisition prospects and are entertaining several highly accretive opportunities. We have recently hired a vice president to head our acquisitions effort and will continue to develop and strengthen the team and processes to capture the tremendous opportunities before us. We have a competitive advantage in the industry and our opportunity for value creation through acquisitions is quite large as an increasing number of good operators look for an exit strategy.

We recently closed two stores and are in the process of reviewing a handful of others that do not generate appropriate returns. We will allocate the capital freed up by these underperforming stores to acquisitions and more attractive projects.

Business Investments, Capital Expenditures and Technology

We are actively rolling out a new Loan Origination System (“LOS”) which we expect to complete within the next few months. As we have discussed, the LOS will be transformational for our company, increasing the funnel of potential customers and the retention of existing customers that have high life-time value. We are receiving more than 16,000 on-line credit applications each month. Because of the high and increasing level of interest in our offering, the LOS will provide data enabling us to be more selective in choosing customers to finance and structure our deals to improve success rates. Attracting and retaining higher credit customers over time will drive down credit losses. We will have the ability to continuously update our scoring system and apply risk-based pricing to capture the desired market share. We are excited about the enormous benefits from access to robust data. In addition, the LOS will reduce the time it takes to complete a sale, providing more time to focus on customer service. Lastly, streamlining back-office functions will provide significant efficiencies when compared to current processes.

Our implementation of Microsoft Dynamics 365 Enterprise Resource Planning project (“ERP”), including our Customer Relationship Management (“CRM”) module, is also progressing and, like the LOS, our expectations are high. These platforms will significantly improve our back-office accounting, inventory management/procurement, information technology and other functions while elevating our customer service levels. In addition to achieving operational gains through improved utilization of data, we expect to see cost savings as we eliminate manual processes and improve efficiency. We expect the ERP to be completed by early calendar year 2024.

We expect capital expenditures to be approximately $12 million for the fiscal year 2024 and spending in our first quarter is in line with that estimate. We completed most of our significant facilities projects in 2023.

Conference Call

Management will hold a conference call on Tuesday, September 5, 2023, at 11:00 a.m. Eastern Time to discuss quarterly results. Participants may access the conference call via webcast using this link: Webcast Link Here. To participate via telephone, please register in advance using this Registration Link. Upon registration, all telephone participants will receive a one-time confirmation email detailing how to join the conference call, including the dial-in number along with a unique PIN that can be used to access the call. All participants are encouraged to dial in 10 minutes prior to the start time.

A replay of the conference call and webcast will be available on-demand, which will be available for 12 months.

About America's Car-Mart

America’s Car-Mart, Inc. (the “Company”) operates automotive dealerships in 12 states and is one of the largest publicly held automotive retailers in the United States focused exclusively on the “Integrated Auto Sales and Finance” segment of the used car market. The Company emphasizes superior customer service and the building of strong personal relationships with its customers. The Company operates its dealerships primarily in smaller cities throughout the South-Central United States, selling quality used vehicles and providing financing for substantially all of its customers. For more information about America’s Car-Mart, including investor presentations, please visit our website at www.car-mart.com.

Non-GAAP Financial Measures

This press release contains financial information determined by methods other than in accordance with generally accepted accounting principles (GAAP). We present total debt, net of total cash, to finance receivables, a non-GAAP measure, as a supplemental measure of our performance. We believe total debt, net of total cash, to finance receivables is a useful measure to monitor leverage and evaluate balance sheet risk. This measure should not be considered in isolation or as a substitute for reported GAAP results because it may include or exclude certain items as compared to similar GAAP-based measures, and such measures may not be comparable to similarly-titled measures reported by other companies. We strongly encourage investors to review our consolidated financial statements included in publicly filed reports in their entirety and not rely solely on any one, single financial measure or communication. The most directly comparable GAAP financial measure, as well as a reconciliation to the comparable GAAP financial measure, for non-GAAP financial measures are presented in the tables of this release.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements address the Company’s future objectives, plans and goals, as well as the Company’s intent, beliefs and current expectations regarding future operating performance and can generally be identified by words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “foresee,” and other similar words or phrases. Specific events addressed by these forward-looking statements may include, but are not limited to:

- future returns on equity;

- operational infrastructure investments;

- same dealership sales and revenue growth;

- customer growth;

- gross profit percentages;

- gross profit per retail unit sold;

- business acquisitions;

- technological investments and initiatives;

- future revenue growth;

- receivables growth as related to revenue growth;

- new dealership openings;

- performance of new dealerships;

- interest rates;

- future credit losses;

- the Company’s collection results, including but not limited to collections during income tax refund periods;

- seasonality; and

- the Company’s business, operating and growth strategies and expectations.

These forward-looking statements are based on the Company’s current estimates and assumptions and involve various risks and uncertainties. As a result, you are cautioned that these forward-looking statements are not guarantees of future performance, and that actual results could differ materially from those projected in these forward-looking statements. Factors that may cause actual results to differ materially from the Company’s projections include, but are not limited to:

- general economic conditions in the markets in which the Company operates, including but not limited to fluctuations in gas prices, grocery prices and employment levels;

- the availability of quality used vehicles at prices that will be affordable to our customers, including the impacts of changes in new vehicle production and sales;

- the availability of credit facilities and access to capital through securitization financings or other sources on terms acceptable to us to support the Company’s business;

- the Company’s ability to underwrite and collect its contracts effectively;

- competition;

- dependence on existing management;

- ability to attract, develop, and retain qualified general managers;

- changes in consumer finance laws or regulations, including but not limited to rules and regulations that have recently been enacted or could be enacted by federal and state governments;

- the ability to keep pace with technological advances and changes in consumer behavior affecting our business;

- security breaches, cyber-attacks, or fraudulent activity;

- the ability to identify and obtain favorable locations for new or relocated dealerships at reasonable cost;

- the ability to successfully identify, complete and integrate new acquisitions; and

- potential business and economic disruptions and uncertainty that may result from any future public health crises and any efforts to mitigate the financial impact and health risks associated with such developments.

Additionally, risks and uncertainties that may affect future results include those described from time to time in the Company’s SEC filings. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made.

Contact: Vickie Judy, CFO at (479) 464-9944

Investor_relations@car-mart.com

(1) Subsequent to the issuance of our interim financial statements for the period ended July 31, 2022, certain immaterial errors were identified and have been corrected in our historical information related to the classification of deferred revenue of ancillary products at the time an account is charged off and the calculation for allowance for credit losses. As a result, certain amounts for sales revenue, provision for credit losses, charge-offs, net of collateral recovered, gross profit per vehicle sold and the allowance for credit losses have been revised from the amounts previously reported to correct these errors. The impact of these adjustments resulted in an increase in diluted earnings per share for the three months ended July 31, 2022, of $0.07. Management has evaluated the materiality of these corrections to its prior period financial statements from a quantitative and qualitative perspective and has concluded that this change was not material to any prior annual or interim period.

(2) Calculation of this non-GAAP financial measure and a reconciliation to the most directly comparable GAAP measure are included in the tables accompanying this release.

| America's Car-Mart, Inc. |

| Consolidated Results of Operations |

| (Dollars in thousands) |

| (Unaudited) |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | % Change | | | As a % of Sales |

| | | | Three Months Ended | | 2023 | | | Three Months Ended |

| | | | July 31, | | vs. | | | July 31, |

| | | | | 2023 | | | | 2022 | | | 2022 | | | 2023 | | | 2022 | |

| Operating Data: | | | | | | | | | | | | | | | | |

| | | Retail units sold | | 15,912 | | | | 15,536 | | | 2.4 | % | | | | | | |

| | | Average number of stores in operation | | 155 | | | | 154 | | | 0.6 | | | | | | | |

| | | Average retail units sold per store per month | | 34.2 | | | | 33.6 | | | 1.8 | | | | | | | |

| | | Average retail sales price(1) | $ | 18,799 | | | $ | 18,065 | | | 4.1 | | | | | | | |

| | | Total gross profit per retail unit sold(1) | $ | 6,768 | | | $ | 6,524 | | | 3.7 | | | | | | | |

| | | Total gross profit percentage | | 34.6 | % | | | 34.4 | % | | 0.4 | | | | | | | |

| | | Same store revenue growth | | 8.2 | % | | | 21.5 | % | | | | | | | | | |

| | | Net charge-offs as a percent of average finance receivables(1) | | 5.8 | % | | | 5.1 | % | | | | | | | | | |

| | | Total collected (principal, interest and late fees) | $ | 165,747 | | | $ | 148,221 | | | 11.8 | | | | | | | |

| | | Average total collected per active customer per month | $ | 535 | | | $ | 516 | | | 3.7 | | | | | | | |

| | | Average percentage of finance receivables-current (excl. 1-2 day) | | 80.5 | % | | | 80.4 | % | | | | | | | | | |

| | | Average down-payment percentage | | 5.0 | % | | | 5.4 | % | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Period End Data: | | | | | | | | | | | | | | | | |

| | | Stores open | | 154 | | | | 154 | | | - | % | | | | | | |

| | | Accounts over 30 days past due | | 4.4 | % | | | 3.6 | % | | | | | | | | | |

| | | Active customer count | | 104,734 | | | | 96,899 | | | 8.1 | | | | | | | |

| | | Principal balance of finance receivable | $ | 1,440,707 | | | $ | 1,185,276 | | | 21.6 | | | | | | | |

| | | Weighted average total contract term | | 46.9 | | | | 44.0 | | | 6.6 | % | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Statements of Operations: | | | | | | | | | | | | | | | | |

| | | Revenues: | | | | | | | | | | | | | | | | |

| | | Sales(1) | $ | 311,569 | | | $ | 294,476 | | | 5.8 | % | | 100.0 | % | | 100.0 | % |

| | | Interest income | | 56,456 | | | | 44,342 | | | 27.3 | | | 18.1 | | | 15.1 | |

| | | Total | | 368,025 | | | | 338,818 | | | 8.6 | | | 118.1 | | | 115.1 | |

| | | | | | | | | | | | | | | | | | | |

| | | Costs and expenses: | | | | | | | | | | | | | | | | |

| | | Cost of sales | | 203,879 | | | | 193,115 | | | 5.6 | | | 65.4 | | | 65.6 | |

| | | Selling, general and administrative | | 46,470 | | | | 43,234 | | | 7.5 | | | 14.9 | | | 14.7 | |

| | | Provision for credit losses(1) | | 96,323 | | | | 76,241 | | | 26.3 | | | 30.9 | | | 25.9 | |

| | | Interest expense | | 14,274 | | | | 7,345 | | | 94.3 | | | 4.6 | | | 2.5 | |

| | | Depreciation and amortization | | 1,693 | | | | 1,151 | | | 47.1 | | | 0.5 | | | 0.4 | |

| | | Loss on disposal of property and equipment | | 166 | | | | 8 | | | - | | | 0.1 | | | - | |

| | | Total | | 362,805 | | | | 321,094 | | | 13.0 | | | 116.4 | | | 109.0 | |

| | | | | | | | | | | | | | | | | | | |

| | | Income before taxes | | 5,220 | | | | 17,724 | | | | | | 1.7 | | | 6.0 | |

| | | | | | | | | | | | | | | | | | | |

| | | Provision for income taxes(1) | | 1,034 | | | | 4,027 | | | | | | 0.3 | | | 1.4 | |

| | | | | | | | | | | | | | | | | | | |

| | | Net income | $ | 4,186 | | | $ | 13,697 | | | | | | 1.3 | | | 4.7 | |

| | | | | | | | | | | | | | | | | | | |

| | | Dividends on subsidiary preferred stock | $ | (10 | ) | | $ | (10 | ) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Net income attributable to common shareholders | $ | 4,176 | | | $ | 13,687 | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Earnings per share: | | | | | | | | | | | | | | | | |

| | | Basic(1) | $ | 0.65 | | | $ | 2.15 | | | | | | | | | | |

| | | Diluted(1) | $ | 0.63 | | | $ | 2.07 | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Weighted average number of shares used in calculation: | | | | | | | | | | | | | | | | |

| | | Basic | | 6,381,704 | | | | 6,373,326 | | | | | | | | | | |

| | | Diluted | | 6,635,002 | | | | 6,601,586 | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

(1) Subsequent to the issuance of our financial statements for the period ended July 31, 2022, certain immaterial errors were identified and have been corrected in our historical information related to the classification of deferred revenue of ancillary products at the time an account is charged off and the calculation for allowance for credit losses. The amount of deferred revenue related to ancillary products for a customer account that is charged off has historically been recognized as sales revenue at the time of charge-off because the earnings stream for the deferred revenue is completed at the time of charge-off. It was determined that this amount should more appropriately be recorded as a reduction to customer accounts receivable at the time of charge-off, thus reducing the amounts historically reported in sales revenue, net charge-offs, the provision for credit losses and the allowance for credit losses. As a result, certain amounts for sales revenue, provision for credit losses, charge-offs, net of collateral recovered, and the allowance for credit losses have been revised from the amounts previously reported to correct these errors. The impact of these adjustments resulted in an increase in diluted earnings per share for the three months ended July 31, 2022 of $0.07. Management has evaluated the materiality of these corrections to its prior period financial statements from a quantitative and qualitative perspective and has concluded that this change was not material to any prior annual or interim period.

| America's Car-Mart, Inc. |

| Condensed Consolidated Balance Sheet and Other Data |

| (Dollars in thousands) |

| (Unaudited) |

| | | | | | | | | |

| | | | | | | | | |

| | | | | July 31, | | April 30, | | July 31, |

| | | | | | 2023 | | | | 2023 | | | | 2022 | |

| | | | | | | | | |

| Cash and cash equivalents | | $ | 6,314 | | | $ | 9,796 | | | $ | 4,362 | |

| Restricted cash from collections on auto finance receivables | $ | 85,887 | | | $ | 58,238 | | | $ | 37,521 | |

| Finance receivables, net(1) | | $ | 1,126,992 | | | $ | 1,074,464 | | | $ | 930,149 | |

| Inventory | | $ | 117,186 | | | $ | 109,290 | | | $ | 145,181 | |

| Total assets(1) | | $ | 1,504,721 | | | $ | 1,420,431 | | | $ | 1,258,255 | |

| Revolving lines of credit, net (2) | | $ | (1,035 | ) | | $ | 167,231 | | | $ | 188,921 | |

| Non-recourse notes payable, net | $ | 711,789 | | | $ | 471,367 | | | $ | 323,105 | |

| Treasury stock | | $ | 297,489 | | | $ | 297,421 | | | $ | 297,421 | |

| Total equity(1) | | $ | 504,729 | | | $ | 498,547 | | | $ | 488,304 | |

| Shares outstanding | | | 6,381,954 | | | | 6,371,404 | | | | 6,367,605 | |

| Book value per outstanding share(1) | $ | 79.15 | | | $ | 78.56 | | | $ | 76.75 | |

| | | | | | | | | |

| | | | | | | | | |

| Finance receivables: | | | | | | |

| | Principal balance | | $ | 1,440,707 | | | $ | 1,373,372 | | | $ | 1,185,276 | |

| | Deferred revenue - accident protection plan | | (54,716 | ) | | | (53,065 | ) | | | (46,896 | ) |

| | Deferred revenue - service contract | | (70,883 | ) | | | (67,404 | ) | | | (53,459 | ) |

| | Allowance for credit losses(1) | | (314,442 | ) | | | (299,608 | ) | | | (255,836 | ) |

| | | | | | | | | |

| | Finance receivables, net of allowance and deferred revenue | $ | 1,000,666 | | | $ | 953,295 | | | $ | 829,085 | |

| | | | | | | | | |

| | | | | | | | | |

| | Allowance as % of principal balance net of deferred revenue | | 23.91 | % | | | 23.91 | % | | | 23.58 | % |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Changes in allowance for credit losses: | | | | | |

| | | | | Three months ended | | |

| | | | | July 31, | | |

| | | | | | 2023 | | | | 2022 | | | |

| | Balance at beginning of period(1) | $ | 299,608 | | | $ | 237,823 | | | |

| | Provision for credit losses(1) | | 96,323 | | | | 76,241 | | | |

| | Charge-offs, net of collateral recovered(1) | | (81,489 | ) | | | (58,228 | ) | | |

| | | Balance at end of period | $ | 314,442 | | | $ | 255,836 | | | |

| | | | | | | | | | | | | | | | |

(1) Subsequent to the issuance of our financial statements for the period ended July 31, 2022, certain immaterial errors were identified and have been corrected in our historical information related to the classification of deferred revenue of ancillary products at the time an account is charged off and the calculation for allowance for credit losses. The amount of deferred revenue related to ancillary products for a customer account that is charged off has historically been recognized as sales revenue at the time of charge-off because the earnings stream for the deferred revenue is completed at the time of charge-off. It was determined that this amount should more appropriately be recorded as a reduction to customer accounts receivable at the time of charge-off, thus reducing the amounts historically reported in sales revenue, net charge-offs, the provision for credit losses and the allowance for credit losses. As a result, certain amounts for sales revenue, provision for credit losses, charge-offs, net of collateral recovered, and the allowance for credit losses have been revised from the amounts previously reported to correct these errors. The impact of these adjustments resulted in a cumulative decrease in the allowance for credit losses of $10.0 million at July 31, 2022. Management has evaluated the materiality of these corrections to its prior period financial statements from a quantitative and qualitative perspective and has concluded that this change was not material to any prior annual or interim period.

(2) As of the period ended July 31, 2023, the revolving line of credit balance was $0; however, $1.0 million of amortized debt issuance costs is being reflected at the period end, which would have normally been netted against the carrying balance.

| America's Car-Mart, Inc. |

| Condensed Consolidated Statements of Cash Flows |

| (Dollars in thousands) |

| (Unaudited) |

| | | | | | |

| | | | Three months ended |

| | | | July 31, |

| | | | | 2023 | | | | 2022 | |

| | | | | | |

| Operating activities: | | | |

| | Net income | $ | 4,186 | | | $ | 13,697 | |

| | Provision for credit losses(1) | | 96,323 | | | | 76,241 | |

| | Losses on claims for accident protection plan | | 7,769 | | | | 6,108 | |

| | Depreciation and amortization | | 1,693 | | | | 1,151 | |

| | Finance receivable originations | | (297,732 | ) | | | (287,416 | ) |

| | Finance receivable collections | | 109,291 | | | | 103,879 | |

| | Inventory | | 23,953 | | | | (521 | ) |

| | Deferred accident protection plan revenue(1) | | 1,651 | | | | 6,570 | |

| | Deferred service contract revenue(1) | | 3,479 | | | | 7,358 | |

| | Income taxes, net(1) | | 770 | | | | 3,621 | |

| | Other(2) | | 3,218 | | | | 8,910 | |

| | | Net cash used in operating activities | | (45,399 | ) | | | (60,402 | ) |

| | | | | | |

| Investing activities: | | | |

| | Purchase of property and equipment and other(2) | | (850 | ) | | | (6,920 | ) |

| | | Net cash used in investing activities | | (850 | ) | | | (6,920 | ) |

| | | | | | |

| Financing activities: | | | |

| | Change in revolving credit facility, net | | (168,516 | ) | | | 144,036 | |

| | Payments on non-recourse notes payable | | (116,862 | ) | | | (74,532 | ) |

| | Change in cash overdrafts | | - | | | | 1,108 | |

| | Issuances of non-recourse notes payable | | 360,340 | | | | - | |

| | Debt issuance costs | | (4,091 | ) | | | (89 | ) |

| | Purchase of common stock | | (68 | ) | | | (5,196 | ) |

| | Dividend payments | | (10 | ) | | | (10 | ) |

| | Exercise of stock options and issuance of common stock | | (377 | ) | | | 1,301 | |

| | | Net cash provided by financing activities | | 70,416 | | | | 66,618 | |

| | | | | | |

| Increase (decrease) in cash, cash equivalents, and restricted cash | $ | 24,167 | | | $ | (704 | ) |

| | | | | | | | | | | |

(1) Subsequent to the issuance of our financial statements for the period ended July 31, 2022, certain immaterial errors were identified and have been corrected in our historical information related to the classification of deferred revenue of ancillary products at the time an account is charged off and the calculation for allowance for credit losses. The amount of deferred revenue related to ancillary products for a customer account that is charged off has historically been recognized as sales revenue at the time of charge-off because the earnings stream for the deferred revenue is completed at the time of charge-off. It was determined that this amount should more appropriately be recorded as a reduction to customer accounts receivable at the time of charge-off, thus reducing the amounts historically reported in sales revenue, net charge-offs, the provision for credit losses and the allowance for credit losses. As a result, certain amounts for sales revenue, provision for credit losses, charge-offs, net of collateral recovered, and the allowance for credit losses have been revised from the amounts previously reported to correct these errors. Management has evaluated the materiality of these corrections to its prior period financial statements from a quantitative and qualitative perspective and has concluded that this change was not material to any prior annual or interim period.

(2) Prepaid expenses and other assets at July 31, 2022, reflects an immaterial reclassification of approximately $7.4 million of capitalized implementation costs related to a cloud-computing arrangement previously recorded in Property and equipment, net, and did not impact operating income.

| America's Car-Mart, Inc. | |

| Reconciliation of Non-GAAP Financial Measures | |

| (Dollars in thousands) | |

| (Unaudited) | |

| | | | | | | |

| Calculation of Debt, Net of Total Cash, to Finance Receivables: | |

| | | | | July 31, 2023 | | April 30, 2023 |

| | | Debt: | | | |

| | | | Revolving lines of credit, net (1) | $ | (1,035 | ) | | $ | 167,231 | |

| | | | Non-recourse notes payable, net | | 711,789 | | | | 471,367 | |

| | | Total debt | $ | 710,754 | | | $ | 638,598 | |

| | | | | | | |

| | | Cash: | | | |

| | | | Cash and cash equivalents | $ | 6,314 | | | $ | 9,796 | |

| | | | Restricted cash from collections on auto finance receivables | | 85,887 | | | | 58,238 | |

| | | Total cash, cash equivalents, and restricted cash | $ | 92,201 | | | $ | 68,034 | |

| | | | | | | |

| | | Debt, net of total cash | $ | 618,553 | | | $ | 570,564 | |

| | | | | | | |

| | | Principal balance of finance receivables | $ | 1,440,707 | | | $ | 1,373,372 | |

| | | | | | | |

| | | Ratio of debt to finance receivables | | 49.3 | % | | | 46.5 | % |

| | | Ratio of debt, net of total cash, to finance receivables | | 42.9 | % | | | 41.5 | % |

| | | | | | | |

(1) As of the period ended July 31, 2023, the revolving line of credit balance was $0; however, $1.0 million of amortized debt issuance costs is being reflected at the period end, which would have normally been netted against the carrying balance.

EXHIBIT 99.2

America’s Car-Mart Names Doug Campbell CEO & Board Member

ROGERS, Ark., Sept. 05, 2023 (GLOBE NEWSWIRE) -- America’s Car-Mart, Inc. (NASDAQ: CRMT) (“America’s Car-Mart,” “we” or the “Company”) today announced that its board of directors has elected current President Doug Campbell to succeed Jeff Williams as Chief Executive Officer and to serve as a director of the Company, each effective October 1, 2023. Williams will remain with the Company as CEO Emeritus through the end of fiscal year 2024. Williams will also continue his service on the board.

The Company also reported its first quarter fiscal 2024 earnings results today. See associated press release America’s Car-Mart Reports First Quarter Fiscal 2024 Earnings.

“Since 2018, America’s Car-Mart has grown its customer base 50%, doubled book value per share, increased finance receivables from $500 million to $1.4 billion, and diversified its funding through a successful securitization program. We have also embarked on several investment projects critical to our long-term success and increasing productivity. Importantly, to reach our full potential, we have aggressively recruited key talented executives. Doug is top among these new talents, and I’m very pleased that he will become CEO of America’s Car-Mart. Doug is a great leader and will take our company to the next level,” said Williams.

Campbell is excited about capitalizing on the Company’s 42-year history and its strong brand to drive future growth. “I’m thrilled to have such an incredible opportunity to lead America’s Car-Mart as CEO,” said Campbell. “Over the last year I’ve witnessed how dynamic, resourceful, and agile our associates and leaders are. Jeff has led the Company through a challenging environment while kicking off some of the most important initiatives in our Company’s history. I’m thankful for his leadership and ongoing assistance through the transition. I look forward to building upon the momentum Jeff has put in motion, and working with our team on the next chapter of growth and transformation while continuing to give back to the communities we serve.”

Board Chair Josh Welch recognized Campbell and Williams for their leadership and the transformational initiatives put in place during the past year. “Doug has learned our business quickly – he appreciates our culture, the importance of our value proposition to any community, has made meaningful improvements to our operations and is an excellent leader. Jeff positioned the Company for substantial long-term growth and profitability; Doug has the skillsets to elevate our execution, delivering on the enormous demand for basic transportation and credit in towns across the country,” said Welch. “We are grateful for the many key business initiatives launched under Jeff’s leadership. Jeff continues to be a large shareholder in America’s Car-Mart and will continue his dedicated work until the end of fiscal year 2024, subsequently remaining as a consultant to the Company to help ensure a smooth transition.”

Before joining America’s Car-Mart in October 2022, Campbell was Senior Vice President, Head of Fleet Services for the Americas, at Avis Budget Group after serving as Vice President of Remarketing leading their wholesale, retail, and factory program disposals. He led the strategic growth of the direct-to-consumer initiative and the overhaul of a business-to-business online direct sales platform, both contributing to meaningful reductions in overall fleet costs. Prior to joining Avis Budget Group, he worked for AutoNation in both corporate and field leadership roles. Previously, he spent 15 years at Coral Springs Auto Mall as an Executive General Manager overseeing several brands selling both new and used vehicles.

Campbell will continue to serve as President of the Company upon his appointment as Chief Executive Officer.

About America's Car-Mart

America’s Car-Mart, Inc. (the “Company”) operates automotive dealerships in 12 states and is one of the largest publicly held automotive retailers in the United States focused exclusively on the “Integrated Auto Sales and Finance” segment of the used car market. The Company emphasizes superior customer service and the building of strong personal relationships with its customers. The Company operates its dealerships primarily in smaller cities throughout the South-Central United States, selling quality used vehicles and providing financing for substantially all of its customers. For more information about America’s Car-Mart, including investor presentations, please visit our website at www.car-mart.com.

____________________________

Contact: Vickie Judy, CFO at (479) 464-9944

Investor_relations@car-mart.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

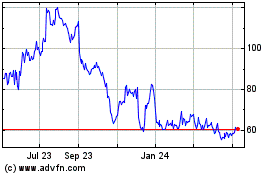

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Apr 2024 to May 2024

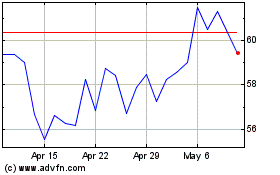

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From May 2023 to May 2024