false

0000799850

0000799850

2024-01-24

2024-01-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 24, 2024

AMERICA’S CAR-MART, INC.

(Exact name of registrant as specified in its charter)

| Texas |

0-14939 |

63-0851141 |

| (State or other jurisdiction of incorporation) |

(Commission file number) |

(I.R.S. Employer Identification No.) |

1805 North 2nd Street, Suite 401, Rogers, Arkansas 72756

(Address of principal executive offices, including zip code)

(479) 464-9944

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock,

par value $0.01 per share |

CRMT |

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule

405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act. ☐

|

Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers. |

On January 24, 2024, America’s Car-Mart,

Inc. (the “Company”), through its principal operating subsidiary, America’s Car Mart, Inc., entered into Amendment No.

1 (the “Amendment”) to the Amended and Restated Employment Agreement, dated December 19, 2023 and effective as of October

1, 2023, with the Company’s President and CEO, Douglas W. Campbell (the “Agreement”).

The Amendment revises the terms of Mr. Campbell’s

restricted stock award under the Agreement to be based on the fair market value of the Company’s common stock as of the signing

date of Agreement rather than October 1, 2023, and extends the timetable for granting his restricted stock and stock option awards as

provided in the Agreement. Under the terms of the Amendment, no later than January 29, 2024, Mr. Campbell will receive an award of restricted

shares of common stock with a fair market value of $3.36 million, based on the closing pricing of the Company’s common stock as

of the trading day immediately preceding December 19, 2023, and a stock option award representing shares of common stock with a target

fair market value of $5.04 million. The restricted shares will vest in three equal annual installments on September 30th in each of the

next three years, and the stock options will vest in their entirety on December 19, 2026, subject to certain performance conditions to

be determined by the Committee. The Committee has determined that the vesting of the stock options will be based equally on the Company’s

four-quarter average return on equity during the period from November 1, 2023 to October 31, 2026, and the 90-day average of the closing

price of the Company’s common stock as reported on the Nasdaq Stock Market during the period from December 19, 2023 to December

18, 2026, with the number of options vesting to be within a range of 0% to 150% of the target award determined on a straight-line basis

between the threshold and maximum amounts based on the Company’s actual performance achieved for each measure, subject to a threshold

level of performance being achieved. The restricted stock and stock option awards were granted by the Company on January 25, 2024.

As previously disclosed, under the terms of the

Amendment, Mr. Campbell will not be eligible to receive any further long-term equity incentive awards until October 1, 2026. Thereafter,

Mr. Campbell will be eligible for additional long-term incentive awards under the Company’s Amended and Restated Stock Option Plan

and its Amended and Restated Stock Incentive Plan (and any successor plans) at the discretion of the Committee.

The foregoing description of the material terms

of the Amendment is qualified in its entirety by reference to the full text of the Amendment, a copy of which is attached hereto as Exhibit

10.2 and is incorporated herein by reference.

|

Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

|

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

America’s Car-Mart, Inc. |

|

| |

|

|

|

| Date: January 30, 2024 |

|

/s/ Vickie D. Judy |

|

| |

|

Vickie D. Judy |

| |

|

Chief Financial Officer |

| |

|

(Principal Financial Officer) |

Exhibit 10.2

AMENDMENT NO. 1 TO

the Amended and

Restated Employment Agreement

This Amendment No. 1 to the Amended and Restated Employment Agreement,

dated January 24, 2024 (the "Amendment"), is by and between AMERICA’S CAR MART, INC.,

an Arkansas corporation (the “Company”), and DOUGLAS CAMPBELL (the “Executive”,

and together with the Company, the "Parties", and each, a "Party").

WHEREAS, the Parties have entered into Amended and Restated Employment

Agreement, signed as of December 19, 2023 and effective as of October 1, 2023 (the "Existing Agreement"); and

WHEREAS, the Parties desire to amend the Existing Agreement to amend the Compensation provision

with respect to Long Term Incentives on the terms and subject to the conditions set forth herein; and

WHEREAS, pursuant to Section 26 of the Existing Agreement, the amendment contemplated by the

Parties must be contained in a written agreement signed by each Party;

NOW, THEREFORE, in consideration of the foregoing and other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

1.

Definitions. Capitalized

terms used and not defined in this Amendment have the respective meanings assigned to them in the Existing Agreement.

2.

Amendments to the Existing

Agreement. As of the Effective Date (as defined below), Section 4(c) of the Existing Agreement is hereby amended by replacing

Section 4(c) in its entirety with the following:

(c) Long-Term Incentives.

During the Employment Term, the Executive shall be eligible to participate in the Parent Company’s Amended and Restated Stock Option

Plan (the “Option Plan”) and the Parent Company’s Amended and Restated Stock Incentive Plan (the “Incentive

Plan”) (and any successor incentive plans thereto) to the extent that the Compensation Committee, in its sole discretion, determines

is appropriate. Notwithstanding the foregoing, prior to the third anniversary of the Effective Date, the Executive shall not be eligible

to receive any additional long-term incentive awards under the Option Plan or the Incentive Plan (or any successor incentive plans thereto)

other than awards already made to the Executive and the awards set forth in this Section 4(c). By no later than January 29, 2024, the

Parent Company will grant to the Executive long-term incentive awards with a total target fair market value as of $8,400,000, consisting

of the following:

(i) Restricted shares of Parent Company Stock, pursuant to

the Incentive Plan, having a fair market value of $3,360,000, which shares will vest in three equal annual installments, with the first

installment vesting on the day immediately prior to the first anniversary of the Effective Date, the second installment vesting on the

day immediately prior to the second anniversary of the Effective Date, and the third installment vesting on the day immediately prior

to the third anniversary of the Effective Date, in each case subject to the Executive’s continued employment under this Agreement

and subject to the conditions set forth in an applicable award agreement pursuant to Article VI of the Incentive Plan. The number of restricted

shares shall be determined based on the per share closing price of the Parent Company Stock as reported on the trading day immediately

preceding the Signing Date; and

(ii) A non-qualified stock option to purchase shares of Parent Company Stock, pursuant to the Option Plan, having a target fair

market value of $5,040,000, which option will vest on the third anniversary of the Signing Date, or as soon as reasonably practicable

thereafter, subject to the Executive’s continued employment under this Agreement and subject to the conditions set forth in an applicable

award agreement pursuant to the Option Plan, including without limitation the Company’s achievement of certain performance conditions

to be determined by the Compensation Committee.

3.

Date of Effectiveness; Limited

Effect. This Amendment will become effective on October 1, 2023 (the "Effective

Date"). Except as expressly provided in this Amendment, all of the terms and provisions of the Existing Agreement are and will

remain in full force and effect and are hereby ratified and confirmed by the Parties. Without limiting the generality of the foregoing,

the amendments contained herein will not be construed as an amendment to or waiver of any other provision of the Existing Agreement or

as a waiver of or consent to any further or future action on the part of either Party that would require the waiver or consent

of the other Party. On and after the Effective Date, each reference in the Existing Agreement to "this Agreement," "the

Agreement," "hereunder," "hereof," "herein," or words of like import

will mean and be a reference to the Existing Agreement as amended by this Amendment.

4.

Miscellaneous.

(a)

This Amendment is governed by and construed in accordance with the laws of the State of Arkansas

without regard to the conflict of laws provisions of such State.

(b)

This Amendment shall inure to the benefit of and be binding upon each of the Parties and each of their respective

permitted successors and permitted assigns.

(c)

The headings in this Amendment are for reference only and do not affect the interpretation of this Amendment.

(d)

This Amendment may be executed in counterparts, each of which is deemed an original, but all of which constitute one and the same

agreement. Delivery of an executed counterpart of this Amendment electronically shall be effective as

delivery of an original executed counterpart of this Amendment.

(e)

This Amendment constitutes the sole and entire agreement between the Parties with respect to the subject matter contained herein,

and supersedes all prior and contemporaneous understandings, agreements, representations, and warranties, both written and oral, with

respect to such subject matter.

IN WITNESS WHEREOF, the Parties have executed this Amendment on the date first written above.

| |

COMPANY:

America’s Car Mart, Inc.,

An Arkansas Corporation

|

| |

By /s/ Vickie D. Judy

Name: Vickie D. Judy

Title: Chief Financial Officer

|

| |

EXECUTIVE: |

| |

|

| |

/s/ Douglas Campbell

Douglas Campbell

|

| |

|

| |

|

| |

|

3

v3.24.0.1

Cover

|

Jan. 24, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 24, 2024

|

| Entity File Number |

0-14939

|

| Entity Registrant Name |

AMERICA’S CAR-MART, INC.

|

| Entity Central Index Key |

0000799850

|

| Entity Tax Identification Number |

63-0851141

|

| Entity Incorporation, State or Country Code |

TX

|

| Entity Address, Address Line One |

1805 North 2nd Street

|

| Entity Address, Address Line Two |

Suite 401

|

| Entity Address, City or Town |

Rogers

|

| Entity Address, State or Province |

AR

|

| Entity Address, Postal Zip Code |

72756

|

| City Area Code |

(479)

|

| Local Phone Number |

464-9944

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock,

par value $0.01 per share

|

| Trading Symbol |

CRMT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

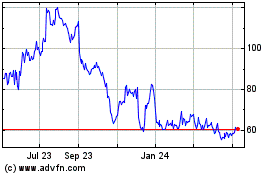

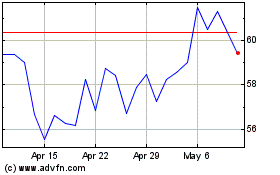

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Apr 2023 to Apr 2024