Total Holiday Sales for the quarter-to-date period ending

January 4, 2025 of $174.4 million, at the high end of

expectations

Quarter-to-date Fiscal 2024 comparable store sales growth of

7.1%, consistent with accelerated top-line momentum as reported in

Q3 Fiscal 2024

Expects Sales and EBITDA* results for second half of Fiscal

2024 to be at the high end of previously provided outlook

Citi Trends, Inc. (NASDAQ: CTRN), a leading specialty value

retailer of apparel, accessories and home trends for way less spend

primarily for African American and multicultural families in the

United States, today announced results for its holiday selling

period.

Total sales for the quarter-to-date period ending January 4,

2025 of $174.4 million compared to $169.0 million in the same

period in 2023. Comparable store sales, calculated on a shifted

9-week to 9-week basis, increased 7.1% versus 2023.

Ken Seipel, Chief Executive Officer, said, "I am pleased to

report that our holiday sales were at the high end of our

expectations as our revised product assortment, including exciting

off-price deals, resonated well with the families we serve.

Importantly, our 7.1% comparable store sales growth was driven by

improvements in both traffic and basket throughout the period.

Consistent with our Q3 Fiscal 2024 sales results, our holiday sales

results represent good customer acceptance of our efforts to adjust

our product value strategy and improved operational processes. As a

result of holiday performance, we now expect second half sales and

EBITDA* results to be at the high end of our previously provided

outlook."

Mr. Seipel continued, "I would like to thank the entire Citi

Trends team for their continued hard work and dedication throughout

the holiday season. Retail is a team sport, depending on all areas

to execute well to delight our customers. From the merchants who

selected trendy styles at amazing prices, to the supply chain team

who moved the goods at increased speed, to our store teams who once

again amazed our loyal customers, the Citi Trends team was ready

for holiday like never before. My belief in the Company’s potential

to deliver much improved financial results remains strong and we

will continue to refine and improve our team-based execution as we

look forward to the Spring selling season."

Second Half 2024 Outlook

The Company is reaffirming its previously provided outlook for

the second half of Fiscal 2024 as follows:

- Expecting second half comparable store sales to be on the high

end of the range of up low to mid-single digits compared to the

second half of fiscal 2023; total sales expected to be flat to down

low-single digits due to the 53rd week last year and store

closures

- Second half gross margin is expected to be approximately

39%

- Second half EBITDA* is expected to be on the high end of the

range of $1.5 million to $4 million

- The Company expects to end fiscal 2024 with approximately 590

stores

- Year-end cash balance is expected to be in the range of $60

million to $65 million

- Capital expenditures for the full year are expected to be in

the range of $14 million to $18 million

The Company is also reaffirming its prior comments about the

outlook for the fourth quarter of Fiscal 2024 as follows:

The Company’s implied fourth quarter comparable store sales are

expected to be on the high end of the range of up low to mid-single

digits with total sales down low to mid-single digits vs. Q4 2023

due to the 53rd week last year and store closures. Q4 gross margin

is expected to be in the range of 39% to 40% and SG&A is

expected to be approximately $76 million. Q4 EBITDA* is expected to

be on the high end of the range of $5 million to $7 million.

ICR Conference Presentation and

Webcast

As previously announced, Citi Trends is scheduled to present

today at 11:30 a.m. Eastern Time at the 2025 ICR Conference. The

audio portion of the event will be webcast live and can be

accessed, along with the corresponding slide presentation, on the

Company’s website, cititrends.com, under the Investor Relations

section, beginning today at 11:30 a.m. ET. An online archive will

be available for a period of 90 days following the

presentation.

About Citi Trends

Citi Trends, Inc. is a leading specialty value retailer of

apparel, accessories and home trends for way less spend primarily

for African American and multicultural families in the United

States. The Company operates 592 stores located in 33 states. For

more information, visit www.cititrends.com or your local store.

*Non-GAAP Financial

Measures

The Company is unable to provide a full reconciliation of the

forward-looking non-GAAP financial measure used in the Fiscal 2024

outlook without unreasonable effort because it is not possible to

predict certain of its adjustment items with a reasonable degree of

certainty. This information is dependent upon future events and may

be outside of the Company’ control and its unavailability could

have a significant impact on its financial results.

Forward-Looking

Statements

All statements other than historical facts contained in this

news release, including statements regarding the Company’s future

financial results and position, business policy and plans,

objectives and expectations of management for future operations and

capital allocation expectations, are forward-looking statements

that are subject to material risks and uncertainties. The words

"believe," "may," "could," "plans," "estimate," “expects,”

"continue," "anticipate," "intend," "expect," “upcoming,” “trend”

and similar expressions, as they relate to the Company, are

intended to identify forward-looking statements, although not all

forward-looking statements contain such language. Statements with

respect to earnings, sales or new store guidance are

forward-looking statements. Investors are cautioned that any such

forward-looking statements are subject to the finalization of the

Company’s quarter-end financial and accounting procedures, are not

guarantees of future performance or results, and are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified. Actual results or developments may differ

materially from those included in the forward-looking statements as

a result of various factors which are discussed in our Annual

Reports and Quarterly Reports on Forms 10-K and 10-Q, respectively,

and any amendments thereto, filed with the Securities and Exchange

Commission. These risks and uncertainties include, but are not

limited to, uncertainties relating to general economic conditions,

including inflation, energy and fuel costs, unemployment levels,

and any deterioration whether caused by acts of war, terrorism,

political or social unrest (including any resulting store closures,

damage or loss of inventory); or other factors; changes in market

interest rates and market levels of wages; impacts of natural

disasters such as hurricanes; uncertainty and economic impact of

pandemics, epidemics or other public health emergencies such as the

ongoing COVID-19 pandemic; transportation and distribution delays

or interruptions; changes in freight rates; the Company’s ability

to attract and retain workers; the Company’s ability to negotiate

effectively the cost and purchase of merchandise inventory risks

due to shifts in market demand; the Company’s ability to gauge

fashion trends and changing consumer preferences; consumer

confidence and changes in consumer spending patterns; competition

within the industry; competition in our markets; the duration and

extent of any economic stimulus programs; changes in product mix;

interruptions in suppliers’ businesses; the impact of the cyber

disruption we identified on January 14, 2023, including legal,

reputational, financial and contractual risks resulting from the

disruption, and other risks related to cybersecurity, data privacy

and intellectual property; temporary changes in demand due to

weather patterns; seasonality of the Company’s business; changes in

market interest rates and market level wages; the results of

pending or threatened litigation; delays associated with building,

remodeling, opening and operating new stores; and delays associated

with building, and opening or expanding new or existing

distribution centers. Any forward-looking statements by the

Company, with respect to guidance, the repurchase of shares

pursuant to a share repurchase program, or otherwise, are intended

to speak only as of the date such statements are made. Except as

required by applicable law, including the securities laws of the

United States and the rules and regulations of the Securities and

Exchange Commission, the Company does not undertake to publicly

update any forward-looking statements in this news release or with

respect to matters described herein, whether as a result of any new

information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250113845180/en/

Tom Filandro ICR, Inc. CitiTrendsIR@icrinc.com

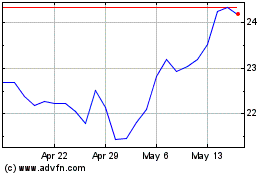

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Dec 2024 to Jan 2025

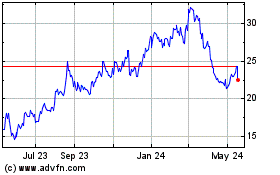

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jan 2024 to Jan 2025